- Home

- »

- Healthcare IT

- »

-

Dental Simulator Market Size & Share, Industry Report, 2030GVR Report cover

![Dental Simulator Market Size, Share & Trends Report]()

Dental Simulator Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Application (Dental Training & Education, Treatment Planning), By End-use (Dental Schools, Hospitals & Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-972-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Simulator Market Size & Trends

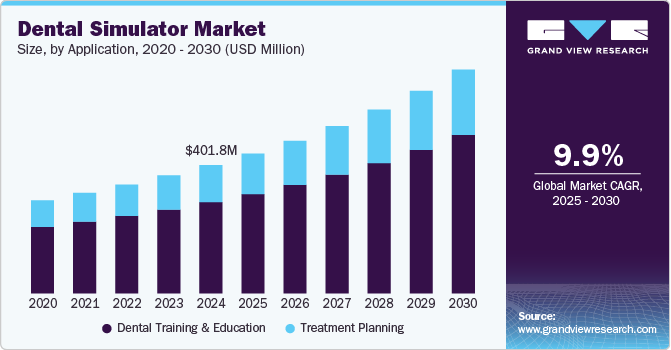

The global dental simulator market size was estimated at USD 401.8 million in 2024 and is expected to grow at a CAGR of 9.87% from 2025 to 2030. The growth is attributed to the growing need to implement simulation-based training in dental practices, such as surgery, thereby reducing the cost spent on cadavers and other study models, and the rising awareness about human-like dental simulators with haptic feedback responses in dental schools of developing countries. In addition, the advancements in dental treatment outcomes enabled using smile simulators are further fueling industry growth.

Virtual reality has been extensively applied in dentistry to assist dental training and to replace traditional teaching methods in preclinical practices. Technological and scientific developments have gradually combined dentistry with cloud-computing, deep learning technology, and 5G to offer students better learning assistance with diverse training modules. Simulation units also include patient simulators that display symptoms of dental diseases and respond to the treatment, thereby showing simulated emotions. This feature aids dental training practitioners to enhance their skills in handling patients.

Moreover, companies in the dental simulator industry are launching various technologically advanced solutions with better features, which is also enhancing growth. For instance, in February 2021, Uni Sim introduced the world’s first portable dental training simulator, incorporating advanced virtual reality and haptics technology. The innovative solution includes a laptop and haptic device, enabling dental students to practice treatment procedures virtually from home or any remote location. This groundbreaking development is set to redefine dental education by offering a flexible and immersive training experience.

The rising number of dental education programs is a significant factor contributing to the growth of the industry. This expansion necessitates an increased demand for advanced training tools and equipment, particularly dental simulators. These simulators are essential in practical training settings, enabling students to hone their skills within a controlled environment. According to the Commission on Dental Accreditation’s report on enrollment and graduation trends for dental education programs for the 2023-24 academic year, published in March 2024, there has been a 9.1% increase in accredited predoctoral dental education programs in the U.S. from 2019 to 2023. In addition, advanced programs saw a modest increase of 0.7%. This growth in accredited programs reflects a heightened interest in dental education, which is expected to drive the utilization of these simulators for training students enrolled in these programs.

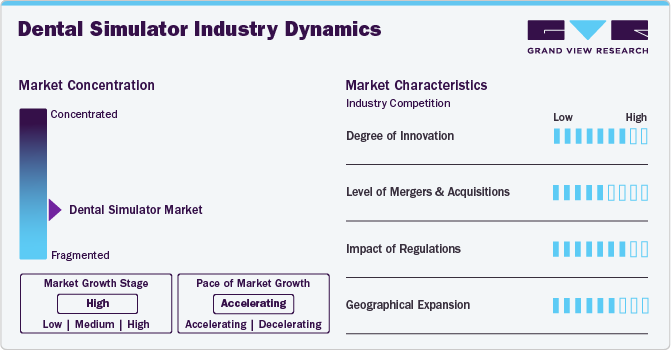

Market Concentration & Characteristics

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. The x-axis shows the level of industry concentration, ranging from low to high. The y-axis represents various market characteristics, such as degree of innovation, impact of regulations, industry competition, service and product expansion, level of partnerships and collaboration activities, and regional expansion.

The industry is experiencing a high degree of innovation. Innovations such as the integration of features such as pressure sensors, timers, and Bluetooth connectivity, not only improve the effectiveness of dental Simulators but also make them more appealing to consumers. These advancements allow for personalized oral health management, where devices can track specific issues like gingivitis or teeth grinding and provide tailored recommendations for users.

The emphasis on creating realistic simulations for training purposes also reflects a commitment to innovation within the sector, as these tools are essential for developing practical skills among dental professionals. For instance, Nissin Dental Products Inc. has a large range of advanced simulators specifically designed as pediatric, geriatric, and interactive humanoid patient simulators. These simulators simulate the expressions and reactions depending on the accidents made during the treatment. Such advanced units attract the attention of dental students and increase their compliance and convenience in learning.

Several key players are actively engaging in mergers & acquisitions to foster growth & innovation and improve their competitiveness by combining the expertise & efforts of different organizations. For instance, in January 2022, Dentsply Sirona announced its partnership with the University of Toulouse in France to introduce the company’s simulation units as preclinical laboratory equipment.

The regulatory framework for the dental Simulators industry involves compliance with industry-specific guidelines and standards to enhance oral health and hygiene and is subject to strict regulations primarily governed by the U.S. Food and Drug Administration (FDA). For instance, manufacturers must classify their devices according to the risk they pose, with dental Simulators typically falling under Class II or Class III categories. Class II devices require a premarket notification (510(k)) demonstrating that the device is substantially equivalent to an already marketed device, while Class III devices necessitate a more rigorous premarket approval (PMA) process due to their higher risk profile. Additionally, manufacturers must comply with Good Manufacturing Practices (GMP) to ensure quality control throughout production.

The industry is experiencing significant geographical expansion as institutions worldwide increasingly recognize the value of advanced training technologies. Emerging markets, particularly in Asia-Pacific, are witnessing rapid adoption due to the growing demand for modernized dental education. Countries like India are at the forefront, with leading institutions integrating simulation technologies to enhance training standards.

Component Insights

Based on components, the hardware segment dominated the market with the largest revenue share of 73.18% in 2024 and is anticipated to grow at a significant CAGR from 2025 to 2030. Hardware facilities in dental simulators comprise display devices, such as 3D glasses and 2D display units, other stereoscopic display systems, and simulation tools, such as handheld styluses, foot control pedals, and physical hand or finger rests. The growth of the segment is owing to the rising adoption of electrically connected care technologies in dental healthcare and education, and the availability of many simulation workstations, phantom heads, patient simulators, and accessories.

Furthermore, the software segment is expected to grow at a significant CAGR of 10.14% over the forecast period. The increasing number of people adopting dental training and treatment simulation software due to its convenience and cost-effectiveness is anticipated to drive the growth of this segment over the forecast period. The training simulation software comprises training contents of different dental fields, with fundamental skills and clinical cases. It also has teaching & practice systems, evaluation (automatic & teacher-guided), force feedback, and simulated operating sounds.

Application Insights

Based on application, the dental training & education segment dominated the market with the largest revenue share in 2024. The growth of this segment can be attributed to many dental graduates around the world showing interest in new ways of learning dentistry with proper dental simulation units. Education systems are constantly evolving with new trends & technologies, and advanced concepts, such as simulation tools, are already embraced in dental training.

Moreover, the global migration of dental students to access such advanced holistic approaches is enhancing the opportunities for the market. For instance, in January 2023, the University of Saskatchewan College of Dentistry integrated augmented reality simulators into its dental training program, marking a significant advancement in how dental students learn and practice their skills. These simulators provide a realistic environment for students to engage in procedures such as drilling, filling, and cleaning teeth on virtual patients.

The treatment planning segment is expected to grow at a significant CAGR during the forecast period. The growth is attributed to the rising dental consciousness among the population coupled with the convenience of undergoing dental simulation to simulate outcomes before undertaking any treatment. The availability of a significant number of such smile-simulating and treatment-simulating software coupled with cost-effective subscription options is anticipated to boost segment growth.

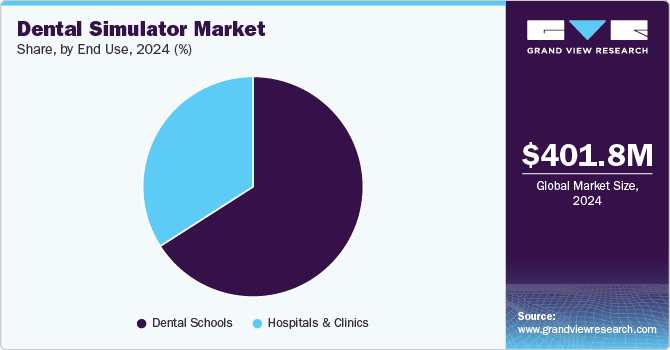

End Use Insights

Based on end use, the dental school segment dominated the market with a revenue share of over 65.00% in 2024. The growing number of dental schools in developing countries with better simulation training facilities is attributed to the growth of the segment. For instance, there are over 310 dental schools in India, and most of them are privately held with better infrastructure units. In addition, dental education tourism in developed countries is significantly contributing to segmental growth.

The hospitals & clinics segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is driven by the rising incorporation of dental treatment simulator units and software in dental hospitals. Moreover, a few simulation clinics are specifically organized to provide simulation-based training for students and fresh graduates.

An increasing focus on advanced learning, cost-effectiveness, minimizing errors, and replacing cadaver models are widely fueling the growth of the segment. In March 2023, Planmeca unveiled several new AI-based tools for its comprehensive dental software platform, Planmeca Romexis. Planmeca Romexis is a versatile and robust software platform designed to accommodate a wide array of 2D and 3D imaging, as well as CAD/CAM applications. It offers a comprehensive solution suitable for various dental specialties and clinics of all sizes.

Regional Insights

North America dental simulator market dominated the global industry with the largest revenue share of over 39.34% in 2024. The growth is attributed to the increasing investments in advanced equipment to improve patient care and maintain a competitive edge in dental practices. In July 2023, The Elite Practice reported that the Canada Digital Adoption Program (CDAP) announced a total funding of USD 4 billion aimed at assisting small- to medium-sized enterprises in adopting digital technologies.

In addition, the growth of dental tourism and robust healthcare infrastructure further bolsters market expansion. According to PlacidWay, LLC, Mexico and Costa Rica stand out as the most affordable and high-quality destinations for dental tourism globally, where patients can access cost-effective dental treatments comparable to those available in other countries.

Moreover, the region acts as a center for innovation, with companies consistently advancing simulation technology. The proactive stance of regulatory agencies in maintaining product quality and ensuring patient safety boosts the credibility of dental simulators within the area. In addition, the presence of prominent manufacturers and research institutions significantly contributes to the dental simulator industry expansion.

U.S. Dental Simulator Market Trends

The dental simulator market in the U.S. held the largest share in 2024. The equipped clinics and facilities offer advanced technology that allows dental students and professionals to practice their skills in a controlled environment. These clinics utilize various simulators, including manikins and virtual reality systems, to replicate real-life dental procedures. For instance, in August 2024, the Case Western Reserve University School of Dental Medicine announced a significant upgrade to its simulation clinic, which involved an investment of USD 2.6 million. This upgrade is aimed at enhancing the educational experience for dental students by providing them with state-of-the-art facilities and technology that simulate real-world clinical environments.

Europe Dental Simulator Market Trends

The dental simulator market in Europe is experiencing significant growth, driven by the increasing emphasis on modernizing dental education and enhancing training methodologies. Moreover, Universities and training institutions across Europe are adopting these technologies to address the demand for skilled professionals and improve patient care outcomes.

For instance, in 2021, the School of Dentistry at Leeds University became the first in the world to implement haptic simulators powered by proprietary software. This innovative system utilizes dental models derived from real patients, featuring anatomically accurate contact points and gingival margins, setting a new standard in dental training technology. Moreover, institutions in countries like Germany, France, and the UK are leading in integrating dental simulators into their curricula, setting benchmarks for innovation and fostering a new generation of proficient dental practitioners.

The UK dental simulator market is expected to grow significantly over the forecast period. The growth is driven by increasing emphasis on hands-on training in dental education. Traditional methods often involve observing procedures or practicing on patients with limited prior experience. In September 2023, the new CGDent-GC Award initiative was launched, which is aimed at enhancing the skills and knowledge of Foundation Dentists in the field of aesthetic dentistry. This award represents a collaboration between the College of General Dentistry (CGDent) and GC, a well-known manufacturer of dental materials and equipment. The primary goal is to provide comprehensive training that focuses on aesthetic dental procedures, which are increasingly in demand among patients.

The dental simulator market in Germany held a significantshare in 2024. The increasing International Dental Show (IDS) which serves as a pivotal platform for innovation and networking within the dental industry, significantly influences the growth of dental Simulators in Germany. The IDS 40th edition took place in March 2023 in Cologne, Germany. This biennial exhibition is recognized as one of the largest and most important trade fairs for dental professionals worldwide. The event typically attracts a diverse audience, including dental practitioners, manufacturers, suppliers, and other stakeholders in the dental field.

Asia Pacific Dental Simulator Market Trends

The dental simulator market in Asia Pacific is anticipated to register the fastest growth rate during the forecast period. The fast-paced growth can be attributed to the improving penetration of simulation studies in dental practices. The growing adoption of dental tool manufacturing facilities in the region is supporting the growth of the regional market. Furthermore, increasing investments in the dental healthcare sector in countries, such as Australia, China, India, and Japan, among others, are also expected to augment the region’s growth.

Japan dental simulator market held a significant revenue share in 2024. The Japanese government has actively promoted oral health initiatives aimed at improving public awareness about dental hygiene. Campaigns that encourage regular dental check-ups and proper brushing techniques have led to an increased acceptance of innovative dental products like Simulators. A notable example is the introduction of smart toothbrushes that connect to mobile apps, allowing users to track their brushing habits and receive personalized feedback on their oral care routines. This integration of technology into everyday dental care has resonated well with tech-savvy consumers in Japan.

The dental simulator market in India is witnessing growth as educational institutions increasingly adopt advanced technologies to enhance dental training and education. These simulators, integrating virtual reality and haptics, provide a hands-on, immersive learning experience for students, improving skill development and practice efficiency. The growing emphasis on modernizing dental education is driving the demand for such innovative solutions across the country.

For instance, Saveetha Dental College and Hospitals became the first institution in India to adopt Virteasy Dental simulators. Despite the challenges of the pandemic, the installation and training processes were conducted virtually, showcasing the flexibility of the technology. The setup, featuring five simulators and phantom heads, highlights the college's commitment to advancing dental education and sets a precedent for other institutions in the country.

Key Dental Simulator Company Insights

The market is fragmented, with the presence of several market players.The market players undertake several strategic initiatives, such as partnerships & collaborations, product launches, mergers & acquisitions, and geographical expansion to maintain their position and grow in the market.

Key Dental Simulator Companies:

The following are the leading companies in the dental simulator market. These companies collectively hold the largest market share and dictate industry trends.

- Dentsply Sirona

- Nissin Dental Products Inc.

- KaVo Dental

- HRV Simulation

- Navadha Enterprises

- VOXEL-MAN

- Image Navigation

- Tangshan UMG Medical Instrument Co., Ltd.

- Dental Art S.p.A.

- 3Shape A/S

Recent Developments

-

In May 2024, DS Core launched the SureSmile Simulator, powered by a digital tool designed to enhance treatment acceptance in orthodontics through advanced visualization techniques. This system allows dental professionals to create highly detailed 3D simulations of potential treatment outcomes for patients. By providing a visual representation the simulator aims to improve patient understanding and engagement in their orthodontic treatment plans.

-

In July 2023, the University of Portsmouth introduced UNI-SIM, a cutting-edge haptic and virtual reality training simulator designed specifically for medical education. This innovative platform aims to enhance the learning experience for future doctors by providing realistic simulations that mimic real-life medical scenarios. The integration of haptic feedback allows users to engage with the simulator in a way that closely resembles actual physical interactions, making it an invaluable tool for training.

-

In March 2023, Planmeca showcased a comprehensive array of innovative products across various categories, including dental care units, imaging devices, software solutions, and CAD/CAM technologies at the International Dental Show (IDS). This event is recognized as one of the leading trade fairs for dental professionals globally, providing a platform for companies to present their latest advancements and technologies.

Dental Simulator Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 437.8 million

Revenue forecast in 2030

USD 701.1 million

Growth rate

CAGR of 9.87% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Norway, Denmark, Sweden, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, and Kuwait

Dentsply Sirona; Nissin Dental Products Inc.; KaVo Dental; HRV Simulation; Navadha Enterprises.; VOXEL-MAN; Image Navigation; Tangshan UMG Medical Instrument Co., Ltd.; Dental Art S.p.A.; 3Shape A/S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Simulator Market Report Segmentation

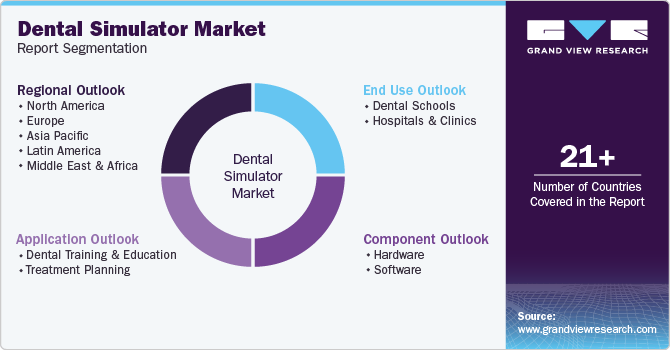

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental simulator market report based on component, application, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Training & Education

-

Treatment Planning

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Schools

-

Hospitals & Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental simulator market size was estimated at USD 401.8 million in 2024 and is expected to reach USD 437.8 million in 2025.

b. The global dental simulator market is expected to grow at a compound annual growth rate (CAGR) of 9.87% from 2025 to 2030 to reach USD 701.1 million by 2030.

b. North America dominated the dental simulator market with the largest revenue share of 39.34% in 2024. This is attributable to the high penetration of simulation dental technologies in the region coupled with the presence of a large number of key players.

b. Some key players operating in the dental simulator market include Dentsply Sirona; Nissin Dental Products Inc.; KaVo Dental; HRV Simulation; Navadha Enterprises.; VOXEL-MAN; Image Navigation; Tangshan UMG Medical Instrument Co., Ltd.; Dental Art S.p.A.; 3Shape A/S

b. Key factors that are driving the dental simulator market growth include the advancements in virtual reality and haptics, increasing demand for experiential learning, rising dental education standards, and the need for cost-effective, safe training environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.