- Home

- »

- Renewable Energy

- »

-

Colombia Hydrogen Generation Market Size Report, 2030GVR Report cover

![Colombia Hydrogen Generation Market Size, Share & Trends Report]()

Colombia Hydrogen Generation Market (2025 - 2030) Size, Share & Trends Analysis Report By Systems, By Technology (Steam Methane Reforming, Coal Gasification), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-991-0

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

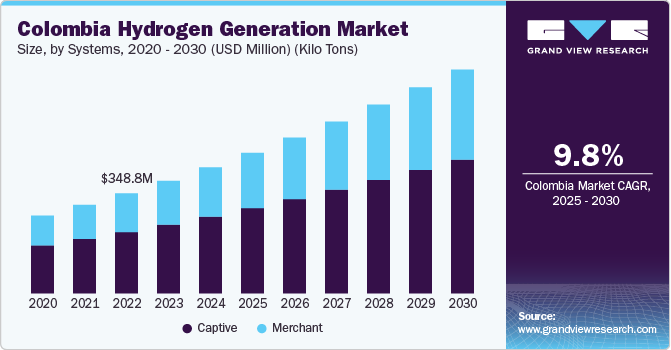

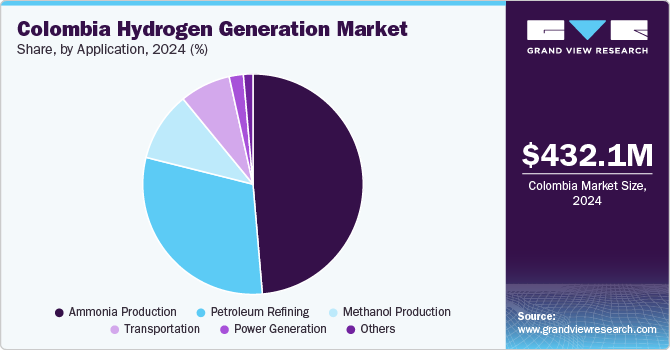

The Colombia hydrogen generation market size was estimated at USD 432.08 million in 2024 and projected to grow at a CAGR of 9.8% from 2025 to 2030. The growth is anticipated to be driven by the rising demand for cleaner fuel and the increasing governmental regulations for the desulphurization of petroleum products. Hydrogen is an effective energy carrier, and this attribute is expected to contribute significantly to its further penetration into newer markets.

Colombia’s electricity demand is anticipated to witness an increase of nearly two-thirds of the current demand in the forecast period. Focus on projects related to distributed power & utility is anticipated to bolster the demand for hydrogen generation market growth over the forecast period.

Drivers, Opportunities & Restraints

Colombia's hydrogen generation market is driven by several key factors that position the country as a potential leader in the green hydrogen sector. Abundant Renewable Energy Resources: Colombia boasts significant renewable energy potential, particularly in solar and wind, which can facilitate the production of green hydrogen at competitive costs. The Guajira region alone has an estimated solar capacity of 42 GW, making it a prime area for hydrogen production.

The country's existing industrial infrastructure, particularly in oil and gas, provides a foundation for transitioning to low-carbon hydrogen solutions, with plans to replace conventional fossil fuels in various sectors12. These factors collectively create a robust framework for the growth of Colombia's hydrogen market, aiming to meet both internal demand and export opportunities while contributing to global decarbonization efforts.

Colombia's hydrogen generation market faces several significant restraints that could hinder its growth and development. Comprehensive regulations are facilitate hydrogen production and use. The country must finalize a roadmap consisting of 60 actions by 2030, which remains a work in progress.

Systems Insights

The captive segment led with a revenue share of 60.9% in 2024. The market is anticipated to expand significantly because the captive generation of hydrogen, which is defined as on-site generation, eliminates several issues related to the transportation and distribution of hydrogen. In Colombia and its bordering countries, captive hydrogen production accounts for most supply routes. A minor amount of merchant hydrogen production is also carried out in the region. There was a 2.5 Mt H2/year demand for pure hydrogen.

Ammonia manufacturing (1.2 Mt2/year) and oil refining (1.3 Mt H2/year), as well as demand from other sectors like electronics, food, processing, glass-making, and transportation, are the sources of pure hydrogen demand. Site hydrogen generation in small-scale industries has gained more popularity owing to new technologies being offered at affordable prices in comparison to delivered distribution channels. Colombia and Chile accounted for almost 8% of the regional hydrogen demand in 2019. In Colombia, oil refining is responsible for most of the demand for hydrogen.

Technology Insights

Steam methane reforming held the largest share of 92.5% in 2024. In Colombia, steam methane reformers are utilized to produce the majority of the hydrogen needed in refineries. The steam methane reforming process is a mature and advanced technology in hydrogen generation. Other factors driving the growth of the Colombia hydrogen generation market include operational benefits such as high conversion efficiency associated with the steam methane reforming process. The Steam Methane Reforming segment is expected to keep its lead over the forecast period.

Coal gasification, which uses coal as a raw material for producing hydrogen, has been in practice for nearly two centuries. Moreover, it is also recognized as a mature technology for hydrogen generation. Colombia has a huge domestic resource in coal. Using coal to generate hydrogen for the transportation sector is expected to aid Colombia in reducing its dependency on imported petroleum products.

Technologies considered under the others segment include electrolysis and pyrolysis processes. Over the last decade, there has been an increase in new electrolysis installations to produce hydrogen from water, wherein PEM technology is gaining a significant share in the market as the process emits only oxygen as a byproduct without carbon emission.

Application Insights

The ammonia production segment led the industry and accounted for the largest revenue share of 48.6% in 2024. The segment will maintain its lead throughout the forecast period. Ammonia’s potential as a carbon-free fuel, hydrogen carrier, and energy store represents an opportunity for renewable hydrogen technologies to be deployed at an even greater scale. Hydrogen is typically produced on-site at ammonia plants from a fossil fuel feedstock.

The market is anticipated to witness steady growth in all segments as the demand for hydrogen increases. Methanol is currently considered one of the most useful chemical products and is a promising building block for obtaining more complex chemical compounds, such as acetic acid, methyl tertiary butyl ether, dimethyl ether, methylamine, etc. Methanol is the simplest alcohol, appearing as a colorless liquid with a distinctive smell, and can be produced by converting CO2 and H2, with the further benefit of significantly reducing CO2 emissions in the atmosphere.

Key Colombia Hydrogen Generation Company Insights

Colombia's hydrogen generation market features a diverse array of companies actively engaged in both production and innovation. Key players include Ecopetrol, the state-owned oil company, which is transitioning from gray to green hydrogen through pilot projects at its refineries. Engie and Siemens are also prominent, collaborating on initiatives to develop hydrogen infrastructure and technology. Other significant contributors include Air Products and Chemicals, Linde, and Air Liquide, all of which leverage their expertise in gas production to enhance hydrogen generation capabilities.

Key Colombia Hydrogen Generation Companies:

- Linde plc

- Ecopetrol

- Air Products and Chemicals, Inc

- Air Liquide International S.A

- Messer SE & Co. KGaA

- SOL SpA

- Claind srl

- HYGEAR

- Siemens Energy

- Engie

- Cummins Inc

Recent Developments

-

In April 2024, The Japan Bank for International Cooperation (JBIC) Colombia have formalized their partnership to enhance the hydrogen sector by signing a Memorandum of Understanding (MOU) on April 10. This significant agreement is designed to promote collaboration in hydrogen production and its derivatives, such as ammonia.

-

In March 2022, Ecopetrol Group launched its first green hydrogen production pilot project in Colombia, featuring a 50-kilowatt PEM (Proton Exchange Membrane) electrolyzer and 270 solar panels at the Cartagena Refinery. The initiative aims to gather insights on the operation, maintenance, reliability, and scalability of the employed technologies.

Colombia Hydrogen Generation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 481.63 million

Revenue forecast in 2030

USD 766.97 million

Growth rate

CAGR of 9.8% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD Million, Volume in Kilo Tons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, Volume Forecast, competitive landscape, growth factors and trends

Segments covered

Systems, technology, application, region

Country Scope

Colombia

Key companies profiled

Linde plc; Air Products and Chemicals, Inc.; Air Liquide International S.A; Messer SE & Co. KGaA; SOL SpA; Claind srl; HYGEAR; Siemens Energy; Engie; Cummins Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Colombia Hydrogen Generation Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented Colombia hydrogen generation market report based on systems, technology, application, and region:

-

Systems Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030) .

-

Captive

-

Merchant

-

-

Technology Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

-

Steam Methane Reforming

-

Coal Gasification

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

-

Methanol production

-

Ammonia Production

-

Petroleum Refining

-

Transportation

-

Power Generation

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The Colombia hydrogen generation market size was estimated at USD 432.08 million in 2024 and is expected to reach USD 481.63 million in 2025.

b. The Colombia hydrogen generation market is expected to grow at a compounded annual growth rate of 9.8% from 2025 to 2030 to reach USD 766.97 million by 2030.

b. In technology segment, steam methane reforming dominated the Colombia hydrogen generation market in terms of revenue with the highest share in 2024. This is attributable due to operational benefits such as high conversion efficiency associated with the steam methane reforming process.

b. Some key players operating in the Colombia hydrogen generation market include Linde Plc; Air Products and Chemicals, Inc; Air Liquide International S.A; Messer SE & Co. KGaA.; SOL SpA; Claind srl; Hygear.

b. Key factors driving the Colombia hydrogen generation market growth include shifting trend towards cleaner energy, high natural gas production, and favorable government regulations supporting potential of hydrogen production in the country over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.