- Home

- »

- Biotechnology

- »

-

Downstream Processing Market Size, Industry Report, 2030GVR Report cover

![Downstream Processing Market Size, Share & Trends Report]()

Downstream Processing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Chromatography Systems, Filters), By Technique (Purification, Formulation), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-495-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Downstream Processing Market Summary

The global downstream processing market size valued at USD 41.81 billion in 2024 and projected to reach USD 94.79 billion by 2030, growing at a CAGR of 14.49% from 2025 to 2030. The downstream processing industry’s growth is primarily driven by the growing demand for biologics, including monoclonal antibodies, vaccines, and recombinant proteins, which require efficient purification and separation techniques.

Market Size & Trends:

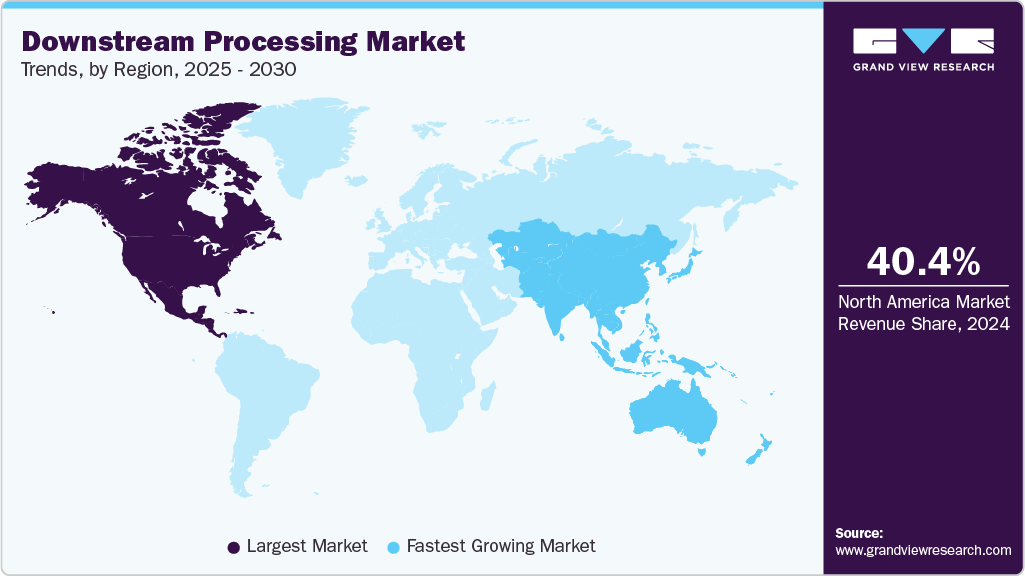

- North America dominated the downstream processing industry with the largest revenue share of 40.4% in 2024.

- The U.S. is the largest downstream processing industry for downstream processing.

- Based on products, the chromatography systems segment dominated the market for downstream processing and accounted for the largest revenue share of 41.43% in 2024.

- By technique, the purification by chromatography segment dominated the downstream processing market and accounted for the largest revenue share of 41.79% in 2024.

- Based on application, the antibiotic production segment dominated the market for downstream processing. It generated the largest revenue share of 29.84% in 2024.

Key Market Statistics:

- 2024 Market Size: USD 41.81 billion

- 2030 Projected Market Size: USD 94.79 billion

- CAGR (2025-2030): 14.49%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing Market

Advancements in single-use technologies and automation are streamlining workflows, reducing contamination risks, and improving scalability. Additionally, increased R&D investments in biopharmaceuticals, the rise of biosimilars, and expanding vaccine manufacturing capabilities globally are further fueling market growth. Regulatory support for high-purity biologics and the surge in cell and gene therapies are also contributing to the market’s upward trajectory.

Emerging technologies for the integration & intensification of downstream bioprocesses

The downstream processing market is witnessing a growing shift from traditional, segmented workflows toward integrated downstream processing (iDSP) solutions. While traditional DSP involves separate, often manual steps for cell separation, purification, and polishing, integrated DSP consolidates these processes into more streamlined, automated systems. This integration improves process efficiency, reduces footprint, lowers operational costs, and minimizes product loss, all critical in the context of rising biologics demand. The increasing focus on continuous manufacturing, coupled with the need to accelerate time-to-market for complex biologics such as monoclonal antibodies, cell and gene therapies, and biosimilars, is fueling the adoption of integrated DSP systems. For instance,

- In June 2022, Merck announced a collaboration with Agilent Technologies to address a significant industry gap in Process Analytical Technologies (PAT) for downstream processing (DSP) in biopharmaceutical manufacturing. This partnership aims to advance real-time monitoring and automated control of critical process parameters (CPPs) and critical quality attributes (CQAs) during downstream bioprocessing, which is essential for enabling real-time release and Bioprocessing 4.0. Additionally, regulatory encouragement for process intensification and growing investments in single-use technologies further support the transition toward integrated solutions.

Note: ATPS: Aqueous two-phase separation; DSP: Downstream processing; EBA: Expanded bed adsorption.

A rise in R&D activities pertaining to advanced bioprocess technologies has resulted in the adoption of continuous downstream processing systems for multicomponent separations, perfusion chromatography systems, high-throughput process development, and high-resolution membrane systems. This has led to an increase in the need for improving bioprocessing technologies for addressing the purification bottleneck.

-

In March 2024, at a BioProcess International exhibition, Noritake showcased its Column-Less Continuous Purification System, a groundbreaking technology designed to transform the clarification step in biopharmaceutical manufacturing. This innovative system offers a novel alternative to traditional clarification methods, significantly improving efficiency and reducing costs.

Moreover, a rise in the utilization of downstream processing techniques for the development of COVID-19 vaccines was a significant driving factor during the pandemic period. In March 2022, Rentschler Biopharma and Vetter released the launch of Xpert Alliance, a collaborative representation of their strategic relationship. The visualization was intended to "bring to life" this continuing collaboration and highlight its successful operation in offering effective solutions to customers' evolving and growing demands in the field of challenging biopharmaceuticals. Furthermore, in January 2021, Thermo Fisher Scientific announced that it supported 250 projects for COVID-19 therapy as well as vaccine production in 2020. The company leverages its CDMO capabilities as well as its bioprocess consumables and equipment offerings for these projects. It has also partnered with Singapore and the U.S. government to expand its vaccine and therapy development capacities. Similar efforts have been made by EMD Millipore, Cytiva, Pall Biotech, and other companies to use their bioprocess offerings for COVID-19 therapeutics development.

The number of CMOs in the market for downstream processing has increased as outsourcing helps pharmaceutical manufacturers reduce the high initial capital investment and procedure costs. CMOs help drug manufacturers in optimizing downstream purification, in addition to other processes such as cell culture preparation, chromatography, mixing, concentration, process monitoring, and disposable technologies. For instance, in October 2022, FUJIFILM Diosynth Biotechnologies and RoosterBio announced a strategic collaboration aimed at advancing the GMP manufacturing of cell and exosome therapies. This partnership combines FUJIFILM Diosynth’s extensive manufacturing capabilities with RoosterBio’s expertise in cell therapy technologies.The collaboration includes downstream stages such as purification processes for exosomes derived from MSCs.

Market Concentration & Characteristics

The downstream processing industry is experiencing moderate to high innovation, driven by the growing complexity of biologics, cell and gene therapies, and mRNA products. Key innovations include single-use technologies, continuous processing systems, advanced chromatography resins, and process analytical technologies (PAT). Continuous and automated systems, in particular, show high disruption potential by improving efficiency and enabling real-time quality control. While regulatory and infrastructure constraints temper adoption, demand for scalable, cost-effective, and high-throughput purification solutions is accelerating innovation, especially for emerging modalities.

The need for technological integration and portfolio expansion among major bioprocessing players primarily drives the M&A activities in the downstream processing industry. Large companies are acquiring smaller firms with niche innovations in chromatography, filtration, single-use systems, and continuous processing to stay competitive and meet the evolving demands of biologics manufacturing. This consolidation trend is also fueled by the growth of contract development and manufacturing organizations, which seek to enhance their downstream capabilities through strategic acquisitions. For instance, in October 2020, Repligen Corporation, a leading provider of bioprocessing technologies and solutions, acquired ARTeSYN Biosolutions, which strengthened its position in the bioprocess systems. The acquisition of ARTeSYN adds advanced single-use downstream processing technologies to Repligen’s portfolio. This complements Repligen’s existing offerings in upstream and downstream bioprocessing, enabling the company to provide more integrated and flexible solutions to biopharmaceutical manufacturers.

Regulations have a significant impact on the downstream processing market, acting as both a driver and a constraint for innovation. Regulatory agencies like the FDA and EMA promote frameworks such as Quality by Design (QbD) and Process Analytical Technology (PAT), encouraging manufacturers to adopt more robust, consistent, and real-time quality control methods. This pushes the industry toward automation and continuous processing. However, stringent validation and compliance requirements can slow the adoption of novel technologies, especially in GMP environments. Overall, regulations are shaping the market toward higher quality and efficiency, while also increasing complexity and cost in implementation.

Product expansion in the downstream processing industry is accelerating as companies diversify their offerings to meet the evolving needs of complex biologics, including monoclonal antibodies, cell and gene therapies, and mRNA-based products. Firms are expanding portfolios with advanced chromatography resins, single-use systems, filtration technologies, and integrated continuous processing solutions. This expansion is often driven by customer demand for modular, scalable, and cost-effective solutions, as well as the need to support a broader range of modalities. Product innovation is also increasingly focused on compatibility, automation, and sustainability, enabling manufacturers to enhance process efficiency and flexibility.

Regional expansion in the downstream processing industry is gaining momentum, particularly in emerging markets such as Asia-Pacific and Latin America. Driven by the growth of local biopharmaceutical manufacturing, favorable government initiatives, and increasing investments in healthcare infrastructure, companies are establishing production facilities, partnerships, and distribution networks in these regions. Asia-Pacific, especially China and India, is becoming a key hub due to lower manufacturing costs and a rising number of domestic biotech firms.

Products Insights

The chromatography systems segment dominated the market for downstream processing and accounted for the largest revenue share of 41.43% in 2024. Continuous R&D to improve the efficiency and speed of chromatography systems is anticipated to propel the segment's growth. In April 2021, Thermo Fisher Scientific launched the HyPeak chromatography system, its company's only single-use chromatography system for bioprocessing, with significant functions in therapeutic protein as well as vaccine development. A rise in the deals and developments pertaining to chromatography systems also facilitates segment growth. For instance, in January 2021, Sartorius Stedim Biotech announced the acquisition of the chromatography equipment business from Novasep. This will assist Sartorius in developing novel chromatography systems, which in turn will overcome efficiency issues and bottlenecks in downstream processing.

The filters segment is expected to register the fastest CAGR from 2025 to 2030. The rise in the utility of filters for viral inactivation is the key factor driving this market for downstream processing. In September 2020, a team of researchers from Pennsylvania State University analyzed the efficiency of BioEX hollow fiber and Planova 20N virus filters for the removal of viral-sized particles. Such studies are anticipated to increase the adoption rate of filters for the downstream processing of biologics.

Technique Insights

The purification by chromatography segment dominated the downstream processing market and accounted for the largest revenue share of 41.79% in 2024. Single-use chromatography and filtration systems are considered the gold standards in downstream bioprocessing. Hence, companies are engaging in business development strategies such as acquisition, merger, and agreement for expanding their chromatography portfolio. For instance, in December 2021, Repligen bought Newton, New Jersey-based BioFlex Solutions. The purchase adds to and enhances Repligen's single-use fluid management product line, as well as simplifies its supply chain. The integration of BioFlex Solutions strengthens its system offering by further integrating components and assemblies. Similarly, in August 2021, Danaher Corporation completed the acquisition of Aldevron. Aldevron will function as a separate operational business and brand inside Danaher's Life Sciences sector.

Solid-liquid separation is expected to witness the highest CAGR from 2025 to 2030. There are several advantages of solid-liquid separation, such as it is simple, cost-effective, and well-suited for continuous mode manufacturing. However, high shear forces generated are a common hurdle with this technique. Therefore, to cope with such problems, recent developments such as depth filters include multistage depth filtration, alternating tangential flow microfiltration, and tangential flow filtration methods are increasingly adopted for high cell density processes.

Application Insights

The antibiotic production segment dominated the market for downstream processing. It generated the largest revenue share of 29.84% in 2024, owing to the wide applications of antibiotics for the treatment of several disorders. More than 700,000 people die of antibiotic-resistant bacteria annually. This leads to high demand for the development of antibiotics, which, in turn, propels the market growth.

Antibodies production is expected to grow at the fastest CAGR by 2030, owing to the rise in demand for monoclonal antibodies. The launch of novel products for the efficient purification of antibodies also propels segment growth. For instance, in January 2021, Cytiva launched HiScreen Fibro PrismA for process development and purification of monoclonal antibody (mAb). The product features a fiber-based Protein A platform, which enables a 20-fold increase in productivity.

Regional Insights

North America dominated the downstream processing industry with the largest revenue share of 40.4% in 2024, driven by advanced biomanufacturing infrastructure, robust R&D investments, and a strong presence of key biopharmaceutical companies. The region’s emphasis on innovation, supportive regulatory frameworks, and rising demand for biologics further fueled market growth. Strategic partnerships and technological advancements in purification and separation techniques have enhanced production efficiency, contributing significantly to market expansion. Additionally, increasing government support for biologics and biosimilars development has solidified North America's leadership position in the global downstream processing landscape.

U.S Downstream Processing Market Trends

The U.S. is the largest downstream processing industry for downstream processing, mainly due to its advanced biopharmaceutical sector, significant R&D investments, and strong regulatory support. The presence of major industry players and growing demand for biologics and biosimilars further drive market growth. Additionally, continuous technological innovations enhance process efficiency, solidifying the U.S. position in the global market.

Europe Downstream Processing Market Trends

Europe holds a significant share of the global downstream processing industry, supported by a strong biopharmaceutical industry, well-established research infrastructure, and favorable government policies. The region benefits from increasing investments in life sciences, a growing demand for biologics, and strategic collaborations between academia and industry. Countries like Germany, the UK, and Switzerland lead in innovation and production capabilities. Additionally, regulatory harmonization across the European Union facilitates smoother product development and commercialization processes. Technological advancements in chromatography, filtration, and purification methods enhance operational efficiency. These factors collectively position Europe as a key player in the global downstream processing landscape.

The UK downstream processing market is experiencing strong growth, owing to increased investment in biopharmaceutical research, a skilled workforce, and a supportive regulatory environment. The government's focus on expanding the life sciences sector and strategic collaborations between academic institutions and industry players is accelerating innovation. Rising demand for biologics and biosimilars, coupled with advancements in purification and separation technologies, further enhances production capabilities. These factors collectively position the UK as a dynamic and growing hub within the global market.

Germany's downstream processing market is experiencing significant growth, driven by its strong pharmaceutical and biotechnology sectors, advanced manufacturing capabilities, and continuous investment in research and development. The presence of leading biopharma companies and a well-established infrastructure for biologics production enhances the country’s market position. Supportive government initiatives and public-private partnerships foster innovation and technological advancements in purification, filtration, and separation processes. Germany’s strategic location within Europe and adherence to high regulatory standards make it a key hub for downstream processing activities across the region and beyond.

Asia Pacific Downstream Processing Market Trends

The Asia Pacific downstream processing industry is expected to grow significantly during the forecast period owing to rising investments in biopharmaceutical manufacturing, expanding healthcare infrastructure, and increasing demand for biosimilars and biologics. Countries such as China, India, and South Korea are emerging as key players due to cost-effective production capabilities and favorable government initiatives. The region is witnessing a surge in contract manufacturing and research activities, supported by a growing pool of skilled professionals. Additionally, advancements in downstream technologies and increasing clinical trials are further propelling market expansion, positioning Asia-Pacific as a major contributor to global downstream processing growth.

China's downstream processing market is set to grow significantly, fueled by robust government support, expanding biopharmaceutical manufacturing, and increasing demand for biosimilars. Rapid infrastructure development, rising R&D investments, and a growing talent pool further drive innovation. Strategic collaborations with global biotech firms and advancements in purification technologies are enhancing production efficiency, positioning China as a key player in the global downstream processing landscape.

The downstream processing industry in Japan is growing rapidly, owing to its strong biopharmaceutical sector, advanced technological capabilities, and increasing focus on precision medicine. Government support for innovation and rising demand for biologics and biosimilars are driving market expansion. Collaborative efforts between academia and industry and investments in state-of-the-art purification and separation technologies further strengthen Japan’s position in the global market.

Middle East & Africa Downstream Processing Market Trends

The Middle East and Africa downstream processing industry is projected to drive the demand for downstream processing due to increasing investments in healthcare infrastructure, rising prevalence of chronic diseases, and growing interest in biotechnology and pharmaceutical manufacturing. Government initiatives to diversify economies and boost local drug production are fostering industry growth. Countries like the UAE, Saudi Arabia, and South Africa are leading regional efforts by establishing research hubs and partnering with global biopharma firms. Additionally, expanding access to advanced medical treatments and a rising demand for biosimilars are expected to further accelerate the regional market expansion.

The Kuwait downstream processing market is projected to grow steadily, owing to increased government investment in healthcare, rising demand for biopharmaceuticals, and efforts to diversify the economy. Developing local manufacturing capabilities and partnerships with international biotech firms further support market expansion and technological advancement.

Key Downstream Processing Company Insights

Companies are increasingly focusing on the development of new products for downstream processing. For instance, in February 2022, Sartorius completed its purchase of Novasep's chromatography section. The portfolio bought includes chromatography systems designed largely for smaller biomolecules like peptides, oligonucleotides, and insulin, as well as new technologies for biologics' continuous production. Furthermore, in January 2023, the company collaborated with RoosterBio Inc. to enhance its downstream purification processes for exosome-based therapies.

The heatmap analysis of the downstream processing market reveals a clear trend of intensified activity across multiple growth levers. Notably, product expansion and regional expansion are emerging as high-impact strategies, driven by increasing demand for biopharmaceuticals and the push to serve emerging markets. Regulatory influence also remains strong, shaping innovation pathways and quality standards. Meanwhile, medium levels of M&A activity and innovation reflect a cautiously optimistic landscape, where strategic collaborations and technology upgrades continue to support competitive positioning. Overall, the market demonstrates a robust and multi-dimensional growth potential, underpinned by a convergence of regulatory momentum, global outreach, and strategic investments.

Key Downstream Processing Companies:

The following are the leading companies in the downstream processing market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Sartorius Stedim Biotech S.A

- Thermo Fisher Scientific Inc.

- Danaher

- Repligen

- 3M Company

- Corning Corporation

- Lonza Group Ltd

- Dover Corporation

- Eppendorf AG

Recent Developments

-

In April 2025, Sartorius, a global leader in bioprocess solutions, entered into a non-exclusive CDMO collaboration with Mabion S.A., a biopharmaceutical company based in Poland. This partnership aims to provide customers with a seamless, integrated service offering that accelerates biologics development and manufacturing, reduces complexity, and ensures high-quality product delivery to market faster and more efficiently. Through this development, Mabion will focus on upstream process optimization.

-

In June 2024, Ecolab Life Sciences, through its Purolite resin business, and Repligen Corporation commercially launched DurA Cycle, a new Protein A chromatography affinity resin designed specifically for large-scale purification in commercial biologics manufacturing, particularly for monoclonal antibodies.

-

In December 2022, AGC Biologics and W.L. Gore & Associates formed a collaboration to advance Protein A-based purification technology combined with contract development and manufacturing services for antibody therapies. This partnership leverages Gore’s innovative GORE Protein Capture Devices, which use a unique expanded polytetrafluoroethylene (ePTFE) membrane technology to improve Protein A affinity purification, alongside AGC Biologics’ global manufacturing network and expertise in monoclonal antibody (mAb) development and GMP manufacturing.

Downstream Processing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 48.20 billion

Revenue forecast in 2030

USD 94.79 billion

Growth rate

CAGR of 14.49% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technique, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Merck KGaA; Sartorius Stedim Biotech S.A; Thermo Fisher Scientific Inc.; Danaher, Repligen; 3M Company; Corning Corporation; Lonza Group Ltd; Dover Corporation; Eppendorf AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Downstream Processing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global downstream processing market report on the basis of product, technique, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Chromatography Systems

-

Filters

-

Evaporators

-

Centrifuges

-

Dryers

-

Others

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Disruption

-

Solid-liquid Separation

-

Filtration

-

Centrifugation

-

-

Concentration

-

Evaporation

-

Membrane Filtration

-

-

Purification By Chromatography

-

Formulation

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibiotic Production

-

Hormone Production

-

Antibodies Production

-

Enzyme Production

-

Vaccine Production

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global downstream processing market size was estimated at USD 41.81 billion in 2024 and is expected to reach USD 48.20 billion in 2025.

b. The global downstream processing market is expected to grow at a compound annual growth rate of 14.49% from 2025 to 2030 to reach USD 94.79 billion by 2030

b. Chromatography systems dominated the downstream processing market with a share of 41.43% in 2024. This is attributable to a rise in the adoption of single-use chromatography systems coupled with constant research and development initiatives.

b. Some key players operating in the downstream processing market include Merck KGaA; Sartorius Stedim Biotech S.A; Thermo Fisher Scientific Inc.; Danaher, Repligen; 3M Company; Corning Corporation; Lonza Group Ltd; Dover Corporation; Eppendorf AG

b. Key factors that are driving the downstream processing market growth include the commercial success of biopharmaceuticals, rising adoption of single-use technology in bioprocessing, and expansion of bioprocessing capacity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.