- Home

- »

- Communication Services

- »

-

Customer Experience Management Market Size Report 2033GVR Report cover

![Customer Experience Management Market Size, Share, & Trends Report]()

Customer Experience Management Market (2026 - 2033) Size, Share, & Trends Analysis Report By Analytical Tools (EFM Software, Speech Analytics, Text Analytics, Web Analytics & Content Management), By Touch Point, By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-502-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Customer Experience Management Market Summary

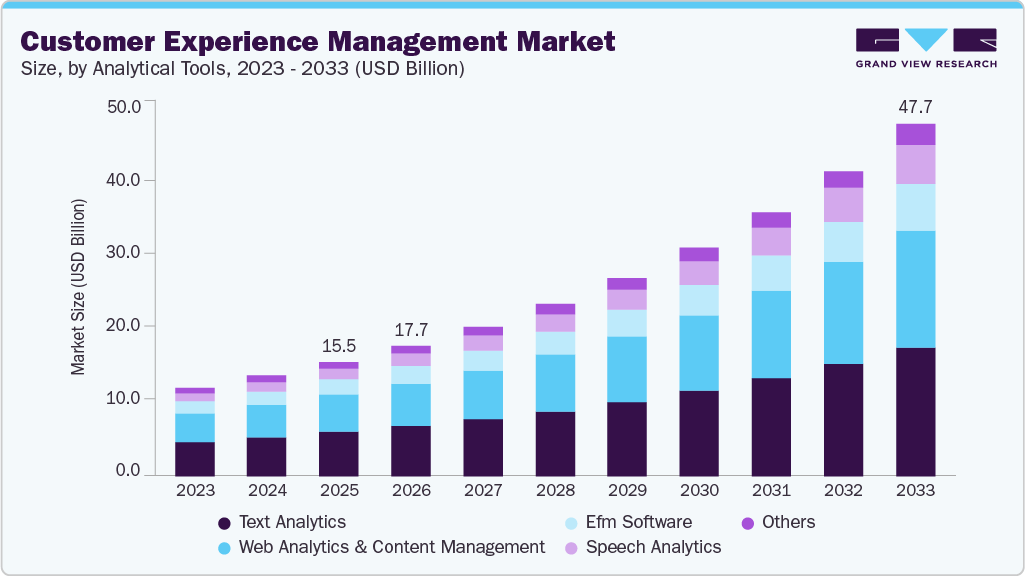

The global customer experience management market size was estimated at USD 15.55 billion in 2025 and is projected to reach USD 47.72 billion by 2033, growing at a CAGR of 15.2% from 2026 to 2033 due to enterprises’ increasing recognition of customer experience as a critical source of competitive differentiation in highly saturated and digitally mature markets. As products and pricing become easier to replicate, organizations are focusing on delivering consistent, personalized, and seamless experiences across the entire customer journey to improve retention, lifetime value, and brand loyalty.

Key Market Trends & Insights

- North America customer experience management dominated the global market with the largest revenue share of 42.4% in 2025.

- The customer experience management industry in the U.S. is expected to grow significantly over the forecast period.

- Based on analytical tools, text analytics led the market and held the largest revenue share of 38.9% in 2025.

- In terms of deployment, the cloud segment held the dominant position in the market and accounted for the largest revenue share in 2025.

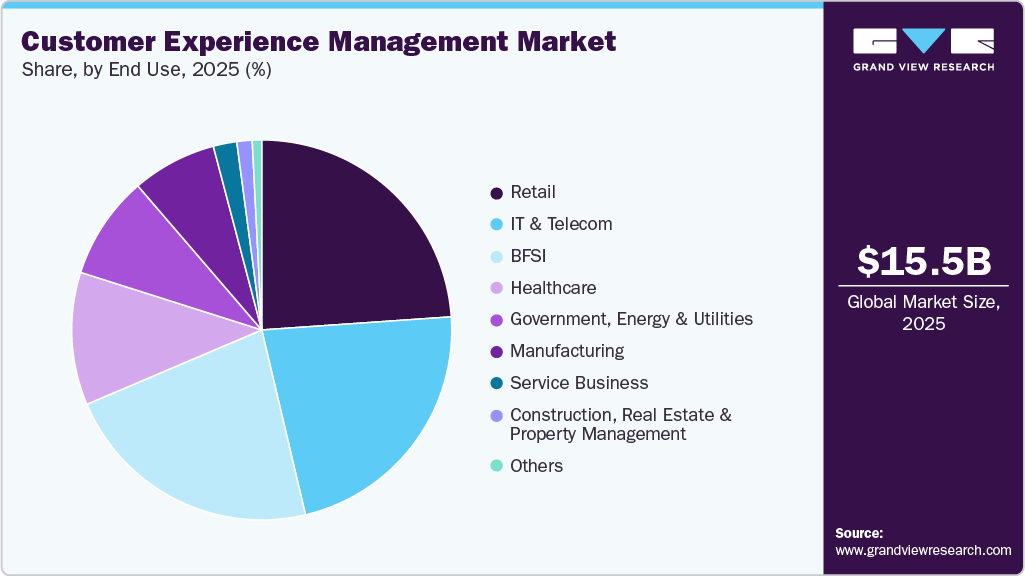

- Based on end use, the BFSI segment is expected to grow at the fastest CAGR from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 15.55 Billion

- 2033 Projected Market Size: USD 47.72 Billion

- CAGR (2026-2033): 15.2%

- North America: Largest market in 2025

- Asia Pacific: Fastest-growing market

This strategic shift has elevated customer experience management (CEM) from a supporting function to a core business priority, prompting sustained investment in platforms and services that enable end-to-end journey orchestration, omnichannel engagement, and real-time experience optimization. Rapid digitalization and the proliferation of customer interaction channels are further accelerating CEM adoption. Customers engage with brands across websites, mobile apps, social media, contact centers, messaging platforms, and physical touchpoints, creating fragmented data and complex journeys. CEM solutions address this complexity by unifying customer data across channels, enabling a single view of the customer, and supporting consistent experiences regardless of touchpoint. The growth of e-commerce, digital banking, telehealth, and app-based services has significantly increased interaction volumes, reinforcing demand for scalable, cloud-based CEM platforms.

Advances in artificial intelligence, analytics, and automation represent another growth driver for the CEM market. AI-powered capabilities such as sentiment analysis, speech and text analytics, predictive modeling, and real-time personalization enable organizations to proactively identify customer needs, anticipate churn, and tailor interactions at scale. Generative AI and conversational AI are further enhancing self-service, virtual assistants, and agent support, improving both customer satisfaction and operational efficiency. For instance, in September 2025, Adobe launched its AI agents aimed at enhancing how businesses create, deliver, and optimize customer experiences. Powered by the Adobe Experience Platform (AEP) Agent Orchestrator, the agents leverage real-time enterprise data, content, and workflows to understand customer context and take relevant actions across marketing and experience journeys. By anchoring AI capabilities within AEP, Adobe enables enterprises to drive more personalized, efficient, and ROI-focused customer engagement at scale.

Analytical Tools Insights

The text analytics segment dominated the market and accounted for the revenue share of 38.9% in 2025, owing to the exponential rise in unstructured customer-generated data. Customers increasingly express opinions, complaints, and preferences through text-rich channels such as social media, reviews, chat transcripts, emails, and survey responses. Traditional analytics tools are inadequate for extracting actionable insights from this unstructured text. Text analytics solutions, leveraging natural language processing (NLP), semantic analysis, and machine learning, enable enterprises to systematically analyze sentiment, intent, themes, and emerging patterns.

The speech analytics segment is anticipated to grow at the fastest CAGR during the forecast period, driven by the demand for real-time insights and operational responsiveness. Customers expect rapid resolution and personalized interactions, and delayed analysis of call data limits an organization’s ability to respond effectively. Real-time speech analytics, powered by advances in automatic speech recognition (ASR) and natural language processing (NLP), enables organizations to monitor live calls, flag critical issues, and prompt agents with relevant guidance during conversations.

Touch Point Insights

The call centers segment dominated the market and accounted for the largest revenue share in 2025 due to the evolution of call center technologies toward intelligent, data-driven customer engagement. Traditional call centers are being transformed through the integration of analytics, automation, and artificial intelligence. Speech analytics, real-time sentiment scoring, and predictive routing are enhancing the quality and efficiency of voice interactions. These advancements enable call centers to proactively identify customer intent, anticipate needs, and deliver tailored support, thereby elevating the strategic value of the call center as a customer experience differentiator rather than only a cost center.

The web services segment is anticipated to grow at the fastest CAGR during the forecast period, driven by the rapid shift of customer interactions toward digital-first and self-service channels. Websites, web portals, and browser-based applications have become the primary interface for customer engagement across industries such as retail, BFSI, telecom, travel, and healthcare. Customers increasingly prefer web-based touchpoints for activities such as product discovery, onboarding, transactions, support, and issue resolution as they offer convenience and accessibility.

Deployment Insights

The cloud segment dominated the market and accounted for the largest revenue share in 2025, driven by the shifting enterprise preference toward scalable, flexible, and cost-efficient technology solutions. Organizations are increasingly moving away from traditional on-premises deployments that require substantial upfront capital expenditure, lengthy implementation cycles, and ongoing maintenance. Cloud-based CEM solutions eliminate the need for heavy infrastructure investments, enabling companies of all sizes, especially small and midsize enterprises, to adopt advanced CX capabilities with lower entry barriers.

The on-premises segment is expected to grow at a significant CAGR during the forecast period, owing to the stringent data security and compliance requirements faced by large enterprises and regulated industries. Organizations across sectors such as banking, financial services, healthcare, government, and defense often operate under rigorous regulatory frameworks that require strict controls over customer data, auditability, and data residency. On-premises implementations enable these organizations to retain full control of sensitive information within their own infrastructure, reducing perceived risk and simplifying compliance with local data protection laws, industry standards, and internal governance policies.

Enterprise Size Insights

The large enterprise segment dominated the market and accounted for the largest revenue share in 2025, driven by the scale and complexity of customer interactions that these organizations must manage. Large enterprises operate across multiple regions, products, and channels, resulting in vast and disparate customer data sources. To maintain competitive advantage and operational efficiency, these organizations increasingly require robust CEM solutions that can consolidate data from CRM systems, contact centers, digital platforms, and field services.

The small & medium enterprises segment is expected to grow at a significant CAGR during the forecast period, owing to increasing recognition among SMEs that superior customer experience is central to business sustainability and growth. Historically, SMEs invested little in technology and relied heavily on manual processes and ad-hoc customer interactions. To remain competitive with larger enterprises and meet these elevated expectations, SMEs are adopting CEM solutions that help them personalize interactions, manage omnichannel communication, and systematically capture customer feedback.

End Use Insights

The retail segment dominated the market and accounted for the largest revenue share in 2025, driven by the retailers’ increasing focus on delivering personalized, consistent, and omnichannel customer journeys to differentiate themselves in a highly competitive and digitally disrupted environment. Rapid growth of e-commerce, mobile shopping, and social commerce has significantly increased customer touchpoints, compelling retailers to deploy CEM platforms that integrate data across online and offline channels to gain a unified view of customer behavior.

The BFSI segment is expected to grow at a significant CAGR over the forecast period, driven by rapidly evolving customer expectations and heightened competition among financial institutions. In today’s digital economy, banking and insurance customers increasingly demand seamless, personalized, and contextually relevant interactions across all touchpoints. Traditional branch-centric service models are being supplanted by digital channels such as mobile banking, chatbots, and online portals. To retain and grow customer bases, BFSI organizations are investing heavily in CEM solutions that unify customer data, enable omnichannel engagement, and support tailored experiences throughout the entire customer lifecycle.

Regional Insights

The customer experience management industry in North America dominated the global market with the largest revenue share of 42.4% in 2025, driven by the maturity of digital ecosystems and the widespread adoption of experience-led business models across industries such as retail, healthcare, telecom, and technology. Enterprises in the region prioritize CX as a board-level KPI, closely tied to revenue growth and shareholder value, which sustains high investment in advanced journey orchestration, experience analytics, and CX governance platforms.

U.S. Customer Experience Management Market Trends

The customer experience management industry in the U.S. is expected to grow significantly at a CAGR of 12.9% from 2026 to 2033, due to intense competition in consumer-facing industries and the rapid scaling of AI-driven customer engagement solutions. U.S. enterprises are aggressively deploying generative AI, conversational AI, and predictive analytics to differentiate customer interactions and improve agent productivity at scale.

Europe Customer Experience Management Market Trends

The customer experience management industry in Europe is anticipated to register considerable growth from 2026 to 2033, driven by regulatory-led experience standardization and data protection requirements. Organizations invest in structured CEM frameworks to ensure compliant, transparent, and consistent customer interactions across borders, languages, and channels.

The UK customer experience management industry is expected to grow rapidly in the coming years, owing to the financial services sector’s strong focus on customer outcomes and service quality benchmarks. Regulatory initiatives emphasizing fair customer treatment and service transparency have pushed banks, insurers, and utilities to adopt advanced CEM solutions for journey monitoring and experience assurance.

The customer experience management industry in Germany held a substantial market share in 2025 due to the enterprise demand for operational excellence and process consistency across manufacturing, automotive, and B2B services. German organizations emphasize structured customer journeys, service reliability, and data-driven continuous improvement rather than pure engagement metrics.

Asia Pacific Customer Experience Management Market Trends

The customer experience management industry in the Asia Pacific held a significant share in the global market in 2025, due to large-scale digital population growth and rising middle-class consumption across emerging economies. Organizations must manage high interaction volumes across mobile-first channels, languages, and cultural contexts, driving demand for scalable, cloud-based CEM solutions.

The Japan customer experience management industry is expected to grow rapidly in the coming years, driven by the transformation of traditional service models to address labor shortages and aging demographics. Enterprises are adopting CEM solutions to standardize service quality, digitize customer interactions, and reduce dependency on manual processes.

The customer experience management industry in China held a substantial market share in 2025, due to the dominance of platform-based digital ecosystems and real-time customer engagement models. Enterprises leverage CEM solutions to manage hyper-personalized experiences across social commerce, live streaming, and in-app interactions within closed digital environments.

Key Customer Experience Management Company Insights

Key players in the customer experience management industry include IBM Corporation, Oracle Corp., SAP SE, Adobe, and Open Text Corporation. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In January 2026, Medallia, Inc. and AI customer experience leader Ada formed a strategic partnership to deliver a joint solution that combines Ada’s real-time, AI-powered capabilities with Medallia’s omnichannel customer experience and operational intelligence. The integration enables CX and contact center leaders to quickly turn insights into automated actions, addressing customer issues, guiding purchasing decisions, and managing complex workflows more effectively.

-

InNovember 2025, Open Text Corporation expanded its collaboration with SAP to offer AI-enabled cloud content management integrated with SAP S/4HANA Cloud. The enhanced solution unifies content and data, enabling organizations to deliver smarter, scalable, and more seamless customer experiences. This partnership strengthens capabilities for managing enterprise information while supporting advanced analytics and automation, positioning both companies to address growing demand in the customer experience management market.

-

In October 2025, Oracle unveiled its Fusion Applications AI Agent Marketplace on, aiming to boost enterprise adoption of AI by allowing customers to implement partner-developed AI agents within Oracle Fusion Cloud Applications. These agents are designed to streamline key operational processes, including customer engagement and experience management, by integrating intelligent automation and analytics. In addition, Oracle introduced new AI agents within its Fusion Cloud Applications that enhance marketing, sales, and service operations, enabling personalized interactions and deeper customer engagement across enterprise workflows.

Key Customer Experience Management Companies:

The following key companies have been profiled for this study on the customer experience management market.

- Adobe Inc.

- Avaya Inc.

- Clarabridge

- Freshworks Inc.

- Genesys

- IBM Corporation

- Medallia Inc.

- Miraway

- Open Text Corporation

- Oracle Corporation

- Qualtrics

- SAP SE

- SAS Institute Inc.

- Service Management Group (SMG)

- Tech Mahindra Ltd.

- Verint

- Zendesk

Customer Experience Management Market Report Scope

Report Attribute

Details

Market size in 2026

USD 17.73 billion

Revenue forecast in 2033

USD 47.72 billion

Growth Rate

CAGR of 15.2% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Analytical tools, touch point, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Adobe Inc.; Avaya Inc.; Clarabridge; Freshworks Inc;

Genesys; IBM Corporation; Medallia Inc.; Miraway; Open Text Corporation; Oracle Corporation; Qualtrics; SAP SE; SAS Institute Inc.; Service Management Group (SMG); Tech Mahindra Ltd.; Verint; Zendesk

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Customer Experience Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global customer experience management market report based on analytical tools, touch point, deployment, enterprise size, end use, and region.

-

Analytical Tools Outlook (Revenue, USD Billion, 2021 - 2033)

-

EFM Software

-

Speech Analytics

-

Text Analytics

-

Web Analytics & Content Management

-

Others

-

-

Touch Point Outlook (Revenue, USD Billion, 2021 - 2033)

-

Stores/Branches

-

Call Centers

-

Social Media Platform

-

Email

-

Mobile

-

Web Services

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premises

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Small & Medium Enterprises

-

Large Enterprise

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Retail

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Government, Energy & Utilities

-

Construction, Real Estate & Property Management

-

Service Business

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global customer experience management market size was estimated at USD 15.55 billion in 2025 and is expected to reach USD 17.73 billion in 2026.

b. The global customer experience management market is expected to grow at a compound annual growth rate of 15.2% from 2026 to 2033, reaching USD 47.72 billion by 2033.

b. The text analytics segment dominated the global customer experience management market in 2023, accounting for a revenue share of nearly 39.0%owing to the exponential rise in unstructured customer-generated data. Customers increasingly express opinions, complaints, and preferences through text-rich channels such as social media, reviews, chat transcripts, emails, and survey responses.

b. The market growth can be attributed to enterprises’ increasing recognition of customer experience as a critical source of competitive differentiation in highly saturated and digitally mature markets. As products and pricing become easier to replicate, organizations are focusing on delivering consistent, personalized, and seamless experiences across the entire customer journey to improve retention, lifetime value, and brand loyalty.

b. The call centers segment dominated the market and accounted for the largest revenue share in 2025 due to the evolution of call center technologies toward intelligent and data-driven customer engagement.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.