- Home

- »

- Medical Devices

- »

-

Clinical Trial Imaging Market Size And Share Report, 2030GVR Report cover

![Clinical Trial Imaging Market Size, Share & Trends Report]()

Clinical Trial Imaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Modality (Computed Tomography Scan, Magnetic Resonance Imaging), By Therapeutic Area, By Services, By End Use, Region, And Segment Forecasts

- Report ID: GVR-2-68038-628-8

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Trial Imaging Market Summary

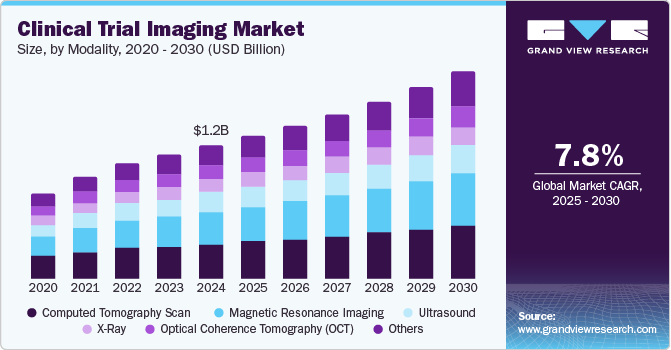

The global clinical trial imaging market size was estimated at USD 1.23 billion in 2024 and is projected to reach USD 1.91 billion by 2030, growing at a CAGR of 7.8% from 2025 to 2030. The growth of the clinical trial imaging market is expected to be driven by the expanding biotechnology and pharmaceutical sectors, alongside increasing investments in research and development to create new therapeutics for various diseases.

Key Market Trends & Insights

- North America clinical trial imaging market held the largest share of the global clinical trial imaging market at 47.93% in 2024.

- Asia Pacific clinical trial imaging market is anticipated to exhibit the fastest growth rate of 8.4% during the forecast period.

- Based on modality, the computed tomography (CT) scan segment captured the highest market share of 25.87% in 2024.

- Based on therapeutic area, the oncology segment held the largest market share of 23.63% in 2024.

- Based on services, the reading and analytical services segment held the largest market share at 30.95% in 2024 and is expected to grow at a CAGR of 8.4% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 1.23 Billion

- 2030 Projected Market Size: USD 1.91 Billion

- CAGR (2025-2030): 7.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Medical imaging plays a critical role in advancing the development of innovative life science products. Despite the dynamic nature of the medical imaging industry, the biotechnology and pharmaceutical sectors continue to demonstrate sustained growth. This trend is largely attributed to heightened investments in medical imaging companies and the prevalence of mergers and acquisitions that incorporate advanced imaging technologies to enhance the clinical trial process for medical devices.

Advancements in imaging technology significantly enhance the collection, evaluation, and submission of clinical trial imaging data, thereby driving market growth. Technology-enabled imaging, particularly through the use of image analysis software, offers numerous advantages for clinical studies, including improved consistency, data accuracy, adaptability, and regulatory compliance. For instance, image analysis software aids in directing and managing the reader's workflow by analyzing specific imaging time points. In addition, the increasing utilization of imaging technology, coupled with advancements in computational power, is anticipated further to boost the role of imaging in clinical trials. The Quantitative Imaging Biomarkers Alliance (QIBA) has established standardized methods and imaging procedures, creating uniform protocols for achieving statistical rigor and precision in clinical trial endpoints.

The COVID-19 pandemic has significantly impacted healthcare systems worldwide, disrupting medical studies and research activities and reducing sponsorship for clinical trials. Ongoing studies faced delays, while many planned trials were canceled. Contributing factors included unfavorable regulatory changes, supply chain disruptions, recruitment challenges, concerns about viral transmission, and the temporary shutdown of numerous manufacturers during lockdowns. However, the emergence of virtual imaging trials during the pandemic is expected to create new opportunities to adopt imaging technologies. In addition, advancements in computational models are improving the assessment of CT and radiography images, which may facilitate early diagnosis of COVID-19 patients.

The clinical trial imaging market is witnessing substantial growth, driven by rising investments in research and development for new therapeutics. The number of registered clinical trials has surpassed 400,000 globally, further necessitating robust imaging solutions, particularly in oncology, cardiology, and neurology. In addition, integrating advanced imaging techniques and AI-powered analysis is projected to enhance data accuracy. The COVID-19 pandemic also accelerated the adoption of virtual imaging trials, with about 30% of clinical trials utilizing virtual methodologies by 2021, demonstrating new efficiencies in trial designs and continuity during disruptions.

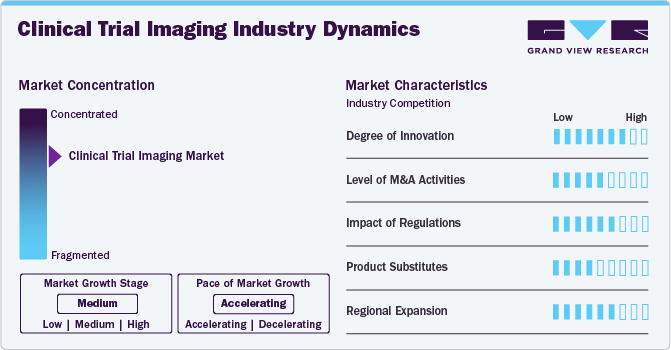

Market Concentration & Characteristics

The market's current growth stage is medium, with an accelerating growth trajectory. The clinical trial imaging sector is marked by a notable level of innovation, driven by an increase in the number of biotechnology and pharmaceutical companies. This evolving landscape compels manufacturers to deliver optimal medicines and treatments. In addition, the rising number of drug discoveries within these companies is promoting advancements in medical imaging and its enhanced adoption on a global scale. This trend is contributing to a growing demand for the integration of imaging technologies within clinical trial studies.

The clinical trial imaging market is characterized by a high level of concentration and competition. Industry participants are diligently pursuing opportunities to enhance their global presence through strategic partnerships, collaborations, and acquisitions aimed at entering new markets and regions. Increasingly, organizations are partnering with esteemed research institutions and healthcare providers, such as the Mayo Clinic and various academic medical centres, to leverage specialized expertise and evaluate their technologies in real-world clinical environments.

The degree of innovation in the clinical trial imaging market is rapidly increasing, fueled by advancements in digital imaging technologies that enhance efficiency, cost-effectiveness, and accuracy. For instance, using 3D imaging techniques in clinical trials has improved data quality and patient outcomes, with studies showing a 25% increase in diagnostic accuracy compared to traditional 2D imaging. In addition, artificial intelligence and machine learning are revolutionizing imaging capabilities. These innovations drive the development of more sophisticated imaging solutions, positioning the clinical trial imaging market for continued growth as technology advances and new applications are discovered.

The level of merger and acquisition activities in the clinical trial imaging market is notably high, with many companies seeking to consolidate their positions and gain a competitive advantage by acquiring complementary technologies or expertise. For instance, in 2022, the total value of mergers and acquisitions in the healthcare sector exceeded USD 300 billion, highlighting the aggressive consolidation trend. This pattern is expected to persist as the market evolves and becomes increasingly competitive. Advances in technology, coupled with a growing demand for more efficient and accurate clinical trial imaging solutions, are expected to drive further consolidation and M&A activity in the market, enabling companies to enhance their capabilities and expand their service offerings.

Regulatory authorities play a crucial role in the clinical trial imaging market, significantly influencing its dynamics. The market is heavily regulated, requiring companies to adhere to strict guidelines to ensure the safety and efficacy of their imaging technologies. For instance, according to the U.S. Food and Drug Administration (U.S. FDA), around 80% of new medical devices, including imaging systems, undergo extensive premarket review processes, extending the time to market by an average of 12 to 18 months. In addition, the complexity of regulatory requirements can impact the development timelines for new imaging technologies. For instance, a survey conducted by the Regulatory Affairs Professionals Society (RAPS) found that 57% of respondents indicated regulatory hurdles were the leading cause of delays in product launches in the medical imaging sector.

Product substitutes in the clinical trial imaging market consist of alternative imaging technologies and methods that can replace traditional imaging techniques. For instance, ultrasound and optical imaging technologies are increasingly being explored as viable alternatives to MRI and CT scans. Moreover, software-based analysis tools are gaining traction, providing similar diagnostic insights as traditional imaging methods but at a lower cost. For instance, a study published in the Journal of Medical Imaging found that advanced software solutions can reduce imaging costs by up to 30% while maintaining diagnostic accuracy. These tools also enhance efficiency by streamlining the analysis process, leading to faster decision-making in clinical trials.

The clinical trial imaging market is witnessing significant regional expansion efforts, particularly in emerging markets, driven by the increasing demand for clinical trial imaging services. In addition, the rise of precision medicine and personalized treatments is expected further to propel the growth of the clinical trial imaging market. The National Institutes of Health (NIH) estimates that the precision medicine market is USD 100 billion, emphasizing the need for imaging technologies to support individualized treatment approaches. Companies are investing heavily in new technologies and partnerships in response to these trends. For instance, a leading imaging company recently acquired a start-up specializing in advanced imaging analytics for precision medicine applications, highlighting a strategic move to enhance its capabilities in this rapidly evolving area. Overall, the combination of rising demand in emerging markets and the growth of precision medicine is prompting companies to expand their regional presence and innovate their offerings, allowing them better to serve a global customer base with diverse needs.

Modality Insights

Computed Tomography (CT) scan segment captured the highest market share of 25.87% in 2024 highlighting its essential role in diagnostic imaging. This prominence can be attributed to several factors, including the technology's ability to deliver detailed cross-sectional images rapidly, which is crucial for accurate diagnosis and treatment planning in clinical trials. Advancements in CT technology, such as low-dose and dual-energy CT scans, have also improved these imaging modalities' safety and diagnostic capabilities. For instance, the American College of Radiology reports that these innovations have led to a 20% reduction in radiation exposure for patients, making CT scans more appealing to both clinicians and patients. In addition, the rising prevalence of chronic diseases and the growing elderly population globally are driving demand for advanced imaging solutions. The World Health Organization estimates that by 2030, chronic diseases are expected to account for nearly 75% of all deaths, highlighting the critical need for effective diagnostic tools such as CT scans in clinical trials.

The magnetic resonance imaging segment is expected to grow at the fastest CAGR of 8.7% from 2025 to 2030, reflecting its expanding role in the clinical trial imaging market. This rapid growth is driven by advancements in MRI technology, broader applications in various medical fields, and a rising preference for non-invasive imaging techniques. This growth is particularly notable in oncology and neurology, where MRI is essential for providing detailed images of soft tissues. For instance, a study published in the Journal of Clinical Oncology revealed that MRI is used in about 60% of clinical trials for brain tumor treatments, highlighting its critical importance in assessing treatment efficacy and guiding clinical decisions. Innovative technologies such as functional MRI (fMRI) and diffusion-weighted imaging (DWI) are further enhancing the diagnostic capabilities of MRI. For instance, a research article in the American Journal of Neuroradiology found that fMRI significantly improves surgical planning for brain tumor patients, resulting in better outcomes and increasing its adoption in clinical trials.

Therapeutic Area Insights

Oncology segment held the largest market share of 23.63% in 2024. Factors such as the high prevalence of cancer cases and the constant need for new and innovative therapies to treat various types of cancer are expected to fuel the market growth. Oncology trials often involve complex imaging requirements due to the need to assess tumour size, response to treatment, and disease progression. Various imaging modalities, such as CT scans, MRI, PET scans, and others, are used to evaluate the effectiveness of cancer treatments. This complexity results in a larger share of the clinical trial imaging market being dedicated to oncology. Advances in imaging technologies, such as PET-CT, molecular imaging, and functional MRI, have significantly improved the ability to visualize and assess tumours and their response to treatment. These advances have made imaging an integral part of oncology trials. The global cancer burden continues to increase, leading to a growing number of oncology clinical trials. This trend is expected to drive the dominance of the oncology segment in the clinical trial imaging market.

The neurovascular diseases segment is expected to grow at the fastest CAGR of 8.8% from 2025 to 2030. This growth can be attributed to increasing awareness, advancements in diagnostic technologies, and a growing aging population. This growth is particularly significant given the rising prevalence of conditions such as stroke, transient ischemic attacks (TIAs), and vascular dementia. For instance, according to the World Health Organization (WHO), stroke is the second leading cause of death globally, responsible for approximately 11 million deaths each year. In the U.S., the Centers for Disease Control and Prevention (CDC) estimates that nearly 795,000 people experience a stroke annually, underscoring the urgent need for effective treatment and prevention strategies.

Services Insights

The reading and analytical services segment held the largest market share at 30.95% in 2024 and is expected to grow at a CAGR of 8.4% from 2025 to 2030, highlighting its critical role in ensuring the accuracy and reliability of imaging data in clinical research. This segment encompasses services that involve interpreting imaging results, quality assurance, and the application of advanced analytical techniques to derive insights from imaging data. Several factors contribute to this segment's dominance, such as the increasing complexity of clinical trials, particularly in oncology and neurology, necessitating highly specialized reading services. In addition, advancements in imaging technology, such as high-resolution MRI and PET scans, have created a demand for skilled professionals who can accurately interpret these complex images. For instance, the American College of Radiology emphasizes that high-quality readings are essential for assessing treatment efficacy and ensuring patient safety, further elevating this segment's importance.

In addition, integrating artificial intelligence (AI) and machine learning into reading and analytical services is revolutionizing the field. For instance, a study published in Nature demonstrated that AI algorithms could enhance diagnostic accuracy by up to 20% compared to traditional methods, making them increasingly valuable in clinical trial settings. As a result, companies are investing in these technologies to improve reading efficiency and reduce turnaround times, further solidifying the segment's market position. The growing emphasis on data-driven decision-making in clinical trials also underscores the importance of analytical services. Regulatory agencies, such as the FDA, require robust statistical analysis and data interpretation to support the approval of new treatments, driving demand for comprehensive reading and analytical services.

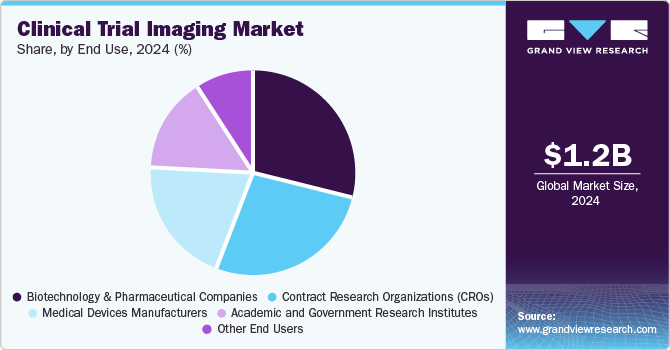

End Use Insights

The biotechnology and pharmaceutical companies segment accounted for the largest share of 28.7% in 2024. The factor attributing to the dominance of this segment is the need to develop new drugs and therapies to cure chronic diseases. The rise in the number of biotechnology and pharmaceutical companies is making it necessary for manufacturers to provide the best possible medicine to the end-user as competition is striking the companies. Biotechnology and pharmaceutical companies are making innovative drug discoveries, and the need for clinical trial imaging is expected to increase, ultimately fueling the market growth. This dominance is driven by the increasing urgency to innovate and improve healthcare outcomes as the prevalence of chronic conditions rises globally. For instance, according to the World Health Organization, chronic diseases, including diabetes, cardiovascular diseases, and cancer, are responsible for approximately 73% of all deaths worldwide. This alarming statistic highlights the critical need for effective treatments, driving pharmaceutical and biotechnology firms to invest significantly in research and development.

The contract research organizations (CROs) segment is expected to grow significantly with a CAGR of 8.5% over the forecast period, owing to its essential role in developing new drugs and therapies for chronic diseases. This dominance is driven by the increasing urgency to innovate and improve healthcare outcomes as the prevalence of chronic conditions rises globally. For instance, according to the World Health Organization, chronic diseases, including diabetes, cardiovascular diseases, and cancer, are responsible for approximately 73% of all deaths worldwide. This alarming statistic highlights the critical need for effective treatments, driving pharmaceutical and biotechnology firms to invest significantly in research and development.

Regional Insights

North America clinical trial imaging market held the largest share of the global clinical trial imaging market at 47.93% in 2024. This dominance can be attributed to several key factors, including the presence of major outsourcing companies and a significant increase in research and development activities within the region. In addition, the North American market is propelled by the rising elderly population and the growing prevalence of chronic diseases. North America leads globally in the number of clinical trials conducted and serves as the primary hub for outsourcing activities in this sector. Cost considerations also play a crucial role in the decision to outsource clinical trials to external research organizations.

U.S. Clinical Trial Imaging Market Trends

U.S. clinical trial imaging market held the largest share of the North America clinical trial imaging market, driven by several factors, including the growing demand for advanced medical imaging technologies in clinical research, the significant presence of pharmaceutical and biotechnology companies in the region, and increasing funding for clinical trials. Funding for these trials originates from various sources, including government agencies, private investors, charities, universities, and other research institutions. However, the majority of funding is typically provided by the pharmaceutical companies with the greatest financial interest in completing the trial, enabling them to develop and promote products for which they hold intellectual property rights.

Europe Clinical Trial Imaging Market Trends

Europe clinical trial imaging market is experiencing growth driven by several key factors. These include the rapidly expanding elderly population and the increasing prevalence of chronic conditions such as Parkinson's, Huntington's, and Alzheimer's disease, which are fostering greater adoption of clinical trials in the region. In addition, research laboratories are actively exploring ways to reduce operational costs, leading to the integration of imaging techniques within clinical trials. It is noteworthy that approximately 4,000 medicine-related clinical trials receive approval in the European Union (EU) each year. While the majority of these trials are conducted in Western European countries, there is a concerning decline in the number of such trials across the region.

UK clinical trial imaging market is expected to grow fastest over the forecast period owing to technological advancements and the increasing prevalence of chronic disorders. For instance, according to the National Statistics Bureau, the number of people living with chronic conditions in the UK is expected to reach approximately 21 million by 2030, significantly increasing the demand for innovative treatment solutions and clinical trials. However, the Association of British Pharmaceutical Industry has noted a trend where drug companies are increasingly conducting their clinical trials in countries such as Spain and Australia rather than the UK.

The France clinical trial imaging market is projected to grow significantly during the forecast period, driven by factors such as the increasing adoption of advanced medical imaging technologies and the growing geriatric population. The elderly demographic is particularly susceptible to developing chronic disorders. For instance, according to data published by the National Institute of Statistics and Economic Studies in January 2022, approximately 6.1% of the population in France is aged between 60 and 64 years, while around 5.75% are aged between 65 and 69 years. In addition, the geriatric population of the country is expected to exceed 24.1% of the total population, reaching approximately 16.09 million by 2030. This rising geriatric population is expected to have a positive impact on the growth of the clinical trial imaging market in France.

Germany clinical trial imaging market held the largest share of the Europe clinical trial imaging market reflecting its prominent position in the region. This dominance can be attributed to several factors, including the country's strong healthcare infrastructure, robust research and development capabilities, and a significant number of pharmaceutical and biotechnology companies operating within its borders. The rising burden of chronic disorders, along with the growing adoption of technologically advanced imaging devices, and increasing initiatives and investments from the public and private sectors, are the key factors fuelling the growth of the German clinical trial imaging market. For instance, according to The Global Cancer Observatory, 628519 new cases of cancer were estimated in Germany in 2020.

Asia Pacific Clinical Trial Imaging Market Trends

Asia Pacific clinical trial imaging market is anticipated to exhibit the fastest growth rate of 8.4% during the forecast period. This growth is due to rapid population increase, heightened R&D efforts, and a rising demand for better therapies. For instance, according to Clinicaltrialsarena.com, in the period between 2017 and 2022, the Asia-Pacific (APAC) region experienced a remarkable growth rate of around 10% in clinical trials, surpassing the growth rate of other major regions such as the US, Europe, and RoW. This growth rate was significantly higher than the overall average growth rate of 5.3% yearly. Most clinical research conducted in all regions is attributable to Phase II clinical trials, which has been a consistent trend over the past five years. However, the number of Phase I trials in APAC is also increasing. APAC accounts for 57% of Phase I trials and 49% of Phase II trials worldwide as of 2022. While the geographical distribution of Phase III trials is more uniform across regions, APAC still dominates due to its larger urban population than the US and Europe. The aforementioned statistics emphasize the fastest growth rate during the forecast period.

China clinical trial imaging market holds a dominant share in the Asia Pacific clinical trials imaging market owing to the increasing number of clinical trials conducted in the country, which has resulted in a significant surge in demand for imaging services. In 2022, China accounted for approximately 27.7% of global clinical trial activity. Additional contributing factors include advancements in imaging technology, government initiatives aimed at supporting clinical research, and a robust healthcare infrastructure. These elements collectively enhance China's standing in the clinical trial imaging market within the Asia-Pacific region.

Japan clinical trial imaging market is primarily driven by the growing demand for advanced imaging technologies and the emergence of several key players focused on developing innovative imaging solutions tailored to the specific requirements of clinical trials. The Japanese government is also implementing initiatives to support the growth of the clinical trial imaging market, which is expected to further enhance market dynamics during the forecast period. A notable player in this sector is Hitachi Medical, which is developing a range of imaging solutions, including Magnetic Resonance Imaging (MRI) and CT scanners, specifically designed to meet the needs of clinical trials. Hitachi Medical is actively involved in several clinical trials across Japan, encompassing studies in neurology, oncology, and cardiology.

Latin America Clinical Trial Imaging Market Trends

Latin America clinical trial imaging market is experiencing steady growth, driven by an increasing number of clinical trials conducted in the region, rising demand for medical imaging technologies, and the availability of skilled healthcare professionals. For instance, Brazil accounted for over 9,000 clinical trial studies, leading other countries in Latin America, while Mexico followed with nearly 5,000 clinical trials as of June 2023. In addition, the presence of emerging market players such as BioClinica, Inc., Biocorp Clinical Laboratory, Inc., and Radiant Sage LLC is anticipated to contribute to a notable growth rate during the forecast period.

Middle East & Africa Clinical Trial Imaging Market Trends

Middle East & Africa clinical trial imaging marketis anticipated to witness robust growth over the forecast period. This growth can be attributed to the increasing number of clinical trials in the region, which has resulted in a heightened demand for imaging solutions to assist in diagnosing and monitoring diseases. In 2020, the Middle East and Africa accounted for an 11.2% share of global clinical trial activity. Key players in the Middle East and Africa clinical trial imaging market include Bioclinica, Inc., ICON plc, IXICO plc, Intrinsic Imaging LLC, and Radiant Sage LLC, all of which offer a range of imaging solutions and services to support clinical trials.

Key Clinical Trial Imaging Company Insights

Several market players are expanding their global footprint by establishing partnerships, collaborations, and acquisitions to access new markets and regions. Collaborations with research institutions and healthcare providers, such as the Mayo Clinic and academic medical centers, are becoming more common to access expertise and test their technologies in real-world clinical settings. For instance, In September 2023, GE HealthCare announced a strategic collaboration with Mayo Clinic to advance innovation in the fields of medical imaging and theragnostic. This partnership aims to drive the development of new technologies and solutions that can enhance medical diagnostics and patient care.

Key Clinical Trial Imaging Companies:

The following are the leading companies in the clinical trial imaging market. These companies collectively hold the largest market share and dictate industry trends.

- IXICO plc

- Navitas Life Sciences

- Resonance Health

- ProScan Imaging

- Radiant Sage LLC

- Medpace

- Biomedical Systems Corp

- Cardiovascular Imaging Technologies

- Intrinsic Imaging

- BioTelemetry

Recent Developments

-

In March 2023, Clario launched a cloud-based image viewer specifically for clinical trials. This innovation aims to streamline medical image analysis and improve its accessibility within the clinical research context.

-

In May 2023, Cleerly has partnered with ProScan Imaging to provide personalized solutions for cardiac health, which involve analyzing and devising treatment strategies for cardiovascular issues. The partnership is expected to leverage Cleerly's AI-powered platform to examine coronary CT angiography (CCTA) images.

Clinical Trial Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.32 billion

Revenue forecast in 2030

USD 1.91 billion

Growth rate

CAGR of 7.8% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, therapeutic area, services, end use, region

Regional scope

North America, Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway Japan; China; India; Thailand; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

IXICO plc; Navitas Life Sciences; Resonance Health; ProScan Imaging; Radiant Sage LLC; Medpace; Biomedical Systems Corp; Cardiovascular Imaging Technologies; Intrinsic Imaging; BioTelemetry

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trial Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical trial imaging market based on modality, therapeutic area, services, end use and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Computed Tomography Scan

-

Magnetic Resonance Imaging

-

X-Ray

-

Ultrasound

-

Optical Coherence Tomography (OCT)

-

Other Modalities

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurovascular Diseases

-

Cardiovascular Diseases

-

Orthopedics & MSK Disorders

-

Oncology

-

Ophthalmology

-

Nephrology

-

Other Therapeutic Areas

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Trial Design and Consultation Services

-

Reading and Analytical Services

-

Operational Imaging Services

-

System and Technology Support Services

-

Project and Data Management

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology and Pharmaceutical Companies

-

Medical Devices Manufacturers

-

Academic and Government Research Institutes

-

Contract Research Organizations (CROs)

-

Other End Users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trial imaging market size was estimated at USD 1.23 billion in 2024 and is expected to reach USD 1.32 billion in 2025.

b. The global clinical trial imaging market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2030 to reach USD 1.91 billion by 2030.

b. Oncology segment held the largest market share of 23.63% in 2024. Factors such as the high prevalence of cancer cases and the constant need for new and innovative therapies to treat various types of cancer are expected to fuel the market growth.

b. Some key players operating in the clinical trial imaging market include IXICO plc, Navitas Life Sciences, Resonance Health, ProScan Imaging, Radiant Sage LLC, Medpace, Biomedical Systems Corp, Cardiovascular Imaging Technologies, Intrinsic Imaging, BioTelemetry

b. The growth of the clinical trial imaging market is expected to be driven by the expanding biotechnology and pharmaceutical sectors, alongside increasing investments in research and development to create new therapeutics for various diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.