- Home

- »

- Next Generation Technologies

- »

-

Community Cloud Market Size, Share & Growth Report, 2030GVR Report cover

![Community Cloud Market Size, Share & Trends Report]()

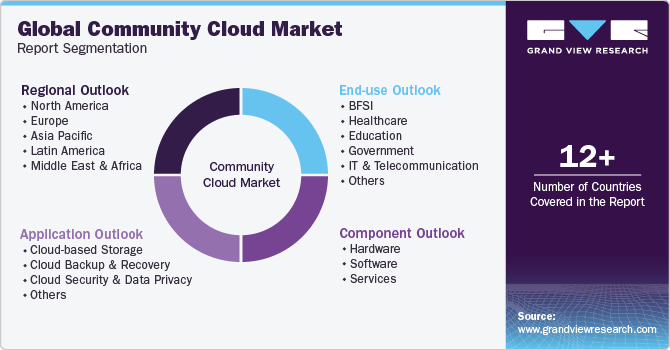

Community Cloud Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Application (Cloud-based Storage, Cloud Backup & Recovery), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-260-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Community Cloud Market Size & Trends

The global community cloud market size was estimated at USD 6.62 billion in 2023 and is projected to grow at a CAGR of 29.2% from 2024 to 2030. The increasing implementation of regulatory compliances and industry-based security requirements are driving the market growth. The global data protection and privacy legislation is diverse and constantly evolving. For example, the California Department of Justice amended the California Consumer Privacy Act (CCPA) in March 2021. The act offers consumers better control over the personal data that businesses collect. By using the community cloud, the implementation of such laws can be ensured.

The community cloud offers industry-based security requirements to regulations such as the Payment Card Industry Data Security Standard (PCI DSS) for the BFSI industry and the Health Insurance Portability and Accountability Act (HIPAA) for the healthcare industry. For instance, Salesforce, Inc. offers a health cloud that delivers improved care and personalized patient experience and simplifies access to healthcare. Salesforce Health Cloud facilitates seamless collaboration among various teams within a service provider, offering a comprehensive 360-degree view of patient data on a platform compliant with HIPAA standards, leading to enhanced outcomes.

Community cloud technology enables businesses to scale their data management infrastructure quickly and easily without incurring significant upfront costs. As data volumes and complexity grow, companies can add more resources to their community cloud database to handle the increased workload. It ensures businesses have the necessary resources to manage their data management needs without investing in costly hardware or software. Community cloud technology offers companies improved data security and disaster recovery capabilities. Community cloud providers offer robust security features and backup solutions, ensuring that data is protected from unauthorized access, loss, or system failures. Knowing that their data is secure and recoverable in a disaster can give businesses peace of mind.

Market Concentration & Characteristics

The market growth stage is high and the pace of growth is accelerating. Government initiatives for adopting community cloud technology in the public and private sectors contribute to market growth. Many organizations recognize the benefits of community clouds, such as cost-effectiveness, enhanced security, and compliance with the regulations, which drive the adoption of community clouds, thus driving the market's growth.

The market is fragmented, featuring several global and regional players. The market players are investing in research & development (R&D) to develop advanced solutions and gain a competitive edge. These investments in R&D highlight the commitment to innovation, driving the growth of community cloud services to meet the evolving demands of users. Moreover, they are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change. These collaborations enable companies to leverage, pool resources, and expand their market reach. By joining forces, organizations can harness complementary strengths, accelerate product development, and enhance their competitive position in the marketplace.

Component Insights

The hardware segment led the market with the largest revenue share of 66.0% in 2023 and is expected to continue its dominance over the forecast period. The hardware in community clouds provides the fundamental infrastructure on which the cloud services are built. It includes servers, storage devices, networking equipment, and data centers. A network relies on physical hardware such as routers, switches, and high-speed cables to serve as the fundamental infrastructure on which virtual networks are built. Security is one of the significant features of the community cloud, and hardware plays a vital role in maintaining it.

The software segment is anticipated to witness the fastest CAGR during the forecast period. Cloud-based software is the application or program managed, stored, and available through the cloud infrastructure. It is generally stored on cloud servers and offers distributed storage, memory, and processing power over the Internet. The applications are stored on remote servers instead of physical locations. The cloud-based software provides benefits such as excellent flexibility, reduced costs, improved data security, and regular updates.

Application Insights

The cloud-based storage segment held the largest revenue share in 2023. Cloud-based storage within a community cloud framework offers storage for organizations and groups with shared interests or requirements. Community cloud-based storage is a platform that enables multiple organizations, such as research institutions, educational institutions, and regional healthcare networks, to store and manage their data securely while sharing specific resources and infrastructure.

Community cloud-based storage enhances collaboration. Organizations within the community can securely share data and resources, promoting more efficient collaboration and data exchange. Many organizations are introducing cloud-based storage solutions to meet the escalating demand in the market. For instance, in July 2023, DigiBoxx, a cloud storage service provider, launched Megh3, a data storage solution for individuals and corporations. Megh3 offers customers simple, fast, and expandable storage solutions at affordable prices.

The cloud security and data privacy segment is expected to witness the fastest CAGR during the forecast period. A community cloud provides a secure and controlled environment suitable for organizations with stringent security and privacy needs. The community cloud is designed to meet industry-specific regulations and compliance requirements, promoting trust and confidence among the participating organizations.

Data privacy is maintained over the community cloud to protect the organization from potential cyberattacks and other cyber threats. Furthermore, community cloud providers implement stringent security measures, such as firewalls, intrusion detection systems, and continuous monitoring, to protect against external threats.

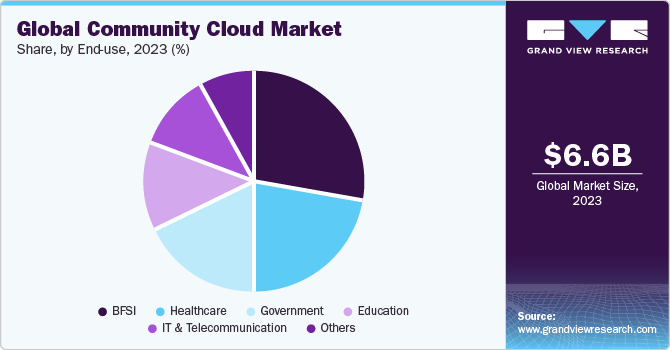

End-use Insights

The BFSI segment held the largest revenue share in 2023 and is projected to grow at a significant CAGR over the forecast period. These organizations are frequently required to exchange sensitive financial information, customer data, and regulatory compliance data, and a community cloud provides a dedicated and trusted environment for such purposes. Community clouds deliver these institutions the advantage of shared resources and expense efficiencies.

The institutions can collaborate in investments for infrastructure, safety protocols, and compliance measures, resulting in a cost-effective solution for small and medium-sized financial organizations. One of the major factors driving the community cloud market growth in the BFSI sector is enhanced data safety and compliance. In 2022, the Indian government reported 1,160,000 cyberattacks on the banking sector in India, marking a threefold increase compared to 2019, thus driving the market growth.

The IT & telecommunication segment is expected to witness the fastest CAGR during the forecast period. The sector requires secure and enhanced computing environments for multiple purposes, such as network infrastructure management, data storage, and developing next-generation communication technologies. Community cloud provides an ideal infrastructure for ensuring compliance with industry-specific regulations and data security standards.

Many multinational companies offer community cloud services to help organizations develop their business on the cloud. For instance, in August 2021, IBM launched IBM Cloud LinuxONE Virtual Servers for VPC. This launch gives distinctive choices for companies and individuals seeking to expand their presence in the cloud supported by a high-performance Linux server tailored for enterprise use.

Regional Insights

North America dominated the market with a revenue share of 35.3% in 2023. This growth is attributed to the secure and controlled environment that the community cloud provides. Many regional companies use community cloud to overcome web compromise safety and security measures. For instance, in January 2022, New Relic formed a Python script that uses the community cloud to identify suspicious SQL queries and reports it to their New Relic One platform. The platform was first introduced and demoed at KubeCon 2022 in Detroit, Michigan.

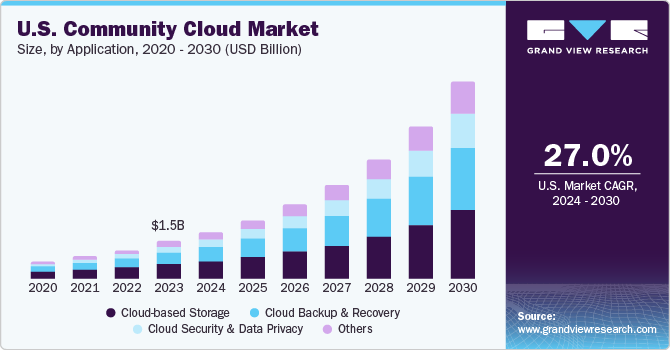

U.S. Community Cloud Market Trends

The U.S. captured a 63.6% share of the global community cloud market in 2023 and is expected to grow at a significant CAGR of 27.0% from 2024 to 2030. The increasing need for compliance and security across various industries such as finance, healthcare, and government due to stringent data security and privacy regulations is driving the market growth.

Europe Community Cloud Market Trends

Europe was identified as a lucrative region in this industry due to the collaborative nature of the community cloud. This cloud model encourages collaboration and information sharing among organizations with the same interests, which leads to innovation and improved business processes. For instance, in September 2023, EUMETSAT and the ECMWF launched the European Weather Cloud. It provides seamless access to functions, services, and online data from EUMETSAT and ECMWF. EWC is a community cloud that offers substantial flexibility, enabling data and service users to personalize and implement their applications and workflows while creating and presenting web-based services.

The UK community cloud market is expected to grow at a significant CAGR over the forecast period, due to the increasing number of collaborative projects between government entities and corporate organizations in the region. For instance, in March 2020, Atos signed a four-year contract worth USD 13.56 million to manage and deliver a cloud platform for Britain's rail infrastructure operations.

The community cloud market in Germany is expected to grow over the forecast period. Germany is a leading hub for manufacturing and industrial innovation, which contributes to the market growth. With many companies operating in the machinery, automotive, electronics, and engineering sectors, there is a growing need for efficient data management, and the community cloud provides an ideal infrastructure for it.

Asia Pacific Community Cloud Market Trends

The Asia Pacific is anticipated to grow at the fastest CAGR of 32.2% during the forecast period. The rapid economic growth in the region is expected to drive the growth of the community cloud industry as it offers scalable and cost-effective cloud solutions.

The China community cloud market is expected to grow at a significant CAGR over the forecast period, owing to the growing concerns of data breaches and cyberattacks on the public cloud platforms in the region. Community clouds enhance security and strengthen organizations' defenses against evolving cybersecurity threats. Huawei Cloud is one of the prominent players in the Chinese market and is ranked first in China's financial cloud infrastructure market in 2022. It has transformed China's 12 joint-stock commercial and Big 6 banks on the cloud.

The community cloud market in India is expected to grow significantly over the forecast period due to the country's rapid developments in IT infrastructure. Moreover, the country's developing financial sector drives demand for the community cloud services.

Middle East & Africa Community Cloud Market Trends

Middle East & Africa is expected to witness growth during the forecast period. The growing awareness of cybersecurity threats and the need for robust data protection measures are driving organizations the adoption of community cloud in the Middle East & Africa. Community clouds offer enhanced security features, such as encryption, access controls, and threat detection, tailored to the needs of specific industries or communities, thereby mitigating the risks associated with data breaches and cyberattacks.

The UAE community cloud market is expected to grow significantly over the forecast period. The industries in UAE are adopting community cloud to expand their businesses and cater to the consumer demand. For instance, in July 2021, EI-Technologies MENA, a CRM partner delivering technology consulting services, signed contracts with four industries to push their digital transformation strategies. Under the agreement, the company will provide high-end CRM resolutions and cloud consulting services from Marketing Cloud, Salesforce Service Cloud, Community Cloud, eCommerce Cloud, and Sales Cloud.

Key Community Cloud Company Insights

Some of the key players operating in the market include Microsoft; IBM; Amazon Web Services, Inc.; Cloud4C; and phoenixNAP.

-

IBM Corporation is a technology company that provides hardware, software, and IT and consulting services. The software business covers the company's software solutions, hybrid cloud platform, and optimizations for that platform. It helps customers create data-driven, secured, modernized, and automated environment for data storage and exchange. Their software arm includes two business areas, namely, transaction processing and hybrid platforms & solutions. The consulting business offers market-leading capabilities and deep industry expertise in technology implementation and business transformation.

-

Microsoft is a multinational technology corporation that provides computer software, personal computers, consumer electronics, and other services. The company operates through segments including Productivity and Business Processes, More Personal Computing, and Intelligent Cloud business. The company's Intelligent Cloud segment provides private, public, community, and hybrid cloud services and server products. The company's server products and cloud services include Windows Server, Visual Studio, and Azure. Azure provides customers with networking, computing, and storage solutions. It provides solutions for next-generation computing types, such as high-performance and quantum computing.

-

PhoenixNAP is an IT service provider delivering technology solutions from locations worldwide that are easy to deploy and have reasonable OpEx payment options, a strong up-time, and quick response time. PhoenixNap's services include secure and scalable data center facilities, high-performance cloud computing, and a robust network infrastructure. PhoenixNap is a PCI DSS Service Provider, and its primary facility has undergone audits to achieve SOC Type 2 and SOC Type 1 certification.

Key Community Cloud Companies:

The following are the leading companies in the community cloud market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Cloud4C

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Microsoft

- Salesforce, Inc

- CTRLS Datacenters Ltd.

- phoenixNAP

- Akamai Technologies

- Amazon Web Services, Inc.

- Atos SE

- Broadcom

- Dell, Inc.

- Google,Inc.

- FourNet

Recent Developments

-

In February 2023, Intel established a next-generation processor research and development lab at the CtrlS Datacenters facility in Bengaluru. This new facility extends Intel’s global advanced data center development labs and focuses on developing new microprocessor architectures. Moreover, the initiative includes the launch of Rated-4 Datacenters, DR as a Service (DRaaS), the first Rated Four cloud with the first community cloud for banks, and built-in DR.

-

In February 2022, IBM GBS acquired 7Summits, which has a background in the Salesforce Experience cloud and has developed 70 accelerators based on the Experience cloud. The acquisition aligns with the strategy to divest a significant portion of its GTS business.

Community Cloud Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.37 billion

Revenue forecast in 2030

USD 39.03 billion

Growth rate

CAGR of 29.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Netherlands; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Cisco; Cloud4C; Hewlett Packard Enterprise (HPE); IBM; Atos SE; Microsoft; Salesforce; CTRLS Datacenters Ltd.; phoenixNAP; Akamai Technologies; Amazon Web Services; Broadcom; Dell Inc.; Google Inc.; FourNet

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Community Cloud Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global community cloud market report based on component, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Networking

-

Storage

-

Server

-

-

Software

-

Enterprise Applications Software

-

Business Intelligence & Dashboard

-

Collaboration Tool Software

-

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based Storage

-

Cloud Backup and Recovery

-

Cloud Security and Data Privacy

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Healthcare

-

Education

-

Government

-

IT & Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global community cloud market size was estimated at USD 6.62 billion in 2023 and is expected to reach USD 8.37 billion in 2024

b. The global community cloud market is expected to grow at a compound annual growth rate of 29.2% from 2024 to 2030, reaching USD 39.03 billion by 2030

b. North America dominated the market with a revenue share of 35.3% in 2023. Regional growth is attributed to the secure and controlled environment that the community cloud provides.

b. Some key players operating in the community cloud market include Cisco, Cloud4C, Hewlett Packard Enterprise (HPE), IBM, Atos SE, Microsoft, Salesforce, CTRLS Datacenters Ltd., phoenixNAP, Akamai Technologies, Amazon Web Services, Broadcom Inc., Dell Inc., Google Inc., FourNet

b. The factors such as increasing trends in the implementation of regulatory compliances and industry-based security requirements are driving the growth of the community cloud market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.