- Home

- »

- Beauty & Personal Care

- »

-

Dry Shampoo Market Size And Share, Industry Report, 2030GVR Report cover

![Dry Shampoo Market Size, Share & Trends Report]()

Dry Shampoo Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Spray, Powder, Others), By Distribution Channel (Online, Offline), By End-use (Men, Women, Children), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-932-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dry Shampoo Market Summary

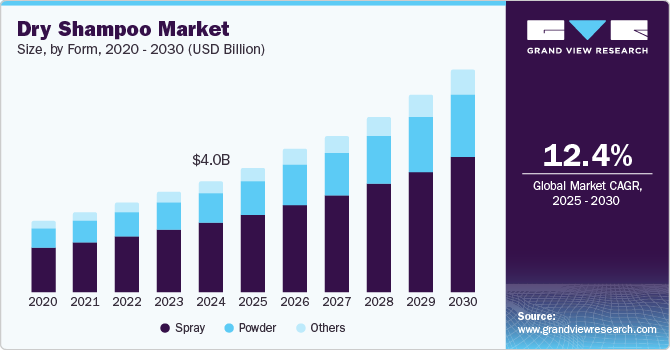

The global dry shampoo market size was estimated at USD 4.04 billion in 2024 and is projected to reach USD 8.09 billion by 2030, growing at a CAGR of 12.4% from 2025 to 2030. This growth is attributed to several factors, including changing consumer lifestyles, growing awareness about advanced hair care products, and increasing popularity of waterless products.

Key Market Trends & Insights

- The North America dry shampoo market dominated with a revenue share of 36.7% in 2024

- The U.S. dry shampoo market dominated North America, driven by strong consumer spending power in the U.S.

- By form, the spray segment dominated the industry with the largest revenue share of 62.2% in 2024.

- By distribution channel, the offline segment dominated the dry shampoo industry with the largest revenue share in 2024.

- By end use, the women end use segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.04 Billion

- 2030 Projected Market Size: USD 8.09 Billion

- CAGR (2025-2030): 12.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As modern consumers lead busier lives, they seek fast and effective solutions for maintaining their hair without the need for traditional washing methods. Dry shampoo offers a practical alternative that allows users to refresh their hair quickly, making it particularly appealing to those with busy schedules.

The rising trend of sustainability and eco-consciousness among consumers is also contributing to the expansion of the dry shampoo industry, with several brands offering organic and sustainable products. Many individuals are becoming aware of the environmental impact of their personal care products and are opting for dry shampoo as a liquid-free solution. This shift is further fueled by concerns over water scarcity in various regions, prompting consumers to choose products that align with their requirements. For instance, in urban areas where water usage is heavily monitored, dry shampoo effectively helps maintain personal hygiene while reducing water consumption.

Moreover, the innovations in formulation leading to the launch of natural and organic dry shampoos and their easy availability have significantly influenced market dynamics. With increasing numbers of consumers avoiding synthetic chemicals due to awareness about their impact on health, hair care brands are developing products free from harmful ingredients such as parabens and sulfates. This shift toward natural products with the rising number of health-conscious consumers aligns with broader trends in the beauty industry that emphasize transparency and ingredient integrity. As a result, natural dry shampoos are gaining market share, appealing to a demographic prioritizing environmental sustainability.

Form Insights

The spray segment dominated the industry with the largest revenue share of 62.2% in 2024 due to its ease of application, as dry shampoo sprays are designed to deliver a fine mist that absorbs excess oil and refreshes hair without the need for water, making them ideal for busy lifestyles. This format also allows users to apply the product directly at the roots, providing instant results and volume, which is particularly appealing to consumers who prioritize time-saving solutions in their hair care routines. In addition, these products effectively absorb excess oil and sweat from the scalp, helping eliminate odor between washes. This makes them ideal for long days or post-workout refreshments.

The powder segment is expected to grow at the highest CAGR over the forecast period due to its increasing appeal among consumers seeking natural and chemical-free hair care solutions. Unlike sprays, powder dry shampoos are often formulated with organic ingredients, attracting individuals who prefer chemical-free personal care products. This segment allows for precise application, enabling users to target specific areas of the scalp and hair, ensuring even distribution and effective oil absorption. The fine powder not only cleanses but also adds texture and volume to the hair, making it easier to style thin hair and giving it a fuller appearance. For instance, Captain Blankenship, a company based in the U.S., offers powdered dry shampoos made from organic arrowroot and kaolin clay, which absorb oil and nourish the scalp. Growing preference for natural products is contributing to the rapid expansion of the powder segment in the dry shampoo industry.

Distribution Channel Insights

The offline segment dominated the dry shampoo industry with the largest revenue share in 2024 due to consumers' preference for shopping channels that allow them to see, touch, and assess the quality of dry shampoos before purchasing in order to make the right buying decision. Offline retail spaces, such as supermarkets and specialty stores, provide immediate access to various brands and formulations, allowing for easy price comparisons and the opportunity to seek advice from knowledgeable staff. There are in-store promotions and expert recommendations that influence consumers' choices. This shopping experience is particularly important for personal care products, where consumers often want to ensure that they select the right product for their hair type and needs.

The online segment is expected to grow at the highest CAGR over the forecast period due to the increasing shift in consumer shopping habits toward e-commerce platforms. As more consumers, particularly millennials and younger generations, embrace online shopping, brands are enhancing their digital presence to meet this demand. Online retail offers significant advantages, such as easy access to various products, user reviews that aid decision-making, and convenient home delivery. Furthermore, promotional strategies such as discounts and special offers on brand websites attract more customers, further driving online sales.

End-use Insights

The women end use segment dominated the market with the largest revenue share in 2024 with the increasing number of working women and their need for fast and efficient hair care solutions. These products often come with pleasant fragrances that help mask odors, leaving hair smelling fresh without the need for a full wash. Many dry shampoos have travel-friendly packaging and are available in compact sizes that are easy to carry, making them perfect for travel or on-the-go touch-ups. Furthermore, dry shampoo helps maintain a polished look throughout the week, maintains vibrancy and longevity of hair color, and reduces the need for salon visits or professional blowouts, making it a cost-effective option for maintaining style between washes.

The men end use segment is expected to grow at the fastest CAGR over the forecast period due to the increasing acceptance of grooming products among men and the effectiveness of dry shampoos in managing oily hair and scalp. The rise of trendy hairstyles and the influence of social media have further fueled this acceptance, encouraging men to invest in hair care products that enhance their style while saving time. Regular use of dry shampoo allows men to prolong the time between washes and helps maintain their hairstyle in busy schedules.

Regional Insights

The North America dry shampoo market dominated with a revenue share of 36.7% in 2024, primarily due to the strong cultural emphasis on personal grooming and appearance in North America. Consumers actively seek products that enhance their beauty routines. Dry shampoo fits seamlessly into this culture by offering an instant solution for maintaining clean hair. Major beauty brands such as Batiste, Dove, and Living Proof have established significant market presence in North America, with marketing efforts and wide product availability contributing to high consumer awareness. In addition, dry shampoos are readily available across various retail channels, including drugstores, supermarkets, and specialty beauty shops. This accessibility encourages impulse purchases.

U.S. Dry Shampoo Market Trends

The U.S. dry shampoo market dominated North America, driven by strong consumer spending power in the U.S., which allows individuals to invest in personal care products. The U.S. brands are at the forefront of developing innovative formulations, targeting specific concerns (e.g., hydration, scalp health) with specialty ingredients. Furthermore, the rise of beauty influencers on platforms like Instagram and TikTok has significantly boosted the visibility of dry shampoo products, leading to increased consumer interest and acceptance among younger demographics. Moreover, several brands offer tinted dry shampoos specifically designed for darker hair colors to minimize visible residue and ensure seamless blending.

Asia Pacific Dry Shampoo Market Trends

Asia Pacific dry shampoo market is expected to grow at the highest CAGR over the forecast period due to rapid urbanization and changing consumer lifestyles, leading to the demand for convenient personal care products such as dry shampoo that fit into fast-paced daily routines. The expanding middle class population in many Asia Pacific countries and increased disposable income, have led to a surge in consumer spending on personal care products, including premium dry shampoos. The Asia Pacific region has a growing trend toward natural and organic personal care products, leading to increased demand for natural formulations in dry shampoos that are free from harmful chemicals.

China dominated the Asia Pacific dry shampoo market, driven by rapid urbanization, changing consumer lifestyles, and the country's bustling cities, characterized by fast-paced living. These factors have increased the demand for quick and effective personal care solutions, making dry shampoo an attractive option for busy individuals. With rising pollution levels in urban areas, consumers are increasingly concerned about the health of their hair and scalp. Dry shampoo provides a solution to hair damage caused by daily exposure to dust and pollution and helps maintain clean hair without frequent washes. For instance, many young professionals in cities such as Shanghai rely on dry shampoo to quickly refresh their hair before heading to work or social events, further driving the market growth.

Europe Dry Shampoo Market Trends

Europe's dry shampoo market is expected to grow significantly over the forecast period, driven by urban lifestyles becoming fast-paced and individuals looking for swift & efficient ways to maintain their appearance, saving the time consumed in traditional way of washing and styling hair. There is a significant trend of clean beauty in Europe, with consumers increasingly seeking products free from harsh chemicals. This has prompted brands to develop natural and organic dry shampoos that align with these values. Dry shampoos often feature scents that cater to regional preferences, incorporating floral or herbal notes popular among European consumers.

Key Dry Shampoo Company Insights

Procter & Gamble, Unilever, L'Oréal S.A., Church & Dwight Co., Inc., Henkel AG & Co. KGaA, Klorane, Revlon., Estée Lauder Companies Inc., Living Proof., and Amika. are among some of the key players in the dry shampoo industry. These companies employ various strategies to maintain a competitive edge, including launching innovative products that cater to diverse consumer preferences. They focus on developing natural formulations and multifunctional benefits to meet the rising demand for eco-friendly options.

-

Procter & Gamble offers a diverse range of dry shampoo products that cater to various consumer needs, focusing on formulations that provide effective oil absorption and refreshment without water. The company invests significantly in research & development to enhance product quality and introduce new variants, such as formulations with natural ingredients, which align with the growing consumer preference for eco-friendly solutions.

-

Unilever emphasizes the development of dry shampoos that offer both convenience and natural & organic ingredients. Its strategic initiatives primarily include expanding its product range and entering emerging markets, where rising disposable income is driving the demand for personal care products.

Key Dry Shampoo Companies:

The following are the leading companies in the dry shampoo market. These companies collectively hold the largest market share and dictate industry trends.

- Procter & Gamble

- Unilever

- L'Oréal S.A.

- Church & Dwight Co., Inc.

- Henkel AG & Co. KGaA

- Klorane

- Revlon.

- Estée Lauder Companies Inc.

- Living Proof.

- Amika.

Recent Developments

-

In November 2024, Amika. launched Perk Up Ultra Oil Control dry shampoo and collaborated with a leading beauty agency to develop a comprehensive marketing campaign, while educating consumers about the new product’s benefits.

-

In March 2024, K18 Hair launched AirWash, a dry shampoo that uses innovative odorBIND smart-release biotechnology. This new non-aerosol formula is scalp-friendly and effectively eliminates odor. The product features translucent microbeads, which absorb additional oil without leaving a starchy buildup or white cast, making it suitable for all hair colors and types.

Dry Shampoo Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.52 billion

Revenue forecast in 2030

USD 8.09 billion

Growth rate

CAGR of 12.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, Russia, Poland, Ukraine, Netherlands, Denmark, Norway, Sweden, Finland, Iceland, China, Japan, India, Australia, South Korea, Singapore, Brazil, South Africa

Key companies profiled

Procter & Gamble, Unilever, L'Oréal S.A., Church & Dwight Co., Inc., Henkel AG & Co. KGaA, Klorane, Revlon., Estée Lauder Companies Inc., Living Proof., Amika.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dry Shampoo Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dry shampoo industry report based on form, end-use, distribution channel, and region:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Spray

-

Powder

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Children

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Russia

-

Poland

-

Ukraine

-

Netherlands

-

Denmark

-

Norway

-

Sweden

-

Finland

-

Iceland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.