- Home

- »

- Electronic & Electrical

- »

-

Cruise Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Cruise Market Size, Share & Trends Report]()

Cruise Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Ocean Cruises, River Cruises), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68039-927-3

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cruise Market Summary

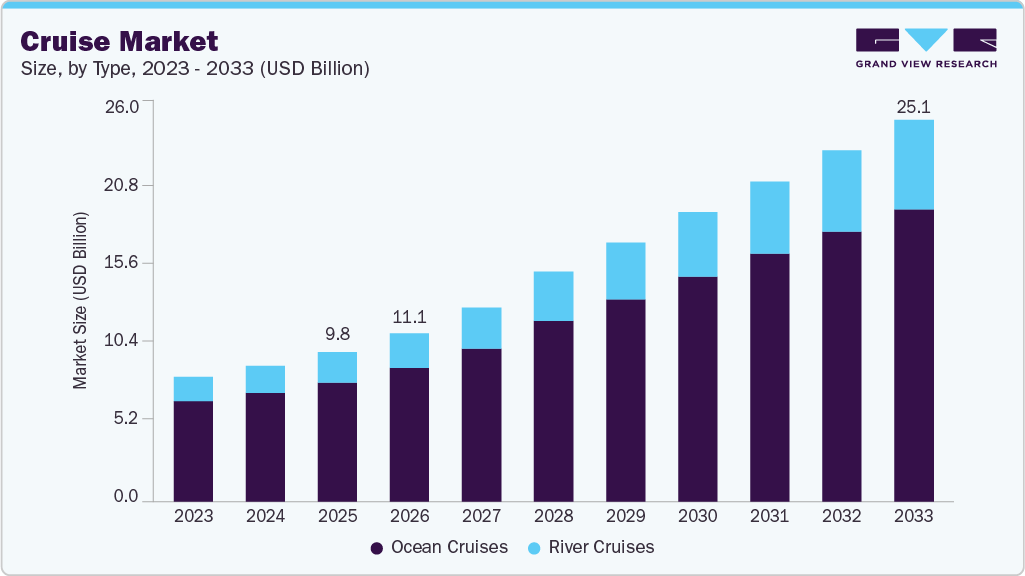

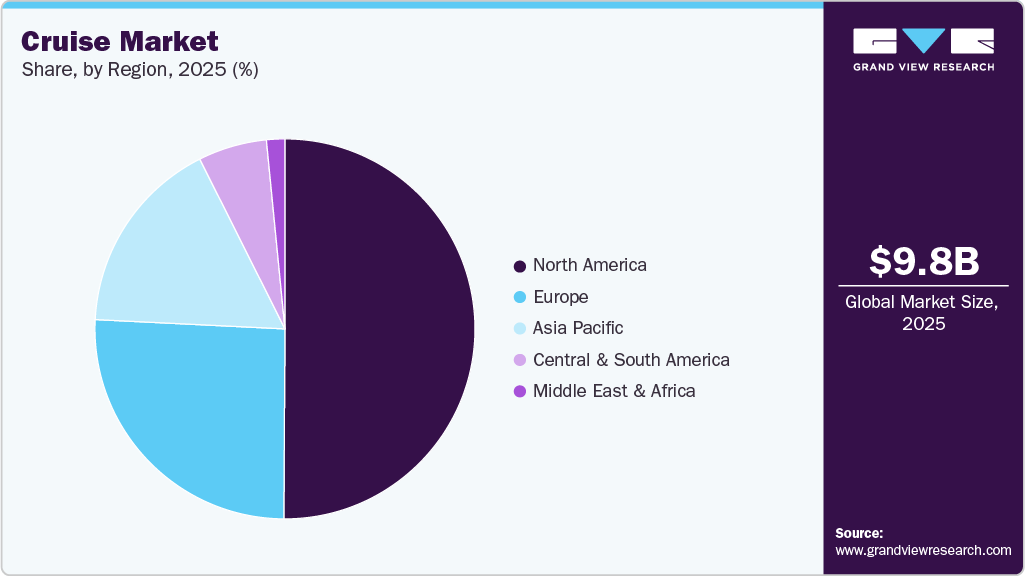

The global cruise market size was estimated at USD 9.84 billion in 2025 and is projected to reach USD 25.06 billion by 2033, growing at a CAGR of 12.4% from 2026 to 2033. The global cruise industry has experienced a growing demand, driven by a confluence of consumer preferences, broader tourism trends, and evolving perceptions of experiential and luxury travel.

Key Market Trends & Insights

- By region, North America led the market with a share of 50.1% in 2025.

- The cruise industry in the U.S. is expected to grow at a CAGR of 12.4% from 2026 to 2033.

- By type, ocean cruises led the market and accounted for a share of 79.7% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 9.84 Billion

- 2033 Projected Market Size: USD 25.06 Billion

- CAGR (2026-2033): 12.4%

According to data from the Cruise Lines International Association (CLIA), the sector is recovering steadily from the downturn caused by the COVID-19 pandemic, with passenger volumes continuing to grow and forecasts indicating further increases in 2025. In 2024, the industry catered to approximately 34.6 million cruise passengers, and this figure is expected to rise to 37.7 million in 2025, reflecting increased traveler engagement with cruise travel formats.A primary factor underlying increased demand in the cruise market is the growing consumer preference for all-inclusive and experience-rich travel offerings. Ocean cruises provide a comprehensive vacation framework in which accommodation, transportation, dining, and entertainment are integrated into a single itinerary, appealing to travelers seeking simplified planning, predictable costs, and curated onboard experiences. Leading operators in the carnival cruise market and other major cruise lines continue to enhance ship-based amenities, entertainment, and service personalization, further strengthening the value proposition of cruise travel.

In parallel, the river cruise market is benefiting from rising interest in culturally immersive and slow-travel experiences. River cruises offer access to multiple inland destinations through centrally located ports, allowing travelers to explore historic cities, cultural landmarks, and regional cuisine with minimal logistical complexity. The combination of destination-rich itineraries, smaller vessel experiences, and premium service positioning has made river cruising an attractive alternative for travelers seeking a more intimate and culturally focused travel experience.

The broader rise in global travel and tourism also contributes to cruise industry growth. Following pandemic-related travel restrictions, there has been a strong revival in discretionary tourism purchases, with travelers prioritizing leisure and memorable experiences over routine vacations. Industry surveys and tourism commentary highlight growing interest in slower, more immersive forms of travel that allow for deeper engagement with destinations and cultures. Cruise itineraries that include accessible tours, shore excursions, and themed experiences reflect this demand for meaningful travel encounters. In 2024, U.S. tourism broadly rebounded, with domestic trips exceeding 2.4 billion and international visitors estimated in the low to mid70 million range, while cruises generated several billion dollars in U.S. market revenue and remained a key, fast‑growing segment of American leisure travel.

In addition, the cruise ship market is witnessing a growing shift toward cruise formats that cater to evolving lifestyle and personal travel preferences, including solo travel and small-ship or expedition cruising. Travel advisor networks report rising interest in flexible cruise travel options within the cruise ship market, such as off-peak sailings, solo-friendly itineraries, and routes designed around moderate climates and distinctive, experience-led destinations. These trends reflect broader changes in leisure travel behavior within the cruise ship market, where travelers increasingly prioritize personalization, flexibility, and freedom of choice over traditional mass-market cruising models.

Moreover, the intersection between cruise travel and luxury experiential tourism further reinforces the market’s expansion. Cruises are increasingly positioned as premium leisure experiences, offering enhanced amenities, specialized services, and bespoke activities that resonate with affluent travelers seeking exclusivity and comfort.

Consumer Insights

The global cruise industry is witnessing sustained expansion, supported by evolving consumer preferences toward experiential travel, integrated leisure offerings, and value-driven tourism models. Cruises are increasingly perceived not merely as a mode of transportation, but as comprehensive leisure ecosystems that combine travel, accommodation, entertainment, dining, and destination experiences within a single, organized package.

A key consumer trend driving cruise demand is the growing preference for experience-led tourism. Travelers are prioritizing immersive, multi-dimensional vacations that offer relaxation, entertainment, cultural exposure, and social engagement. Cruises align well with this preference by enabling passengers to visit multiple destinations while enjoying curated onboard experiences such as live entertainment, wellness programs, culinary events, and cultural activities. This convergence of travel and entertainment has positioned cruises as a compelling alternative to traditional land-based vacations.

Another significant factor supporting cruise industry growth is the all-inclusive value proposition. Cruise packages typically bundle accommodation, meals, entertainment, and transportation into a single price, reducing the complexity of trip planning and offering greater cost transparency. This bundled model is particularly attractive to families, multi-generational travel groups, and time-constrained travelers who value convenience and predictability in vacation spending. As discretionary travel budgets face increased scrutiny, consumers continue to favor travel formats that deliver high perceived value relative to cost.

The expansion of tourism, leisure, and entertainment spending has further reinforced cruise demand. As global travel confidence continues to recover, consumers are increasingly allocating discretionary income toward leisure activities that combine relaxation with entertainment. Cruises benefit directly from this trend, as they offer extensive on-board entertainment such as shows, events, and recreational amenities alongside destination-based experiences. The ability to deliver continuous entertainment without frequent logistical transitions enhances the appeal of cruising as a stress-free leisure option.

Type Insights

Ocean cruises dominated the global market with the largest market share of 79.7% in 2025. Consumer demand for ocean cruises is increasing as travelers seek all-inclusive, hassle-free vacation experiences that combine transportation, accommodation, dining, and entertainment into a single offering. Cruises appeal strongly to consumers looking for value and convenience, as they eliminate the need for complex travel planning while providing access to multiple destinations in one trip. The growing emphasis on experiential travel has further supported demand, with cruise operators enhancing onboard amenities, wellness offerings, culinary experiences, and entertainment options to attract a broader consumer base.

The river cruises are expected to grow at a CAGR of 14.4% from 2026 to 2033. River cruises offer smaller vessels, curated itineraries, and frequent access to city centers and historic towns, which appeal to consumers looking for convenience, authenticity, and slower-paced travel. The all-inclusive nature of river cruising, covering accommodation, dining, excursions, and onboard experiences, also provides cost transparency and reduces travel complexity. In addition, rising interest in experiential tourism, culinary exploration, and heritage-focused travel is encouraging consumers to choose river cruises as a premium yet relaxed way to explore multiple destinations within a single journey.

Regional Insights

North America Cruise Market Trends

North America cruise industry accounted for a global revenue share of 50.1% in 2025. Cruises appeal to a broad demographic by combining accommodation, dining, entertainment, and multiple destinations within a single package, reducing planning complexity for travelers. Growing interest in experiential and leisure travel, particularly among retirees and multigenerational families, is supporting demand, while cruise operators continue to introduce newer ships, enhanced onboard amenities, and diverse itineraries tailored to North American travelers. In addition, improved port infrastructure and expanded homeport options across the U.S. and Canada have made cruise travel more accessible, further contributing to market growth.

U.S. Cruise Market Trends

The cruise industry in the U.S. is expected to grow at a CAGR of 12.4% from 2026 to 2033, owing to the strong consumer demand for convenient, value-oriented vacation experiences that combine travel, accommodation, dining, and entertainment into a single offering. U.S. travelers are increasingly attracted to cruises for their predictable pricing, diverse itineraries, and broad appeal across age groups, particularly among families and older travelers seeking hassle-free travel. Cruise operators have also expanded their fleets with larger, more modern ships that offer enhanced onboard amenities, entertainment options, and experiential dining, which has helped reposition cruising as a premium yet accessible leisure option.

Europe Cruise Market Trends

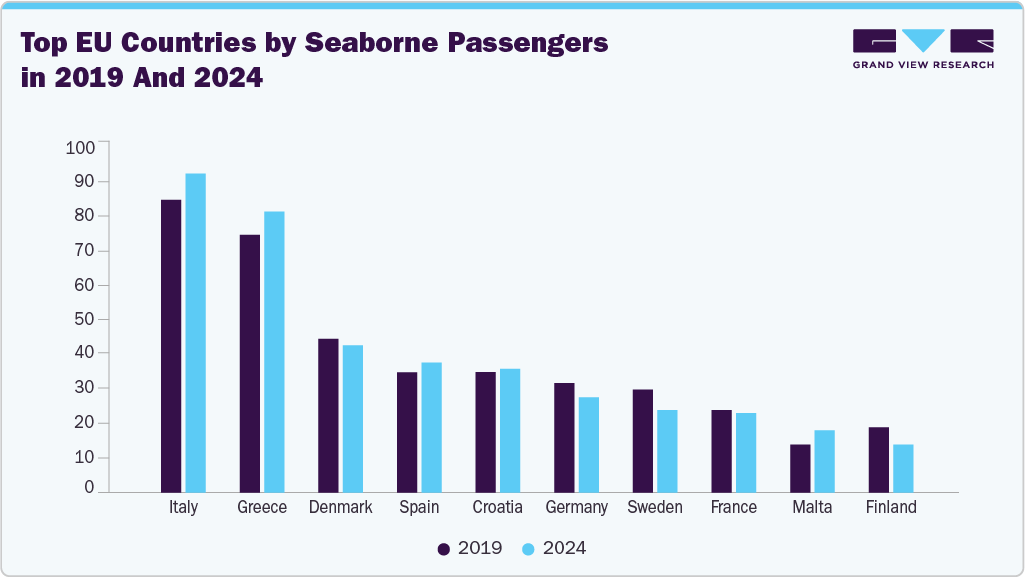

Europe cruise industry is expected to grow at a CAGR of 12.1% from 2026 to 2033. European travelers increasingly favor cruises for their ability to offer seamless transportation, accommodation, dining, and entertainment within a single package, reducing the complexity of trip planning. In addition, cruise operators have expanded itineraries across the Mediterranean, Northern Europe, and river cruise routes, appealing to both first-time and repeat travelers. Investments in newer, more sustainable ships, enhanced onboard experiences, and destination-focused excursions have further strengthened demand, particularly among middle-aged and older travelers seeking comfort and experiential travel.

Asia Pacific Cruise Market Trends

Asia Pacific cruise industry is expected to grow at a CAGR of 13.4% from 2026 to 2033. Consumers in the region are increasingly attracted to cruises for their convenience, value-for-money bundled offerings, and the ability to visit multiple destinations within a single trip. Improved port infrastructure, expanding homeports in countries such as China, Japan, Singapore, and Australia, and the introduction of shorter, region-focused itineraries have further enhanced accessibility for first-time cruisers. In addition, cruise operators are tailoring onboard experiences, dining options, and entertainment to regional preferences, supporting broader adoption and sustained growth across the Asia Pacific market.

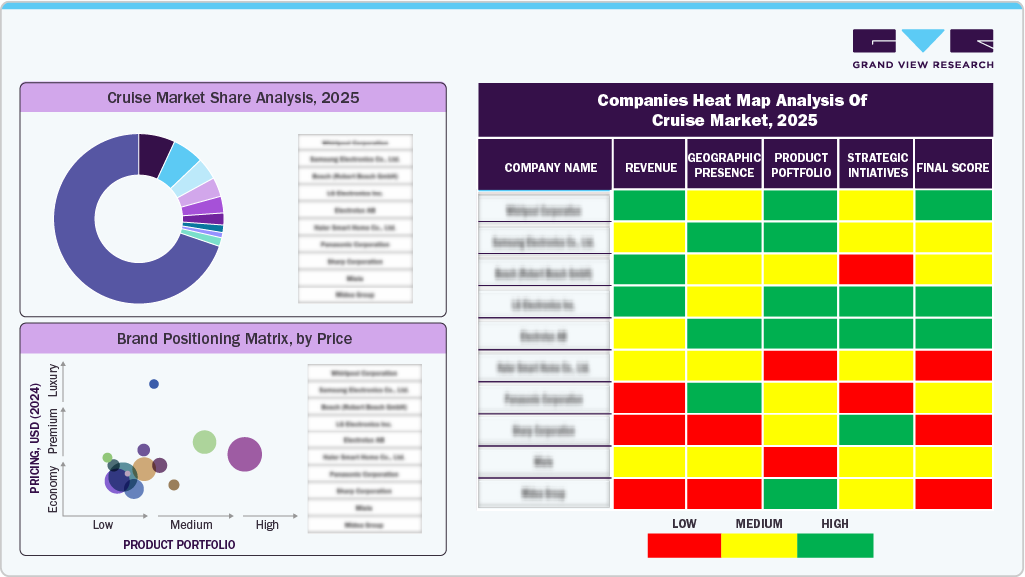

Key Cruise Company Insights

The presence of large, prominent key players and small local players characterizes the global market. Most of the market share is occupied by the two companies, Carnival Corporation & Plc. and Royal Caribbean Group.

Key companies are focused on new initiatives to increase their clientele. Such as multigenerational packages targeting family travel, kids' theme cruise vacations for children, mystery theme cruise vacations, etc. These key players operating in the global cruise industry are focusing particularly on expanding their business to the untapped regions or countries.

Key Cruise Companies:

The following key companies have been profiled for this study on the cruise market

- Carnival Corporation & Plc

- Royal Caribbean Group

- MSC Cruises S.A.

- Norwegian Cruise Line Holdings Ltd.

- Disney Cruise Line

- Genting Hong Kong Limited

- Fred. Olsen Cruise Lines

- Cruiseaway

- Island Queen Cruises

- Luxury Cruise Connections

Cruise Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 11.07 billion

Revenue forecast in 2033

USD 25.06 billion

Growth Rate, Value

CAGR of 12.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy Spain; China; India, Japan; Australia; Singapore; Brazil; and Saudi Arabia

Key companies profiled

Carnival Corporation & Plc; Royal Caribbean Group; MSC Cruises S.A.; Norwegian Cruise Line Holdings Ltd.; Disney Cruise Line; Genting Hong Kong Limited; Fred. Olsen Cruise Lines; Cruiseaway; Island Queen Cruises; Luxury Cruise Connections

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cruise Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cruise market report based on type and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Ocean Cruises

-

River Cruises

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Singapore

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cruise market was estimated at USD 9.84 billion in 2025 and is expected to reach USD 11.07 billion in 2026.

b. Some of the key players operating in the cruise market include Carnival Corporation & Plc; Royal Caribbean Group; MSC Cruises S.A.; Norwegian Cruise Line Holdings Ltd.; Disney Cruise Line; Genting Hong Kong Limited; Fred. Olsen Cruise Lines; Cruiseaway; Island Queen Cruises; Luxury Cruise Connections

b. Key factors that are driving the cruise market growth include a luxurious form of traveling that involves an all-in-one inclusive holiday on a cruise and also the increase in tourism across the globe.

b. The global cruise market is expected to grow at a compound annual growth rate of 12.4% from 2026 to 2033 to reach USD 25.06 billion by 2033.

b. Ocean cruises dominated the global market with the largest market share of 79.7% in 2025. Consumer demand for ocean cruises is increasing as travelers seek all-inclusive, hassle-free vacation experiences that combine transportation, accommodation, dining, and entertainment into a single offering.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.