- Home

- »

- Renewable Chemicals

- »

-

Crude Sulfate Turpentine Market Size, Industry Report, 2033GVR Report cover

![Crude Sulfate Turpentine Market Size, Share & Trends Report]()

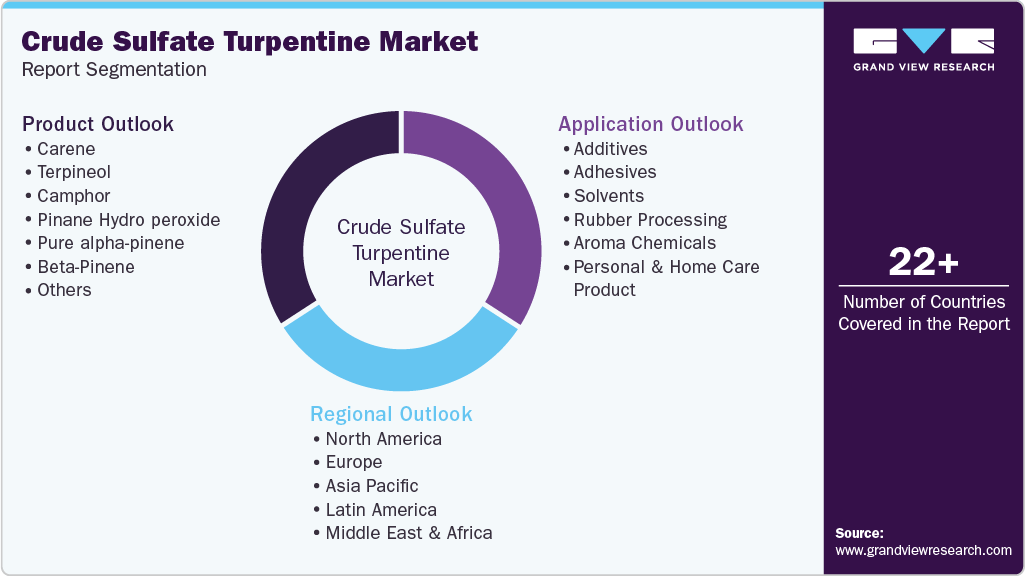

Crude Sulfate Turpentine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Carene, Terpineol, Camphor, Pinane Hydro peroxide, Pure alpha-pinene, Beta-Pinene, Terpene Resins, Limonene), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-759-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Crude Sulfate Turpentine Market Summary

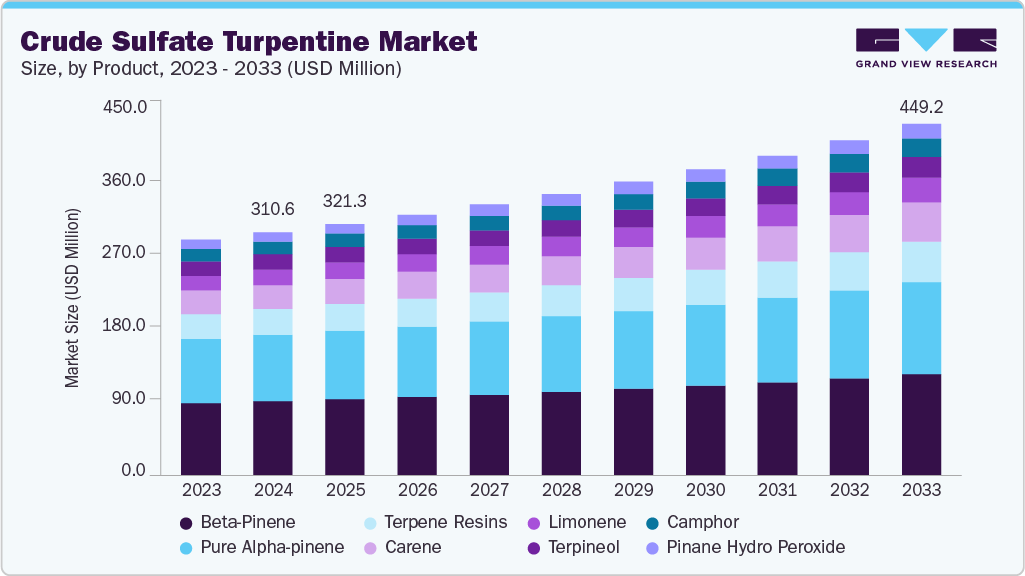

The global crude sulfate turpentine market size was estimated at USD 310.6 million in 2024 and is projected to reach USD 449.2 million by 2033, growing at a CAGR of 4.3% from 2025 to 2033. The growth in the crude sulfate turpentine market is driven by its widespread application in aroma chemicals and fragrances; the product serves as a critical bio-based raw material in the fragrance and flavor industry.

Key Market Trends & Insights

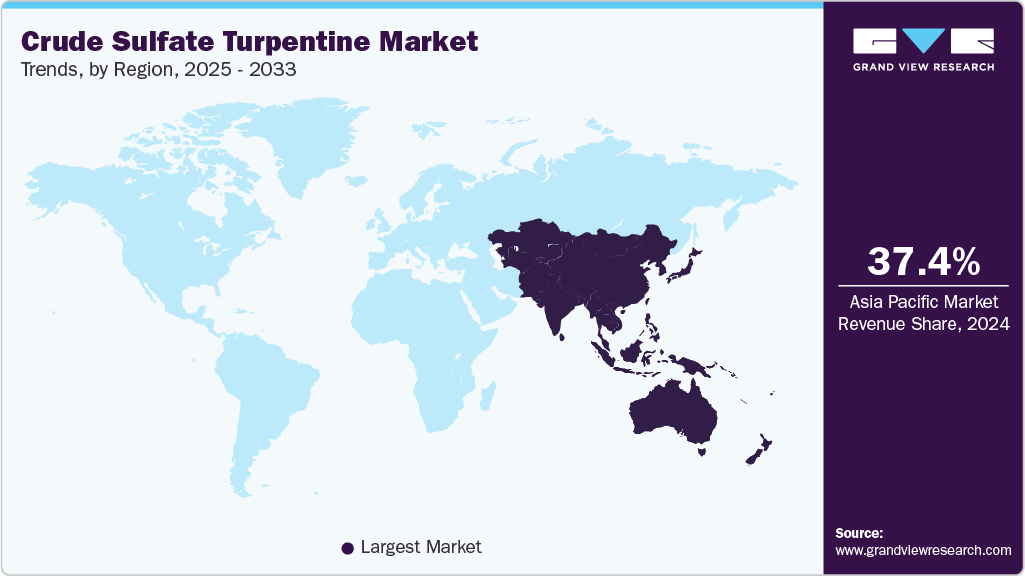

- Asia Pacific dominated the global crude sulfate turpentine market with the largest revenue share of 37.4% in 2024.

- The crude sulfate turpentine market in the U.S. is expected to grow at a substantial CAGR of 4.2% from 2025 to 2033.

- By product, the carene segment is expected to grow at a considerable CAGR of 5.6% from 2025 to 2033 in terms of revenue.

- By application, the additives segment is expected to grow in revenue at a considerable CAGR of 5.2% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 310.6 Million

- 2033 Projected Market Size: USD 449.2 Million

- CAGR (2025-2033): 4.3%

- Asia Pacific: Largest market in 2024

Its primary application lies in producing key aroma chemicals such as citronellol, geraniol, dihydromyrcenol, and linalool, foundational to the perfumer’s palette. These compounds are widely used to create floral, citrus, woody, and fresh scent notes in perfumes, personal care products, household cleaners, and air fresheners. Crude sulfate turpentine-derived molecules are valued for their olfactory properties and their renewable origin, which supports sustainable and eco-conscious fragrance development.

Alpha-pinene, crude sulfate, and turpentine-derived fragrance ingredients are rising due to their natural origin and versatile applications. Compounds like linalool, dihydromyrcenol, and methoxycitronellal are widely used in perfumes, personal care products, and home care products. Linalool also serves as an intermediate in the production of vitamins A and E. Increasing consumer preference for bio-based, sustainable aroma chemicals is driving the growth of this market segment.

The Beta-pinene-based crude sulfate turpentine is growing steadily for its key component of turpentine, which is widely used in the production of fragrance compounds like geraniol, nerol, linalool, and citronellol, which are essential in perfumes, soaps, and detergents. It also serves as a precursor for myrcene, a vital intermediate in aroma chemical synthesis. Its high optical purity makes it valuable for applications requiring stereospecific compounds. Market demand is growing due to rising interest in bio-based ingredients and expanding use in the personal care and fine fragrance industries.

The crude sulfate turpentine demand in soap manufacturing is growing due to its role in enhancing fragrance, improving texture, and offering natural antimicrobial benefits. Its derivatives, like pine oil, are increasingly used in bar and liquid soaps for their fresh scent and cleaning efficacy. With rising consumer preference for natural and functional ingredients, CST-based components are gaining traction in personal care and detergent markets.

However, volatility in raw material costs creates uncertainty in procurement, disrupts production planning, and affects the demand-supply balance of CST-based finished products, thereby restraining market growth.

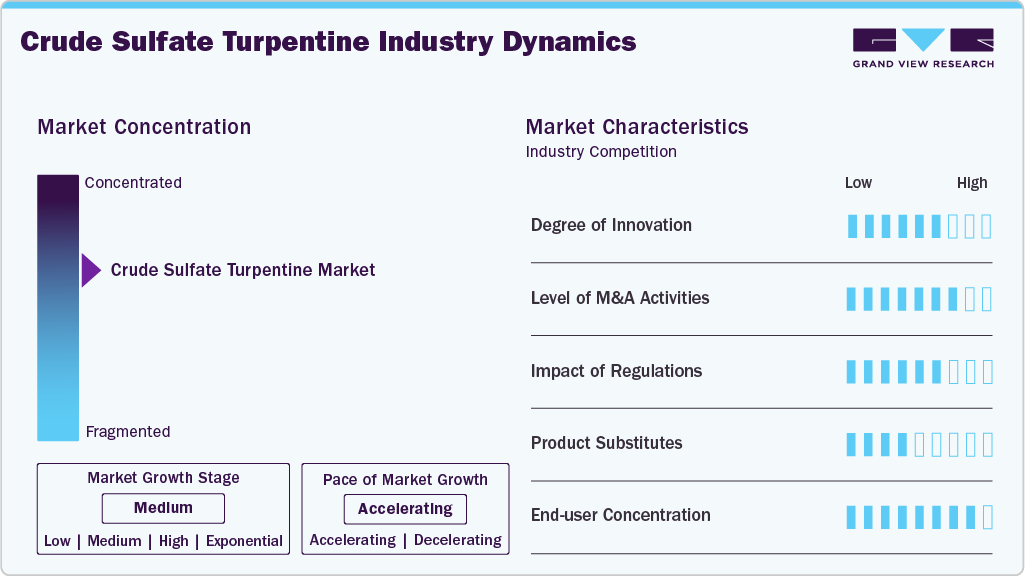

Market Concentration & Characteristics

The global crude sulfate turpentine market is concentrated, with a mix of established international players such as DRT, Kraton, and Ingevity competing alongside emerging regional producers and specialty chemical companies. CST-derived products serve a wide range of industries, including fragrances, adhesives, rubber processing, coatings, and home care, where natural origin, performance, and regulatory compliance are key. Moreover, these products are converted into poly-terpenes, which are used in adhesives, specialty inks, electronic solvents, vitamins, pharmaceuticals, disinfectants, and other products. The concentration of the products varies with the change in geographical areas.

However, Crude Sulfate Turpentine faces a notable threat from substitutes, largely due to the presence of more affordable and consistently available synthetic alternatives. Petroleum-based compounds such as polyacrylics, styrene-butadiene copolymers, and various synthetic solvents.

Product Insights

Beta-pinene-based crude sulfate turpentine dominated the industrial market, with a revenue share of 30.7% in 2024, due to being more chemically versatile and commercially valuable. Beta-pinene is often reserved for higher-value applications, especially where optical purity is essential. Naturally sourced beta pinene from crude sulfate turpentine is about 90-95% optically pure, making it ideal for stereospecific synthesis and a key raw material for high-value fragrance compounds. It produces intermediates like myrcene, which leads to geraniol, nerol, linalool, citronellol, and citral, all essential in perfumes, soaps, and vitamin synthesis. β-Ionone and menthol, derived from these pathways, are widely used in cosmetics, flavors, and pharmaceuticals. Compounds like nopol, Lyral, and anisaldehyde add value to the perfumery and flavor industries.

The carene base crude sulfate turpentine product is the fastest-growing crude sulfate turpentine market due to its clear, colorless liquid with a resinous, oily, aromatic scent obtained from the distillation of crude sulfate turpentine, a by-product of the pulp and paper industry. It is primarily used as a raw material in synthesizing biodegradable insecticides for pyrethroids, and it is widely applied in agriculture and public health. Additionally, it finds applications in fragrances, resins, solvents, and pharmaceuticals. Market demand for Carene is growing due to the increasing adoption of eco-friendly agrochemicals, rising interest in bio-based aroma ingredients for personal care, and the shift toward sustainable, CST-derived terpene alternatives to petroleum-based chemicals.

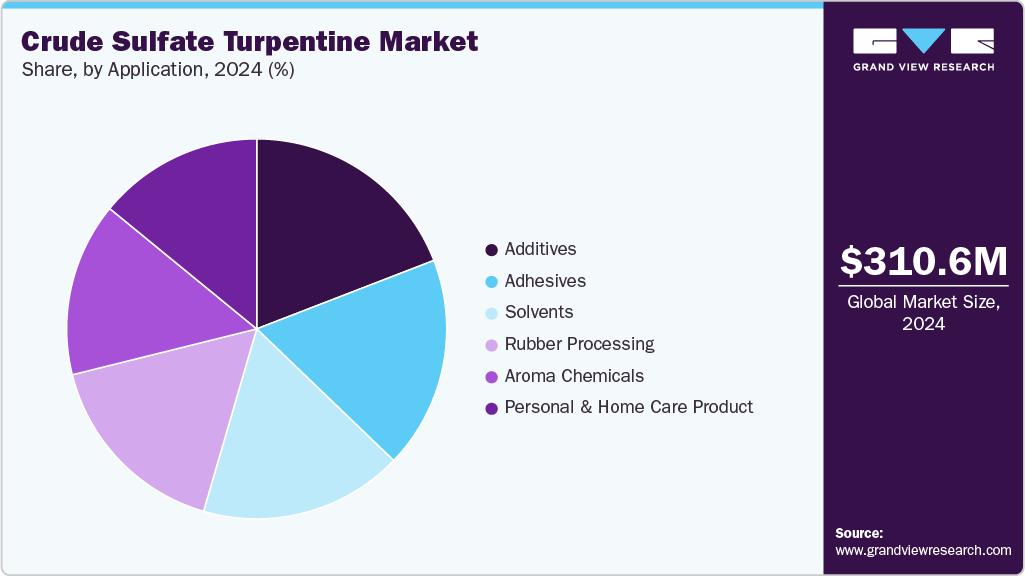

Application Insights

Aroma chemicals-based chemical absorbents dominated the crude sulfate turpentine market, with a 41.4% revenue share in 2024, rising due to their role in producing natural aroma and flavor compounds like limonene, linalool, and geraniol. These product-derived terpenes are widely used in citrus drinks, confectionery, and spice extracts, supporting clean-label and plant-based product trends. Their GRAS (generally recognized as safe) status and cost-effectiveness further boost their appeal as sustainable alternatives to traditional flavoring agents.

Additive-based crude sulfate turpentine application market products are growing steadily due to their valuable building block in the production of resins and plasticizers, enhancing flexibility, tackiness, and processing stability in rubber and plastic products. Rubber compounding, especially for tires and footwear, improves adhesion and mechanical strength. Additionally, alpha-pinene is modified into terpene phenolic resins used in pressure-sensitive and hot melt adhesives, boosting tack, peel strength, and heat resistance—ideal for packaging, labeling, and construction applications. It also plays a role in formulating lubricant base stocks and fuel additives, improving viscosity, and reducing friction, particularly in biodegradable and bio-based lubricants.

Regional Insights

Asia Pacific crude sulfate turpentine market dominates due to its extensive use in manufacturing bio-based aroma chemicals, solvents, adhesives, and synthetic resins across growing industrial sectors. Product-derived terpenes, such as alpha-pinene and beta-pinene, are key intermediates in producing flavors, fragrances, and performance chemicals used in personal care, home care, and agrochemical formulations.

Rapid industrialization, expanding manufacturing hubs, and rising demand for sustainable and renewable raw materials support crude sulfate turpentine usage across countries like China, India, and Southeast Asia. Additionally, product-based components are increasingly used in coatings, inks, and sealants for packaging and electronics, aligning with the region's booming electronics, FMCG, and construction industries. This surge in industrial and consumer applications continues to drive robust demand for crude sulfate turpentine across the Asia Pacific.

China crude sulfate turpentine market is emerging as a key market, driven by rapid industrialization and expanding demand across various downstream applications. The country’s thriving manufacturing sector fuels product derivatives like pure alpha-pinene, beta-pinene, terpineol, limonene, and terpene resins to produce additives, adhesives, and solvents. Aroma chemicals and ingredients are increasingly used in personal care, home care, and flavor formulations, catering to China’s growing consumer goods market. Additionally, product derivatives play a vital role in rubber processing and specialty materials, supporting the automotive and electronics industries. This broad-based demand, aligned with China’s push for bio-based raw materials and sustainable manufacturing, ensures robust growth for the product in the region.

Europe Crude Sulfate Turpentine Market Trends

Europe's crude sulfate turpentine market is experiencing steady growth, supported by rising demand across the personal care and adhesives sectors. A key crude sulfate turpentine-derived product, terpineol, is widely used in aroma chemicals and fragrance compositions, offering floral and lilac-like notes vital in perfumery and cosmetics.

In the adhesives industry, crude sulfate turpentine-based terpene resins play a crucial role in pressure-sensitive adhesives used in packaging and labeling, offering excellent tack and bonding performance. Product derivatives such as alpha-pinene and limonene are also gaining traction as bio-based solvents and additives, aligning with Europe's shift toward sustainable and low-VOC formulations. This expanding utilization across high-value sectors is boosting the region's crude sulfate turpentine market demand.

North America Crude Sulfate Turpentine Market Trends

The North American crude sulfate turpentine market is experiencing stable growth, driven by the expanding demand across industrial sectors such as adhesives, personal care, and rubber processing. Pure alpha-pinene holds major significance among its derivatives due to its critical role in synthesizing terpene resins, key adhesive ingredients, and sealants used in packaging, construction, and the automotive industry. These resins enhance product performance with improved tack, peel strength, and environmental resistance.

U.S. Crude Sulfate Turpentine Market Trends

In the U.S. crude sulfate turpentine market, with a growing demand for bio-based and sustainable alternatives to petrochemical inputs, CST-based products are increasingly integrated into green formulations. Applications in rubber compounding, home and personal care fragrances, and solvent systems also contribute to the market’s upward trajectory. As manufacturers seek renewable raw materials to meet environmental standards, the crude sulfate turpentine market is positioned for consistent expansion across diverse end-use industries.

Middle East & Africa Crude Sulfate Turpentine Market Trends

The Middle East & Africa crude sulfate turpentine market is witnessing rising demand driven by the expanding use of pure alpha-pinene in aroma chemicals, particularly in producing fragrance ingredients and menthol synthesis. With growing urbanization and consumer preference for enhanced sensory experiences in personal and home care products, alpha-pinene’s role as a natural, bio-based intermediate has gained significant momentum.

The regional rise in demand for green solvents, sustainable additives, and bio-based materials in adhesives, rubber processing, and cosmetic formulations supports these applications. The demand aligns with industrial trends toward low-toxicity, high-performance materials that support cleaner production practices across multiple sectors.

Latin America Crude Sulfate Turpentine Market Trends

The Latin American Crude Sulfate Turpentine market is steadily growing, driven by increasing demand for pure alpha-pinene, a key ingredient in aroma chemicals and perfumery. Alpha-pinene is extensively used to synthesize fragrances and flavoring agents, supporting the expanding personal and home care industry across the region.

The product compounds, like linalool and menthol, are widely found in air fresheners, cosmetics, and cleaning products. As consumers seek more bio-based and sustainable formulations, crude sulfate turpentine-derived aroma ingredients are gaining traction, fueling regional demand and promoting growth in natural ingredient supply chains.

Key Crude Sulfate Turpentine Company Insights

Some key players operating in the crude sulfate turpentine market include DSM-Firmenich and Kraton Corporation

-

dsm‑firmenich (formerly part of DSM and now merged with Firmenich), based in the Netherlands and Switzerland, is an emerging yet increasingly influential player in the Crude Sulfate Turpentine (CST) market. The company specializes in upcycled pine terpenes, including alpha-pinene, beta-pinene, and terpinolene—sourced from CST residues. These molecules are refined into high-value aroma ingredients like Pinene Alpha PERF™ and Terpinolene Pure, which are used to impart fresh, coniferous-citrus notes in premium perfumery, personal care, and home care products. With a strong focus on green chemistry, renewable-carbon sourcing, and fragrance innovation, dsm‑firmenich leverages CST-derived terpenes to meet rising consumer demand for sustainable, natural fragrance ingredients.

ORGKHIM Biochemical Holding and Pinova, Inc. is an emerging market participants in the crude sulfate turpentine market.

-

Pinova, Inc. is a specialized and emerging leader in the Crude Sulfate Turpentine (CST) market, leveraging its unique operations centered around CST-derived products. Headquartered in the southeastern U.S., Pinova processes pine stumps to extract high-value terpenes and resins, including refined limonene and rosin esters, serving industrial niches such as adhesives, food & beverage flavors, and personal care. The company has strategically invested in its Brunswick, Georgia, facility to meet FDA GMP standards, supporting growth in regulated sectors, while its renewable feedstock approach reinforces sustainability credentials. Backed by private equity investment, Pinova has amplified its technical service and innovation capabilities, focusing on specialty adhesive tackifiers, flavor/fragrance ingredients, and bio-based construction materials, positioning it as a fast-growing and agile player in pine-derived chemistry.

Key Crude Sulfate Turpentine Companies:

The following are the leading companies in the crude sulfate turpentine market. These companies collectively hold the largest market share and dictate industry trends.- dsm-firmenich

- Ingevity

- Kraton Corporation

- ORGKHIM Biochemical Holding

- Pine Chemical Group

- International Flavors & Fragrances, Inc. (IFF)

- Symrise

- WestRock Company

- Stora Enso

- Harting Technology Group

- Pinova, Inc.

- Weyerhaeuser Company

Recent Developments

-

In May 2023, Firmenich International SA ("Firmenich") is announcing the completion of its merger with DSM to establish DSM-Firmenich AG. The merger between DSM and Firmenich, now known as DSM‑Firmenich, strengthens the company's position as a global leader in aroma ingredients and specialty chemicals, driving further growth in the Crude Sulfate Turpentine market. By combining DSM's biotechnology and nutrition expertise with Firmenich's flavor and fragrance capabilities, the merged entity gains enhanced access to crude sulfate turpentine. These serve as essential building blocks for aroma chemicals used across perfumery, personal care, food flavors, and nutraceuticals.

-

In May 2025, Weyerhaeuser’s $375 million acquisition of 117,000 acres of high-quality timberlands in North Carolina and Virginia strengthens its Southern Timberlands portfolio, ensuring a steady, long-term supply of raw materials like pine, essential for Crude Sulfate Turpentine production. With 81% planted pine and robust harvest yields, the deal supports sustained crude sulfate turpentine feedstock availability, enhancing supply chain stability and growth in downstream markets such as adhesives, aroma chemicals, and resins.

Crude Sulfate Turpentine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 321.3 million

Revenue forecast in 2033

USD 449.2 million

Growth rate

CAGR of 4.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico, UK; Germany; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

dsm-firmenich; Ingevity; Kraton Corporation; ORGKHIM Biochemical Holding; Pine Chemical Group; International Flavors & Fragrances, Inc. (IFF); Symrise; WestRock Company; Stora Enso; Harting Technology Group; Pinova, Inc.; Weyerhaeuser Company

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Crude Sulfate Turpentine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global crude sulfate turpentine market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Carene

-

Terpineol

-

Camphor

-

Pinane Hydro peroxide

-

Pure alpha-pinene

-

Beta-Pinene

-

Terpene Resins

-

Limonene

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Additives

-

Adhesives

-

Solvents

-

Rubber Processing

-

Aroma Chemicals

-

Personal & Home Care Product

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global crude sulfate turpentine market size was estimated at USD 652.6 million in 2019 and is expected to reach USD 682.0 million in 2020.

b. The global crude sulfate turpentine market is expected to grow at a compound annual growth rate of 3.5% from 2019 to 2025 to reach USD 806.2 million by 2025.

b. North America dominated the crude sulfate turpentine market with a share of 59% in 2019. This is attributable to increasing application of the product in additives, adhesives, solvents, rubber processing, aroma chemicals, and personal & home care

b. Some key players operating in the crude sulfate turpentine market include Les Dérivés Résiniques et Terpéniques-DRT, Ingevity, Kraton Corporation, ORGKHIM Biochemical Holding, Pine Chemical Group, International Flavors & Fragrances, Inc. (IFF)

b. Key factors that are driving the market growth include increasing usage of CST derivatives such as alpha-pinene and beta-pinene as flavorings and fragrances in food & beverage and aroma chemical applications

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.