- Home

- »

- Clinical Diagnostics

- »

-

Drug Screening Market Size & Trends, Industry Report, 2030GVR Report cover

![Drug Screening Market Size, Share & Trends Report]()

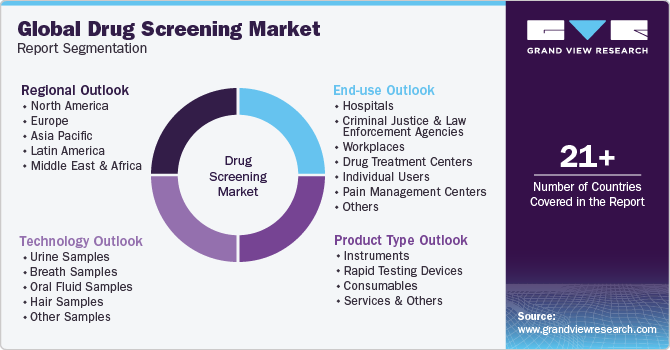

Drug Screening Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Instruments, Consumables), By Sample Type (Urine Sample, Breath Sample), By End-use (Drug Treatment Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-303-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Drug Screening Market Summary

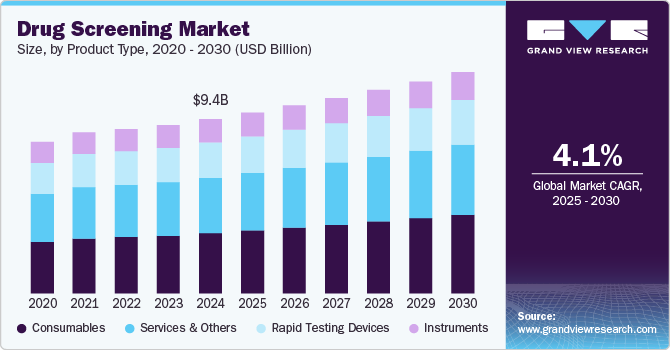

The global drug screening market size was valued at USD 9.45 billion in 2024 and is projected to reach USD 11.99 billion by 2030, growing at a CAGR of 4.1% from 2025 to 2030. The market growth is attributed to the rising substance abuse, stringent regulations, government funding, technological advancements.

Key Market Trends & Insights

- North America drug screening dominated the global market and accounted for the largest revenue share of 38.8% in 2024.

- The drug screening market in the U.S. dominated the North American market with the largest revenue share in 2024.

- Based on product type, the consumables segment accounted for the largest revenue share of 34.5% in 2024.

- Based on sample type, the urine samples segment dominated the market with the largest revenue share of 41.3% in 2024.

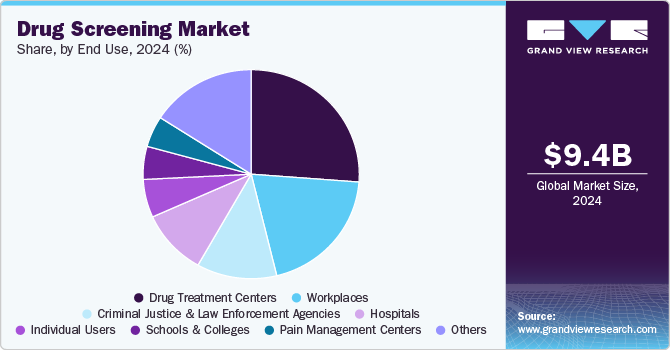

- Based on end use, the drug treatment centers segment held the dominant position in the market and accounted for the largest revenue share of 26.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.45 Billion

- 2030 Projected Market Size: USD 11.99 Billion

- CAGR (2025-2030): 4.1%

- North America: Largest market in 2024

Increasing demand for substance testing across sectors such as healthcare and sports, driven by the need for effective substance abuse detection and management are among driving factors.

The increasing consumption of drugs and alcohol globally is a significant driver for the growth of the industry. For instance, around 83.4 million adults (29%) in the EU have reportedly used illicit drugs at least once, according to the 2023 European Drug Report. In addition, drug use continues to be high worldwide, with an estimated 296 million users in 2021, representing 5.8% of the global population aged 15-64. This substantial increase in illicit substance and alcohol consumption, often associated with public safety concerns, is expected to escalate the demand for illicit substance screening solutions and propel industry growth.

The growing number of individuals engaging in drug use globally is directly contributing to the increased demand for screening products and services, driving innovation and advancements in the industry to cater to the rising need for effective screening solutions. Furthermore, developing improved screening technology and increasing awareness of the benefits of illicit substance screening are creating business opportunities. Moreover, the increased alcohol consumption among adolescents and the elderly is likely to fuel the demand for testing kits. The advent of workspace-based regulatory steps is expected to create opportunities for the market players, further contributing to the market's expansion.

According to the Quest Diagnostics Drug Testing Index Analysis, post-accident workforce drug positivity for cannabis reached a 25-year high in 2022. Based on more than 10.6 million hairs, de-identified urine, and oral-fluid substance test results, this analysis provides crucial insights into substance use patterns among the American workforce, highlighting the significance of substance testing in workplace settings. In addition, the growth of substance testing on arrests by police forces within England and Wales has resulted in nearly 100,000 drug tests conducted on suspects since March 2022. The data from these sources highlight the significant impact of testing initiatives on addressing illicit substance-related issues in law enforcement and workplace environments.

The regulatory body's approval of the new drug test also contributes to the industry expansion. For instance, in October 2023, the FDA's approval of the Alltest Fentanyl Urine Test Cassette, a rapid test for detecting fentanyl in urine, contributed to the expansion of the industry. This development provides a new tool for the preliminary detection of fentanyl, a significant driver in market's growth. The test's ability to detect fentanyl in urine samples helps in addressing the opioid crisis by enabling early detection and intervention. This innovation is expected to drive the demand for products and services, particularly in the context of opioid abuse and misuse.

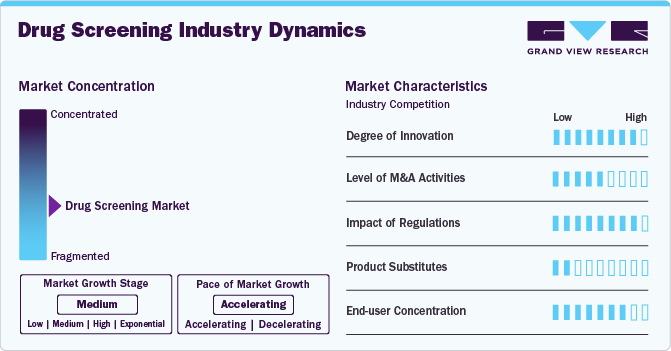

Market Concentration & Characteristics

The degree of innovation is high in market, particularly in developing sensitive lab-based testing methods and wearable devices for real-time drug use and metabolites monitoring. Saliva-based testing, known for its non-invasiveness and quick results, is developing testing, promising increased accessibility and accuracy. Several players engage in mergers and acquisitions to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. For instance, in April 2022, Saladax Biomedical acquired portfolio for antipsychotic drug testing from Janssen Pharmaceutica NV, expanding its intellectual property to cover major antipsychotic drugs. This acquisition enables Saladax to develop tests for hospitals and point-of-care settings.

The stringent regulatory framework for drug screening products is a major restraint on the industry, delaying innovation and increasing development costs. The regulatory framework is very stringent in countries where the industry has high potential to grow due to the availability of a large patient pool. The market shows a high end-user concentration, with a significant portion of revenue generated from a limited number of key customers, primarily in the workplace and healthcare sectors. This concentration is driven by a few major players' dominance and reliance on government-funded programs and regulations.

Product Type Insights

Consumables accounted for the largest revenue share of 34.5% in 2024. This dominance is attributed to the fact that consumables, such as assay kits, sample collection devices, and calibrators & controls, are crucial for on-site illicit substance testing, readily available, and must be repeatedly purchased due to their one-time use. In addition, immunoassay analyzers, often used with consumables, provide quick and cost-effective screening of samples in various matrices, further contributing to the segment's significance in the market. This reliance on consumables for accurate and efficient drug testing processes highlights their pivotal role in the drug screening industry. Moreover, a product launch by the industry player further contributes to the segment's growth. For instance, in June 2023, Sysmex launched assay kits to measure amyloid beta (Aβ) levels in blood, which can help identify Aβ accumulation in the brain, a characteristic of Alzheimer's disease.

Services and others are expected to grow at a CAGR of 4.1% over the forecast period, owing to their significant role in providing essential services and support for substance screening processes. This segment encompasses screening services, laboratory services, and other related services crucial for accurate and efficient testing. For instance, drug testing laboratories, drug treatment centers, and pain management centers fall under this category, offering specialized services for drug testing. In addition, this segment includes analytical instruments, rapid testing devices, and drug screening services that play a vital role in conducting drug tests effectively. The growth of this segment is driven by the increasing demand for reliable screening measures, the rise in substance abuse issues, and the need for innovative testing technologies to address evolving challenges in drug testing.

Sample Type Insights

Urine samples dominated the market with the largest revenue share of 41.3% in 2024. Urine is most often the preferred test substance because of its ease of collection. Urine testing is non-invasive, detecting a wide range of drugs, including illegal and prescription drugs, and provides a longer detection window for drug use identification. The rising application of urine drug testing for monitoring patients with long-term opioid therapy further propelled the segment’s growth. In addition, urine drug testing is generally more cost-effective compared to other testing methods, such as hair testing. These advantages and the growing demand for comprehensive and reliable drug screening contributed to the urine samples segment's dominance.

Oral fluid samples are expected to grow at a CAGR of 3.6% over the forecast period. Oral fluid samples are easier to collect compared to other sample types, making the testing process more convenient and less invasive for individuals. In addition, oral fluid samples can rapidly detect drug substances, allowing for quicker results and decision-making. Moreover, the enforcement of stringent laws and regulations for substance examination methods and alcohol testing by authorities has also contributed to the growth of the oral fluid samples segment. This segment is expected to continue its dominance due to the growing demand for efficient and less invasive testing methods.

End Use Insights

Drug treatment centers held the dominant position in the market and accounted for the largest revenue share of 26.2% in 2024. This is owing to the growing emphasis on substance abuse treatment and rehabilitation, which has increased the penetration of drug testing services in these settings. These centers play an important role in offering comprehensive care and supporting individuals who are struggling with substance abuse.

Hospitals are expected to grow at the fastest CAGR of 5.2% from 2025 to 2030, owing to increasing substance abuse and chronic disease cases requiring accurate testing. Advances in rapid, point-of-care technologies enable faster results, enhancing patient care. In addition, strict regulatory standards and a focus on patient and workplace safety boost demand for drug screening in hospital settings. Furthermore, hospitals use drug screening for diagnosis, treatment monitoring, and rehabilitation support.

Pain management centers are expected to grow over the forecast period. The increasing prevalence of chronic pain conditions drives the need for efficient drug screening within these facilities. In addition, the presence of key companies in the market supports the growth of this segment through strategic initiatives and technological innovations.

Regional Insights

North America drug screening dominated the global market and accounted for the largest revenue share of 38.8% in 2024. The region's high consumption of illegal substances and the necessity for workplace drug tests significantly contributed to its market share. In 2022, the U.S. recorded over 80,000 opioid-involved overdose deaths. The prevalence of opioid-related deaths in both countries underscores the urgent need for effective screening measures. In addition, with an estimated 13.2 million people injecting illicit substances in 2021, North America has the highest number of individuals engaging in injection substance use globally. This growing trend emphasizes the importance of robust public health interventions and strategies to address the risks related to substance abuse, further solidifying North America's position as a dominant force in the market.

U.S. Drug Screening Market Trends

The drug screening market in the U.S. dominated the North American market with the largest revenue share in 2024, owing to frequent approvals and product launches, aided by increasing investment in the advancement of substance screening solutions. In addition, the opioid epidemic and increasing substance abuse have led to a surge in demand for advanced and rapid drug screening solutions. The legalization of cannabis in several states has further necessitated the adoption of sophisticated testing methods to ensure workplace and public safety.

Asia Pacific Drug Screening Market Trends

The Asia Pacific drug screening market is expected to grow at a CAGR of 5.0% over the forecast period. The presence of a large target population, high unmet clinical needs, and developing healthcare is anticipated to provide high growth potential for the industry in the region. The region's increasing investment in healthcare infrastructure and research and development activities, leading to advancements in technologies and methodologies. In addition, the rising prevalence of chronic diseases, the need for effective disease monitoring, and the growing trend of outsourcing drug discovery services have fueled the demand in the Asia Pacific region. Furthermore, the growing awareness about the importance of illicit substance screening in diagnosing and treating diseases is also contributing to the growth of the Asia Pacific region.

The drug screening market in China led the Asia Pacific market with the largest revenue share in 2024, primarily driven by the growing focus on improving healthcare R&D, aided by the development of novel technologies. Furthermore, the country’s zero-tolerance policy towards drug use has resulted in comprehensive screening programs targeting high-risk groups and occupations. Investments in advanced testing technologies, such as urine, hair, and blood tests, support detecting a wide range of substances. Moreover, integrating precision medicine and using big data for personalized treatment further contributes to market development.

Europe Drug Screening Market Trends

The European drug screening market was identified as a lucrative region in this industry in 2024. The growth of the market in the region can be attributed to the increasing substance abuse in the region and the local presence of key market players in this region. In addition, an increase in drug-related road accidents and the need for forensic toxicology services are driving demand for advanced screening solutions. Furthermore, the region is also witnessing technological innovation, including automation and AI-driven analytics, which improve drug test reliability and speed.

Key Drug Screening Company Insights

Key players are using existing customer bases in the region to prioritize maintaining high-quality standards and gaining high market size access. This strategy is useful for brands that have already built trust in the market. These players are heavily investing in advanced technology and infrastructure, allowing them to process and analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

-

Siemens Healthineers manufactures and supplies a broad spectrum of drug testing assays, including reagents for drugs of abuse, therapeutic drug monitoring, and specimen validity tests.

-

Omega Laboratories, Inc. manufactures and delivers state-of-the-art drug screening kits and laboratory services, including FDA-cleared hair and oral fluid tests and emerging breath testing technologies for cannabis detection.

Key Drug Screening Companies:

The following are the leading companies in the drug screening market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Quest Diagnostics Incorporated

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc.

- Siemens Healthcare AG

- Laboratory Corporation of America Holdings

- Alfa Scientific Designs, Inc.

- OraSure Technologies, Inc.

- Omega Laboratories, Inc.

- Drägerwerk AG & Co. KGaA

- Bio-Rad Laboratories, Inc.

Recent Developments

-

In December 2023, Quest Diagnostics introduced a new 88-compound test panel for psychoactive substances to detect substance misuse. The panel, utilizing advanced testing methods, aims to identify NPS in patients, address the evolving drug epidemic, and enhance patient care.

-

In October 2023, ProciseDx Inc. received FDA clearance for therapeutic drug monitoring tests for adalimumab and infliximab, known as Procise ADL and Procise IFX, to quantify substance levels in patients with inflammatory bowel diseases. These tests, intended for hospital and moderate complexity clinical laboratories, provide quick results in 5 minutes, aiding in personalized dosing and optimizing care for IBD patients.

Drug Screening Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.81 billion

Revenue forecast in 2030

USD 11.99 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product type, sample type, end use, and region.

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; and Kuwait

Key companies profiled

Abbott; Quest Diagnostics Incorporated; F. Hoffmann-La Roche Ltd; Thermo Fisher Scientific Inc.; Siemens Healthcare AG; Laboratory Corporation of America Holdings; Alfa Scientific Designs, Inc.; OraSure Technologies, Inc.; Omega Laboratories, Inc.; Drägerwerk AG & Co. KGaA; Bio-Rad Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drug Screening Market Report Segmentation

This report forecasts revenue growth at global, regional and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global drug screening market report based on product type, sample type, end use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Immunoassays Analyzers

-

Chromatography Instruments

-

Breath Analyzer

-

Fuel Cell Breath Analyzer

-

Semi-Conductor Breath Analyzer

-

Others Breath Analyzer

-

-

-

Rapid Testing Devices

-

Urine Testing Devices

-

Drug Testing Cups

-

Dip Cards

-

Drug Testing Cassettes

-

-

Oral Fluid Testing Devices

-

-

Consumables

-

Assay Kits

-

Sample Collection Devices

-

Calibrators & Controls

-

Other Consumables

-

-

Services & Others

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Urine Samples

-

Breath Samples

-

Oral Fluid Samples

-

Hair Samples

-

Other Samples

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Criminal Justice & Law Enforcement Agencies

-

Workplaces

-

Drug Treatment Centers

-

Individual Users

-

Pain Management Centers

-

Schools & Colleges

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.