- Home

- »

- Advanced Interior Materials

- »

-

Construction Additives Market Size, Industry Report, 2030GVR Report cover

![Construction Additives Market Size, Share & Trends Report]()

Construction Additives Market (2024 - 2030) Size, Share & Trends Analysis By Product (Chemical, Mineral, Fiber), By End Use (Residential, Commercial, Infrastructure) By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-2-68038-092-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Construction Additives Market Summary

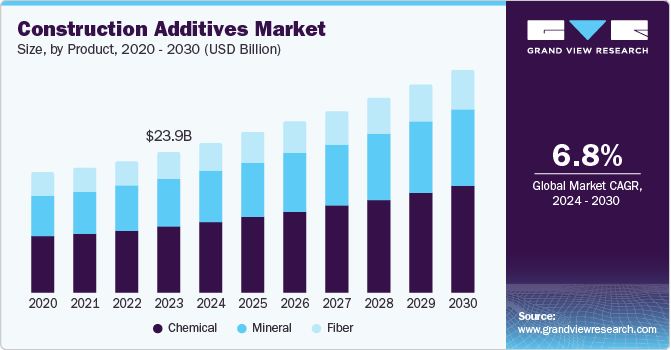

The global construction additives market size was valued at USD 23.87 billion in 2023 and is projected to reach USD 37.71 billion by 2030, growing at a CAGR of 6.8% from 2024 to 2030. As cities expand to accommodate increasing populations, the demand for residential, commercial, and industrial construction projects has increased.

Key Market Trends & Insights

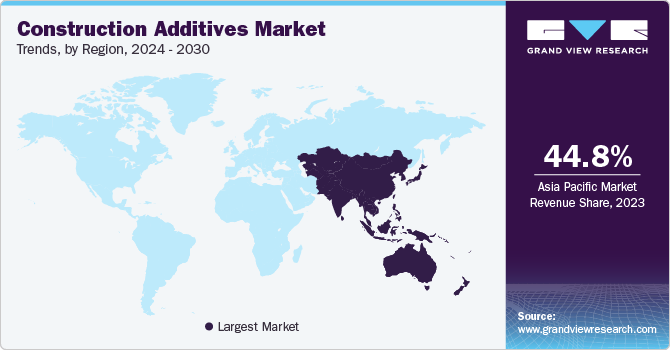

- The Asia Pacific construction additives market accounted for the largest revenue share of 44.8% in 2023.

- Based on product, the chemical segment dominated the market and accounted for a revenue share of 47.9% in 2023.

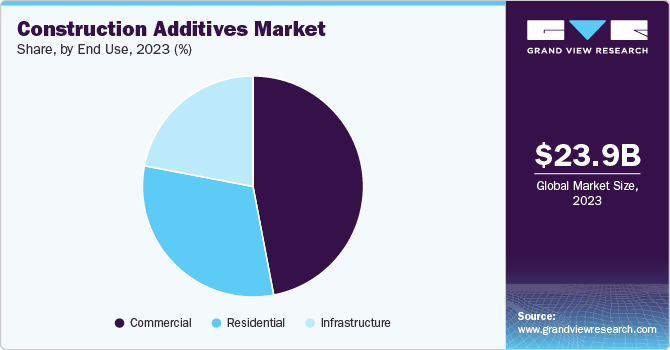

- Based on end use, the commercial segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 23.87 Billion

- 2030 Projected Market Size: USD 37.71 Billion

- CAGR (2024-2030): 6.8%

- Asia Pacific: Largest market in 2023

This urban growth necessitates improved construction materials to meet the durability, strength, and efficiency requirements. Construction additives are essential in enhancing the properties of construction materials, leading to their increased adoption in large-scale infrastructure projects.

The increasing trend of renovation and retrofitting activities, particularly in markets such as Europe and North America, is driving the demand for construction additives. Aging infrastructure and buildings require repair and reinforcement, involving specialized construction additives such as repair mortars, sealants, and bonding agents. Additionally, the need to upgrade buildings to meet modern safety and environmental standards fuels the market for these products. The focus on extending the lifespan of existing structures while improving their performance is a significant factor driving the construction additives market.

The growing awareness of sustainable construction practices contributes to expanding the construction additives market. As the construction industry moves towards reducing its environmental impact, there is a rising demand for eco-friendly materials that minimize waste and reduce buildings' carbon footprint. Construction additives that enhance resource use efficiency, such as water-reducing admixtures and lightweight aggregates, are increasing in the market. To cater to these demands, companies are initiating new product lines. For instance, in January 2023, CEMEX launched bio-sourced admixtures as part of its Vertua building solutions portfolio to significantly reduce the carbon footprint associated with concrete production. These innovative admixtures utilize renewable, natural, and locally sourced raw materials, leading to a carbon footprint reduction of up to 70% compared to traditional oil-based admixtures. Admixtures are combined with concrete mixes to improve workability, strength, and water demand while decreasing related carbon emissions and promoting more sustainable construction practices.

Product Insights

The chemical segment dominated the market and accounted for a revenue share of 47.9% in 2023. Chemical additives, such as plasticizers, superplasticizers, accelerators, and retarders, are essential in modifying the properties of concrete and mortar to achieve specific performance characteristics. The construction industry's ongoing objective of higher performance and more durable materials ensures the continued growth of chemical construction additives. The need for enhanced performance in construction materials significantly drives the demand for chemical construction additives.

The mineral segment is expected to register the fastest CAGR during the forecast period. Fly ash, slag, and silica fume are cheaper than conventional cement, providing an economical alternative for concrete production. These materials are by-products of industries such as power generation and steel manufacturing, making them readily available in large quantities. The economic advantages of using these materials, combined with their ability to enhance the properties of concrete, make them a suitable option for builders and contractors, especially in cost-sensitive construction projects.

End Use Insights

The commercial sector accounted for the largest market revenue share in 2023. Time is an essential factor in commercial construction projects, as delays lead to significant financial losses. Accelerators and rapid-setting additives are in demand for projects with fast timelines, as they enable faster setting and curing of concrete. Self-compacting concrete, which relies on specific additives to flow and settle under its weight, reduces the need for extensive labor and equipment, speeding up the construction process. The growing emphasis on completing commercial projects quickly and efficiently, without compromising quality, drives the use of these construction additives.

The residential segment is anticipated to register a significant CAGR over the forecast period. As populations grow and urbanization accelerates, particularly in emerging economies, there is an increasing demand for low-cost housing solutions. Construction additives play an essential role in fulfilling this demand by enhancing the properties of construction materials, making them more cost-effective and efficient. Additionally, using additives that accelerate curing times speeds up construction processes, enabling faster delivery of residential units in areas with housing shortages. The global need for affordable housing significantly drives the residential sector's use of construction additives.

Regional Insights

The North America construction additivesmarket is expected to witness significant growth over the forecast period. North America experiences a wide range of climatic conditions, from the hot deserts to the cold and wet regions. This diversity in climate drives the demand for construction additives that enhance the performance of building materials under extreme weather conditions. Additives that improve freeze-thaw resistance reduce water permeability, and enhance durability are crucial in areas with harsh winters. In hot climates, additives that reduce heat absorption and improve the thermal performance of materials are in high demand. The need for high-performance construction materials that withstand these extreme conditions significantly drives the adoption of construction additives in North America.

U.S. Construction Additives Market Trends

The U.S. construction additivesmarket is expected to witness significant growth over the forecast period. The U.S. housing market has seen significant growth, with a strong demand for new homes and multi-family residential buildings. The commercial sector is also witnessing robust activity, constructing new office buildings, retail spaces, and industrial facilities. According to The Construction Association, Construction is a major contributor to the U.S. economy. In the first quarter of 2023, there were more than 919,000 construction establishments in the U.S. The industry utilizes 8.0 million employees and produces about $2.1 trillion worth of structures per year. Construction additives are essential in these sectors to improve the strength, durability, and aesthetics of materials used in construction. The continued growth of the residential and commercial construction sectors increases the development of the construction additives market in the region.

Asia Pacific Construction Additives Market Trends

The Asia Pacific construction additivesmarket accounted for the largest revenue share of 44.8% in 2023. Major cities in the region are experiencing rapid urbanization, leading to increased demand for new residential, commercial, and industrial buildings. This growth necessitates using high-performance construction materials, where construction additives play a critical role. The government's focus on revitalizing aging infrastructure through initiatives further boosts the demand for construction additives. These additives are essential in ensuring the durability, strength, and sustainability of materials used in large-scale projects, including highways, bridges, and public buildings.

The China construction additives market accounted for the largest revenue share in 2023. The country's growing network of mega-cities, such as Beijing, Shanghai, and Shenzhen, increases demand for high-quality construction materials. These urban centers are expanding due to the complexity of their construction projects. Skyscrapers, large commercial complexes, and advanced infrastructure systems require construction materials with superior performance characteristics. Construction additives that improve materials' strength, durability, and aesthetics are critical in meeting the standards required for these high-profile projects. The rise of world-class infrastructure and buildings in China's mega-cities increases the construction additives market as developers and contractors pursue to ensure that their projects meet international standards.

Europe onstruction Additives Market Trends

The Europe construction additivesmarket is expected to witness significant growth over the forecast period. Construction additives that enhance buildings' structural integrity and resilience against these hazards are becoming increasingly important. The country's increasing frequency and severity of natural disasters, such as floods, earthquakes, and wildfires, drive the demand for disaster-resilient construction materials. The focus on building disaster-resilient infrastructure significantly drives construction additives in the regions as governments, developers, and homeowners pursue to protect properties from natural disasters.

The UK construction additives market is expected to witness significant growth over the forecast period. As residential construction continues to expand, using construction additives that improve materials' quality, durability, and energy efficiency is becoming increasingly important. Additives that enhance the workability of concrete, reduce shrinkage, and improve resistance to environmental factors are in high demand in the residential sector. Additionally, the trend towards more sustainable and energy-efficient homes further drives the use of eco-friendly additives in residential construction. The growth of the residential real estate market in the country significantly drives the demand for the construction additives market.

Key Construction Additives Company Insights

Key player’s construction additivesmarket includes BASF SE, Dow Inc., Cemex, S.A.B. de C.V, W. R. Grace & Co.-Conn., Fosroc, Inc. and others.

-

Dow Inc. provides various advanced and sustainable solutions across multiple industries. The company's product portfolio includes performance materials, industrial intermediates, and plastics, catering to packaging, infrastructure, and consumer care sectors. Dow's offerings in the construction industry include various construction chemicals and additives, such as insulation materials, sealants, adhesives, and coatings.

-

BASF SE holds an extensive portfolio of high-performance products and innovative solutions across various industries. In the construction sector, BASF offers a comprehensive range of construction chemicals and additives that enhance building materials' performance, durability, and sustainability. Their product offerings include concrete admixtures, cement additives, waterproofing solutions, and protective coatings.

Key Construction Additives Companies:

The following are the leading companies in the construction additives market. These companies collectively hold the largest market share and dictate industry trends.

- W. R. Grace & Co.-Conn.

- CHRYSO

- Dow

- BASF

- Cemex, S.A.B. de C.V.

- Fosroc, Inc.

- CICO Group

- Sika AG

- Evonik Industries AG

- RPM International Inc.

Recent Developments

-

In June 2021, JSW Cement expanded its business by entering the construction chemicals sector and launching a range of green products to enhance construction sustainability. The product line includes Krysta Leakproof integral crystalline waterproofing compound, Enduro Plast ready-mix plaster, and Duraflor floor hardener. The company established a 0.3-million-ton manufacturing facility in Ballari, Karnataka, to produce its construction chemical product range.

-

In July 2024, Nouryon entered a strategic distribution agreement with Brenntag Specialties to distribute asphalt additives in the U.S. The partnership aims to improve Nouryon's presence in the U.S. asphalt market and provide customers with a broader range of innovative products. The collaboration focuses on distributing various asphalt additives, including anti-stripping agents and emulsifiers. The partnership enables customers to receive exceptional logistics support and access to local inventory, which are essential factors during the asphalt paving season.

Construction AdditivesMarket Report Scope

Report Attribute

Details

Market size value in 2024

USD 25.45 billion

Revenue forecast in 2030

USD 37.71 billion

Growth rate

CAGR of 6.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Argentina, Brazil, South Arabia, South Africa

Key companies profiled

W. R. Grace & Co.-Conn., CHRYSO, Dow, BASF, Cemex, S.A.B. de C.V., Fosroc, Inc., CICO Group., Sika AG, Evonik Industries AG, RPM International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

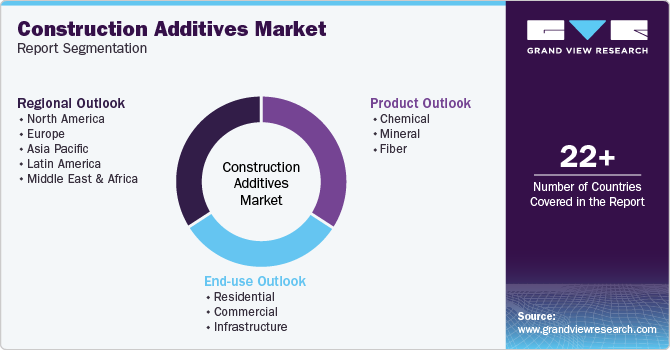

Global Construction Additives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the construction additivesmarket report based on product, end use and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Chemical

-

Mineral

-

Fiber

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Infrastructure

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.