- Home

- »

- Medical Devices

- »

-

COVID-19 Clinical Trials Market Size, Industry Report, 2030GVR Report cover

![COVID-19 Clinical Trials Market Size, Share & Trends Report]()

COVID-19 Clinical Trials Market (2024 - 2030) Size, Share & Trends Analysis Report By Phase (Phase I, Phase II, Phase III, Phase IV), By Product (Therapeutics, Drugs), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-907-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

COVID-19 Clinical Trials Market Summary

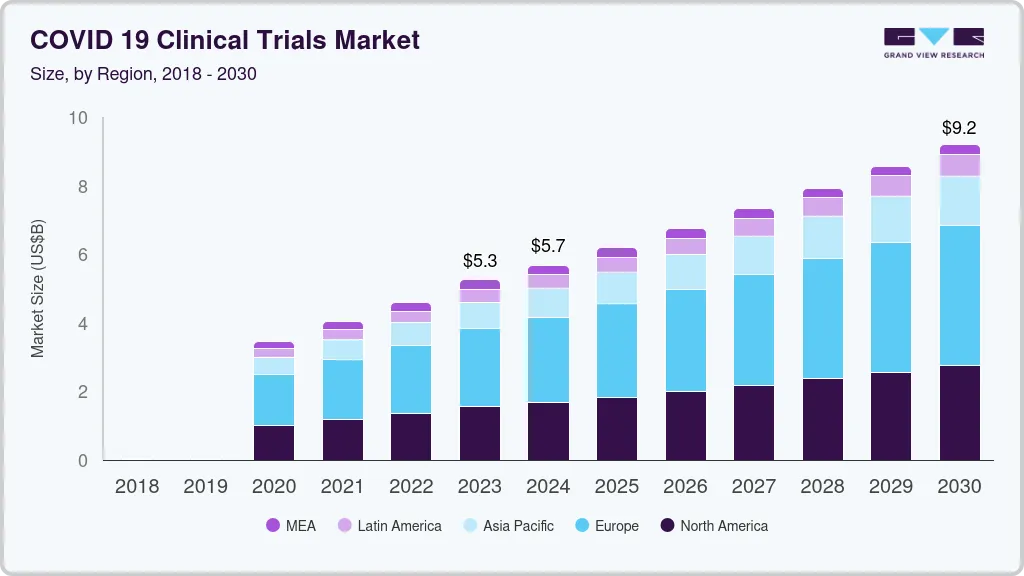

The global COVID-19 clinical trials market size is valued at 5.26 billion in 2023 and is projected to reach USD 9.21 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.3% from 2024 to 2030. The market is majorly driven by the rapid spread of coronavirus leading to a staggering number of deaths globally thus putting pressure on healthcare organizations to provide therapeutics/vaccines.

Key Market Trends & Insights

- Europe is the largest contributor to the global market accounting for almost 46.8% of the revenue share in 2020.

- Based on phase, the Phase II segment accounted for the largest market share of 30.3% in 2020.

- Based on product, the vaccines segment held the largest market share of over 75% as of 2020.

Market Size & Forecast

- 2023 Market Size: USD 5.26 Billion

- 2030 Projected Market Size: USD 9.21 Billion

- CAGR (2024-2030): 8.3%

- Europe: Largest market in 2020

The increasing research activities on a global scale are also creating demand for COVID-19 clinical trials, boosting the market growth. Factors such as globalization of clinical trials, demand for CROs to conduct clinical trials, and technological evolution, are further anticipated to drive growth. As per the World Health Organization (WHO), till June 24th, 2020, the virus had infected around 9.1 million people globally and had claimed more than 0.47 million lives with 80% cases in the U.S. and Europe overtaking China where the pandemic first began in December 2019. The U.S., Brazil, Russia, India, and the U.K. are the five most affected countries by the pandemic.

The WHO declared this disease as a pandemic due to the widespread scale of the outbreak and also warned that the worst of this is yet to come. Also, the United Nations stated that it is the worst global crisis since World War II. The current pandemic poses a severe health risk to the entire population. A key to successfully battling COVID-19 lies in clinical research. At present, almost all the major research-based pharmaceutical firms, numerous other biotechnology and biopharmaceutical companies, as well as research institutes are engaged in a race to develop an effective treatment against COVID-19. Hence, the regulators in the U.S. and Europe also offer various options for action and procedural facilitation to enable faster access to effective vaccines and drugs to combat the pandemic. For instance, in April 2020, the National Institute of Health together with the Foundation for the NIH (FNIH) launched a public-private partnership (ACTIV) to accelerate treatment and vaccine options for coronavirus.

The rapidly evolving threat owing to the outbreak of COVID-19 is impacting lives, communities, businesses, and industries around the world. With businesses shuttered, flights grounded, and participants scared to leave their homes, running clinical trials has become extremely difficult. Hence, the regulatory agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), the National Institutes of Health (NIH), China’s National Medical Products Administration, along with several other countries have issued guidelines for conducting trials during the outbreak of coronavirus, and are in complete support of incorporating virtual services.

In March 2020, the WHO launched “Solidarity”, international clinical trials, to provide effective treatment against the coronavirus. It consists of comparing four treatment options with the standard of care to assess their effectiveness against the virus. In May, WHO also announced an international alliance for instantaneously developing several candidate vaccines to prevent the disease spread, calling this effort the Solidarity trial for vaccines.

Phase Insights

The Phase II segment accounted for the largest market share in 2020, it contributed to 30.3% of the global COVID-19 clinical trials market in 2020. This is attributed to the fact that the maximum number of therapeutics and vaccines in development are in Phase II. Out of 184 products in development, around 59% of products are currently in Phase II.

Companies involved in the development of therapeutics and vaccines are AstraZeneca plc; Applied Therapeutics Inc.; Celgene Corp.; Novartis AG; and Viriom Inc. to name a few. Companies are collaborating with other firms to accelerate the development of therapeutics and vaccines. For instance, Abbvie partnered with global authorities to determine the efficiency of HIV drugs in treating COVID-19. It is supporting basic research and clinical studies, working with European health authorities and the U.S. FDA, Centers for Disease Control and Prevention (CDC), the Biomedical Advanced Research and Development Authority, and the National Institute of Health to coordinate these efforts.

Product Insights

The vaccines segment held the largest market share of over 75% as of 2020. This is mainly due to the huge investments in the development of vaccines. As of July 2020, a total of 157 vaccines are in development. Around 95% of vaccines in development are new for COVID-19, and 5% are both repurposed and redirected. Supportive government efforts are also boosting the market growth. For instance, the NIH launched the clinical trial network “COVID-19 Prevention Trials Network (COVPN)” in July to test the vaccines for COVID-19.

The therapeutic segment is projected to witness the fastest CAGR of 10.0% over the forecast period. The growth is attributed to a large number of therapeutics are in development as compared to vaccines. Approximately 160 therapeutic agents including antivirals are under clinical investigation for treating COVID-19. The majority of these are repurposed drugs with fewer than 20 novel or near-novel antivirals currently in human trials. Although the race is toward the rapid development of a vaccine, the long term goal would be to focus on therapeutics, reflecting on the higher CAGR.

Regional Insights

Europe is the largest contributor to the global market accounting for almost 46.8% of the revenue share in 2020. This is attributed to the large number of clinical trials initiated within the region. Also, the launch of various clinical trial platforms by the U.K. government such as “Accelerating Covid-19 Research and Development Platform” (ACCORD) and AGILE to speedup drug development is supporting the market growth.

North America follows Europe with the second largest market share. Many U.S.-based CROs are supporting the fast track execution of COVID-19 clinical trials by providing various platforms for research purposes. For instance, in April 2020, IQVIA joined the ACCORD-2 collaboration that will accelerate the development of novel treatments for coronavirus. The company is expected to offer a research platform across the U.K. to enable numerous clinical trials regardless of sponsors.

Besides, the support of the U.S. government is boosting the market for COVID-19 clinical trials. For instance, in March 2020, the National Institute of Health together with Foundation for the NIH (FNIH) launched a public-private partnership to accelerate treatment & vaccine options for Coronavirus. The planned partnership “Accelerating COVID-19 Therapeutic Interventions & Vaccines (ACTIV)” aims to develop a collaborative framework for prioritizing drug and vaccine candidates, coordinating regulatory processes, streamlining clinical trials, and leveraging assets among all partners to quickly respond to the current and future pandemics.

Asia Pacific is anticipated to witness lucrative growth over the forecast period. This is due to the increasing COVID-19 cases in the region and efforts to combat the disease. According to the WHO, India is among the top countries with the highest number of COVID-19 cases. On June 25th, 2020, the number of people infected with coronavirus reached 4, 73,105 taking over 14, 894 deaths. Efforts are being taken by the government to accelerate the development of effective products against coronavirus.

For instance, the South Korean Ministry of Food and Drug Safety (MFDS) has stated the “Go-expedite” program, to speed up a review process for the coronavirus treatment and vaccine with particular timelines. Besides, The Drug Controller General of India has also offered various measures for accelerating the process from giving accelerate approval for the repurposed drug to waiving animal study and providing flexible pathways that previously would have taken months.

Key Companies and Market Share Insights

Some of the players operating in the market are Moderna, Inc.; GlaxoSmithKline plc; Pfizer Inc.; Johnson & Johnson; and Gilead Sciences Inc. Noteworthy factors affecting the competitive nature are the rapid adoption of advanced technology for improved healthcare. The key players are often involved in collaborations and partnerships to accelerate the production of vaccines and drugs against coronavirus. For instance, Johnson & Johnson partnered with Rega Institute for Medical Research, University of Leuven (Belgium) to work on identifying novel or existing compounds with antiviral activity against the coronavirus. There are significant international efforts ongoing to diagnose, treat, and prevent infections from the coronavirus. Sanofi & GSK collaborated to combine innovative technologies to produce an adjuvanted COVID-19 vaccine. In February 2020, Sanofi announced a collaboration with Biomedical Advanced Research & Development Authority (BARDA), a part of the U.S. Department of Health and Human Services to advance a novel vaccine candidate. Some of the prominent players in the COVID-19 clinical trials market include:

-

INOVIO Pharmaceuticals

-

AbbVie Inc.

-

BioNTech SE

-

Novavax

-

Takeda

COVID-19 Clinical Trials Market Report Scope

Report Attribute

Details

Market Size value in 2024

USD 5.68 billion

Revenue forecast in 2030

USD 9.21 billion

Growth Rate

CAGR of 8.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phase, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

The U.S.; Canada; The U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Mexico; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Key companies profiled

Moderna, Inc.; GlaxoSmithKline plc; Pfizer Inc.; Johnson & Johnson; Gilead Sciences Inc.

customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global COVID-19 clinical trials market report on the basis of phase, product, and region:

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutics

-

Vaccines

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

The Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global COVID-19 clinical trials market size was estimated at USD 3.5 million in 2019 and is expected to reach USD 5.0 billion in 2020.

b. The global COVID-19 clinical trials market is expected to grow at a compound annual growth rate of 9.5% from 2021 to 2027 to reach USD 9.9 billion by 2027.

b. Europe dominated the COVID-19 clinical trials market with a share of 46.8% in 2019. This is attributable to This is attributed to the large number of clinical trials initiated within the region.

b. Some key players operating in the COVID-19 clinical trials market include Moderna, Inc.; GlaxoSmithKline plc; Pfizer Inc.; Johnson & Johnson; and Gilead Sciences Inc.

b. Key factors that are driving the market growth include the rapid spread of coronavirus leading to a staggering number of deaths globally thus putting pressure on healthcare organizations to provide therapeutics/ vaccines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.