- Home

- »

- Drilling & Extraction Equipments

- »

-

Coiled Tubing Market Size & Share, Industry Report, 2033GVR Report cover

![Coiled Tubing Market Size, Share & Trends Report]()

Coiled Tubing Market (2026 - 2033) Size, Share & Trends Analysis Report By Services (Well Intervention & Production, Drilling), By Operations (Circulation, Pumping, Logging, Perforation), By Application (Onshore, Offshore), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-813-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coiled Tubing Market Summary

The global coiled tubing market size was estimated at USD 1.99 billion in 2025 and is projected to reach USD 2.79 billion by 2033, growing at a CAGR of 4.5% from 2026 to 2033. According to the U.S. Energy Information Administration (EIA), global liquid fuel consumption is expected to reach 103.5 million barrels per day by the end of 2025, up from 100.4 million barrels per day in 2023.

Key Market Trends & Insights

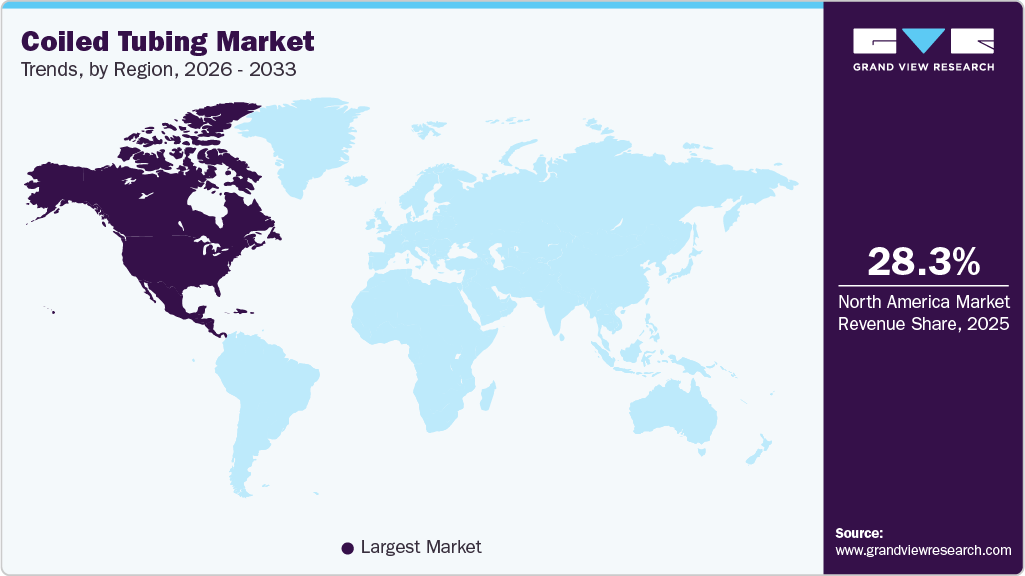

- North America dominated the coiled tubing market with the largest market revenue share of 28.3%.

- By services, the well intervention & production segment is anticipated to register the fastest CAGR of 4.6% from 2026 to 2033.

- By operations, logging accounted for the largest market revenue share of over 20.6% in 2025.

- By application, the offshore segment is anticipated to register the fastest CAGR of 5.1% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 1.99 Billion

- 2033 Projected Market Size: USD 2.79 Billion

- CAGR (2026-2033): 4.5%

- North America: Largest market in 2025

This surge prompts upstream companies to invest in enhanced oil recovery (EOR) and unconventional resources such as shale formations. Coiled tubing provides a quick and cost-effective solution for well intervention and workover operations, which are crucial for maintaining and enhancing production, particularly in horizontal and multistage fracked wells across regions such as North America.

Technological advancements in coiled tubing equipment have significantly expanded its application scope. Innovations such as larger diameter tubes and stronger, corrosion-resistant materials have enabled deeper and higher-pressure operations. For instance, the U.S. Department of Energy (DOE) has supported research and development (R&D) initiatives under the Office of Fossil Energy and Carbon Management to improve downhole tools and real-time data acquisition systems, thereby enhancing the efficiency of coiled tubing interventions. These improvements are particularly crucial in unconventional plays, such as the Permian Basin, where operational precision and speed are essential.

The growing need for well maintenance in aging oil fields is another major driver. Data from the International Energy Agency (IEA) indicate that more than 70% of the global oil output originates from mature fields, many of which require regular interventions to maintain production. In countries such as Saudi Arabia and the U.S., where many large fields are over 40 years old, coiled tubing is widely used for cleanouts, acid stimulation, and gas lifting. These applications help sustain production at a relatively low cost, supporting national oil production goals without major new field development.

Environmental regulations are increasingly shaping market dynamics in favor of coiled tubing. The U.S. Environmental Protection Agency (EPA) has established stricter regulations for oilfield operations, particularly regarding methane emissions and the impacts on land use. Coiled tubing, which requires less surface disruption and fewer emissions than traditional rigs, aligns well with these regulatory goals. For instance, coiled tubing interventions typically reduce emissions by over 30% compared to conventional workover rigs, according to studies cited by the DOE. This makes it a preferred method in regions with stringent environmental compliance, such as California and the North Sea.

Offshore exploration projects are also making significant contributions to market growth. The International Association of Oil & Gas Producers (IOGP) reports that offshore production accounts for nearly 30% of global oil output. Projects in regions such as the Gulf of Mexico and the Eastern Mediterranean are utilizing coiled tubing for complex well-servicing operations due to its compact footprint and operational efficiency. The U.S. Bureau of Ocean Energy Management (BOEM) has recently approved multiple deepwater drilling permits, indicating a positive outlook for offshore activity and, by extension, coiled tubing demand.

Drivers, Opportunities & Restraints

The coiled tubing market is primarily driven by the growing need for cost-effective well intervention and maintenance operations, particularly in mature oil fields. According to the IEA, more than 50% of global crude oil production in 2023 originated from aging fields, many of which require frequent maintenance to sustain output. Coiled tubing offers an efficient, lower-cost alternative to traditional drilling rigs for acidizing, cleanouts, and nitrogen-lifting operations. In addition, the surge in unconventional hydrocarbon extraction, especially in shale formations in the U.S. and Canada, has significantly bolstered demand, as coiled tubing enables faster and more precise interventions in horizontal wells.

Significant opportunities lie in developing advanced coiled tubing technologies and expanding offshore exploration activities. Innovations such as real-time data transmission tools, larger tubing diameters, and high-pressure-resistant materials are enhancing the applicability of coiled tubing in deep and complex wells. Moreover, offshore regions such as the Gulf of Mexico, West Africa, and Southeast Asia are seeing increased investment in exploration. According to the U.S. BOEM, approved offshore drilling permits rose by over 15% in 2024, creating a favorable environment for coiled tubing deployment due to its minimal surface footprint and operational flexibility.

The setup and maintenance of coiled tubing units involve substantial capital investment, which can deter small and mid-sized service providers. Furthermore, extreme well conditions, such as very high temperatures and pressures, can limit the effectiveness of conventional coiled tubing systems, requiring frequent upgrades and material enhancements. Market volatility in crude oil prices also poses a risk, as lower prices often lead to reduced drilling and well-servicing activities, directly impacting demand for coiled tubing services.

Services Insights

By services, the well intervention & production segment is anticipated to register the fastest CAGR of 4.6% from 2026 to 2033. Coiled tubing enables efficient well-intervention services, such as scale removal, acid stimulation, and cleanouts, without the need to halt production or dismantle surface infrastructure. These capabilities make it vital for extending well life, improving recovery rates, and reducing downtime, particularly in cost-sensitive environments such as North America and the Middle East.

Drilling is anticipated to register a notable CAGR over the forecast period. Coiled tubing drilling (CTD) enables continuous circulation of drilling fluids while allowing rapid deployment and retrieval without the need to make or break pipe connections. This reduces non-productive time (NPT), enhances operational safety, and lowers overall costs. Coiled tubing's flexibility allows it to navigate through high-angle or horizontal wellbores more easily than conventional drill strings, making it ideal for re-entry drilling operations.

Operations Insights

By operations, logging accounted for the largest market revenue share of 20.6% in 2025. Coiled tubing-conveyed logging is particularly advantageous in highly deviated or horizontal wells where conventional wireline tools face deployment challenges. It enables logging while circulating fluids, which helps in maintaining well control and ensuring accurate data acquisition in challenging environments. Technological advancements are further strengthening the capabilities of coiled tubing logging services. Advancements in logging tools, including compact formation evaluation sensors, distributed temperature sensing (DTS), and real-time telemetry systems, have enhanced the precision and speed of data collection.

Pumping is anticipated to register the fastest CAGR over the forecast period. Coiled tubing-assisted pumping operations, such as acidizing, cementing, nitrogen lifting, and chemical injection, allow precise fluid placement at targeted depths while maintaining continuous well control. This is particularly valuable in mature wells, where selective stimulation is needed to restore declining production. The pumping segment also benefits from advancements in fluid delivery technologies and pressure control systems, which enhance accuracy, reduce waste, and improve safety in unconventional reservoirs, such as the Bakken and Permian basins. Operators frequently rely on coiled tubing for post-fracturing cleanouts and matrix acidizing to improve formation permeability.

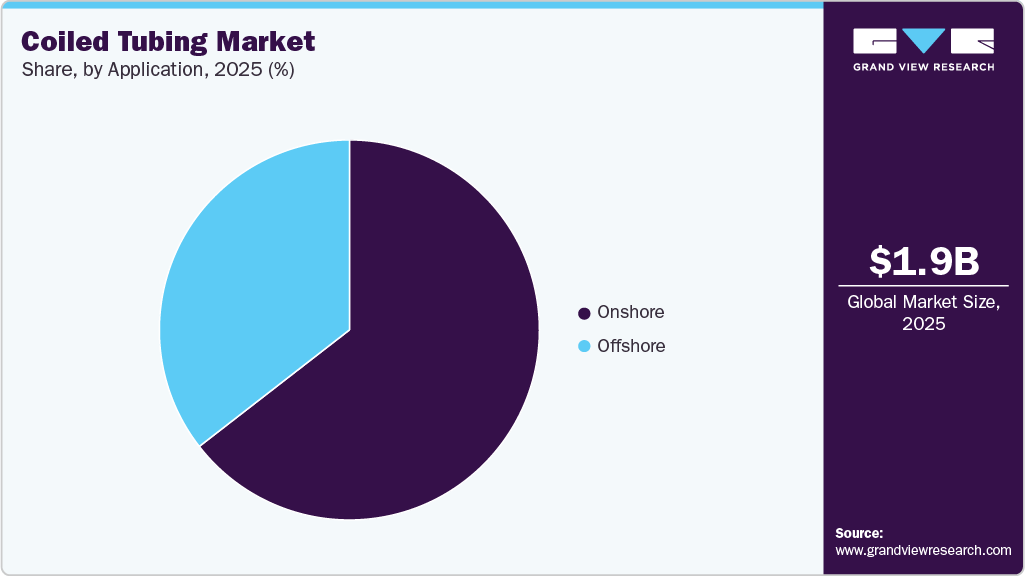

Application Insights

The onshore segment of the coiled tubing market is growing steadily due to the large number of oil and gas fields located on land, particularly in regions such as North America, the Middle East, and the Asia Pacific. These fields are mature and require regular maintenance to stabilize production levels. Coiled tubing is commonly used onshore for tasks such as well cleanouts, acidizing, nitrogen lifting, and supporting hydraulic fracturing. Its ability to perform these operations quickly and at a lower cost than traditional methods makes it a popular choice for onshore applications, particularly in shale-rich areas where frequent well intervention is necessary.

By application, the offshore segment is anticipated to register the fastest CAGR of 5.1% from 2026 to 2033. Offshore is anticipated to grow significantly over the forecast period due to the increasing number of deepwater and ultra-deepwater exploration and production projects. Offshore wells are often more complex and expensive to drill and maintain, making the efficient and compact nature of coiled tubing services especially valuable. Coiled tubing enables quick well interventions, cleanouts, and stimulation without the need for large rigs, thereby reducing downtime and costs. Operators rely on coiled tubing for safe and efficient operations in confined-space settings, such as challenging offshore environments, including the Gulf of Mexico, the North Sea, and offshore West Africa.

Regional Insights

North America dominated the coiled tubing market with the largest market revenue share of 28.3%. The North America coiled tubing industry is experiencing a rapid expansion, primarily driven by the ongoing growth of horizontal drilling across the U.S. and Canada. These wells often require frequent well intervention, cleanouts, and stimulation, making coiled tubing a highly preferred solution due to its cost efficiency and speed. Operators in key shale basins, such as the Permian and Montney, increasingly use coiled tubing for post-fracturing operations and workovers, thereby extending the productive life of wells. The market also benefits from a well-established oilfield services infrastructure, which supports the widespread deployment of coiled tubing units.

U.S. Coiled Tubing Market Trends

The coiled tubing industry in the U.S. is expanding steadily due to growing activity in shale plays and mature oilfields. Operators are increasingly using coiled tubing for well clean-outs, acidizing, and other intervention services that help restore and enhance production without requiring large rigs. Offshore activity also contributed to the market’s expansion, with the EIA forecasting U.S. offshore oil production to hold steady near 1.8 million barrels per day in 2025, supported by over a dozen new projects in the Gulf of Mexico.

Asia Pacific Coiled Tubing Market Trends

The coiled tubing industry in the Asia Pacific is experiencing strong growth, primarily driven by the increasing oil and gas exploration and production activities in countries such as China, India, Indonesia, and Australia. Governments in the region are actively promoting domestic energy development to reduce dependence on imports. For instance, under India’s Hydrocarbon Exploration and Licensing Policy (HELP), the Ministry of Petroleum and Natural Gas has introduced reforms to attract foreign and private investments in exploration and production. These efforts have increased onshore and offshore drilling operations, creating a greater need for efficient well intervention services. With its ability to reduce operational costs and downtime, coiled tubing is being increasingly adopted for cleanouts, acidizing, and well stimulation tasks.

Europe Coiled Tubing Market Trends

The coiled tubing industry in Europe is expanding steadily due to the need to maintain and enhance output from mature oil and gas fields, particularly those in the North Sea. According to the Norwegian Petroleum Directorate, most offshore wells require regular well interventions, and the use of coiled tubing helps reduce operating costs by approximately 30% compared to traditional methods.

Latin America Coiled Tubing Market Trends

The coiled tubing industry in Latin America is growing steadily as oil and gas producers respond to the increasing number of regional energy projects, driven by government support. National oil company Petrobras has led exploration and development efforts in Brazil's offshore pre-salt fields. The Brazilian government continues to open its deepwater basins to foreign investment, fueling demand for efficient offshore well services, such as coiled tubing, to carry out interventions and logging in challenging environments.

Middle East & Africa Coiled Tubing Market Trends

The coiled tubing industry in the Middle East and Africa is experiencing steady growth, primarily driven by increased oilfield development and rising demand for efficient well servicing techniques. Many countries in the region, such as Saudi Arabia, the UAE, and Kuwait, are investing in enhancing recovery from mature fields, which requires frequent interventions. Coiled tubing is widely used for cleanouts, stimulation, and nitrogen lifting operations, as it enables faster, more cost-effective servicing without the need for heavy rigs.

Key Coiled Tubing Company Insights

Some of the key players operating in the market include Tenaris, Sandvik AB, and others.

-

Tenaris is a leading global supplier of steel pipes and related services for the oil and gas industry, with a significant presence across North America, South America, and the Asia-Pacific. It offers a comprehensive range of products for demanding downhole applications, including workovers, drilling, logging, perforating, and stimulation. It pioneered API certification in this segment and continues to innovate with its proprietary BlueCoil technology, which delivers significantly higher fatigue resistance and string life than conventional offerings.

-

Sandvik AB is a global engineering company based in Sweden, known for producing high-quality materials and tools for industries like mining, construction, and manufacturing. The company has a long history and operates in many countries, offering advanced metal cutting and drilling solutions. The company manufactures long-length, seamless stainless steel and nickel alloy tubes used in oil and gas operations. These tubes are ideal for well intervention, chemical injection, and control lines because they can handle high pressure and resist corrosion.

Key Coiled Tubing Companies:

The following key companies have been profiled for this study on the coiled tubing market.

- AMETEK Inc.

- AMARDEEP STEEL

- Baker Hughes

- HandyTube LLC.

- NOV

- Oshwin Overseas

- Sandvik AB

- SLB

- Tenaris

- Webco Industries

Recent Development

-

In May 2025, Halliburton deployed its largest-ever coiled tubing intervention system at its New Iberia Training Facility in Louisiana. This advanced system features a coiled tubing injector, Halliburton's V135HP, a reel capable of holding 36,000 feet of 2-3/8-inch coiled tubing, and a tension lift frame with a remarkable 750-ton capacity.

-

In April 2025, Alleima launched a pioneering on-site tubing solution designed specifically for hydrogen projects in Canada. This mobile machine can straighten and cut thick-walled coiled tubing directly on-site, eliminating the need for off-site processing. The innovation streamlines the installation of hydrogen refueling stations by delivering tubing cuts to exact specifications on demand, reducing waste, labor, and potential weak points in the system caused by fittings or welds.

Coiled Tubing Market Report Scope

Report Attribute

Details

Market definition

The coiled tubing market includes the sale deployment of coiled tubing units in different end uses.

Market size value in 2026

USD 2.05 billion

Revenue forecast in 2033

USD 2.79 billion

Growth rate

CAGR of 4.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, volume in units, and CAGR from 2026 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Services, operations, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Poland; France; Russia; China; Australia; Brazil; Argentina; UAE; Saudi Arabia; South Africa; Libya

Key companies profiled

Tenaris; Sandvik AB; HandyTube LLC.; NOV; SLB; Baker Hughes; Oshwin Overseas; Webco Industries; AMETEK Inc.; AMARDEEP STEEL

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coiled Tubing Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coiled tubing market report on the basis of services, operations, application, and region.

-

Services Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

Well Intervention & Production

-

Well Completion

-

Well Cleaning

-

Others

-

-

Drilling

-

Others

-

-

Operations Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

Circulation

-

Pumping

-

Logging

-

Perforation

-

Others

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

Onshore

-

Offshore

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Poland

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

Libya

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The key factors driving the growth of the coiled tubing market include the increasing importance of shale reserves and a growing emphasis on optimizing well production.

b. The global coiled tubing market size was estimated at USD 1.99 billion in 2025 and is expected to reach USD 2.05 billion in 2026.

b. The global coiled tubing market is expected to grow at a compound annual growth rate of 4.5% from 2026 to 2033 to reach USD 2.79 billion by 2033.

b. By operations, logging accounted for the largest market revenue share of over 20.6% in 2025.

b. Some of the key players in the global coiled tubing market include Tenaris, Sandvik AB, HandyTube LLC, NOV, SLB, Baker Hughes, Oshwin Overseas, Webco Industries, AMETEK Inc., and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.