- Home

- »

- Medical Devices

- »

-

Dental Impression System Market Size, Industry Report, 2033GVR Report cover

![Dental Impression System Market Size, Share & Trends Report]()

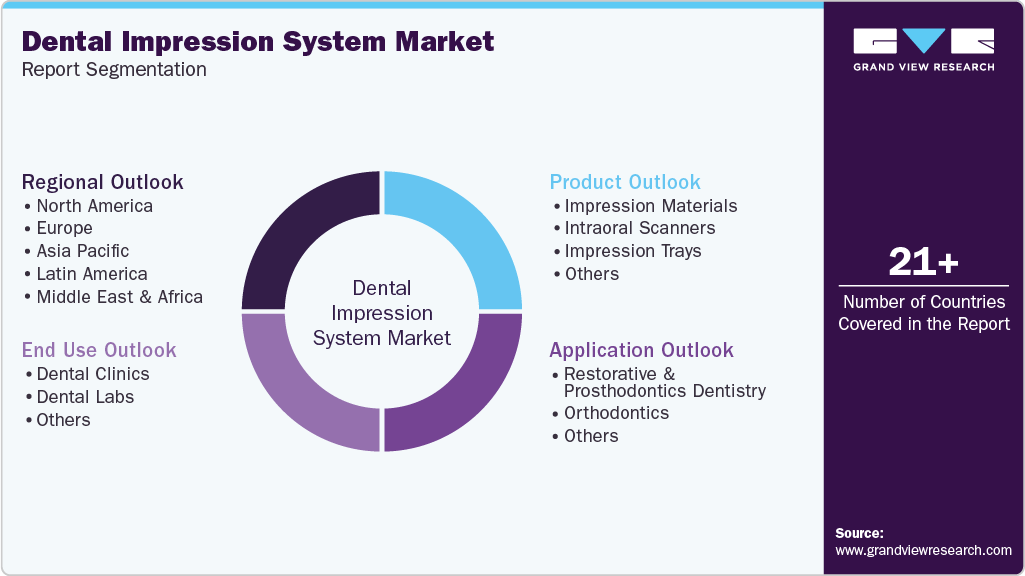

Dental Impression System Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Impression Materials, Intraoral Scanners), By Application (Restorative & Prosthodontics Dentistry, Orthodontics), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-318-2

- Number of Report Pages: 187

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Impression System Market Summary

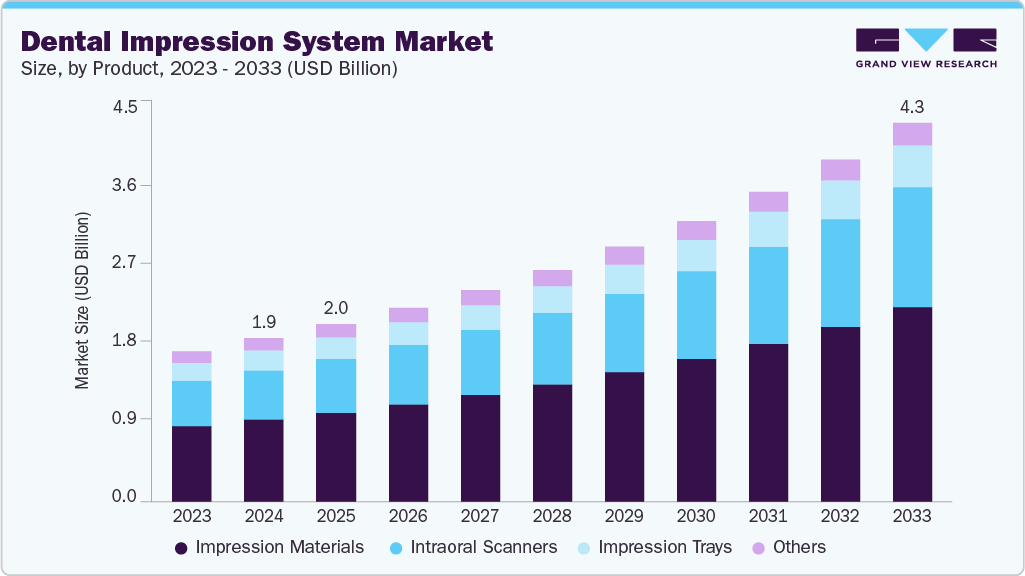

The global dental impression system market size was estimated at USD 1.86 billion in 2024 and is projected to reach USD 4.31 billion by 2033, growing at a CAGR of 9.9% from 2025 to 2033. The dental impression system market is primarily driven by increasing demand for precise, digital, and CAD (Computer-Aided Design)/CAM (Computer-Aided Manufacturing) solutions, rising dental disorders, and advancements in impression materials.

Key Market Trends & Insights

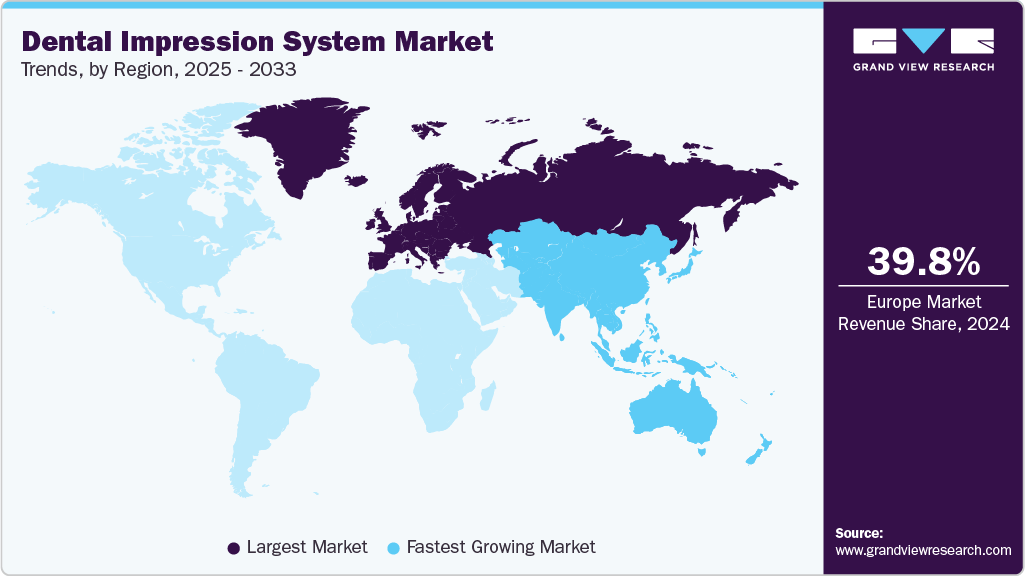

- Europe dominated the dental impression system market with the largest revenue share of 39.81% in 2024.

- The dental impression system market in the U.S. accounted for the largest market revenue share of 84.46% in North America in 2024.

- Based on product, the impression materials segment led the market with the largest revenue share of 50.18% in 2024.

- Based on application, the restorative & prosthodontics dentistry segment led the market with the largest revenue share of 49.86% in 2024.

- By end use, the dental clinics segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.86 Billion

- 2033 Projected Market Size: USD 4.31 Billion

- CAGR (2025-2033): 9.9%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing dental tourism and technological innovations enhance accuracy and patient comfort, fueling market growth. In addition, the adoption of digital impression systems boosts efficiency and reduces turnaround time. The growing prevalence of dental disorders-including tooth decay, periodontal disease, tooth loss, dental caries, and plaque-is a key driver of the dental impression systems market. According to the World Health Organization, published in March 2025, over 1 billion people globally suffer from severe periodontal disease and overall oral diseases affect nearly 3.7 billion people globally. In addition, nearly 7% of adults aged 20+ and around 23% of those aged 60+ experience complete tooth loss, increasing the need for dentures and implants that require precise dental impressions. A report by Humble Memorial Dental published in February 2025 states that 3.5 billion people suffer from oral diseases globally, with cavities affecting over 90% of adults and gum disease impacting nearly half of those aged 30 and above. This rising disease burden significantly boosts demand for dental impression materials, scanners, and trays used in restorative and prosthetic procedures.

Furthermore, dental disorders affec both children and adults across various age groups, highlighting a widespread oral health challenge that underscores the growing need for effective dental impression materials and systems.

In addition, the growing demand for cosmetic dentistry is expected to drive the dental impression systems market significantly. As patients increasingly prioritize appearance and smile enhancement, there is a notable rise in procedures such as dental implants, veneers, crowns, and dentures. According to a study published by Twin Dental New York in June 2025, approximately 5 million new dental implants are placed annually in the U.S. alone.

According to data from Total Health Dental Care published in April 2025, approximately 15 million adults in the U.S. have received crown and bridge replacements for missing teeth. This rising demand for cosmetic and restorative dentistry is expected to drive sustained growth in the dental impression system market.

Trends in Cosmetic & Restorative Dental Care

-

Teeth whitening remains the most popular cosmetic dental treatment (According to American Dental Association)

-

In the U.S., over 150 million people are missing at least one tooth, yet only about a million receive treatment each year, accounting for approximately 2.5 million implants. (According to American Academy of Implant Dentistry, AAID, 2022)

-

Invisalign is the leading dental procedure preferred by patients. (According to Humble Memorial Dental Group, 2025)

-

One of the most groundbreaking technologies shaping the future of cosmetic dentistry is 3D printing.

Technological advancements are driving significant growth in the dental impression systems market. Innovations such as intraoral scanners, 3D scanning, and CAD/CAM integration have enhanced diagnostic accuracy and treatment efficiency. Incorporating AI and machine learning improves image analysis, automates treatment planning, and reduces errors. Future developments, including compact scanners and augmented reality, promise greater speed, comfort, and interactive patient experiences. Integration with digital treatment platforms enables a seamless workflow from diagnosis to restoration. These advancements are anticipated to improve clinical outcomes and present strong market opportunities as dental practices increasingly adopt digital solutions to meet evolving patient expectations.

Furthermore, companies are developing products that support multi-modality assessments and personalized oral health reports. For instance, in October 2024, Align Technology, Inc. launched iTero intraoral scanner product innovations that deliver a versatile solution for general practitioner (“GP”) dentists. The Align Oral Health Suite, integrated with iTero Element Plus and iTero Lumina, enhances patient engagement by visually presenting oral health conditions and treatment options chairside. It supports increased revenue and better doctor-patient communication. It integrates the Invisalign Outcome Simulator Pro, which enables real-time, in-face visualizations of potential orthodontic and ortho-restorative outcomes.

Technological Advancements

Company Name

Product Launch

KoLs

Align Technology, Inc.

In October 2024, Align Technology, Inc. launched iTero intraoral scanner product innovations that deliver a versatile solution for general practitioner (“GP”) dentists.

"The iTero intraoral scanner innovations introduced today will enable doctors to present a variety of options to their patients, supporting chairside education and communication, that helps deliver a great patient experience and supports patients making informed choices about their dental treatment in consultation with their doctor. In today’s modern digital dentistry practice, the iTero intraoral scanner can help increase patient understanding and treatment acceptance and help drive adoption of the Align Digital Platform, a proprietary combination of software, systems, and services designed to provide a seamless experience and workflow that integrates and connects all users - doctors, labs, patients, and consumers.” Said Karim Boussebaa, Align Technology executive vice president and managing director for the iTero scanner and services business.”

Planmeca Oy

In March 2025, Planmeca announced its first handheld intraoral X-ray device. The Planmeca ProX GO provides space- and time-saving chairside efficiency for both traditional clinics and radiology rooms, as well as mobile dental clinics, nursing homes, and emergency situations. The new device is set to debut at IDS in Cologne from 25-29 March 2025, with plans for a subsequent sales launch in the U.S. market.

“Planmeca ProX GO represents just the kind of creative thinking and flexible, future-ready solutions that we want to bring to the dental industry,” states Timo Müller, Vice President of Planmeca’s X-ray division. “There is a real demand for versatile portable products like this, which enable high quality imaging in fast-paced and changing environments, such as busy clinics, mobile operatories, and emergency situations. We’re truly excited to be bringing yet another tech and usability innovation to dental professionals all over the world, starting in the U.S. market.”

Source: BD, Stryker, Grand View Research

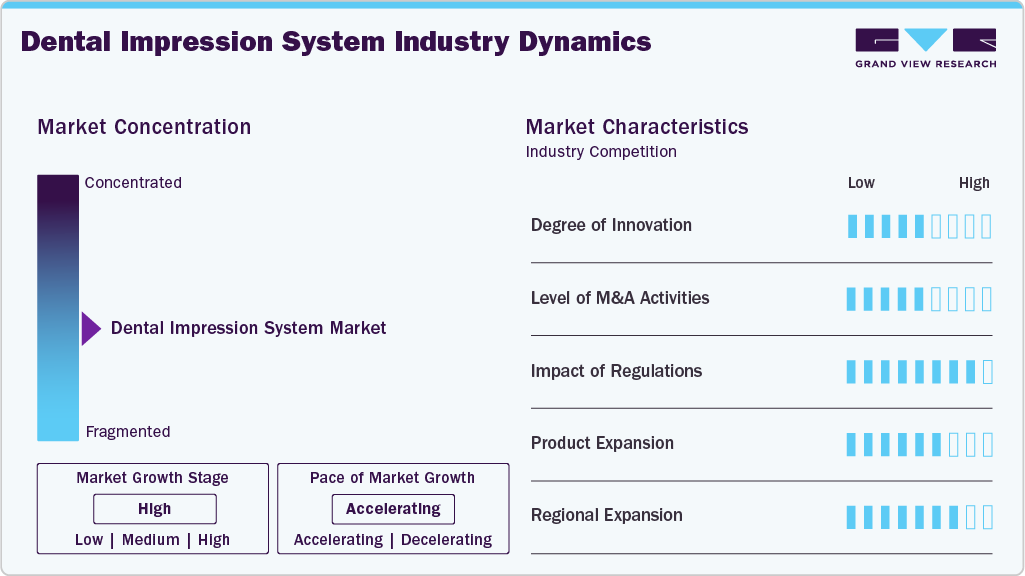

Market Concentration & Characteristics

The dental impression system market is experiencing a high degree of innovation, driven by significant shift towards digital and advanced technologies. Traditional impression techniques, such as putty and tray-based methods, are gradually being replaced or supplemented by digital solutions, reflecting a high level of innovation driven by technological advancements. For instance, in June 2024, 3Shape announced one of its largest product launches to date. For dentists, the most affordable intraoral scanner ever, TRIOS Core was launched, as was a redesigned version of the award-winning TRIOS 3 intraoral scanner. In addition, an entirely new product line, TRIOS Ready Tips, 3Shape’s first single-use intraoral scanner tip, was introduced.

Regulatory frameworks are pivotal in shaping the dental impression system market by establishing safety, efficacy, and quality standards for both devices and products. These devices are generally classified as Class I or Class II medical devices, depending on their intended use and risk profile. In September 2024, the U.S. Food and Drug Administration (FDA) released finalized guidance titled “Dental Impression Materials - Performance Criteria for Safety and Performance-Based Pathway”. This document is intended for industry and FDA staff and supports the use of the Safety and Performance-Based Pathway for 510(k) premarket notification submissions. Instead of demonstrating substantial equivalence to a predicate device through traditional comparative testing, manufacturers can now show that their dental impression material meets FDA-accepted performance criteria.

The dental impression system market has seen a moderate to high level of M&A activity over the past several years, driven by ongoing technological innovation, market expansion opportunities, and the need for strategic positioning. Companies are expected to likely continue to seek acquisitions that provide competitive advantages in digital dentistry. For instance, in September 2023, Straumann Group entered into an agreement to acquire AlliedStar, a manufacturer of intraoral scanners (IOS) in China. This acquisition will allow the Group to provide customers in China with a competitive intraoral scanner solution and to expand into additional price-sensitive markets and customer segments in the future. As part of the Straumann Group, AlliedStar will continue to serve its existing distribution channels.

The threat of product substitutes is low because there are no significant external alternative products that can replace dental impression material and systems.

The dental impression system market is characterized by a relatively high level of concentration, with a few major companies holding significant market shares. Some of the key companies include Dentsply Sirona, 3Shape, and Align Technology, among others.

Product Insights

On the basis of product, impression materials segment held the largest share in 2024 due to their widespread clinical use, ease of application, and cost-effectiveness. Advances in elastomeric materials enhanced accuracy and patient comfort, making them the preferred choice for various dental procedures, thereby maintaining their market leadership over digital alternatives.

Intraoral Scanners segment is expected to witness the significant growth over the forecast period due to their digital precision, improved patient comfort, and faster workflow. Technological advancements, increasing adoption of digital dentistry, and growing demand for accurate, minimally invasive procedures are driving rapid growth in this segment.

Application Insights

On the basis of application, restorative & prosthodontics dentistry segment held the largest share in 2024 primarily due to the high demand for crowns, bridges, dentures, and implants, which require precise impressions for accurate fitting and longevity. The growing prevalence of dental caries, tooth wear, and edentulism worldwide further drives the need for restorative procedures. In addition, technological advancements in impression materials and digital workflows have improved treatment outcomes, making this segment more favorable among dental practitioners. The increasing aging population and rising awareness about oral health also contribute to the segment’s dominance, ensuring sustained market growth in restorative and prosthodontics applications.

Orthodontics segment is expected to witness the fastest CAGR over the forecast period due to increasing demand for clear aligners, braces, and digital orthodontic solutions. Advancements in digital impression technology enable precise, customized treatments, improving patient outcomes and comfort. Rising prevalence of malocclusions and cosmetic dentistry trends further drive demand. In addition, the growing adoption of 3D scanning and CAD/CAM systems streamlines orthodontic workflows, reducing treatment time. These factors contribute to rapid market growth, making orthodontics the leading application segment during this period.

End Use Insights

On the basis of end use, Dental Clinics segment dominated the dental impression system market in 2024 due to their widespread presence and primary role in routine dental care. Clinics offer convenient, quick, and cost-effective services, attracting a broad patient base. The adoption of advanced digital impression systems in clinics enhances treatment accuracy and patient comfort, furthving growth. In addition, the increasing number of dental visits for preventive, restorative, and cosmetic procedures boosts demand for impression systems.

However, Dental Labs segment is projected to witness fastest growth rate over the forecast period due to increasing demand for customized dental prosthetics, crowns, bridges, and implants. Advances in digital impression technology enable labs to produce highly accurate restorations efficiently. The rising prevalence of dental diseases, coupled with the growing trend towards same-day and minimally invasive procedures, fuels the need for precise and rapid manufacturing solutions. In addition, the shift towards digital workflows in dental laboratories enhances productivity and reduces turnaround times, driving significant growth in this segment as labs adopt advanced impression systems to meet rising patient and practitioner demands.

Regional Insights

The Europe dental impression system market accounted for largest revenue share of 39.81% in 2024. The European dental impression system market is growing, driven by demographic trends, healthcare policy support, and the digitalization of dental practices. Europe has a large and aging population, with increasing demand for restorative dental procedures such as crowns, bridges, and implants, which require accurate dental impressions. Countries like Germany, France, Italy, and the UK have well-established dental care systems, and there is a strong push toward modernizing clinics with digital tools, particularly intraoral scanners and CAD/CAM technologies. These digital impression systems offer enhanced accuracy, reduced discomfort, and faster results, which align with the growing patient expectations for high-quality, efficient care. On 1 January 2024, the EU population was estimated at 449.3 million people, and more than one-fifth (21.6%) were aged 65 years and over.

Germany Dental Impression System Market Trends

Germany dental impression system market dominated the market with the largest revenue share of 23.80% in 2024 due to country’s well-established and insurance-supported dental care system, which enables wide access to both preventive and restorative dental services. The statutory health insurance (SHI) system covers a broad range of dental procedures, including those requiring impressions-such as crowns, bridges, and dentures, thereby ensuring sustained baseline demand for impression materials and technologies.

North America Dental Impression System Market Trends

The North American dental impression system market is witnessing significant growth, primarily fueled by the region's advanced dental care infrastructure and growing emphasis on precision dentistry. As the prevalence of dental disorders-such as edentulism, dental caries, and periodontal diseases-increases, especially among the aging population, the demand for restorative and prosthetic dental treatments is rising. This has, in turn, elevated the importance of accurate and high-quality dental impressions for the fabrication of crowns, bridges, dentures, and implants. Traditional impression materials like alginate and polyvinyl siloxane continue to be used widely; however, the market is experiencing a rapid shift toward digital solutions such as intraoral scanners and chairside CAD/CAM systems. These digital systems enhance diagnostic accuracy and patient comfort, streamline workflows, and reduce turnaround times for dental labs.

U.S. Dental Impression System Market Trends

The U.S. dental impression system market is experiencing robust growth, driven by a combination of demographic, technological, and healthcare-related factors. A key contributor is the country’s aging population, which continues to fuel demand for prosthetic and restorative procedures such as dentures, crowns, and bridges-all of which require precise dental impressions. At the same time, the popularity of cosmetic dentistry is rising, with more patients seeking treatments that enhance their appearance and function. This surge in cosmetic and restorative procedures is further supported by the growing adoption of digital dentistry. Intraoral scanners and CAD/CAM technologies are increasingly replacing traditional materials, offering greater accuracy, faster turnaround times, and improved patient comfort, thereby accelerating the shift toward digital workflows in dental clinics. As per the CDC, 2022, nearly 46% of U.S. adults have gum disease.

Asia Pacific Dental Impression System Market Trends

The Asia Pacific dental impression system market is experiencing fastest CAGR from 2025 to 2033 driven by rising dental healthcare awareness, increasing disposable incomes, and expanding access to dental services across urban and rural areas. Countries such as China, India, Japan, South Korea, and Australia are witnessing a surge in demand for restorative and cosmetic dentistry procedures, which in turn is boosting the adoption of advanced impression systems. The growing middle-class population and increased public and private investments in healthcare infrastructure make modern dental technologies more accessible to a broader patient base.

China’s dental impression system market is undergoing growth, driven by strong demand for restorative and cosmetic dentistry, a rapidly aging population, and increasing access to advanced dental technologies. With the country accounting for the largest share of the Asia-Pacific dental impression system market, expansion is fueled by the rise of dental service organizations, the modernization of clinics, and government-backed healthcare reforms such as Healthy China 2030. Urbanization and a growing middle class are accelerating the demand for high-quality dental care, particularly for implants, crowns, and orthodontics-all of which rely heavily on precise impressions. While traditional materials like alginate and silicone still dominate in volume, digital systems, especially intraoral scanners and CAD/CAM workflows-are gaining rapid traction in tier-1 and tier-2 cities. Moreover, the booming dental 3D printing sector, tied closely to digital impression workflows, reflects the country’s commitment to integrating innovative solutions across dental practices.

Latin America Dental Impression System Market Trends

The Latin American dental impression system market is growing, driven by improving access to dental care, rising awareness of oral health, and a gradual shift toward digital dentistry. Countries such as Brazil and Argentina are witnessing increasing demand for restorative and prosthodontic procedures, fueled by a growing middle class and higher spending on aesthetic and functional dental treatments.

Middle East Africa Dental Impression System Market Trends

The Middle East and Africa dental impression system market is expanding, supported by improving healthcare infrastructure, rising urbanization, and growing demand for aesthetic and restorative dental procedures. In the Middle East, countries such as the UAE, Saudi Arabia, and Kuwait are investing in healthcare modernization, including the dental sector. This leads to increased adoption of advanced technologies such as intraoral scanners and CAD/CAM systems, particularly in private clinics and high-end dental centers. Patients in these markets are becoming more aware of oral health and increasingly seeking premium, time-efficient dental services that favor digital impression systems.

Key Dental Impression System Company Insights

The dental impression system market is moderately fragmented, with both major and local market competitors. Due to the fact that the current market players are stepping up their efforts to grab the majority in dental impression system market, fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many market participants are engaging in various strategic activities, such as application launches, mergers and acquisitions, and geographic growth, in an effort to gain a competitive edge over rivals. Thus, with various strategies adopted by the market players, the dental impression system market is predicted to impel during the forecast period.

Key Dental Impression System Companies:

The following are the leading companies in the dental impression system market. These companies collectively hold the largest market share and dictate industry trends.

- Dentsply Sirona

- Solventum

- Henry Schein, Inc.

- GC Corporation

- Kulzer GmbH (Mitsui Chemicals, Inc.)

- Kerr Corporation (Envista)

- 3Shape A/S

- Ivoclar Vivadent

- Planmeca Oy

- COLTENE Group

- Ultradent Products Inc.

- Septodont Holding

- Zest Dental Solutions

- Parkell, Inc.

- Kettenbach GmbH & Co. KG

- Keystone Industries

- DMG

- Align Technology, Inc.

Recent Development

-

In March 2025, Planmeca Oy announced its first handheld intraoral X-ray device. The Planmeca ProX GO provides space- and time-saving chairside efficiency for both traditional clinics and radiology rooms, as well as mobile dental clinics, nursing homes, and emergency situations. The new device is set to debut at IDS in Cologne from 25-29 March 2025, with plans for a subsequent sales launch in the U.S. market.

-

In March 2025, OMNIVISION, one of the leading global developers of semiconductor technology-including advanced digital imaging, analog, and display solutions-and Biotech Dental, a specialist in the design and manufacture of medical devices and digital solutions for dental applications, have announced a partnership. This collaboration involves Biotech Dental utilizing multiple medical-grade camera modules from OMNIVISION in the development of its new Scan4All 3D intraoral scanners, Iris by Starck.

-

In September 2024, Dentsply Sirona announced the launch of a new, versatile, and innovative intraoral scanner: Primescan 2. Powered by the DS Core cloud platform2, this new wireless scanner is cloud-native, allowing it to perform scans on any internet-connected mobile or desktop device-without the need for a dedicated computer.

-

In June 2024, GC Europe announced that it has begun construction on a state-of-the-art production facility, marked by a traditional Japanese groundbreaking ceremony. The event was attended by GC’s global management team and Takenaka, the construction company. The project is expected to be completed by the end of 2025. The new 4,200-square-meter facility will enhance GC Europe's production and logistics capabilities.

Dental Impression System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.02 billion

Revenue forecast in 2033

USD 4.31 billion

Growth rate

CAGR of 9.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait, UAE

Key companies profiled

Dentsply Sirona; Solventum; Henry Schein, Inc.; GC Corporation; Kulzer GmbH (Mitsui Chemicals, Inc.); Kerr Corporation (Envista); 3Shape A/S; Ivoclar Vivadent; Planmeca Oy; COLTENE Group; Ultradent Products Inc.; Septodont Holding; Zest Dental Solutions; Parkell, Inc.; Kettenbach GmbH & Co. KG; Keystone Industries; DMG; Align Technology, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Impression System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global dental impression system market report on the basis of product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Impression Materials

-

Intraoral Scanners

-

Impression Trays

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Restorative & Prosthodontics Dentistry

-

Orthodontics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Dental Clinics

-

Dental Labs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental impression system market size was estimated at USD 1.86 billion in 2024 and is expected to reach USD 2.02 billion in 2025.

b. The global dental impression system market is expected to grow at a compound annual growth rate of 9.93% from 2025 to 2033 to reach USD 4.31 billion by 2033.

b. Europe dominated the dental impression system market with a share of 39.81% in 2024. This is attributable to the high prevalence of dental diseases and a growing demand for cosmetic dentistry, the presence of key market players and ongoing research and development activities.

b. Some of the players operating in this market are Dentsply Sirona, Solventum, Henry Schein, Inc., GC Corporation, Kulzer GmbH (Mitsui Chemicals, Inc.), Kerr Corporation (Envista), 3Shape A/S, Ivoclar Vivadent, Planmeca Oy, COLTENE Group, Ultradent Products Inc., Septodont Holding, Zest Dental Solutions, Parkell, Inc., Kettenbach GmbH & Co. KG, Keystone Industries, DMG, and Align Technology, Inc.

b. Key factors that are driving the dental impression system market growth include the increasing demand for dental restorations and orthodontic treatments, advancements in digital impression technology, and a growing geriatric population requiring dental care. Additionally, the rising prevalence of dental disorders and the adoption of CAD/CAM systems in dentistry are fuelling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.