- Home

- »

- Advanced Interior Materials

- »

-

Cordless Power Tools Market Size, Industry Report, 2033GVR Report cover

![Cordless Power Tools Market Size, Share & Trends Report]()

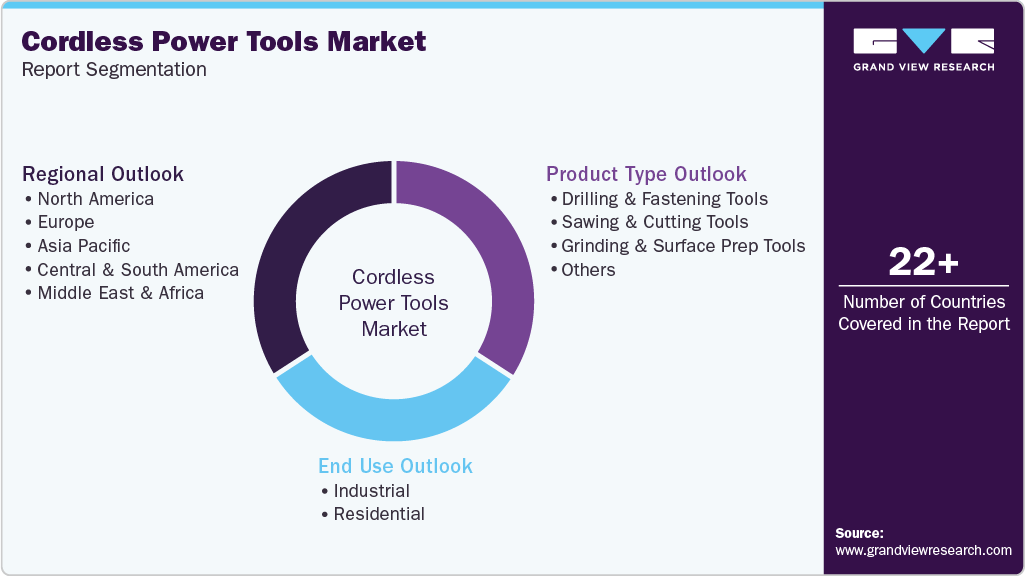

Cordless Power Tools Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Drilling & Fastening Tools, Sawing & Cutting Tools, Grinding & Surface Prep Tools), By End Use (Industrial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-783-6

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cordless Power Tools Market Summary

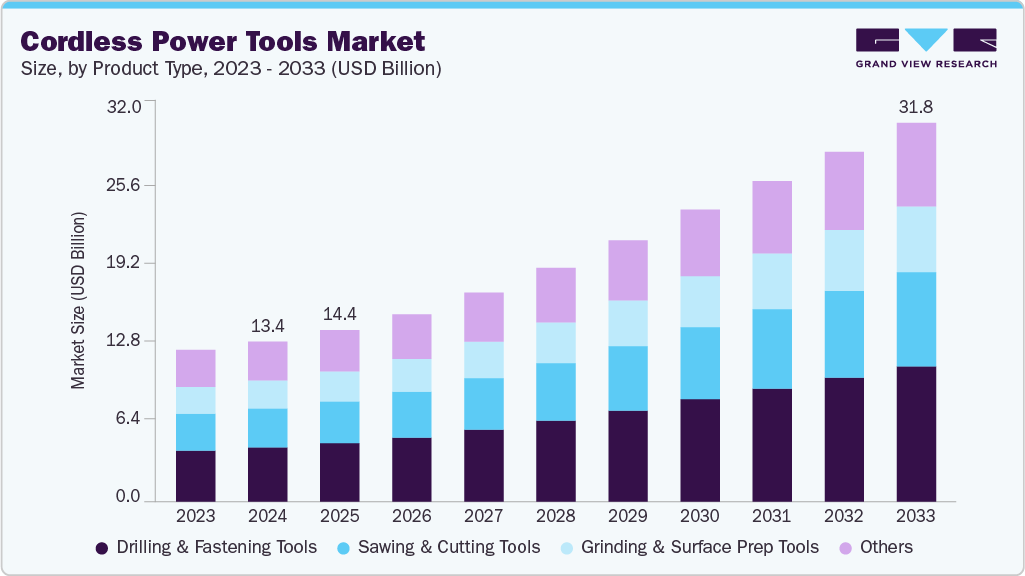

The global cordless power tools market size was estimated at USD 13.44 billion in 2024 and is projected to reach USD 31.82 billion by 2033, growing at a CAGR of 10.4% from 2025 to 2033. The demand for cordless power tools is rapidly increasing due to the growing emphasis on operational flexibility, portability, and ease of use across construction, automotive, and manufacturing sectors.

Key Market Trends & Insights

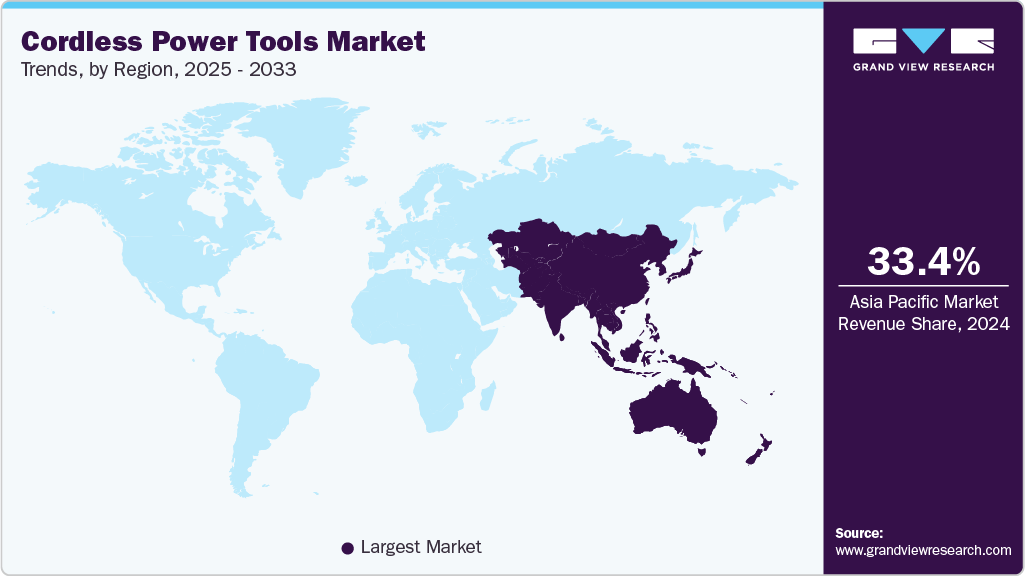

- Asia Pacific dominated the cordless power tools market with the largest revenue share of 33.4% in 2024.

- By product type, the drilling & fastening tools segment is expected to grow at the fastest CAGR of 11.1% from 2025 to 2033.

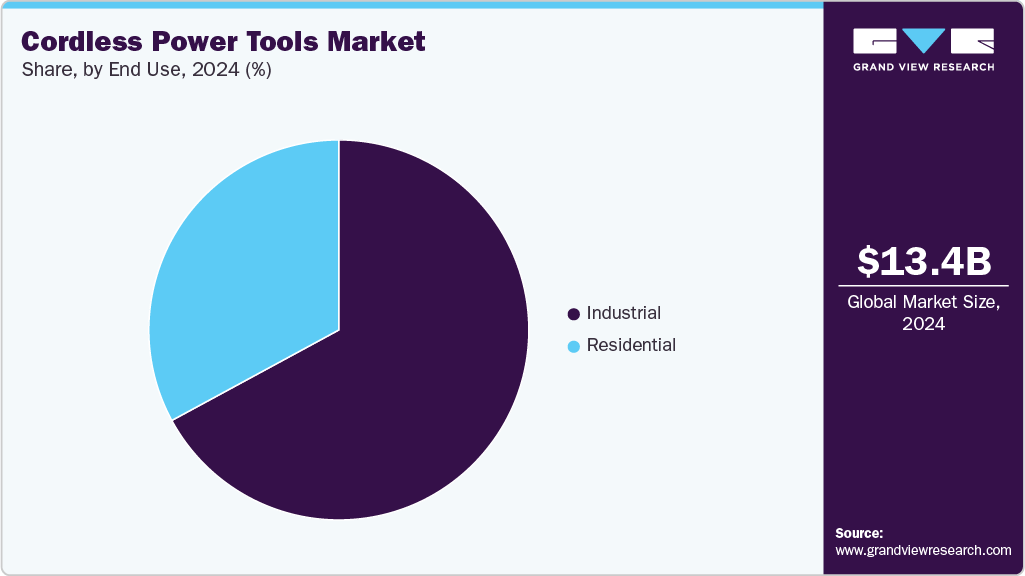

- By end use, the industrial segment is expected to grow at the fastest CAGR of 10.7% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 13.44 Billion

- 2033 Projected Market Size: USD 31.82 Billion

- CAGR (2025-2033): 10.4%

- Asia Pacific: Largest market in 2024

The shift from corded to battery-operated tools is accelerated by advancements in lithium-ion batteries, which provide longer runtimes and faster charging. Additionally, the surge in home improvement and DIY projects, particularly in developed economies, is fueling consumer-level adoption. The professional trades segment is also witnessing higher demand as cordless tools reduce downtime and enhance mobility on-site. The increasing need for efficient maintenance and repair activities across industries further strengthens market growth globally.Technological advancements in battery chemistry, such as lithium-ion and solid-state batteries, are key growth drivers for the cordless power tools industry. Manufacturers are focusing on improving energy density, durability, and power output to match the performance of corded tools. The rise of smart, connected power tools with IoT integration and digital monitoring features is enhancing productivity and precision. Rapid industrialization and urbanization in emerging economies are increasing construction and infrastructure activities, boosting tool consumption. Additionally, labor shortages in the construction sector are driving automation and the adoption of high-efficiency tools that minimize physical strain and time.

The market is witnessing continuous innovations, particularly in battery management systems, brushless motor technology, and tool connectivity. Major players are launching smart cordless tools integrated with Bluetooth and app-based performance monitoring. Modular battery systems compatible across multiple tools are emerging as a key trend, improving cost-effectiveness for professionals. Lightweight and ergonomic designs are gaining popularity to reduce user fatigue. Sustainable manufacturing practices and recyclable battery technologies are being prioritized by top brands. Furthermore, the integration of AI and sensors for predictive maintenance is redefining tool reliability and user safety.

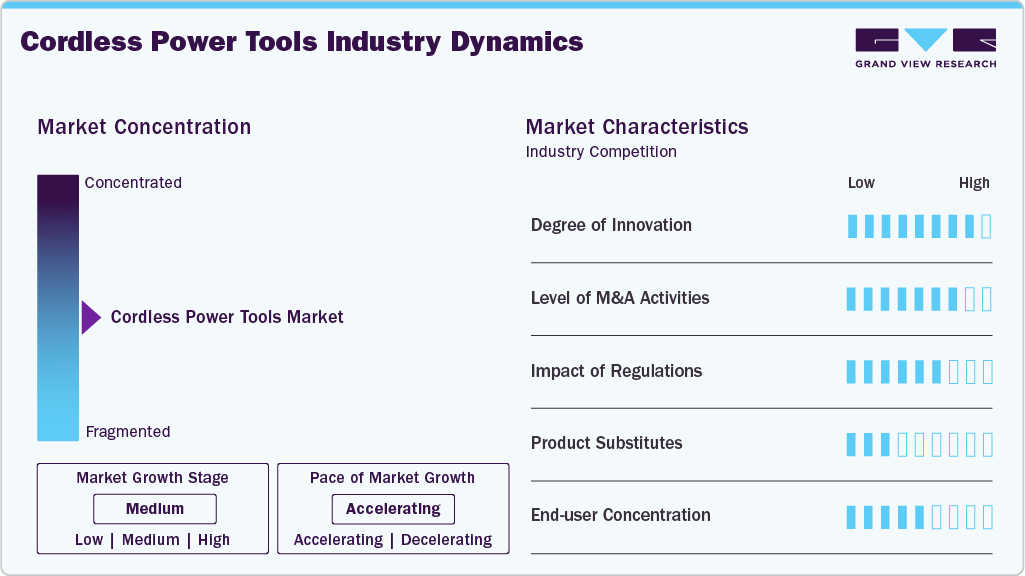

Market Concentration & Characteristics

The cordless power tools market is moderately consolidated, with leading players such as Stanley Black & Decker, Bosch, Makita, and Hilti commanding significant global shares. These companies dominate due to extensive product portfolios, strong distribution networks, and continuous R&D investment. However, emerging Asian manufacturers are expanding rapidly by offering affordable and durable alternatives. The market sees moderate entry barriers due to high capital and technological requirements, though niche segments like gardening and DIY tools attract smaller firms. Strategic partnerships, acquisitions, and product innovations are reshaping competition dynamics.

The threat of substitutes is relatively low as cordless tools provide unmatched mobility and convenience compared to corded alternatives. Pneumatic and hydraulic tools serve as substitutes in specific industrial applications but are less preferred due to limited flexibility and maintenance challenges. However, the high cost of advanced cordless systems can push budget-conscious consumers toward traditional wired tools. With battery prices declining and performance improving, cordless variants are increasingly replacing older technologies across industries, further minimizing substitute threats.

Product Type Insights

The drilling & fastening tools segment of the cordless power tools market held the highest revenue share of 33.8% in 2024, due to their widespread use across construction, manufacturing, and assembly operations. These tools are essential for applications such as fastening bolts, screws, and rivets, as well as drilling holes in various materials like wood, metal, and concrete. Their versatility, combined with compact design and improved torque control, makes them indispensable for both professionals and DIY users. Continuous advancements in brushless motor technology and ergonomic design have enhanced tool performance, driving sustained demand across industrial and commercial sectors.

The sawing & cutting tools segment is expected to grow at a significant CAGR of 10.6% over the forecast period, fueled by increasing use in woodworking, metal fabrication, and renovation projects. The development of high-efficiency cordless circular saws, reciprocating saws, and jigsaws with extended battery life and advanced safety features is transforming user experience. Rising construction and interior remodeling activities, coupled with growing preference for lightweight and portable equipment, are further accelerating adoption. The integration of smart sensors for precise cutting and reduced material wastage is also a key trend boosting demand in this segment.

End Use Insights

The industrial segment led the cordless power tools industry with the highest revenue share of 67.1% in 2024, driven by extensive usage across construction, automotive, aerospace, and manufacturing industries. Industrial professionals rely on these tools for their reliability, durability, and high power output in demanding environments. The shift toward automation and smart manufacturing has further increased the adoption of cordless solutions for faster assembly and maintenance operations. Additionally, the growing focus on worker efficiency and reduced downtime has made cordless tools an integral part of industrial equipment portfolios globally.

The residential segment is expected to grow at a significant CAGR of 9.7% over the forecast period, supported by the rising popularity of DIY culture and home improvement activities. Consumers are increasingly investing in cordless drills, screwdrivers, and saws for household repairs, furniture assembly, and renovation tasks. E-commerce platforms and retail chains are making these tools more accessible, while product innovations like quick-charging batteries and lightweight designs enhance convenience. As disposable incomes rise and awareness of tool versatility spreads, residential adoption of cordless power tools is set to expand rapidly, particularly in urban markets.

Regional Insights

Asia Pacific dominated the global cordless power tools market with the largest revenue share of 33.4% in 2024, driven by massive infrastructure development, rapid urbanization, and robust growth in construction and automotive manufacturing. Countries such as China, Japan, India, and South Korea are investing heavily in smart manufacturing and housing projects, which boost tool consumption. The expansion of small and medium enterprises (SMEs) and a growing DIY culture in urban areas further accelerate market growth. Government initiatives promoting industrialization and domestic manufacturing are strengthening local production capacity. Moreover, the availability of low-cost labor and raw materials supports competitive pricing and global export potential. With increasing adoption of advanced lithium-ion tools, Asia Pacific is set to maintain its dominant position through 2032.

China Cordless Power Tools Market Trends

The China cordless power tools market represents the largest market for cordless power tools in Asia Pacific, due to its extensive manufacturing ecosystem, cost-efficient production, and export-oriented strategies. The nation’s growing construction and renewable energy projects drive demand for versatile tools used in assembly, maintenance, and installation. Government support for infrastructure expansion, coupled with initiatives such as “Made in China 2025,” is encouraging the production of technologically advanced cordless tools. Major domestic players are innovating with lithium-ion batteries and lightweight, high-performance tools to meet rising industrial standards. The increasing presence of e-commerce platforms also enhances tool accessibility across consumer and professional segments.

North America Cordless Power Tools Market Trends

North America remains a mature yet growing market for cordless power tools, driven by strong demand from the construction, automotive, and residential renovation sectors. The U.S. and Canada are witnessing significant investments in smart manufacturing and advanced repair technologies, promoting cordless tool adoption. The DIY culture and preference for convenient, portable equipment among consumers further contribute to market expansion. Growing usage of brushless motor technology and connected, app-based tool monitoring systems are transforming user efficiency. Manufacturers are also focusing on sustainability, offering recyclable batteries and energy-efficient designs that align with regulatory standards.

The U.S. dominates North America cordless power tools landscape with consistent innovation and high adoption rates across both consumer and industrial applications. A strong focus on home improvement, repair, and remodeling activities drives retail sales, particularly through online platforms like Amazon and Home Depot. Professional contractors are increasingly shifting toward battery-powered solutions to enhance productivity and reduce maintenance costs. Manufacturers like Stanley Black & Decker, Milwaukee Tool, and DeWalt are investing heavily in smart cordless systems that integrate Bluetooth connectivity and real-time diagnostics. Furthermore, the country’s emphasis on green construction and infrastructure modernization continues to stimulate tool demand.

Europe Cordless Power Tools Market Trends

Europe’s cordless power tools industry is supported by stringent safety regulations, sustainability goals, and the adoption of eco-friendly technologies. Countries like Germany, the UK, France, and Italy are leading in innovation, integrating ergonomic designs and smart features into professional-grade tools. The construction and manufacturing industries are the primary users, with a growing share of demand from residential renovation projects. The European Union’s focus on carbon reduction and energy efficiency encourages the use of advanced, low-emission tools. Increased R&D collaboration among European manufacturers enhances competitiveness and performance quality across the market.

The Germany cordless power tools market is expected to grow during the forecast period. Germany serves as a technological hub for cordless power tools, with strong demand from the automotive, engineering, and manufacturing sectors. The country’s precision-driven industries rely heavily on high-performance cordless tools for assembly, maintenance, and repair operations. Innovations in brushless motors and battery systems are particularly prevalent among German brands, ensuring superior reliability and output. The government’s ongoing investment in Industry 4.0 and factory automation is further driving cordless adoption. Local players and international brands alike are focusing on ergonomic, compact, and energy-efficient designs to align with the country’s sustainability goals.

Central & South America Cordless Power Tools Market Trends

The Central & South America cordless power tools industry is witnessing steady growth as construction and infrastructure development gain momentum in countries like Brazil, Mexico, and Chile. Rising urbanization and a recovering industrial sector are boosting demand for versatile cordless tools. Increasing imports from Asia and North America are improving product availability and affordability across regional markets. The proliferation of retail and e-commerce platforms is making premium cordless tools accessible to small contractors and DIY consumers. Additionally, regional governments’ emphasis on energy-efficient and sustainable construction practices supports long-term growth prospects.

Middle East & Africa Cordless Power Tools Market Trends

The Middle East & Africa region is emerging as a key growth frontier for cordless power tools, supported by large-scale infrastructure and industrial projects. The Gulf countries, particularly Saudi Arabia and the UAE, are investing in mega-projects under Vision 2030 and national diversification plans, boosting professional tool demand. Infrastructure modernization, construction of new cities, and expansion in oil & gas and renewable energy sectors drive market penetration. Africa’s growing construction and repair activities are also creating opportunities for cordless tool manufacturers. Increasing partnerships between international and regional distributors are improving market access and brand presence.

Key Cordless Power Tools Company Insights

Some of the key players operating in the market include Ideal Power Tools and Stanley Black & Decker.

-

Ideal Power Tools is an India-based manufacturer known for its cost-effective and durable cordless tools catering to both professional and DIY users. The company focuses on accessible technology and reliable performance across drills, saws, grinders, and impact drivers. With a strong domestic distribution network, Ideal Power Tools has built a reputation for offering value-driven solutions suitable for small contractors and industrial maintenance applications.

-

Stanley Black & Decker is a global leader in the power tools market, known for brands such as DeWalt, Craftsman, and Black+Decker. The company has been at the forefront of cordless innovation, pioneering brushless motors, advanced lithium-ion batteries, and connected smart tool technologies. Its products cater to professional tradespeople, industrial users, and home improvement consumers. With robust R&D and global distribution, Stanley Black & Decker continues to shape the future of cordless tool efficiency, ergonomics, and safety standards across multiple industries.

Ryobi and Hilti are some of the emerging participants in the cordless power tools market.

-

Ryobi, a subsidiary of Techtronic Industries (TTI), is widely recognized for its extensive range of cordless power tools designed for both consumer and professional applications. The brand is particularly strong in the DIY and prosumer segment, offering high-value, feature-rich tools at competitive prices. Its ONE+ battery system, which powers over 200 tools, exemplifies modular innovation and user convenience. Ryobi’s strong presence in North America, Europe, and Asia, backed by TTI’s global R&D capabilities, enhances its reputation for reliability and versatility.

-

Hilti is a Switzerland-based multinational specializing in professional-grade cordless power tools tailored for construction, engineering, and industrial applications. The company is renowned for its precision, durability, and focus on high-performance cordless systems. Hilti invests heavily in R&D, particularly in battery technology, safety features, and digital fleet management solutions. Its strong after-sales service and direct sales model differentiate it from competitors.

Key Cordless Power Tools Companies:

The following are the leading companies in the cordless power tools market. These companies collectively hold the largest market share and dictate industry trends.

- Ideal Power Tools

- Festool

- Ryobi

- Stanley Black & Decker

- Bosch

- Makita

- Hilti

- DeWalt

- Milwaukee

- Craftsman

Recent Developments

-

In August 2025, Festool entered the market with the HLC 82. This tool features an 82mm width with a spiral blade cutter that makes pulling cuts for a cleaner, quieter finish.

Cordless Power Tools Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.40 billion

Revenue forecast in 2033

USD 31.82 billion

Growth rate

CAGR of 10.4% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

Ideal Power Tools; Festool; Ryobi; Stanley Black & Decker; Bosch; Makita; Hilti; DeWalt; Milwaukee; Craftsman

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cordless Power Tools Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the cordless power tools market report based on product type, end use, and region:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Drilling & Fastening Tools

-

Sawing & Cutting Tools

-

Grinding & Surface Prep Tools

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cordless power tools market size was estimated at USD 13.44 billion in 2024 and is expected to reach USD 14.40 billion in 2025.

b. The global cordless power tools market is expected to grow at a compound annual growth rate of 10.4% from 2025 to 2033 to reach USD 31.82 billion by 2033.

b. The drilling & fastening tools segment held the highest revenue market share of 33.8% in 2024, due to their widespread use across construction, manufacturing, and assembly operations.

b. Some of the key players operating in the cordless power tools market include Ideal Power Tools, Festool, Ryobi, Stanley Black & Decker, Bosch, Makita, Hilti, DeWalt, Craftsman, and Milwaukee.

b. Rising demand for convenient, portable, and efficient tools in construction, automotive, and DIY applications is driving the cordless power tools market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.