- Home

- »

- Distribution & Utilities

- »

-

Commercial Airport Lighting Market Size, Share Report, 2030GVR Report cover

![Commercial Airport Lighting Market Size, Share & Trends Report]()

Commercial Airport Lighting Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Runway Lighting System, Taxiway Lighting Systems), By Technology (LED, Non-LED), By Position (Insert Airfield Lights, Elevated Airfield Lights), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-408-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Commercial Airport Lighting Market Trends

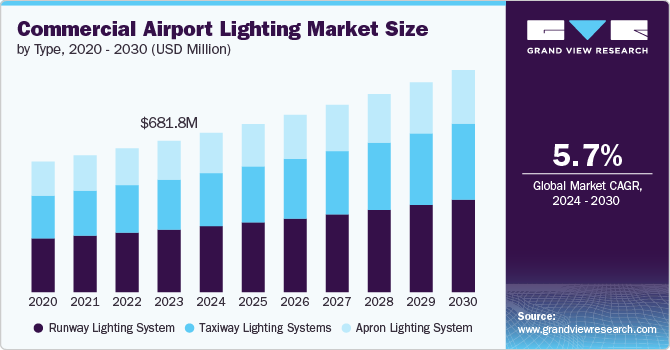

The global commercial airport lighting market size was estimated at USD 681.81 million in 2023 and is expected to grow at a CAGR of 5.7% from 2024 to 2030. The market is propelled by increasing air traffic, stringent aviation safety regulations, and a growing emphasis on operational efficiency. Expanding airport infrastructure, coupled with modernization initiatives, is driving demand for advanced lighting systems.

As airports and aviation companies prioritize passenger security and operational efficiency, investments in advanced safety measures become paramount. The rising sales of safety equipment in the aviation sector are linked to the increasing emphasis on improving runway safety. Enhanced lighting systems, precision guidance tools, and innovative monitoring technologies are pivotal in mitigating risks and ensuring smooth airfield operations. This surge in demand for safety solutions presents lucrative opportunities for providers in the industry. By aligning with regulatory requirements and staying abreast of evolving standards, companies can capitalize on this trend, driving further commercial airport lighting market forecast in sales of runway safety equipment.

Type Insights

Based on type, the market is segmented into runway lighting system, taxiway lighting systems, and apron lighting system. Among these runway lighting system holds the largest revenue share of over 41.0% in 2023. Runway lighting is indispensable for aircraft landings and takeoffs, especially during low visibility conditions. It is a fundamental component of aviation safety, making it a mandatory requirement for all commercial airports. Stringent aviation regulations mandate specific standards for runway lighting systems, driving consistent demand for these products, thus contributing to its high market share.

Taxiway lighting system is expected to grow at the fastest CAGR from 2024 to 2030. Taxiway lighting systems are essential components of airport infrastructure that guide aircraft safely from the runway to their gates and vice versa. They provide illumination for aircraft during ground movement, enhancing safety and operational efficiency. Airports worldwide are striving to improve operational efficiency and reduce delays. Advanced taxiway lighting systems contribute to smoother aircraft traffic flow, leading to shorter turnaround times and increased airport capacity, thus contributing to its high growth rate.

Technology Insights

Based on the technology the market is segmented into LED and non-LED. Among these LED accounted for highest revenue market share of over 82.0% in 2023 and is expected to grow with fastest CAGR of 5.8% over the forecast period. LED technology is characterized by high energy efficiency, long lifespan, and superior performance. Its rapid adoption is fueled by government incentives and environmental concerns.

Non-LED technology still holds a niche market share, primarily in older airports or for specific applications where cost or other factors might favor traditional lighting solutions. However, this segment is expected to decline steadily as LED technology becomes more affordable and efficient.

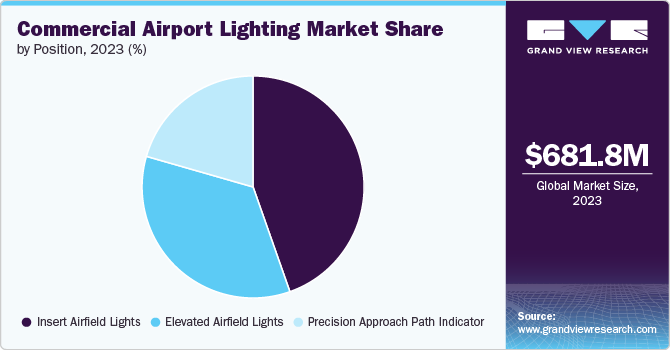

Position Insights

Based on the position, the market is segmented into insert airfield lights, elevated airfield lights, and precision approach path indicator (PAPI). Among these, insert airfield lights dominated the market and accounted for a revenue share of over 44.0% in 2023. These lights can be used for a variety of purposes, including runway edge lights, centerline lights, and taxiway edge lights. Many existing airports have been designed with inset lighting systems, making it easier and more cost-effective to replace or upgrade them with newer technologies like LED.

Elevated airfield lights is expected to demonstrate the fastest CAGR of 6.1% over forecast period on account of their superior visibility and safety. Elevated airfield lights are lights positioned above the ground, typically on towers or poles. They provide illumination for runways, taxiways, and aprons. Unlike inset lights, which are embedded in the ground, elevated lights offer a higher vantage point, enhancing visibility, especially in adverse weather conditions, which contributes to its growth rate.

Regional Insights

North America dominated the market and accounted for the largest revenue share of over 34.0% in 2023. The region boasts a well-established aviation industry with a large number of commercial airports, creating a substantial demand for airport lighting systems. The region has been at the forefront of lighting technology development, with companies investing heavily in research and development. This has led to the creation of innovative lighting solutions that meet the evolving needs of the aviation industry.

U.S. Commercial Airport Lighting Market Trends

The U.S. dominated the market in North America in 2023 and accounted for a revenue share of over 76.0%. The U.S. has a vast network of commercial airports, including some of the busiest in the world. This large number of airports translates into a significant demand for lighting systems. Furthermore, there is investment directed by the Federal Aviation Administration (FAA) to airports in the country for capacity expansion and reconstruction which can significantly influence growth in the country. For instance, in March 2024, the FAA announced that it is awarding USD 130.0 million to 100 airports across the country for capacity expansion and USD 20.0 million for smaller airports reconstruction. This initiative by the U.S. government agency can positively influence the market in the country.

Europe Commercial Airport Lighting Market Trends

Commercial airports in fast-developing aviation markets such as Armenia, Uzbekistan, and Albania are seeing exponential growth in passenger traffic, and those in tourism- and VFR3-dependent EU countries such as Portugal, Poland, and Greece have also surged above their pre‑pandemic volumes. This has resulted in increased investments in construction of new airports in these countries, indicating a positive growth forecast for the market. For instance, in March 2024, Portugal announced its plan to build a new international airport in Alcochet. This new airport is expected to be ready by 2034 which can drive the demand for lighting systems.

Asia Pacific Commercial Airport Lighting Market Trends

Asia Pacific market is expected to grow at the fastest CAGR of 6.5% over the forecast period. This region is experiencing rapid airport development driven by economic growth and increasing air travel. Furthermore, China's massive infrastructure projects are propelling market growth, while India's burgeoning aviation sector is fueling rapid expansion of the market.

Key Commercial Airport Lighting Company Insights

The market is characterized by a significant presence of market players. Competitive strategies such as investments in research & development, partnerships, and mergers and acquisitions are prevalent as companies strive to enhance their market positions. Sealite Pty Ltd t/as Sealite & Avlite is a globally recognized company specializing in the design, manufacturing, and supply of innovative airfield lighting equipment. Avlite serves a diverse customer base, including government agencies, military organizations, and commercial airport operators. Their products are utilized in various regions, including the Middle East, North America, Europe, Africa, and the Caribbean.

-

In July 2024, S4GA announced that its solar runway lighting solution is currently being tested at one of the African airports. This solar airfield lighting is entirely powered by solar energy and is ideal for remote locations with non-existent or limited electrical infrastructure.

-

In July 2024, ARC was awarded a supply contract by a South American international airport to supply self-contained solar LED Runway Lighting. These lights supplied by ARC are ICAO compliant and provide cost effective illumination without requirement of trenching.

Key Commercial Airport Lighting Companies:

The following are the leading companies in the commercial airport lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Sealite Pty Ltd t/as Sealite & Avlite

- vosla GmbH

- S4GA

- OCEM Airfield Technology

- Honeywell International, Inc

- Airport Lighting Company

- ADB SAFEGATE

- OCEM Airfield Technology

- Signalight

- Eaton

- Hali-Brite

- Astronics Corporation

- Airfield Lighting Systems Ltd

- GMR ENLIGHTS s.r.l.

- ARC

Commercial Airport Lighting Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 718.35 million

Revenue forecast in 2030

USD 1.0 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, technology, position, region

Regional scope

North America; Europe; Asia Pacific; Central & South America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; UAE

Key companies profiled

Sealite Pty Ltd t/as Sealite & Avlite; vosla GmbH; S4GA; OCEM Airfield Technology; Honeywell International, Inc.; Airport Lighting Company; ADB SAFEGATE; OCEM Airfield Technology; Signalight; Eaton; Hali-Brite; Astronics Corporation; Airfield Lighting Systems Ltd; GMR ENLIGHTS s.r.l.; ARC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commercial Airport Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global commercial airport lighting market report based on type, technology, position, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Runway Lighting System

-

Taxiway Lighting Systems

-

Apron Lighting System

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

LED

-

Non-LED

-

-

Position Outlook (Revenue, USD Million, 2018 - 2030)

-

Insert Airfield Lights

-

Elevated Airfield Lights

-

Precision Approach Path Indicator (PAPI)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global commercial airport lighting market was estimated at USD 681.81 million in 2023 and is expected to surpass USD 718.35 million in 2024.

b. The global commercial airport lighting market is expected to grow at a CAGR of 5.7% from 2024 to 2030 to reach USD 1.0 billion by 2030

b. North America region dominated commercial airport lighting market with a revenue share of over 34.0% in 2023. The region boasts a well-established aviation industry with a large number of commercial airports, creating a substantial demand for airport lighting systems.

b. Some of the key players in the commercial airport lighting market include Sealite Pty Ltd t/as Sealite & Avlite; vosla GmbH; S4GA; OCEM Airfield Technology; Honeywell International, Inc.; Airport Lighting Company; ADB SAFEGATE; and OCEM Airfield Technology.

b. Increasing air traffic and growing construction of new airports are driving the commercial airport lighting market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.