- Home

- »

- Medical Devices

- »

-

Dental Tourism Market Size & Share, Industry Report, 2033GVR Report cover

![Dental Tourism Market Size, Share & Trends Report]()

Dental Tourism Market (2025 - 2033) Size, Share & Trends Analysis Report By Service (Dental Implants, Orthodontics), By Provider (Hospitals, Dental Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-031-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Tourism Market Summary

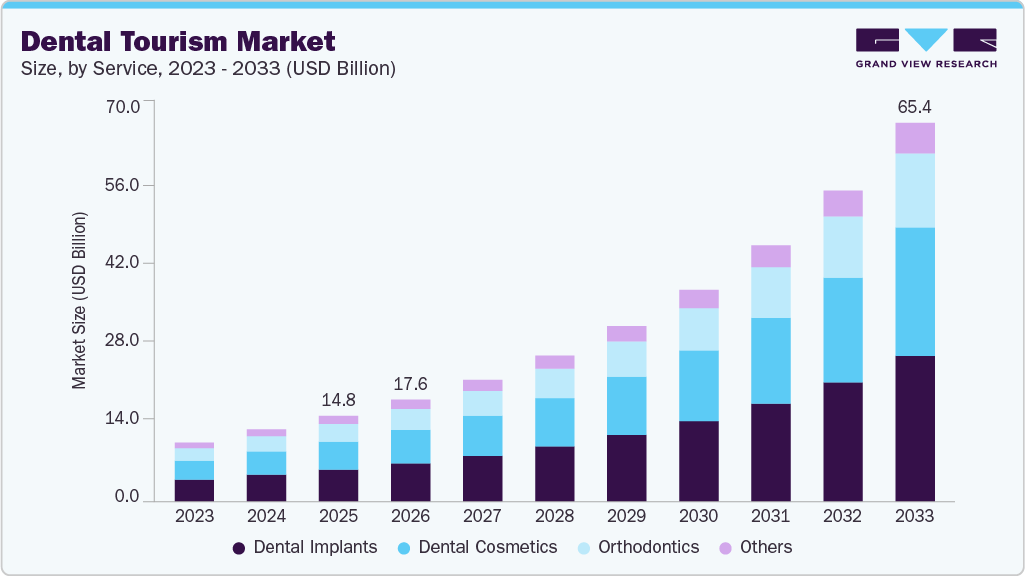

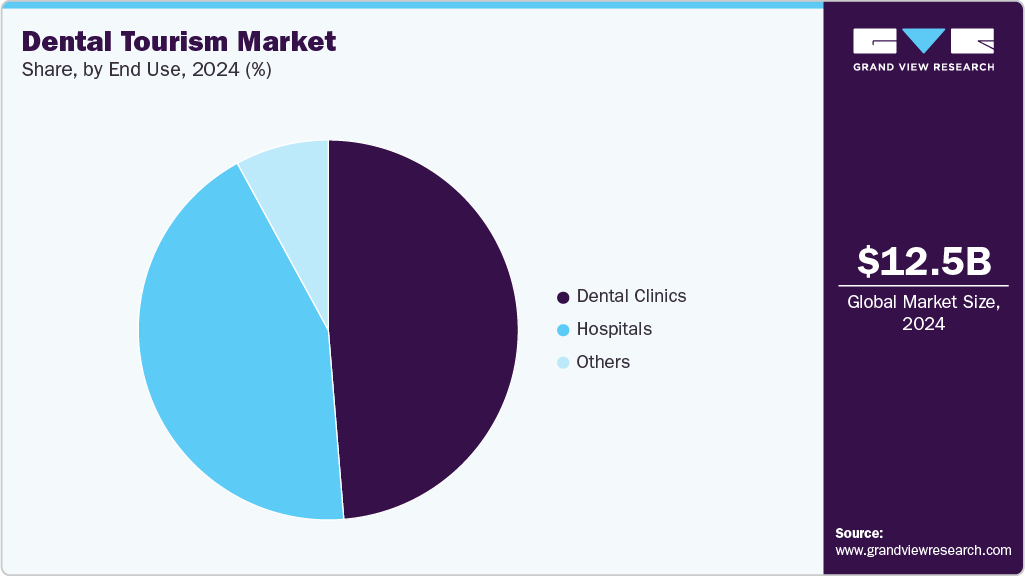

The global dental tourism market size was estimated at USD 12.48 billion in 2024 and is expected to reach USD 65.39 billion in 2033, growing at a CAGR of 20.41% during the forecast period. This growth is attributed to the increasing prevalence of tooth abnormalities and rising cost of procedures in developed countries, which is encouraging patients to seek affordable yet quality treatments abroad.

Key Market Trends & Insights

- Asia Pacific market dominated the global market in 2024 and accounted for the largest revenue share of 46.88%

- India market is anticipated to register the fastest growth rate during the forecast period.

- In terms of service segment, the dental implants segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.48 Billion

- 2033 Projected Market Size: USD 65.39 Billion

- CAGR (2025-2033): 20.41%

- Asia Pacific: Largest market in 2024

Moreover, the availability of advanced technology and skilled professionals in popular dental tourism destinations attracts international patients who require specialized procedures such as implants, cosmetic dentistry, and orthodontics. In addition, the ease of international travel, improved healthcare infrastructure, and relaxed visa policies have further supported market growth.Increasing Prevalence of Dental Abnormalities

The rising prevalence of tooth issues, such as misaligned teeth, tooth loss, discoloration, and other oral health concerns, combined with an increasing emphasis on aesthetic dentistry, drives market growth. Many people seek affordable, advanced oral treatments that restore functionality and improve their teeth's appearance.

As per the WHO estimates published in March 2025, oral diseases affect nearly 3.7 billion people worldwide, making them one of the most prevalent health challenges. Moreover, in 2019, oral diseases represented a significant global health burden, affecting nearly 3.5 billion people worldwide, with most cases concentrated in middle-income countries. The economic toll is immense, exceeding USD 380 billion annually, or about 4.8% of global direct health expenditures, underscoring the high cost of treatment and care. Untreated tooth decay alone impacts 2.5 billion people, while severe periodontal disease affects 1 billion, complete tooth loss affects 350 million, and oral cancer affects 380,000 individuals.

Case Study : Oral Health Challenges in the U.S.: Insights from the 2024 CDC Oral Health Surveillance Report:

Background:

Oral health is a vital aspect of overall well-being; however, disparities exist across different age groups, socioeconomic statuses, and racial and ethnic backgrounds in the United States. The 2024 Oral Health Surveillance Report by the Centers for Disease Control and Prevention (CDC) provides comprehensive data on tooth decay, tooth retention, and edentulism. This report offers valuable insights into the severity and prevalence of various oral health conditions.

Key Findings

-

Tooth Decay in Children:

-

Prevalence: Over 10% of children aged 2-5 years and nearly 20% of children aged 6-8 years have at least one untreated cavity in their primary teeth.

-

Disparities: Children from high-poverty families are nearly three times more affected (18%) than those from low-poverty families (6.6%).

-

Impact: The average number of untreated cavities and filled teeth varies significantly, with Mexican children having the highest average number of filled teeth at 4.2.

-

-

Tooth Decay in Permanent Teeth:

-

Adolescents and Adults: 10% of adolescents (ages 12-19) and 20% of adults (ages 20-64) have at least one untreated cavity in their permanent teeth.

-

-Risk Factors: Higher prevalence of tooth decay is associated with factors such as high poverty, minority racial groups, lower education levels, and smoking. For example, 41.4% of current smokers have untreated cavities.

-

- Severity: Adults aged 50-64 have a lower prevalence of untreated cavities at 17.3% compared to younger adults at 21.8%. However, the number of missing teeth due to disease increases with age.

-

-

Tooth Retention and Edentulism:

-

Tooth Loss: Over 10% of adults aged 65-74 and nearly 20% of adults aged 75 or older are edentulous, meaning they have lost all their teeth.

-

-Age and Socioeconomic Gaps: Older adults from high-poverty groups, with less education, and those who smoke exhibit significantly higher rates of tooth loss. For instance, 21.8% of Black adults aged 65 and older are edentulous, compared to the national average of 13%.

-

Average Tooth Count: Adults aged 20-34 have an average of 27 teeth, which declines steadily with age, reaching an average of 19.8 teeth among those aged 75 and older.

-

Case Observations

-

Disparities: The data reveal significant disparities in oral health outcomes that are influenced by factors such as race, income, education, and lifestyle choices such as smoking. These disparities highlight the need for targeted interventions to reach vulnerable populations.

-

Economic Burden: Untreated cavities and tooth loss in disadvantaged groups can result in higher healthcare costs, decreased quality of life, and increased risks of systemic health issues, including cardiovascular disease and diabetes.

-

Preventive Care Gaps: Many children and adults, particularly those in high-poverty households, are not receiving timely oral care. This gap indicates the necessity for public health initiatives, improved insurance coverage, and community-based oral acre programs.

Recommendations

-

Expand Access to Preventive Care: Implement school-based oral care programs and community clinics to provide screenings and preventive treatments.

-

Target At-Risk Populations: Create educational campaigns specifically designed for low-income and minority groups, focusing on oral hygiene and affordable treatment options.

-

Integrate Oral Health into Primary Care: Encourage regular tooth check-ups within primary healthcare settings to incorporate oral health as part of comprehensive health management.

-

Address Social Determinants: Enact policies to reduce poverty, enhance education, and reduce smoking rates, as these measures could indirectly improve oral health outcomes.

Growing Demand for Aesthetic Dentistry

Aesthetic dentistry enhances the appearance of one’s smile and boosts self-confidence, making it a highly sought-after service. Consequently, dental clinics in popular tourist destinations attract international patients who combine their treatments with leisure travel. This trend contributes to market growth, as clinics offer package deals, shorter recovery times, and personalized care tailored to clients worldwide.

In addition, cosmetic dentistry has been greatly transformed by new technologies and treatment methods. These advancements have brought about advanced tools, materials, and procedures that offer professionals more effective and efficient solutions. As a result, cosmetic treatments have become more accessible and attractive to patients. For instance, with 3D printing, dentists can use a digital wand to scan the teeth, design customized oral appliances, and print them directly in their on-site dental lab. This eliminates the requirement for old techniques, which allow for more precise and efficient oral care treatments.

Elevated Treatment Expenses in Developed Nations

In the U.S., routine check-ups cost USD 100-USD 300, while complex procedures can reach USD 1,500. Cosmetic treatments are often thousands. Countries such as Canada and Australia have lower prices, but costs still deter many. In Europe, prices vary, with Eastern Europe offering significant savings. Conversely, developing countries such as India, Mexico, and Thailand provide oral care services at much lower rates, with routine check-ups costing as little as USD 10-USD 20. These lower costs are due to low operational expenses and labor, with many clinics offering quality care. This affordability leads more patients from high-cost nations to seek oral care abroad, promoting the industry.

Basic Dental Procedures Costs by Country (USD)

Procedure

USA

Mexico

Thailand

Turkey

Costa Rica

India

Hungary

Check-up/Cleaning

150-300

30-50

40-60

30-50

45-70

15-30

35-55

Basic Filling

200-400

40-80

35-75

35-70

50-90

20-45

45-85

Tooth Extraction

150-450

50-100

45-90

40-80

55-120

25-60

50-100

X-rays (Full)

100-250

35-70

30-65

30-60

40-80

20-40

35-75

Source: LAND OF SMILE Dental Center in Turkey

Major Dental Procedures Costs by Country (USD)

Procedure

USA

Mexico

Thailand

Turkey

Costa Rica

India

Hungary

Root Canal

700-1500

200-500

150-450

150-400

250-500

100-300

200-450

Crown

800-2000

250-600

200-550

180-500

300-650

150-400

250-550

Dental Implant

3000-6000

700-1800

800-2200

650-1500

900-2000

500-1500

800-1900

Full Dentures

1000-3000

350-900

300-800

300-750

400-1000

200-600

350-850

Source: LAND OF SMILE Dental Center in Turkey

Cosmetic Dental Procedures Costs by Country (USD):

Procedure

USA

Mexico

Thailand

Turkey

Costa Rica

India

Hungary

Teeth Whitening

500-1000

150-400

125-350

120-300

175-450

100-300

150-400

Veneers (per tooth)

800-2500

300-800

250-700

200-600

350-850

200-600

300-750

Dental Bonding

300-600

100-250

80-200

75-180

100-300

50-150

90-220

Source: LAND OF SMILE Dental Center in Turkey

Access to Advanced Dental Technologies and Quality Care in Emerging Markets

Many patients from developed countries encounter high costs, long waiting times, and limited access to specialized treatments in their home countries. In contrast, emerging markets such as Mexico, Thailand, Turkey, and India offer state-of-the-art equipment, highly trained professionals, and internationally accredited clinics at a fraction of the cost.

These markets are increasingly investing in modern infrastructure, including digital imaging, laser dentistry, and implantology, which make complex procedures such as tooth implants, veneers, and cosmetic dentistry more accessible and affordable. For instance, in July 2025, Solventum, formerly known as 3M Health Care, launched its two innovative oral care products, the 3M Clinpro Clear Fluoride Treatment and 3M Filtek Easy Match, in Thailand. These products aim to enhance patient care and streamline oral procedures.

Miss Thamolwan Laovittayanurak, Business Leader, Dental Solutions, Solventum Thailand, said:

"For over 70 years, from 3M Healthcare to Solventum, we have earned trust as a leader in dental innovation. We continue to advance this expertise as a dedicated healthcare company, committed to inventing new solutions that address global health challenges. We adhere to the principles of 'listening and never stopping development,' paying close attention to real clinical contexts to deliver precise solutions that improve everyone healthier and create sustainable change."

Growing Partnerships Between Airlines and Dental Clinics

The growing collaboration between airlines and clinics is a significant market driver. This partnership enhances accessibility, affordability, and convenience for international patients seeking oral care treatments. Airlines often offer bundled packages that include discounted airfare, priority booking, and flexible travel arrangements when partnering with reputable clinics abroad. This integration simplifies the planning of medical trips, reduces travel-related stress, and provides cost-effective solutions compared to domestic treatments in high-cost regions.

Moreover, these partnerships foster trust and streamline logistics, encouraging more individuals to travel for tooth procedures. For instance, in March 2023, Bamboovement, a Dutch eco-conscious brand, partnered with KLM Royal Dutch Airlines to offer plastic-free dental kits for premium economy passengers. Launched in September 2022, these amenity kits feature bamboo toothbrushes and biodegradable toothpaste tablets. This initiative aims to tackle the problem of over one billion plastic toothpaste tubes, dental floss, and toothbrushes discarded in landfills and oceans yearly.

Expansion of Accreditation for International Dental Facilities

Accreditation from recognized bodies, such as the Joint Commission International (JCI), Accreditation Canada, and the International Society for Quality in Health Care (ISQua), ensures that clinics adhere to strict standards of care, hygiene, patient safety, and clinical excellence. This fosters greater trust among international patients seeking affordable, high-quality oral care treatments abroad. Consequently, more patients are willing to travel to countries such as Thailand, Mexico, Turkey, and India, where accredited centers offer lower-cost world-class services than their home countries.

For instance, Thailand’s Dental Council accreditation has attracted patients from Europe and Australia, while Mexico’s Council of Dental Accreditation ensures that clinics meet North American standards, drawing visitors from the U.S. Similarly, Turkey’s Joint Commission-accredited facilities are increasingly popular among patients from Europe and the Middle East seeking cosmetic dentistry and implants. These accreditations provide reassurance and promote cross-border healthcare, ultimately driving market growth.

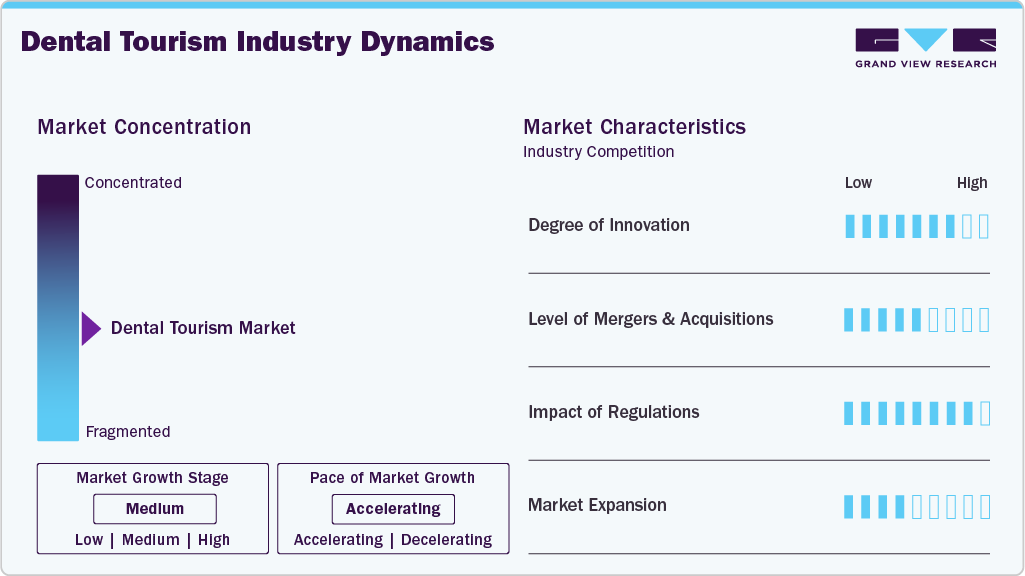

Market Characteristics & Concentration

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. There is a high degree of innovation, a moderate level of merger & acquisition activities, a high impact of regulations, and moderate industry expansion.

The industry is experiencing a high degree of innovation. In May 2025, Coastland Dental, a premier dental practice in Burbank, launched advanced oral care technologies to enhance patients' comfort, efficiency, and personalization of oral care. By incorporating iTero scanning, CAD/CAM same-day restorations, Digital Smile Design, and other innovative technologies, the practice aims to help patients achieve healthier, more confident smiles with greater ease. Dr. Artur Arkelakyan, the Founder of Coastland Dental, said:

“We are always looking for ways to make the dental experience better for our patients, so each visit is more comfortable, more predictable, and more efficient. Our new technologies allow us to deliver high-quality results while minimizing time in the chair and helping patients visualize their future smiles before even treatment begins.”

Several key players are actively engaging in partnerships & collaborations to promote growth & innovation and improve their competitiveness by combining the expertise & efforts of different organizations. For instance, in May 2025, Smile Source and ACT Dental announced their merger to form a united entity focused on empowering independent practices across the U.S. This strategic partnership combines ACT Dental's expertise in coaching and education with Smile Source's extensive network of over 1,000 private practice dentists. The aim is to provide enhanced support, resources, and a sense of community for dentists who seek to thrive in an evolving healthcare landscape.

The market is regulated by a variety of guidelines designed to ensure patient safety, quality of care, and ethical business practices. These regulations generally cover clinics' licensing and accreditation, cross-border healthcare delivery, patient rights, and data protection. Many countries require clinics to comply with national health standards, obtain professional certifications, and adhere to proper sanitation and infection control protocols. For instance, Thailand’s accreditation system for international healthcare providers, Mexico’s requirement for licensed professionals to treat foreign patients, and the European Union’s directive on cross-border healthcare ensure that patients can access treatment in other member states with transparent pricing and quality standards.

In September 2025, Pearl launched Imagecheck, an innovative AI-powered platform for real-time quality assurance of dental X-rays. Unlike traditional methods that evaluate image quality after capture, Imagecheck seamlessly integrates into clinical imaging workflows, providing immediate, automated feedback at the point of capture. The platform also includes reporting capabilities that track performance across multiple providers or offices, helping to standardize imaging practices and identify training needs. Currently available as an add-on to Pearl’s Second Opinion product, Imagecheck is set to integrate with leading imaging and practice management platforms and has received regulatory approvals in over 120 countries.

Service Insights

Based on service, the dental implants segment held a significant share of 37.24% in 2024. The rising incidence of dental injuries due to car accidents and sports injuries supports the need for dental implants. According to a report by the American Academy for Implant Dentistry, each year, over 15 million individuals in the U.S. receive crown and bridge replacements for missing teeth, supporting the need for tooth implants. Dental implants are long-term replacements that are said to be a restorative treatment that protects and supports natural bone while simultaneously serving as a secure foundation for a prosthesis.

The dental cosmetics segment is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to the increased awareness of aesthetics, affordability, and advanced treatment options. As people pay more attention to their physical appearance, influenced by social media and a desire for improved self-confidence, many seek cosmetic oral procedures such as teeth whitening, veneers, and smile makeovers. Moreover, internationally accredited clinics, advanced dental technologies, and skilled cosmetic dentists attract patients from areas where such services may be expensive or limited.

Providers Insights

Based on providers, the dental clinics segment held a significant share of 48.70% in 2024. This growth is primarily driven by the improved global connectivity, streamlined visa processes, and favorable exchange rates, making traveling for oral care more accessible and appealing. Moreover, increasing awareness of dental health and cosmetic dentistry, and attractive package deals that combine treatment with leisure travel have further encouraged patients to opt for foreign clinics. Many destinations also offer shorter waiting times and personalized care, effectively addressing the limitations of domestic healthcare systems. These combined factors continue to drive the expansion of clinics that cater to the growing demand for cross-border dental care.

The hospitals segment is expected to grow at the fastest CAGR during the forecast period. This is due to rising healthcare costs in developed countries, and the increasing demand for affordable, high-quality oral care treatments has led many patients from North America, Europe, and Australia to seek cost-effective procedures abroad. Treatments such as dental implants, cosmetic dentistry, and orthodontics are often available at a fraction of the price in countries such as Mexico, Thailand, Hungary, and India. Moreover, hospitals in these emerging markets invest in advanced dental technologies and internationally accredited facilities and hire skilled professionals to attract global patients. The availability of tailored oral care tourism packages, which include travel, accommodation, and post-treatment care, further enhances the appeal of seeking dental services internationally.

Regional Insights

Asia Pacific accounted for the largest revenue share in 2024 due to the strong dental care markets in India, Thailand, and Malaysia. The cost of treatment in countries such as India, Brazil, and Thailand is one-third that in the UK or the U.S. Medical tourism destinations provide affordable and easily accessible services, such as medical, cosmetic, and dental surgeries, at significantly lower costs. Low labor cost is the major factor for affordable medical treatment at popular medical tourism destinations.

Japan Dental Tourism Market Trends

The dental tourism market in Japanheld a significant revenue share in 2024. The introduction of ZimVie's next-generation TSX dental implant in February 2024 in Japan is enhancing the country's dental tourism sector. Japan is a strategic hub for advanced dental procedures. The innovative design of the TSX implant focuses on improved primary stability and peri-implant health, addressing the rising demand for immediate and reliable dental solutions. In addition, its compatibility with digital workflows streamlines procedures, attracting international patients seeking top-quality oral care. This advancement positions Japan as a premier destination for dental tourism, offering cutting-edge treatments that appeal to a global clientele.

India dental tourismis driven by establishing a state-level dental council to expand oral care services to rural communities. Rural areas have long faced gaps in oral healthcare access due to limited infrastructure, workforce shortages, and lower awareness, creating a large, underserved patient base. By setting up a Dental Council, the state provides a structured framework for regulating standards, incentivizing practitioners, and facilitating partnerships with private players. This opens opportunities for dental tourism to step in with scalable models that centralize administration, enable group practices, and bring affordable preventive and restorative care to remote populations.

In addition, such initiatives often come with government support, public-private collaborations, and funding for mobile clinics and outreach programs, which reduce entry barriers for dental tourism. Hence, the council’s focus on rural expansion improves healthcare equity and creates fertile ground for dental tourism to grow its networks, tap into new patient segments, and strengthen its market presence in India.

North America Dental Tourism Market Trends

The dental tourism market in North America held a significant revenue share in 2024. The U.S. presently has the major cluster of dental tourism across the globe. This is because the country has good reimbursement policies, the presence of key providers, and a rising oral care services market. As per Straumann, independent practices in North America, China, and Europe have decreased over the years. There is a rise in demand for dental tourism, which is anticipated to boost the market growth in the region.

The U.S. dental tourism market is experiencing significant growth, driven by the aging population, which is leading to increased demand for restorative and prosthetic oral care services as seniors utilize more dental care. In addition, expanding benefits and Medicaid at the state level brings more patients into the healthcare system, further increasing demand. There’s also a noticeable shift among younger dentists who prefer employment over solo practice ownership due to various challenges, including administrative burdens and student debt, resulting in more practice sales to dental tourism.

Moreover, private equity and strategic investors are keen on investing in scalable healthcare platforms, facilitating the acquisition and funding of dental tourism. In January 2025, VideaHealth secured USD 40 million in an oversubscribed Series B funding round led by Spark Capital. The funds will enhance VideaHealth's AI-driven diagnostic technology to improve oral care, increase diagnostic accuracy, and streamline workflows. The investment aims to scale operations, expand partnerships with dental tourism and insurers, and advance technology development for broader adoption of AI in dentistry.

Europe Dental Tourism Market Trends

The dental tourism market in Europe is expected to witness high growth due to the varied dynamics in key countries. Germany, despite its slow consolidation due to a prevalence of single-dentist practices and strong statutory insurance, is recovering in M&A activity. The UK is witnessing a boom in private dentistry driven by dissatisfaction with NHS services, providing opportunities for dental tourists to expand. Meanwhile, Spain's fragmented market offers significant consolidation potential, despite challenges faced by low-cost chains. Moreover, companies such as Colosseum Dental Group operate over 620 modern, well-equipped clinics and 50 dental laboratories across eleven European countries, treating over 6 million patients per year with the support of more than 12,500 dental professionals. The Group’s investments in innovations, modern technologies, and digital workflows improve patient outcomes & service efficiency and enhance operational integration and scalability.

Italy dental tourism market is currently undergoing consolidation, as larger dental tourism companies are engaged in investment strategies to expand their network and market share. For instance, Adria Dental Group's strategic investment in Implant Centre Martinko significantly enhances the dental tourism sector in Italy. This expansion introduces a network known for its advanced dental implantology and aesthetic dentistry to the Italian market, providing high-quality treatments at competitive prices. Italy, already a favored destination for dental tourism, will benefit from this development as patients gain access to state-of-the-art facilities and internationally recognized expertise. The presence of Adria Dental Group in Italy not only raises the standard of dental care but also attracts international patients seeking affordable, top-tier dental services. This, in turn, stimulates the local economy and reinforces Italy's position as a leading hub for dental tourism.

Dr Damir Martinko, the founder of Implant Centre Martinko, shared:

“Joining Adria Dental Group marks a transformative milestone for our clinic. This collaboration enhances conditions for our dedicated staff and elevates the level of care we provide to our patients. As pioneers in establishing Croatia as a top destination for premium dental care, we are now positioned to build on this success with the support and expertise of Adria Dental Group.”The dental tourism market in Spain is influenced by the increasing strategic alliances, such as mergers and collaborations by market players. For instance, in February 2024, Alantra Private Equity acquired a majority stake in 13 dental laboratories, boosting Spain's dental tourism sector. The focus is on labs specializing in high-demand services like prosthetics and orthodontics. By consolidating these under the Digitaldent brand, operational efficiency and treatment quality improve, enhancing the patient experience. Plans to expand to at least 25 laboratories and enter other European markets indicate a commitment to growth in response to rising demand, further strengthening Spain's position in dental tourism and contributing to economic growth.

Latin America Dental Tourism Market Trends

The dental tourism market in Latin America is anticipated to grow significantly due to increasing demand for affordable and standardized dental care, driven by a growing middle class and government oral health initiatives. A notable shortage of independent dental practices in rural and semi-urban areas presents opportunities for dental tourism to provide consistent services. The rise of digital dentistry and teledentistry enhances efficiency, attracting patients and dentists. In addition, private equity and international dental groups are investing in the region, motivated by its fragmented market and potential for consolidation. These trends are collectively propelling the growth of the dental tourism model in Latin America.

Brazil dental tourism market held the largest market share in 2024 due to the CIGOH's focus on sustainable oral health at a major dental conference in January 2025, which boosts the country's market by raising awareness of oral health. This fosters public and private investments in preventive care and aligns dental tourism's goals of standardizing practices and expanding access. The conference encourages using eco-friendly materials and efficient resource management, enhancing patient trust in quality care. Moreover, it promotes collaboration between academia, government, and corporate dental groups, facilitating the rapid expansion of dental tourism across Brazil.

Middle East and Africa Dental Tourism Market Trends

The dental tourism market in MEA is anticipated to grow significantly due to increased demand for accessible and affordable dental care, driven by population growth, urbanization, and heightened awareness of oral health. A rising middle class and higher disposable incomes are boosting interest in basic and cosmetic dental services. Government investments in healthcare and the shortage of dentists, especially in rural areas, create a favorable dental tourism environment. Integrating digital technologies such as teledentistry and AI enhances patient care, while international dental groups and private equity investments foster consolidation in the sector.

The UAE dental tourism market is witnessing an increasing awareness of oral health and growing strategic initiatives such as acquisitions and collaborations by market players to expand their global reach. For instance, in May 2023, Al Meswak Dental Clinics acquired dental facilities in the UAE, further enhancing the country's market by increasing capacity and accessibility for international patients. With improved infrastructure and advanced technology, Al Meswak offers comprehensive, high-quality treatments that attract foreign patients seeking affordable care. This growth reinforces the UAE's reputation as a leading medical tourism destination, streamlining patient experiences and boosting confidence in preventive and cosmetic dental services.

Key Dental Tourism Company Insights

The market is fragmented, with many dental service providers present. The market players undertake several strategic initiatives to maintain their position and grow, such as partnerships and collaborations, product launches, mergers and acquisitions, and geographical expansion.

Key Dental Tourism Companies:

The following are the leading companies in the dental tourism market. These companies collectively hold the largest market share and dictate industry trends.

- Franco-Vietnamese Hospital

- Apollo Hospitals Enterprise Ltd.

- Fortis Healthcare

- Clove Dental

- Medlife Group

- Raffles Medical Group

- Oris Dental Centre

- Dubai Dental Hospital

- Imperial Dental Specialist Center

- Liberty Dental Clinic

- ThantakIt International Dental Center

- ARC Dental Clinic

Recent Developments

- In August 2025, Empower Dental Upland opened in California, expanding the Empower Dental Group’s presence in the state. The new practice focuses on advanced dental technology, personalized treatment, and compassionate care for the Upland community. Combining innovative equipment with a patient-centered approach aims to enhance oral health and provide accessible, high-quality dental services to meet the region's growing demand.

"From the very beginning, our goal was to create a space where patients could feel both reassured and empowered," said Dr. Khachatryan. "Technology is an essential part of that vision. It allows us to deliver predictable outcomes and reduce recovery times while keeping patient experience at the center."

- In July 2024, Dental Care Alliance (DCA) initiated a groundbreaking deployment of Overjet's artificial intelligence (AI) technology across its over 400 affiliated practices. This collaboration marks a significant advancement in dental care, as it combines DCA's extensive reach with Overjet's FDA-cleared AI platform, which is trained on millions of X-rays to detect, outline, and quantify oral diseases with millimeter-level precision. This initiative encourages trust and understanding between clinicians and patients, which may result in higher case acceptance rates.

“Transforming dental care through AI isn’t just about innovation or technology,” said Jason Heffelfinger, CEO of Dental Care Alliance. “It’s about empowering our supported providers, advancing precision, personalizing patient experiences, and pioneering a new era of oral health. We are proud to partner with Overjet as the first DSO to implement this game-changing platform across our family of more than 400 affiliated practices.”

- In July 2024, Smartee Denti-Technology's collaboration with Spring Airlines to unveil a themed airplane at Shanghai Hongqiao International Airport marks a significant milestone in dental tourism. This innovative partnership celebrated the 20th anniversaries of both companies and features an aircraft decorated with Smartee's branding. This design symbolizes their commitment to aesthetic excellence in invisible orthodontics.

Dental Tourism Market Report Scope

Report Attribute

Details

Market size in 2025

USD 14.80 billion

Revenue forecast in 2033

USD 65.39 billion

Growth rate

CAGR of 20.41% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, providers, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Costa Rica; Mexico; Italy; Spain; Poland; Czech Republic; Hungary; Croatia; Japan; China; India; Thailand; Malaysia; Philippines; Brazil; UAE; Israel; Turkey

Key companies profiled

Franco-Vietnamese Hospital; Apollo Hospitals Enterprise Ltd.; Fortis Healthcare; Clove Dental; Medlife Group; Raffles Medical Group; Oris Dental Centre; Dubai Dental Hospital; Imperial Dental Specialist Center; Liberty Dental Clinic; ThantakIt International Dental Center; ARC Dental Clinic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

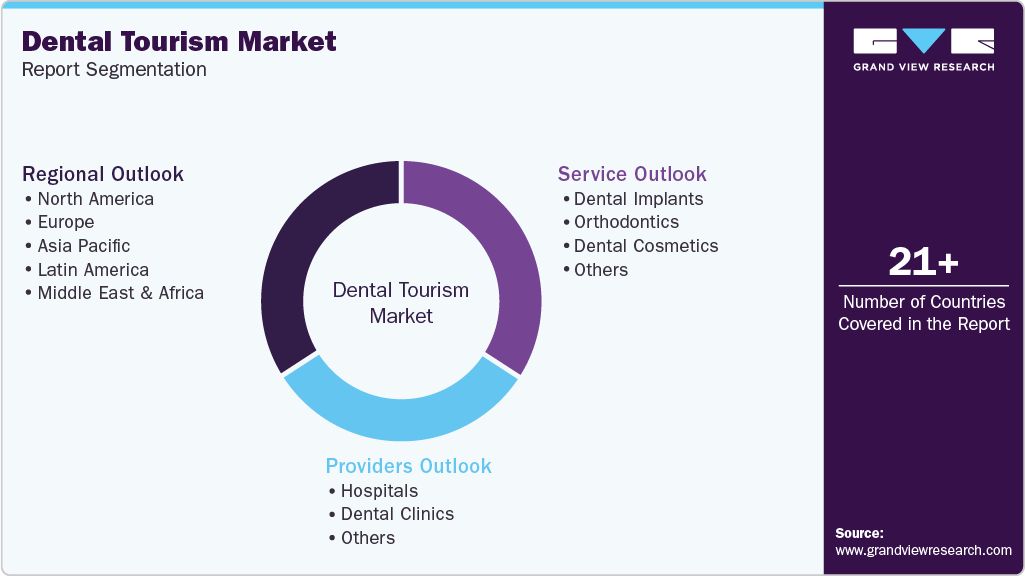

Global Dental Tourism Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global dental tourism market report based on service, provider, and region.

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Dental Implants

-

Orthodontics

-

Dental Cosmetics

-

Others

-

-

Providers Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hospitals

-

Dental Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Costa Rica

-

Mexico

-

-

Europe

-

Italy

-

Spain

-

Poland

-

Czech Republic

-

Hungary

-

Croatia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Malaysia

-

Philippines

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Israel

-

Turkey

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.