- Home

- »

- Next Generation Technologies

- »

-

Cloud Gaming Market Size & Share, Industry Report, 2030GVR Report cover

![Cloud Gaming Market Size, Share & Trends Report]()

Cloud Gaming Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (File Streaming, Video Streaming), By Device (Smartphones, Tablets, Smart TVs), By Gamer Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-847-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Gaming Market Summary

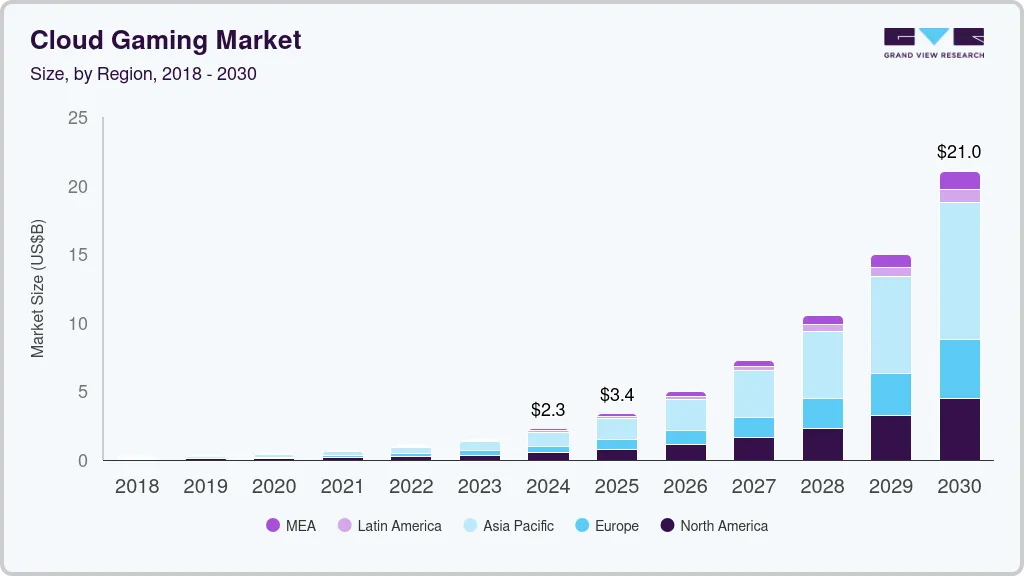

The global cloud gaming market size was valued at USD 2.27 billion in 2024 and and is projected to reach USD 21.04 billion by 2030, growing at a CAGR of 44.3% from 2025 to 2030. The market growth is largely fueled by the expanding availability of high-speed internet and the widespread adoption of 5G technology.

Key Market Trends & Insights

- The cloud gaming market in Asia Pacific accounted for the largest market share of over 45% in 2024.

- The cloud gaming market in Europe is expected to grow at a CAGR of over 43% from 2025 to 2030.

- Based on type, the video streaming segment dominated the market with a market share of over 54% in 2024.

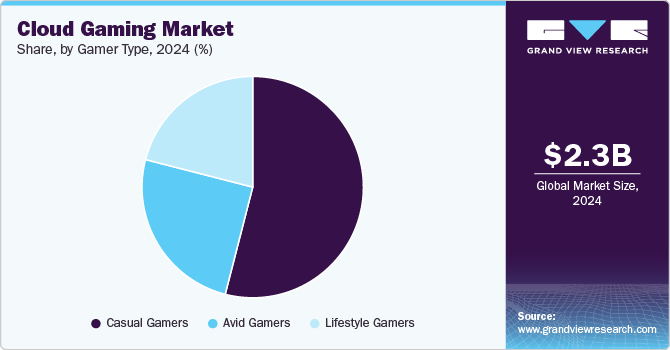

- Based on gamer type, the casual gamer segment accounted for the largest market share in 2024, owing to the accessibility and convenience that cloud gaming offers.

- Based on device, the gaming consoles segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.27 Billion

- 2030 Projected Market Size: USD 21.04 billion

- CAGR (2025-2030): 44.3%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

In addition, the cost-effectiveness of cloud gaming plays a pivotal role, as it eliminates the need for costly hardware, enabling broader access to premium gaming experiences. The rising use of smartphones as primary gaming devices further accelerates the market expansion, alongside the availability of expansive game libraries and subscription-based models that offer flexibility and value. These factors are expected to present lucrative growth opportunities for market expansion.

The cross-platform gameplay is gaining traction in the cloud gaming industry, driven by growing consumer demand for seamless and flexible gaming experiences. By enabling users to initiate gameplay on one device, such as a smartphone, and continue uninterrupted on another, such as a tablet, PC, or smart TV, platforms are removing traditional hardware limitations. This functionality is powered by a centralized cloud infrastructure that ensures real-time synchronization of user data and game progress. This trend is expected to play a crucial role in shaping long-term user loyalty and driving sustained growth in the competitive cloud gaming industry landscape.

Furthermore, AI and machine learning are playing a key role in boosting the cloud gaming industry growth, owing to their ability to enhance user experience and backend efficiency significantly. Gamers are increasingly seeking smoother performance, dynamic gameplay, and personalized experiences, and AI technologies are playing a crucial role in fulfilling these demands. From real-time graphics enhancement to intelligent matchmaking and content recommendations, AI enables scalable, responsive, and more immersive gaming, which aligns perfectly with the cloud’s dynamic infrastructure. These factors are driving the cloud gaming industry's growth.

Furthermore, the trend toward cloud-native game development is expanding because developers are beginning to realize the unique potential of the cloud beyond just streaming. Designing games specifically for cloud platforms allows for innovative features such as massive real-time multiplayer, dynamic world updates, and advanced AI behavior, which are difficult to implement in traditional gaming formats. This growing shift is leading developers to transition from porting games to designing cloud-first, thereby driving the market expansion.

Moreover, the growing strategic partnerships between cloud gaming services and smart device manufacturers are significantly enhancing the accessibility of cloud gaming by integrating gaming capabilities directly into everyday devices. For instance, in January 2025, LG Electronics and Xbox announced a significant partnership to enhance cloud gaming experiences on LG Smart TVs. This collaboration introduces the Xbox app and a new Gaming Portal on select LG TVs, allowing Xbox Game Pass Ultimate subscribers to stream hundreds of games directly from the cloud. Such strategies by key companies are expected to drive the cloud gaming industry expansion in the coming years.

Type Insights

The video streaming segment dominated the market with a market share of over 54% in 2024, owing to the increasing demand for on-demand, high-quality entertainment. The popularity of platforms such as Netflix, Amazon Prime, and YouTube has led to a cultural shift towards streaming media, encouraging gamers to seek similar experiences with games. The growing advancements in cloud infrastructure and internet speeds, particularly 5G, enable high-definition game streaming without expensive hardware. This convenience, coupled with the ability to access a vast library of games through subscription models, is driving the integration of gaming with existing video streaming services, further expanding the market.

The file streaming segment is expected to witness the highest CAGR of over 45% from 2025 to 2030, driven by the growing need for seamless, instant access to game files and content without needing physical downloads or storage. As internet speeds improve and cloud infrastructure becomes more reliable, gamers can access and play their games from any device with minimal latency, reducing the burden on local storage. This trend is particularly relevant in a world increasingly reliant on cloud storage, where gamers can switch between devices without losing progress, fostering a more flexible and accessible gaming experience.

Gamer Type Insights

The casual gamer segment accounted for the largest market share in 2024, owing to the accessibility and convenience that cloud gaming offers. With no need for high-end gaming hardware, casual gamers can easily access a wide range of games through subscription services such as Xbox Cloud Gaming, Google Stadia, and Amazon Luna, which allow them to play on smartphones, tablets, or smart TVs. The appeal lies in the ability to play games on the go, the low barrier to entry, and the lack of need for consoles or powerful PCs. Moreover, the growing availability of affordable, casual-friendly game libraries and the increasing popularity of mobile gaming are driving segmental growth.

The avid gamers segment is expected to witness a significant CAGR from 2025 to 2030, owing to their demand for high-quality, immersive gaming experiences without the constraints of expensive hardware. Cloud gaming services such as GeForce NOW and Xbox Cloud Gaming enable them to access AAA titles with high-definition graphics and low-latency performance, often on multiple devices like smartphones, tablets, or laptops. The ability to instantly access games without long download times or hardware upgrades appeals to avid gamers who are looking for seamless, flexible, and high-performance gaming experiences. With the increasing availability of 5G and advanced cloud computing technologies, the segment is expected to grow significantly in the coming years.

Device Insights

The gaming consoles segment accounted for the largest market share in 2024, fueled by the evolution of consoles that integrate cloud gaming capabilities, offering players the option to stream games directly to their devices. In addition, the push towards digital-only games, coupled with more affordable and efficient cloud gaming services, is also driving the shift away from physical discs and towards streaming as the preferred method for gaming, thereby driving segmental growth.

The smartphone segment is expected to witness the highest CAGR from 2025 to 2030, owing to the increasing power of mobile devices, which can now handle high-quality game streaming. The widespread availability of 5G networks offers faster and more reliable connections, reducing latency and improving game quality. Moreover, smartphones' ubiquity andthe ubiquity of smartphones and their ability to serve as all-in-one gaming devices are key drivers in this segment’s growth.

Regional Insights

North America accounted for a significant share of over 22% in 2024, primarily driven by the region's advanced technological infrastructure, including widespread access to 5G and fiber-optic networks, which enable seamless, high-quality gaming experiences. Furthermore, partnerships between tech giants andhardware manufacturers have boosted the accessibility of cloud gaming on a range of devices, including smartphones, smart TVs, and gaming consoles. The region’s gaming culture, combined with a growing demand for mobile and cross-platform play, also fuels the rapid growth of the cloud gaming market.

U.S. Cloud Gaming Market Trends

The cloud gaming market in the U.S. accounted for the highest share of over 87% in 2024, owing to the country’s advanced digital infrastructure, including widespread 5G and fiber-optic networks, which support high-quality, low-latency gaming. The growing adoption of cloud gaming is further fueled by the versatility of services that allow gamers to access content across multiple devices, such as smartphones, consoles, and smart TVs. These factors are expected to drive the market growth in the U.S.

Europe Cloud Gaming Market Trends

The cloud gaming market in Europe is expected to grow at a CAGR of over 43% from 2025 to 2030. Increased internet speeds, a strong gaming culture, and a growing appetite for immersive gaming experiences drive this growth. Subscription-based services are gaining popularity, offering cost-effective access to a wide range of games. In addition, the integration of cloud gaming with other entertainment platforms is enhancing user engagement and expanding the reach of services.

The UK cloud gaming market is expected to grow at a significant rate in the coming years, driven by high broadband and 5G penetration, enabling seamless, low-latency gaming experiences across multiple devices. Furthermore, the UK's gaming culture, driven by a youthful demographic and the growing popularity of esports, is fueling demand for flexible, high-quality gaming solutions, particularly on smart TVs and mobile platforms.

The cloud gaming market in Germany is fueled by its well-developed internet infrastructure, providing the foundation for smooth, high-performance gaming experiences. Germany’s focus on sustainability and minimalism is also driving the popularity of digital solutions that eliminate the need for physical consoles.

Asia Pacific Cloud Gaming Market Trends

The cloud gaming market in Asia Pacific accounted for the largest market share of over 45% in 2024, driven by substantial investments in 5G infrastructure and the widespread adoption of smartphones. The region is seeing a surge in demand for cloud gaming owing to the affordability of cloud gaming platforms, and the increasing number of mobile users is further fueling market growth, making high-quality gaming accessible to a broader audience.

Japan cloud gaming market is gaining traction, fueled by high-speed internet and 5G connectivity, enabling seamless gaming experiences across various devices such as smartphones, smart TVs, and consoles. Technological innovations in cloud computing and streaming technologies enhance game quality and accessibility. Moreover, the rising demand for enhanced gaming experiences and the growing popularity of esports are contributing to the market's expansion.

The cloud gaming market in China is rapidly expanding, supported by growing advancements in 5G infrastructure, improvements in smartphone technology, and robust cloud services. Subscription-based gaming models are gaining popularity, offering cost-effective access to a vast library of games. The growing integration with streaming platforms also enhances user engagement and expands the reach of cloud gaming services in the country, thereby driving market growth.

Key Cloud Gaming Company Insights

Some key players operating in the market include Amazon Web Services, Inc. and NVIDIA Corporation.

-

Amazon Web Services, Inc., a subsidiary of Amazon.com, is a cloud infrastructure provider, offering a broad set of services, including computing, storage, databases, AI, and machine learning. In the cloud gaming space, AWS supports game developers and publishers through services such as Amazon GameLift, a managed service for deploying, operating, and scaling multiplayer game servers.

-

NVIDIA Corporation is a global player in graphics processing technologies and AI computing. It has become a key player in cloud gaming through its GeForce NOW platform, which allows users to stream high-end games to low-power devices. The company is investing in AI and generative technologies for gaming, including collaborations with key companies to integrate AI-powered avatars and storytelling tools into the gaming ecosystem.

Ubitus K.K. and Backbone Labs are some emerging market participants in the cloud gaming market.

-

Ubitus K.K. specializes in cloud gaming technology, GPU virtualization, and AI-driven solutions. The company offers a comprehensive cloud gaming platform, GameCloud, capable of streaming AAA titles across various devices, including consoles, PCs, and mobile platforms.

-

Backbone Labs is a U.S.-based technology company specializing in mobile gaming. The company offers the Backbone One controller and the Backbone app, which consolidates cloud gaming, remote play, and native mobile games into a single accessible portal. Backbone has partnered with major platforms such as NVIDIA GeForce NOW, Xbox Cloud Gaming, and PlayStation Remote Play, enabling users to play console-quality games on their smartphones.

Key Cloud Gaming Companies:

The following are the leading companies in the cloud gaming market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Apple Inc.

- Backbone Labs

- Electronic Arts, Inc.

- Google LLC

- Intel Corporation

- International Business Machines Corporation (IBM Corporation)

- Microsoft Corporation

- NVIDIA Corporation

- Sony Interactive Entertainment

- Ubitus K.K.

- Tencent Holdings Ltd.

Recent Developments

-

In March 2025, Amazon Web Services, Inc. (AWS) introduced Amazon GameLift Streams, a managed service enabling developers to stream games at up to 1080p resolution and 60 frames per second to any device with a WebRTC-enabled browser. This capability supports a variety of 3D engines with minimal to no code modification, allowing for quick deployment and testing.

-

In January 2025, NVIDIA Corporation announced plans to launch its GeForce NOW cloud gaming service in India by the first half of the year. The service will be powered by a new data center equipped with GeForce RTX 4080 GPUs, enabling gamers to stream AAA titles in 4K resolution at 60fps without needing high-end hardware.

-

In March 2024, Ubitus K.K. announced a strategic investment from NVIDIA Corporation to enhance its generative AI and cloud gaming capabilities across Asia. This partnership aimed to leverage NVIDIA's accelerated computing to advance Ubitus' AI-driven solutions.

Cloud Gaming Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.36 billion

Revenue forecast in 2030

USD 21.04 billion

Growth rate

CAGR of 44.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, device, gamer type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE

Key companies profiled

Amazon Web Services, Inc.; Apple Inc.; Backbone Labs; Electronic Arts, Inc.; Google LLC; Intel Corporation; IBM Corporation; Microsoft Corporation; NVIDIA Corporation; Sony Interactive Entertainment; Ubitus K.K.; Tencent Holdings Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Gaming Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud gaming market report based on type, device, gamer type, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

File Streaming

-

Video Streaming

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Tablets

-

Gaming Consoles

-

PCs & Laptops

-

Smart TVs

-

Head-Mounted Displays

-

-

Gamer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Casual Gamers

-

Avid Gamers

-

Lifestyle Gamers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global cloud gaming market size was estimated at USD 2.27 billion in 2024 and is expected to reach USD 3.36 billion in 2025.

b. The global cloud gaming market is expected to grow at a compound annual growth rate of 44.3% from 2025 to 2030 to reach USD 21.04 billion by 2030.

b. Asia Pacific dominated the cloud gaming market with a share of over 45% in 2024. This is attributable to the cost-effective nature of the cloud gaming platforms promoting its usage across various new customer classes that vary in investing in gaming systems due to its cost.

b. Some key players operating in the cloud gaming market include Amazon Web Services Inc.; Apple, Inc.; Electronic Arts, Inc.; Google Inc.; Intel Corporation; International Business Machines Corporation; Microsoft Corporation; NVIDIA Corporation; Sony Interactive Entertainment LLC; and Ubitus Inc.

b. Key factors driving the cloud gaming market growth include growing penetration of high-speed internet, rising adoption of smart devices, increasing utilization of gaming as a service, and digital transformation in the media & entertainment industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.