- Home

- »

- Medical Devices

- »

-

Dental Fillings Market Size & Share, Industry Report, 2030GVR Report cover

![Dental Fillings Market Size, Share & Trends Report]()

Dental Fillings Market (2025 - 2030) Size, Share & Trends Analysis Report By Filling Type (Direct, Indirect), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68038-123-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Fillings Market Size & Trends

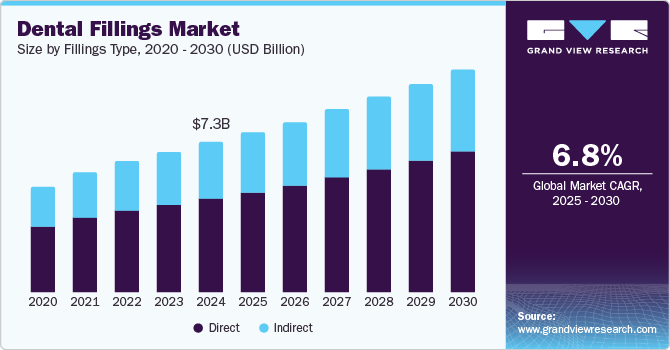

The global dental fillings market size was valued at USD 7.3 billion in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2030. The increasing prevalence of dental caries is a major driving factor. In addition, the high rates of other dental conditions, such as tooth decay and cavities, due to unhealthy eating habits, along with rising patient awareness and a growing geriatric population, are expected to fuel the market.

Dental caries is among the most common oral diseases among children and the elderly in developing nations, primarily due to unhealthy dietary habits and poor dental hygiene. According to the 2022 WHO Global Oral Health Status Report, nearly 3.5 billionpeople worldwide have oral diseases, with about 75% living in middle-income countries. The report also estimated that 2 billion people suffer from dental caries in their permanent teeth, while 514 million children experience dental caries in their primary teeth. Such high prevalence is expected to increase the demand for dental care services and products significantly.

The growing demand for dental aesthetics is also projected to drive market growth. More individuals are seeking cosmetic procedures due to heightened awareness and rapid technological advancements. The two primary groups driving this demand are baby boomers and millennials. Baby boomers primarily seek dental aesthetics such as implants and veneers to maintain a youthful appearance, while millennials are more focused on tooth whitening, orthodontics, and unique procedures such as dental bling.

Innovations in tooth-filling materials are expected to drive market growth. Amalgam, the most traditionally used material for dental fillings, has been modernized with silver and mercury. Silver amalgam is durable and approved by the Food and Drug Administration (FDA) for children six and older. Composite fillings have also been enhanced with powdered glass acrylic resin to match the color of natural teeth better. According to the American Dental Association, gold is one of the most durable and expensive filling materials available, lasting up to 20 years.

The increasing government initiatives to enhance dental health are driving the growth of the dental fillings market. For example, the National Oral Health Programme (NOHP) outlines the Indian Dental Association's (IDA) goals for better dental health, initiated in 2020. Under the NOHP, the IDA introduced various cards for check-ups and preventive care, including the Child Oral Health Card, Corporate Oral Health Card, Family Oral Health Card, Special Privilege Card, Muskaan, and Platinum Oral Health Card. These initiatives aim to improve access to dental care and raise awareness about oral health among different population segments.

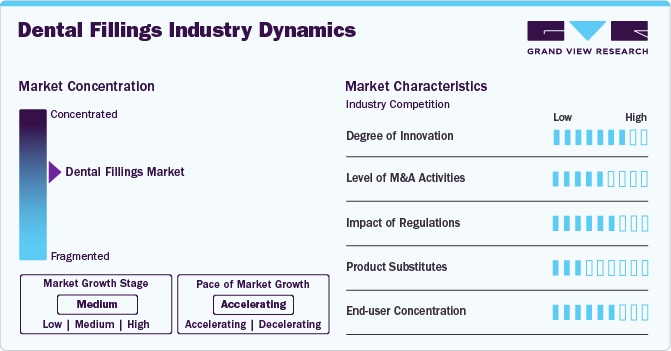

Market Characteristics

The dental filling market is in the high growth stage, and the pace of market growth is accelerating, driven by rising awareness of oral health and advancements in dental technology. The market is characterized by a high degree of innovation, with manufacturers focusing on new materials and techniques for better durability, aesthetics, and patient comfort. Providers are investing in research and development of composite resins, ceramics, and bioactive materials, aligning with the increasing demand for more effective and long-lasting solutions.

The dental fillings market sees moderate-to-high levels of merger and acquisition (M&A) activity, as key players consolidate to enhance their portfolios and expand their geographical reach. This move is expected to drive innovation and further enhance product offerings.

Regulatory scrutiny in the dental fillings market is increasing, with more stringent guidelines on product safety, material composition, and patient health. Manufacturers are required to submit extensive clinical trial data to gain approval for new products, and ongoing compliance with these standards is crucial for market participation.

Although there are a few substitutes for dental fillings, such as crowns and inlays, these alternatives are often more costly and require additional procedures. Fillings remain the most cost-effective and commonly used option for dental restoration, especially for cavities or minor tooth decay. However, advancements in these substitutes and their growing accessibility may pose a challenge to the dental filling market in the future.

End-user concentration in the dental fillings market is driven by dental clinics, private practitioners, and hospitals, which continue to dominate the adoption of dental filling materials. With many manufacturers offering similar product solutions, dental practitioners often seek competitive pricing, rebates, and deals from distributors to maintain cost-effectiveness. The growing awareness of oral health and increased disposable income is fuelling demand for premium dental filling solutions, further intensifying competition among market players.

Filling Type Insights

The direct filling segment dominated the dental fillings market with a revenue share of around 62.4% in 2024 and is projected to maintain its leadership position over the forecast years. This can be attributed to the procedure's simplicity, also referred to as chairside filling, as it can be completed on the same day a patient visits the dentist. The most commonly used material for dental fillings is silver amalgam. Direct filling procedures take less time than indirect fillings, which is expected to increase market interest. In addition, they start to heal dental conditions soon after treatment, further encouraging the use of direct fillings and driving growth in this segment.

An indirect filling segment is expected to grow significantly over the forecast period due to the rising demand for veneers and dentures. Other common restoration procedures include crowns, inlays, onlays, and bridges. Advances in adhesive dentistry are also driving growth in the indirect fillings segment. Innovations such as 3D imaging, CAD technologies, and the introduction of laser dentistry are likely to support the segment growth.

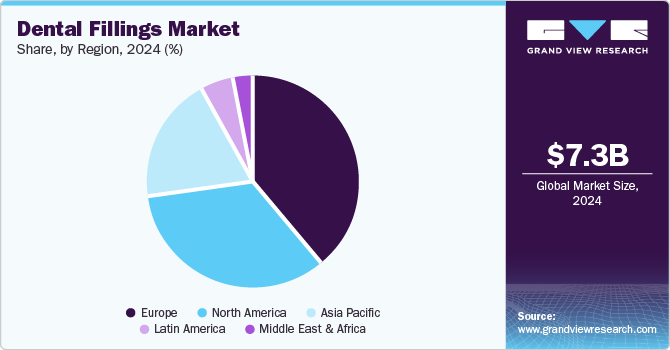

Regional Insights

North America dental fillings market is expected to grow significantly due to several factors. The rising number of dental problems, such as cavities, is increasing the demand for dental fillings. Technological advancements, such as better materials that look like natural teeth, are also attracting more patients. In addition, people are becoming more aware of their oral health and are interested in cosmetic procedures. Government policies that support dental care access and insurance coverage further boost the market. Overall, this combination of factors is driving strong growth in the dental fillings market in North America.

U.S. Dental Fillings Market Trends

The U.S. dental fillings market is expected to grow significantly as it shifts towards more aesthetic and durable materials. Composite resin fillings, which blend in with natural teeth, are becoming popular, especially among younger patients who prefer a natural look. At the same time, silver amalgam fillings remain a common choice for back teeth because they are cost-effective and long-lasting. There is also a growing demand for ceramic and gold fillings, which are strong and durable but more expensive. The market growth is driven by advances in dental technology, rising awareness of oral health, and a preference for materials that offer both function and appearance. Overall, patients are increasingly looking for fillings that combine quality, longevity, and a natural appearance.

Europe Dental Fillings Market Trends

Europe dental fillings market dominated the global market, with a revenue share of 39.2% in 2024. This growth is driven by the increasing prevalence of dental caries and gum diseases, which create a higher demand for fillings. Many people in Europe are becoming more aware of their oral health and are seeking cosmetic dentistry options, leading to a preference for aesthetic materials such as composite resins. In addition, advancements in dental technology are improving the quality and effectiveness of filling materials. The aging population in Europe, which often faces dental issues, also contributes to the market's expansion. These factors are expected to support continued growth in the European dental fillings market.

The Germany dental fillings market is seeing significant growth due to the rising prevalence of dental issues such as cavities and gum disease. There is an increasing demand for aesthetic solutions, with resin-based composite fillings becoming popular for their natural appearance. Advancements in dental technology, such as digital dentistry and 3D printing, are improving the quality and efficiency of treatments. In addition, greater awareness of oral health is encouraging more people to seek preventive care and regular dental check-ups. Overall, these factors contribute to a positive outlook for the dental fillings market in Germany.

Asia Pacific Dental Fillings Market Trends

The Asia Pacific dental fillings market is experiencing rapid growth, with a projected compound annual growth rate (CAGR) of 8.3% during the forecast period. Rising disposable incomes drive this Growth, improving healthcare infrastructure, and increasing awareness of oral hygiene. Resin-based composite fillings are particularly in demand due to their aesthetic appeal and enhanced durability compared to traditional materials such as amalgam. In addition, the growing trend toward minimally invasive dental procedures is boosting the adoption of advanced filling materials. The rising prevalence of dental caries, especially in urban areas, and an aging population with more dental restoration needs are further contributing to market expansion. Government initiatives promoting oral health and increasing dental insurance coverage are also making dental care more accessible to a larger population segment.

The China dental fillings market is experiencing significant growth, driven by several key trends. The increasing prevalence of dental caries and gum disease is boosting the demand for various filling materials. There is a rising preference for aesthetic solutions, with resin-based composite fillings gaining popularity due to their natural appearance and improved bonding properties. In addition, advancements in dental technology, such as digital dentistry and 3D printing, are enhancing treatment options and efficiency. The growing awareness of oral hygiene among the population and an expanding middle class with higher disposable incomes are encouraging more people to seek dental care. Overall, these factors are contributing to a positive outlook for the dental fillings market in China.

Key Dental Fillings Company Insights

The dental market is experiencing significant transformation, driven by technological advancements, increasing awareness of oral health, and a growing demand for dental services. Some key players in this dynamic market are Dentsply Sirona, known for its comprehensive range of dental products; GC America Inc., a significant provider of dental materials and equipment; Coltene Group, which focuses on dental consumables and equipment; Kerr Corporation, specializing in restorative materials; Den-Mat Holdings, LLC, targeting aesthetic dental products; DMG Chemisch-Pharmazeutische Fabrik GmbH, offering a variety of dental materials; Kettenbach SNC, recognized for innovative products; KURARAY NORITAKE DENTAL INC., providing advanced dental materials; and SDI Limited, focusing on dental consumables and restorative solutions. These companies are adopting various growth strategies, including mergers and acquisitions, expansion of product portfolios, and investment in research and development (R&D) for innovative filling materials, all essential for addressing the rising prevalence of dental diseases and meeting consumer demands for high-quality dental care.

Key Dental Fillings Companies:

The following are the leading companies in the dental fillings market. These companies collectively hold the largest market share and dictate industry trends.

- Dentsply Sirona

- GC America Inc.

- SDI Limited

- Coltene Group

- Den-Mat Holdings, LLC

- DMG Chemisch-Pharmazeutische Fabrik GmbH

- Kettenbach SNC

- KURARAY NORITAKE DENTAL INC.

- Kerr Corporation

Recent Developments

-

In August 2024, COLTENE Group launched the BRILLIANT Lumina tooth whitening product. This new offering allows COLTENE to reach new customers in the aesthetics market. The Lumina formula is unique because it does not contain hydrogen peroxide, making it gentler on teeth while providing effective whitening results.

Dental Fillings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.8 billion

Revenue forecast in 2030

USD 10.9 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Filling type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Dentsply Sirona; GC America Inc.; SDI Limited; Coltene Group; Den-Mat Holdings, LLC; DMG Chemisch-Pharmazeutische Fabrik GmbH; Kettenbach SNC; KURARAY NORITAKE DENTAL INC.; Kerr Corporation.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Fillings Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global dental fillings market based on filling type, and region:

-

Filling Type Outlook (Revenue, USD Million, 2018 - 2030)

-

DIRECT

-

Amalgam

-

Composites

-

Glass Ionomer

-

Others

-

-

INDIRECT

-

All-Ceramic

-

Metal-Ceramic

-

Metal Alloys

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental fillings market size was estimated at USD 7.3 billion in 2024 and is expected to reach USD 7.8 billion in 2025.

b. The global dental fillings market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2030 to reach USD 10.9 billion by 2030.

b. Europe dominated the dental fillings market with a share of 39.1% in 2024. This is attributable to high prevalence of dental caries and gum disease.

b. Some key players operating in the dental fillings market include Dentsply Sirona, GC America, SDI Limited, Coltene Whaledent, DenMat Holdings, DMG Chemisch-Pharmazeutische Fabrik, Kettenbach, Kuraray Noritake Dental, Kerr Corporation

b. Key factors that are driving the market growth include increasing prevalence of dental caries, increasing patient awareness and growing geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.