- Home

- »

- Homecare & Decor

- »

-

Drinkware Market Size And Share, Industry Report, 2030GVR Report cover

![Drinkware Market Size, Share & Trends Report]()

Drinkware Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Glasses, Cups, Mugs), By Material (Glass, Silicone, Plastic), By Distribution Channel (Supermarkets, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-223-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2020 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Drinkware Market Size & Trends

The global drinkware market size was valued at USD 34.7 billion in 2023 and is expected to register a CAGR of 4.1% from 2024 to 2030. Growing hospitality, food service industry and increasing number of beverage consumers are driving the market. Drinkware manufacturing companies are introducing ecofriendly and innovative designer products, fostering market growth further. These products are available according to the different types of beverages and purposes. The increasing awareness about the harmful effects of plastic drinkware on health and on environment is also powering the market of recyclable products. Manufacturers are introducing durable and safe material based products, eventually driving the growth of market.

The rapid increase in the number of hotels and coffee shops worldwide, driven by the expansion of chains such as Starbucks and Café Coffee Day (CCD), is significantly propelling the growth of the drinkware market. This proliferation of hospitality venues has led to a heightened demand for a variety of drinkware products, including cups, mugs, tumblers, and glassware, to cater to the diverse needs of their customers. As these establishments strive to enhance the customer experience and brand identity, they are investing in high-quality, aesthetically appealing, and durable drinkware. The increasing consumer preference for on-the-go beverages and the expanding culture of coffee and tea consumption in urban areas underscore the importance of drinkware in the hospitality sector.

Starbucks, one of the world's leading coffeehouse chains, demonstrated substantial growth in its global presence, with the total number of stores increasing from 33,833 to 38,027 in 2023. This significant expansion reflects the company's strategic efforts to enhance its market footprint and cater to the growing demand for high-quality coffee and related beverages. Particularly in Asia Pacific region, with increased income range, people are spending more money on hoteling, ultimately, increasing the demand of drinkware products considerably.

Product Insights

The glasses segment shared the highest revenue of 31.3% of the global market in 2023. This is attributed to the vast applications and types of glasses that are used to consume a wide variety of beverages across the globe. The increasing global consumption of a variety of beverages, including wine, beer, spirits, and non-alcoholic drinks, has significantly driven the demand for glasses. As consumers seek to enhance their drinking experiences, the need for specialized and high-quality glassware has risen. According to Nawon, beer, wine, whisky, soft drinks and juices are the most consumed beverages in the world and glasses are the most suitable containers to serve and consume these drinks.

Tumblers segment is expected to grow at fastest CAGR of 6.3% over the forecast period. The increasing trend of consuming beverages on the go has significantly boosted the demand for tumblers, driven by modern lifestyles that prioritize convenience and mobility. As individuals balance busy work schedules, commuting, and various activities, the need for portable and reliable drinkware has become paramount. Tumblers, designed to keep beverages at the desired temperature for extended periods, cater perfectly to this demand. Their spill-proof designs, durability, and ability to maintain the freshness of both hot and cold drinks make them an essential accessory for people on the move.

Materials Insights

The plastic material segment captured the largest market share of 37.5% in terms of revenue in the year 2023. Plastic drinkware is generally more affordable than glass, stainless steel, or ceramic, making it a cost-effective option accessible to a wider range of consumers, including those in price-sensitive markets. Its affordability is coupled by its high durability and shatter-resistance, distinguishing it from glass drinkware, which is prone to breaking. This makes plastic drinkware a preferred choice for households with children, outdoor activities, and casual dining establishments where safety and longevity are paramount considerations, driving the growth of segment.

The metal segment is expected to register a substantial growth rate with a CAGR of 4.3% over the forecast period. The global movement towards environmental sustainability has significantly boosted the demand for reusable drinkware. Metal drinkware, being recyclable and often made from recycled materials, aligns well with eco-conscious consumer preferences and efforts to reduce plastic waste.

Distribution Channel Insights

The supermarket segment held the highest market share of 39.4% in terms of revenue in the year 2023. Customers purchase consumer goods such as drinkware from supermarkets for the virtue of availability, discounted rates, quality of products and number of options to choose. Particularly aged customers, prefer to visit the store and check the products for better understanding,

The online and e-commerce segment is forecasted to grow at a highest CAGR of 4.8% from 2024 to 2030. Increasing number of e-commerce sites and applications, particularly urban working population is preferring to purchase from online mode. Multiple brands and drinkware products including local products are available with doorstep delivery options within a reasonable time on these sites, attracting a sizable customer base. Customers receive these products in proper packaging to avoid any damage to the products and online portals have the easy return options as well, making this option one of the most preferred. According to Enterprisetoday, in the year 2023, 80% of the shoppers intend to purchase online instead of in-store options.

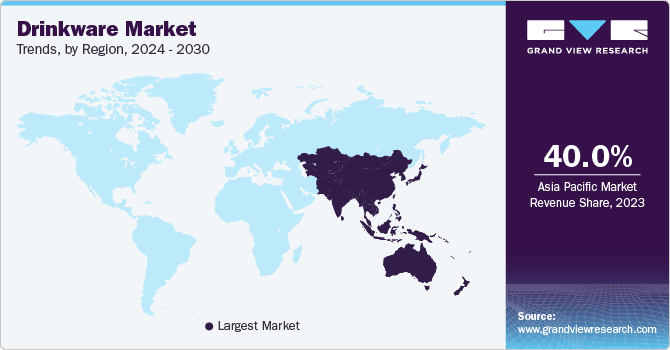

Regional Insights

The Asia Pacific region held the highest market share of 40.0% in terms of revenue in the year 2023. Traditional and cultural shifts in beverage consumption patterns are influencing the drinkware market. The increasing popularity of tea, coffee, and other beverages in the Asia Pacific region is driving demand for specialized drinkware products. Innovations in drinkware design and materials are enhancing product appeal. Features such as improved insulation, spill-proof designs, and ergonomic shapes make modern drinkware more functional and attractive to consumers is fostering regional market growth. The number of hotels, bars and restaurants is growing significantly as well. The developing culture of consuming beverages according to seasons has also impacted the drinkware market considerably.

In China, tea is the most consumed beverage across all the age groups and is part of the culture as well. Rapid urbanization in China has led to significant lifestyle changes, with a growing middle class that prioritizes convenience and quality in everyday products. This shift has increased demand for a variety of drinkware options suitable for busy urban lifestyles.

North America Drinkware Market Trends

North America held the highest revenue share of 27.6% in 2023 and is expected to grow at CAGR of 4.2% from 2024 to 2030. Popularity of alcoholic beverages and coffee is driving the growth of market in North American region. The growth of coffee shops and beverage chains, such as Starbucks and Tim Hortons, has increased the demand for branded and high-quality drinkware. These establishments often promote reusable cups and tumblers as part of their sustainability initiatives, encouraging customers to adopt environmentally friendly habits. A survey conducted by Gallup in December 2022 indicated, the number of adults in U.S. who consume alcoholic beverages is 63% of total adult population. In addition, the 73% of U.S. population drinks coffee every day, shaping the market growth.

U.S. Drinkware Market Trends

The growing trend of drinking packaged water is significantly contributing to the regional growth of the drinkware market in the U.S. This trend is particularly prominent among the working population, tourists, and sports enthusiasts who prefer the convenience and perceived health benefits of bottled mineral water, demand for portable drinkware products such as reusable water bottles is increased. These consumers prioritize portability, durability, and ease of use in their drinkware, driving manufacturers to innovate and offer products that meet these needs. The preference for bottled water underscores the importance of having reliable and convenient drinkware, leading to increased market opportunities for high-quality bottles that can be used repeatedly. The emphasis on reducing single-use plastic waste aligns with the adoption of reusable drinkware, further propelling market growth. This convergence of lifestyle trends and environmental considerations highlights the dynamic factors driving the demand for portable drinkware in the U.S.

Europe Drinkware Market Trends

The flourishing tourism and hospitality sector in Europe is attracting many tourists, thereby increasing the need for different types of drinkware products in hotels, bars and pubs. According to ITB BERLIN, more than 700 million tourists visited Europe in 2023, which is 54.5% share of the total international tourists in the world. Moreover, manufacturing companies across the world are adopting latest business models to reach a larger customer base. Product modifications, innovations in manufacturing techniques are playing important role in the increase of Europe drinkware market.

Key Drinkware Company Insights

Key companies in drinkware market are Tupperware Brands Corporation, SIGG Switzerland AG, GmbH, CamelBak Products, LLC., Klean Kanteen, Contigo. Organizations are mainly focusing on research and development to provide ecofriendly products. Secondly, the large companies are looking to expand production capacities, distribution network and adopt innovation. There are many small companies operating locally in the market by product modifications.

-

Steelite International operates in design and manufacturing of tableware. Their product variety includes tumblers and barware, glasses for wine, pitchers. They offer products made of china, glass, metal and wood. Steelite International currently provides their products in more than 140 countries. Their main objective is to provide eco-friendly products by emphasizing recycling of waste material and reducing emission during the process.

-

AnHui DeLi Glassware is a China based company operating in production of household glassware backed by in house research and development as well. Company offers wide range of drinkware, including glass cups, mugs, tumblers, wine glasses, and teapots. AnHui DeLi provides customized solutions to meet specific client requirements, making it a preferred supplier for both retail and hospitality sectors.

Key Drinkware Companies:

The following are the leading companies in the drinkware market. These companies collectively hold the largest market share and dictate industry trends.

- Tupperware Brands Corporation

- SIGG Switzerland AG, GmbH

- CamelBak Products, LLC

- Klean Kanteen

- Contigo

- Aquasana Inc.

- Steelite International

- Ocean Glass

- Arc International

- AnHui DeLi Glassware

Recent Developments

-

In June 2024, Tupperware Brands Corporation announced their association with Macy’s stores in the U.S. All their products will be available to purchase in the stores and online on Macy.com as well. At selected stores, live demonstrations were conducted for customers for storing and preserving food.

-

In February 2023, RCR Crystalleria Italiana, a manufacturer of crystal glassware, launched its new product line, further strengthening its collaboration with Steelite International. This launch showcases RCR's commitment to combining Italian craftsmanship with innovative design, offering high-quality glassware that caters to diverse hospitality needs. The new collection aims to enhance the dining experience by providing elegant, durable, and eco-friendly options

Drinkware Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 36.1 billion

Revenue forecast in 2030

USD 45.9 billion

Growth Rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2020 - 2023

Forecast period

2024 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Latin America and MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, , India, Australia, South Korea, Brazil, and South Africa

Key companies profiled

Tupperware Brands Corporation, SIGG Switzerland AG, GmbH, CamelBak Products, LLC, Klean Kanteen, Contigo, Aquasana Inc., Steelite International, Ocean Glass, Arc International, AnHui DeLi Glassware

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drinkware Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global drinkware market report based on product, material, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2020 - 2030)

-

Glasses

-

Cups and Mugs

-

Water Bottles

-

Tumblers

-

Thermoses and Flasks

-

Others

-

-

Material Outlook (Revenue, USD Million, 2020 - 2030)

-

Glass

-

Silicone

-

Plastic

-

Metal

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2020 - 2030)

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Online/E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.