- Home

- »

- Next Generation Technologies

- »

-

Commercial Refrigeration Equipment Market Report, 2033GVR Report cover

![Commercial Refrigeration Equipment Market Size, Share & Trends Report]()

Commercial Refrigeration Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Beverage Refrigeration, Display Showcases), By System Type, By Capacity, By Application, By Refrigerant, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-531-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Commercial Refrigeration Equipment Market Summary

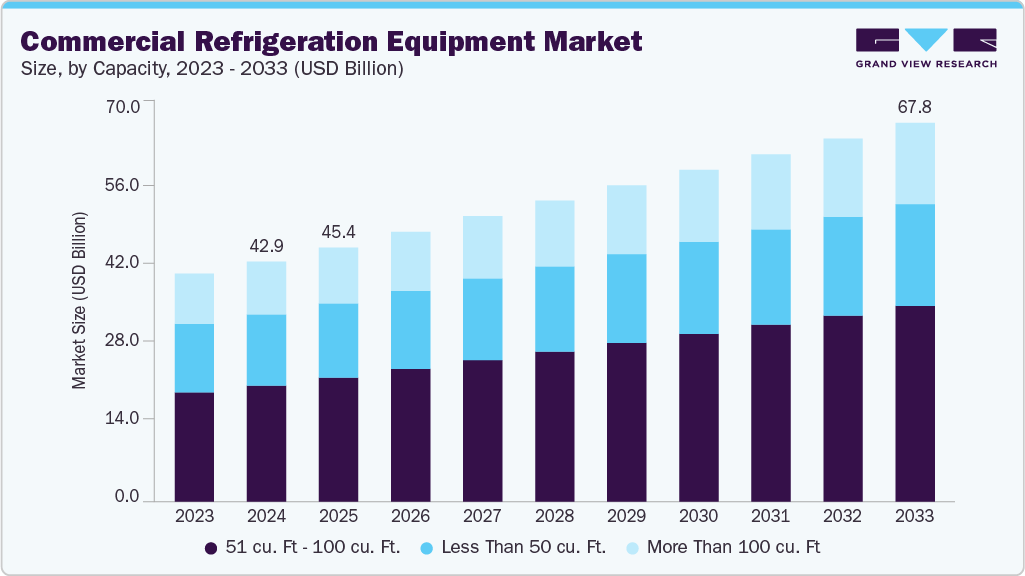

The global commercial refrigeration equipment market size was valued at USD 42.94 billion in 2024 and is projected to reach USD 67.80 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The growth is primarily driven by the hospitality and tourism sector.

Key Market Trends & Insights

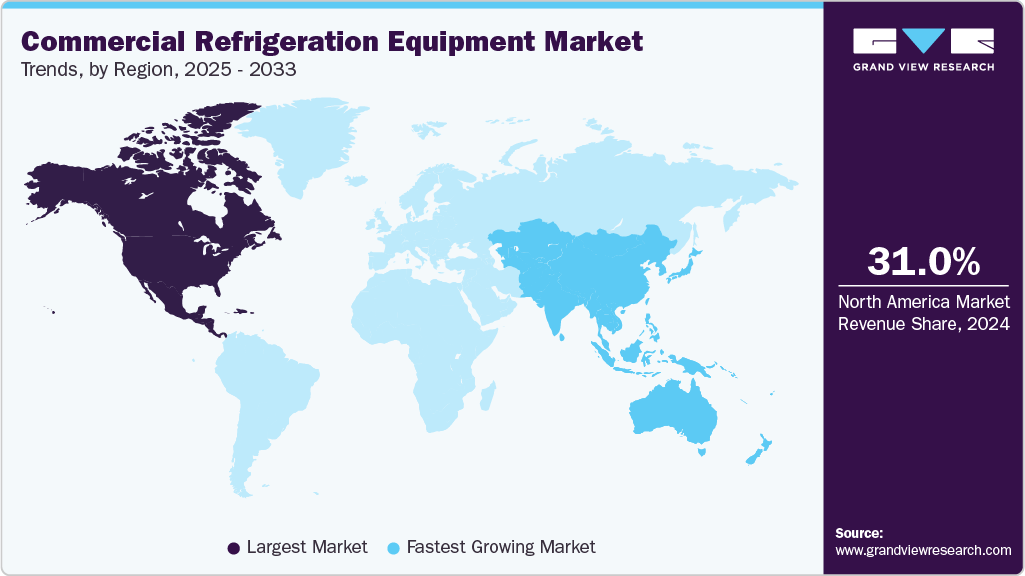

- North America dominated the global commercial refrigeration equipment market with the largest revenue share of over 31% in 2024.

- The commercial refrigeration equipment market in the U.S. led the North American region and held the largest revenue share in 2024.

- By product, the refrigerators & freezers segment led the market and held the largest revenue share of over 28% in 2024.

- By system type, the self-contained segment led the market and held the largest revenue share of over 86% in 2024.

- By capacity, the 51 cu. Ft - 100 cu. Ft. segment dominates the market and holds the largest revenue share of over 49% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 42.94 Billion

- 2033 Projected Market Size: USD 67.80 Billion

- CAGR (2025-2033): 5.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing preference among end-consumers for takeaway meals is expected to drive market growth over the forecast period. Increasing regulatory implications resulting in the adoption of lower global warming potential (GWP) commercial refrigerants, coupled with ongoing technological breakthroughs, will also provide growth prospects for the market. The growth is primarily driven by the increasing demand for energy-efficient and eco-friendly refrigeration solutions across the retail, hospitality, and healthcare sectors. The rising emphasis on reducing greenhouse gas emissions and compliance with stringent environmental regulations encourages the adoption of advanced refrigerants and sustainable cooling technologies. The integration of IoT-enabled monitoring systems and smart temperature controls is enhancing operational efficiency, predictive maintenance, and food safety, thereby accelerating market adoption. Ongoing innovations in modular and plug-in refrigeration units are improving installation flexibility and cost-effectiveness, which is expected to drive the commercial refrigeration equipment industry expansion.

The rising demand for energy-efficient and eco-friendly refrigeration solutions is significantly fueling the growth of the commercial refrigeration equipment industry. With increasing regulatory pressure and growing environmental awareness, businesses in food retail, hospitality, and cold storage are actively shifting towards equipment that consumes less energy and uses low-GWP (Global Warming Potential) refrigerants. Manufacturers are investing heavily in the development of inverter-based compressors, smart defrost systems, and LED lighting integrations. This transition reduces operating costs for end-users and aligns with global sustainability goals, thereby accelerating market expansion.

Additionally, the increasing need for advanced food safety and storage solutions is becoming a major growth driver for the market. As global supply chains grow more complex and foodborne illness regulations tighten, commercial enterprises are prioritizing refrigeration units with precise temperature control, real-time monitoring, and data logging capabilities. The integration of IoT and remote diagnostics in modern commercial refrigeration systems ensures compliance, reduces spoilage, and enhances operational transparency, boosting adoption across supermarkets, restaurants, and logistics facilities.

Furthermore, the rapid growth of the foodservice and retail industries particularly in emerging markets is creating robust demand for commercial refrigeration equipment. Expanding urbanization, rising disposable incomes, and evolving consumer habits are driving the proliferation of quick-service restaurants, convenience stores, and hypermarkets. The increasing construction of commercial kitchens and retail outlets is directly translating into higher demand for a wide range of refrigeration systems, from reach-in freezers to refrigerated display cases, thereby boosting the commercial refrigeration equipment industry growth.

Moreover, technological advancements in refrigeration equipment design and automation are enhancing user experience and operational efficiency. Features such as adaptive defrost, touchscreen controls, automatic door closers, and cloud-based performance analytics are redefining the industry standard. These innovations allow for better energy optimization, minimal maintenance, and improved equipment lifespan. Manufacturers that integrate such smart technologies into their commercial refrigeration solutions are witnessing greater traction among end-users seeking performance, durability, and ease of use further propelling market growth.

Product Insights

The refrigerators and freezers segment dominated the market with the largest revenue share of over 28% in 2024, driven by the global expansion of the travel and tourism industry, which has led to the proliferation of food joints, cafes, and quick-service restaurants requiring reliable refrigeration solutions. The inclusion of blast chillers, known for their rapid cooling capabilities to inhibit bacterial growth and preserve food safety, further strengthens the segment. The increasing use of commercial refrigeration units in the healthcare sector for storing vaccines, tissue samples, and sensitive medical supplies under tightly controlled temperatures continues to expand the application scope and reinforces the segment’s momentum in the commercial refrigeration equipment industry.

The beverage refrigeration segment is expected to witness the highest CAGR of over 6% from 2025 to 2033. This growth is attributed to the rising global consumption of bottled drinks, energy beverages, dairy-based drinks, and ready-to-serve refreshments. The segment is further driven by the rapid expansion of convenience stores, fuel stations, cafes, and quick-service restaurants. Innovations such as energy-efficient glass-door coolers, smart temperature regulation, and LED-based product illumination are enhancing product visibility and appeal, contributing to the segment’s rapid adoption in the commercial refrigeration equipment market.

Capacity Insights

The 51 cu. Ft. to 100 cu. Ft. segment accounted for the largest market share in 2024, owing to the rising demand for mid-sized refrigeration units that balance storage capacity with space efficiency. These units are particularly favored by small to medium-sized restaurants, convenience stores, and catering businesses that require reliable cold storage without occupying excessive floor space. The segment’s growth is further supported by technological advancements such as digital temperature controls, energy-efficient compressors, and modular shelving systems. This combination of performance, footprint optimization, and cost-effectiveness continues to drive the dominance of this segment in the commercial refrigeration equipment industry.

The more than 100 cu. Ft. segment is expected to witness a significant CAGR from 2025 to 2033. This is driven by the rising demand for large-sized and energy-efficient refrigeration units across small-format retail stores, cafes, and food trucks. As urban spaces become increasingly constrained, businesses are prioritizing refrigeration solutions that offer optimal storage within minimal footprints. The growing trend of modular kitchen setups, point-of-sale coolers, and countertop merchandisers is reinforcing the need for large-capacity systems. These units are gaining traction in healthcare and pharmaceutical applications for storing temperature-sensitive items in clinics and labs, further propelling the segment's expansion in the commercial refrigeration equipment market.

Application Insights

The food service segment accounted for the largest market share in 2024, owing to the rapid expansion of quick-service restaurants, cloud kitchens, and full-service dining establishments worldwide. This growth is driving demand for reliable refrigeration systems to ensure food safety, extend shelf life, and maintain compliance with health regulations. The need for walk-in coolers and prep table refrigeration units that support high-volume kitchen operations is particularly pronounced. The increasing frequency of dining-out trends, coupled with the emergence of organized food delivery platforms, reinforces the segment’s dominance in the commercial refrigeration equipment industry.

The pharmaceutical retail segment is expected to witness the highest CAGR from 2025 to 2033. This growth is driven by the rapid expansion of pharmaceutical manufacturing and cold chain logistics infrastructure. Pharmaceutical companies are prioritizing energy-efficient and highly reliable cold storage units to ensure product safety and regulatory compliance. The rising focus on personalized medicine and the distribution of mRNA-based therapies is driving the need for ultra-low temperature refrigeration, reinforcing the segment’s leadership in the commercial refrigeration equipment industry.

Refrigerant Insights

The synthetic refrigerants (HFCs, HCFCs) segment accounted for the largest market share in 2024, owing to their widespread availability, proven reliability, and established infrastructure across commercial refrigeration systems. These refrigerants are extensively used in a broad range of equipment, including reach-in coolers, display cases, and walk-in freezers. Their favorable thermodynamic properties ensure consistent cooling performance, ease of servicing, and compatibility with existing equipment. The combination of technical reliability and cost-efficiency reinforces the dominance of the synthetic refrigerants segment in the commercial refrigeration equipment industry.

The natural refrigerants segment is expected to witness the highest CAGR from 2025 to 2033. This growth is driven by stringent environmental regulations and global initiatives to phase down high-GWP synthetic refrigerants. Technological advancements in system design such as improved heat exchangers, microchannel coils, and leak-proof components have enhanced the safety and performance of natural refrigerant-based systems. Increasing demand for eco-friendly refrigeration in food retail, cold chain logistics, and healthcare facilities is further propelling the segment’s expansion.

Distribution Channel Insights

The retailers segment accounted for the largest market share in 2024, owing to the rising demand for mid-sized commercial refrigeration systems that offer a balance between capacity and energy efficiency. These systems are widely adopted by supermarkets, grocery chains, and convenience stores to ensure optimal product preservation and temperature control across varied merchandise categories. Technological advancements such as remote monitoring, adaptive defrosting, and natural refrigerant-based systems are enhancing system reliability while minimizing operational costs. This integration of performance, compliance, and sustainability continues to strengthen the segment’s leadership in the commercial refrigeration systems industry.

The OEMs (original equipment manufacturers) segment is expected to witness the highest CAGR from 2025 to 2033. This is driven by the rising demand for compact and energy-efficient refrigeration units across small-format retail stores, cafes, and food trucks. The growing trend of modular kitchen setups, point-of-sale coolers, and countertop merchandisers is reinforcing the need for small-capacity systems. OEMs are also driving growth by accelerating R&D investments to develop advanced compressor technologies, leveraging IoT for remote diagnostics and system optimization, and offering customized refrigeration solutions tailored to specific industry needs. Furthermore, strategic partnerships between OEMs and component suppliers are enhancing production efficiency and reducing time-to-market for next-generation refrigeration systems.

System Type Insights

The self-contained segment accounted for the largest market share in 2024, owing to the rising preference for plug-and-play refrigeration solutions across foodservice outlets, convenience stores, and small retail chains. These units offer simplified installation, mobility, and low maintenance requirements, making them ideal for businesses seeking quick deployment and operational flexibility. Regulatory shifts favoring low-GWP refrigerants and the integration of eco-friendly compressors and insulation technologies are prompting end-users to replace older systems with modern self-contained units, reinforcing the segment’s dominance in the commercial refrigeration equipment market.

The remotely operated refrigerators segment is expected to witness a significant CAGR from 2025 to 2033. This growth is driven by the rising demand for real-time temperature monitoring and remote asset management across the pharmaceutical and logistics sectors. The integration of features such as remote diagnostics, automated alerts, and usage analytics ensures minimal downtime, reduced operational costs, and enhanced compliance. As end-users prioritize transparency, automation, and smart inventory control, investment in remotely operated refrigeration solutions continues to accelerate, solidifying the segment’s leadership in the commercial refrigeration equipment industry.

Regional Insights

North America commercial refrigeration equipment market accounted for the largest share of over 31% in 2024, primarily driven by the mature retail industry and the availability of major supermarket chains, such as Walmart, Costco, Kroger, Publix, etc., in the region. Besides, the strong presence of various leading manufacturers of commercial refrigeration equipment, coupled with the early adoption of smart equipment across commercial kitchens, is favoring the expansion of the commercial refrigeration equipment market.

U.S. Commercial Refrigeration Equipment Market Trends

The commercial refrigeration equipment market in the U.S. is expected to grow at a CAGR of over 4% from 2025 to 2033. The expansion of retail chains, convenience stores, and grocery stores, along with increasing demand for fresh and frozen food products in the U.S. region, is expected to drive market growth in the upcoming years. Technological innovation aimed at reducing energy consumption and reducing the impact on the environment by focusing on the application of natural refrigerants is expected to strengthen the expansion of the commercial refrigeration equipment industry in the U.S.

Europe Commercial Refrigeration Equipment Market Trends

The commercial refrigeration equipment market in Europe is expected to grow at a CAGR of over 3% from 2025 to 2033. In Europe, the market is driven by stringent energy efficiency regulations and increasing adoption of eco-friendly refrigerants in response to the EU’s F-Gas Regulation and sustainability goals. Retailers and foodservice operators are investing in next-generation refrigeration systems that minimize carbon footprints and ensure regulatory compliance. The growing focus on food safety, traceability, and cold chain integrity is boosting demand for smart, connected refrigeration units. With strong governmental support for green technologies and the modernization of commercial infrastructure, the market for commercial refrigeration equipment in Europe continues to gain momentum.

The U.K. commercial refrigeration equipment market is expected to grow at a significant rate in the coming years. The country benefits from a well-established food retail and hospitality sector, supported by a strong network of supermarkets, restaurant chains, and convenience stores. The rising demand for chilled ready meals, organic produce, and online grocery delivery services is accelerating investments in reliable cold storage infrastructure, fostering a favorable environment for market expansion in the U.K.

The commercial refrigeration equipment market in Germany is fueled by the country’s strong food retail infrastructure, stringent energy efficiency regulations, and rising demand for sustainable refrigeration technologies. Germany’s leadership in implementing environmentally friendly policies, such as phasing out high-GWP refrigerants, has prompted widespread adoption of next-generation cooling systems. The expansion of supermarket chains, organic food retailers, and convenience stores across urban centers is driving consistent growth, solidifying Germany’s position as a key market in the European region.

Asia Pacific Commercial Refrigeration Equipment Market Trends

The commercial refrigeration equipment market in Asia Pacific is expected to grow at the highest CAGR of over 7% from 2025 to 2033, fueled by rapid urbanization, expanding retail infrastructure, and rising consumer demand for frozen and chilled food products across emerging economies. Countries are witnessing a surge in supermarket chains, cold storage facilities, and quick-service restaurants, driving the need for reliable refrigeration systems. Government initiatives supporting food safety, reduction of post-harvest losses, and infrastructure development in cold chain logistics are further boosting market growth. Increasing investments by global manufacturers and local players are reinforcing the region’s leadership in the commercial refrigeration equipment industry.

The Japan commercial refrigeration equipment market is gaining traction, driven by the country’s advanced retail infrastructure and stringent food safety regulations. Japan’s dense urban population and limited retail space have accelerated demand for compact, high-performance refrigeration units. The government’s push toward reducing carbon emissions has encouraged the adoption of natural refrigerants and energy-efficient technologies. The integration of smart monitoring systems and IoT-enabled refrigeration solutions is also enhancing operational efficiency and compliance, further propelling the market's expansion across Japan.

The commercial refrigeration equipment market in China is rapidly expanding. China's booming food retail and e-commerce sectors, driven by rising urbanization and a growing middle class, are significantly increasing the demand for advanced refrigeration solutions. The surge in online grocery delivery services and fresh food e-commerce platforms is prompting investments in cold chain infrastructure and energy-efficient commercial refrigeration units. The combination of consumer demand, regulatory support, and technological advancement is propelling the market's growth.

Key Commercial Refrigeration Equipment Companies Insights

Key players operating in the commercial refrigeration equipment market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Commercial Refrigeration Equipment Companies:

The following are the leading companies in the commercial refrigeration equipment market. These companies collectively hold the largest market share and dictate industry trends.

- AHT Cooling Systems GmbH

- Carrier.

- Daikin Industries Ltd.

- Dover Corporation

- Electrolux AB

- Ali Group

- Hussmann Corporation

- Illinois Tool Works Inc.

- Johnson Control

- Lennox International Inc.

- Whirlpool Corporation

- Panasonic Corporation

Recent Developments

-

In May 2025, AHT Cooling Systems GmbH introduced SPI CIRCUMPOLAR, a patented modular pump station for semi-plug-in water-loop refrigeration systems. This innovation enhances flexibility, scalability, and integration in the commercial refrigeration equipment industry, driving sustainability and efficiency improvements. Such advancements are pivotal in addressing the growing demand for eco-friendly and high-performance refrigeration solutions across the global retail and foodservice sectors.

-

In May 2025, Hussmann Corporation signed an exclusive distribution partnership with Lithuanian manufacturer Refra to offer transcritical CO₂ racks and R290 heat pump solutions across Australia and New Zealand, expanding its natural‑refrigerant portfolio. This strategic move strengthens Hussmann’s commitment to sustainable refrigeration and reinforces its competitive position in the global commercial refrigeration equipment market.

-

In April 2025, Daikin launched the Pro‑C CRAH range, new computer room air handlers delivering 30-210 kW cooling, optimized controls, and modular architecture to boost efficiency in data center refrigeration applications. This launch underscores Daikin's commitment to innovation and strengthens its competitive position in the commercial refrigeration equipment industry.

Commercial Refrigeration Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.43 billion

Revenue forecast in 2033

USD 67.80 billion

Growth rate

CAGR of 5.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Report updated

August 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, system type, refrigerant, capacity, application, distribution channel, and region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; South Africa

Key companies profiled

AHT Cooling Systems GmbH; Carrier.; Daikin Industries Ltd.; Dover Corporation; Electrolux AB; Ali Group; Hussmann Corporation; Illinois Tool Works Inc.; Johnson Control; Lennox International Inc.; Whirlpool Corporation; Panasonic Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Commercial Refrigeration Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global commercial refrigeration equipment market report based on product, application, system type, refrigerant, capacity, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Transportation Refrigeration Equipment

-

Trailers

-

Trucks

-

Shipping Containers

-

-

Refrigerators & Freezers

-

Walk-in-Refrigerators

-

Reach-in Refrigerators

-

Chest

-

-

Beverage Refrigeration

-

Display Showcases

-

Ice Cream Cabinets

-

Bakery/Deli Display

-

Others

-

-

Ice Merchandisers & Ice Vending Equipment

-

Other Equipment

-

-

System Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Self-contained

-

Remotely Operated

-

-

Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Less than 50 cu. Ft

-

51 to 100 cu. Ft

-

More than 100 cu. Ft

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food Service

-

Food & Beverage Retail

-

Hypermarkets

-

Supermarkets

-

Convenience Store

-

Specialty Food Store

-

Others

-

-

Hotels and Hospitality

-

Pharmaceuticals

-

Healthcare

-

Biotechnology

-

Chemicals

-

Others

-

-

Refrigerant Outlook (Revenue, USD Million, 2021 - 2033)

-

Synthetic Refrigerants (HFCs, HCFCs)

-

Natural Refrigerants

-

Carbon Dioxide (CO2)

-

Ammonia (NH3)

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

OEMs (Original Equipment Manufacturers)

-

Distributors and Wholesalers

-

Retailers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global commercial refrigeration equipment market was estimated at USD 42.94 billion in 2024 and is expected to reach USD 45.43 billion in 2025.

b. The global commercial refrigeration equipment market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 67.80 billion by 2033.

b. The Asia Pacific commercial refrigeration equipment market is expected to grow at the highest CAGR of over 7% from 2025 to 2033, fueled by rapid urbanization, expanding retail infrastructure, and rising consumer demand for frozen and chilled food products across emerging economies. Government initiatives supporting food safety, reduction of post-harvest losses, and infrastructure development in cold chain logistics are further boosting market growth. Increasing investments by global manufacturers and local players are reinforcing the region’s leadership in the commercial refrigeration equipment industry.

b. The key players in the commercial refrigeration equipment market are AHT Cooling Systems GmbH, Carrier., Daikin Industries Ltd., Dover Corporation, Electrolux AB, Ali Group, Hussmann Corporation, Illinois Tool Works Inc., Johnson Control, Lennox International Inc., Whirlpool Corporation, Panasonic Corporation

b. Key drivers of the commercial refrigeration equipment market include the rising demand for energy-efficient and eco-friendly cooling solutions, growing adoption of advanced refrigeration systems, increasing investments in cold chain infrastructure, technological advancements, and stringent government regulations promoting low-GWP natural refrigerants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.