- Home

- »

- Next Generation Technologies

- »

-

Digital Battlefield Market Size, Share & Growth Report, 2030GVR Report cover

![Digital Battlefield Market Size, Share & Trends Report]()

Digital Battlefield Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (5G, IoT, AI, Blockchain, Cloud Computing, AR & VR), By Component, By End Use (Land, Naval, Air, Space), By Installation, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-359-1

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Battlefield Market Size & Trends

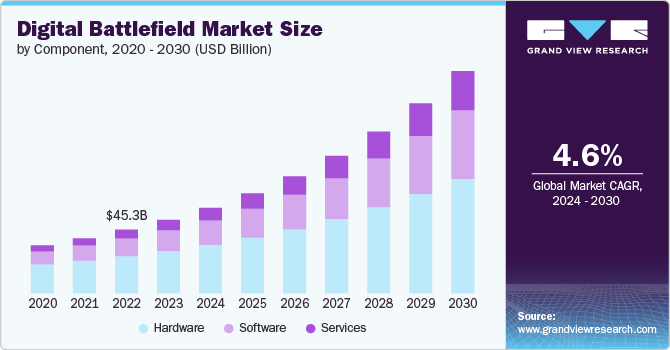

The global digital battlefield market size was valued at USD 52.46 billion in 2023 and is expected to grow at a CAGR of 17.2% from 2024 to 2030. The market is witnessing a significant trend toward integrating artificial intelligence (AI) and machine learning (ML) to enhance decision-making and operational efficiency. AI-driven analytics are increasingly being used to process vast amounts of data from various sensors, providing real-time insights and predictive capabilities. This trend allows for more accurate threat detection, resource allocation, and strategic planning, making military operations more agile and responsive to evolving battlefield conditions.

Cyber warfare has become a critical component of modern military strategy, driving significant investment in digital battlefield technologies. Countries are developing sophisticated cyber defense and offense capabilities to protect critical infrastructure, disrupt enemy communications, and gather intelligence. The focus on cybersecurity within the digital battlefield includes advanced encryption, intrusion detection systems, and AI-driven cybersecurity solutions to counter increasingly sophisticated cyber threats.

Furthermore, the use of unmanned systems, including drones and robotic ground vehicles, is expanding rapidly within the market. These systems offer numerous advantages, such as reducing human risk, enhancing surveillance capabilities, and increasing operational reach. Advances in autonomous navigation, AI, and sensor technologies are enabling more complex and coordinated missions, from reconnaissance to targeted strikes, contributing to the growing reliance on unmanned systems in military operations.

The adoption of augmented reality (AR) and virtual reality (VR) technologies is becoming a major trend in the market. AR provides soldiers with real-time information overlays in the field, enhancing situational awareness and decision-making. VR is used for immersive training simulations, allowing military personnel to practice and refine their skills in realistic, risk-free environments. This trend is improving preparedness and effectiveness in various combat scenarios.

Moreover, the market is placing a strong emphasis on data analytics and big data, a trend that is transforming intelligence, surveillance, and reconnaissance (ISR) activities. The ability to collect, analyze, and interpret vast amounts of data from diverse sources is becoming crucial for gaining actionable insights and maintaining a strategic advantage. Advanced analytics platforms, powered by AI and ML, are being deployed to process big data in real time, underscoring this trend as key to informed decision-making and adaptability on the battlefield.

Industry Dynamics

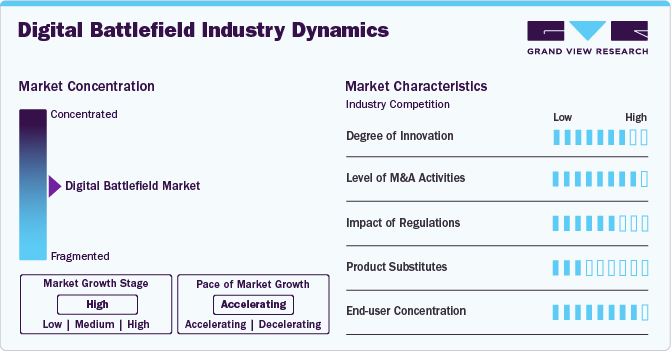

The market exhibits a high degree of innovation, driven by rapid advancements in artificial intelligence, cybersecurity, unmanned systems, and communication technologies. The continuous development of sophisticated AI algorithms, autonomous drones, and secure communication networks reflects the intense focus on improving operational efficiency, situational awareness, and strategic decision-making in military operations.

The market experiences a high level of mergers and acquisitions (M&A), driven by the need for companies to rapidly acquire advanced technologies and capabilities. Defense contractors, technology firms, and cybersecurity companies are actively engaging in M&A to strengthen their portfolios and enhance their competitive edge.

The market is highly impacted by regulations due to the critical importance of ensuring national security, operational integrity, and ethical considerations in military technologies. Governments and international bodies impose stringent regulations and standards on the development, deployment, and use of digital battlefield technologies to protect sensitive data, ensure interoperability, and prevent misuse.

The market has a low level of product substitutes. The specialized nature of digital battlefield technologies, which include advanced AI, cybersecurity measures, unmanned systems, and secure communication networks, offers capabilities that traditional military technologies cannot match. These innovations are crucial for modern warfare's strategic and operational demands, providing real-time data analysis, enhanced situational awareness, and improved decision-making.

The market exhibits a high level of end-user concentration, primarily driven by its significant adoption within government and defense sectors. These sectors are the primary consumers of digital battlefield technologies, investing heavily in advanced systems to enhance national security, intelligence, and defense capabilities. The concentration is further intensified by large defense budgets and strategic defense initiatives of major countries.

Component Insights

The hardware segment dominated the market in 2023, with a revenue share of around 57% due to the increasing demand for advanced physical components such as sensors, communication devices, and unmanned systems. Continuous advancements in these technologies, coupled with substantial defense investments in upgrading and expanding hardware capabilities, drove significant growth in this segment, making it the dominant component in the market.

The services segment is expected to record a significant CAGR of over 21% from 2024 to 2030, driven by the increasing need for ongoing support, maintenance, and upgrades of complex digital battlefield systems. As military and defense organizations adopt advanced technologies, they require specialized services such as cybersecurity, training, systems integration, and data analytics to ensure optimal performance and adaptability. The rapid evolution of technology and the need for continuous operational readiness further fuel demand for comprehensive service solutions, driving substantial growth in this segment.

Technology Insights

The IoT segment held the highest revenue share in 2023 due to the growing adoption of interconnected devices and sensors that enhance situational awareness and operational efficiency. The integration of IoT with other advanced technologies, such as AI and robotics, allows for more coordinated and effective military operations. This widespread implementation of IoT solutions in military applications significantly contributed to the segment's leading revenue share.

The AI segment is estimated to register the highest growth rate from 2024 to 2030, due to its pivotal role in enhancing autonomous decision-making, predictive analytics, and operational efficiencies. AI algorithms enable military systems to analyze vast amounts of data in real time, identify patterns, and adapt to dynamic battlefield conditions autonomously. Defense agencies are increasingly prioritizing AI-driven technologies for intelligence gathering, threat detection, and mission planning, and hence, the demand for AI solutions in the digital battlefield is projected to surge, driving substantial growth in this segment.

End Use Insights

The land segment accounted for the highest market share in 2023, due to the increasing deployment of ground-based digital battlefield technologies for military operations. Ground forces require advanced systems for reconnaissance, surveillance, and tactical operations, driving demand for land-based installations such as AI-powered command centers, unmanned ground vehicles, and secure communication networks. The emphasis on enhancing situational awareness and operational capabilities on land further propelled the growth of this segment, making it the dominant end-use category in the market.

The space segment is anticipated to expand at the highest CAGR from 2024 to 2030, due to increasing reliance on satellite-based technologies for communication, surveillance, and reconnaissance in military operations. Space assets provide critical capabilities for global positioning, real-time intelligence gathering, and enhancing command and control functions across theaters of operation. As defense agencies prioritize space-based assets to strengthen their strategic capabilities, including satellite constellations and space-based sensors, the demand for advanced digital battlefield solutions in the space segment is expected to grow significantly.

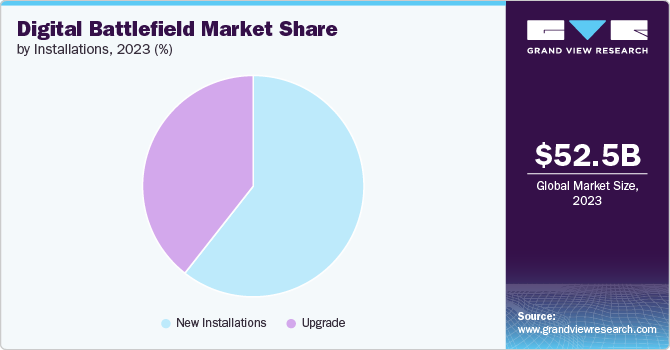

Installations Insights

The new installations segment held the highest revenue share in 2023, due to ongoing modernization efforts and the adoption of advanced digital technologies by defense forces worldwide. Governments and military organizations are investing in upgrading their infrastructure with state-of-the-art digital battlefield systems to enhance operational capabilities and maintain technological superiority. This includes deploying new installations of AI-driven command and control centers, unmanned systems, secure communication networks, and integrated IoT devices, reflecting a robust demand for cutting-edge military installations globally.

The upgrade segment is estimated to register the highest growth rate from 2024 to 2030, as defense forces increasingly prioritize enhancing existing infrastructure with advanced technologies. With rapid technological advancements and evolving threat landscapes, military agencies are focusing on upgrading their digital battlefield systems to maintain competitiveness and operational effectiveness.

Regional Insights

North America digital battlefield market accounted for a significant revenue share of over 39% in 2023, driven by strong investment in AI, cybersecurity, and unmanned systems, which are bolstering defense capabilities. With a robust defense industrial base and substantial government funding, the region leads in developing cutting-edge technologies for enhanced military readiness and operational effectiveness.

U.S. Digital Battlefield Market Trends

The digital battlefield market in the U.S. is anticipated to grow at a CAGR of over 16% from 2024 to 2030. The U.S. is advancing rapidly with substantial military R&D investments and collaborations between defense contractors and tech firms. The country's strategic initiatives emphasize AI-driven decision-making, cybersecurity resilience, and the integration of unmanned systems for diverse military applications. The U.S. military's emphasis on maintaining technological superiority is driving continuous advancements in digital warfare capabilities, positioning it at the forefront of the global market.

Asia Pacific Digital Battlefield Market Trends

The digital battlefield market in Asia Pacific accounted for a significant revenue share of over 24% in 2023 due to the rapid modernization of military forces, driving demand for advanced digital warfare solutions. The region's geopolitical dynamics and increasing defense budgets are fueling innovations in unmanned systems, cyber warfare, and satellite technologies, shaping the future of military operations in Asia Pacific.

India digital battlefield market is estimated to record the highest growth rate from 2024 to 2030, due to the growing trend toward enhancing indigenous defense capabilities and military readiness through advanced digital battlefield solutions. With initiatives like Make in India and strategic partnerships with global defense suppliers, India aims to strengthen its defense industrial base and achieve self-sufficiency in critical defense technologies.

The digital battlefield market in China is projected to grow at a CAGR from 2024 to 2030. China is advancing rapidly in the market with strategic investments in AI, cyber capabilities, and space-based technologies for military modernization. The country's ambitious military modernization programs, such as the development of hypersonic weapons and satellite constellations, underscore its commitment to enhancing defense capabilities.

Japan digital battlefield market is projected to grow at a CAGR from 2024 to 2030. With a focus on unmanned systems, cyber defenses, and resilient communication networks, Japan aims to bolster its military readiness and contribute to regional stability.

Europe Digital Battlefield Market Trends

The digital battlefield market in Europe is anticipated to register a CAGR of around 15% from 2024 to 2030, owing to robust defense spending and the integration of advanced technologies in military operations. The European Union's initiatives on defense cooperation and technological innovation foster collaborations among member states, driving advancements in digital battlefield capabilities and ensuring strategic autonomy in defense affairs.

UK digital battlefield market is projected to grow at a CAGR from 2024 to 2030. The UK is at the forefront of cybersecurity and AI-driven defense solutions within Europe, emphasizing resilience against cyber threats and advancements in autonomous systems. With investments in next-generation military technologies and collaborative efforts with NATO allies, the UK plays a pivotal role in shaping the future of digital warfare capabilities across the region.

The digital battlefield market in Germany is estimated to record a CAGR from 2024 to 2030. Germany leads in autonomous systems and communications technologies for defense, reflecting a trend toward enhancing military capabilities through technological innovation. The country's defense strategy focuses on AI applications, cybersecurity resilience, and interoperable communication networks to strengthen operational effectiveness.

Middle East And Africa (MEA) Digital Battlefield Market Trends

The digital battlefield market in the Middle East and Africa (MEA) region is anticipated to grow at the highest CAGR of around 17% from 2024 to 2030. The region's strategic location and geopolitical dynamics drive demand for cybersecurity solutions, unmanned systems, and surveillance technologies to address evolving threats and maintain stability.

Saudi Arabia digital battlefield market accounted for a considerable revenue share in 2023. The country is prioritizing digital defense capabilities as part of Vision 2030 initiatives, focusing on enhancing military readiness and diversifying economies through defense industry growth.

Key Digital Battlefield Company Insights

Some of the key players operating in the market are Lockheed Martin Corporation and Northrop Grumman Corporation, among others.

-

Lockheed Martin Corporation is an aerospace, defense, and security company. It is the contractor, known for its advanced technology platforms and solutions across air, land, sea, space, and cyber domains. Lockheed Martin's diverse portfolio includes fighter jets such as the F-35 Lightning II, missile systems, satellite systems, and advanced cybersecurity capabilities. The company's innovations in autonomous systems, artificial intelligence, and advanced manufacturing are pivotal in shaping the future of defense capabilities.

-

Northrop Grumman Corporation known for its expertise in autonomous systems and cybersecurity, Northrop Grumman provides critical capabilities for modern warfare environments. Their innovations enhance operational efficiency and situational awareness on the battlefield.

Elbit Systems Ltd., AeroVironment, Inc. are some of the emerging participants in the digital battlefield market.

-

Elbit Systems Ltd. is a defense technology company based in Israel, specializing in a wide range of advanced solutions for defense, homeland security, and commercial applications. The company develops and integrates cutting-edge platforms and systems, including unmanned systems, military aircraft upgrades, electro-optics, and electronic warfare systems.

-

AeroVironment, Inc. is a provider of unmanned aircraft systems (UAS) and tactical missile systems for military and commercial applications. Based in the United States, the company specializes in developing innovative solutions that enhance reconnaissance, surveillance, and intelligence gathering capabilities. The company also offers advanced tactical missile systems such as the Switchblade, designed for precision strike missions. With a strong focus on advanced technology and operational efficiency, AeroVironment continues to play a crucial role in shaping the future of unmanned systems in defense and beyond.

Key Digital Battlefield Companies:

The following are the leading companies in the digital battlefield market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus S.A.S

- AeroVironment, Inc.

- BAE Systems, Inc.

- Elbit Systems Ltd.

- General Dynamics Corporation

- L3Harris Technologies Inc.

- Lockheed Martin Corporation

- Nothrop Grumman Corporation

- RTX Corporation

- Thales Group

Recent Developments

-

In May 2024, L3Harris Technologies advanced the U.S. Army's capabilities with its latest Hawkeye III Lite Very Small Aperture Terminal (VSAT), delivering resilient and scalable SATCOM solutions. These systems enhance battlefield communication with lightweight, modular designs and high-speed data capabilities, crucial for rapid deployment and maneuverability

-

In June 2024, Airbus S.A.S partnered with AI start-up NeuralAgent for the Future Combat Air System (FCAS), which marks a significant leap in military aviation innovation. By integrating cutting-edge AI technologies, the collaboration aims to revolutionize combat aircraft capabilities with autonomous operations, enhanced situational awareness, predictive maintenance, and advanced training simulations

-

In April 2024, ANSYS, Inc. partnered with BAE Systems, Inc. to expedite the adoption of digital engineering and Model-Based Systems Engineering (MBSE) within the Department of Defense (DoD). This partnership aligns with the latest DoD guideline focusing on transitioning BAE Systems' customers from traditional manual processes to modernized approaches for system design, delivery, and operational efficiency through MBSE methodologies

Digital Battlefield Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 60.94 billion

Revenue forecast in 2030

USD 158.21 billion

Growth Rate

CAGR of 17.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Component, technology, installations, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Airbus S.A.S; AeroVironment, Inc.; BAE Systems, Inc.; Elbit Systems Ltd.; General Dynamics Corporation; L3Harris Technologies Inc.; Lockheed Martin Corporation; Nothrop Grumman Corporation; RTX Corporation; Thales Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Battlefield Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels, and analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global digital battlefield market report based on component, technology, installations, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

5G

-

IoT

-

AI

-

Blockchain

-

Cloud Computing

-

Big Data

-

AR and VR

-

Others

-

-

Installations Outlook (Revenue, USD Billion, 2018 - 2030)

-

New Installations

-

Upgrade

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Land

-

Naval

-

Air

-

Space

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital battlefield market size was estimated at USD 52.46 billion in 2023 and is expected to reach USD 60.94 million in 2024.

b. The global digital battlefield market is expected to grow at a compound annual growth rate of 17.2% from 2024 to 2030 to reach USD 158.21 million by 2030.

b. North America dominated the digital battlefield market with a share of around 39% in 2023, driven by strong investment in AI, cybersecurity, and unmanned systems, which are bolstering defense capabilities.

b. Some key players operating in the digital battlefield market include Airbus S.A.S, AeroVironment, Inc., BAE Systems, Inc., Elbit Systems Ltd., General Dynamics Corporation, L3Harris Technologies Inc., Lockheed Martin Corporation, Nothrop Grumman Corporation, RTX Corporation, Thales Group.

b. Key factors that are driving the digital battlefield market growth include integrating artificial intelligence (AI) and machine learning (ML), the use of unmanned systems, including drones and robotic ground vehicles and adoption of augmented reality (AR) and virtual reality (VR) technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.