- Home

- »

- Medical Devices

- »

-

Drug Delivery Devices Market Size, Industry Report, 2033GVR Report cover

![Drug Delivery Devices Market Size, Share & Trends Report]()

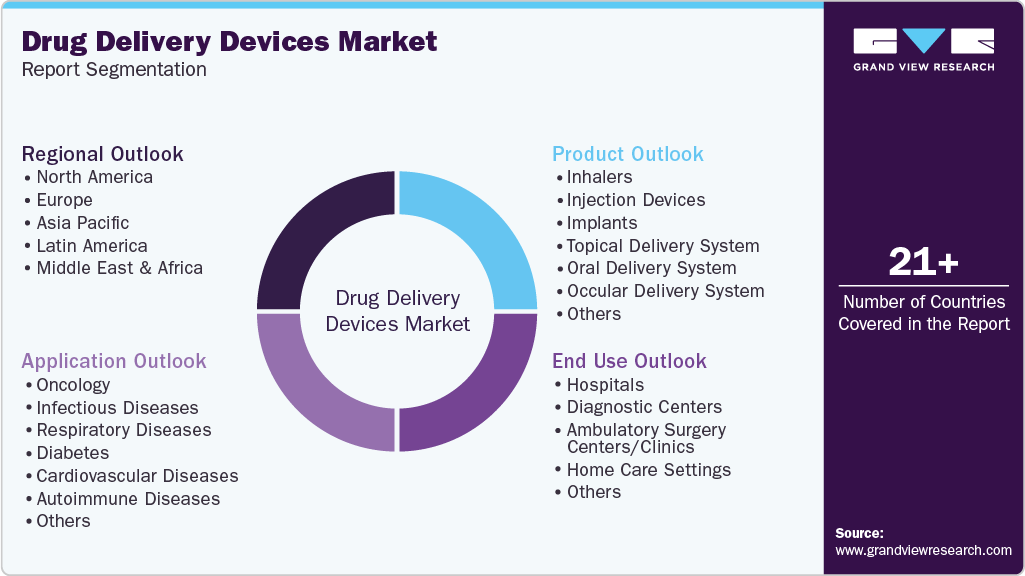

Drug Delivery Devices Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Inhalers, Injection Devices, Transdermal Patches), By Application (Oncology, Infectious Diseases, Respiratory Diseases, Diabetes), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-435-2

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Drug Delivery Devices Market Summary

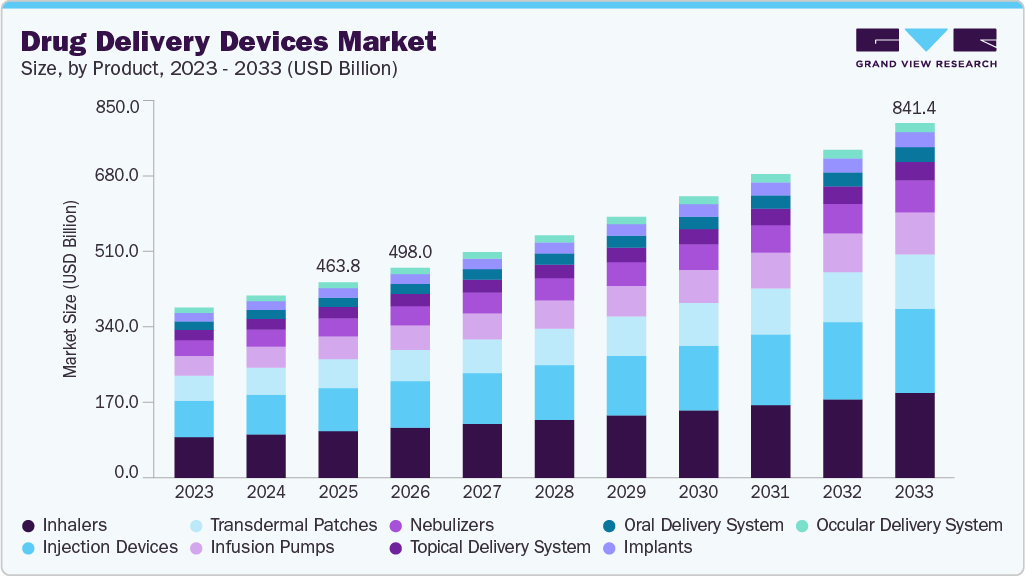

The global drug delivery devices market size was valued at USD 463.8 billion in 2025 and is projected to reach USD 841.4 billion by 2033, growing at a CAGR of 7.8% from 2026 to 2033. The growing adoption of advanced technology for precise drug delivery is driving market expansion.

Key Market Trends & Insights

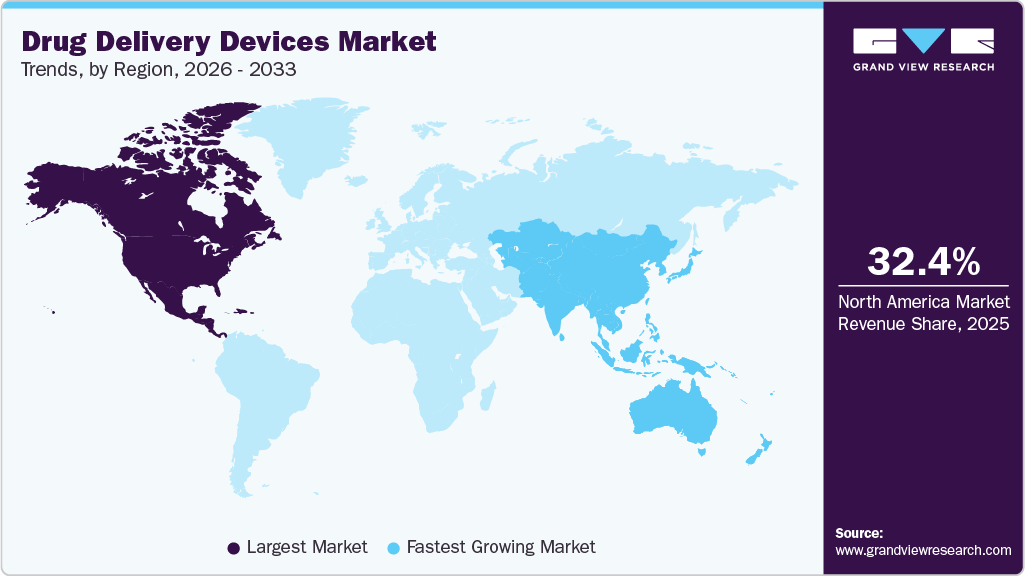

- North America’s drug delivery devices market held the largest share of 32.4% of the global market in 2025.

- The U.S. drug delivery devices industry is expected to grow significantly over the forecast period.

- By product, the inhalers segment held the highest market share of 23.9% in 2025.

- By application, diabetes accounted for the leading market share in 2025.

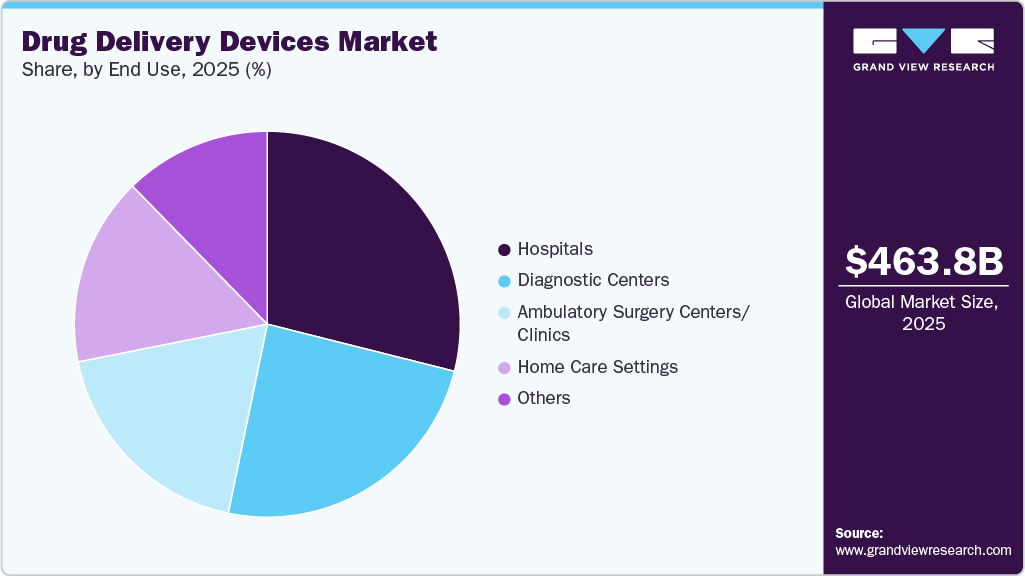

- By end use, the hospital segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 463.8 Billion

- 2033 Projected Market Size: USD 841.4 Billion

- CAGR (2026-2033): 7.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

In June 2024, Aptar Digital Health and SHL Medical partnered to enhance injectable therapy experiences by integrating Aptar’s SaMD platform with SHL’s connected drug delivery solutions, including the Molly Connected Cap. This collaboration aims to improve self-injection therapy through digital health innovations. These devices optimize the connected drug delivery devices market, minimizing dosage and side effects, which lowers costs by reducing active pharmaceutical ingredient use. The novel drug delivery devices market is also anticipated to witness accelerated R&D efforts owing to rising demand.

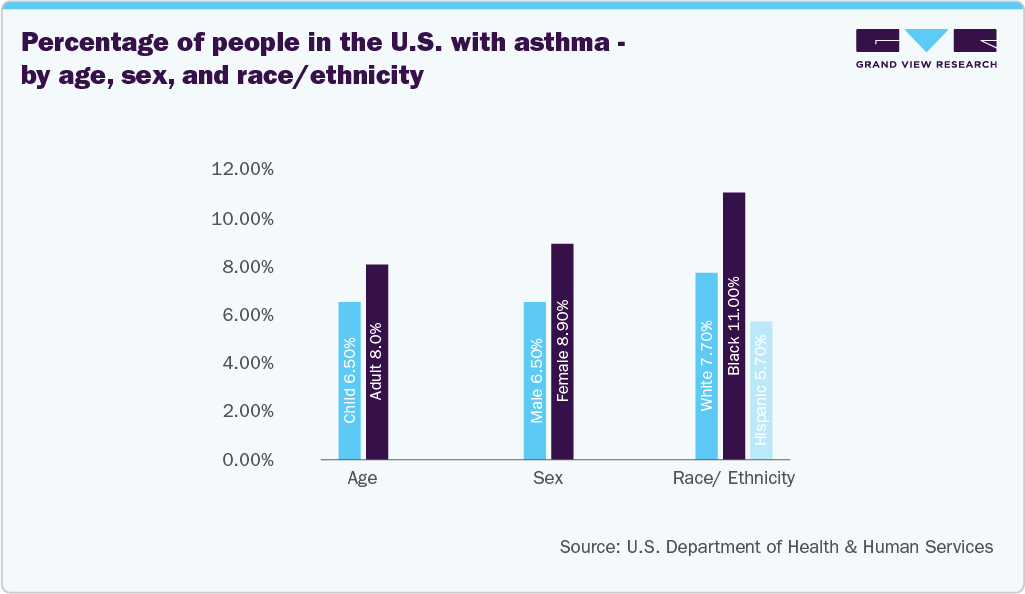

Drug delivery devices are used for conditions such as asthma, chronic obstructive pulmonary disease (COPD), diabetes, cancer, cardiovascular diseases, and chronic pain. These devices ensure precise, targeted delivery of medications, improving efficacy and patient compliance while minimizing side effects. According to the Asthma and Allergy Foundation of America, Asthma affects over 27 million people in the U.S., roughly 1 in 12 individuals. Among adults aged 18 and older, over 22 million have asthma, with a higher prevalence in females (10.8%) compared to males (6.5%). Asthma ranks among the most common and expensive diseases in the U.S. For instance, according to National Asthma Council Australia Ltd, the Salflumix Easyhaler, added to the Pharmaceutical Benefits Scheme (PBS) on April 1, 2024, treats asthma and COPD with fluticasone propionate/salmeterol in two strengths: 250/50 and 500/50. It is a dry powder inhaler that requires shaking before use and has a dose counter. The Easyhaler is suitable for various ages and disease severities. In addition, it is entirely carbon neutral.

The rising elderly population has heightened the need for subcutaneous devices for diagnosing and treating various chronic health conditions. Studies indicate that individuals aged 65 and older face increased risks of serious ailments such as heart disease, asthma, respiratory infections, COPD, diabetes, and other disorders, as aging weakens the immune system, thus driving the subcutaneous drug delivery devices market.

In January 2024, researchers at Sahmyook University developed a light-responsive nanofiber-based drug delivery system for skin cancer. This system, incorporating camptothecin and doxorubicin within polyionic coatings and gold nanorods, enables precise, sequential drug release under near-infrared light, enhancing treatment accuracy. Professor Myoung-Hwan Park from Sahmyook University supports this approach, emphasizing that nano-engineered platforms enable controlled drug delivery, optimizing cancer therapy outcomes. He highlights the potential of nanoplatforms for real-world applications, including topical treatments for psoriasis, skin wounds, and infections. Moreover, Professor Park further commented that,

"Conventional drugs can be efficiently delivered in a controlled manner through nano-engineered platforms, and such an approach increases the overall effectiveness of the treatment. This approach improves outcomes in cancer drug therapy by ensuring precise delivery at optimal dosages. Our nanoplatform shows significant potential for real-life practical applications in the form of topical drug products for various skin disorders, such as psoriasis, skin cancer, skin wounds, bacterial and fungal infections. Accordingly, the integration of nanofibers with on-demand drug delivery systems can open up new possibilities for drug therapy."

The rising elderly population has heightened the need for drug delivery devices for diagnosing and treating various chronic health conditions. Studies indicate that individuals aged 65 and older face increased risks of serious ailments such as heart disease, asthma, respiratory infections, COPD, diabetes, and other disorders, as aging weakens the immune system. Consequently, the growing elderly demographic and its burden of chronic illnesses are driving hospitalization rates. According to American Heart Association data published in June 2024, researchers predict that by 2050, the prevalence of cardiovascular disease will rise to 15% of the population, up from 11.3% in 2020, excluding individuals with high blood pressure. This includes a projected doubling of stroke rates. The expressions that support our drug delivery systems market assumption are,

"The last decade has seen a surge of cardiovascular risk factors such as uncontrolled high blood pressure, diabetes and obesity, each of which raises the risks of developing heart disease and stroke, it is not surprising that an enormous increase in cardiovascular risk factors and diseases will produce a substantial economic burden. The last of the Baby Boomers will hit 65 in 2030, so about 1 in 5 people in the U.S. will be over 65, outnumbering children for the first time in U.S. history. Since cardiovascular risk increases with age, the aging population increases the total burden of cardiovascular disease in the country. By 2060, more than two-thirds of children will belong to underserved, disenfranchised populations, which traditionally have higher rates of cardiovascular disease and risk factors,"

- Dr. Dhruv S. Kazi, Vice Chair of The Advisory Writing Group

The increased use of drug delivery devices has reduced dosage errors and minimized needlestick injuries. Devices with simple drug administration protocols enhance treatment adherence. According to the Annals of Internal Medicine, about half of patients prescribed chronic medications stop taking them within the first year, leading to significant healthcare consequences: 125,000 deaths, 10% of hospitalizations, and annual costs of USD 17 billion in the U.S. Therefore, pain-free drug delivery devices can effectively manage numerous chronic medical conditions.

Technological advancements in drug delivery devices are revolutionizing the market by enhancing precision, efficacy, and patient convenience. Innovations such as smart drug delivery systems, including wearable devices and implantable pumps, allow real-time medication monitoring and controlled release. Nanotechnology-based delivery, like nanoparticles and nanofibers, enables targeted therapy, minimizing side effects and improving therapeutic outcomes. For instance, in January 2024, in collaboration with West Pharmaceutical Services and PA Consulting, Tyndall National Institute announced a smart wearable microneedle device for at-home drug delivery. This innovative device painlessly administers medication and features sensors for precise dose control, a micropump, and smartphone connectivity. It aims to enhance patient self-management, reduce healthcare costs, and promote sustainability with reusable & disposable components. This breakthrough is expected to transform treatment for chronic conditions, making at-home care more efficient and user friendly.

Some Expressions That Support Our Study Are Mentioned Below:

“There is now a clear healthcare drive globally to move from hospital to the home to improve the overall patient experience and help reduce healthcare costs. Being a leader in the field of at-home self-injection technologies, West is investing significantly in R&D. This highly collaborative initiative with Tyndall and PA has the potential to have a huge societal impact, empowering patients to take their medication at home via microneedles in a more efficient, painless and safe manner. This project is at the forefront of a movement towards more sustainable at home drug delivery options, which may become the norm as the industry looks to find more sustainable ways to treat patients worldwide”

- Project Leader and Senior Manager of Research and Technology at West, Dr Alex Lyness

“Utilizing our world-leading research expertise in information and communications technology, we have worked with West and PA to harness the innovative applications of microneedles to create a prototype drug delivery device that has the potential to transform at-home patient care in an unprecedented way.”

- Dr Conor O'Mahony, Principal Researcher at the Tyndall National Institute

“The sustainable aspect to this device concept is something we haven’t seen in this field up to this point, with its pioneering design culminating in a prototype that effortlessly fits into a patient’s daily routines, enhancing user engagement, and ensuring adherence. We believe this is the future of wearable drug delivery systems.”

- Medical Design Director and PA lead on the project, Eugene Canava

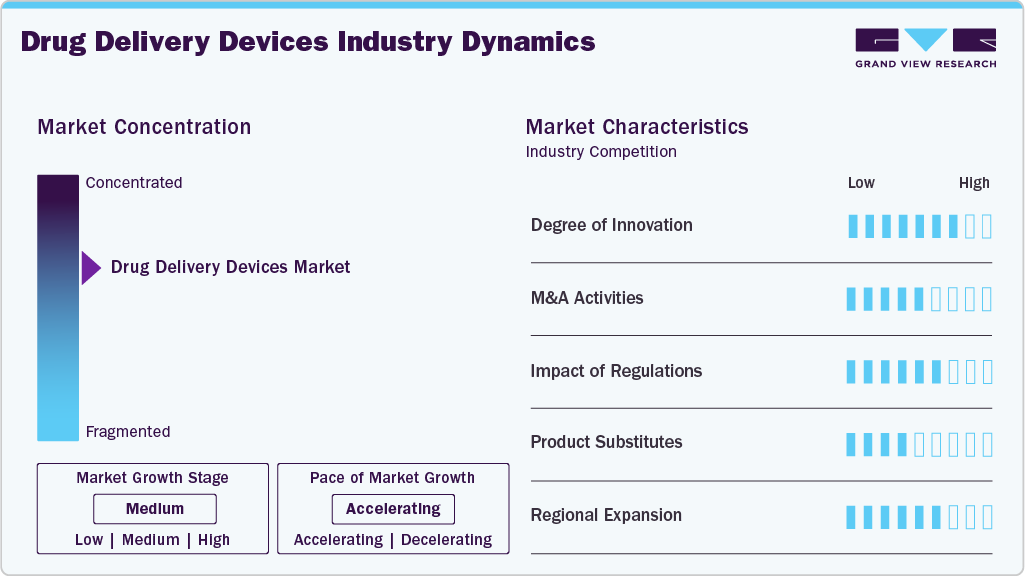

Market Concentration & Characteristics

The industry is moderately to highly concentrated, with key players like Pfizer, Inc., BD, Johnson & Johnson and Novartis AG holding significant market shares. These companies dominate through technological advancements, extensive R&D, and strategic mergers. High entry barriers due to regulatory requirements and capital investment needs further consolidate the market.

The industry is highly innovative, driven by technological advancements and growing demand for patient-focused solutions. Notable developments include the Serum Institute of India's (SII) May 2024 investment in IntegriMedical to enhance Needle-Free Injection System (N-FIS) technology. Additionally, as of October 2024, PharmaJet continues advancing needle-free injection systems, addressing concerns over needlestick injuries, cross-contamination, and cost inefficiencies. Regarding this, Adar Poonawalla, CEO of Serum Institute of India, stated,

"At SII, we continuously explore investments in technologies that support our mission of making healthcare accessible and affordable globally. IntegriMedical's Needle-Free Injection Systems (N-FIS) mark a major breakthrough in drug delivery, offering a needle-free approach for vaccines. We see this innovation transforming vaccine administration, enhancing comfort for both patients and healthcare providers.

Regulations play a crucial role in the industry, ensuring safety, efficacy, and compliance. Agencies like the FDA, EMA, and ISO impose stringent requirements on product development, clinical trials, and manufacturing. Strict approval processes can delay market entry but enhance product reliability. Evolving guidelines, such as those for combination products and digital health integration, push companies to innovate while maintaining compliance. Regulatory hurdles also increase costs, impacting small manufacturers. However, standardized regulations improve patient safety and market trust. Adherence to compliance frameworks drives quality, shaping industry growth and fostering advancements in drug delivery technology.

The industry is witnessing a rise in mergers and acquisitions, driven by the increasing need for research and development, reflecting its evolving landscape. In September 2024, Phillips Medisize, a subsidiary of Molex, announced plans to acquire Vectura from Philip Morris. Vectura, known for its inhaled drug delivery devices and formulations, was purchased by Philip Morris in 2021 for USD 1.2 billion as part of its “Beyond Nicotine” initiative. This acquisition is expected to strengthen Phillips Medisize’s capabilities in inhalation drug delivery solutions.

The industry faces competition from alternative delivery methods, acting as product substitutes. Traditional oral medications, transdermal patches, and needle-free injection systems offer non-invasive options, reducing reliance on syringes and infusion pumps. Emerging technologies like smart pills, microneedle patches, and implantable drug delivery systems further challenge conventional devices. Biopharmaceutical advancements, including cell and gene therapies, also introduce novel drug administration approaches. While substitutes enhance patient compliance and reduce side effects, regulatory approvals and cost considerations impact adoption. The industry continues innovating to improve efficacy, ensuring drug delivery devices remain competitive amid evolving treatment alternatives.

Regional expansion in the drug delivery devices industry involves strategic initiatives by companies to penetrate new geographic markets beyond their existing presence. This expansion is driven by opportunities in emerging economies with increasing healthcare infrastructure and rising chronic disease burden. Companies focus on adapting products to local regulatory requirements, healthcare practices, and patient needs. For instance, in April 2023, Ypsomed announced it to build a new production facility in the Changzhou National Hi-tech District, China, with an investment of over USD 38.97 million. Set to begin operations in the second half of 2024, the plant will manufacture injection systems to meet the growing demand in the Chinese market. This expansion aims to shorten supply chains and reduce carbon footprint by producing locally.

Product Insights

The inhalers segment led the market with a 23.9% share in 2025, driven by the demand for asthma treatment. However, conventional metered-dose inhalers contribute significantly to greenhouse gas emissions. For instance, in May 2024, Dr. Miguel Divo of Brigham and Women's Hospital highlights dry powder inhalers as an eco-friendly alternative. These inhalers, which do not emit hydrofluorocarbon gases, offer the same efficacy while reducing environmental impact. With 144 million inhalers prescribed annually in the U.S., switching to sustainable options could significantly lower emissions, equating to removing 500,000 gas-powered cars from the road each year.

The injectable segment is expected to expand at the fastest CAGR over the forecast period. Many companies are advancing in this area, such as ApiJect Systems Corp, which announced in October 2024 a USD 425,000 initial grant from the Bill & Melinda Gates Foundation. This funding will support the development of cost-effective Prefilled ApiJect Injectors for injectable medicines and vaccines, focusing on expanding access to safe, single-use prefilled syringes in low- and middle-income countries (LMICs).

The need to provide advanced solutions to curb the impact of non-communicable diseases is driving technological innovations in the implantable drug delivery devices market. According to a World Health Organization (WHO) report published in September 2023, chronic diseases account for 74% of global deaths. These include cardiovascular diseases, cancer, and diabetes.

Application Insights

The diabetes segment dominated the market in 2025 with a 21.0% share. According to the Institute for Health Metrics and Evaluation, over 500 million people had diabetes as of June 2023, affecting all demographics. Diabetes, ranked among the top 10 causes of death and disability, has a global prevalence of 6.1%, with North Africa and the Middle East leading at 9.3%, projected to rise to 16.8% by 2050. In Latin America and the Caribbean, prevalence is expected to reach 11.3%.

French researchers have developed a novel drug delivery system that may reduce the dosing frequency of semaglutide for type 2 diabetes and weight control to once a month. This innovation is presented at The European Association for the Study of Diabetes (EASD) annual meeting in Madrid (September 2024).

"Glucagon-like peptide-1 agonist (GLP-1) drugs have transformed type 2 diabetes care, but weekly injections can be burdensome. A monthly injection could enhance adherence, improve quality of life, and reduce side effects," said Dr. Claire Mégret, ADOCIA, Lyon, France.

The new hydrogel platform enables sustained drug release over 1 to 3 months, ensuring controlled semaglutide delivery, preventing early bursts and toxicity, thereby driving market growth.

The Central Nervous System (CNS) disorders segment is estimated to grow at a CAGR of 8.3% over the forecast period. The growing incidence of neurological disorders such as Parkinson’s disorder, Alzheimer’s disease, Hunter’s syndrome, and brain tumors is expected to boost the segment growth over the forecast period. Therefore, to enhance the treatment of these neurological disorders, new devices are being developed for the CNS based on rational drug design and using receptor-ligand interaction for understanding the appropriateness of drug delivery at the site.

End Use Insights

The hospitals segment held the largest market share in 2025 with a share of 28.9%, driven by the rising demand for surgical interventions and preventive procedures. With increasing outpatient visits-approximately 125.7 million according to the CDC-hospitals are central to providing care that requires specialized drug delivery during surgeries and treatments. This surge is largely due to the growing number of surgeries, such as angioplasties, organ transplants, and trauma-related operations, all of which require precise and controlled drug administration.

Diagnostic centers also held a significant share in the market in 2025. Various diagnostic centers are focusing on developing and adopting novel delivery devices for delivering drugs accurately. The Center for Drug Delivery and Nanomedicine (CDDN) is focusing on capturing existing expert knowledge, both scientifically and technically, in biomedical science research and material for creating nanomedicine programs and interdisciplinary delivery. Moreover, the main mission of the center is to understand the efficiency and safety of various drugs and to develop innovative methods.

Regional Insights

North America drug delivery devices market dominated the overall global market and accounted for a 32.4% revenue share in 2025. This is due to a well-established healthcare sector, dedication to innovation, advanced infrastructure, strong R&D focus, and high prevalence of chronic conditions like diabetes, autoimmune disorders, and cardiovascular diseases. The American Diabetes Association reported that 38.4 million Americans (11.6% of the population) had diabetes, underscoring the need for accessible and effective management tools, including drug delivery devices.

U.S. Drug Delivery Devices Market Trends

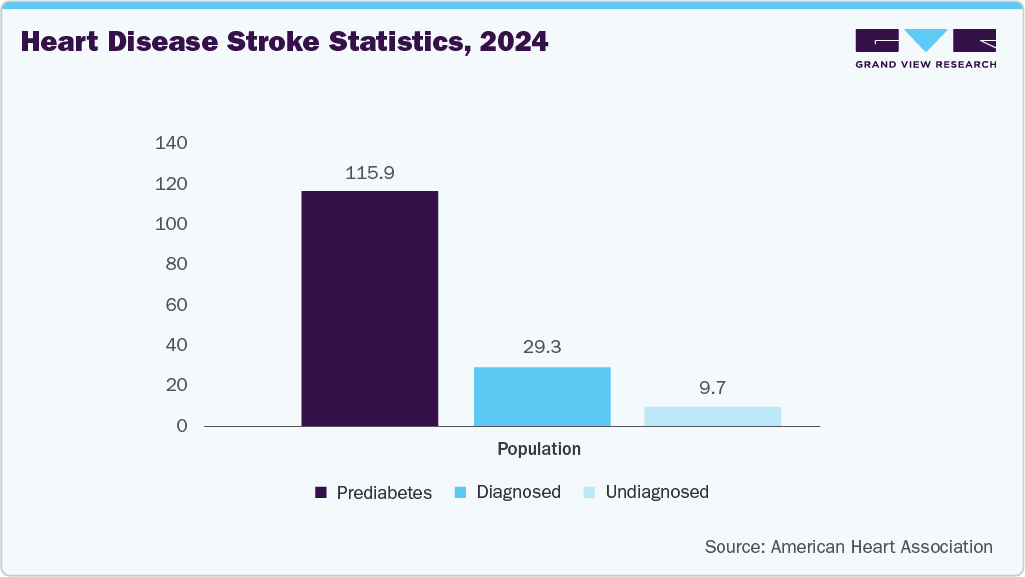

The drug delivery devices market in the U.S. held a significant share of North America's drug delivery devices market in 2025. The U.S. drug delivery devices market is heavily impacted by the high prevalence of diabetes and prediabetes, with approximately 136 million adults affected as of November 2023, according to the CDC. Leading companies in this market, such as Insulet Corporation, Enable Injections, Amgen, BD, Consort Medical Plc, Ypsomed AG, Eli Lilly, Novo Nordisk, Sanofi, Merck, and AstraZeneca, are actively developing and marketing innovative drug delivery devices to meet the increasing demand driven by chronic diseases, particularly diabetes.

Europe Drug Delivery Devices Market Trends

The drug delivery devices market in Europe is witnessing dynamic growth, supported by technological innovations and increasing healthcare needs. In 2025, Europe held the second-largest revenue share in the global drug delivery devices market. Major markets include the UK, France, Germany, Italy, and Spain. This growth is driven by the rising prevalence of chronic diseases like diabetes, which necessitate regular medication.

In January 2025, research ahead of Pharmapack Europe ranked Basel as Europe’s top location for launching drug device companies, securing 33% of votes. “We play a vital role in propagating drug delivery innovation,” said Sherma Ellis-Daal, Pharmapack Europe’s brand director.

Switzerland and Germany were also top choices for biomanufacturing, with Basel excelling in research infrastructure. “Smaller companies will lead the next med-tech innovation,” noted Stèfan Halbherr, CEO of InnoMedica.

The UK drug delivery devices market is experiencing notable growth, driven by the presence of an established healthcare system, a significant number of healthcare professionals. Furthermore, the presence of well-trained & skilled surgeons, technological advancements, favorable government initiatives, rising healthcare expenditure, and high adoption of minimally invasive surgeries are expected to contribute to market growth.

The drug delivery devices market in France is anticipated to grow significantly during the forecast period due to increasing infectious disease prevalence, rapid technological advancements, and rising consumer awareness. The geriatric population's growth rate was 1.8%, nearly four times the population growth. This growing and aging population, along with lifestyle and environmental changes, is expected to drive the prevalence of chronic diseases such as cancer, cardiovascular ailments, diabetes, hypertension, and respiratory conditions, thereby increasing the demand for drug delivery devices.

Germanydrug delivery devices market is experiencing notable growth as the German manufacturers have established a strong reputation for producing high-quality medical devices. The country’s rigorous quality control standards and adherence to safety regulations further enhance this reputation. As a result, healthcare providers trust German-made medical devices leading to increased sales and market dominance.

Asia Pacific Drug Delivery Devices Market Trends

The drug delivery devices marketAsia Pacificis growing rapidly due to rising disposable incomes, improving healthcare infrastructure, and strong economic growth in emerging economies like Japan, China, and India. The large population with low per capita income has driven high demand for affordable treatments. Multinational companies are investing in developing economies, such as India and China, to strengthen their market presence. Consequently, numerous collaborative partnerships and strategic alliances among key companies in the region are expected to create lucrative growth opportunities.

Japandrug delivery devices market is set for rapid growth due to the substantial elderly population with chronic health conditions, increasing the demand for efficient, patient-friendly drug delivery methods. According to the World Economic Forum, over 1 in 10 people in Japan were aged 80 and above in 2023. This demographic shift boosts the prevalence of chronic diseases like COPD and heart failure due to high comorbidities. Consequently, the adoption of drug delivery devices is rising, supported by Japan's healthcare system, which prioritizes technological advancements and patient-centric care.

The drug delivery devices market in China is expected to experience significant growth over the forecast period due to the unmet needs of its growing population. Furthermore, supportive regulatory policies and reimbursement frameworks are expected to enhance the adoption of advanced drug delivery devices. For instance, in July 2024, Zai Lab Limited and argenx announced that China’s National Medical Products Administration approved the Biologics License Application for efgartigimod alfa (subcutaneous injection) (efgartigimod SC), 1,000 mg (5.6 ml)/vial. The injection is approved as an add-on to standard therapy for treating adult patients with generalized myasthenia gravis who are anti-acetylcholine receptor antibody positive.

India drug delivery devices market is propelled by favorable medical device regulations and higher healthcare spending. The establishment of new corporate hospitals, structured training initiatives, and awareness campaigns on drug delivery devices are anticipated to drive market expansion. As one of the top three countries for diabetes prevalence, India faces a significant health challenge. According to a 2023 study by the Indian Council of Medical Research - India Diabetes (ICMR INDIAB), approximately 101 million individuals in India are living with diabetes. As a result, the demand for drug delivery devices is expected to increase significantly during the forecast period.

Latin America Drug Delivery Devices Trends

The drug delivery devices market in Latin Americais fueled by the growing elderly demographic. Aging brings about heightened vulnerability to numerous chronic ailments, prompting the need for drug delivery devices as a treatment option. This, coupled with the demand for medications, is propelling market growth in the region.

Middle East & Africa Drug Delivery Devices Market Trends

Thedrug delivery devices market in the Middle East & Africais anticipated to expand during the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this region. For instance, as per the Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Drug Delivery Devices Companies Insights

Key players operating in the drug delivery devices market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Drug Delivery Devices Companies:

The following are the leading companies in the drug delivery devices market. These companies collectively hold the largest market share and dictate industry trends.

- Gerresheimer AG

- W. L. Gore & Associates, Inc.

- Abbott

- Terumo Medical Corporation

- Stryker

- Medtronic

- Boston Scientific Corporation

- Novartis AG

- Becton, Dickinson and Company

- Teleflex Incorporated

Recent Developments

-

In January 2025, Phillips Medisize, a Molex company, completed the acquisition of Vectura Group Ltd., enhancing its inhalation drug delivery capabilities. This strategic move adds expertise in dry powder inhalers, metered dose inhalers, nasal inhalers, and nebulizers, broadening Phillips Medisize's portfolio in pharmaceutical device design and manufacturing.

-

In January 2025, Nipro and Nemera announced the successful compatibility testing of Nemera's UniSpray device with Nipro's unit-dose microvials. This collaboration aims to enhance nasal drug delivery by combining Nipro's precision glass vials with Nemera's intuitive nasal spray device, offering a reliable solution for single-dose nasal medication administration.

Drug Delivery Devices Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 498.0 billion

Revenue forecast in 2033

USD 841.4 billion

Growth rate

CAGR of 7.8% from 2026 to 2033

Actual Data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Gerresheimer AG; W. L. Gore & Associates, Inc.; Abbott; Terumo Medical Corporation; Stryker; Medtronic; Boston Scientific Corporation; Novartis AG; Becton, Dickinson and Company; Teleflex Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drug Delivery Devices Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global drug delivery devices market report on the basis of product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Inhalers

-

Metered-dose inhalers (MDIs)

-

Dry powder inhalers (DPIs)

-

Others

-

-

Injection Devices

-

Prefilled Syringes

-

Auto-injectors

-

Pen injectors

-

Needle-free injectors

-

Wearable injectors

-

-

Implants

-

Contraceptive implants

-

Drug-eluting stents

-

Biodegradable implants

-

-

Topical Delivery System

-

Creams

-

Gels

-

Ointments

-

-

Oral Delivery System

-

Controlled-release tablets and capsules

-

Buccal and sublingual tablets

-

-

Occular Delivery System

-

Nebulizers

-

Transdermal Patches

-

Infusion Pumps

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Infectious Diseases

-

Respiratory Diseases

-

Diabetes

-

Cardiovascular Diseases

-

Autoimmune Diseases

-

Central Nervous System Disorders

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Diagnostic Centers

-

Ambulatory Surgery Centers/Clinics

-

Home Care Settings

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global drug delivery devices market size was estimated at USD 463.8 billion in 2025 and is expected to reach USD 498.0 billion in 2026.

b. The global drug delivery devices market is expected to grow at a compound annual growth rate of 7.8% from 2026 to 2033 to reach USD 841.4 billion by 2033.

b. North America dominated the drug delivery devices market with a share of 32.4% in 2025. This is attributable to the presence of major market players in the region and the growing trend towards targeted drug delivery systems.

b. Some key players operating in the drug delivery devices market include Pfizer, Inc, Johnson & Johnson Services, Inc., F. Hoffmann-La Roche, Ltd, Novartis AG, BD, Bayer AG, uniQure N.V., Sibiono GeneTech Co. Ltd., Shanghai Sunway Biotech Co., Ltd, and Human Stem Cells Institute.

b. Key factors that are driving the market growth include the increasing prevalence of chronic disorders, growing importance to develop a patient complaint drug delivery system, and the increasing R&D expenditure related to drug delivery device by pharma companies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.