- Home

- »

- Plastics, Polymers & Resins

- »

-

Dairy Packaging Market Size & Share, Industry Report, 2030GVR Report cover

![Dairy Packaging Market Size, Share & Trends Report]()

Dairy Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Glass, Metal, Paper & Paperboard), By Packaging Type (Cans, Bottle, Bags & Pouches, Films & Wraps), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-910-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dairy Packaging Market Summary

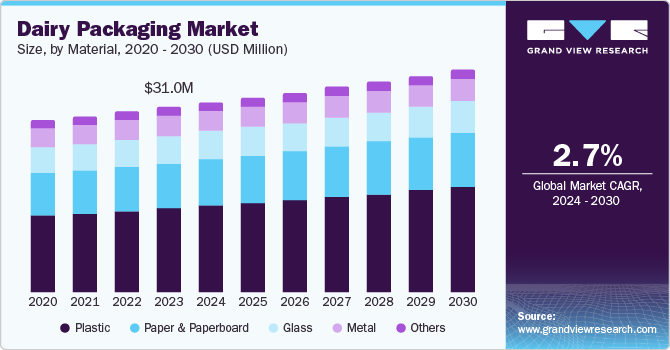

The global dairy packaging market size was valued at USD 31.0 million in 2023 and is projected to reach USD 37.4 billion by 2030, growing at a CAGR of 2.7% from 2024 to 2030. This growth is driven by the increasing demand for dairy products, particularly in emerging economies.

Key Market Trends & Insights

- The Asia Pacific region held the largest revenue share of 35.2% in the global market in 2023.

- By material, the plastic segment accounted for 45.1% of the market revenue in 2023.

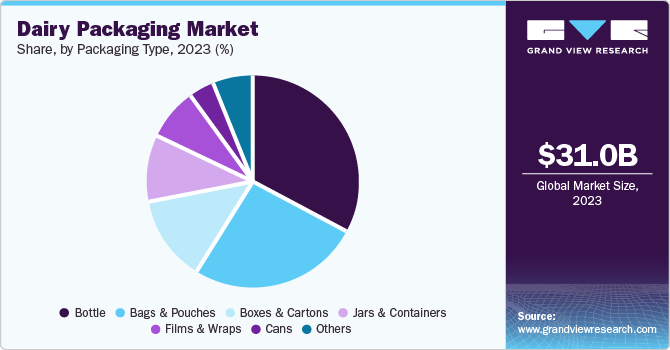

- By packaging type, the bottle segment dominated the market in 2023.

- By packaging type, the bags and pouches segment is expected to grow the fastest over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 31.0 million

- 2030 Projected Market Size: USD 37.4 Million

- CAGR (2024-2030): 2.7%

- Asia Pacific: Largest market in 2023

As disposable incomes rise and dietary preferences shift towards healthier options, the consumption of dairy products is expected to increase, necessitating more packaging solutions. Additionally, the growing trend of convenience foods and ready-to-eat dairy products is boosting the need for efficient and attractive packaging.

The global dairy packaging market is currently experiencing a prominent shift towards sustainable and eco-friendly packaging materials, such as biodegradable plastics and recyclable paperboard, in response to increasing environmental concerns. Smart packaging solutions, which include features such as freshness indicators and QR codes for product information, are also gaining traction. Looking ahead, the market is expected to see further integration of advanced technologies such as modified atmosphere packaging (MAP) and aseptic packaging, which help in preserving the quality and extend the shelf life of dairy products. Moreover, the growing popularity of plant-based dairy alternatives is likely to influence packaging trends, requiring new solutions to cater to this expanding segment.

Material Insights

The plastic segment accounted for 45.1% of the market revenue in 2023 attributed to the versatility and durability of plastic materials widely used for dairy products such as milk, yogurt, and cheese. Plastics offer excellent barrier properties, protecting dairy products from contamination and extending their shelf life. Additionally, the lightweight nature of plastic reduces transportation costs and carbon emissions, making it a cost-effective and environmentally friendly option. Innovations in plastic packaging, such as the development of biodegradable and recyclable plastics, are further enhancing the appeal of this segment.

The paper and paperboard segment is expected to grow at a CAGR of 3.0% from 2024 to 2030 driven by the increasing consumer demand for eco-friendly and sustainable packaging options. Paper and paperboard materials are biodegradable and recyclable, aligning with the global shift towards reducing plastic waste and promoting environmental sustainability. These materials are particularly popular for packaging products such as butter, cream, and other dairy items that do not require the same level of barrier protection as liquid dairy products. Additionally, advancements in paper and paperboard packaging technologies, such as improved moisture resistance and strength, are expanding their applications in the dairy industry.

Packaging Type Insights

The bottle segment dominated the market in 2023 as bottles are particularly favored for liquid dairy products such as milk, yogurt drinks, and cream due to their durability, ease of handling, and ability to provide excellent protection against contamination. The use of materials such as PET (polyethylene terephthalate) in bottle manufacturing offers several advantages, including lightweight properties, recyclability, and the ability to maintain product freshness over extended periods. Additionally, bottles are often designed with user-friendly features such as resealable caps, which enhance convenience for consumers. The dominance of this segment is also driven by the increasing demand for single-serve and on-the-go dairy products, which are typically packaged in bottles.

The bags and pouches segment is expected to grow the fastest over the forecast period from 2024 to 2030 attributed to the rising demand for flexible packaging solutions that offer convenience and cost-effectiveness. Bags and pouches are particularly popular for products such as cheese, butter, and powdered milk, where flexibility and space efficiency are crucial. These packaging types are lightweight, which reduces transportation costs and environmental impact.

Moreover, advancements in packaging technology have led to the development of high-barrier pouches that provide excellent protection against moisture, oxygen, and light, thereby extending the shelf life of dairy products. The increasing consumer preference for eco-friendly packaging options is also driving the adoption of bags and pouches, as they often use less material and are easier to recycle compared to rigid packaging.

Regional Insights

North America accounted for a significant share of the global dairy packaging market revenue in 2023 driven by the high consumption rates of dairy products such as milk, cheese, and yogurt in the region. The presence of advanced packaging technologies and stringent regulations regarding food safety and quality further bolster the market. For instance, the U.S. Food and Drug Administration (FDA) enforces strict guidelines that ensure the safety and integrity of dairy packaging. The region’s well-established dairy industry and continuous innovation in packaging materials and designs contribute to its strong market position.

U.S. Dairy Packaging Market Trends

The U.S. held a substantial revenue share of the North American dairy packaging market in 2023 attributed to the large-scale production and consumption of dairy products in the country. The U.S. market is characterized by a high demand for innovative packaging solutions that enhance product shelf life and safety. For instance, the adoption of aseptic packaging, which allows dairy products to be stored without refrigeration, is gaining traction. Additionally, the growing trend of single-serve and on-the-go dairy products is driving the need for convenient packaging formats.

Asia Pacific Dairy Packaging Market Trends

The Asia Pacific dairy packaging market held the largest revenue share of 35.2% in the global market in 2023 primarily due to the rapidly growing population, rising disposable incomes, and increasing consumption of dairy products in countries such as China and India. The region is witnessing a surge in demand for both traditional dairy products and plant-based alternatives, driving the need for diverse packaging solutions. The expansion of the retail sector and the growing popularity of e-commerce are contributing to market growth, as they require efficient and attractive packaging to appeal to consumers.

China accounted for a significant market share of the Asia Pacific dairy packaging market driven by its large population and the increasing consumption of dairy products, particularly among the urban middle class. The demand for high-quality and safe packaging solutions is rising, fueled by growing health awareness and stringent food safety regulations. For instance, the Chinese government has implemented strict standards for food packaging to ensure consumer safety. The National Mandatory Standard for Requirements of Restricting Excessive Packaging for Fresh Edible Agricultural Products (GB43284-2023) by the PRC State Administration for Market Regulation (SAMR), which aims to curb excessive packaging, is likely to drive dairy producers to adopt more sustainable and efficient packaging solutions. By limiting the interspace ratio and the number of packaging layers, the regulation encourages the use of minimal yet effective packaging materials.

Europe Dairy Packaging Market Trends

The European dairy packaging market is expected to grow at a CAGR of 2.4% from 2024 to 2030 driven by the increasing interest in sustainable packaging solutions and stringent regulations on food safety and packaging sustainability. For instance, the European Union’s Circular Economy Action Plan aims to make all packaging recyclable or reusable by 2030. Countries such as Germany, France, and the UK are seeing a surge in demand for eco-friendly packaging materials such as biodegradable plastics and recyclable paperboard.

The dairy packaging market in the UK is projected to experience steady growth over the forecast period supported by the increasing demand for sustainable and convenient packaging solutions. The UK market is also characterized by a strong focus on innovation, with manufacturers investing in new technologies and materials to enhance packaging efficiency and reduce environmental impact. For instance, the adoption of smart packaging solutions, which include features such as freshness indicators and QR codes for product information, is on the rise.

Middle East And Africa Dairy Packaging Market Trends

The Middle East and Africa dairy packaging market is expected to grow the fastest over the forecast period driven by the increasing consumption of dairy products in the region, supported by rising disposable incomes and changing dietary preferences. The adoption of flexible packaging solutions such as pouches and bags is increasing due to their cost-effectiveness and convenience. In addition, the expansion of the retail sector and the growing popularity of e-commerce are contributing to the market growth, as they require efficient and attractive packaging to appeal to consumers.

Key Dairy Packaging Company Insights

The global dairy packaging market is driven by several key companies, including Amcor plc, Sonoco Products Company, Greiner Packaging, Constantia Flexibles, and Tetra Pak.

-

Amcor plc offers various innovative and sustainable packaging options tailored to dairy products such as cheese, yogurt, and butter. Amcor’s solutions include recycle-ready materials such as AmPrima and DairySeal, designed to meet the growing consumer demand for environmentally friendly packaging.

-

Tetra Pak is renowned for its comprehensive dairy processing and packaging solutions. With over 70 years of experience, Tetra Pak provides end-to-end solutions that cover everything from milk and yogurt to cream and cheese. Their aseptic packaging technology, which includes the well-known Tetra Pak cartons, allows dairy products to be stored without refrigeration until opened.

Key Dairy Packaging Companies:

The following are the leading companies in the dairy packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Greiner Packaging

- Sonoco Products Company

- Mondi

- Berry Global Inc.

- Constantia Flexibles

- DS Smith

- Tetra Pak

- Winpak LTD

- ProAmpac

- Smurfit Kappa

- Stanpac Inc

- Alfipa

- Sealed Air

- Graham Packaging

Recent Developments

-

In October 2023, IVE Group entered into a definitive agreement to acquire 100% of JacPak, a leading provider of fiber-based packaging solutions for diverse industries, including fast-moving consumer goods, dairy, cosmetics, and pharmaceuticals. This strategic acquisition marks IVE’s entry into the domestic fiber-based packaging market.

-

In August 2024, Greatview Aseptic Packaging Company Limited firmly rejected an unsolicited takeover bid from Jingfeng Holding Limited. Jingfeng had made a pre-conditional voluntary general offer for Greatview, which the company deemed hostile. Greatview clarified that the proposed combination with Shandong NewJF is fundamentally incompatible and would not be beneficial to its shareholders.

Dairy Packaging Market Scope

Report Attribute

Details

Market size value in 2024

USD 31.8 million

Revenue forecast in 2030

USD 37.4 million

Growth rate

CAGR of 2.7% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, packaging type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Key companies profiled

Amcor plc, Greiner Packaging, Sonoco Products Company, Mondi, Berry Global Inc., Constantia Flexibles, DS Smith, Tetra Pak, Winpak LTD, ProAmpac, Smurfit Kappa, Stanpac Inc, Alfipa, Sealed Air, Graham Packaging

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dairy Packaging Market Report Segmentation

This report forecasts revenue growth of the dairy packaging market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dairy packaging market report based on material, packaging type, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Glass

-

Metal

-

Paper & Paperboard

-

Others

-

-

Packaging Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cans

-

Bottle

-

Bags & Pouches

-

Films & Wraps

-

Boxes & Cartons

-

Jars & Containers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.