- Home

- »

- Advanced Interior Materials

- »

-

Cryogenic Equipment Market Size, Industry Report, 2033GVR Report cover

![Cryogenic Equipment Market Size, Share & Trends Report]()

Cryogenic Equipment Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Tank, Valve, Pumps, Vaporizers, Vacuum Jacketed Piping), By Cryogen (Nitrogen, Oxygen, Argon, Liquified Natural Gas, Hydrogen), By Application, By End-use (Metallurgy, Automotive), By Region, And Segment Forecasts

- Report ID: 978-1-68038-810-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cryogenic Equipment Market Summary

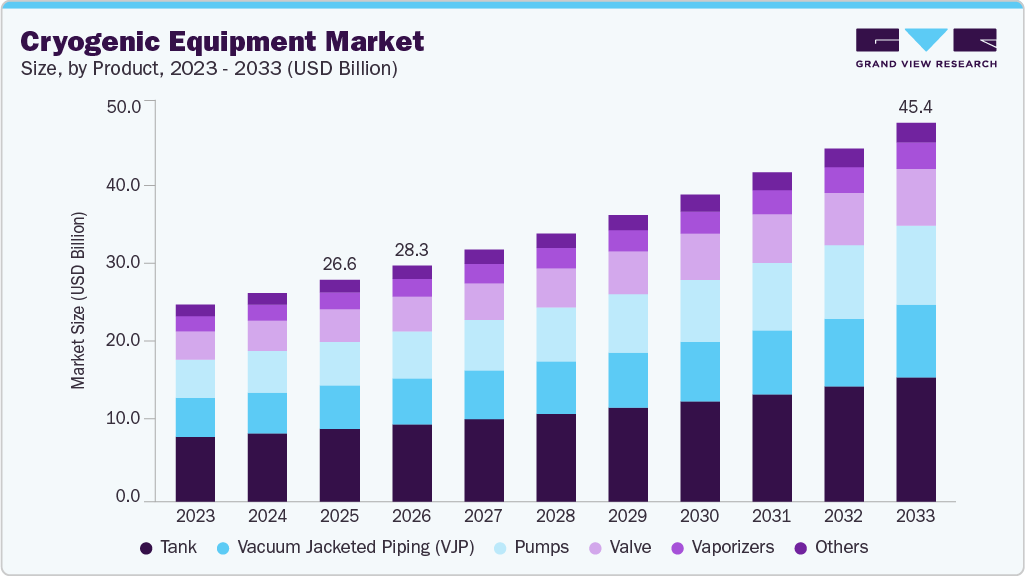

The global cryogenic equipment market size was estimated at USD 26,573.8 million in 2025 and is expected to reach USD 45,390.9 million by 2033, growing at a CAGR of 7.0% from 2026 to 2033. The growing demand for cryogenic equipment is closely tied to the global expansion of LNG infrastructure.

Key Market Trends & Insights

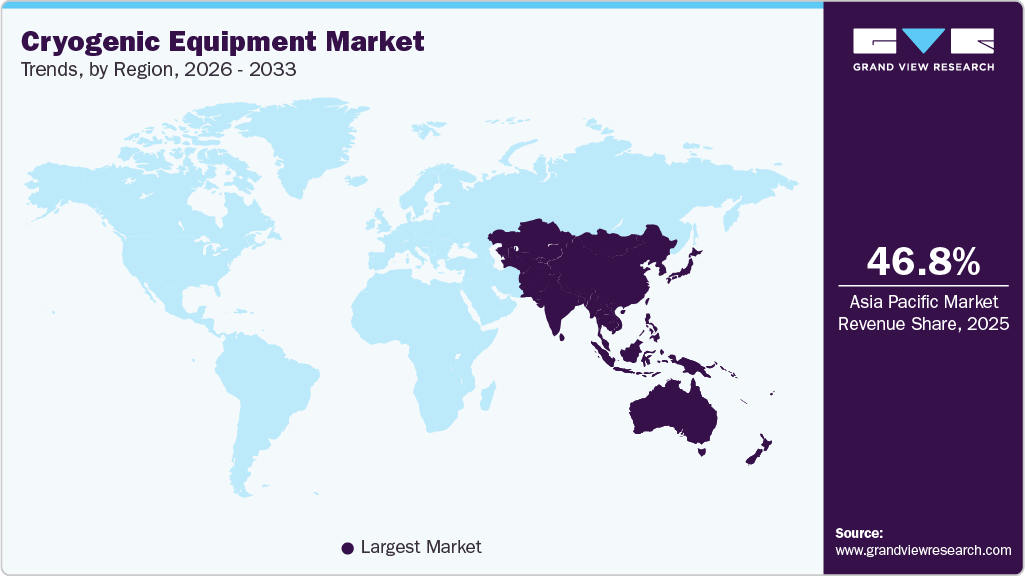

- Asia Pacific dominated the cryogenic equipment market with the largest revenue share of 46.8% in 2025.

- China’s cryogenic equipment market is being driven strongly by the rapid build-out of hydrogen production capacity and associated infrastructure.

- By product, the tank segment dominated the market with a revenue share of 32.8 % in 2025.

- By technology, the PCR segment held the largest market share of 62.16% in 2025.

- By cryogen, the liquified natural gas segment accounted for a revenue share of 31.7% in 2025.

- By application, the storage segment accounted for a revenue share of 56.2% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 26,573.8 Million

- 2033 Projected Market Size: USD 45,390.9 Million

- CAGR (2026-2033): 7.0%

- Asia Pacific: Largest market in 2025

As countries work to diversify their energy mix and transition away from high-carbon fuels, LNG is gaining prominence as a cleaner and more flexible energy option. This shift is driving major investments in import terminals, liquefaction plants, and storage facilities across both established and emerging markets. Since LNG must be stored and transported at extremely low temperatures, the deployment of advanced cryogenic tanks, valves, pumps, and vaporizers becomes critical to the safe and efficient operation of these facilities.

Technological advancements have significantly enhanced the capabilities and efficiency of cryogenic equipment used in the food & beverage sector. Innovations, such as advanced cryogenic freezers and liquid nitrogen-based cooling systems, have improved the speed and uniformity of freezing processes, resulting in better-quality products. New product offerings, including compact and energy-efficient cryogenic systems, have been developed to cater to various scales of operations, from small-scale food processors to large industrial plants.

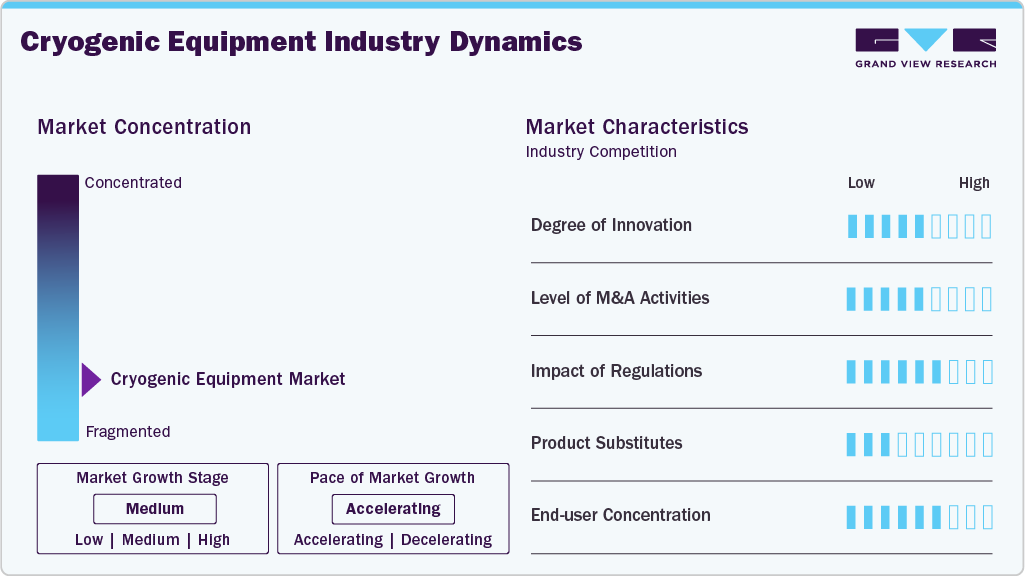

Market Concentration & Characteristics

The industry is highly fragmented due to the presence of numerous global and regional manufacturers serving diverse end-use industries. Large multinational companies dominate advanced and large-scale systems, while many small and mid-sized players focus on niche applications, customized solutions, or specific geographies. Fragmentation is further driven by varying technology requirements across sectors such as food processing, healthcare, chemicals, and energy. Differences in regulatory standards, customer preferences, and after-sales service capabilities also prevent market consolidation, sustaining a competitive and dispersed supplier landscape.

The cryogenic equipment industry shows a high degree of innovation, driven by efficiency, safety, and automation needs. Manufacturers focus on advanced insulation materials, energy-efficient designs, digital monitoring, and automation-enabled controls. Innovation is also supported by growing demand from LNG, hydrogen, healthcare, and food processing sectors. However, long equipment lifecycles and high development costs slow disruptive innovation, favoring incremental technological improvements.

Merger and acquisition activity in the market is significant and largely strategic. Larger players acquire specialized or regional manufacturers to expand product portfolios, strengthen service networks, and enter emerging markets. M&A is also driven by the need for advanced technologies and turnkey capabilities. However, high capital intensity and strong family-owned or regional firms limit large-scale consolidation across the industry.

Regulations significantly shape the market by enforcing strict safety, quality, and environmental standards. Compliance with pressure vessel codes, hazardous material handling norms, and energy-efficiency regulations influences product design and manufacturing costs. Environmental policies promoting clean energy, LNG, and hydrogen adoption are accelerating demand for cryogenic systems. Conversely, complex certification requirements can delay product launches and restrict smaller players’ market entry.

Drivers, Opportunities & Restraints

Growing demand for liquefied gases across industries such as energy, healthcare, and food processing. Rising LNG trade, expanding hydrogen infrastructure, and increased use of industrial gases in medical and manufacturing applications require reliable cryogenic storage, transport, and processing systems. This sustained demand directly fuels investment in advanced cryogenic equipment worldwide.

Global transition toward clean energy, particularly hydrogen and LNG, is creating significant opportunities in the market. Government support for low-carbon fuels, hydrogen mobility, and energy storage is increasing demand for cryogenic tanks, pumps, and heat exchangers. Emerging economies investing in gas infrastructure also present growth potential, especially for cost-effective, modular, and scalable cryogenic solutions.

High capital and operational costs present a significant challenge in the industry. Designing, manufacturing, and maintaining systems that operate at extremely low temperatures requires advanced materials, precision engineering, and skilled labor. Additionally, stringent safety regulations and complex certification processes increase costs and lengthen project timelines, making market entry difficult for smaller manufacturers and limiting rapid adoption.

Product Insights

The tank segment dominated the market with a revenue share of 32.8 % in 2025. Cryogenic tanks serve as the primary storage vessels for liquefied gases such as LNG, liquid nitrogen, oxygen, hydrogen, and argon. These tanks are engineered to maintain extremely low temperatures through double-walled, vacuum-insulated constructions that minimize heat ingress and ensure product purity and stability. Their application spans industrial gas distribution, LNG terminals, hydrogen production facilities, food processing, metals and mining, and healthcare, making them essential assets across multiple end-use sectors. The increasing deployment of hydrogen hubs, LNG regasification facilities, and large-scale industrial gas plants continues to reinforce the importance of high-integrity cryogenic storage systems.

The pumps segment is expected to grow at a considerable CAGR of 7.7% from 2026 to 2033 in terms of revenue. The pumps segment is expected to grow significantly, due to increasing LNG utilization, rising industrial gas consumption, and strong momentum in hydrogen production and export projects. For instance, Nikkiso Cryogenic Industries offers regasification and submerged motor pumps designed for high-reliability cryogenic fluid transfer. As liquefaction and regasification capacities grow globally, and as hydrogen mobility and fuel infrastructure evolve, demand for robust cryogenic pump systems continues to increase across both greenfield installations and plant upgrades.

Cryogen Insights

The liquified natural gas segment accounted for a revenue share of 31.7% in 2025. The LNG cryogenic equipment market is shaped by macro energy trends, including gas demand growth, LNG trade dynamics, infrastructure investment in import/export terminals, and the emergence of small-scale LNG and bunkering solutions. Near-term growth is tied to project cycles in terminal construction, fleet bunkering adoption by shipping, and industrial fuel-switching decisions. In the medium term, LNG equipment demand will also be influenced by how markets integrate lower-carbon fuels, such as bio-LNG and hydrogen carriers, and by volatility in global gas prices that affect investment timing.

The hydrogen segment is expected to grow at a considerable CAGR of 7.8% from 2026 to 2033 in terms of revenue. The hydrogen segment is growing significantly. Market demand for cryogenic hydrogen infrastructure is accelerating as countries scale electrolyzer projects, hydrogen hubs, and clean-fuel corridors for transport, industry, and power applications. These developments require an extensive range of cryogenic technologies, including liquefaction units, vacuum-insulated storage tanks, high-integrity pumps and vaporizers, and specialized piping systems designed to minimize thermal losses and prevent material brittleness.

Application Insights

The storage segment accounted for a revenue share of 56.2% in 2025. Market demand for cryogenic storage is supported by the expansion of industrial gas consumption, the build-out of LNG and hydrogen infrastructure, and the modernization of food, medical, and manufacturing facilities. Several manufacturers in the market offer such for storage. For instance, Chart Industries' cryogenic storage tanks, Linde’s insulated cryogenic tanks, and INOX India's vacuum-insulated storage tanks are all examples of products in the market engineered to maintain ultra-low temperatures and ensure safe, long-duration storage. Increased adoption of these systems across the energy, healthcare, and metallurgy sectors continues to drive growth in the storage application segment.

The distribution segment is expected to grow at a considerable CAGR of 7.2% from 2026 to 2033 in terms of revenue. The distribution applications segment is driven by the expansion of industrial gas consumption, growth in LNG regasification and fuel-distribution facilities, and increased adoption of liquid hydrogen and other emerging cryogens. The rising complexity of industrial gas networks and the push for safer, more efficient handling practices continue to reinforce the importance of robust cryogenic distribution systems.

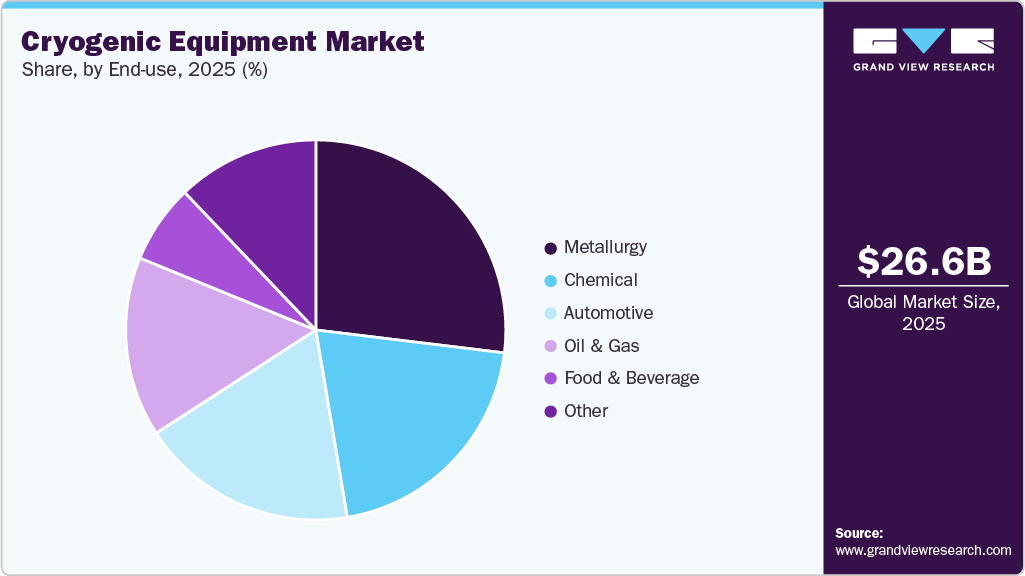

End-use Insights

The metallurgy segment accounted for a revenue share of 26.9% in 2025. The metallurgy segment constitutes one of the largest consumers of cryogen equipment, and its scale of production directly supports sustained demand for cryogenic equipment. According to World Mining Data, 2025, there has been a continued expansion across major metallic commodities, reflecting strong activity in steelmaking, non-ferrous refining, and alloy production, all of which require significant volumes of liquid oxygen, nitrogen, and argon for oxidation control, decarburization, inerting, temperature regulation, and enhanced furnace efficiency.

The automotive segment is expected to grow at a considerable CAGR of 7.9% from 2026 to 2033 in terms of revenue. The automotive segment is expected to grow significantly during the forecast period. The expansion of electric vehicle manufacturing continues to be a central driver of cryogenic demand, despite the slight softening in overall vehicle volumes. Battery-electric and hybrid vehicle programs require extensive use of cryogenic cooling and inert-gas environments during battery-cell production, electrode processing, and thermal-management testing. Aluminium-intensive EV platforms also rely on argon-based welding and precision machining processes, where cryogenic temperature control enhances material characteristics and dimensional stability.

Regional Insights

The cryogenic equipment market in Asia Pacific dominated the market and accounted for 46.8% of the global market share in 2025 as the region accelerates its transition toward hydrogen and low-carbon energy systems. The region hosts the world’s largest build-out of hydrogen production capacity, with green hydrogen capacity now representing roughly half of global installed capacity and expanding at double-digit annual rates. Large-scale electrolyzer deployments, hydrogen hubs, renewable-powered production clusters, and the development of import and export corridors across Northeast and South Asia are creating extensive requirements for cryogenic equipment.

China Cryogenic Equipment Market Trends

China’s cryogenic equipment market is being driven strongly by the rapid build-out of hydrogen production capacity and associated infrastructure. By the end of 2024, China had established roughly 125,000 tonnes per year of green hydrogen production capacity, about 50% of the global green capacity at that date, and green capacity grew more than 60% year-on-year as new projects came on line. Policymakers and planners are prioritizing large electrolyzer projects, clustered hydrogen hubs, and integration with abundant renewable power, which together create a clear need for cryogenic technologies: liquefaction units, ultra-low-temperature storage tanks, vacuum-insulated transfer piping, and specialized pumps and heat exchangers to move and store hydrogen safely at very low temperatures.

India is expected to grow significantly in the cryogenic equipment market, driven by rising LNG imports, expanding gas-based infrastructure, and increasing demand from healthcare, chemicals, and food processing industries. Government initiatives promoting clean energy, city gas distribution, and hydrogen development are accelerating investments in cryogenic storage and transportation systems. Additionally, industrialization and domestic manufacturing growth are strengthening demand for industrial gas handling and cryogenic technologies.

North America Cryogenic Equipment Market Trends

North America cryogenic equipment market benefits from a broad and mature industrial ecosystem in which energy production, metals processing, and advanced manufacturing collectively reinforce sustained demand for cryogenic systems. The region hosts one of the world’s most active oil and natural gas industries, characterized by expanding upstream productivity, large-scale gas processing networks, and ongoing development of LNG liquefaction, export, and handling infrastructure.

The U.S. is expected to experience strong growth in the cryogenic equipment market, supported by expanding LNG production and exports, advanced healthcare infrastructure, and increasing investment in hydrogen and clean energy projects. Demand from aerospace, defense, and industrial gas sectors further drives market expansion. Technological leadership, strict safety standards, and continued infrastructure upgrades are encouraging adoption of high-performance, energy-efficient cryogenic storage, processing, and transportation equipment.

Canada is expected to witness steady growth in the cryogenic equipment market, driven by rising LNG export projects, expanding industrial gas usage, and increasing investments in clean energy and hydrogen infrastructure. Growth in the healthcare and food processing sectors also supports demand for cryogenic storage and handling systems. Additionally, the government's focus on reducing emissions and developing energy infrastructure is encouraging the adoption of advanced, efficient cryogenic equipment across industries.

Europe Cryogenic Equipment Market Trends

The cryogenic equipment market in Europe is expected to grow at a 6.8% CAGR during the forecast period and is expanding in response to the region’s accelerating transition toward hydrogen and low-carbon energy systems. Ambitious national strategies across major EU economies are driving large-scale investment in electrolysis capacity, hydrogen hubs, and transport networks. Regional electrolyzer deployment targets now span the multi-gigawatt range, with plans for several countries to add multi-GW hydrogen production capacity by 2030 and further expansion by 2035.

Germany's cryogenic equipment market is one of the most advanced in Europe, benefiting significantly from the country’s accelerating shift toward electric mobility. According to the German Association of the Automotive Industry (VDA), German manufacturers produced 673 thousand units of electric vehicles in the first half of 2025, marking a 23% increase compared to the previous year and reaching the highest EV production level ever recorded in the country. Battery-electric vehicles (BEVs) accounted for the majority of output, with production up 29% year-on-year, while plug-in hybrid production grew by 6%.

France’s cryogenic equipment market is expected to grow as the country accelerates its hydrogen transition under an updated national strategy that prioritizes energy sovereignty and the use of low-carbon electricity. The plan calls for 4.5 GW of installed electrolysis capacity by 2030, increasing to 8 GW by 2035, with the intention of meeting domestic hydrogen demand without the need for imports through at least the mid-2030s. This long-term commitment to scaling hydrogen production, supported by substantial public funding and a focus on a broad suite of electrolyzer technologies, considerably increases the need for cryogenic systems used for hydrogen liquefaction, ultra-low-temperature storage, and secure transport.

Middle East & Africa Cryogenic Equipment Market Trends

The cryogenic equipment market in the Middle East & Africa is expanding as the region positions hydrogen, low-carbon fuels, and energy diversification at the center of long-term industrial and economic transformation. Across the Gulf states, large-scale renewable-powered hydrogen developments, carbon-capture integration, and emerging export corridors to Europe and Asia are creating strong demand for cryogenic technologies essential for liquefaction, ultra-low-temperature storage, and marine transport of hydrogen and ammonia.

Saudi Arabia’s cryogenic equipment market is expanding rapidly as the Kingdom builds one of the world’s most ambitious clean-hydrogen ecosystems. The NEOM Green Hydrogen Project, now around 80% complete, is an example of the country’s growing hydrogen production. Powered by 4 GW of integrated wind and solar capacity, the facility will produce roughly 600 tonnes of green hydrogen per day, exported as ammonia, once commissioning begins in 2027. With an expected reduction of 5 million tonnes of CO₂ emissions annually, the project represents the world’s largest green hydrogen–ammonia complex and sets a new benchmark for large-scale cryogenic hydrogen handling. Projects of this magnitude require extensive liquefaction systems, ultra-low-temperature storage, vacuum-insulated pipelines and marine export infrastructure, making Saudi Arabia a major demand center for advanced cryogenic equipment.

Latin America Cryogenic Equipment Market Trends

The cryogenic equipment market in Latin America is expanding as the region strengthens its industrial base, modernizes manufacturing capabilities, and advances large-scale energy and natural gas development. Growing investment in natural gas extraction, midstream infrastructure, and LNG-related projects, particularly across resource-rich basins, has increased demand for cryogenic systems used in gas purification, dehydration, NGL extraction, and low-temperature separation. As countries pursue LNG export potential and enhance domestic gas treatment capacity, they increasingly require liquefaction equipment, large-format cryogenic storage, vaporizers, and insulated pipelines designed to handle ultra-low-temperature gases safely and efficiently.

Brazil’s rapidly growing food and agribusiness sector provides a strong and stable demand base. As one of the world’s largest exporters of meat, poultry, dairy, and processed foods, Brazil depends on cryogenic freezing, chilling, and modified-atmosphere packaging to maintain product quality throughout production and cold-chain logistics. The expansion of export-oriented processing plants, along with stricter hygiene and quality standards, continues to increase consumption of liquid nitrogen and CO₂, further driving investment in modern cryogenic handling technologies.

Key Cryogenic Equipment Company Insights

Key players operating in the cryogenic equipment market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include Chart Industries Inc., Linde plc and Air Liquide SAamong others.

-

Chart Industries Inc. is a global manufacturer of highly engineered cryogenic equipment used across various industries, including energy, industrial gas, and biomedical. The company's product portfolio includes a wide range of cryogenic solutions such as storage tanks, transportation vessels, and heat exchangers designed to handle and store gases at extremely low temperatures. The company is known for its innovative technology and commitment to quality, providing solutions that support applications in Liquefied Natural Gas (LNG), hydrogen, carbon capture, and life sciences.

-

Linde plc, a global operator in industrial gases and engineering, offers a comprehensive range of products in the cryogenic equipment market, including cryogenic storage tanks, cryogenic vaporizers, cryogenic pumps, and cryogenic distribution systems. The company also supplies cryogenic freezers, cryogenic cylinders, and LNG systems. These products are crucial for applications in healthcare, food preservation, energy, and industrial manufacturing, ensuring the efficient, safe & reliable handling and transportation of cryogenic gases such as oxygen, nitrogen, and LNG.

Key Cryogenic Equipment Companies:

The following are the leading companies in the cryogenic equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Chart Industries Inc.

- Linde plc

- Nikkiso Co. Ltd.

- Standex International

- INOX India Limited

- Air Liquide SA

- Premier Cryogenics Ltd.

- Galileo Technologies S.A.

- Herose GmbH

- Wessington Cryogenics

- Braunschweiger Flammenfilter GmbH

- Lapesa Grupo Empresarial s.l

- MAN Energy Solutions SE

- Cryogas Equipment Private Limited

- Cryo Pur

Recent Developments

-

In October 2025, Air Liquide expanded its presence in India by entering into an agreement to acquire NovaAir, an industrial gas producer and supplier. This strategic move strengthens Air Liquide’s footprint in the Indian market, enhancing its ability to serve local industrial and energy customers.

-

In September 2025, Nikkiso Clean Energy & Industrial Gases Group (Nikkiso CE&IG) completed a multimillion-Euro expansion of its Wurzen, Saxony, Germany fabrication facility, doubling its European manufacturing capacity. The expansion enhances production capabilities for clean energy and industrial gas equipment, supporting increased demand across Europe. Additionally, Nikkiso opened a new European office, strengthening regional operations, customer support, and its presence in the European cryogenic and industrial gases markets.

Cryogenic Equipment Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 28,270.9 million

Revenue forecast in 2033

USD 45,390.9 million

Growth rate

CAGR of 7.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, cryogen, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Chart Industries Inc.; Linde plc; Nikkiso Co. Ltd.; Standex International; INOX India Limited; Air Liquide SA; Premier Cryogenics Ltd.; Galileo Technologies S.A.; Herose GmbH; Wessington Cryogenics; Braunschweiger Flammenfilter GmbH; Lapesa Grupo Empresarial s.l; MAN Energy Solutions SE; Cryogas Equipment Private Limited; Cryo Pur

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cryogenic Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cryogenic equipment market report on the basis of product, cryogen, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Tank

-

Valve

-

Pumps

-

Vaporizers

-

Vacuum Jacketed Piping (VJP)

-

Others

-

-

Cryogen Outlook (Revenue, USD Million, 2021 - 2033)

-

Nitrogen

-

Oxygen

-

Argon

-

Liquified Natural Gas

-

Hydrogen

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Distribution

-

Storage

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil & Gas

-

Metallurgy

-

Automotive

-

Food & Beverage

-

Chemical

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cryogenic equipment market size was estimated at USD 26,573.8 million in 2025 and is expected to reach USD 28,270.9 million in 2026.

b. The global cryogenic equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.0% from 2026 to 2033 and reach USD 45,390.9 million by 2033.

b. The tank segment dominated the market with a revenue share of 32.8 % in 2025. Cryogenic tanks serve as the primary storage vessels for liquefied gases such as LNG, liquid nitrogen, oxygen, hydrogen, and argon. These tanks are engineered to maintain extremely low temperatures through double-walled, vacuum-insulated constructions that minimize heat ingress and ensure product purity and stability. Their application spans industrial gas distribution, LNG terminals, hydrogen production facilities, food processing, metals and mining, and healthcare, making them essential assets across multiple end-use sectors.

b. Some of the key players operating in the cryogenic equipment market include Chart Industries Inc., Linde plc, Nikkiso Co. Ltd., Standex International, INOX India Limited, Air Liquide SA, Premier Cryogenics Ltd., Galileo Technologies S.A., Herose GmbH, Wessington Cryogenics, Parkson Corporation, Lapesa Grupo Empresarial s.l, MAN Energy Solutions SE, Cryogas Equipment Private Limited., Cryo Pur.

b. Key factors driving the cryogenic equipment market include rising demand for LNG, growth in industrial gases, expanding healthcare and medical applications, advancements in space and aerospace industries, and increasing adoption of hydrogen and clean energy technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.