- Home

- »

- Advanced Interior Materials

- »

-

Composite Strengthening Systems Market Size Report, 2030GVR Report cover

![Composite Strengthening Systems Market Size, Share & Trends Report]()

Composite Strengthening Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fiber-Reinforced Polymer (FRP), Fabric-Reinforced Cementitious Matrix (FRCM)), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-330-7

- Number of Report Pages: 68

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

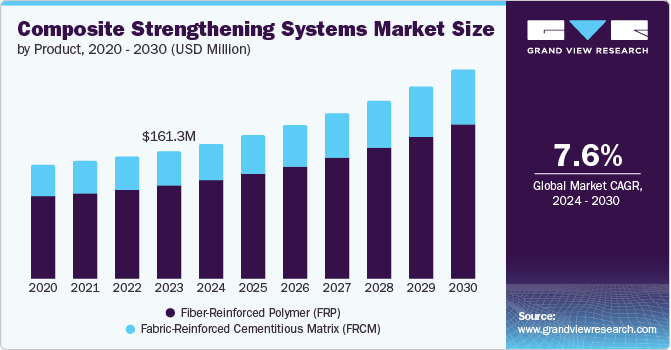

The global composite strengthening systems market size was estimated at USD 161.3 million in 2023 and is projected to grow at a CAGR of 7.6% from 2024 to 2030. The market growth is attributed to the rising demand for repairs and retrofitting of old buildings worldwide. Moreover, the demand for lightweight and sustainable building materials in the U.S., Canada, South Korea, and Germany is expected to drive the demand for composite strengthening systems over the forecast period.

High disposable income levels have been a mark of growth for the middle-class population in developing countries such as India, Brazil, South Africa, and Russia. These markets are witnessing a surge in urbanization, which has helped trigger middle-class income levels. The increasing demand for residential buildings, on account of the above-mentioned factor, is expected to drive construction spending, therefore leading to the growth of the composite strengthening systems market.

After the outbreak of covid-19, countries around the world experienced an economic slowdown. Hence, to revive the economy the national governments have launched initiatives to revive the economy, through investment in constrictions and infrastructural development. For instance, China announced investments worth USD 74.9 billion to revive the slowing economy. China’s continuous demand for infrastructural, residential, and industrial expansion has generated a need for new construction projects.

Similarly, owing to the growing industrialization, the demand for commercial spaces has also increased in the last few years. This has propelled the growth of the construction industry, and this trend is expected to continue over the forecast period.

However, the presence of cement, shotcrete, epoxy mortar, anchors, and epoxy resins is expected to be key barriers for composite strengthening systems manufacturers over the forecast period. They are an ideal material for repair works as they add extra strength to walls and other building structures owing to their high-performing physical characteristics.

Some of the major raw materials used to produce composite strengthening systems include carbon fiber and E-glass fabrics. This is due to the high tensile strength, light weightiness, and durability of these materials. These materials help in improving the load-bearing capacity of the buildings without adding any excessive weight to the structures. Some of the major suppliers of raw materials in JPS Composite Materials, LeapTech, LLC., BGF Industries, Hexcel, Mitsubishi Chemical Corporation, and Solvay.

Industry Dynamics

Market growth stage is medium, and pace of the growth is accelerating. The degree of innovation is moderate as construction industry is evolving with innovative methods and materials. For instance, carbon fiber is now used for composite strengthening systems owing to its durability, strength, and lightweight properties.

The global composite strengthening systems market is moderately consolidated with a few key players holding a majority of the market share. Their expertise in R&D, intellectual properties, and established brands make it difficult for the new entrants to operate profitably in the market. However, growing demand for product innovation coupled with the development of products in specific applications is expected to augment the potential market opportunity.

The market is governed by several bodies around the world that pass regulations regarding the production/use of composite strengthening systems such as American Concrete Institute (ACI) and the International Concrete Repair Institute (ICRI). These organizations influence and pass regulations by influencing product standards, building codes, safety requirements, and environmental regulations.

Superior properties of composites such as design flexibility, corrosion resistance, and high performance at elevated temperatures reduce the threat of substitutes to some degree. However, presence of cement, shotcrete, epoxy mortar, anchors, and epoxy resins is expected to remain a key threat. Owing to these factors, the threat of substitutes remains high.

The end-users of composite strengthening systems include residential as well as commercial structures such as buildings, industrial sites, and infrastructural projects including bridges, heritage sites, and tunnels & culverts. The use of composite strengthening systems helps in improving in durability and performance of the structures, thereby leading to a medium level of end user concentration.

Product Insights

Fiber-reinforced polymer (FRP) accounted for the fastest and largest market in 2023, with a revenue share of73.0% owing to the increasing rate of retrofitting and rehabilitation of aging structures around the world. FRP composite materials, such as carbon fiber-reinforced polymers (CFRP) and glass fiber-reinforced polymers (GFRP), offer exceptional strength-to-weight ratios, providing high strength and stiffness while being lightweight.

FRP exhibits excellent resistance to corrosion, fatigue, and environmental degradation, making them ideal for strengthening and reinforcing various structural elements such as beams, columns, slabs, walls, and bridges. These factors are expected to boost the product demand over the forecast period.

Fabric-reinforced cementitious matrix (FRCM) is expected to grow at the significant CAGR of 7.0% over the forecast period. FRCM systems consist of a cementitious matrix reinforced with high-strength fibers, such as carbon, glass, or aramid. These materials offer high tensile strength, flexural strength, and crack resistance. They also provide excellent durability, fire resistance, and resistance to moisture and chemical exposure, resulting in the substantial growth of the product.

FRCM systems are suitable for strengthening and repairing various structural elements, including concrete, masonry, and timber. They are commonly used for retrofitting, rehabilitation, and seismic retrofitting of buildings, bridges, tunnels, and other infrastructure. Hence, with the increasing retrofitting projects for building and infrastructural activities, the demand for FRCM composite strengthening systems is forecasted to grow over the coming years.

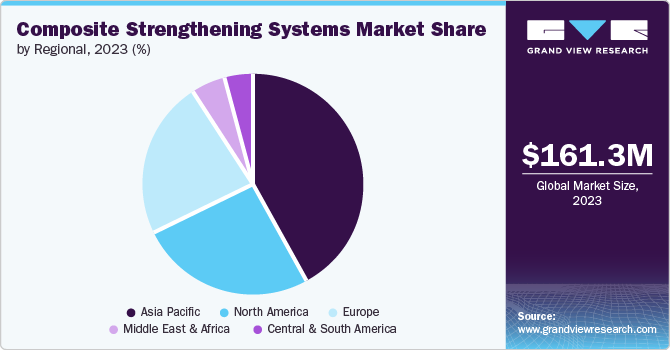

Regional Insights

North America composite strengthening systems market is rising owing to increasing renovation and refurbishment activities, which aim to maintain the structural integrity of buildings and ensure the safety of residents in developed economies such as the U.S. and Canada.

U.S. Composite Strengthening Systems Market Trends

The U.S. has several seismic-prone states, which damages to buildings and infrastructure of the country. These factors further increase the refurbishment activities, which in turn, increases the demand for composite strengthening systems in the U.S.

Asia Pacific Composite Strengthening Systems Market Trends

The composite strengthening systems market in Asia Pacific accounted for the largest revenue market share of 41.7% in 2023. This growth is attributed to the growing infrastructural development in countries such as India, China, Japan, and Australia, rising awareness of the benefits of strengthening systems, and favorable government policies related to the use of sustainable construction materials.

Composite strengthening systems market in India is growing at a CAGR of 8.2% over the forecast period from 2024 to 2030. The rapid urbanization and economic expansion in the country have led to massive investments in new infrastructure projects like bridges, tunnels, highways, airports, and industrial facilities in the country.

China composite strengthening systems market accounted for the largest revenue share of 39.1% in the region for the year 2023 owing to the boost in the number of renovations of old neighborhoods and community development under the 14th Five Year Plan introduced in 2020.

Europe Composite Strengthening Systems Market Trends

The composite strengthening systems market in Europe was valued at USD 36.8 million in 2023. The countries in the region such as the UK, France, and Italy have rich cultures of ancient and historic places such as castles, palaces, town halls, and churches. This results in continuous renovation activities related to the strengthening of structures to preserve them. This is expected to keep the demand for composite strengthening systems market in the region over the coming years.

UK composite strengthening systems market is growing and the UK government is expected to introduce positive policy stimulus to support the growth in the commercial and civil engineering sectors, thereby boosting the demand for composite strengthening systems in the UK.

The composite strengthening systems in Germany accounted for a revenue of USD 6.5 million in 2023. The country is well-known for its architectural heritage comprising many historic structures. This is expected to drive the demand for renovation activities to strengthen the structures in order to preserve them.

Poland composite strengthening systems market haswitnessed an increased growth of 0.3% in the GDP in 2023, moreover, economic growth in 2024 is expected to oscillate around 2.3%. Positive economic developments in the country are expected to boost the per capita income, thereby driving the demand for housing. This, in turn, is anticipated to have a positive impact on the growth of Poland's composite strengthening systems market.

Composite strengthening systems market in Netherlands accounted for the revenue of a share of 5.7% in the Europe market, in 2023. According to Cultural Heritage Agency, the country has the presence of thirteen sites listed in the UNESCO World Heritage Sites list. These sites are considered a crucial part of the country’s culture and preservation of the following structures is important. This is expected to fuel the demand for composite strengthening systems in Netherlands.

Central & South America Composite Strengthening Systems Market Trends

Central & South America composite strengthening systems market is growing at a CAGR of 6.9% from 2024 to 2030. Government investments in tunnels, bridges, and residential and commercial buildings are projected to drive the need for composite strengthening systems. For instance, in 2023 the plans for development of a new underwater tunnel for Brazil’s port of Santos.

Middle East & Africa Composite Strengthening Systems Market Trends

Middle East & Africacomposite strengthening systems market is expected to reach USD 12.9 million by the end of 2030. The rapid urbanization in major economies of the MEA region such as Saudi Arabia, UAE, and South Africa is expected to contribute to increased demand for construction and infrastructure solutions, including composite strengthening systems.

Key Composite Strengthening Systems Company Insights

Some of the key players operating in the market include Simpson Strong-Tie Company, Inc., Sika Canada Inc., Master Builders Solutions, and Freyssinet:

-

Simpson Strong-Tie Company, Inc. produces & offers its products through various product lines including connectors, fastening systems, lateral systems, structural steel, anchoring systems, repair, and protection & strengthening systems.

-

Sika Canada Inc. is a subsidiary of Sika Group. The production and regional offices of the company are located in Ontario, Alberta, and British Columbia. Additionally, it offers its products through three segments including construction professionals, industry & manufacturing, and DIY & home improvements.

Norcon Corporation, Concrete Repairs Ltd., Gateway Composites LLC, Blome International and Shanghai Horse Construction Co., Ltd are some of the emerging participants in the market.

-

Shanghai Horse Construction Co., Ltd is involved in the production of structural strengthening systems. Furthermore, it has a production facility of 5000 cubic meters located in China.

-

Blome International offers corrosion-resistant linings and coatings for various industries including chemical processing, food & beverage, metals & mining, power, pulp & paper, etc.

Key Composite Strengthening Systems Companies:

The following are the leading companies in the composite strengthening systems market. These companies collectively hold the largest market share and dictate industry trends.

- Master Builders Solutions

- Concrete Repairs Ltd.

- Shanghai Horse Construction Co., Ltd

- Blome International

- Bhor Chemicals and Plastics Pvt. Ltd.

- Simpson Strong-Tie Company, Inc.

- Sika Canada Inc.

- Freyssinet

- Gateway Composites LLC

- Norcon Corporation

Recent Developments

-

In May 2023, Sika AG acquired MBCC Group, a construction chemical supplier. The acquisition helps Sika strengthen its position across the globe. MBCC Group has operations across 60 countries with 95 production facilities and 6,200 employees.

-

In March 2022, Sika AG acquired Sable Marco Inc., a company involved in the manufacturing of mortars and cementitious materials. The acquisition will drive new opportunities for Sika in Eastern Canada, by improving the company's access to retail distribution channels in Canada.

Composite Strengthening Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 170.6 million

Revenue forecast in 2030

USD 264.4 million

Growth rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Belgium; Netherlands; Poland; Switzerland; Austria; Sweden; Portugal; Norway; Ireland; China; India; Australia

Key companies profiled

Master Builders Solutions; Concrete Repairs Ltd.; Shanghai Horse Construction Co., Ltd; Blome International; Bhor Chemicals and Plastics Pvt. Ltd.; Simpson Strong-Tie Company, Inc.; Sika Canada Inc.; Freyssinet; Gateway Composites LLC; Norcon Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Composite Strengthening Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global composite strengthening systems market report based on product and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fiber-Reinforced Polymer (FRP)

-

Fabric-Reinforced Cementitious Matrix (FRCM)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Belgium

-

Netherlands

-

Poland

-

Switzerland

-

Austria

-

Sweden

-

Portugal

-

Norway

-

Ireland

-

-

Asia Pacific

-

China

-

India

-

Australia

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global composite strengthening systems market size was estimated at USD 161.3 million in 2023 and is expected to reach USD 170.6 million in 2024.

b. The global composite strengthening systems market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 264.4 million by 2030.

b. Among products, fiber-reinforced polymer (FRP) accounted for the largest market in 2023 with a revenue share of 73.0% owing to increasing rate of retrofitting and rehabilitation of aging structures around the world.

b. Some of the key players operating in the composite strengthening systems market include Master Builders Solutions, Concrete Repairs Ltd., Shanghai Horse Construction Co., Ltd., Blome International, Bhor Chemicals and Plastics Pvt. Ltd., Simpson Strong-Tie Company, Inc., and Sika Canada Inc..

b. The key factor that is driving the composite strengthening systems includes the rising demand for repairs and retrofitting of old buildings worldwide and rising demand for lightweight and sustainable building materials in the U.S., Canada, South Korea, and Germany.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.