Industry Insights

The global cumene market size was worth USD 18.8 billion in 2016. Its growing demand in various applications such as laminates, composites, and plastics, is expected to be the key factor driving market growth.

Cumene is an organic compound, which is also known as isopropyl benzene. It is formed by an aliphatic substitution of aromatic compounds and is a constituent of refined fuels & crude oil. Isopropylbenzene is characterized by its colorless & flammable nature, which boils at a temperature of 152oC. For commercial usage, it is manufactured by the Friedel-Crafts alkylation method.

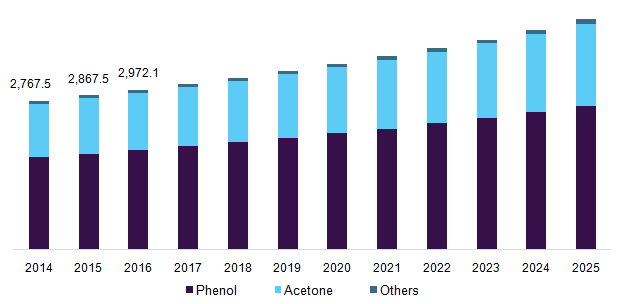

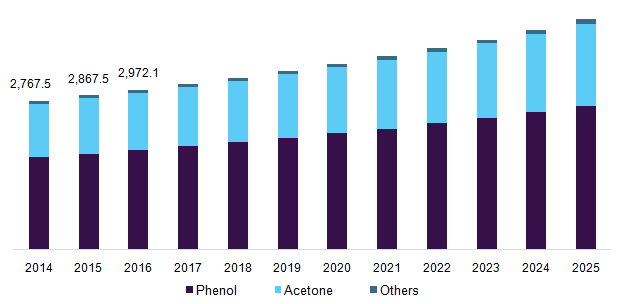

U.S. cumene market revenue by application, 2014 - 2025 (Kilotons)

The U.S. market by application was valued at 2,972.1 kilotons in 2016 and is projected to grow at a steady rate over the forecast period. Increasing demand for enamels, lacquers, and paints, along with the growing cumene usage for the manufacturing of steel, iron, and rubber in the country, is anticipated to boost the market growth.

The organic compound isopropyl benzene is also utilized for the production of other chemicals such as phenols, and acetone. All the pure cumene compounds, produced on an industrial scale are transformed into cumene hydroperoxide. This compound is employed as an intermediate for the production of chemicals, such as acetone and phenol for industrial use.

Cumene is a highly stable compound but has the tendency to form peroxides when it comes in contact with air. It is known to be incompatible with some reactions when coupled with strong oxidizing agents Owing to this factor, it is often checked for peroxide content prior to distillation or heat treatment.

Production Insights

Cumene is manufactured primarily by the reaction between benzene and propylene. These raw materials are stored in huge tanks of 500MT capacity prior to being pumped by centrifugal pumps. The recycled benzene is then mixed with the pumped benzene and then passed through a stream of 25 atm pressure. This mixture is later mixed with propylene in a vaporized state at a temperature of 243oC. The final mixture is then passed through a superheater to attain a temperature of 350oC.

The vaporized mixture is then mixed with solid phosphoric acid which acts as a catalyst and helps to obtain a stable cumene product. Solid phosphoric acid along with alumina is utilized as a catalyst in order to obtain a highly stable and safe product. These reactions can be carried out in liquid or gaseous states. However, to obtain high conversion and stable products, a gaseous state is used.

Friedel-Crafts alkylation method is also utilized to manufacture cumene. The method is obtained by the addition of aluminum chloride to aromatic benzene. This reaction takes place at a temperature of around 130oC. Some of the disadvantages of the method includes such as environmental hazard, high corrosion, and tedious washing for the removal of catalyst.

Modern industrial processes employ the usage of zeolites as a catalyst for the production of cumene. Zeolites have various advantages over aluminum chloride. The use of zeolites helps to reduce the formation of olefin oligomers and polyalkylbenzenes, which thus enables attain a yield of 98%. The catalyst also enables to attain alkylation at lower pressure and temperatures.

Application Insights

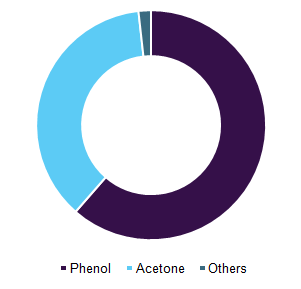

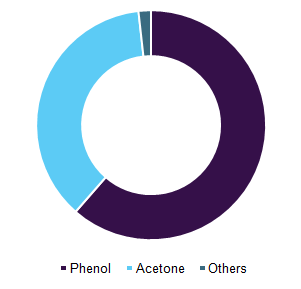

The global market cumene is benefitting on account of increasing demand for phenol and acetone. Phenol emerged as the largest application segment and accounted for over 61.4% of the total market revenue in 2016.

Global cumene market revenue by application, 2016 (%)

Isopropylbenzene is used extensively for the production of phenols and its derivatives. Some of the phenol derivatives produced with the help of cumene include phenol resins, caprolactam, bisphenol A, and alkyl phenols. Bisphenol A is the largest derivative of phenol which is further utilized for the production of polycarbonate and epoxy resins. The polycarbonate resins are mixed with glass and metals for use in the automotive sector.

The polycarbonate derived from Bisphenol-A using cumene, finds its application in security (sheets & glazing), and architectural outlets. The polycarbonate is also utilized for the production of versatile and compact discs. Epoxy resins are utilized in high performance, adhesives, electrical laminates, coatings, paving, and flooring applications.

The phenol resins derived using isopropyl benzene finds its usage in the home construction sector in the form of adhesives for structured wood panels, and in the production of mineral wool insulations as binders. Caprolactam another derivative of phenol, which is primarily utilized for the manufacturing of nylon 6.

Acetone is another important chemical produced by means of cumene. The various acetone derivatives produced with the help of isopropyl benzene include methyl methacrylate, solvent, bisphenol A, and aldol chemicals. The methyl methacrylate derived from cumene is mainly employed for the production of copolymers and homopolymers. These polymers are used in the manufacturing of liquid crystal displays and flat-screen television sets.

Regional Insights

Asia Pacific was the leading market and accounted for 47.8% of the overall market revenue in 2016. The region is expected to grow at an estimated CAGR of 4.3% from 2017 to 2025. The growth in the construction and automotive industry coupled with technology advancement, especially in countries such as China, India, and Japan, is anticipated to propel the market in the region over the next eight years.

Asia Pacific was followed by Europe and accounted for 25.3% of the overall market share in 2016 and is anticipated to grow at an anticipated CAGR of 4.0% from 2017 to 2025. Rising demand for surfactants, rubber additives, laminates, molded plastics, and protective coatings, coupled with the established automotive & construction industry in the region, is anticipated to positively drive the market over the forecast period.

Cumene Market Share Insight

The cumene market is characterized by the presence of a large number of established players. Major players in the industry include Dow Chemical Company, JX Holdings, ExxonMobil Corporation, BASF SE, China Petroleum & Chemical Corporation, Saudi Basic Industries Corporation, INEOS Group, Total S.A., and Sinopec Group Ltd. Some of the companies such as Koch Industries and Royal Dutch Shell plc. are investing in R&D activities to develop stable isopropyl benzene which does not form peroxides when they come in contact with atmospheric air.

Report Scope

|

Attribute

|

Details

|

|

Base year for estimation

|

2016

|

|

Actual estimates/Historical data

|

2014 - 2015

|

|

Forecast period

|

2017 - 2025

|

|

Market representation

|

Revenue in USD Million and CAGR from 2017 to 2025

|

|

Regional scope

|

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

|

|

Country scope

|

U.S., UK, France, Germany, China, South Korea, Japan

|

|

Report coverage

|

Revenue forecast, company share, competitive landscape, growth factors and trends

|

|

15% free customization scope (equivalent to 5 analyst working days)

|

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

|

Segments Covered in the report

This report forecasts volume and revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global cumene market on the basis of production, application, and region:

-

Production Outlook ((Revenue, USD Million; Volume, Kilotons) 2014 - 2025)

-

Zeolite

-

Solid phosphoric acid

-

Aluminum chloride

-

Application Outlook ((Revenue, USD Million; Volume, Kilotons) 2014 - 2025)

-

Phenol

-

Phenol resins

-

Caprolactam

-

Bisphenol A

-

Alkylphenols

-

Others

-

Acetone

-

Solvent use

-

Methyl methacrylate

-

Bisphenol A

-

Aldol Chemicals

-

Others

-

Others

-

Regional Outlook ((Revenue, USD Million; Volume, Kilotons) 2014 - 2025)

-

North America

-

Europe

-

Asia Pacific

-

Central & South America

-

Middle East & Africa