- Home

- »

- Medical Devices

- »

-

Dental Bone Grafts And Substitutes Market Size Report, 2030GVR Report cover

![Dental Bone Grafts And Substitutes Market Size, Share & Trends Report]()

Dental Bone Grafts And Substitutes Market (2023 - 2030) Size, Share & Trends Analysis Report By Material Type (Allograft, Xenograft, Synthetic), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-153-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2021 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Bone Grafts And Substitutes Market Summary

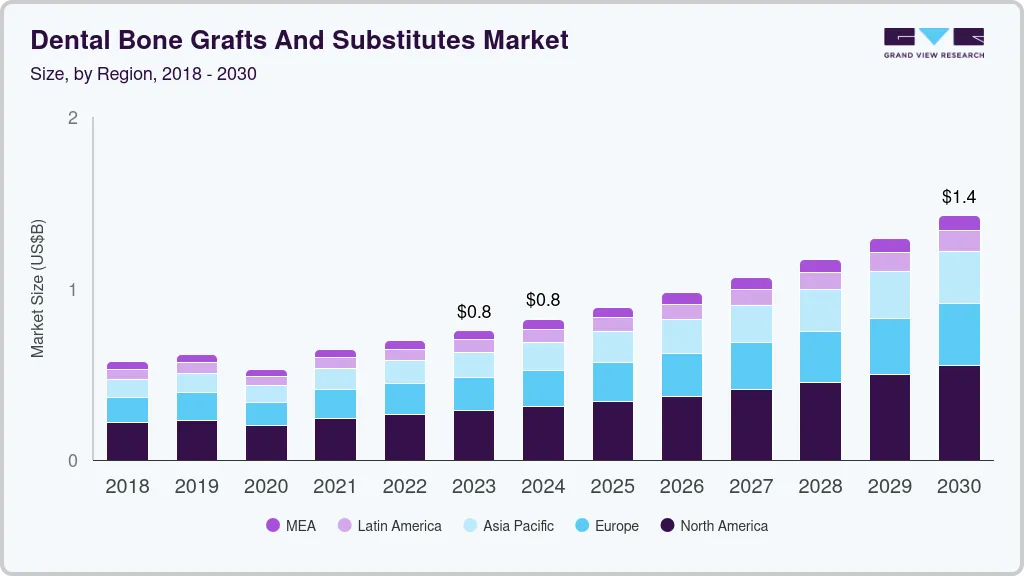

The global dental bone grafts and substitutes market size was estimated at USD 696.9 million in 2022 and is projected to reach USD 1.4 billion by 2030, growing at a compound annual growth rate (CAGR) of 9.5% from 2023 to 2030. Increasing the use of bone grafts in density, and a growing number of dental implant surgeries are propelling the revenue.

Key Market Trends & Insights

- North America dominated the global dental bone grafts and substitutes market in terms of the revenue share of 38.0% in 2022.

- Asia Pacific region is expected to show the highest growth of rate 10.9% over the forecast period.

- Based on material type, the xenograft product segment held the largest revenue share of 48.2% in 2022.

- Based on application, the socket preservation segment held the largest revenue share of 33.3% in 2022.

- Based on end-use, the dental clinic segment held the largest revenue share of 76.3% as of 2022.

Market Size & Forecast

- 2022 Market Size: USD 696.9 Million

- 2030 Projected Market Size: USD 1.4 Billion

- CAGR (2023-2030): 9.5%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The advent of COVID-19 resulted in significant revenue losses, especially in the first and second quarters of 2021. This was mainly due to the fact that the majority of dental practices around the globe were halted in light of surging COVID-19 cases and the risk of disease transmission. However, as the dental bone graft market is recovering from the impact of COVID-19 as dental treatments have been resumed drastically as measures to curb the virus have been successful.

Dental implant surgery has now become very popular with advanced surgical techniques such as bone grafts and bone regeneration. Moreover, increasing success rates of these surgeries are fueling the market. According to the American Dental Association report, around 95% to 98% success rate has been reported for implant surgeries as of 2019. Around 5 million implant procedures are performed in the U.S. every year. Bone grafting prior to implant placement helps to maintain the existing jaw and increases the chances of successful implant surgery, thus fueling revenue.

The U.S. allograft product segment is expected to witness a high compound annual growth of 9.8% during the forecast period. The use of biocompatible and synthetic dental grafts is a growth-propelling factor for the market. TCP is mostly used as a synthetic scaffold in dentistry. It provides higher osteoconductivity as compared to allografts. The increasing initiatives by the industry players such as new product launch, merger & acquisition is also affecting the revenue. For instance, In May 2018, Dentsply Sirona collaborated with Datum Dental, Ltd. for the distribution of the OSSIX brand which is indicated for bone and tissue regeneration.

Growing dental tourism in developing countries is propelling the market. Asia Pacific region especially China, and India is one of the major contributors to this growth. The low cost of dental treatment and the availability of surgeons will lead to an increase in the number of foreign patient visits for these procedures. The cost for socket preservation and ridge augmentation is nearly 1/4th as compared to the U.S. and Europe. The aforementioned factors are expected to propel revenue in the coming years.

The rising target population plays a significant role in the growth of the dental bone grafts & substitutes market. According to the Department of Economic and Social Affairs Population Division, the global share of people 60 years and above has grown from 9.2% in 1990 to 11.7% in 2013, and this share is expected to rise to 21.1% by 2050. With an elevated prevalence of periodontal disease,root caries, and edentulous along with the geriatric population the demand for dental grafting is increasing.

The onset of the pandemic strained the dental industry as measures were taken by the state governments globally to curb the transmission of the virus and as dental treatments are high-contact services, the majority of dental practices were halted. Companies like Dentsply Sirona and Institut Straumann AG reported operational and supply chain constraints as a result of the pandemic which directly affected their revenues. However, dental practices resumed by the end of 2020 under strict Covid-19 protocols and guidelines, after the introduction of an effective vaccine. Dentsply Sirona stated that its End-Use and Equipment segment which comprises dental bone graft materials reported a 28.7% growth in 2021.

Material Type Insights

The xenograft product segment held the largest revenue share of 48.2% in 2022. Based on product, the market is segmented into xenograft, allograft, and synthetic material. A xenograft is a bone taken from an animal source such as a bovine and implanted into the human body. The most commonly used xenograft is Bio-Oss. Key industry players are taking the initiative to launch new xenograft products for better penetration. For instance, in 2019 Marks Biotech Inc. launched Novobone, a xenograft in order to improve its bone grafting product portfolio. The other key players include ACE Surgical, BioHorizons, etc.

The synthetic segment is expected to exhibit the highest growth of 10.6% over the forecast period. The growth can be attributed to its higher osteoconductivity, hardness, and better acceptance. There are various types of synthetic materials available in the market such as ceramic, polymer-based, BMPs, etc. The chance of disease transmission is low with synthetic grafting as compared to xenograft & allograft, which further boosts the growth. Moreover, increasing demand to develop biocompatible grafts to reduce adverse reactions is driving this segment.

Increasing uses of synthetic grafts with HAP and TCP which have shown better biocompatibility as compared to others are fueling the growth. The polymer-based grafts also have shown good biocompatibility. The industry players are continuously trying to develop new products with better biocompatibility, bioactivity, and suitable mechanical properties. For instance, in June 2019, Biogennix received 510(K) clearance from USFDA for Agilon, which is fully biocompatible with human bone. The aforementioned factors are boosting revenue.

Application Insights

Advancements in bone grafting materials, such as the advent of synthetic bone materials, have led to an increase in the adoption of socket preservation procedures which captures 33.3% as of 2022. The application segment includes Ridge Augmentation, Sinus Lift, Periodontal Defect Regeneration, Implant Bone Regeneration, and Socket Preservation. It is a method that is used to decrease bone loss after tooth extraction from a tooth socket in the alveolar bone. An escalating number of dental implant surgeries and increasing awareness among people about oral health care are the driving factors for the growth of this segment.

The sinus lift segment is expected to register the fastest CAGR of 10.4% over the forecast period. Ridge augmentation also held a significant revenue share owing to its quick recovery time and painless procedure. The demand for this procedure is increasing in order to achieve long-term survival and successful implant placement. Moreover, alveolar volume gain is also possible with the help of ridge augmentation, thus boosting growth. Some of the most common grafting materials used are Puros by Zimmer Biomet, Bio-Oss by Osteohealth, INFUSE bone graft by Medtronic, etc.

End-use Insights

The dental clinic end-use segment held the largest revenue share of 76.3% as of 2022. With a growing number of dental graft surgeries performed annually, clinics are gaining popularity due to their convenience, and easy availability of surgeons. Compared to hospitals, these clinics are specialized to deliver safer and quicker same-day procedures. Moreover, growing awareness regarding oral health is further propelling the market.

Private dental clinics or specialty clinics are present in large numbers and typically have skilled practitioners specializing in bone grafting procedures. Manufacturing companies have a wide delivery network and target dental clinics primarily through direct sales; multiple smaller clinics tend to collectively bring in more customers than a single hospital. For instance, the Institute Straumann stated in its annual report that its professionals primarily operated in 1,300 dental clinics, as of 2020, and place 300,000 implants annually.

The hospital segment is anticipated to witness the highest growth rate of 10.2% over the forecast period. The growth can be attributed to the availability of a wide range of reconstructive procedures under these facilities. Few hospitals are self-funded and are associated with tissue banks aiming to provide class-leading services. Moreover, hospitals collaborate with various insurance companies for better and fast reimbursement. Owing to all these benefits the overall footfall in hospitals is more as compared to clinics.

Regional Insights

North America dominated the global dental bone grafts and substitutes market in terms of the revenue share of 38.0% in 2022. The increasing target population and the increasing number of dental implant surgeries in this region are driving growth. Europe held the second-largest share and is expected to show lucrative growth in the coming years. Asia Pacific region is expected to show the highest growth of rate 10.9% over the forecast period. The growth can be attributed to an increased number of medical tourism and government initiatives. Moreover, a growing aging population in this region is further increasing the risk of dental problems. On the contrary, stringent regulatory guidelines in some countries can limit growth in the near future. In South Korea, the product should be approved by the Korean Food and Drug Administration (KFDA) before marketing. In the case of Australia, the graft products are regulated by Therapeutic Goods Administration (TGA). The stringent regulatory scenario in these countries creates a barrier for foreign players to enter the market.

Medical tourism in India and China for dental grafting surgeries is another growth-propelling factor for the market. In addition, the availability of resources that enable the development of advanced End-Use at a cheaper cost is resulting in an increased number of manufacturing facilities in these countries.China has released Order 650 (former Order 276), Regulations for the Supervision and Administration of Medical Devices, to restrict foreign investment in the country, mainly to protect the domestic medical devices manufacturing industry. As a result, the number of local bone graft manufacturers is anticipated to grow in near future.

Key Companies & Market Share Insights

The industry is marked by the presence of various small and large industry players. The market is highly fragmented and competitive in nature. Geistlich, ACE Surgical, Zimmer Biomet & BioHorizons held the major share of the U.S. as of 2022. The players are constantly involved in strategic initiatives such as acquisitions, new product launches, technological advancements, and collaborations in order to gain deeper penetration. For instance, In March 2021, Institut Straumann signed an investment agreement with the Shanghai Xin Zhuang Industrial Park to establish its first Campus in China which will comprise a manufacturing plant, education, and innovation center in the country.

The China Campus will provide various educational programs as well as products from the Straumann Group’s implant and orthodontics portfolio for China, catering to the rapidly growing demands of Chinese dentists and patients for dental solutions. In March 2019, BioHorizons acquired Intra-Lock to include the IntraSpin system in its portfolio for better penetration. Some of the prominent players in the global dental bone gratfs and substitutes market include:

-

Dentsply Sirona

-

Biohorizons Inc.

-

Zimmer Biomet

-

Dentsply Sirona

-

Rti Surgicals

-

Medtronic

-

Geistlich Pharma Ag

-

Dentium Co, Ltd.

-

Orthogen.

-

Lifenet Health

Dental Bone Grafts And Substitutes Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 754.7 million

Revenue forecast in 2030

USD 1.4 billion

Growth rate

CAGR of 9.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Market representation

Revenue in USD million and CAGR from 2023 to 2030

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Material type; application; end use, region

Country Scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Dentsply Sirona; Biohorizons Inc.; Zimmer Biomet; Dentsply Sirona; Rti Surgicals; Medtronic; Geistlich Pharma Ag; Dentium Co, Ltd.; Orthogen.; Lifenet Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Bone Grafts And Substitutes Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global dental bone grafts and substitutes market report on the basis of material type, application, end-use, and region:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Autograft

-

Allograft

-

Demineralized Bone Matrix

-

Others

-

-

Xenograft

-

Synthetic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Ridge Augmentation

-

Sinus Lift

-

Periodontal Defect Regeneration

-

Implant Bone Regeneration

-

Socket Preservation

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Dental clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental bone grafts and substitutes market size was estimated at USD 696.9 million in 2022 and is expected to reach USD 754.7 million in 2023.

b. The global dental bone grafts and substitutes market is expected to grow at a compound annual growth rate of 9.5% from 2023 to 2030 to reach USD 1.4 billion by 2030.

b. North America dominated the dental bone grafts and substitutes market with a share of 38.0% in 2022. This is attributable to the increasing target population and the number of dental implant surgeries being performed in this region.

b. Some key players operating in the dental bone grafts and substitutes market include Geistlich Pharma AG; Medtronic; Zimmer Holding Inc.; RTI Surgical, Inc.; and Dentsply Sirona; Geistlich; ACE Surgical; and Zimmer Biomet & BioHorizons.

b. Key factors that are driving the dental bone grafts and substitutes market growth include the increasing use of bone grafts and substitutes in dentistry, the increasing usage of biocompatible & synthetic dental grafts, and the growing number of dental implant surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.