- Home

- »

- Distribution & Utilities

- »

-

Cryogenic Tanks Market Size & Share, Industry Report, 2030GVR Report cover

![Cryogenic Tanks Market Size, Share & Trends Report]()

Cryogenic Tanks Market (2025 - 2030) Size, Share & Trends Analysis Report By Cryogenic Liquid (Liquefied Natural Gas, Liquid Nitrogen, Liquid Oxygen, Liquid Hydrogen), By Application, By End-use (Food & Beverages, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-743-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cryogenic Tanks Market Summary

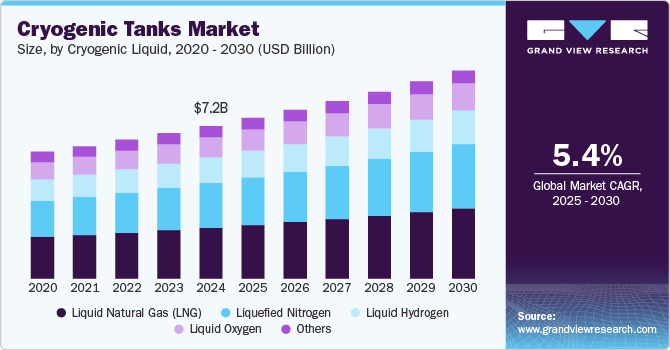

The global cryogenic tanks market size was estimated at USD 7.16 billion in 2024 and is projected to reach USD 9.77 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030. The growth of this market is primarily influenced by factors such as growing demand for liquefied natural gas (LNG), liquefied oxygen, and nitrogen across multiple regions and enhancements initiated by the healthcare industry and government in developing economies such as India.

Key Market Trends & Insights

- Asia Pacific cryogenic tanks market dominated the global industry with a revenue share of 35.8 % in 2024.

- China cryogenic tanks market held the largest revenue share of the regional industry in 2024.

- By cryogenic liquid, liquid natural gas (LNG) segment dominated the global cryogenic tanks industry with a revenue share of 33.2% in 2024.

- By application, the storage segment held the largest revenue share of the cryogenic tanks market in 2024.

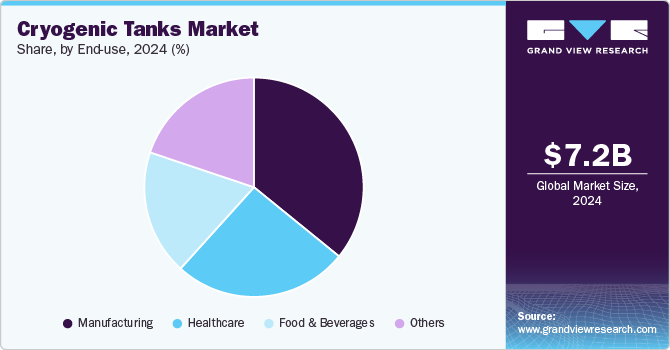

- By end use, the manufacturing segment dominated the global cryogenic tanks industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.16 Billion

- 2030 Projected Market Size: USD 9.77 Billion

- CAGR (2025-2030): 5.4%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Significant utilization by industries such as food services, energy, scientific research, and healthcare is expected to generate a surge in demand for this market. Increasing industrial applications, technology advancements such as enhanced insulations, innovation in materials, and growing demand for cryogenic tanks in developing economies such as India are adding lucrative growth opportunities.

In recent years, multiple industries, such as food processing, food manufacturing, energy & power, healthcare, and others, have been using cryogenic tanks for various purposes. The food industry uses cryogenic tanks for cryogenic freezing and storage of liquid nitrogen used in the process. The energy sector utilizes cryogenic tanks to transport and store liquefied natural gases. LNG production and distribution plays a vital role in increasing demand for cryogenic tanks.

Efficient insulation provided by the product and added safety features such as relief valves, ventilations, and leak detection systems have also contributed to this market's growth. Cryogenic tanks are often developed with aluminum alloys or stainless steel. These materials can withstand extremely low temperatures without compromising their insulating capacities.

Increasing collaborations, utilization by various industries, and contracts among organizations are adding growth opportunities to this market. For instance, in November 2024, Cashman Preload Cryogenics (CPC) by JAY CASHMAN, INC., was given a contract for 100,000m3 storage tanks. The Delaware River Partners (DRP) contract with CPC includes engineering, procurement, and construction of fully confined tanks with prestressed concrete wall, outer precast, shell of carbon steel, and dome of carbon steel.

Cryogenic Liquid Insights

Liquid Natural Gas (LNG) segment dominated the global cryogenic tanks industry with a revenue share of 33.2% in 2024. This segment is mainly driven by factors such as the increasing focus of multiple industries on effective storage, utilization, and transport of liquefied natural gas. This includes industries such as energy & power, healthcare, food processing, and food service. It is extensively used in a few more sectors, such as chemical manufacturing, power generation, metal processing, etc. Cryogenic tanks with efficient insulation and the capacity to withstand extremely low temperatures during utilization or storage are the most preferred solutions associated with LNG. Research and educational institutions that utilize cryogenic tanks to store LNG used in laboratories also hold a small share of this segment.

The liquefied nitrogen segment is anticipated to experience the highest CAGR during the forecast period. This segment is primarily influenced by the growing utilization of liquid nitrogen in the food industry. Companies also produce liquid nitrogen products used in food processing for household users. Construction industries utilize liquid nitrogen for freezing materials and pipes. It is also used extensively in medical treatments, electronics, fabrications, etc. These industries prefer cryogenic tanks for the storage and transportation of liquid nitrogen.

Application Insights

The storage segment held the largest revenue share of the cryogenic tanks market in 2024. This is attributed to factors such as the increasing focus of multiple industries on utilizing liquid nitrogen and LNG in processes such as freezing and more. Cryogenic tanks are characterized by high-performing insulations and durable materials that can withstand extreme temperatures. Industries such as energy, food processing, and others constantly require these gases in larger quantities. Companies and users prefer storing these gases inside premises with necessary safety measures.

The transportation segment is projected to experience at a significant CAGR during the forecast period. This segment's growth is mainly influenced by factors such as increasing demand from various industries and the flammable nature of gases transported or stored in cryogenic tanks. For instance, when vaporized or mixed with air, LNG is highly flammable and can cause serious damage to property and human life. The strict regulations and protocols regarding transporting and storing such gases contribute to the growing utilization of cryogenic tanks.

End-use Insights

The manufacturing segment dominated the global cryogenic tanks industry in 2024. This is attributed to factors such as the increasing utilization of multiple gases in industry processes. This includes oxygen, nitrogen, and others. Exposure to these gases in unattended environments and temperatures can cause hazards that might result in large-scale impacts. To prevent such accidents and damages, companies that include these gases in manufacturing prefer using cryogenic tanks for safe storage and transportation.

The healthcare segment is projected to experience the fastest CAGR during the forecast period. This market segment is mainly influenced by the growing demand for essential gases used in medical treatments, such as liquefied oxygen, argon, and nitrogen. Advanced medical treatments such as organ transplants, storage of blood or stem cells, and vaccine storage processes also require cryogenic tanks. The rise in healthcare expenditure in developing economies is expected to create growth for this market during the next few years.

Regional Insights

Asia Pacific cryogenic tanks market dominated the global industry with a revenue share of 35.8 % in 2024. This is attributed to the increasing demand for cryogenic tanks from the healthcare industry in countries such as India and a strong industrial environment in countries such as China. Multiple industries have been using cryogenic tanks to store and transport the gases involved in the process. Enhanced safety provided by the cryogenic tanks and efficient insulation capacities offered are expected to deliver growth for this segment.

China Cryogenic Tanks Market Trends

China cryogenic tanks market held the largest revenue share of the regional industry in 2024. This market is primarily influenced by the increasing demand from industrial users, which store essential gases such as nitrogen, hydrogen, LNG, and others in premises for convenience and operational excellence. This requires safe and secure storage solutions such as cryogenic tanks.

Europe Cryogenic Tanks Market Trends

Europe was identified as one of the key regions of the cryogenic tank industry in 2024. This market is mainly driven by aspects such as the growing use of LNG in the energy sector, increasing applications in the healthcare industry, and the use of liquid nitrogen and other gases in the food industry. These include gases such as helium, hydrogen, nitrogen, argon, oxygen, and others. Businesses prefer highly insulated cryogenic tanks to transport and store these gases to avoid highly flammable gasses being exposed to the air.

Germany cryogenic tanks market held the largest revenue share of the regional industry in 2024. This is attributed to the country's strong manufacturing industry. Multiple manufacturing companies have been utilizing liquefied gases for various processes. These gases are primarily stored in cryogenic tanks owing to high-performance insulation and capacity to withstand extremely cold temperatures.

North America Cryogenic Tanks Market Trends

North America cryogenic tanks market is projected to experience significant growth over the forecast period. Increasing utilization of LNG as a clean energy source in the region, growing demand for liquid nitrogen in the food services industry, and rising use of essential gases by the healthcare sector are some of the key growth driving factors for cryogenic tanks. The enhanced availability facilitated by multiple manufacturers and service providers in the region is expected to fuel market growth in the forecast period.

The U.S. cryogenic tanks market dominated the regional industry in 2024. This is attributed to factors such as the robust healthcare industry operating in the country and the presence of multiple manufacturing facilities that utilize gases such as hydrogen and others for multiple industrial processes. The U.S. is home to multiple industries that rely on the utilization of liquefied gases. These include metal processing, food processing, energy, aerospace, healthcare, and others. This is expected to add newer growth opportunities for this market.

Key Cryogenic Tanks Company Insights

Some of the key companies operating in global cryogenic tanks industry include INOX India Limited, SURETANK, Cryofab, Inc, Linde PLC, Chart Industries and other. Supply contracts with international organizations have contributed to consolidating multiple market participants. Key players have been adopting strategies such as capacity expansions, portfolio enhancements, mergers, and acquisitions to address the growing demand from various industries and competition.

-

INOX India Limited, one of the global industry participants in cryogenic equipment, offers a range of solutions for essential gases. These include storage and transportation solutions for industrial gases, industrial application solutions for LNG, beer kegs as sustainable packaging solutions, cylinders for gases, and more.

-

Chart Industries, specializing in cryogenic tank solutions, provides an extensive portfolio of solutions for industrial applications. This includes solutions associated with bulk CO2 carbonation, bulk storage tanks, carbon dioxide enrichment, cryogenic transport trailers, flow measurement, ISO containers, laser assist gas systems, packaged gases liquid cylinders, and others.

Key Cryogenic Tanks Companies:

The following are the leading companies in the cryogenic tanks market. These companies collectively hold the largest market share and dictate industry trends.

- Chart Industries

- Cryofab, Inc.

- INOX India Limited

- Linde PLC

- Air Products and Chemicals, Inc.

- Cryolor

- AIR WATER INC

- Wessington Cryogenics

- Super Cryogenic Systems Pvt Ltd.

- FIBA Technologies, Inc.

- ISISAN A.Ş.

- SURETANK

- Eden Cryogenic LLC

Recent Developments

-

In November 2024, INOX India Limited, a company manufacturing cryogenic tanks, announced that it secured its latest large-scale supply order and associated contract from Highview Power, UK. The contract is linked to Highview Power's Liquid Air Energy Storage (LAES) facility in Carrington, Manchester, UK.

-

In September 2024, Cryogenic Technology Resources (CTR) was acquired by TransTech Group (TransTech), a portfolio company of the private holding company Bridge Industries (Bridge). The acquisition of one of the participants in the cryogenic and high-pressure bulk gas storage and transfer solutions industry is expected to strengthen TransTech’s portfolio and generate comprehensive partnership opportunities for the company.

Cryogenic Tanks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.52 billion

Revenue forecast in 2030

USD 9.77 billion

Growth rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Cryogenic liquid, application, end-use, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, Germany, Russia, UK, Italy, China, India, Japan, Australia, Brazil, Argentina, UAE, Saudi Arabia

Key companies profiled

Chart Industries; Cryofab, Inc.; INOX India Limited; Linde PLC; Air Products and Chemicals, Inc.; Cryolor; AIR WATER INC; Wessington Cryogenics; Super Cryogenic Systems Pvt Ltd.; FIBA Technologies, Inc.; ISISAN A.Ş.; SURETANK; Eden Cryogenic LLC

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cryogenic Tanks Market Report Segmentation

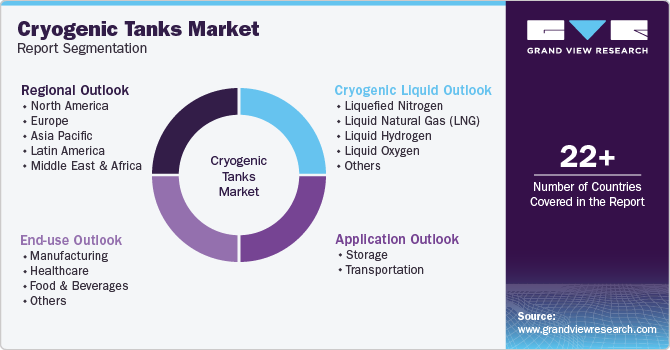

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global cryogenic tanks market report based on cryogenic liquid, application, end-use, and region.

-

Cryogenic Liquid Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquefied Nitrogen

-

Liquid Natural Gas (LNG)

-

Liquid Hydrogen

-

Liquid Oxygen

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Storage

-

Transportation

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Healthcare

-

Food & Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.