- Home

- »

- Biotechnology

- »

-

DNA And Gene Cloning Services Market Size Report, 2033GVR Report cover

![DNA And Gene Cloning Services Market Size, Share & Trends Report]()

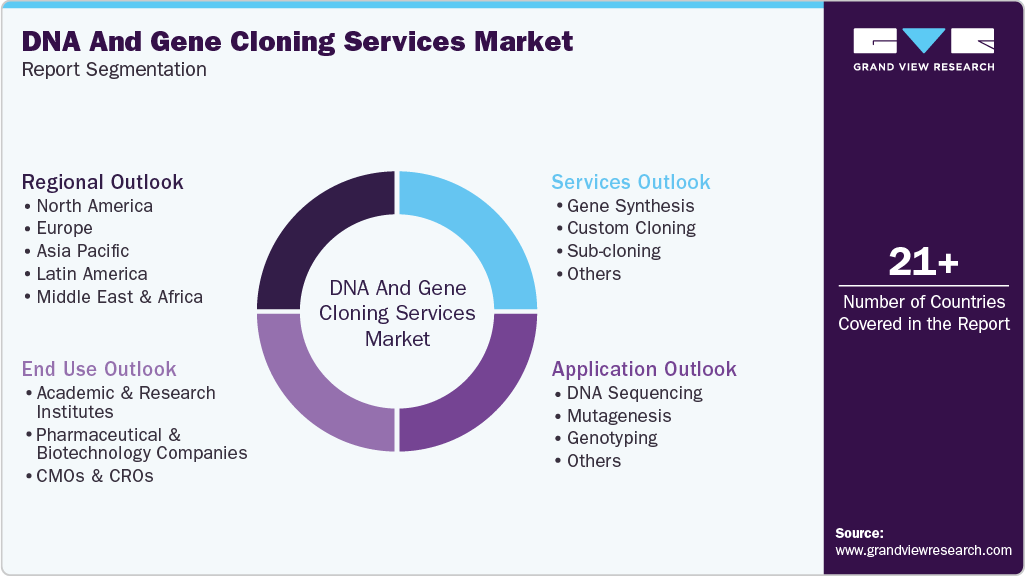

DNA And Gene Cloning Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Service (Gene Synthesis, Custom Cloning, Sub-Cloning), By Application (DNA Sequencing, Mutagenesis, Genotyping), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-383-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

DNA And Gene Cloning Services Market Summary

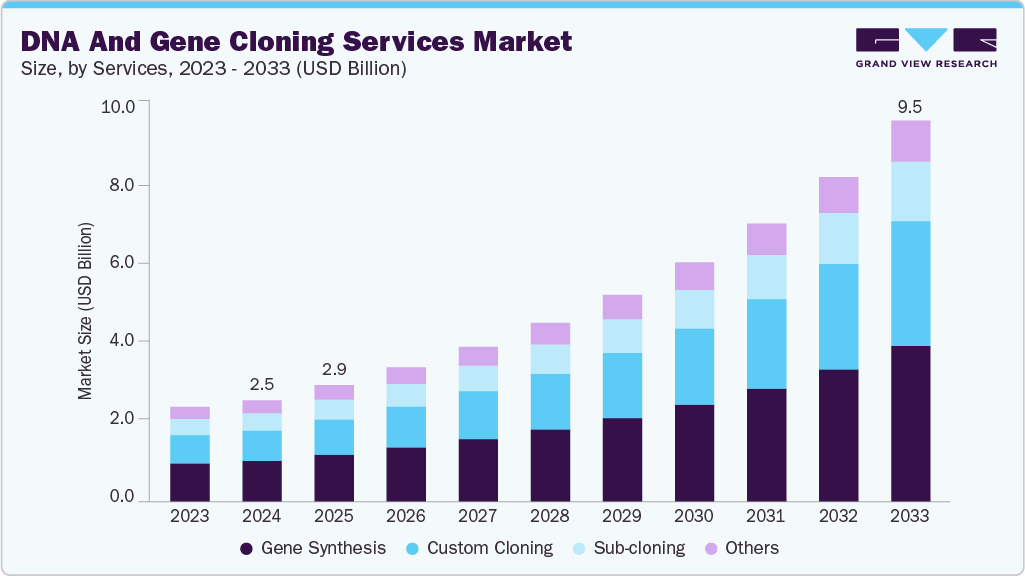

The global DNA and gene cloning services market size was estimated at USD 2.51 billion in 2024 and is projected to reach USD 9.46 billion by 2033, growing at a CAGR of 15.98% from 2025 to 2033. Advancements in DNA and gene cloning technology, rising acceptance of gene therapy, and increasing demand for personalized medicine are some of the factors driving market growth.

Key Market Trends & Insights

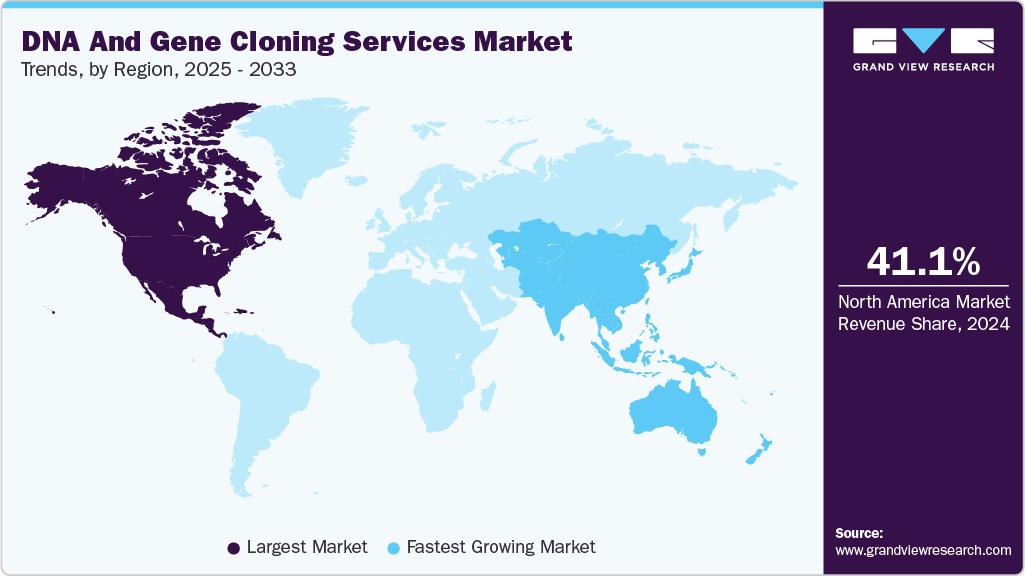

- The North America DNA and gene cloning services industry held the largest share of 41.14% of the global market in 2024.

- The DNA and gene cloning services industry in the U.S. is expected to grow significantly over the forecast period.

- By service, the gene synthesis services segment held the largest market share of 40.21% in 2024.

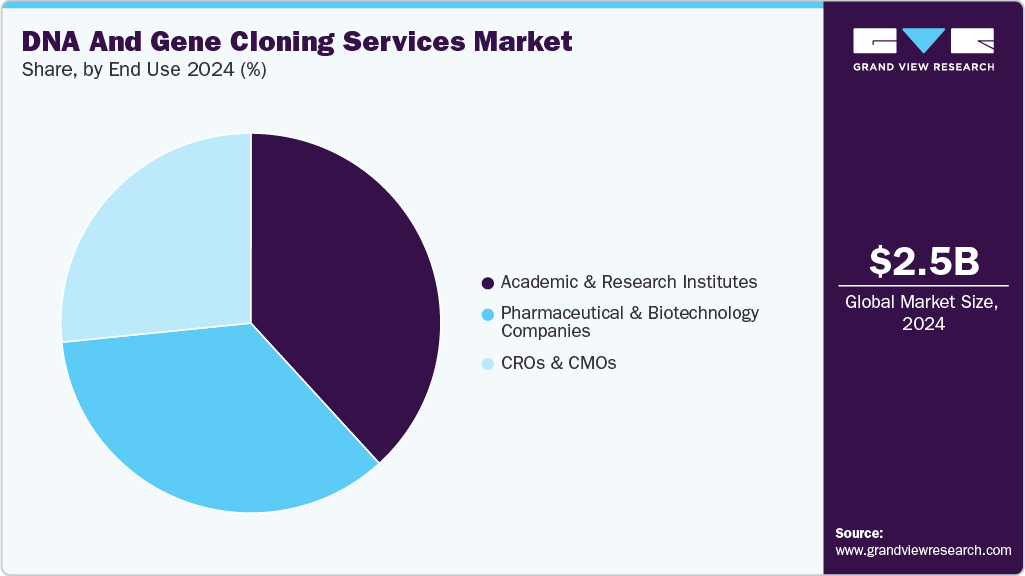

- Based on end use, the academic and research institutes segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.51 Billion

- 2033 Projected Market Size: USD 9.46 Billion

- CAGR (2025-2033): 15.98%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Need to reduce turnaround time, cost, and technical complexity

The need to reduce turnaround times, cut expenses, and avoid the technical difficulties of internal workflows is a major driver of demand for DNA and gene cloning services. For biotech startups, academic labs, and pharmaceutical companies, traditional cloning is costly and time-consuming due to the need for specialized equipment, controlled lab environments, and qualified molecular biologists. Organizations are increasingly outsourcing cloning to obtain advanced capabilities without delays or investment in internal infrastructure due to the growing competition in drug discovery, synthetic biology, and gene therapy.

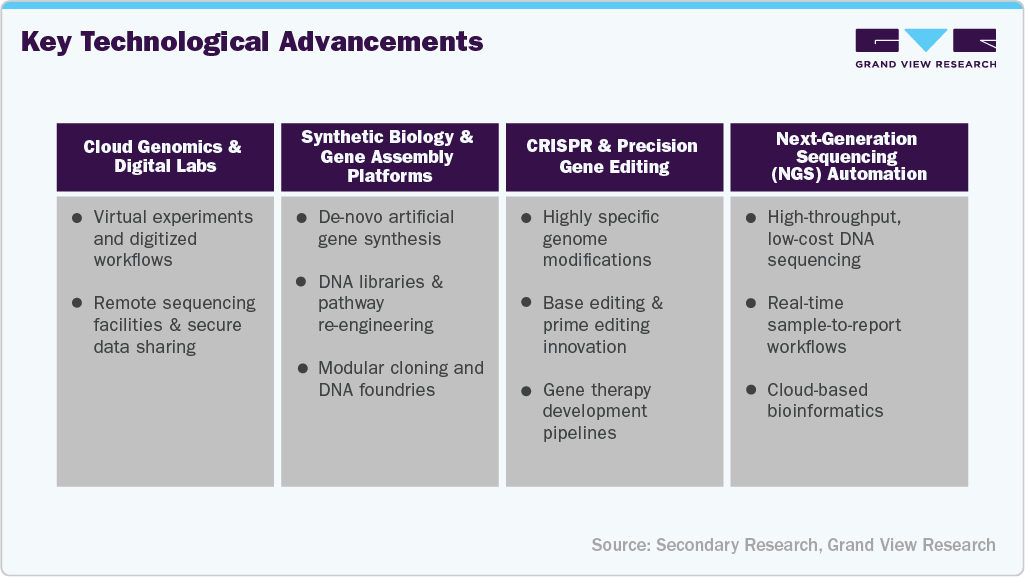

Genetic research and applications are changing because of recent technological developments in the DNA and gene cloning industries. Automated cloning, synthetic biology, and AI-driven gene design innovations are drastically cutting costs, streamlining complicated workflows, and speeding up turnaround times. These advancements speed up the development of therapeutics, diagnostics, and research applications by increasing efficiency and accuracy, as well as making customized gene synthesis and cloning services more accessible.

Research timelines can be accelerated by using outsourced cloning services, which offer stable cell lines, expression clones, and ready-to-use plasmids. Organizations can avoid major sources of delay in molecular biology projects by doing away with the need to troubleshoot failures, optimize protocols, and repeat experiments. These services enable end users to concentrate on downstream tasks such as therapeutic development, protein expression, and pathway engineering by producing custom constructs with high accuracy, quick turnaround, and scalability.

Demand for customized constructs for CRISPR & gene editing

Customized cloning solutions that enable precise genome modification are in high demand due to the increasing use of CRISPR and other gene-editing tools. Accurately engineered components such as gRNA vectors, donor repair templates, knock-in/knockout constructs, multiplex plasmids, and screening libraries are necessary for CRISPR workflows; creating these internally requires sophisticated knowledge and a great deal of troubleshooting. Researchers are depending more on customized cloning services that match sequences, species, and vector systems as CRISPR spreads throughout functional genomics, disease modeling, therapeutics, plant science, and microbial engineering.

Researchers can obtain sequence-verified plasmids that are optimized for their experiments without having to deal with complicated construct design, thanks to CRISPR-ready cloning platforms. Pre-validated constructs reduce failure risk, expedite R&D, and avoid expensive delays in translational research and drug discovery. Custom gRNA pools, donor vectors, and high-fidelity editing constructs made for specific cell lines or genomes guarantee reproducibility and accelerate the development of downstream applications such as phenotypic screening, knockout validation, and cell therapy development. As a result, outsourced CRISPR construct design is a key factor driving the market for DNA and gene cloning services.

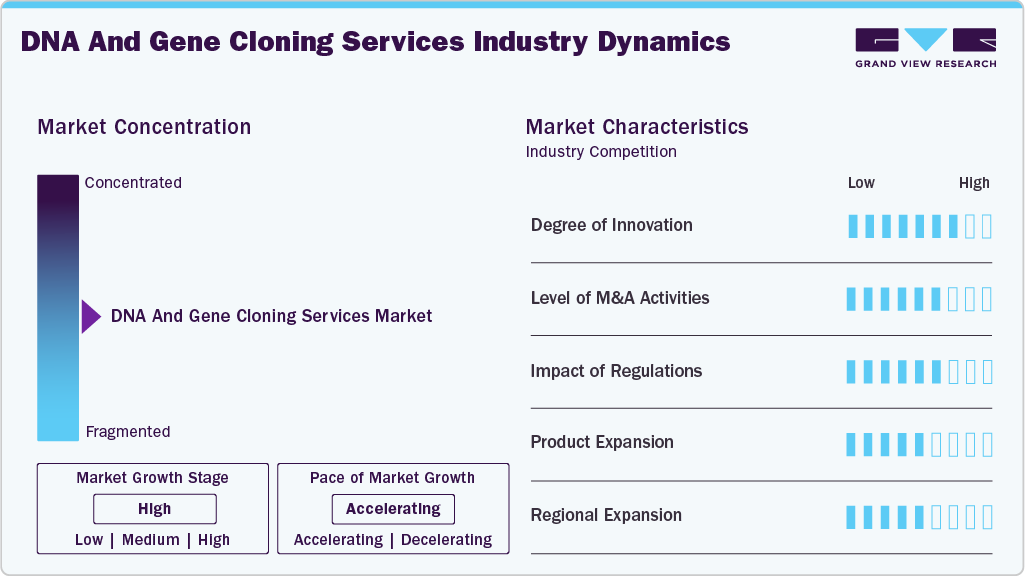

Market Concentration & Characteristics

Advances in genetic engineering and cloning technologies, as well as the growing need for gene therapies and personalized medicine, are driving a high level of innovation in the DNA and gene cloning services industry. The market is witnessing an increase in the use of cutting-edge DNA cloning technologies, which is driving expansion and opening up new business prospects for firms that provide gene synthesis, custom cloning, sub-cloning, and other related services. For instance, in February 2024, Twist Bioscience expanded its Express Genes service to larger DNA preps, enhancing rapid, scalable gene synthesis and driving growing demand in the DNA and gene cloning services industry.

The DNA and gene cloning industry is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to several factors, including the desire to gain a competitive advantage in industry and the need to consolidate in a rapidly growing market. However, market players are engaged in collaboration and partnerships to expand their service portfolios owing to the rapid advancements in molecular & recombinant DNA technologies. For instance, in May 2021, Charles River Laboratories in the U.S. acquired Vigene Biosciences for USD 292.5 million, enhancing its viral vector, plasmid DNA, and gene therapy CDMO capabilities, expanding its U.S. and global portfolio.

Gene cloning raises ethical concerns related to genetic manipulation, potential misuse of technology, and implications for biodiversity. Regulatory bodies often impose guidelines to ensure the responsible use of gene cloning techniques and to address ethical dilemmas associated with altering genetic material.

Key players are adopting the strategy of increasing production capacity and expanding their market reach to improve the availability of their products in diverse geographic areas. Moreover, companies are launching new platforms to strengthen their product & service portfolio. For example, in June 2024, Syngene International Ltd. launched a platform that uses high-throughput clone screening for rapid and enhanced protein production.

The DNA and gene cloning industry is witnessing moderate regional expansion, driven by an increasing customer base for cloned products. Moreover, as scientific awareness of cell and gene therapy continues to grow globally and access to biotechnological tools improves in emerging markets, major market players are expected to enhance their regional expansion efforts.

Service Insights

The gene synthesis services segment led the market with a revenue share of 40.21% in 2024, enabling custom DNA creation without templates. It supports codon optimization, enhanced protein expression, and services such as cloning, mutagenesis, and plasmid preparation.

The custom cloning services segment is expected to witness fastest growth over the forecast period. Custom cloning services offer a range of benefits, including saving time, ensuring accuracy in cloning procedures, and providing access to specialized vectors and cloning techniques that may not be readily available in a laboratory setting. The custom cloning services include gene synthesis & mutagenesis services, molecular cloning services, shRNA & RNAi cloning services.

Application Insights

The DNA sequencing segment led the market in 2024 with a 39.77% revenue share and is expected to grow at the fastest CAGR throughout the forecast period. Gene cloning supports sequencing by amplifying specific genes via vectors, enabling accurate determination of nucleotide sequences and understanding gene function.

The mutagenesis segment is projected to grow significantly from 2025 to 2033. Gene cloning enables precise mutations, allowing customized genetic constructs for advanced research and applications in genetics, biotechnology, drug development, functional genomics, protein engineering, and therapeutic innovations.

End Use Insights

The academic and research institutes segment dominated the market with the largest revenue share of 38.20% in 2024. The research institutes are entering into collaborations with service providers to speed up their research programs that require the characterization and synthesis of gene fragments. For instance, in January 2024, GSK and Elegen Corporation entered into a collaboration to develop cell-free DNA-based vaccines and medicines. DNA and gene cloning services bridge basic research and clinical applications, aiding the development of therapies, diagnostics, and biomarkers.

The CROs & CMOs segment is expected to grow at the fastest CAGR from 2025 to 2033. It is anticipated that the region's large number of contract manufacturing organizations (CMOs) and contract research organizations (CROs) that provide comprehensive gene synthesis, cloning, and recombinant expression services will attract international biotech and pharmaceutical clients and significantly increase revenue.

Regional Insights

North America DNA and gene cloning services industry dominated and accounted for the largest revenue share of 41.14% in 2024. This growth is attributed to the region’s advanced healthcare infrastructure, strong presence of leading biotechnology firms, and significant funding for recombinant DNA (rDNA) technology research. Moreover, increasing demand for personalized medicine, and the rise in the prevalence of chronic & hereditary diseases are expected to boost the DNA and gene cloning services industry.

U.S. DNA And Gene Cloning Services Market Trends

The DNA and gene cloning services industry in the U.S. is expected to expand between 2025 and 2033 because of increased government funding, a growing emphasis on targeted treatments, regenerative medicine, and the rising incidence of diseases. Moreover, it is projected that growing research in the areas of drug discovery and personalized medicine, along with a significant presence of biotechnology and biopharmaceutical companies, will drive market expansion.

Europe DNA And Gene Cloning Services Market Trends

The Europe DNA and gene cloning services industry is anticipated to grow over the forecast period owing to the strong presence of biopharmaceutical companies producing recombinant vaccines and biologics. Moreover, increasing research and development activities, collaborations between pharmaceutical companies and research institutions, and a growing demand for novel antibiotics, enzymes, etc., further propel market growth. For instance, in June 2022, Charles River Laboratories opened its High-Quality Plasmid DNA Centre of Excellence in Alderley Park, UK, expanding plasmid manufacturing capacity to meet growing DNA and gene cloning industry demand.

The DNA and gene cloning services industry in the UK is expected to grow at a significant rate over the forecast period due to the rising prevalence of cancer and the growing demand for targeted therapies. Furthermore, government laws regarding genetically modified crops are likely to boost the DNA and gene cloning services industry. For instance, in March 2023, the Government of England legalized the commercial production of gene-edited food. Thus, using rDNA technology, scientists can enhance agricultural outcomes & food production.

Germany DNA and gene cloning services industry is anticipated to experience growth from 2025 to 2033, driven by the increasing incidence of genetic disorders and the support of government policies for research in regenerative medicine and personalized therapeutics.

Asia Pacific DNA And Gene Cloning Services Market Trends

The Asia Pacific DNA and gene cloning services industry is expected to experience fastest growth, with a projected CAGR of 17.81% from 2025 to 2033. This is attributed to the rising prevalence of chronic diseases, increasing research activities, advancements in genetic engineering, rising adoption of gene therapies, and a strong presence of biotechnology and biopharmaceutical companies in the region.

The DNA and gene cloning services industry in China is anticipated to grow over the forecast period due to increasing investments in healthcare innovation and research. The country’s focus on advancing biotechnology and immunotherapy coupled with the rising awareness of personalized medicine, is driving the expansion of the DNA and gene cloning services industry in China.

The Japan DNA and gene cloning services industry is expected to witness rapid growth over the forecast period. The increasing prevalence of diseases, coupled with the growing oncological research, anticipates market growth.

MEA DNA And Gene Cloning Services Market Trends

The Middle East and Africa DNA and gene cloning services industry is poised to grow in the near future. Increasing applications of biotechnology and immunomedicine, along with growing applications of biotechnology in agriculture, are contributing to its expansion.

The Kuwait DNA and gene cloning services industry is anticipated to witness growth over the forecast period, owing to the escalating investment in scientific research and development by both governmental and private entities. This investment is driving advances in oncology research, which in turn creates opportunities to develop new and improved cancer treatments.

Key DNA And Gene Cloning Service Company Insights

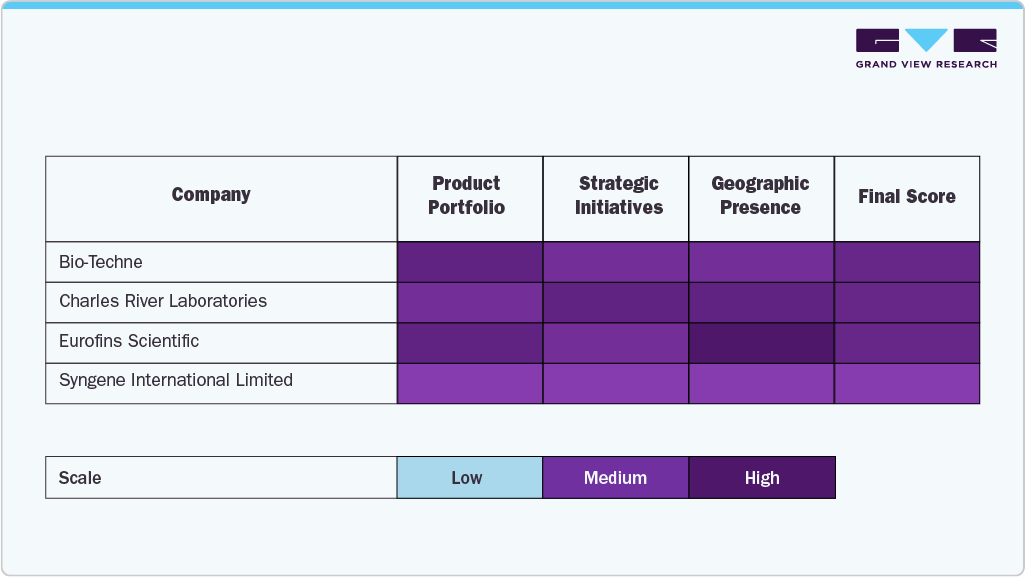

The DNA and gene cloning services industry is dominated by several well-known companies that sustain their dominance through strong product lines, clever partnerships, and ongoing R&D expenditures. Important businesses such as Bio-Techne, Charles River Laboratories, Eurofins Scientific, GenScript, and Danaher Corporation have gained a sizable portion of the market by providing cutting-edge cloning technologies, a wide range of services, and vast international distribution networks.

By offering creative, tailored cloning solutions that satisfy the increasing demand from academic research institutions, pharmaceutical companies, and biotechnology enterprises, emerging and mid-sized players like Syngene International Limited, Twist Bioscience, Thermo Fisher Scientific Inc., Merck KGaA, and Curia Global, Inc. are growing their footprint. To support increasingly complex experimental workflows, these companies prioritize flexibility, high-throughput cloning, and integrated service platforms.

Key DNA And Gene Cloning Services Companies:

The following are the leading companies in the DNA and gene cloning services market. These companies collectively hold the largest market share and dictate industry trends.

- Bio-Techne

- Charles River Laboratories

- Eurofins Scientific

- GenScript

- Danaher Corporation

- Syngene International Limited

- Twist Bioscience

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Curia Global, Inc.

Recent Developments

-

In May 2025, Twist Bioscience in the U.S. revised its collaboration with Ginkgo Bioworks, acquiring long DNA technology licenses, enhancing its DNA synthesis portfolio, and supporting growing demand in the gene cloning services market.

-

In May 2024, Twist Bioscience in the U.S. launched Multiplexed Gene Fragments, enabling pooled synthesis of up to 500 bp DNA, supporting high-throughput screening and driving growth in the DNA and gene cloning services industry.

-

In June 2024, GenScript Biotech Corporation launched the FLASH gene synthesis service. This system reduces the sequence-to-plasmid construct time facilitating R&D in antibody drugs, vaccines, and cell & gene therapy.

-

In November 2023, Twist Bioscience launched Twist Express Genes to deliver clonal genes and gene fragments at scale and with rapid turnaround times.

DNA And Gene Cloning Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.89 billion

Revenue forecast in 2033

USD 9.46 billion

Growth rate

CAGR of 15.98% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Bio-Techne; Charles River Laboratories; Eurofins Scientific; GenScript; Danaher Corporation; Syngene International Limited; Twist Bioscience; Thermo Fisher Scientific Inc.; Merck KGaA; Curia Global, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global DNA And Gene Cloning Services Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global DNA and gene cloning services market report based on service, application, end use, and region:

-

Services Outlook (Revenue, USD Million, 2021 - 2033)

-

Gene Synthesis

-

Custom Cloning

-

Sub-cloning

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

DNA Sequencing

-

Mutagenesis

-

Genotyping

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

CMOs & CROs

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global DNA and gene cloning services market size was estimated at USD 2.51 billion in 2024 and is expected to reach USD 2.89 billion in 2025.

b. The global DNA and gene cloning services market is expected to grow at a compound annual growth rate of 15.98% from 2025 to 2033 to reach USD 9.46 billion by 2033.

b. North America dominated the DNA and gene cloning services market with a share of 41.14% in 2024. This is attributable to the rising adoption of cloning techniques for the development of novel therapeutics for chronic diseases.

b. Some key players operating in the DNA and gene cloning services market include Bio-Techne; Charles River Laboratories; Eurofins Scientific; GenScript; Danaher Corporation; Syngene International Limited; Twist Bioscience; Thermo Fisher Scientific Inc.; Merck KGaA; Curia Global, Inc.

b. Key factors that are driving the market growth include advancements in DNA and gene cloning technology, rising acceptance of gene therapy, and increasing demand for personalized medicine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.