- Home

- »

- Medical Devices

- »

-

Clinical Trial Kits Market Size & Share, Industry Report, 2033GVR Report cover

![Clinical Trial Kits Market Size, Share & Trends Report]()

Clinical Trial Kits Market (2026 - 2033) Size, Share & Trends Analysis Report By Service (Kitting Solutions, Logistics), By Phase (Phase I, Phase II, Phase III, Phase IV), By Application (Small Molecule Trials, Large Molecule Trials), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-614-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Trial Kits Market Summary

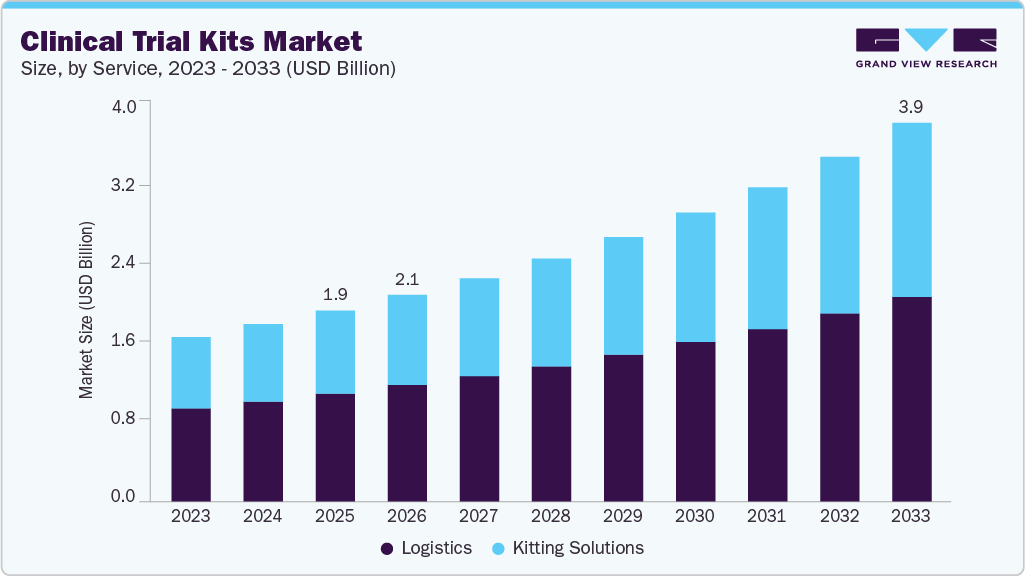

The global clinical trial kits market size was estimated at USD 1.95 billion in 2025 and is projected to reach USD 3.87 billion by 2033, growing at a CAGR of 9.05% from 2026 to 2033. The market is driven by rising number of clinical trials globally, growth of complex therapies & personalized medicine, increasing prevalence of chronic diseases and increasing regulatory requirements for trial standardization and traceability.

Key Market Trends & Insights

- North America clinical trial kits market held the largest share of 43.52% of the global market in 2025.

- The clinical trial kits in the U.S. is expected to grow significantly over the forecast period.

- Based on service, the logistics segment held the largest market share of 56.40% in 2025.

- Based on phase, phase III held the largest market share in 2025.

- Based on application, the small molecule trials segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.95 Billion

- 2033 Projected Market Size: USD 3.87 Billion

- CAGR (2026-2033): 9.05%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The rising global clinical trial activity, driven by sustained investments in pharmaceutical, biotechnology, and medical device R&D, is significantly increasing demand for clinical trial kits. There are more than 550,000 registered studies worldwide where sponsors must manage higher volumes of investigational products, comparator drugs, and sample collection materials. Besides, the increasing geographic dispersion, decentralized trial designs, and direct-to-patient delivery models require standardized, customized, and traceable kits, thereby expanding both the scale and operational value of the clinical trial kits market.Besides, the rapid expansion of gene therapies, cell therapies, and personalized medicine is transforming the requirements for clinical trial supplies. These advanced therapies require specialized delivery systems, patient-specific dosing, and strict adherence to cold-chain handling protocols to ensure optimal efficacy and safety. Besides, personalized, biomarker-driven trials increase the need for customized sample collection and dosing kits for defined patient cohorts. This shift toward customized therapies significantly increases kit complexity, customization, and volume, driving higher revenue potential and long-term market growth.

Furthermore, the rising global burden of chronic diseases such as cardiovascular disorders, cancer, diabetes, and neurological conditions is driving increased clinical research activity. To address long-term disease management and unmet medical needs, pharmaceutical & biotechnology companies are launching an increasing number of trials across these therapeutic areas. These studies require a wide range of diagnostic, biomarker, and safety-monitoring kits throughout development stages, increasing demand for high-quality, standardized clinical trial kits and supporting sustained market growth.

Moreover, regulatory authorities worldwide are enforcing stricter requirements for standardization, labeling, traceability, and accountability of clinical trial materials. Besides, sponsors must ensure that protocols are met, including protocol-specific packaging, serialization, tamper-evident designs, and comprehensive chain-of-custody documentation. In addition, as bulk shipment models become less compliant, demand is shifting toward pre-configured, traceable clinical trial kits that integrate monitoring and documentation features, making regulatory compliance a key factor for the clinical trial kits market.

Opportunity Analysis

The clinical trial kits market presents significant potential, driven by shifts in global clinical research design, regulations, and implementation. The growing regulatory focus on maintaining consistency, traceability, and data integrity in multi-site trials has made it crucial to standardize and auditable distribution of investigational materials. As trials extend across various regions and healthcare settings, sponsors encounter increasing operational complexities in managing drugs, devices, consumables, and documentation.

Clinical trial kits further support mitigating these challenges by decreasing variability at the site level, reducing protocol violations, and enhancing regulatory compliance. The opportunities are increased by government initiatives that encourage quicker approvals, decentralized trial designs, and broader patient participation. These developments are further contributing to a growing need for pre-assembled, ready-to-use kits that facilitate swift site activation and direct patient delivery. Furthermore, high-value segments such as cell therapy trials present significant upside, as these studies require specialized packaging, temperature control, and strict chain-of-identity and custody documentation. Thus, medical device trials, including those involving connected and wearable technologies, depend on standardized kits to ensure consistent device deployment, usability compliance, and reliable data capture across sites and home-based settings.

Impact of U.S. Tariffs on Clinical Trial Kits Market

U.S. tariffs on imported pharmaceutical components, medical devices, packaging materials, and electronic accessories can have an indirect effect on the market for clinical trial kits by raising the costs of inputs and assembly. A significant amount of trial kits depends on materials sourced globally, including diagnostic devices, climate-controlled packaging, labels, and electronic tracking components. Besides this, increased import duties might rise procurement costs for kit assemblers, prompting sponsors and CROs to reevaluate their sourcing approaches. Thus, companies may consider transitioning to domestic production, regional kit assembly, or diversifying suppliers to alleviate cost pressures. Although tariffs may momentarily disrupt pricing and supply timelines, they also promote the localization of supply chains, enhance resilience, and improve long-term operational efficiency in the clinical trial kits market.

Technological Advancements:

Technological advancements are transforming the clinical trial kits market by enabling greater visibility, control, and compliance across increasingly complex global supply chains. The integration of IoT sensors and real-time tracking devices allows continuous monitoring of critical parameters such as temperature, humidity, and location, which is essential for preserving the integrity of biologics, vaccines, and other temperature-sensitive materials. Real-time data sharing across sponsors, CROs, and logistics partners supports proactive issue detection, reduces spoilage risk, and strengthens regulatory compliance, effectively converting trial kits into intelligent, monitored supply assets.

Moreover, digital labeling and serialization technologies are improving traceability and operational efficiency. Electronic labeling and digital display labels reduce manual errors, enable rapid updates in response to protocol amendments, and support compliance with diverse global regulatory requirements, particularly in large, multi-country studies. Besides, blockchain solutions enhance transparency by providing immutable records of chain-of-custody and supply movements, supporting audit readiness and data integrity.

Furthermore, artificial intelligence and predictive analytics further strengthen kit management by optimizing demand forecasting, inventory levels, and distribution routes. By minimizing overstock, shortages, and delays, these technologies improve cost efficiency and trial continuity. Thus, these innovations are elevating clinical trial kits from basic packaging solutions to integral components of a digitally enabled, compliant, and resilient clinical supply ecosystem.

Pricing Model Analysis

The clinical trial kits market is adopting flexible pricing models to address diverse study designs and operational needs. Milestone-based pricing aligns payments with trial progress, reducing upfront costs and financial risk for sponsors. Besides, value-based pricing reflects the operational and compliance benefits delivered by customized kits, particularly in complex or decentralized trials. In addition, fixed-fee models offer predictable costs for defined kit services, supporting budgeting efficiency in early-phase studies. Furthermore, subscription or retainer models provide continuous access to kit assembly, modification, and logistics support, benefiting sponsors managing multiple or long-term trials. Collectively, these pricing approaches improve cost transparency, strengthen sponsor–supplier collaboration, and support scalable, compliant clinical trial execution.

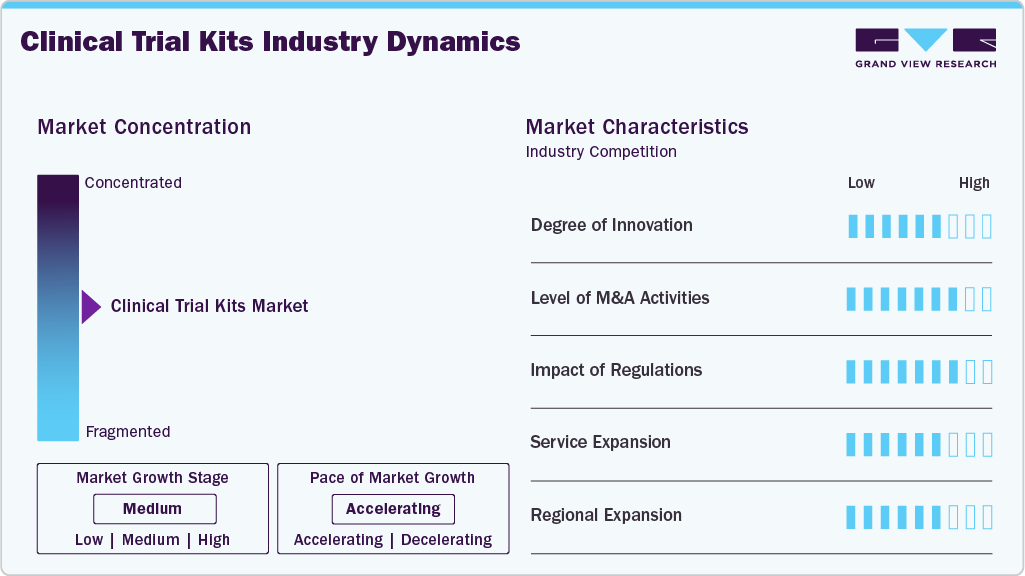

Market Concentration & Characteristics

The clinical trial kits market growth stage is moderate, and pace is accelerating. The market is characterized by the level of merger & acquisitions activities, degree of innovation, regulatory impact, product expansion, and regional expansions.

Innovation in the clinical trial kits market is driven by decentralized trials, complex therapies, and digitalization. Companies are integrating smart packaging, IoT-enabled temperature monitoring, digital labeling, and real-time tracking to enhance supply visibility and compliance. For instance, in September 2025, Almac highlighted its capability to support complex kit assembly outsourcing needs, ranging from low-volume manual kitting to high-volume, semi-automated processes designed to address large-scale commercial market requirements.

Stringent regulatory requirements from authorities such as the FDA and EMA strongly influence the clinical trial kits market. Regulations emphasize standardized labeling, serialization, traceability, cold-chain integrity, and documentation.These requirements increase reliance on pre-configured, protocol-specific kits that ensure compliance, reduce site-level variability, support audit readiness, and minimize the risk of protocol deviations in multi-site studies.

The market is witnessing moderate to high merger and acquisition activity as logistics providers, CDMOs, and CROs expand capabilities. Acquisitions help companies integrate packaging, labeling, cold-chain logistics, and digital tracking solutions, enabling end-to-end clinical supply services. for instance, in September 2025, Clinigen expanded its patient access to essential medicines throughout their lifecycle, announced a definitive agreement to acquire SSI Strategy, a well-regarded strategic consulting firm serving biotech innovators.

Service offerings are expanding beyond basic kit assembly to include demand forecasting, digital inventory management, direct-to-patient delivery, returns handling, and regulatory documentation support. Providers are also offering temperature-controlled packaging, serialization, and real-time monitoring services.

Clinical trial kit providers are expanding into Asia Pacific, Latin America, and the Middle East to support growing clinical research activity. By establishing regional packaging hubs and distribution centers reduces lead times, lowers logistics costs, and improves regulatory responsiveness.

Service Insights

On the basis of the service segment, the logistics segment held the highest market share of 56.40% in 2025. This segment comprises transportation, warehousing & storage, and others. Logistics play a vital role in the market by ensuring the safe, timely, and compliant transportation of investigational drugs, laboratory samples, and patient kits. These services support cold-chain logistics, time-sensitive deliveries, and GMP-compliant warehousing with temperature-controlled storage, inventory control, and just-in-time distribution. Strategic collaborations are enhancing decentralized, patient-centric kitting and logistics efficiency, supporting overall market growth. For instance, in November 2025 Cenmed partnered with Curavit Clinical Research to improve the efficiency and scalability of kitting and logistics services for clinical research.

The kitting solutions segment is expected to witness the fastest growth due to efficient clinical trial execution, enabling the standardized and timely distribution of investigational products, ancillary supplies, and documentation. Besides, rising protocol complexity, personalized medicine, and decentralized trial models are increasing the demand for patient-ready, traceable, and temperature-controlled kits. In addition, protocol-driven design, GMP-compliant sourcing, validated assembly, serialization, and real-time inventory tracking support regulatory compliance and data integrity. Thus, growing adoption of technology-enabled providers and regional kitting hubs further enhances efficiency and drives market growth.

Phase Insights

On the basis of the phase segment, the phase III segment dominated the market in 2025. These phase play a major role for conducting large-scale, multicenter studies that aim to confirm efficacy, monitor safety, and support regulatory approval. The kits are designed to facilitate high patient enrollment, long treatment periods, and a global trial presence while ensuring consistency and compliance across various sites. In addition, phase III kits include investigational medicinal products, comparators or placebos, dosing and administration components, patient compliance aids, and materials for sample collection that align with finalized protocols. In addition, strong emphasis is placed on standardized kit design, robust labeling, and precise randomization to mitigate operational errors and protocol deviations.

The phase I is expected to grow at fastest rate during the forecast period. This segment is primarily concerned with the safety and dose range of a new drug in approximately 20 to 100 healthy volunteers. These trials play a crucial role in supporting first-in-human studies by ensuring safe, accurate, and compliant administration of drugs and collection of data. The kits are tailored to meet the unique needs of early-phase trials, intensive safety monitoring, and rapid protocol adjustments. In addition, the kits typically include investigational medicinal products, placebo or comparator materials, dosing accessories, sample collection supplies, and clear labeling aligned with regulatory and protocol specifications. Besides, these are assembled under controlled conditions to ensure product integrity, traceability, sterility & emphasize tight timelines, temperature control, and real-time inventory visibility, which support frequent site resupply and cohort-based dosing schedules.

Application Insights

On the basis of application, the small molecule trials segment dominated the industry in 2025. These are driving demand for clinical trial kits supporting orally or parenterally administered, chemically synthesized drugs. These kits include tablets, capsules, vials, placebos, comparators, dosing accessories, and patient instructions, ensuring accurate dosing, blinding, and randomization. Besides this, compared with biologics, greater product stability simplifies storage and global distribution. In addition, strict controls over potency, shelf life, and accountability enable efficient inventory management, reduce waste, enhance protocol adherence, and support reliable safety and efficacy outcomes.

The large molecule trials segment is expected to experience the fastest growth rate during the forecast period. This segment includes biologics, cell therapy, gene therapy and others. They support the development of biologics such as monoclonal antibodies, vaccines, and cell & gene therapies, which are highly sensitive to temperature and handling. These kits include investigational biologics, comparators, specialized delivery devices, and detailed preparation instructions. In addition, strict cold-chain management, real-time monitoring, serialization, and traceability ensure compliance and product integrity. The flexible kitting supports complex dosing, extended schedules, reduces operational risk, and ensures high-quality clinical data.

End-use Insights

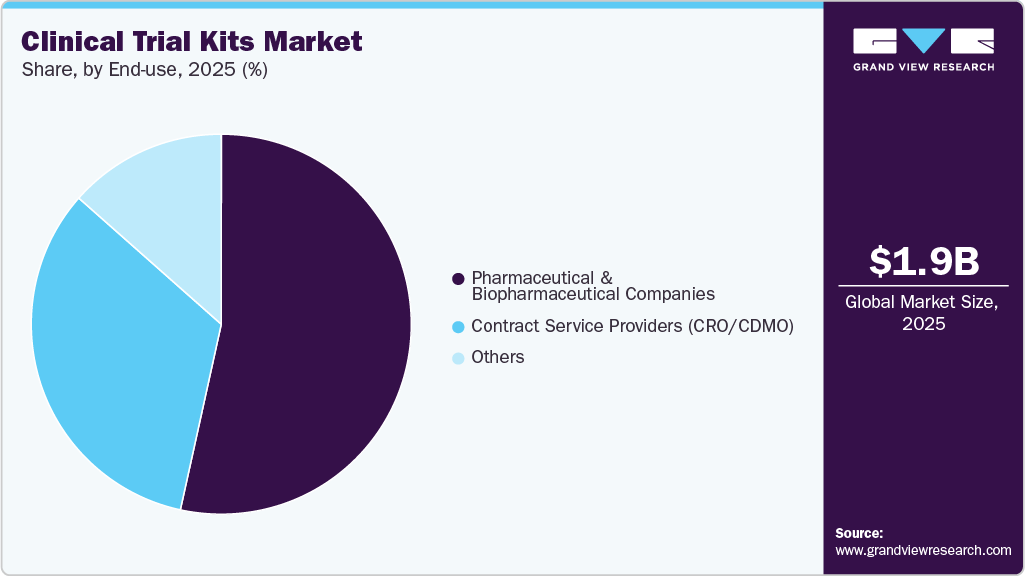

On the basis of the end use, the pharmaceutical & biopharmaceutical companies segment dominated the industry in 2025. These companies rely on clinical trial kit service providers to manage rising study complexity, scale, and regulatory demands. Specialized providers ensure global labeling, packaging, documentation compliance, and reduce non-compliance risks. Besides this, strategically designed kits integrate investigational products, comparators, dosing tools, and sample collection supplies with temperature control and secure logistics. In addition, advanced technologies and expertise improve site efficiency, patient adherence, data reliability, and accelerate clinical development timelines.

The contract service providers, including CROs and CDMOs, play a vital role in delivering compliant and efficient clinical trial kits through protocol-driven design, assembly, labeling, and global distribution. Their expertise supports randomization, blinding, multi-country regulatory compliance, and temperature-sensitive handling. In addition, validated infrastructure, forecasting, and inventory management ensure traceability and timely resupply. In addition, flexible operating models enable rapid adaptation to protocol changes and decentralized trials, reducing sponsor burden and enhancing data quality.

Regional Insights

North America market held the largest market share of 43.52% in 2025. This region is driven by rising trial volume and complexity, particularly in oncology, rare diseases, and advanced therapies. In addition, strong R&D investment, decentralized trial adoption, and direct-to-patient models increase demand for standardized, user-friendly kits. Besides, technological advances in digital tracking and cold-chain logistics enhance efficiency are contributing to market growth. Moreover, countries such as the U.S. and Canada are driving market growth with an increasing number of registered trials, advanced cold-chain logistics, and early adoption of decentralized trial practices, which in turn leads to frequent and large kit deployments.

U.S. Clinical Trial Kits Market Trends

The clinical trial kits market in the U.S. held the largest share in 2025 owing to by the highest number of registered clinical trials globally and a strong biopharmaceutical ecosystem. In addition, robust R&D investments from pharmaceutical, biotechnology, and medical device companies support sustained trial activity. Besides this, growing focus on advanced therapies, including oncology biologics, cell and gene therapies, and personalized medicine, is increasing demand for specialized, protocol-specific kits. Moreover, rapid adoption of decentralized and hybrid trial models is accelerating the use of direct-to-patient and home-based kits. Such factors are expected to drive the market growth.

Canada clinical trial kits market is anticipated to grow from 2026 to 2033 as it has become a hub for outsourcing companies which has led rising need for clinical trial kits. The clinical trial kits market plays an important role within the North American clinical research industry, supported by the regulatory framework, strong public-private research collaboration and a growing number of domestic and multinational clinical trials. For instance, the country accounts for 4% of global clinical trials and is fourth in the number of clinical trial sites, ranking as the G7 leader in clinical trial productivity (number of trials/population). Overall, the country ranked third globally for the total number of new clinical trials and 6, 718 of active trials in 2025.

Europe Clinical Trial Kits Market Trends

Europe clinical trial kits market is driven by rising clinical research in oncology, precision medicine, and infectious diseases, supported by regulatory harmonization under EU CTR 536/2014 and IVDR 2017/746. Besides this, adoption of advanced diagnostic kits, including PSMA-PET radiopharmaceutical cold kits, is strengthening precision trial endpoints. The growth is further supported by decentralized and patient-centric sampling kits, local manufacturing and cold-chain infrastructure, and expanding biologics and cell therapy trials. Besides this, increasing demand for GMP- and IVDR-compliant, standardized kits is enhancing reproducibility, regulatory assurance, and operational efficiency across multinational European studies.

Germany's clinical trial kits market held the largest share in 2025. This market is expanding due to rising clinical research activity, advanced diagnostics investment, and growing domestic manufacturing capacity. For instance, in April 2025, Bruker announced acquisition of Munich-based RECIPE, a leading provider of mass spectrometry-based diagnostic and therapeutic drug monitoring (TDM) assay kits. This strategy is accelerating innovation in high-throughput, MS-based assay kits, supporting complex trial designs. In addition, MLM Medical Labs’ facility expansion strengthens Germany’s ability to produce and distribute large volumes of customized kits, enhancing efficiency across national and European clinical trials.

Clinical trial kits market in UK is anticipated to grow over the forecast period. The country’s market growth is due to increased clinical research activity, strong public–private investment, and wider adoption of decentralized trial models. In addition, government initiatives and expanded trial hubs are increasing trial volumes, boosting demand for investigational product, sampling, and logistics kits. Moreover, rising use of home-based self-sampling and mail-back kits further supports market growth through patient-centric, compliant trial execution.

Asia Pacific Clinical Trial Kits Market Trends

The clinical trial kits market in Asia Pacific is projected to grow at the highest CAGR over the forecast period. The growth of the market is due to rising chronic disease prevalence, expanding patient populations, and increasing focus on precision medicine. In addition, strong growth in clinical research activity across China, Japan, and India, along with rising investments from global pharmaceutical and biopharmaceutical companies, supports demand. Furthermore, government initiatives improving healthcare access further strengthen the market.

China's clinical trial kits market held the largest share in 2025. The country is rapidly expanding due to diverse patient pools, strong government support and rising demand for innovative drugs. In addition, increased outsourcing to CROs, decentralized trials, and home sampling drive patient-centric kit demand. Moreover, NMPA oversight and multinational engagement further enhance quality and global sponsor confidence, supporting rapid market growth across small molecules, biologics, cell & gene therapies, and medical devices.

Japan is the Asia Pacific region's second-largest clinical trial kits market. The country is witnessing growth due to strong pharmaceutical industry, aging population, and rising chronic and rare diseases. In addition, strict PMDA oversight, ICH-GCP alignment, and increasing oncology, regenerative medicine, and cell & gene therapy trials boost demand. Furthermore, adoption of decentralized trials, outsourcing, advanced logistics, digital tracking, and temperature-controlled packaging ensures standardized sample handling, patient adherence, and regulatory compliance, driving market growth.

The clinical trial kits market in India is expected to experience significant growth at a significant CAGR during the forecast period. The country is witnessing considerable growth due to large patient population, cost-effective trials, and expanding clinical research infrastructure. Besides this, adoption of decentralized trials, home sampling, and direct-to-patient delivery, along with technological advancements in digital tracking, automated storage, and cold-chain logistics, enhances efficiency and compliance. Moreover, collaboration with CROs and CDMOs further drives demand for scalable, patient-centric, and regulatory-compliant kitting solutions. For instance, in December 2025, ErlySign announced its screening kit, which will be the Indian diagnostic solution enabling non-invasive oral cancer risk assessment, offering results in the form of low, moderate, or high risk, empowering both clinicians & individuals with insights.

Latin America Clinical Trial Kits Market Trends

The clinical trial kits market in Latin America is projected to grow over the forecast period. The growth in the region is due to expanding trial activity, diverse patient populations, and cost-effective operations. Besides this, adoption of decentralized and digital trial models, AI-enabled management platforms, and advanced cold-chain logistics enhances patient access, data quality, and kit utilization. The regional CROs and academic centers provide customized regulatory, logistics & recruitment support, facilitating complex biologic, device, and patient-centric trials.

The clinical trial kits market in Brazil is expected to grow over the forecast period. The country has increasing clinical trials, regulatory reforms like Law No. 14,874/2024, and a large, diverse patient population attracting global sponsors. Furthermore, growing CRO presence, including ICON, Parexel, Labcorp, and Charles River, enhances regulatory compliance, patient recruitment, and supply chain support.

Middle East and AfricaClinical Trial Kits Market Trends

The Middle East and Africa region is driven by expanding government research funding and public-private collaborations which is expected to drive the clinical trial capacity & supplies, increased diverse patient populations across age groups & disease burdens enhancing recruitment reliability, growing advancements in regional hubs are expected to seek the attention of international sponsors, along with increasing emphasis on digital & decentralized trial models with telemedicine and remote monitoring reducing barriers to participation. In addition, collaborative research networks & cross-institutional partnerships are anticipated to provide knowledge sharing and operational support, driving broader clinical trial activities.

The South Africa Clinical Trial Kits Market is witnessing growth due to robust infrastructure, a diverse population, regulatory oversight, and ongoing trials. Growing adoption enhances quality checks, product development, and bioanalytical services. Entry of small-scale pharmaceutical and medical device companies, along with rising sponsorships and memberships, strengthens clinical research. For instance, in August 2024, Biocair announced its sponsorship & membership with the South African Clinical Research Association (SACRA). This strategic alignment marks a milestone in Biocair's commitment to enhancing supply chain capabilities in South Africa.

Saudi Arabia is emerging as a competitive hub in the clinical trial kits market, driven by government initiatives under Vision 2030, national research programs like SCTE, and technological advancements in healthcare institutions. In addition, growth is supported by multinational sponsor collaborations, international CROs, and digital trial platforms enhancing kit logistics. For instance, in October 2025, SNIH and FCG inaugurated the first private-sector clinical trials unit at Dr. Soliman Fakeeh Hospital, promoting public-private collaboration and expanding clinical trial access.

Key Clinical Trial Kits Company Insights

Key companies in the clinical trial kits market include Brooks Life Sciences (Azenta), Patheon (Thermo Fisher), Labcorp Drug Development, Charles River Laboratories, LabConnect, Almac Group, Cerba Research, and Clinigen. These players lead through specialized kitting, global logistics, regulatory compliance, and technology-enabled solutions, capturing significant market share globally. For instance, in July 2025, Alpha Laboratories has been acquired by the international value-added distribution group Diploma PLC. The transaction was advised by Entrepreneurs Hub Ltd, a corporate finance specialist known for delivering strategic growth guidance and business sale expertise to UK SME owners and entrepreneurs.

Key Clinical Trial Kits Companies:

The following are the leading companies in the clinical trial kits market. These companies collectively hold the largest Market share and dictate industry trends.

- Brooks Life Sciences (Azenta, Inc.)

- Patheon (Thermo Fisher Scientific, Inc.)

- Labcorp Drug Development

- Charles River Laboratories

- LabConnect

- Almac group

- Precision Medicine Group, LLC.

- Cerba Research

- Diploma PLC (Alpha Laboratories)

- United Parcel Service (Marken)

- Clinigen

Recent Developments

-

In November 2025, Almac Group revealed a multi-million-pound investment to expand its Singapore facility, coinciding with the company’s ten-year presence in the country. Led by Almac Clinical Services, the investment reflects a long-term strategy to increase warehouse capacity and strengthen regional clinical supply management capabilities in response to growing client requirements.

-

In July 2025, Almac Clinical Services completed a multi-million-dollar investment at Northern Ireland, focused on enhancing its cold chain service capabilities. The investment included the development of a new ultra-low-temperature (ULT) facility, which has tripled secondary packaging capacity at -15°C to -25°C and doubled ULT storage capacity at -60°C to -80°C. In addition, the upgraded cold chain management center now features expanded 2°C to 8°C secondary production suites, verification and checking areas, new label printing facilities, and dedicated packaging design spaces.

-

In June 2025, LabConnect announce its latest investments in global technology for clinical sample tracking. With the introduction of its enhanced sample tracking services “powered by RFID” the company looks to ensure higher priority and business continuity as samples move through delivery networks to its laboratories.

Clinical Trial Kits Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.11 billion

Revenue forecast in 2033

USD 3.87 billion

Growth rate

CAGR of 9.05% from 2026 to 2033

Historical year

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, phase, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Oman; Qatar

Key companies profiled

Brooks Life Sciences (Azenta, Inc.); Patheon (Thermo Fisher Scientific, Inc.); Labcorp Drug Development; Charles River Laboratories; LabConnect; Almac Group; Precision Medicine Group, LLC.; Cerba Research; Diploma PLC (Alpha Laboratories); United Parcel Service (Marken); Clinigen

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trial Kits Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global clinical trial kits market based on service, phase, application, end-use, and region.

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Kitting Solutions

-

Drug Kits

-

Sample Collection Kits

-

Self-Therapy Kits

-

Medical Device Trial Kits

-

Cell Therapy-Specific Kits

-

Others

-

-

Logistics

-

Transportation

-

Warehousing & Storage

-

Others

-

-

-

Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Molecule Trials

-

Large Molecule Trials

-

Biologics

-

Cell Therapy

-

Gene Therapy

-

Other

-

-

Medical Device Trials

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biopharmaceutical Companies

-

Contract Service Providers (CRO/CDMO)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global clinical trial kits market size was estimated at USD 1.95 billion in 2025 and is expected to reach USD 2.11 billion in 2026.

b. The global clinical trial kits market is expected to grow at a compound annual growth rate of 9.05% from 2026 to 2033 to reach USD 3.87 billion by 2033.

b. North America dominated the clinical trial kits market with a share of 43.52% in 2025. The market growth is attributed to rising trial volume and complexity, particularly in oncology, rare diseases, and advanced therapies. In addition, strong R&D investment, decentralized trial adoption, and direct-to-patient models increase demand for standardized, user-friendly kits. Besides, technological advances in digital tracking and cold-chain logistics are enhancing efficiency, contributing to market growth.

b. Some key players operating in the clinical trial kits market include Key companies profiled Brooks Life Sciences (Azenta, Inc.), Patheon (Thermo Fisher Scientific, Inc.), Labcorp Drug Development, Charles River Laboratories, LabConnect, Almac Group, Precision Medicine Group, LLC., Cerba Research, Diploma PLC (Alpha Laboratories), United Parcel Service (Marken), and Clinigen among others.

b. Key factors driving the growth of the clinical trial kits market include the rising number of clinical trials globally, the expansion of complex therapies & personalized medicine, the increasing prevalence of chronic diseases, and the growing regulatory requirements for trial standardization and traceability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.