- Home

- »

- IT Services & Applications

- »

-

Content Moderation Services Market Size Report, 2030GVR Report cover

![Content Moderation Services Market Size, Share & Trends Report]()

Content Moderation Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Content Type, By Deployment, By Organization Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-458-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Content Moderation Services Market Summary

The global content moderation services market size was estimated at USD 9.67 billion in 2023 and is projected to reach USD 22.78 billion by 2030, growing at a CAGR of 13.4% from 2024 to 2030. The market growth is primarily driven by the rapid growth of user-generated content across digital platforms, such as social media, e-commerce, and online forums.

Key Market Trends & Insights

- The content moderation services market in North America accounted for a share of over 33% of global revenue and dominated it in 2023

- The content moderation services market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030.

- By component, the solution segment held the largest market share of around 59% in 2023.

- By content type, the image segment accounted for the largest revenue share in 2023.

- By deployment, the cloud segment accounted for the largest market share of around 70% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 9.67 Billion

- 2030 Projected Market Size: USD 22.78 Billion

- CAGR (2024-2030): 13.4%

- North America: Largest market in 2023

As businesses increasingly rely on these platforms to engage with consumers, maintaining a safe, compliant, and positive environment has become critical. Regulatory pressures and the risk of reputational damage from inappropriate or harmful content further compel companies to invest in moderation services. Additionally, advancements in artificial intelligence and machine learning are enhancing the efficiency and accuracy of moderation tools, contributing to market expansion. The rise in global internet penetration and the shift towards digital communication and commerce also fuel demand for these services.

The rapid growth of user-generated content across digital platforms, including social media, e-commerce, and online forums, is a key driver of the content moderation services market. As millions of users create and share content daily, businesses face increasing challenges in ensuring their platforms remain free from harmful, inappropriate, or illegal material. This surge in content volume heightens the need for robust moderation systems to protect users and uphold platform integrity.

Currently, 78% of individuals rely on social media as their primary source of information when researching brands. This trend highlights social media's growing importance as a central hub for brand-related content, surpassing traditional discovery and research methods. The interactive nature of social media enables consumers to obtain insights from the brands directly and through community discussions, reviews, and shared experiences. Moreover, with businesses relying heavily on digital interactions for customer engagement and brand reputation, the importance of maintaining a secure and respectful online environment has intensified. Consequently, the demand for advanced content moderation solutions, leveraging human oversight and automated technologies, continues to rise.

Advancements in artificial intelligence (AI) and machine learning (ML) drive the content moderation services market by enhancing moderation processes' efficiency, scalability, and accuracy. AI-powered systems can automatically analyze vast amounts of user-generated content in real-time, identifying harmful, offensive, or inappropriate material with increased precision. Machine learning algorithms continuously improve their detection capabilities by learning from past data, enabling more nuanced content analysis that can adapt to evolving trends and contexts. These technologies also allow for faster response times and reduced reliance on human moderators, lowering operational costs while maintaining the ability to handle large volumes of content. As a result, AI and ML innovations are becoming essential tools for businesses to effectively manage the growing demands of content moderation.

Component Insights

The solution segment held the largest market share of around 59% in 2023. The adoption of content moderation solutions is primarily driven by the increasing need for automated, scalable tools to manage the vast volume of user-generated content on digital platforms. As online interactions grow, businesses require sophisticated solutions to detect, filter, and remove harmful or inappropriate content in real time. Advances in artificial intelligence and machine learning have made these solutions more reliable, enabling platforms to handle large-scale content while minimizing human oversight and reducing operational costs.

The services segment is expected to grow at a significant CAGR from 2024 to 2030. The adoption of content moderation services is propelled by the need for human oversight and expertise in managing complex or context-sensitive content. While automated solutions are effective, there are instances where human judgment is necessary to interpret nuanced situations, such as cultural sensitivities or borderline cases that technology may not accurately address. Additionally, regulatory requirements and compliance with global content standards further drive businesses to seek comprehensive moderation services combining automated tools and expert human moderators to maintain platform integrity and user safety.

Content Type Insights

The image segment accounted for the largest revenue share in 2023. The adoption of content moderation for images is driven by the increasing volume of visual content shared across digital platforms, particularly social media and e-commerce. As users frequently upload and share images, businesses must ensure that inappropriate or harmful visuals, such as violent, explicit, or misleading content, are swiftly identified and removed. Advanced image recognition technologies powered by artificial intelligence have enhanced the ability to accurately detect prohibited or offensive material. Additionally, the need to comply with platform guidelines and legal regulations regarding visual content has further accelerated the demand for image moderation.

The video segment is expected to register the fastest CAGR of over 14% from 2024 to 2030. The adoption of video content moderation is fueled by the growing popularity of video as a primary medium for communication and marketing. The dynamic nature of video content, which often includes both visual and audio elements, presents unique challenges in identifying harmful or inappropriate material. Automated video moderation tools, supported by machine learning algorithms, are increasingly being utilized to analyze large volumes of video content in real time. Businesses adopt these tools to ensure compliance with community standards, protect users from harmful content, and prevent reputational damage while maintaining a safe and engaging environment on their platforms.

Deployment Insights

The cloud segment accounted for the largest market share of around 70% in 2023. Cloud infrastructure's flexibility, scalability, and cost-efficiency drive the adoption of cloud-based content moderation services. Cloud-based solutions enable businesses to easily scale their moderation efforts in response to fluctuations in content volume without the need for significant upfront investment in hardware. Additionally, cloud platforms provide access to the latest technological advancements in AI and machine learning, ensuring faster and more accurate content analysis. The ability to integrate with global platforms and manage content across multiple regions also makes cloud-based services highly appealing, particularly for businesses with geographically distributed user bases. Furthermore, cloud services offer faster deployment and seamless updates, allowing companies to respond to evolving moderation needs more effectively.

The on-premise segment is expected to register a significant CAGR from 2024 to 2030. The adoption of on-premise content moderation services is primarily driven by concerns over data privacy, security, and regulatory compliance. On-premise solutions provide greater control over data storage and processing for industries handling sensitive information, such as healthcare or finance, or operating in regions with stringent data protection laws. These services allow companies to own their content moderation infrastructure fully, ensuring that sensitive data remains within their network. On-premise solutions are also favored by organizations that require custom configurations or operate in environments where internet connectivity may be unreliable. The heightened control and customization options that on-premise services offer are key factors in their continued adoption.

Organization Size Insights

The large enterprises segment accounted for the largest market share in 2023. The adoption of content moderation services among large enterprises is primarily driven by the need to manage vast volumes of user-generated content while maintaining compliance with regulatory standards and protecting brand reputation. With their extensive online presence and diverse global user base, large enterprises require sophisticated moderation solutions to address complex content issues and mitigate risks associated with harmful or inappropriate material. These organizations often invest in comprehensive, scalable moderation systems to ensure their platforms remain secure, user-friendly, and compliant with regional regulations. Additionally, large enterprises are inclined towards integrating advanced technologies, such as AI and machine learning, to enhance the efficiency and accuracy of their content moderation efforts.

The SMEs segment is expected to register the fastest CAGR of over 14% from 2024 to 2030. The adoption of content moderation services among small and medium-sized enterprises (SMEs) is largely driven by the need to manage content while operating within budget constraints. Due to limited resources and personnel, SMEs often face challenges in scaling their moderation efforts. As a result, they seek cost-effective moderation solutions that offer essential functionalities without requiring significant investment in infrastructure or specialized staff. The availability of cloud-based services and outsourced moderation solutions provides SMEs with flexible and affordable options to ensure content compliance and safeguard their online platforms. By leveraging these services, SMEs can focus on their core business activities while maintaining a safe and engaging user environment.

End-use Insights

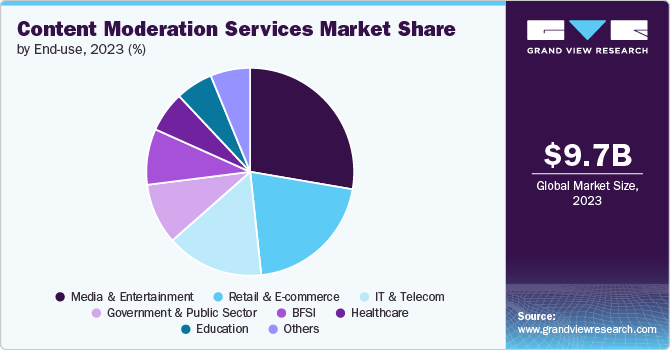

The media & entertainment segment accounted for the largest market share of over 27% in 2023. In the media & entertainment sector, the adoption of content moderation services is driven by the need to manage diverse and high-volume content while ensuring compliance with industry standards and legal regulations. As media platforms, streaming services, and entertainment providers handle extensive user-generated and uploaded content, they must address issues related to copyright infringement, explicit material, and user interactions. Content moderation services are crucial for maintaining platform integrity, protecting brand reputation, and providing a positive user experience. These services help enforce content policies, prevent harmful material dissemination, and ensure compliance with varying regional regulations.

The retail & e-commerce segment is expected to grow significantly over the forecast period. In the retail & e-commerce sector, the adoption of content moderation services is propelled by the need to manage and oversee user-generated content such as product reviews, customer feedback, and user-generated images. Retailers and e-commerce platforms must ensure this content remains accurate, relevant, and free from fraudulent or harmful material to protect consumer trust and maintain a positive brand image. Moderation services play a vital role in preventing the spread of misinformation, managing negative or abusive reviews, and ensuring compliance with advertising and product standards. By effectively moderating user content, retail and e-commerce businesses can enhance the shopping experience, uphold product integrity, and foster a safe and reliable online environment.

Regional Insights

The content moderation services market in North America accounted for a share of over 33% of global revenue and dominated it in 2023. In North America, the market is experiencing a significant shift towards advanced AI and machine learning technologies to handle the increasing volume and complexity of user-generated content. Companies in this region are investing in sophisticated moderation solutions to enhance efficiency and accuracy, driven by stringent regulatory requirements and heightened concerns about data privacy and security.

The content moderation services market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. In the U.S., the market is marked by a focus on leveraging advanced technology to address the dynamic nature of digital content. The market is seeing increased adoption of AI-driven moderation tools to enhance the speed and accuracy of content review processes. Additionally, there is a strong emphasis on addressing regulatory pressures, including compliance with laws related to harmful content and misinformation. U.S. companies are also prioritizing the development of scalable moderation solutions to manage the vast and diverse content generated by large digital platforms and social media channels.

Asia Pacific content moderation services Market Trends

The content moderation services market in Asia Pacific is expected to grow at the highest CAGR of over 14% from 2024 to 2030. In the Asia Pacific region, the market is characterized by rapid growth and diversification due to the region's large and varied digital user base. The demand for content moderation services is driven by the need to manage extensive volumes of user-generated content across multiple languages and cultural contexts. Companies are increasingly adopting both automated and human-centric moderation solutions to address local content sensitivities and compliance requirements. Additionally, there is a rising trend towards integrating AI and machine learning technologies to handle the region's unique content challenges effectively.

Europe Content Moderation Services Market Trends

The content moderation services market in Europe is expected to grow at a significant CAGR of over 13% from 2024 to 2030.The market in Europe is heavily influenced by stringent regulatory frameworks such as the General Data Protection Regulation (GDPR) and the Digital Services Act (DSA). These regulations necessitate robust moderation practices to ensure compliance and protect user data. European businesses are increasingly adopting moderation services that offer strong data protection features and adhere to regional legal requirements. There is also a notable focus on transparency and accountability in moderation processes, reflecting the region's commitment to user rights and platform responsibility.

Key Content Moderation Services Company Insights

Key players operating in the content moderation services market include Amazon Web Services, Inc., Microsoft, opporture, Clarifai, Inc., Sift Science, Inc., Appen Limited, Conectys, Hive, iMerit, and SunTec.AI. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2024, Amazon Rekognition unveiled an upgraded machine-learning model for image content moderation. This update introduces new labels, enhances model accuracy, and adds the capability to identify animated and illustrated content. The content moderation feature of Amazon Rekognition leverages machine learning to detect inappropriate, offensive, and unwanted material.

-

In May 2023, Microsoft introduced a new AI-powered moderation service, Azure AI Content Safety, to promote safer online environments and communities. Available through the Azure AI product platform, this service features a variety of AI models specifically trained to detect inappropriate content in both images and text. The models support multiple languages, including English, French, German, Spanish, Japanese, Chinese, Portuguese, and Italian, and assign severity scores to flagged content. These scores help moderators prioritize which content requires intervention.

Key Content Moderation Services Companies:

The following are the leading companies in the content moderation services market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Appen Limited

- Clarifai, Inc.

- Conectys

- Hive

- iMerit

- Microsoft

- opporture

- Sift Science, Inc.

- SunTec.AI

Content Moderation Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.70 billion

Revenue forecast in 2030

USD 22.78 billion

Growth rate

CAGR of 13.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, content type, deployment, organization size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services, Inc.; Microsoft; opporture; Clarifai, Inc.; Sift Science, Inc.; Appen Limited; Conectys, Hive; iMerit; SunTec.AI

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Content Moderation Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global content moderation services market report based on component, content type, deployment, organization size, end-use, and region:

-

Component Outlook (Revenue; USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Content Type Outlook (Revenue; USD Billion, 2018 - 2030)

-

Image

-

Text

-

Video

-

-

Deployment Outlook (Revenue; USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Organization Size Outlook (Revenue; USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End-use Outlook (Revenue; USD Billion, 2018 - 2030)

-

BFSI

-

Government & Public Sector

-

Healthcare

-

IT & Telecom

-

Media & Entertainment

-

Retail and E-commerce

-

Education

-

Others

-

-

Regional Outlook (Revenue; USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global content moderation services market size was estimated at USD 9.67 billion in 2023 and is expected to reach USD 10.70 billion in 2024

b. The global content moderation services market is expected to grow at a compound annual growth rate of 13.4% from 2024 to 2030 to reach USD 22.78 billion by 2030

b. North America dominated the content moderation services market with a market share of 33.9% in 2023. In North America, the content moderation services market is experiencing a significant shift towards advanced AI and machine learning technologies to handle the increasing volume and complexity of user-generated content. Companies in this region are investing in sophisticated moderation solutions to enhance efficiency and accuracy, driven by stringent regulatory requirements and heightened concerns about data privacy and security

b. Some key players operating in the content moderation services market include Amazon Web Services, Inc., Microsoft, opporture, Clarifai, Inc., Sift Science, Inc., Appen Limited, Conectys, Hive, iMerit, and SunTec.AI.

b. The content moderation services market is primarily driven by the rapid growth of user-generated content across digital platforms, such as social media, e-commerce, and online forums. As businesses increasingly rely on these platforms to engage with consumers, maintaining a safe, compliant, and positive environment has become critical. Regulatory pressures and the risk of reputational damage from inappropriate or harmful content further compel companies to invest in moderation services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.