- Home

- »

- Consumer F&B

- »

-

Dairy Ingredients Market Size, Share & Growth Report, 2030GVR Report cover

![Dairy Ingredients Market Size, Share & Trends Report]()

Dairy Ingredients Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Bakery & Confectionery, Dairy Products, Convenience Foods, Infant Milk Formula, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-384-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dairy Ingredients Market Summary

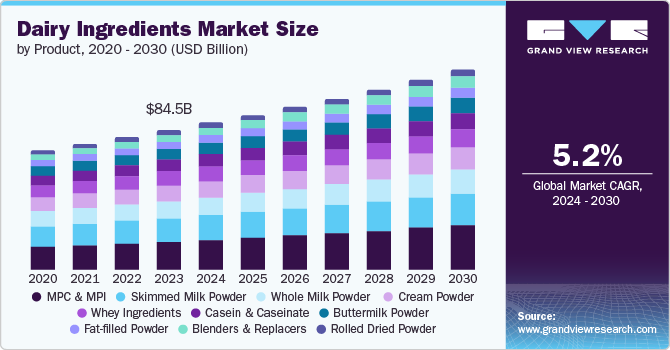

The global dairy ingredients market size was estimated at USD 84,525.9 million in 2023 and is projected to reach USD 120,601.5 million by 2030, growing at a CAGR of 5.2% from 2024 to 2030. The growing popularity of dairy-based products across various sectors, including food and beverage, bakery, confectionery, and dietary supplements fuel the demand for dairy ingredients.

Key Market Trends & Insights

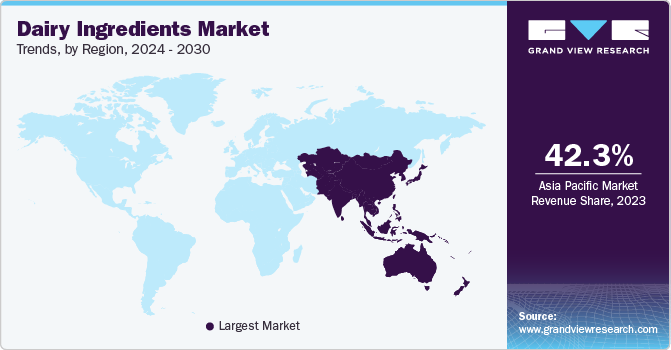

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- In terms of segment, skimmed milk powder (SMP) accounted for a revenue of USD 84,525.9 million in 2023.

- Skimmed Milk Powder (SMP) is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 84,525.9 Million

- 2030 Projected Market Size: USD 120,601.5 Million

- CAGR (2024-2030): 5.2%

- Asia Pacific: Largest market in 2023

Dairy ingredients such as milk powders, whey proteins, casein, and lactose are valued for their nutritional benefits, functional properties, and versatile applications in food processing.

Health awareness and nutrition trends have also significantly boosted the demand for dairy ingredients. Dairy ingredients are rich sources of essential nutrients like calcium, protein, and vitamins, crucial for maintaining bone health, muscle growth, and overall well-being. As consumers become more health-conscious and seek natural, protein-rich alternatives, dairy ingredients offer a compelling solution.

Furthermore, rising disposable incomes and changing dietary patterns in emerging economies have fueled the demand for dairy products and ingredients. Countries in Asia-Pacific, Latin America, and Africa are witnessing a shift towards Western dietary habits and increasing consumption of dairy-based foods and beverages. This demographic shift, urbanization, and rising middle-class populations have created a robust market for dairy ingredients globally. Innovation in product formulations and technological advancements in dairy processing have also contributed to the growth of the dairy ingredients market. Manufacturers are continuously developing new applications and improving the functionality of dairy ingredients to meet consumer demands for clean-label products, enhanced taste profiles, and extended shelf-life.

Moreover, dairy ingredients are integral to the food industry's efforts to address food security and sustainable production challenges. They provide a reliable source of nutrition and contribute to the economic livelihoods of dairy farmers and processors worldwide. As a result, the demand for dairy ingredients is expected to continue its upward trajectory, driven by evolving consumer preferences, health trends, and expanding market opportunities globally.

Product Insights

The MPC (Milk Protein Concentrate) and MPI (Milk Protein Isolate) segment dominated the market in 2023 accounting for a revenue share of 19.7% in 2023. MPC and MPI are valued for their high protein content, making them suitable ingredients for food and beverage manufacturers aiming to enhance nutritional profiles. This high protein content is particularly beneficial in sports nutrition, infant formula, and dietary supplements, where protein fortification is crucial. Another driving factor for the increased demand is the growing consumer awareness and preference for healthier food choices. MPC and MPI are perceived as natural sources of protein derived from milk, preferred by consumers seeking clean-label products with minimal additives. This aligns with broader dietary trends favoring high-protein diets for muscle building, weight management, and overall health.

The skimmed milk powder (SPM) segment held significant market share in 2023.SMP has a longer shelf life than liquid milk, making it a suitable choice for manufacturers seeking stable, longer-lasting dairy products. This attribute enhances its appeal in various food applications where extended shelf life is crucial, such as bakery products, confectionery, and ready-to-eat meals. Furthermore, SMP is chosen for its adaptability in food processing. It is a valuable ingredient in producing various dairy products and formulations. This versatility allows food manufacturers to achieve consistent quality and texture in their products while benefiting from SMP's nutritional profile, which includes high protein content and essential minerals like calcium. Additionally, the growing popularity of health-conscious consumer trends has boosted the demand for low-fat and reduced-calorie options in food products. SMP, being low in fat while retaining essential nutrients, fits well into this trend. It is often used to formulate dietary products, protein supplements, and infant formula, catering to consumers seeking healthier alternatives without compromising nutritional value.

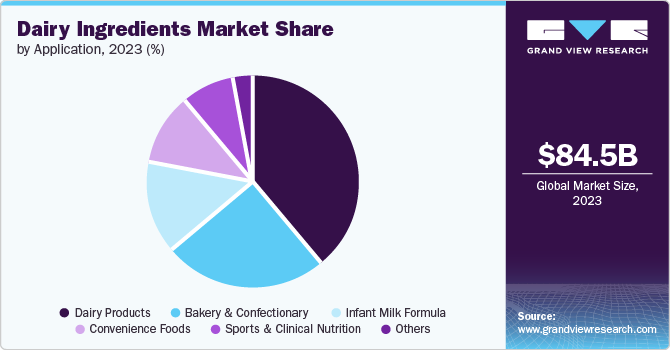

Application Insights

The dairy products segment held the largest market revenue share in 2023. The rising consumer preference for natural and healthy ingredients across various food and beverage categories drives the segment growth. Dairy ingredients, such as milk powders, proteins like whey and casein, and derivatives like lactose, are valued for their nutritional benefits and functionality in food processing. Furthermore, the global trend towards convenience foods and beverages has bolstered the demand for dairy ingredients. Manufacturers are incorporating these ingredients into ready-to-eat meals, bakery products, and nutritional supplements to meet consumer demand for convenient yet nutritious options. Additionally, the increasing disposable incomes in emerging markets have led to greater consumption of dairy-based products. Countries like China and India are witnessing a surge in demand for dairy ingredients as their populations adopt more Western dietary habits and lifestyles.

The convenience foods segment is expected to witness the fastest CAGR over the forecast period. Dairy ingredients, such as milk powders, cheese powders, and yogurt powders, help in enhancing the taste, texture, and nutritional profile of convenience foods like ready-to-eat meals, snacks, and bakery products. These ingredients offer manufacturers extended shelf life, ease of handling, and consistent quality, which are essential for meeting consumer expectations for taste and convenience. Additionally, the rising consumer preference for on-the-go snacks and quick meal solutions further drives the demand for dairy ingredients in the convenience food segment. This trend is reinforced by growing urbanization, busy lifestyles, and increasing disposable incomes, collectively supporting the growth of convenient dairy-based products that cater to modern consumer needs.

Regional Insights

North America dairy ingredients market is witnessed as a lucrative region in this industry. The rising popularity of dairy-based products among consumers seeking natural and nutritious food options drive the market growth in the region. Dairy ingredients such as milk powders, cheese, and butter are essential components in a wide range of food and beverage products, including bakery items, confectionery, and ready-to-eat meals. Moreover, growing consumer preference for protein-rich diets fuels the market demand for dairy ingredients. Additionally, technological advancements in dairy processing have enhanced the functionality and versatility of these ingredients, allowing manufacturers to create innovative products that cater to evolving consumer tastes and preferences. The increasing adoption of convenience foods and beverages also influences the North American market's demand for dairy ingredients.

U.S. Dairy Ingredients Market Insights

U.S. accounted for a significant market share in regional dairy ingredients market in 2023. The increasing awareness of protein-rich food and growing health and wellness concerns is driving the market growth. Dairy ingredients are used in production of several personal care products, such as soaps, shampoos, conditioners, and moisturizers. The rising demand in personal care industry is promoting the market growth. Dairy ingredients are also used in popular beverages such as tea, coffee, and milkshake it increases their flavor by adding creaminess. In addition, lactose, whey protein, and casein are used to prepare baby foods to fulfill their nutritional requirements.

Europe Dairy Ingredients Market Insights

Europe dairy ingredients market is projected to grow at significant CAGR during the forecast period. The growing consumer preference for natural and healthy food options has bolstered the demand for dairy-based products in the region. Additionally, the European dairy industry constantly innovates and diversifies its product offerings, catering to changing consumer tastes and dietary trends such as increased protein consumption. Moreover, the rise in bakery and confectionery sectors across Europe has fueled demand for dairy ingredients like milk powders, butter, and cream, which are essential for enhancing product flavor. Lastly, with an increasing focus on sustainable food production and sourcing, European consumers favor locally sourced dairy ingredients, supporting regional dairy farms and producers.

The dairy ingredients market in UK. The increasing awareness among consumers in the U.K. about the benefits derived from dairy protein for maintaining a healthy lifestyle drives the market. Dairy products are rich in protein and have a higher content of amino acids. Ingredients such as whey protein, milk protein, and casein are also recognized for their anti-aging properties. In addition, following a healthy diet and consuming dairy proteins also helps reduce stress and improve immunity. Dairy ingredients are also used in infant milk formula, which plays a key role in the growth of infants.

Germany dairy ingredients market share in 2023. The growing consumer preference towards healthier and natural food options is driving the demand for dairy ingredients known for their nutritional benefits. Products like yogurt, cheese, and milk-based beverages are increasingly favored for their protein content and probiotic properties, aligning with health-conscious consumer trends. Additionally, the popularity of convenience foods that incorporate dairy ingredients, such as ready-to-eat meals and snacks, has surged, further boosting demand.

Asia Pacific Dairy Ingredients Market Insights

Asia Pacific dominated the market and accounted for a market share of 42.3% in 2023. The rapidly increasing population and urbanization in the region drive the demand for dairy ingredients as individuals seek products that meet their nutritional requirements. Innovations in dairy products, such as new and exciting flavors and improved packaging, provide a wide range of alternatives to consumers. Increased demand for bakery products is also one of the key driving factors. The region's rising food and hotel industry influences the demand for dairy products such as cheese, butter, yogurt, and buttermilk. The impact of Western food culture is leading to the consumption of Western food, such as pizza and burgers, which drives the demand for dairy ingredients.

India dairy ingredients market dominated the market in 2023. India has a rapidly growing population with increasing disposable incomes, leading to higher consumption of dairy products and processed foods that use dairy ingredients. This demographic shift is fueling demand across various segments, including bakery, confectionery, and dairy product manufacturing. The cultural preference for dairy-based products in Indian cuisine drives consistent consumption throughout the year. Additionally, the nutritional value of dairy ingredients such as milk powders, butter, and ghee plays a crucial role in meeting dietary requirements, particularly in a country where vegetarianism is widespread, and dairy is a primary source of protein and essential nutrients.

The dairy ingredients market in China. The rising consumer preference for Western-style diets and products, including dairy-based foods and beverages drives market growth. This shift in dietary habits, influenced by globalization and urbanization trends, has created a growing appetite for dairy ingredients like milk powders, cheese, and butter among Chinese consumers. Moreover, disposable incomes and living standards have increased significantly across China's expanding middle class. As a result, consumers increasingly seek higher-quality food products, including those made with imported or premium dairy ingredients that offer superior nutritional value and safety standards.

Latin America Dairy Ingredients Market Insights

Latin America is anticipated to witness significant growth in the laundry detergent market. The increasing consumer preference for dairy-based products due to their nutritional benefits and versatility in culinary applications drive the market growth in the region. As diets evolve and become more diverse, there is a rising inclination towards incorporating dairy ingredients into everyday meals and snacks. Economic improvements in many Latin American countries have also led to higher disposable incomes, allowing consumers to afford more dairy products and ingredients. This economic growth has also spurred urbanization and changes in lifestyle, where convenience and nutrition play crucial roles in food choices.

Key Dairy Ingredients Company Insights

Some of the key companies include Fonterra Co-Operative Group Limited; Arla Food Ingredients. The key players focus on launching new products and providing cheaper alternatives to existing ones. Major companies are taking strategic initiatives such as mergers, acquisitions, and collaborations.

-

Fonterra Co-Operative Group Limited with their New Zealand Milk Products brand provides a wide range of dairy ingredients including natural cheese, milk powder, cream powder, proteins, and dairy fats sold in more than 130 countries in the world.

-

Arla Food Ingredients offers the casein isolate, Lacprodan MicelPure which is directly extracted form milk without adding harsh acids. which offers the high level of protein with a mild taste for sports and fitness enthusiasts. They also provide proteins and calcium rich coffee and tea for active lifestyle.

Key Dairy Ingredients Companies:

The following are the leading companies in the dairy ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- Fonterra Co-Operative Group Limited

- FrieslandCampina

- Arla Food Ingredients

- Glanbia PLC

- Sodiaal Group

- Dairy Farmers of America Inc.

- Saputo, Inc.

- Schreiber Foods Inc.

- Lactalis American Group, Inc.

- EPI Ingredients

Recent Developments

-

In May 2024, Epi Ingredients announced the launch of a new additive-free butter powder, aiming to meet growing consumer demand for clean-label and natural ingredients. This product innovation addresses the industry's need for versatile and convenient butter alternatives in various food applications.

-

In May 2024, Saputo's Frigo Cheese Heads brand announced the launch of a new whole milk string cheese product aimed at meeting consumer demand for higher-fat dairy snacks. This launch expands their existing line of string cheese products to include a whole milk option, which is positioned to appeal to those seeking a richer and creamier taste experience.

Dairy Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 88.93 billion

Revenue forecast in 2030

USD 120.60 billion

Growth Rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million, volume in kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Singapore, Brazil, Kuwait, UAE, Saudi Arabia and South Africa

Key companies profiled

Fonterra Co-Operative Group Limited; FrieslandCampina; Arla Food Ingredients; Glanbia PLC; Sodiaal Group; Dairy Farmers of America Inc.; Saputo, Inc.; Schreiber Foods Inc.; Lactalis American Group, Inc.; EPI Ingredients

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dairy Ingredients Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dairy ingredients market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, Volume Kilotons, 2018 - 2030)

-

Skimmed Milk Powder (SMP)

-

Whole Milk Powder (WMP)

-

Buttermilk Powder

-

Cream Powder

-

Blenders & Replacers

-

Rolled Dried Powder

-

Fat-filled Powder

-

Permeate Powder

-

Lactose & Derivatives

-

Casein & Caseinate

-

MPC & MPI

-

Whey Ingredients

-

-

Application Outlook (Revenue, USD Million, Volume Kilotons, 2018 - 2030)

-

Bakery & Confectionary

-

Chocolates

-

Ice creams

-

Others

-

-

Dairy Products

-

Recombinant Milk

-

Others

-

-

Convenience Foods

-

Infant Milk formula

-

Sports & Clinical Nutrition

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.