Cresol Market Size & Trends

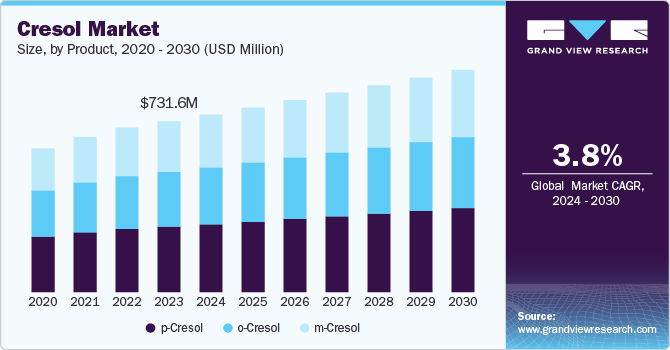

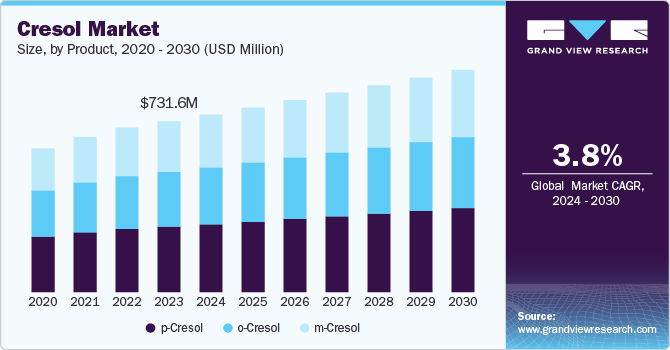

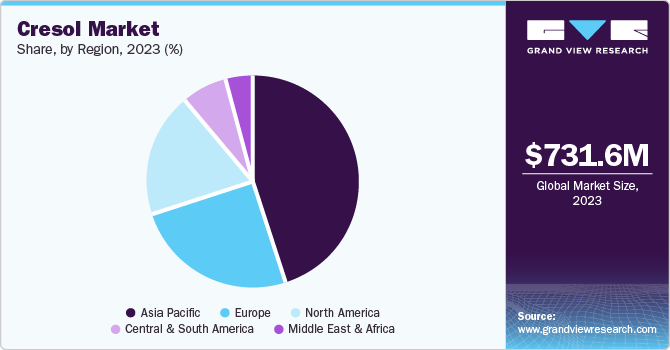

The global cresol market size was valued at USD 731.6 million in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030. The market revenue growth is driven by a growing demand for chemicals in different industries such as pharmaceuticals, flavors & fragrances, and resins. In addition, increased usage of cresol for producing solvents, resins, insecticides, and other related products, are key drivers of market revenue expansion. Furthermore, industries, such as textile, rubber, and pharmaceutical, commonly use cresol as a solvent. It acts as both a detergent and a dissolvent for different substances. The increasing need for cresol in the pharmaceutical industry to produce salicylic acid medications like antiseptics, anesthetics, and disinfectants is driving the market growth.

An important driver of the market is the increasing use of products in the making of pesticides and disinfectants to protect crops against insects and pests, as well as enhancing overall cleanliness and hygiene. Moreover, the positive market outlook is driven by the rapid expansion of industries like chemicals, agrochemicals, and pharmaceuticals. Moreover, cresol, known as hydroxytoluene, refers to a group of aromatic organic compounds categorized as phenols which can be found naturally or synthesized. Cresol, which has meta, para, and ortho isomers, is employed as a disinfectant and antiseptic and has excellent antioxidant properties. Moreover, cresol is utilized as a preservative in the food and beverage industry to prevent the proliferation of bacteria and fungi. Additionally, it acts as a preservative within the cosmetics industry.

The paint and coatings industry are also a major user of cresol. It is utilized in creating specific coatings and paints to improve their performance and durability. Cresol plays a part in creating long-lasting coatings of excellent quality that may withstand environmental elements like UV light and moisture. It helps create varnishes and protective coatings used in a wide range of industries such as automotive and industrial coatings.

Product Insights

p-cresol dominated the market in 2023. p-cresol is the most commonly utilized form of cresol, mainly used in the production of pharmaceuticals and agricultural chemicals, and as a solvent in different chemical processes. It is highly used for its function as a key player in the creation of insecticides and herbicides, as well as in the development of disinfectants and antiseptics. The essential role of p-cresol in the agrochemical sector and the increasing demand for advanced healthcare products are driving the need for it.

m-Cresol is projected to grow at the fastest CAGR over the forecast period. It acts as a precursor in the production of antioxidants, essential for maintaining the stability of rubber and plastic items. Meta-cresol is also used to manufacture dyes and as a solvent in specific chemical processes. The increasing need for meta-cresol is affected by the growth of the automotive and consumer goods industries, where its importance in improving material durability is greatly appreciated. Moreover, a major catalyst is its use in creating important compounds such as Butylated hydroxytoluene (BHT), an antioxidant commonly utilized in food and skincare products. Furthermore, the growing pharmaceutical industry depends heavily on m-Cresol to produce vital drugs and intermediates, playing a key role in its market growth.

o-Cresol finds significance as a building block to produce herbicides, sealing material for electronics, and precursor for dye intermediates. Major derivatives obtained by chlorination of ortho-cresol are used in plant protection agents. o-Cresol derivatives form a significant component in pesticides. Growing concerns regarding crop protection in major agricultural sectors such as cereals and vegetables are anticipated to drive product demand.

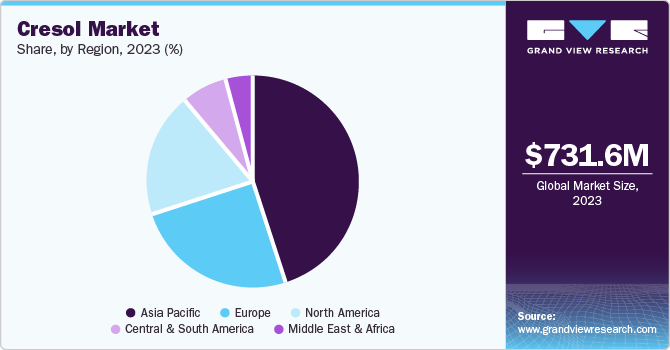

Regional Insights

North America's cresol market is anticipated to witness significant growth in the coming years. The region's growth can be mostly attributed to the high demand for cresol in different products, including chemical disinfectants, intermediates, and preservatives. Additionally, the increasing production of herbicides, resins, and pesticides with cresol is expected to drive market revenue growth in this region.

U.S. Cresol Market Trends

The U.S. cresol market dominated North America cresol market in 2023. The region's strong aerospace and defense industries use cresol derivatives for a variety of purposes, such as composites and advanced materials. Furthermore, the increasing emphasis on renewable energy and energy efficiency has resulted in a higher need for insulation materials containing cresol.

Asia Pacific Cresol Market Trends

Asia Pacific cresol market dominated the market in 2023 on account of growing product demand in the agrochemicals, vitamin E, and electronics sectors in the region. The region's rapid growth is also attributed to its large consumer population and increasing need for personal care products.

The India cresol market held a substantial market share in 2023 driven by the increasing pharmaceutical, agrochemical, automotive sectors, which rely on cresol-based processes. The increasing focus on infrastructure development in the country drives the need for epoxy resins derived from cresol, while the cosmetic industry's use of cresol-based preservatives, thereby enhancing market opportunities.

The China cresol market is expected to grow rapidly in the coming years due to the country's role as a major global center for producing pharmaceuticals, chemicals, and agrochemicals.

Europe Cresol Market Trends

Europe's cresol market was identified as a lucrative region in 2023. This is attributed to the growing need for Cresol in various industries such as pharmaceutical, chemical, and personal care. Additionally, the increasing need for cresol in the construction and automotive sectors in the region is driving market growth.

The U.K. cresol market is expected to grow rapidly in the coming years driven by the emphasis on protecting the environment which has led to the advancement of cresol-derived water treatment substances, fueling market expansion.

Key Cresol Company Insights

Some of the key companies in the cresol market include KANTO KAGAKU TCI AMERICA, Dorf Ketal and other companies. To obtain a competitive advantage in the market, businesses are concentrating on growing their customer base.

-

KANTO KAGAKU offers a wide range of products derived from cresol, including individual cresol isomers and mixtures, as well as various cresol derivatives like cresol sulfonic acids, cresol ethers, and cresol formaldehyde resins.

Key Cresol Companies:

The following are the leading companies in the cresol market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- KANTO KAGAKU

- Mitsui Chemicals, Inc.

- Dorf Ketal

- LANXESS

- Vigon International, LLC.

- TCI AMERICA

- RICCA Chemical Company

- nacalai.com

Cresol Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 760.1 million

|

|

Revenue forecast in 2030

|

USD 952.1 million

|

|

Growth rate

|

CAGR of 3.8% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central & South America; MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, UAE, Oman, Kuwait and Qatar

|

|

Key companies profiled

|

Merck KGaA; KANTO KAGAKU; Mitsui Chemicals, Inc.; Dorf Ketal; LANXESS; Vigon International, LLC;TCI AMERICA;RICCA Chemical Company; and nacalai.com;

|

|

Customization scope

|

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

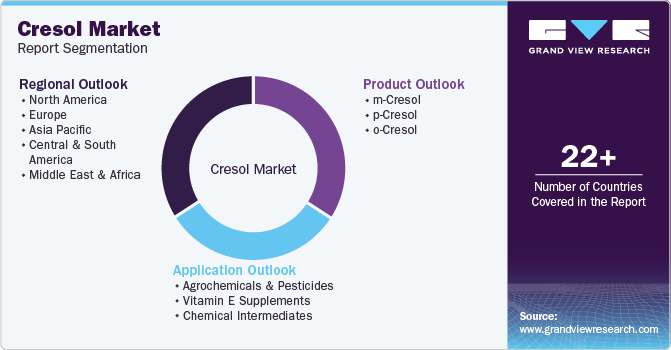

Global Cresol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cresol market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, Kilo Tons,2018 - 2030)

-

m-Cresol

-

p-Cresol

-

o-Cresol

-

Application Outlook (Revenue, USD Million, Kilo Tons, 2018 - 2030)

-

m-Cresol

-

p-Cresol

-

o-Cresol

-

Regional Outlook (Revenue, USD Million, Kilo Tons,2018 - 2030)