- Home

- »

- Next Generation Technologies

- »

-

Connected Agriculture Market Size & Share Report, 2030GVR Report cover

![Connected Agriculture Market Size, Share & Trends Report]()

Connected Agriculture Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment, By Application (Livestock Monitoring, Precision Farming), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-430-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Connected Agriculture Market Size & Trends

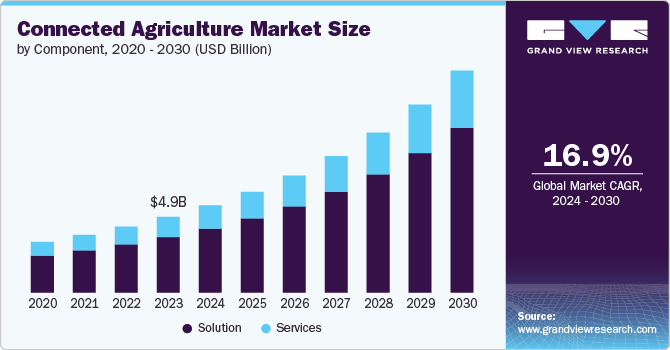

The global connected agriculture market size was estimated at USD 4.95 billion in 2023 and is projected to grow at a CAGR of 16.9% from 2024 to 2030. The global market is experiencing robust growth due to factors such as increasing food demand, technological advancements, government support, the need for climate resilience, and a strong focus on sustainability. Connected agriculture refers to the integration of digital and communication technologies, such as the Internet of Things (IoT), big data, mobile devices, and cloud computing, into agricultural practices.

Connected Agriculture offers numerous benefits, such as enhanced efficiency, resource optimization, and improved traceability and food safety. Automating and optimizing farming practices reduces the need for manual labor, lowers costs, and increases output. Moreover, connected agriculture systems enable detailed tracking of food products from farm to table, improving traceability and ensuring food safety. They also ensure the efficient use of resources like water, fertilizers, and energy, reducing environmental impact.

The proliferation of mobile devices and improved internet connectivity in rural areas are making it easier for farmers to access connected agriculture solutions, including mobile apps for farm management, weather forecasts, and market prices. Mobile platforms are facilitating better communication between farmers, suppliers, and buyers, enhancing market access and price transparency.

Machine Learning (ML) and Artificial Intelligence (AI) are being increasingly utilized for predictive analytics in agriculture. These technologies analyze vast amounts of data from various sources to predict outcomes like yield, pest outbreaks, and optimal planting times. This enables farmers to make more informed decisions, optimize inputs, and reduce waste. Sophisticated IoT sensors across fields and farms allow for real-time monitoring of soil moisture, nutrient levels, weather conditions, and crop health. These sensors provide critical data that helps in the precise application of fertilizers, water, and pesticides, improving efficiency and reducing environmental impact.

Companies are continually innovating and launching advanced solutions for agricultural applications, positively impacting the growth of the connected agriculture market. For instance, in July 2024, Taranis launched Ag Assistant, an AI-driven tool that transforms crop management by integrating diverse data sources-including text, images, and audio-to provide precise, actionable insights for agriculture professionals. This innovative model enhances decision-making efficiency and accuracy, allowing growers and advisors to address field-specific issues with unprecedented speed and effectiveness, revolutionizing farm management in the AI era.

Component Insights

In terms of component, the solution segment dominated the market in 2023 and accounted for more than 73.0% share of the global revenue. The segment’s growth is attributed to the growing need for data-driven decision-making and the increased investment in AgTech startups. The need for real-time data and insights to make informed decisions about crop management, soil health, and weather conditions is driving the demand for integrated solutions that offer comprehensive data analysis and reporting. Moreover, significant investment in AgTech startups is driving innovation and the development of new solutions that cater to the evolving needs of the agricultural sector, further fueling the growth of the solution segment.

The services segment is projected to witness to grow at a considerable CAGR of 16.3% from 2024 to 2030. The increasing complexities and the advancements in technology are driving the segment’s growth. As agricultural technologies become more complex, farmers and agribusinesses increasingly rely on managed services to help with the implementation, maintenance, and optimization of connected solutions. This demand for specialized support drives the growth of services such as system integration, support, and consultancy. The rapid advancement of connected agriculture technologies necessitates comprehensive integration and support services. These services ensure that new technologies are effectively incorporated into existing systems and that users receive the necessary training and support.

Deployment Insights

In terms of deployment, the cloud segment dominated the market in 2023 and accounted for more than 68.0% share of the global revenue. The segment's growth is attributed to the scalability and flexibility of the cloud solutions. Cloud deployment provides scalable resources that can be adjusted based on demand, allowing agricultural businesses to expand or reduce their IT infrastructure as needed. This flexibility is crucial for managing varying data loads and operational requirements. Moreover, cloud deployment allows for remote access to agricultural data and applications, facilitating collaboration among farm managers and other stakeholders. This accessibility is especially important for managing operations across multiple locations.

The on-premises segment is projected to grow at a considerable CAGR of 12.3% from 2024 to 2030. The segment’s growth is attributed to the limited internet connectivity in rural areas. In rural or remote areas where internet connectivity is limited or unreliable, on-premises deployments ensure that agricultural operations can continue without relying on external cloud services. On-premises systems can operate independently of internet access, making them suitable for locations where connectivity issues could disrupt cloud-based solutions. Moreover, on-premises deployment allows agricultural businesses to maintain full control over their data, addressing concerns about data security and privacy.

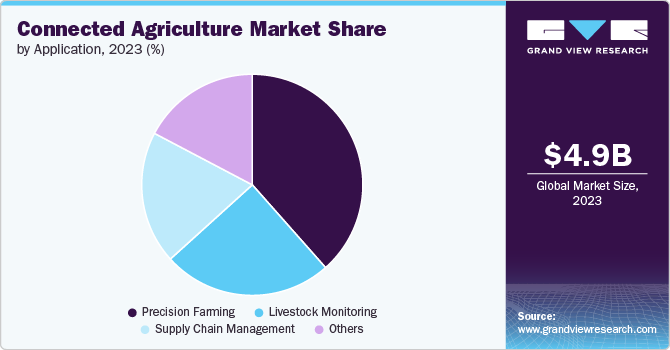

Application Insights

In terms of application, the precision farming segment dominated the market in 2023 and accounted for more than 38.0% share of global revenue. The increase in demand for food production efficiency and rising concerns about climate change and the environment are driving the segment’s growth. Precision farming technologies help optimize crop yields by using data-driven approaches to monitor and manage field conditions. This ensures that resources such as water, fertilizers, and pesticides are used efficiently, enhancing overall productivity. Moreover, it helps adapt to climate change by enabling farmers to monitor and respond to changing weather patterns and soil conditions. This proactive approach helps mitigate the impacts of climate variability on crop production. This is driving the adoption of connected agriculture solutions and services for precision farming applications.

The livestock monitoring segment is projected to grow at a considerable CAGR of 17.0% from 2024 to 2030. The segment's growth is attributed to the rising consumer demand for quality and traceability. Monitoring livestock health and diet directly impacts the quality of animal products such as meat, milk, and eggs. This ensures that consumers receive higher-quality products, which can command premium prices. This is driving the growing adoption of connected agriculture solutions and services in livestock monitoring. Moreover, livestock monitoring systems contribute to improved animal welfare by enabling farmers to monitor and address the needs of individual animals. This aligns with growing consumer demand for ethically produced animal products.

Regional Insights

North America connected agriculture market dominated the global market and accounted for a revenue share of over 37.0% in 2023. The market's growth in the region is attributed to the high technology adoption and the availability of advanced connectivity infrastructure in the region. North America has extensive high-speed internet coverage and, advanced IoT connectivity, and growing connectivity in rural and agricultural areas. This infrastructure supports the deployment of connected agriculture solutions, enabling seamless data transmission and real-time monitoring of farm operations.

U.S. Connected Agriculture Market Trends

The connected agriculture market in the U.S. is expected to grow at a CAGR of 15.9% from 2024 to 2030. The market's growth in the country is attributed to the need to enhance efficiency and increase agricultural output in the country. According to the U.S. Department of Agriculture (USDA), in 2023, agriculture, food, and related industries contributed approximately USD 1.5 trillion to the country's gross domestic product (GDP), representing 5.6% of the total GDP. The adoption of connected agriculture solutions and services can further drive the agricultural output in the country.

Asia Pacific Connected Agriculture Market Trends

The connected agriculture market in Asia Pacific is expected to grow at the highest CAGR of 18.0% from 2024 to 2030. The market’s growth in the region can be attributed to the increasing population and food demand in the region. Asia Pacific is home to a rapidly growing population, leading to increased demand for food. This drives the adoption of connected agriculture technologies to enhance productivity and meet the rising food needs. Moreover, governments across the Asia Pacific region are actively promoting the adoption of smart agriculture technologies through subsidies, grants, and supportive policies. These initiatives lower the financial barriers for farmers to invest in connected agriculture solutions. In August 2024, the Government of India introduced the National Pest Surveillance System (NPSS) to link farmers with agricultural experts for efficient pest management through their smartphones. This initiative seeks to decrease farmers' dependence on pesticide vendors and encourage a more scientific approach to pest control by leveraging AI to analyze pest data and deliver timely, precise recommendations.

Europe Connected Agriculture Market Trends

The connected agriculture market in Europe is expected to grow at a significant CAGR of 16.7% from 2024 to 2030. The market's growth can be attributed to the growing focus on sustainable farming in the region. There is a strong emphasis on reducing the environmental impact of agriculture in Europe. Connected agriculture solutions help in monitoring and managing resources such as water, fertilizers, and pesticides more efficiently, supporting sustainable farming practices.

Key Connected Agriculture Company Insights

Some of the key companies operating in the market include Deere & Company, Trimble Inc., Hexagon AB, Topcon, and BASF SE, among others.

-

Deere & Company is an American multinational corporation founded in 1837. It is a leading manufacturer of agricultural, construction, and forestry machinery. The company is a prominent player in the agriculture industry, with a presence in over 30 countries. The company’s extensive portfolio includes tractors, combine harvesters, planters, sprayers, and various other machinery used in farming.

Sentera and Farmers Edge Inc. are some of the emerging companies in the target market.

-

Sentera, founded in 2014 and headquartered in Minnesota, U.S., is a leading technology company specializing in agricultural data solutions. The company focuses on providing innovative tools for precision agriculture through its advanced imaging and data analytics technologies. The company has made significant advancements in the integration of machine learning and artificial intelligence into its data analysis tools. These innovations enhance the accuracy and speed of crop monitoring and yield predictions. The company has also expanded its product offerings to include more user-friendly and scalable solutions for various farming operations.

Key Connected Agriculture Companies:

The following are the leading companies in the connected agriculture market. These companies collectively hold the largest market share and dictate industry trends.

- Deere & Company

- Trimble Inc.

- AGCO Corporation

- BASF SE

- Bayer AG

- Hexagon AB

- Topcon

- Sentera

- Farmers Edge Inc.

- CLAAS KGaA mbH

Recent Developments

-

In August 2023, Trimble Inc. released a flexible API for its Trimble Agriculture Cloud. This API allows third-party agriculture applications to connect with Trimble Inc.'s equipment and data, streamlining farming operations. The API supports various workflows like farm setup, task records, materials management, and vehicle setup.

-

In September 2022, Deere & Company released a Request for Proposal (RFP) to the satellite industry, looking for satellite services and terminals that offer continuous connectivity for its agricultural machinery. This initiative is designed to facilitate real-time data analysis and autonomous farming, enhancing productivity for Deere & Company’s customers and boosting food and fuel production.

Connected Agriculture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.70 billion

Revenue forecast in 2030

USD 14.51 billion

Growth Rate

CAGR of 16.9% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Deere & Company; Trimble Inc.; AGCO Corporation; BASF SE; Bayer AG; Hexagon AB; Topcon; Sentera; Farmers Edge Inc.; CLAAS KGaA mbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

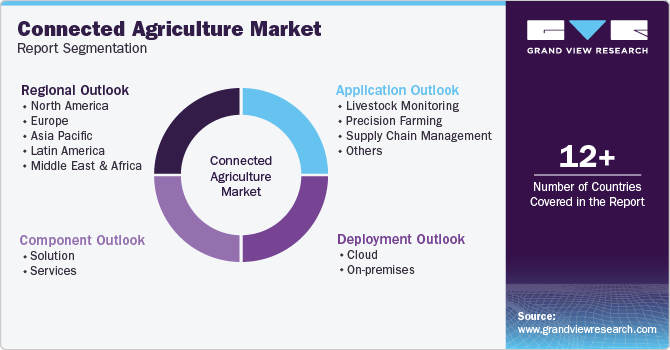

Global Connected Agriculture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global connected agriculture market report based on component, deployment, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Livestock Monitoring

-

Precision Farming

-

Supply Chain Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global connected agriculture market size was estimated at USD 4.95 billion in 2023 and is expected to reach USD 5.70 billion in 2024.

b. The global connected agriculture market is expected to grow at a compound annual growth rate of 16.9% from 2024 to 2030 to reach USD 14.51 billion by 2030.

b. North America dominated the connected agriculture market with a share of over 37.0% in 2023. This is attributable to the developed technological infrastructure and the presence of numerous market players.

b. Some key players operating in the connected agriculture market include Deere & Company, Trimble Inc., AGCO Corporation, BASF SE, Bayer AG, Hexagon AB, Topcon, Sentera, Farmers Edge Inc., and CLAAS KGaA mbH.

b. Key factors driving market growth include the increasing food demand and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.