- Home

- »

- Electronic Security

- »

-

Commercial Radars Market Size And Share Report, 2030GVR Report cover

![Commercial Radars Market Size, Share & Trends Report]()

Commercial Radars Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Antenna, Transmitter), By Platform (Naval, Land), By Frequency (HF/VHF/UHF, L), By Dimension (2D, 3D), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-272-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Commercial Radars Market Size & Trends

The global commercial radars market size was estimated at USD 6.44 billion in 2023 and is expected to grow at a CAGR of 7.6% from 2024 to 2030. Commercial radars are a dynamic market encompassing a wide range of applications such as aviation, marine, weather monitoring, automotive, security, etc. The market has been experiencing growth due to factors such as the increasing demand for weather monitoring systems, rising adoption of Advanced Driver-Assistance Systems (ADAS) in vehicles, air and marine transport expansion, and heightened security measures across various industries.

Technological advancements are continually shaping the commercial radars market. Integration of Artificial Intelligence (AI) and Machine Learning (ML) for enhanced data analysis and decision-making, miniaturization of radar systems for drones and unmanned vehicles, and adoption of phased array systems for more precise and flexible operations further drive the growth of the market. Also, integrating 5G technology into commercial radar systems represents a significant leap forward in performance, efficiency, and capabilities. 5G’s high data transfer rates allow radar systems to process and share vast data in real-time.

Rising geopolitical tensions, cross-border conflicts, and illegal immigration have heightened the need for advanced surveillance and monitoring systems. Radars provide continuous and real-time data, making them indispensable for border security. The Department of Homeland Security (DHS) U.S. Customs and Border Protection (CBP) utilizes Border Surveillance Systems (BSS) to enhance situational awareness along the U.S. border. These systems integrate various commercial technologies such as mobile and fixed video surveillance systems, thermal imaging, ground sensors, radar, and radio frequency sensors to bolster monitoring capabilities along the border.

Market Concentration & Characteristics

The commercial radars industry is concentrated in nature. The pace of industry growth is accelerating and the growth stage is medium. The industry is characterized by a high degree of innovation driven by advancements in radar technology and increasing demands for safety, navigation, and surveillance across various sectors. Radar systems are comparatively more compact and affordable than before without compromising performance. For instance, in November 2023, Simrad Marine Electronics launched HALO 5000 solid-state radar, which provides cutting-edge features such as 130W pulse compression for superior visibility in various conditions, innovative target tracking to monitor numerous radar targets within a 24 nautical mile range, and a modern and compact design that reduces ownership costs compared to conventional radars.

Mergers & Acquisition (M&A) activities are high as companies strive to expand their technological capabilities, market reach, and product portfolios. For instance, in June 2022, Leonardo DRS entered into a strategic merger with RADA, an Israeli radar marker company. The mergers aim to enhance Leonardo's air defense and counter-drone product portfolio by incorporating RADA's radar technology.

The industry's end-user concentration is high as the demand for commercial radars is increasing in sectors such as automotive, aviation and maritime, weather forecasting, ground surveillance, space exploration, and others for safety and surveillance to avoid mishaps.

Component Insights

The antenna segment accounted for the largest revenue share at 21.4% in 2023. The antenna is a crucial element in commercial radars, as it is responsible for transmitting and receiving electromagnetic waves that allow the radar system to detect and locate objects. The performance and capabilities of a radar system are significantly influenced by the design and quality of its antenna. For instance, in January 2023, the Defense Research and Development Organization (DRDO) launched an UnFurlable Reflector Antenna (UFRA) for a space radar system, a vital element for space radars, especially in military space radar applications.

Signal & data processors are anticipated to register the fastest CAGR over the forecast period. Signal and data processors are valuable for processing radar signals to extract useful information about targets. These processors play a vital role in target-clutter separation and include components such as I&Q phase detectors, Moving Target Indication (MTI) techniques, Constant False Alarm Rate (CFAR) detection, plot extraction, and processing that improves the overall radar performance.

Frequency Insights

The S frequency segment accounted for the largest market revenue share in 2023. S-band radar systems are known for monitoring targets over significant distances and through critical atmospheric conditions, making them ideal for applications where extended-range detection is essential. This frequency also provides high-resolution imaging capabilities, allowing for detailed target identification and tracking in commercial settings.

X frequency segment is anticipated to grow at the fastest CAGR over the forecast period. X-band radar systems, which operate at a frequency of 8-12 GHz, are known for their ability to detect small particles due to their shorter wavelength. This makes them particularly useful for studying cloud development and light precipitation, as they can effectively identify tiny water particles and snow. X-band radars have been employed in coastal monitoring to detect changes in river mouth morphology during storm surges and are also utilized for wave field analysis in harbor areas.

Platform Insights

Land platform accounted for the largest market revenue share in 2023. Land-based radar systems are crucial in monitoring and surveilling border security and defense applications. These radars help detect and track potential threats, intrusions, or unauthorized activities, bolstering security measures. Radar technology integrated into vehicles or transportation networks can serve as collision warning systems that detect nearby objects or obstacles in real-time. For instance, in September 2023, Mobileye partnered with Valeo to deliver imaging radars to automakers globally, enabling more intelligent vehicles and enhancing automotive safety and performance.

The naval platform is anticipated to register the fastest CAGR over the forecast period. Commercial radar systems for maritime platforms are typically characterized by compact size, ease of installation, user-friendly interfaces, and cost-effectiveness. These radars are commonly utilized by military forces, commercial shipping companies, fishing fleets, cruise liners, and other maritime operators to enhance situational awareness, improve operational efficiency, and comply with international maritime regulations. For instance, in May 2023, the Indian Navy front-line warships were equipped with Indra’s Lanza 3D surveillance radar incorporating advanced technology and increased capabilities to detect long-range objects.

Dimension Insights

The 2D segment accounted for the largest market revenue share in 2023. The azimuth angle detection feature allows 2D radar systems to determine the horizontal angle of a target object relative to the radar unit. This information is crucial for tracking moving objects and ensuring effective surveillance. 2D radar systems are often more cost-effective, making them suitable for applications without critical elevation.

The 3D segment is anticipated to grow at the fastest CAGR over the forecast period. The increasing demand for surveillance and security systems in various industries, such as aviation, maritime, and defense, is a significant driver for the growth of 3D commercial radars. These radars provide advanced detection capabilities crucial for monitoring and safeguarding critical infrastructure. For instance, in January 2023, Honeywell International Inc. launched RDR-4000, an advanced weather 3D radar system tailored for aircraft use. It is a cutting-edge, automated weather radar system with enhanced resolution that offers a comprehensive perspective of weather conditions from ground level up to 60,000 feet.

Application Insights

Air traffic control & navigation accounted for the largest market share in 2023. Applications for commercial radars, air traffic control, and navigation involve using various surveillance systems and technologies to ensure aircraft's safe and efficient movement. The Federal Aviation Administration (FAA) relies on all-around scanning radar technology that scans through a complete 360-degree span in the horizontal plane. This radar system provides information about detected targets, which is then exhibited on a radar monitor situated in either an air traffic control tower or a regional center.

Airspace monitoring is anticipated to register the fastest CAGR over the forecast period. Commercial radars are vital in airspace monitoring and surveillance, airport perimeter security, weather monitoring, aircraft collision warning, navigation, and more. The growing demand for air travel and the subsequent increase in air traffic drive the need for robust radar systems in airports worldwide. The growth in the market is due to the increasing demand for effective airspace monitoring and management to ensure safety and efficiency in air traffic operations.

Regional Insights

North America accounted for the largest revenue share of 28.3% in 2023. The market has been experiencing growth due to increasing demand for air travel, heightened concerns over security, and the need for weather monitoring and forecasting. Growing investments in radar technology for security enhancement across various sectors fuel the growth of the regional market.

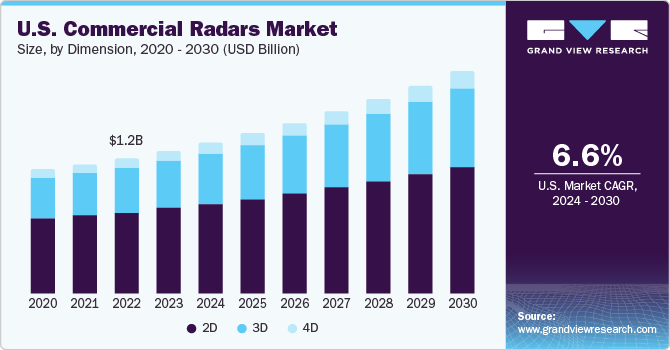

U.S. Commercial Radars Market Trends

The U.S. accounted for over 20% of the global market in 2023 and is expected to grow significantly over the forecast period. In the U.S., the demand for commercial radar systems is driven by factors such as the need for advanced drone detection capabilities at airports, advancements in radar technologies, efficient management of marine transportation, and increasing requirements for weather monitoring and vehicle collision warning systems.

Asia Pacific Commercial Radars Market Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The increasing number of road accidents due to the presence of 2 of the largest populated countries in the world is driving the demand for automotive safety systems, including radars, in the region. According to the World Health Organization (WHO), around 0.6 million road accident fatalities are reported in the region annually, fueling the demand for vehicles' radars for passengers' safety and security.

The China commercial radars market accounted for the largest market revenue share in 2023. China is rapidly advancing in radar technology and has made considerable investments in research and development. The market consists of domestic players such as China Electronics Technology Group Corporation (CETC) and Hikvision, which support the government's policies and investments in the growth of advanced radar systems.

The commercial radars market in India is anticipated to register the fastest CAGR over the forecast period. According to the India Brand Equity Foundation (IBEF), India's aviation market is one of the fastest growing in the world, necessitating enhanced radar systems for air traffic control and management. The country's focus on strengthening its border security and surveillance capabilities has increased demand for advanced radar systems.

Europe Commercial Radars Market Trends

Europe is anticipated to grow significantly over the forecast period. Europe is one of the busiest air travel regions and home to some of the busiest airports in the world, such as Heathrow Airport in the U.K., Istanbul Airport in Turkey, Charles de Gaulle Airport in France, and others. It creates a critical demand for advanced radar surveillance systems to ensure the safety of passengers and maintain the efficiency of aircraft.

Key Commercial Radars Company Insights

Some of the key players operating in the market include Indra Sistemas, S.A., NEC Corporation, and others.

-

Indra Sistemas, S.A. offers a wide range of commercial radars and surveillance systems known for their advanced technologies, reliability, and effectiveness in enhancing air traffic safety and efficiency. These radar systems are utilized in various applications ranging from single-surface aerodrome coverage to the entire country’s route surveillance.

-

NEC Corporation offers commercial radar solutions by delivering innovative and advanced technologies for air traffic control systems and airport operations. NEC provides a comprehensive Air Traffic Control System for managing both route and terminal air traffic, catering to the needs of civil aviation and air defense agencies to ensure air safety and support the increasing demands of air traffic in the future.

Key Commercial Radars Companies:

The following are the leading companies in the commercial radars market. These companies collectively hold the largest market share and dictate industry trends.

- DeTect, Inc.

- Easat Radar Systems Ltd.

- ELDIS Pardubice, s.r.o.

- HENSOLDT AG

- Indra Sistemas, S.A.

- Leonardo S.p.A

- NEC Corporation

- RTX

- Terma

- Thales

Recent Developments

-

In September 2023, RTX and Boeing collaborated to install an Active Electronically Scanned Array (AESA) radar in the U.S. Air Force's B-52 bomber. The radar system allows the user to generate accurate GPS coordinates for the timely and precise launch of guided weapons.

-

In March 2023, DeTect, Inc. launched HARRIER BAR300, its longest-range X-band surveillance radar. The radar is engineered for extensive airspace security, drone operations beyond visual line-of-sight, Aircraft Detection Lighting System (ADLS), bird monitoring, and long-range coastal surveillance applications. It utilizes solid-state technology, ensuring high performance and reliability.

-

In March 2021, Leonardo S.p.A. acquired a 30% stake in GEM elettronica, an Italian firm specializing in 3D short and medium-range surveillance radars. This strategic acquisition by Leonardo aims to bolster its naval electronics offerings, emphasizing the enhancement of short- and medium-range radars for navigation and maritime, coastal, and airport surveillance.

Commercial Radars Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.88 billion

Revenue forecast in 2030

USD 10.66 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, platform, frequency, dimension, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Netherlands; India; China; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

DeTect, Inc.; Easat Radar Systems Ltd.; ELDIS Pardubice, s.r.o.; HENSOLDT AG; Indra Sistemas, S.A.; Leonardo S.p.A; NEC Corporation; RTX; Terma; Thales

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commercial Radars Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global commercial radars market report based on the component, platform, frequency, dimension, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Antenna

-

Transmitter

-

Duplexer

-

Receiver

-

Signal & Data Processors

-

Phased Array

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Naval

-

Land

-

Airborne

-

Space

-

-

Frequency Outlook (Revenue, USD Million, 2018 - 2030)

-

HF/VHF/UHF

-

L

-

S

-

C

-

X

-

K

-

Ku

-

Ka

-

-

Dimension Outlook (Revenue, USD Million, 2018 - 2030)

-

2D

-

3D

-

4D

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Air Traffic Control & Navigation

-

Airspace Monitoring

-

Sea Traffic Control & Navigation

-

Automotive

-

Remote Sensing & Weather Observation

-

Ground Traffic Control

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global commercial radars market size was estimated at USD 6.44 billion in 2023 and is expected to reach USD 6.88 billion in 2024

b. The global commercial radars market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 10.66 billion by 2030

b. North America dominated the commercial radars market with a share of 28.3% in 2023. The market has been experiencing growth due to increasing demand for air travel, heightened concerns over security, and the need for weather monitoring and forecasting.

b. Some key players operating in the commercial radars market include DeTect, Inc.; Easat Radar Systems Ltd.; ELDIS Pardubice, s.r.o.; HENSOLDT AG; Indra Sistemas, S.A.; Leonardo S.p.A; NEC Corporation; RTX; Terma; Thales

b. Factors such as the increasing demand for weather monitoring systems, the rising adoption of Advanced Driver-Assistance Systems (ADAS) in vehicles, air, and marine transport expansion, and heightened security measures across various industries are driving the demand for commercial radars

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.