- Home

- »

- Next Generation Technologies

- »

-

Crowdfunding Market Size And Share, Industry Report, 2030GVR Report cover

![Crowdfunding Market Size, Share, & Trends Report]()

Crowdfunding Market (2025 - 2030) Size, Share, & Trends Analysis Report By Type(Equity-based Crowdfunding, Debt-based Crowdfunding), By Application (Food & Beverage, Technology, Media), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-006-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Crowdfunding Market Summary

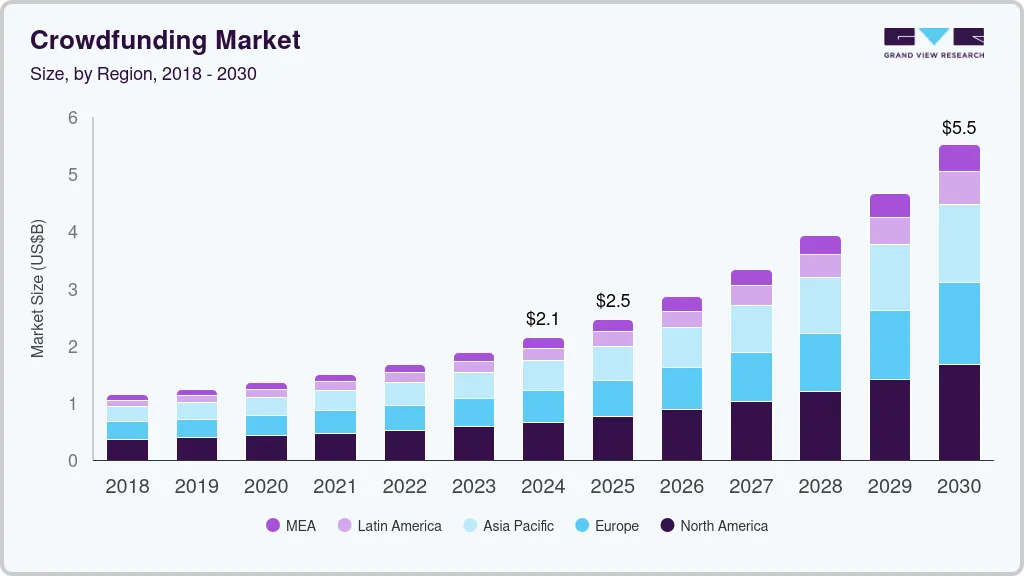

The global crowdfunding market size was estimated at USD 2.14 billion in 2024 and is projected to reach USD 5.53 billion by 2030, growing at a CAGR of 17.6% from 2025 to 2030. Rising crowdfunding activities on social media platforms to increase the demand and presence of upcoming projects is a significant factor driving the market growth.

Key Market Trends & Insights

- The North American region dominated the crowdfunding market in 2024 and accounted for a 30.92% share.

- The crowdfunding market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030.

- By Type, The debt-based crowdfunding segment dominated the market with a revenue share of 60.19% in 2024.

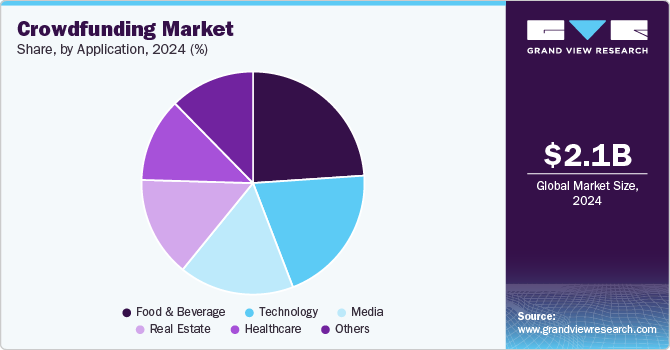

- By Application, The food & beverage segment dominated the market in 2024. The growth of the segment can be attributed to the rising number of food & beverage startup companies across the globe.

Market Size & Forecast

- 2024 Market Size: USD 2.14 Billion

- 2030 Projected Market Size: USD 5.53 Billion

- CAGR (2025-2030): 17.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Social media platforms such as Facebook, Twitter, Reddit, Instagram, and LinkedIn are gaining more popularity for crowdfunding activities to raise funds by collecting donations from investors. At the same time, rising technological innovations in crowdfunding platforms by using artificial intelligence (AI) and machine learning technologies are a major factor contributing to the growth of the market.

Numerous crowdfunding platform providers across the globe are focusing on expanding their presence to help startup companies raise funds from investors. In addition, government entities worldwide are also keen on supporting product launches related to crowdfunding platforms, thereby contributing to the growth of the market. For instance, in May 2021, Government officials in Dubai helped launch Dubai Next, a crowdfunding platform to support entrepreneurship in Dubai. The crowdfunding platform helped to support creative ideas and projects of Emiratis to start their own businesses in Dubai.

Crowdfunding campaigns also offer better exposure to upcoming projects, thereby driving the growth of the market. For instance, as per statistics cited by Zippia, 22.4% of all crowdfunding operations are successful campaigns. Successful crowdfunding campaigns raise an average of USD 28,656, whereas crowdfunding campaigns with personal videos raised 150% more than those campaigns done without videos. Crowdfunding campaigns with daily updates regularly raise 126% more than the campaigns with no updates.

The rising adoption of AI, Blockchain, and machine learning technologies by crowdfunding platforms to mitigate investors' concerns is contributing to the growth of the market. Crowdfunding platforms use AI tools to help people start online campaigns, predict the investor's behavior, create innovative content, detect fraud, show targeted ads, and verify the campaigner's identities. In addition, crowdfunding platforms have also started experimenting with AI-driven chatbots to assist the campaigners in fundraising deals and launch campaigns quickly. Such adoption of technologies is expected to create lucrative growth opportunities for the market players over the forecast period.

The gaming industry is also witnessing successful fundraising campaigns to raise funds through crowdfunding platforms. For instance, Kickstarter, in 2020, raised USD 23 million for video game projects from its own crowdfunding platform. However, a lack of legal framework for secure transactions on crowdfunding platforms may act as a restraint to market growth. Financial regulators across the globe are making efforts to make fundraisers aware of the innovative crowdfunding platforms, thereby contributing to the growth of the market.

Type Insights

The debt-based crowdfunding segment dominated the market with a revenue share of 60.19% in 2024. The rising demand for debt-based crowdfunding by startup companies to raise funds quickly as compared to traditional banks is a major factor driving the segment growth. Debt-based crowdfunding allows startup companies to access funds at a lower cost without navigating through the complicated procedures of conventional banking. Moreover, debt-based crowdfunding also provides investors with better interest rates for funding projects in regular monthly installments. Such factors are anticipated to drive the growth of the segment over the coming years.

The equity-based crowdfunding segment is anticipated to register the highest CAGR over the forecast period. The ability of equity-based crowdfunding to raise funds from individuals in return for the equity share from the company is a significant factor driving the segment growth. Equity-based crowdfunding offers numerous benefits to fundraisers, such as selling the shares to multiple investors, which may help to raise more cash, no repayment of loans or debt-based credit checks, and raising the firms in a single investment. Moreover, equity-based crowdfunding also offers benefits for investors, such as gaining part ownership, investing as per their needs, and allowing investors to choose the businesses they are more passionate about.

Application Insights

The food & beverage segment dominated the market in 2024. The growth of the segment can be attributed to the rising number of food & beverage startup companies across the globe. Food startups are expanding their business to increase their presence in the market. For instance, in November 2022, 8 Myles, a macaroni and cheesemaker, launched an equity crowdfunding campaign and raised money to expand its operation, purchase production equipment to increase capacity, and build brand awareness. Moreover, beverage brands such as Waku also launched a crowdfunding campaign to support their expansion plans.

The technology segment is anticipated to register significant growth over the forecast period. Innovative technologies such as AI, blockchain, and machine learning are becoming increasingly popular throughout the end-use industry. For instance, blockchain technology offers better security and transparency in a number of industries, including cybersecurity, healthcare, finance, and the internet of things. As the demand for these innovative technologies is increasing in various applications, fundraising campaigns for technological companies are also expected to increase, thereby contributing to the growth of the segment.

Regional Insights

The North American region dominated the crowdfunding market in 2024 and accounted for a 30.92% share. The presence of prominent players such as Kickstarter, Indiegogo, Patreon, and Seed&Spark provides a high potential for crowdfunding activities in the North American region. As per statistics from Demandsage, a software company, North America has the highest number of unicorn startups. For instance, the U.S. has 72,560 startups, and Canada has 3,446. As a result, with more startup companies, there would be a huge opportunity for crowdfunding activities, thereby contributing to regional growth.

U.S. Crowdfunding Market Trends

The crowdfunding market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. The market is supported by diverse crowdfunding models, including reward-based, equity-based, donation-based, and debt-based crowdfunding, catering to various needs such as startup financing, creative projects, and social causes. Platforms like Kickstarter, GoFundMe, and Indiegogo dominate the landscape, enabling individuals and businesses to access capital efficiently.

Europe Crowdfunding Market Trends

Europe crowdfunding market is expected to register a moderate CAGR from 2025 to 2030. driven by the region's increasing adoption of alternative financing models and a strong emphasis on supporting innovation and sustainability. Various crowdfunding platforms, including equity-based, reward-based, and donation-based models, are gaining traction across countries like the UK, and Germany.

The UK crowdfunding market held a substantial market share in 2024. The UK crowdfunding market is one of the most developed in Europe, benefiting from a robust regulatory framework and a strong culture of entrepreneurship.

The Germany crowdfunding market is expected to grow rapidly in the coming years. The growth of the German crowdfunding market is fueled by the rising trend of businesses leveraging crowdfunding for renewable energy and sustainability projects, aligning with the country’s environmental goals.

Asia Pacific Crowdfunding Market Trends

Asia Pacific crowdfunding industry is expected to emerge as the fastest-growing regional market over the forecast period. The regional growth can be attributed to the rising internet penetration, which provides better accessibility to crowdfunding platforms. Moreover, favorable economic conditions and increasing digitization create more growth opportunities for online crowdfunding platforms, which, in turn, is boosting the Asia Pacific market growth. In addition, the presence of numerous crowdfunding platforms in this region, such as Wujudkan.com, ArtisteConnect.com, pitchIN.my, and ToGather.Asia creates more growth opportunities for regional market growth.

The China crowdfunding industry held a substantial market share in 2024. The crowdfunding market in China has seen rapid growth in recent years, driven by a strong entrepreneurial culture, widespread digital adoption, and a supportive regulatory environment. As one of the largest and most dynamic markets in Asia, China has seen a surge in crowdfunding platforms, particularly in areas such as technology, gaming, and creative industries.

The Japan crowdfunding market held a notable share in 2024, driven by the growing interest in alternative financing methods and a strong startup ecosystem. As global trends in innovation and entrepreneurship gain momentum in Japan, there is an increasing demand for crowdfunding platforms that offer unique opportunities for individuals and businesses to fund creative, technological, and social impact projects.

Key Crowdfunding Company Insights

Some of the key companies in the crowdfunding industry include Kickstarter, PBC, Indiegogo, Inc., GoFundMe, and others. These companies are leveraging advanced technologies like AI, machine learning, and data analytics to optimize platform operations, enhance user experience, and improve fundraising success rates. To stay competitive, key players are adopting various strategic initiatives such as expanding their platform offerings, forming partnerships, and pursuing mergers and acquisitions to strengthen their market positions.

-

Kickstarter, PBC is one of the leading players in the crowdfunding industry, known for its innovative approach to supporting creative projects, including art, technology, and design. By providing a platform that connects creators with potential backers, Kickstarter has become a key player in enabling entrepreneurs to fund their ideas and bring them to life. Through its extensive user base and global reach, Kickstarter continues to shape the crowdfunding landscape and foster a culture of creativity and innovation.

-

Indiegogo, Inc. is another major player in the crowdfunding market, offering a wide range of crowdfunding options for both personal and business ventures. Known for its flexibility, Indiegogo allows entrepreneurs to raise funds for a variety of causes, from tech innovations to social impact projects. The platform’s integration of cutting-edge technologies and its focus on global expansion have made it a leading crowdfunding destination, particularly in the startup and small business sectors.

Key Crowdfunding Companies:

The following are the leading companies in the crowdfunding market. These companies collectively hold the largest market share and dictate industry trends.

- Kickstarter, PBC

- Indiegogo, Inc.

- GoFundMe

- Fundable

- Crowdcube

- SeedInvest Technology, LLC

- Fundly

- RealCrowd

- RM Technologies LLC.

- Wefunder

Recent Developments

-

In November 2024, Bricksave has acquired Alte, establishing itself as one of the largest global platform for real estate crowdfunding. This acquisition strengthens Bricksave's mission to make real estate investment more accessible and offers investors enhanced opportunities to diversify their portfolios. COO Sofia Gancedo highlighted the milestone as a pivotal step in expanding the platform's reach and improving the user experience by enabling access to new markets. The acquisition aligns with Bricksave's commitment to democratizing real estate investment through accessible, transparent, and profitable solutions.

-

In August 2024, Meteora Developers, a UAE-based real estate developer, has acquired the Emirati property crowdfunding platform Maisour in a multimillion-dollar deal. Founded in 2022, Meteora has a diverse portfolio of projects across the UAE, while Maisour, established in 2021, enables global investors to access the UAE property market through fractional ownership. This acquisition will integrate Maisour's platform with Meteora’s real estate offerings, enhancing opportunities for current and future investors. The deal underscores Meteora's commitment to innovation and expanding accessibility in the UAE’s property market.

Crowdfunding Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.46 billion

Revenue forecast in 2030

USD 5.53 billion

Growth rate

CAGR of 17.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; Spain; China; Japan; India; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Kickstarter, PBC; Indiegogo, Inc.; GoFundMe; Fundable; Crowdcube; SeedInvest Technology, LLC; Fundly; RealCrowd; RM Technologies LLC; Wefunder

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Crowdfunding Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the crowdfunding market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030 )

-

Equity-based Crowdfunding

-

Debt-based Crowdfunding

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030 )

-

Food & Beverage

-

Technology

-

Media

-

Real Estate

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global crowdfunding market size was estimated at USD 2.14 billion in 2024 and is expected to reach USD 2.46 billion in 2025.

b. The global crowdfunding market is expected to grow at a compound annual growth rate of 17.6% from 2025 to 2030 to reach USD 5.53 billion by 2030.

b. North America dominated the crowdfunding market with a share of 30.92% in 2024. The presence of prominent players such as Kickstarter, Indiegogo, Patreon, and Seed&Spark provides a high potential for crowdfunding activities in the North American region.

b. Some key players operating in the crowdfunding market include Kickstarter, PBC; Indiegogo, Inc.; GoFundMe; Fundable; Crowdcube; SeedInvest Technology, LLC; Fundly; RealCrowd; RM Technologies LLC; Wefunder.

b. Key factors that are driving the market growth include rising usage of social media platforms for fundraising and technology innovation in crowdfunding platforms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.