- Home

- »

- Medical Devices

- »

-

Clinical Trial Management Services Market Size Report, 2030GVR Report cover

![Clinical Trial Management Services Market Size, Share & Trends Report]()

Clinical Trial Management Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Services (Clinical Trial Monitoring, Clinical Trial Data Management), By Indication (Oncology, Autoimmune), By End Use (Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-993-8

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Trial Management Services Market Summary

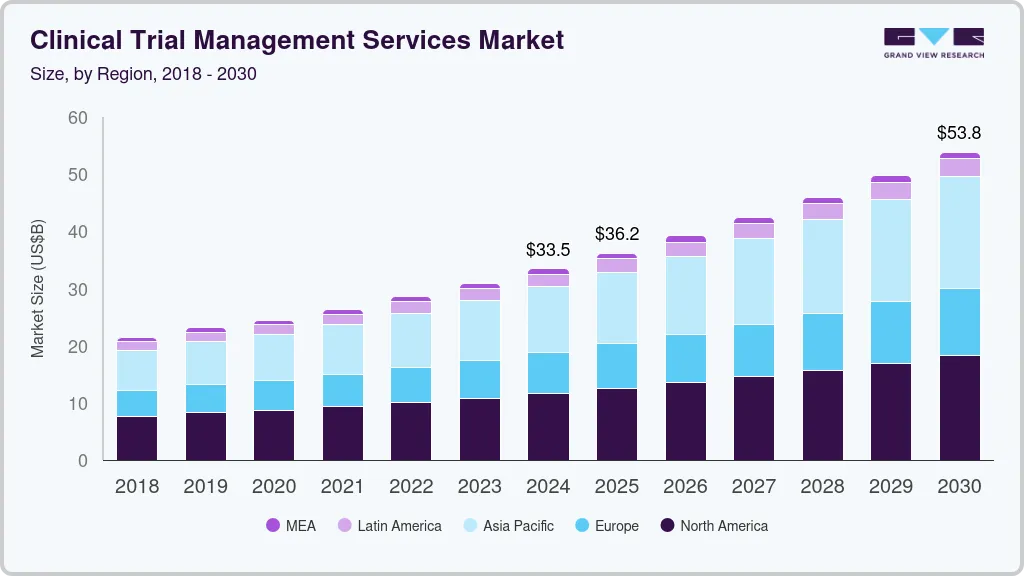

The global clinical trial management services market size was estimated at USD 33,460.6 million in 2024 and is projected to reach USD 53,846.7 million by 2030, growing at a CAGR of 8.3% from 2025 to 2030. The growth of the market is mainly due to increasing technological advancements in clinical trial monitoring services, rising R&D expenditure by pharmaceutical and biopharmaceutical companies, and growing number of outsourced projects related to clinical trial management services.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, clinical trial monitoring accounted for a revenue of USD 9,952.7 million in 2024.

- Medical Writing is the most lucrative services segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 33,460.6 Million

- 2030 Projected Market Size: USD 53,846.7 Million

- CAGR (2025-2030): 8.3%

- North America: Largest market in 2024

Furthermore, the increasing number of clinical trials and stringent regulations pertaining to data management & security are also some of the factors driving the market growth.

The COVID-19 pandemic slowed the market growth due to the momentary pause of clinical studies globally. However, increasing adoption of advanced technologies such as remote monitoring, video visits, phone visits, and EHR by several CROs and research sites has led to the recovery of revenues across the CTMS market by 2021. According to a survey conducted by Oracle in November 2020, 82% of respondents consider the approaches specifically referring to virtual technologies. The surveyed companies integrated the new technologies during the pandemic, which led to improved research methods and results.

Furthermore, increasing demand for new and innovative drugs is also one of the factors which is driving the market growth. Pharmaceutical companies are significantly investing in research and development (R&D) activities to meet the growing need for novel treatments and therapies. These investments are leading to a higher number of trials being conducted, which in turn driving the demand for effective CTMS solutions. By facilitating more efficient trial management, CTMS platform will help to accelerate drug development timelines and improve the overall productivity of R&D efforts. For instance, in June 2024, IQVIA announced the launch of a new technology platform, One Home for Sites. This platform provides a unified sign-on and a centralized dashboard, enabling users to manage all essential systems and tasks associated with the trials they are conducting.

The FDA has already been crucial in assisting the response activities throughout this pandemic and has assisted sponsors in guaranteeing participant safety while adhering to GCP standards. The new laws permit electronic consenting for remote data-gathering applications. In addition, there’s a provision to conduct virtual sessions and ship the investigational product to the participant’s home. This has made it feasible to speed up the participation process and restart the conduct of the trials. The new law would simplify trials in the coming years, thus supporting the industry’s growth. For instance, in May 2023, the U.S. FDA announced to promote the use of decentralized clinical trials (DCTs) for biologics, drugs, and devices. This would allow the conduct of trials at the participants’ location, further enhancing the accessibility for those suffering from rare diseases. Thus, these factors would increase the clinical trial activities further contributing towards the growth of the market.

Services Insights

The clinical trial monitoring segment dominated the clinical trial management services industry in 2024. The rising number of clinical trials and technological advancements in trial monitoring are key factors driving the growth. Early signal identification, subject-level data analysis, and process automation are all approaches to accelerate clinical trials and have a number of significant advantages. Some of these advantages include real-time visibility and automatic monitoring identification. In addition to improving clinical monitoring, these techniques can reduce the overall cost of clinical monitoring for a clinical trial by as much as 40%. This is key to growth for pharmaceutical companies as R&D remains a top priority for most global firms.

Medical writing is anticipated to register the fastest CAGR during the forecast period. An increase in the expiration of several essential patents remains key to the growth of the record number of new trials. Medical writing is a key support activity for a successful trial. It involves the creation of medical documents as an integral part of clinical research. One of the key factors driving the growth of the medical writing segment is an increase in demand for the regulatory frameworks of trials in the pharmaceutical and biopharmaceutical industries.

Indication Insights

The oncology segment dominated the clinical trial management services industry in 2024. The rise in oncology R&D investments, the increasing cancer incidences, and the growing demand for personalized medications, coupled with a surge in innovative developments in the field of oncology, are the key factors driving the growth. For instance, according to the WHO, global cancer cases are predicted to increase to 35 million in 2050 from 20 million in 2020. Moreover, the complexity of cancer as a disease, characterized by its heterogeneous nature, necessitates innovative trial designs that can accommodate various patient populations and treatment regimens, further propelling the need for specialized clinical trial management services.

The autoimmune/inflammation is expected to be the second most lucrative segment during the forecast period. The increasing incidence of autoimmune disorders has led to a surge in R&D investment by pharmaceutical and biopharmaceutical companies. The complexity of trials for autoimmune disorders further fuels the demand for expert management services. In addition, the growing emphasis on personalized medicine and the development of targeted therapies for autoimmune disorders is reshaping the landscape of trials. Researchers are increasingly focusing on identifying biomarkers and genetic factors that influence disease progression and treatment response, underscored by the need for advanced trial management services.

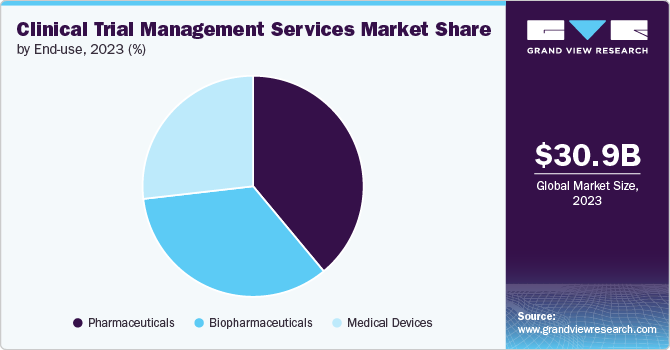

End Use Insights

The pharmaceuticals segment dominated the clinical trial management services industry in 2024. This can be largely attributed to the rise in R&D investments and the development of new drugs over the past two decades. The demand for efficacious, safe, and cost-effective medicine is expected to fuel the development of enhanced pharmaceutical drugs in the coming years. This would drive the demand for these services due to investment in innovative drugs in trials.

The biopharmaceuticals segment is anticipated to register the fastest CAGR during the forecast period. The increasing pipeline of biopharma products, a rise in the prevalence of rare diseases, and a growing number of biological trials are a few of the prominent factors anticipated to support the segment’s lucrative growth. Furthermore, the surge in the number of companies focusing on the development of novel biologics is likely to aid market growth. The International Federation of Pharmaceutical Manufacturers & Associations (IFPMA) estimates that in 2020, the global research-based biopharmaceutical industry spent about USD 198 billion on R&D.

Regional Insights

North America Clinical Trial Management Services Market

North America dominated the clinical trial management services market. The demand for new therapies and drugs has led to a surge in clinical trials across the region. Many pharmaceutical companies are outsourcing their clinical trial activities to Contract Research Organizations (CROs) to reduce costs and focus on core competencies. This trend increases the demand for CTMS as CROs require sophisticated tools to manage multiple trials simultaneously.

U.S. Clinical Trial Management Services Market

The clinical trial management services market in the U.S. held the largest share in North America in 2024, owing to the robust research & development infrastructure and the rising investments in drug discovery & development. In addition, stringent regulations regarding data management and security continue to shape the clinical trial landscape in the U.S. Clinical trial management services help organizations ensure compliance through systematic documentation, monitoring, and reporting capabilities. Moreover, the presence of organizations such as the Decentralized Trials & Research Alliance (DTRA) anticipates market growth.

Europe Clinical Trial Management Services Market

The clinical trial management services market in Europe is expected to grow significantly, owing to the rising prevalence of diseases, increasing demand for personalized medicine, and the strong presence of pharmaceutical companies. Moreover, enhanced collaboration between pharmaceutical companies, CROs, regulatory bodies, and healthcare providers further fuel market growth. Additionally, the increasing adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), and data analytics in clinical trial management has enhanced the efficiency in managing clinical trials.

UK Clinical Trial Management Services Market

The clinical trial management services market in the UK is witnessing significant market demand owing to the stringent regulatory landscape, the presence of major pharmaceutical & biopharmaceutical companies, and the increasing adoption of innovative trial approaches. In addition, the strong infrastructure of the National Health Service (NHS), which provides a robust platform for conducting trials, is a key driver for market growth.

Germany Clinical Trial Management Services CDMO Market

The clinical trial management services market in Germany held the largest share in 2024 in Europe, owing to the rising R&D expenditure by pharmaceutical and biotechnology companies and a well-developed healthcare system. Moreover, recent reforms aimed at streamlining approval processes have made it easier for sponsors to initiate studies, thereby driving demand for the CTMS.

Asia Pacific Clinical Trial Management Services Market

Asia Pacific market is expected to grow at the highest CAGR over the forecast period. APAC countries, including China, Japan, India, and South Korea, are experiencing rapid economic growth and increasing healthcare expenditures. This growth supports investments in healthcare infrastructure, including advanced diagnostic capabilities and clinical trial management services.

China Clinical Trial Management Services Market

In Asia Pacific, China held the largest share of the clinical trial management services market in 2024. China is expected to grow at a considerable rate in the forthcoming years owing to the rising prevalence of chronic diseases such as cancer, cardiovascular diseases, and diabetes, coupled with the growing geriatric population. This rise necessitates more extensive clinical research efforts aimed at developing effective treatments and interventions for these conditions, elevating the need for comprehensive CTMS solutions that can manage complex trial designs associated with chronic disease research.

Japan Clinical Trial Management Services Market

The clinical trial management services market in Japan is expected to grow over the forecast period. Japan boasts a highly advanced healthcare system, skilled workforce, and favorable regulatory environment that supports the adoption and integration of clinical trial management services across clinical settings.

India Clinical Trial Management Services Market

The clinical trial management services market in India is poised to grow in the coming years. The number of clinical trials in India has been steadily increasing, with major pharmaceutical and biotech companies outsourcing research to the country. Furthermore, as major companies establish R&D facilities for drug discovery and development in the country, there is likely to be an increasing demand for clinical trial management services. In addition, the country’s demographic diversity provides access to a large pool of potential participants for clinical trials, further driving market growth.

Latin America Clinical Trial Management Services Market

The Latin America clinical trial management services market is expected to witness considerable growth in the coming years. One of the primary drivers is the region's large and diverse population. This demographic advantage provides a substantial patient pool for clinical trials, enabling researchers to gather diverse data across various demographics and health conditions, further fueling market growth. Moreover, the regulatory landscape in many Latin American countries is evolving, with several nations implementing reforms aimed at streamlining the approval process for clinical trials.

Brazil Clinical Trial Management Services Market

The clinical trial management services market in Brazil is expected to experience significant growth over the forecast period. Brazil's regulatory environment is evolving, with the Brazilian Health Surveillance Agency (ANVISA) implementing reforms aimed at streamlining the approval process for clinical trials. With a growing number of CROs offering specialized services, including patient recruitment, regulatory compliance, and data management, Brazil is well-positioned to capitalize on the increasing global demand for clinical trial management services.

Middle East and Africa Clinical Trial Management Services Market

The Middle East and Africa clinical trial management services market is expected to witness lucrative growth in the coming years. The growth in the region is due to the rising investment in research and development (R&D) by pharmaceutical and biotechnology companies, the increasing prevalence of chronic diseases, the adoption of advanced technology, and the collaboration & partnerships between the pharmaceutical companies, CROs, and research institutes.

South Africa Clinical Trial Management Services Market

The clinical trial management services market in South Africa is driven by the growing investment in research and development (R&D) by both public and private sectors, established regulatory frameworks, and technological advancements.

Key Clinical Trial Management Services Company Insights

The key industry players operating across the clinical trial management services market implement numerous strategic initiatives such as mergers, partnerships, collaborations, acquisitions, etc. The prominent strategies companies undertake are service launches, mergers & acquisitions/joint ventures, partnerships & agreements, expansions, and others to increase market presence and revenue and gain a competitive edge, driving market growth.

Key Clinical Trial Management Services Companies:

The following are the leading companies in the clinical trial management services market. These companies collectively hold the largest market share and dictate industry trends.

- CTI Clinical Trial & Consulting

- Charles River Laboratories

- Medpace Holdings, Inc.

- Wuxi Apptec

- SGS Société Générale de Surveillance SA

- Laboratory Corporation of America Holdings

- IQVIA, Inc.

- Syneous Health

- Atlantic Research Group

- ICON Plc

Recent Developments

-

In November 2023, AstraZeneca launched a new company called Evinova to help CROs to conduct virtual visits, deliver medicines to patients, book telehealth appointments, and track biological samples for trials.

-

In June 2023,MRCT Center and Medable launched a Institutional Review Boards (IRBs)/Ethics Committees (ECs) toolkit for the standardization of decentralized clinical trial ethics review.

-

In May 2023, Allucent partnered with THREAD, a decentralized clinical trial and eCOA technology provider, to assist biotechnology companies in creating and managing customized trials. This partnership aims to help sponsors develop effective and efficient digital strategies for remote engagement and data collection.

-

In January 2023, Curebase introduced an integrated software and services package for digital therapeutic trials to expedite enrollment and enable sponsors to initiate their studies more quickly.

-

In February 2022, Medable launched a partner network that unites service providers, data partners, technology partners, direct-to-patient partners, and site partners to accelerate innovation and simplify the deployment of decentralized trials.

Clinical Trial Management Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 36.21 billion

Revenue forecast in 2030

USD 53.85 billion

Growth Rate

CAGR of 8.26% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, indication, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China, India, South Korea, Thailand, Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

CTI Clinical Trial & Consulting, Charles River Laboratories, Medpace Holdings, Inc., Wuxi Apptec, SGS Société Générale de Surveillance SA, Laboratory Corporation of America Holdings, IQVIA, Inc., Syneous Health, Atlantic Research Group, ICON Plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trial Management Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical trial management services market report based on services, indication, end use, and region.

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Trial Monitoring

-

Regulatory Submissions

-

Clinical Trial Data Management

-

Medical Writing

-

Site management

-

Project management

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Autoimmune/Inflammation

-

Pain management

-

Oncology

-

CNS conditions

-

Diabetes

-

Obesity

-

Cardiovascular

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Biopharmaceuticals

-

Medical Devices

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trial management services market size was estimated at USD 33.46 billion in 2024 and is expected to reach USD 36.21 billion in 2025.

b. The global clinical trial management services market is expected to grow at a compound annual growth rate of 8.26% from 2025 to 2030 to reach USD 53.85 billion by 2030.

b. Based on indication, the oncology segment dominated the market and accounted for the largest revenue share of 37.12% in 2024.

b. Some key players operating in the market include LabCorp, IQVIA, Inc., Syneous Health, Atlantic Research Group, ICON Plc, and a few others.

b. Key factors that are driving the clinical trial management services market growth include increasing investment in R&D programs, preference for outsourcing activities due to time and cost constraints, and increasing adoption of virtual technologies in the process of clinical research.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.