- Home

- »

- Medical Devices

- »

-

Cryotherapy Market Size And Share, Industry Report, 2030GVR Report cover

![Cryotherapy Market Size, Share & Trends Report]()

Cryotherapy Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Cryochambers, Cryosaunas), By Application (Pain Management, Beauty & Wellness), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-146-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cryotherapy Market Summary

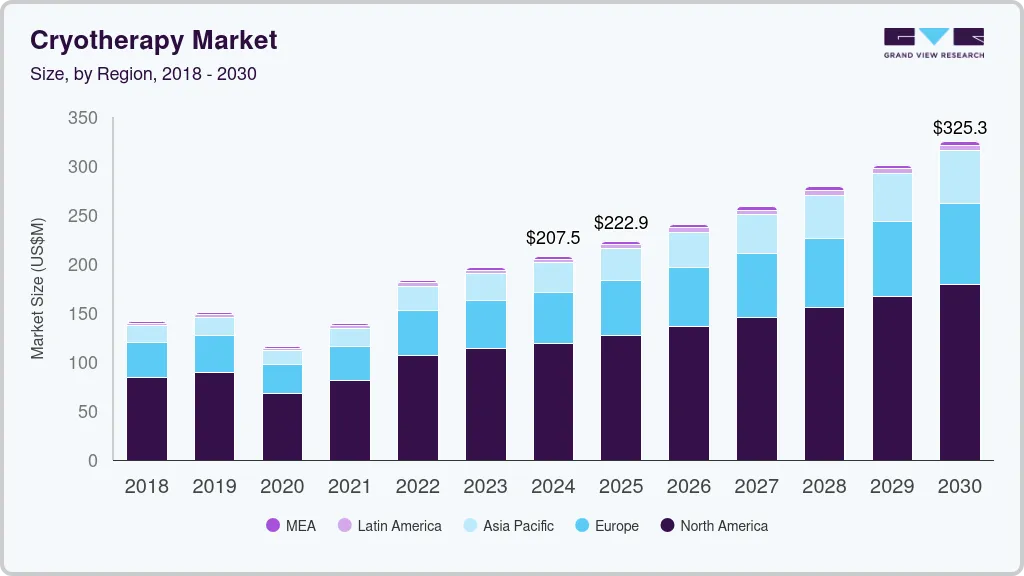

The global cryotherapy market size was estimated at USD 207.5 million in 2024 and is projected to reach USD 325.3 million by 2030, growing at a CAGR of 7.8% from 2025 to 2030. Primary factors driving market growth include the escalating demand for minimally invasive procedures.

Key Market Trends & Insights

- The North America cryotherapy market dominated the global market with a revenue share of 57.4% in 2024.

- Asia Pacific cryotherapy market is expected to register the fastest CAGR of 10.5% in the forecast period.

- Based on product, cryochambers dominated the market and accounted for a share of 51.7% in 2024.

- In terms of applications, beauty & wellness applications led the market with a revenue share of 32.5% in 2024.

- Based on end use, cryotherapy (cryosauna and cryochamber) centers held the largest market share of 48.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 207.5 Million

- 2030 Projected Market Size: USD 325.3 Million

- CAGR (2025-2030): 7.8%

- North America: Largest market in 2024

Patients are increasingly gravitating towards non-invasive treatments to reduce the risks and side effects linked to traditional surgeries. This trend is reflected in the growing adoption of cryotherapy within clinical settings, where it has become an effective treatment option for chronic conditions such as cancer and arthritis, thereby improving patient safety and efficacy.

According to America’s Health Rankings Annual Report 2023, approximately 129 million people in the U.S. were reported to have at least one major chronic condition, projected to grow to around 135 million by 2024, indicating an alarming rise in the incidence of chronic diseases. Furthermore, about 42% of adults were diagnosed with two or more chronic conditions in 2023, a trend expected to escalate to 45% by the following year. This increasing burden of chronic diseases creates a heightened demand for effective and innovative treatment options, such as cryotherapy, which provides new avenues for managing these health challenges.

The surge in cryotherapy’s popularity within the sports and fitness sectors is noteworthy. According to the Global Wellness Institute, approximately 60% of professional athletes utilized cryotherapy for recovery and injury prevention in 2023, with projections suggesting this figure will rise to 68% by 2024, indicating broader acceptance of its benefits. Roughly 40% of fitness centers offered cryotherapy services in 2023, expected to increase to 50% by 2024, thus expanding accessibility to a wider audience. Whole-body cryotherapy has been shown to enhance asprosin secretion and insulin sensitivity in postmenopausal women, supporting type 2 diabetes management. In addition, in 2023, approximately 55% of wellness centers offered cryotherapy for skin rejuvenation, with expectations to increase to 65% by 2024, reflecting heightened consumer interest and social media influence.

Economic factors play a crucial role in shaping the cryotherapy market, notably in emerging economies such as Brazil. According to Trading Economics, in 2023, the average monthly disposable income per capita was approximately BRL 2,500, projected to increase to BRL 2,700 by 2024. Consumers spent an estimated 15% of their disposable income on wellness services in 2023, with this percentage anticipated to rise to 18% in 2024. This is supported by a consumer confidence index projected to grow from 85 to 90, indicating strong future demand for cryotherapy.

Product Insights

Cryochambers dominated the market and accounted for a share of 51.7% in 2024, stemming from their efficacy in whole-body treatment, promoting recovery, reducing inflammation, and alleviating pain. Athletes, fitness enthusiasts, and health-conscious consumers are increasingly drawn to these non-invasive solutions for enhanced muscle repair and overall wellness.

Cryosaunas are expected to grow at the fastest CAGR of 8.4% over the forecast period. Cryosaunas provide effective whole-body treatments for recovery, pain relief, and skin rejuvenation, appealing to athletes and wellness enthusiasts. Their compact design facilitates integration into gyms and spas, while technological advancements have increased affordability and user-friendliness. Growing awareness of cryotherapy benefits in beauty and wellness drives widespread adoption across sectors.

Application Insights

Beauty & wellness applications led the market with a revenue share of 32.5% in 2024. Cryotherapy treatments, including facials, promote collagen production, reduce inflammation, and improve blood circulation, resulting in firmer, brighter skin. Their non-invasive nature attracts consumers seeking non-surgical anti-aging alternatives. Moreover, social media and celebrity endorsements have popularized cryotherapy as a fashionable beauty solution, increasing interest within wellness centers and spas.

Fitness applications are expected to grow at the fastest rate of 8.7% over the forecast period. Cryotherapy effectively reduces inflammation, alleviates muscle soreness, and accelerates recovery from exercise-related injuries. Exposing the body to extreme cold enhances blood circulation, delivering essential oxygen and nutrients to fatigued muscles. Its non-invasive nature attracts fitness enthusiasts, prompting increased adoption in fitness centers as awareness of its benefits grows.

End Use Insights

Cryotherapy (cryosauna and cryochamber) centers held the largest market share of 48.8% in 2024. The growing recognition of cryotherapy’s benefits for recovery, pain management, and overall wellness has resulted in a surge of specialized facilities. Catering to athletes, fitness enthusiasts, and beauty seekers, this trend is bolstered by increased sports participation and social media promotion, further broadening its audience appeal.

Spas & fitness centers are projected to experience the fastest growth of 9.1% over the forecast period. The increasing acknowledgment of cryotherapy’s advantages for recovery, pain relief, and overall wellness appeals to fitness enthusiasts and spa patrons. Consequently, spas and fitness centers are integrating cryotherapy into their services, driven by rising consumer interest in holistic wellness and non-invasive health treatments.

Regional Insights

The North America cryotherapy market dominated the global market with a revenue share of 57.4% in 2024. The region boasts numerous cryotherapy centers and wellness facilities, enhancing access to these treatments. The increasing prevalence of chronic diseases and sports-related injuries has spurred demand for effective recovery solutions. Furthermore, celebrity endorsements and social media influence broaden appeal, attracting a wider audience seeking non-invasive wellness options.

U.S. Cryotherapy Market Trends

The cryotherapy market in the U.S. dominated the North America cryotherapy market with a revenue share of 89.4% in 2024. A robust healthcare system and a strong inclination towards innovative wellness treatments support market growth in the country. With around 3,000 cryotherapy centers nationwide, these services attract a diverse clientele, including athletes and beauty enthusiasts. Increasing consumer focus on fitness and recovery, rising disposable incomes, and awareness of cryotherapy’s benefits foster widespread acceptance across various sectors.

Europe Cryotherapy Market Trends

Europe cryotherapy market held a substantial market share in 2024. The region features a comprehensive network of medical spas and health resorts that integrate cryotherapy into their services, indicating significant consumer interest in noninvasive pain management, recovery, and beauty enhancement solutions. Moreover, technological advancements and expanded product offerings are propelling cryotherapy’s growth across European markets.

The cryotherapy market in Germany is expected to grow rapidly in the forecast period due to a rapidly aging population and rising obesity-related health issues, which boost demand for effective recovery solutions such as cryotherapy. In addition, a strong healthcare infrastructure facilitates technological advancements while growing consumer awareness of wellness and aesthetic treatments propels the demand for non-invasive pain relief and skin rejuvenation options.

Asia Pacific Cryotherapy Market Trends

Asia Pacific cryotherapy market is expected to register the fastest CAGR of 10.5% in the forecast period. The region benefits from a substantial population and increasing disposable incomes in developing nations. Heightened awareness of health and wellness drives demand for innovative treatments such as cryotherapy. Furthermore, increased participation in sports and fitness activities necessitates effective recovery solutions, supported by the growth of wellness centers and spas offering cryotherapy services.

The cryotherapy market in Japan dominated the Asia Pacific cryotherapy market in 2024. Japan’s advanced healthcare system supports the integration of innovative treatments, such as cryotherapy, into mainstream wellness practices. Growing interest among athletes in cryotherapy for performance enhancement further drives demand. The influence of social media and celebrity endorsements significantly raises awareness and acceptance of cryotherapy as a viable health solution.

Key Cryotherapy Company Insights

Some key companies operating in the market include Cryomed, Impact Cryotherapy, Vacuactivus, CryoLiving, and MECOTEC GmbH. Key strategic initiatives involve product innovations, geographic expansion, partnerships to enhance services, marketing campaigns, and collaborations with fitness and wellness centers to broaden consumer reach.

-

Vacuactivus is a global cryotherapy chambers and equipment manufacturer specializing in fitness rehabilitation to enhance wellness, recovery, and weight loss through innovative cryogenic technologies across 50 countries.

-

CryoLiving provides cryotherapy services and equipment, specializing in whole-body treatments that enhance recovery and wellness while educating clients on the benefits of athletic performance and beauty.

Key Cryotherapy Companies:

The following are the leading companies in the cryotherapy market. These companies collectively hold the largest market share and dictate industry trends.

- Cryomed

- Impact Cryotherapy

- Vacuactivus

- CryoLiving

- MECOTEC GmbH

- CRYO Holding Limited

- Cryo Innovations

- C A Manufacturing Sp zoo

- CryoBuilt, Inc.

- CRYONiQ

Recent Developments

-

In September 2024, MECOTEC GmbH partnered with Restore Hyper Wellness, acquiring Zimno Tech to enhance global sales and service of electric cryotherapy chambers and strengthen its market position in wellness solutions.

-

In April 2024, Art of Cryo designed a novel 12-person walkthrough cryotherapy chamber at Cryo Center Coolzone Madeira, promoted as the world’s largest cold therapy treatment facility.

-

In April 2024, MECOTEC introduced its newest cryotherapy innovation, "the cryo:one+ chamber.” This innovative chamber is designed with advanced technology to provide an LED lighting experience.

Cryotherapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 222.9 million

Revenue forecast in 2030

USD 325.3 million

Growth rate

CAGR of 7.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Cryomed; Impact Cryotherapy; Vacuactivus; CryoLiving; MECOTEC GmbH; CRYO Holding Limited; Cryo Innovations; C A Manufacturing Sp zoo; CryoBuilt, Inc.; CRYONiQ

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cryotherapy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cryotherapy market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cryochambers

-

Cryosaunas

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pain Management

-

Beauty & Wellness

-

Fitness

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Cryotherapy (Cryosauna and Cryochamber) Centers

-

Spas & Fitness Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.