- Home

- »

- Next Generation Technologies

- »

-

Cryptocurrency Payment Apps Market, Industry Report, 2033GVR Report cover

![Cryptocurrency Payment Apps Market Size, Share & Trends Report]()

Cryptocurrency Payment Apps Market (2025 - 2033) Size, Share & Trends Analysis Report By Cryptocurrency Type (Bitcoin, Ethereum), By Payment Type, By Type, By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-970-7

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cryptocurrency Payment Apps Market Summary

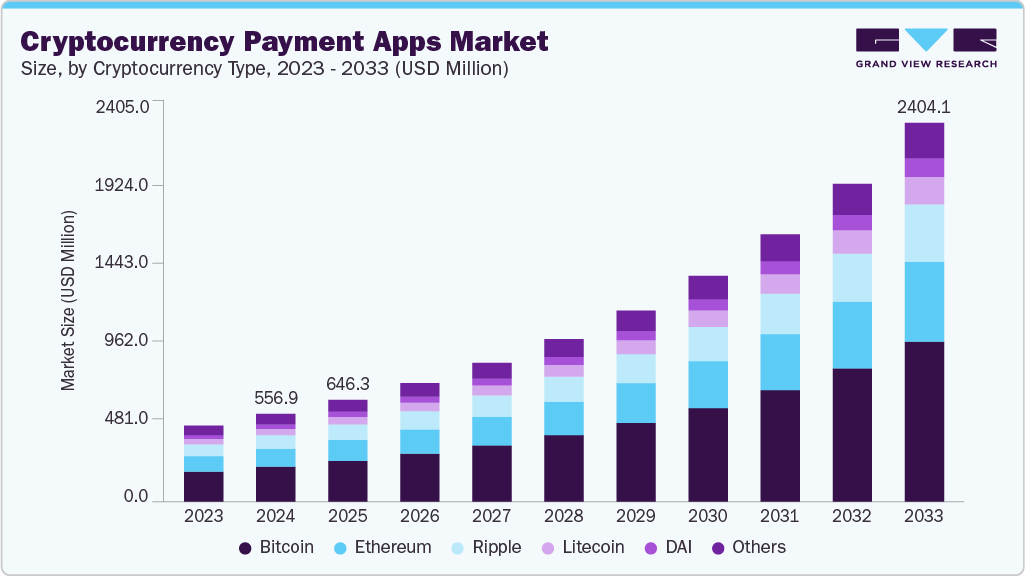

The global cryptocurrency payment apps market size was estimated at USD 556.9 million in 2024 and is projected to reach USD 2,404.1 million by 2033, growing at a CAGR of 17.8% from 2025 to 2033. The emergence of Web3 and blockchain technology created the need for cryptocurrency payment apps to enable individuals to conduct seamless transactions.

Key Market Trends & Insights

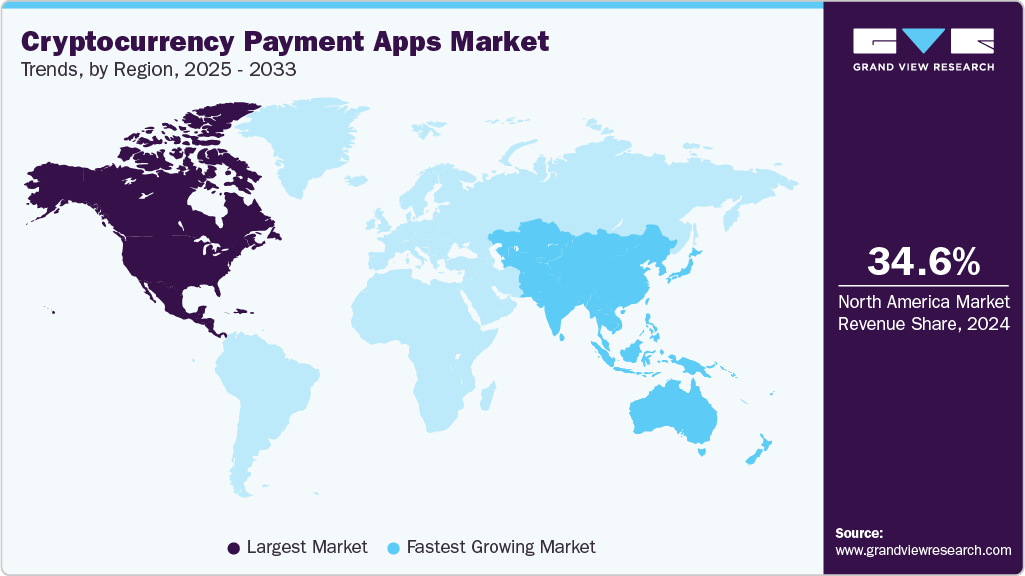

- North America dominated the cryptocurrency payment apps industry and accounted for a share of 34.6% in 2024

- Based on cryptocurrency type, the Bitcoin segment dominated the market in 2024 and accounted for the largest share of 39.9%

- Based on payment type, the in-store payment segment held the largest market share in 2024

- Based on type, the Android segment dominated the market in 2024.

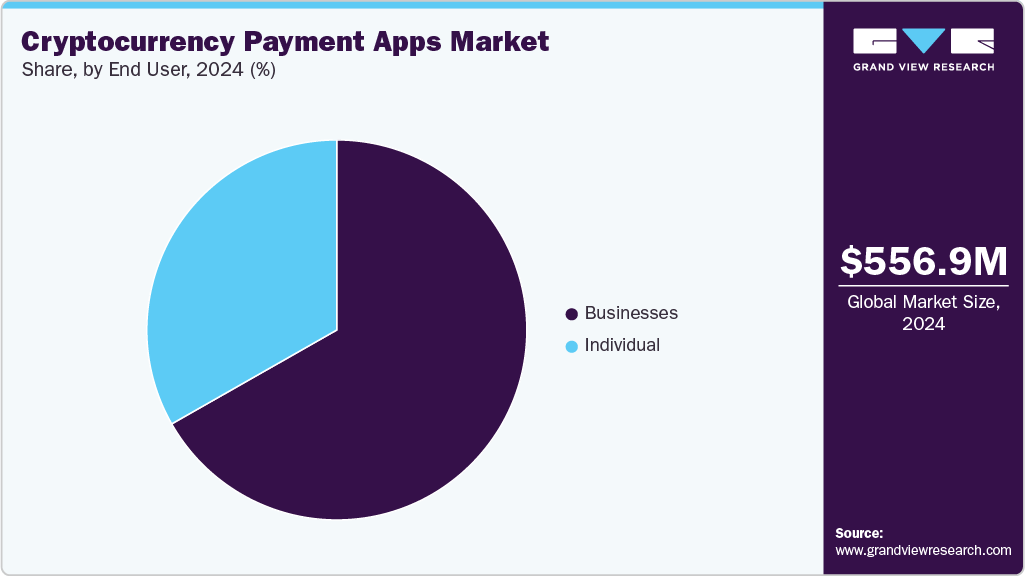

- Based on end user, the businesses segment dominated the market in 2024

Market Size & Forecast

- 2024 Market Size: USD 556.9 Million

- 2033 Projected Market Size: USD 2,404.1 Million

- CAGR (2025-2033): 17.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing adoption of cryptocurrencies globally is the key driver for the market's expansion. People are encouraged to use cryptocurrency payment platforms owing to the decentralized nature of the blockchain, which eliminates mediators such as banks from the payment processing system. It reduces the processing time and accelerates the transaction speed, consequently adding to the increasing popularity of such platforms. In addition, the growing prevalence of cryptocurrencies as an investment option among millennials is also fueling the growth of the cryptocurrency payment apps industry.One of the most transformative trends in the market is the increasing interoperability between crypto payment platforms and traditional banking systems. Crypto apps now allow users to seamlessly convert digital assets into fiat currencies and vice versa, enabling easier withdrawals, direct-to-bank transfers, and debit card functionalities. This fusion is bridging the gap between old and new financial infrastructures, encouraging a smoother transition for users hesitant to move entirely into decentralized finance (DeFi). Thus, increasing integration of cryptocurrency payment apps with traditional financial systems can be attributed to the market’s growth.

The proliferation of mobile payment adoption and advancements in cybersecurity are further propelling the market. Cryptocurrency payment apps are leveraging biometric authentication, multi-signature wallets, and hardware-based security modules to enhance transaction safety. Coupled with the increasing global smartphone penetration, especially in emerging economies, these innovations are making digital asset payments more accessible and secure for a broader audience. In addition, the continual developments and innovations to enhance the consumer’s experience in the blockchain space are expected to create a positive outlook for the market.

The expansion of the DeFi and Web3 ecosystem is playing a pivotal role in advancing cryptocurrency payment apps. However, a lack of awareness about the benefits offered by cryptocurrency payment apps is expected to restrain the growth of the market over the forecast period. In addition, the lack of trust among the users, as no centralized regulator is authenticating this transaction, is one of the major obstacles to the market’s growth. However, the significant efforts taken by some of the market players are anticipated to establish market growth.

Cryptocurrency Type Insights

The bitcoin segment dominated the cryptocurrency payment apps market in 2024 and accounted for the largest share of 39.9%. Dominance is attributable to Bitcoin being the pioneer of the industry. In addition, it guarantees the uncompromised security of the payment systems owing to the proof-of-work mechanism ensured by the users of the decentralized Bitcoin network. Bitcoin, as a blockchain-based currency, needs volunteers to sign hashes that use cryptography to verify transactions over the bitcoin network. This method ensures that transactions are typically irreversible; as a result, Bitcoin has high data security, driving the segment’s growth.

The Ethereum segment is expected to witness a significant CAGR over the forecast period. The major factor of growth is that Ethereum paved the way for Non-Fungible Tokens (NFTs) and laid the foundation for the digital asset revolution. It was the earliest smart-contract-enabled network. In addition, it has become considerably easier to define ownership and control transferability of NFTs due to smart contracts, which is expected to create further opportunities for the market.

Payment Type Insights

The in-store payment segment held the largest share of the cryptocurrency payment apps industry in 2024. The demand for digital payment methods is increasing owing to digitalization and the acceptance of contactless payments. Cryptocurrency payment apps provide a platform to transact in cryptocurrencies, and retailers can accept payments just by installing a QR code or NFC terminal in the POS. Moreover, the transaction fees are comparably lower than the traditional payment platform, which is estimated to attract more consumers to opt for cryptocurrency payment apps.

The online payment segment is expected to grow at the fastest CAGR of 18.3% during the forecast period. One of the major reasons for the segment’s growth is the rising prevalence of e-commerce platforms. Moreover, the recognition of cryptocurrencies and technology globally is driving the segment's growth. In addition, the ease of performing transactions across borders is also promoting growth.

Type Insights

The Android segment dominated the cryptocurrency payment apps market in 2024. The segment’s growth can be attributed to its widespread global adoption and open-source flexibility. With a strong user base in emerging markets, Android serves as a vital platform for reaching unbanked and underbanked populations seeking alternative financial solutions. Its customizable nature also allows developers to integrate blockchain technologies and optimize crypto apps for a broader range of device specifications and price points. Furthermore, Android’s integration with decentralized browsers and support for third-party app stores facilitates innovation and faster deployment of new crypto features.

The iOS segment is expected to witness a notable CAGR over the forecast period. iOS users tend to engage more with digital financial services, including cryptocurrency wallets and payment apps, due to higher disposable income and greater exposure to fintech innovations. Apple’s robust privacy and security architecture also appeals to users concerned about safeguarding their digital assets, making iOS an attractive platform for premium and enterprise-level crypto app solutions. In addition, recent support for blockchain development tools within the Apple ecosystem is gradually fostering more compliant and user-friendly crypto app experiences on iOS.

End User Insights

The businesses segment dominated the cryptocurrency payment apps industry in 2024. Businesses are increasingly adopting cryptocurrency payment apps to cater to evolving customer preferences and tap into global markets with lower transaction costs and faster settlement times. From e-commerce platforms and retail outlets to SaaS providers and freelancers, a growing number of enterprises are accepting cryptocurrencies to enhance payment flexibility and improve customer experience. In addition, crypto payments provide an edge in cross-border trade by eliminating the need for traditional intermediaries and reducing currency conversion complexities.

The individual segment is expected to witness the fastest CAGR over the forecast period. The growing preference and rapid adoption of digital payment methods are fueling the segment’s growth. In addition, social media campaigns to promote the utilization of cryptocurrencies as an investment alternative are also propelling the growth of the segment. Moreover, cryptocurrencies can be kept in a physical wallet or in a digital wallet that you can access from a computer, a phone, or another device, which makes them a reliable alternative to fiat currencies.

Regional Insights

North America dominated the cryptocurrency payment apps industry and accounted for a share of 34.6% in 2024. The presence of several prominent players in the region stimulates market growth. In addition, the collaborative efforts that have been made by some of the market players toward the acceptance of cryptocurrency payments are expected to create further opportunities for regional growth.

U.S. Cryptocurrency Payment Apps Market Trends

The U.S. cryptocurrency payment apps industry held a dominant position in the region in 2024. A key growth driver is the increasing adoption of cryptocurrencies as a payment method by both consumers and businesses. Leading corporations and retailers are beginning to accept digital currencies, significantly enhancing their practical value. This shift is largely fueled by the growing demand for faster, more flexible, and efficient payment solutions-needs that cryptocurrencies are well-positioned to meet.

Europe Cryptocurrency Payment Apps Market Trends

The Europe cryptocurrency payment apps industry is expected to register a notable CAGR from 2025 to 2033. The use of cryptocurrencies for buying goods and services is gaining significant traction in Europe, primarily driven by supportive national regulatory frameworks. Several EU member states are proactively promoting blockchain innovation through grants, tax incentives, and regulatory sandboxes. The growing integration of crypto wallets with e-commerce platforms and neobanks is helping drive adoption across the continent.

The UK cryptocurrency payment apps market is expected to grow at a significant CAGR from 2025 to 2033. The country’s market growth is driven by its position as a major global fintech hub. Regulatory agencies such as the Financial Conduct Authority (FCA) are actively engaging with crypto firms to ensure compliance while fostering innovation. Consumer adoption is gaining momentum, particularly among tech-savvy millennials and digital entrepreneurs who prefer fast and flexible payment options.

The cryptocurrency payment apps market in Germany held a substantial market share in 2024, owing to its early regulatory clarity and strong consumer trust in licensed financial services. As the first country in the EU to officially recognize crypto assets as financial instruments, Germany has enabled banks and fintech firms to integrate digital currencies into their offerings legally. Adoption is rising among both individuals and businesses, supported by a robust economy, high smartphone usage, and growing merchant acceptance of crypto payments.

Asia Pacific Cryptocurrency Payment Apps Market Trends

The Asia Pacific cryptocurrency payment apps industry is expected to grow at a CAGR of 13.1% during the forecast period.The growth is attributable to the rapid technological advancements and growing acceptance of digital currency across the region. The efforts being pursued by several organizations across Asia Pacific to promote the use of cryptocurrency payment apps are also expected to contribute to the growth of the segment. Additionally, an increase in alliances and cooperative efforts among the industry participants in this region is promoting market expansion.

India’s cryptocurrency payment apps market is expected to grow at the fastest growth rate during the forecast period. The market growth is supported by a booming digital economy and one of the world’s largest bases of mobile internet users. While regulatory clarity around crypto assets remains a challenge, rising interest among retail investors and the proliferation of crypto exchanges have significantly driven wallet app downloads and usage.

The cryptocurrency payment apps market in Japan held a substantial market share in 2024. Japan represents one of the most mature and regulated markets for cryptocurrency payment apps globally. Digital currencies, particularly Bitcoin and altcoins, have seen widespread popularity across the country. Japan is well-known for its strong embrace of cryptocurrencies, with a growing number of individuals and businesses actively investing in or utilizing them for a range of financial and transactional purposes. A well-developed fintech ecosystem, high smartphone penetration, and a tech-savvy population have contributed to the growth in the use of crypto payment applications in the country.

Key Cryptocurrency Payment Apps Company Insights

Some of the key companies in the cryptocurrency payment apps industry include Coinbase, Binance, and BitPay, among others. These players are competing on the basis of user experience, transaction speed, security, and the breadth of supported assets. These companies are continuously expanding their service offerings, including integrated wallets, rewards programs, and fiat-to-crypto conversion tools, to retain and grow their user base.

-

Coinbase is one of the most prominent cryptocurrency platforms globally. Initially established as a digital asset exchange, Coinbase has significantly expanded its offerings to include a robust mobile payment app that enables users to buy, sell, store, and use cryptocurrencies for transactions. With a user-friendly interface, institutional-grade security, and support for a wide range of digital currencies, Coinbase is widely used by both individual and institutional investors.

-

Binance offers Binance Pay, a contactless, borderless, and secure crypto payment application. Binance Pay enables users to send and receive payments in cryptocurrency with zero fees, supporting a wide array of tokens. The platform is integrated within the broader Binance ecosystem, which includes trading, savings, NFTs, and DeFi products, offering a seamless experience for users looking to utilize digital assets beyond investment.

Key Cryptocurrency Payment Apps Companies:

The following are the leading companies in the cryptocurrency payment apps market. These companies collectively hold the largest market share and dictate industry trends.

- Coinbase

- BitPay

- Coinomi

- Paytomat

- Apirone OÜ

- SecuX Technology Inc.

- Circle Internet Financial Limited

- Binance

- CoinJar UK Limited

- Cryptopay Ltd.

Recent Developments

-

In June 2025, Kraken introduced a new all-in-one global financial app called Krak, designed to offer users a faster, more cost-effective, and flexible way to manage their money worldwide. The Krak app seamlessly integrates the advantages of cryptocurrencies with traditional financial services. It allows users to send money to over 110 countries, manage a portfolio of more than 300 fiat and digital assets, and earn rewards on their holdings, all within a single, unified platform.

-

In May 2025, Ripple launched cross-border blockchain payment services in the UAE to accelerate cryptocurrency adoption in the region. The system will be primarily utilized by Zand Bank, the UAE’s first fully digital bank, and fintech company Mamo. Ripple’s platform, Ripple Payments, combines stablecoins, cryptocurrencies, and fiat currencies to deliver faster transaction settlements and significantly lower fees compared to traditional cross-border payment systems.

Cryptocurrency Payment Apps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 646.3 million

Revenue forecast in 2033

USD 2,404.1 million

Growth rate

CAGR of 17.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021- 2023

Forecast period

2025 - 2033

Report updated

July 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Cryptocurrency type, payment type, type, end user, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Nordic Countries; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Coinbase; BitPay; Coinomi; Paytomat; Apirone OÜ; SecuX Technology Inc.; Circle Internet Financial Limited; Binance; CoinJar UK Limited; Cryptopay Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cryptocurrency Payment Apps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cryptocurrency payment apps market report based on cryptocurrency type, payment type, type, end user, and region:

-

Cryptocurrency Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Bitcoin

-

Ethereum

-

Litecoin

-

DAI

-

Ripple

-

Others

-

-

Payment Type Outlook (Revenue, USD Million, 2021 - 2033)

-

In-Store Payment

-

Online Payment

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Android

-

iOS

-

Others

-

-

End User Outlook (Revenue, USD Million, 2021 - 2033)

-

Individuals

-

Businesses

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Nordic Countries

-

-

Asia Pacific

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cryptocurrency payment apps market size was estimated at USD 556.9 million in 2024 and is expected to reach USD 646.3 million million in 2025

b. The global cryptocurrency payment apps market is expected to grow at a compound annual growth rate of 17.8% from 2025 to 2033 to reach USD 2.40 billion by 2033

b. The bitcoin segment dominated the market in 2024 and accounted for the largest share of 39.9%.

b. Some key players operating in the cryptocurrency payment apps market include Coinbase; BitPay, Coinomi; Paytomat; Aprione OÜ; SecuX Technology, Inc.; Circle Internet Financial Limited; Binance., CoinJar UK Limited.; Crptopay Ltd.

b. Key factors that are driving the cryptocurrency payment apps market growth include the increasing number of cryptocurrency holders and the rising acceptance of digital currencies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.