Industry Insights

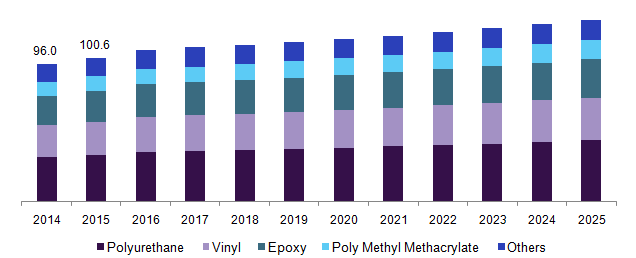

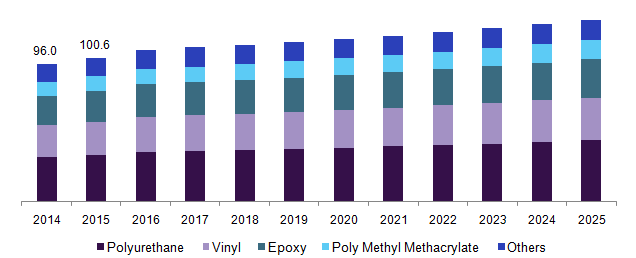

The global construction flooring chemicals market demand was estimated at 3.6 million tons in 2016. Rising demand for advanced flooring products on account of increasing awareness toward durability and good aesthetic features is expected to remain a favorable factor.

Epoxies, vinyl resins, polyurethane, and PMMA are the majorly used chemicals in the flooring industry. Fluctuating crude oil prices are expected to remain a challenging factor for the key industry participants. As a result, some the chemical processing companies are expected to shift their focus from conventional petrochemical feedstock to renewable materials including glycerol as an intermediate for the production of finished floor covering chemicals.

U.S. construction flooring chemicals market by product, 2014 - 2025 (Kilo tons)

The growing importance of durable and impact-resistant flooring solutions in the manufacturing facilities, laboratories, and metal industries to improve safety, and hygiene, as well as reduce VOC emissions is expected to remain a key driving factor. Furthermore, considering the long-term existence and sustainability of concrete floorings, the application of coatings such as resins and PU will eventually propel the demand over the forecast period.

Over the past few years, population growth and urbanization in emerging markets including Brazil, China, and India have resulted in national governments increasing the spending on developing the industries related to packaging, construction, and automotive. As a result, increasing disposable income in the countries mentioned above is expected to play a crucial role in promoting large production platforms to cater to the domestic as well as global demand for commodities, all over increasing the application growth of flooring chemicals in the future.

The market fragmentation was made on account of a vast number of companies engaged in the manufacturing of epoxy resins, vinyl, and polyurethanes. With the latest research and development, companies have excelled in enhancing the existing floor coatings as well as imbibing various properties, to cater to different sets of consumers on a global level. However, by dominance, multi-national players seem to attain a larger section of opportunity than regional players. Since the competitors within the industry are many, the rivalry is high.

The availability of food chains, malls, and coffee outlets has increased, which directly expanded the market for construction flooring chemicals. The growth of middle-class populations and their affinity to take an interest in urban culture living is expected to increase the footfall across luxury resorts, hotels, and shopping complexes. The migration of new generations in a region establishes more opportunities and platforms for companies to invest, which alternatively increases the demand for construction flooring chemicals.

The emergence of technology and manufacturing firms on account of look east policies by developed economies such as One Belt, One Road, and Make in India plans, are driving the construction and chemical industry. Multinational companies are setting up their outposts covering the Asia Pacific region, South Africa as well as parts of Europe, to facilitate the increasing demand for construction flooring chemicals.

Product Insights

Epoxy resins are having a low or high molecular weight and have at least two epoxide groups. Vinyl is one of the alkenyl functional groups, which is polymerized with the aid of a radical initiator or catalyst. Polyurethane is a polymer that is primarily composed of organic units connected by urethane links, whereas polymethyl methacrylate is transparent thermoplastics that are often utilized in sheet form as a lightweight or alternative to glass having properties such as shatter resistance.

Over the past few years, Ineos, developed Hypersal which consists of tailor-made resins for impregnation of decor, overlay, and balance papers, along with hardeners, wetting agents, and release agents in order to increase production efficiency.

Forbo Holdings developed Acoustic linoleum which is capable of reducing impact sound by 14dB (ISO 717-2). It is a twin layer linoleum built up from 2 mm Marmoleum and a 2 mm Corkment backing

LG Chem developed EQ floors, a multi-layered vinyl flooring that has an application in backing sound insulation. The product has excellent shock absorption, sound insulation properties up to 24 decibels, superior durability by reinforced wear layer, and properties of anti-bacterial and Fungicidal treatment.

Application Insights

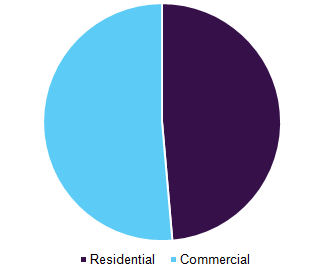

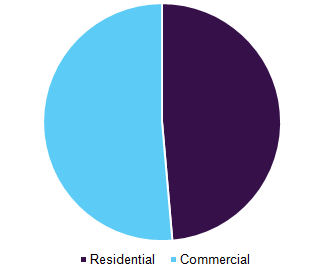

The commercial sector dominated the market, accounting for 51.4% of total volume, in 2016. Rising government spending toward promoting investments in manufacturing sectors catering to the automotive and electronics industry in emerging markets including China and India is expected to have a positive impact.

Construction Flooring chemicals market volume, by application, 2016 (%)

The residential sector is expected to witness volume growth at a CAGR of 4.0% from 2017 to 2025. Extensive requirements for construction flooring chemicals for ensuring low maintenance, resistance to moisture and water, durability, and ease of installation are set to fuel the demand for construction flooring chemicals over the forecast period.

Regional Insights

North America accounted for 6.4% of the global volume share in 2016. The high adoption rate of flooring chemicals in both the residential and commercial sectors including corporate buildings, shopping complexes, airports, and sports stadiums is expected to increase the demand over the forecast period.

Asia Pacific is projected to witness revenue growth at a CAGR of 5.5% from 2017 to 2025. The positive outlook for manufacturing facilities as well as government policies for affordable housing in the major markets including China and India that promotes investments on a domestic level and private overseas investments are expected to be major driving factors.

Central & South America is projected to account for 2.2% of the global revenue share by the end of 2025. The firm foothold of automotive manufacturing hubs such as Mexico and Brazil on account of renewing existing government policies to create favorable tax benefits for Brazilian manufacturers is expected to expand the market size of construction flooring chemicals over the projected period.

The Middle East and Africa are set to witness volume growth at a CAGR of 3.8% from 2014 to 2025. The introduction of government policies toward infrastructural expansion is expected to fuel the demand for construction flooring chemicals during the forecast period. There remains a significant retail development pipeline in Dubai, with approximately 13.3 million square feet of GFA currently in the execution stage, expected to reach practical completion by 2019, which is subject to an increase in the demand for construction flooring chemicals over the forecast period.

Competitive Insights

Key vendors include BASF, SABIC, DOW chemicals, Sinopec., ExxonMobil, DuPont, Ineos, LyondellBasell Industries, Mitsubishi Chemical Corporation, LG Chem, AkzoNobel, Mitsui Chemicals, Forbo Holding, Toray Industries., PPG Industries, Tremco Inc, RPM International Inc, Stonhard Inc, Huntsman Corp, and Borealis.AG

In July 2016, Borealis acquired German plastic recycler MTM Plastics GMBH and MTM Compact GMBH. The acquisition is a move towards recycling and sustainability efforts, where MTM plastics was considered a technology leader in the recycling of mixed post-consumer plastic waste and was one of Europe’s largest producers of post-consumer polyolefin recyclates.

In May 2017, Huntsman Corp, and Clariant AG of Switzerland are merging to create a chemical manufacturer having a value of more than $ 14 billion. The merger will create a global specialty chemical company, where Clariant will have 52 % ownership. The newly merged company will be known as HuntsmanClariant, where plastics and coatings will be an integral part of the new company.

Report Scope

|

Attribute

|

Details

|

|

Base year for estimation

|

2016

|

|

Actual estimates/Historical data

|

2014 & 2015

|

|

Forecast period

|

2017 - 2025

|

|

Market representation

|

Volume in Kilo Tons & CAGR from 2017 to 2025

Revenue in USD Million & CAGR from 2017 to 2025

|

|

Regional scope

|

North America, Europe, Asia Pacific, Central & South America, MEA

|

|

Country scope

|

U.S., Germany, U.K., China, India, Brazil, Saudi Arabia

|

|

Report coverage

|

Revenue & volume forecast, company share, competitive landscape, growth factors and trends

|

|

15% free customization scope (equivalent to 5 analyst working days)

|

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

|

Segments Covered in the Report

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the flooring chemicals market on the basis of product, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million; 2014 - 2025)

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million; 2014 - 2025)

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million; 2014 - 2025)