- Home

- »

- Medical Devices

- »

-

Clinical Trial Central Laboratory Services Market Report, 2030GVR Report cover

![Clinical Trial Central Laboratory Services Market Size, Share & Trends Report]()

Clinical Trial Central Laboratory Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Phase (Phase I, Phase II, Phase III, Phase IV), By Service, By Indication, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-531-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

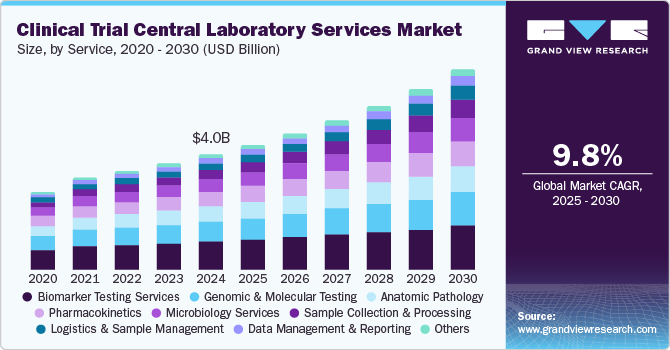

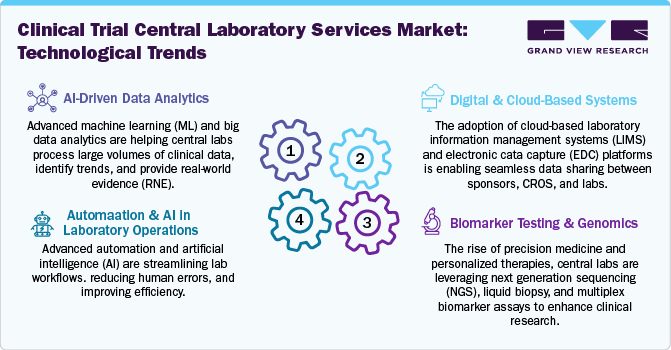

The global clinical trial central laboratory services market size was estimated at USD 4.03 billion in 2024 and is projected to grow at a CAGR of 9.8% from 2025 to 2030. The market growth is due to growing cases of chronic diseases coupled with growing demand for novel treatment options, advancements in precision medicines, and biomarker-driven clinical trials. Moreover, rapid technological advancements in laboratory automation, AI, and data analytics, regulatory standardization, and expansion of clinical trials into global markets are also contributing to market growth.

Furthermore, the growing prevalence of chronic diseases and the increasing demand for innovative treatments also contribute to the clinical trial central laboratory services industry’s growth. Increasing cases of cancer, cardiovascular diseases, and rare genetic disorders led pharmaceutical and biotechnology companies to accelerate drug development. This surge in clinical trials created a strong need for centralized lab services to ensure standardized sample analysis, biomarker testing, and genetic sequencing. Moreover, the growing aging global population, which is more susceptible to chronic illnesses, further boosts the demand for new therapies, making efficient and scalable laboratory solutions essential.

In addition, advancements in precision medicine and companion diagnostics transformed clinical research, increasing reliance on central laboratories. Personalized treatment approaches require highly specialized laboratory tests, including genomic profiling and biomarker-driven patient selection. Central labs play a critical role in maintaining consistency and accuracy in these complex assays across multiple trial sites globally. Pharmaceutical companies are increasingly investing in biomarker-based drug development, which is driving the demand for high-throughput screening, molecular testing, and pharmacogenomics within central laboratory services.

Opportunity Analysis

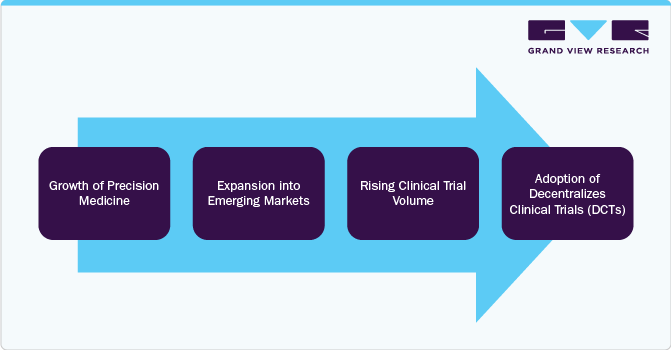

The expansion of precision medicine created a demand for advanced biomarker testing, genetic profiling, and molecular diagnostics, positioning central labs vital in clinical research. In addition, emerging markets are offering new growth avenues due to increasing regulatory approvals, rising patient recruitment, and cost-effective trial operations. The rising volume of clinical trials, fueled by pharma and biotech R&D investments, further enhances the need for efficient laboratory services, with companies outsourcing specialized testing to central labs. Moreover, the adoption of Decentralized Clinical Trials (DCTs) is developing market growth, as remote trials require seamless integration of sample collection, real-time analytics, and regulatory-compliant lab testing.

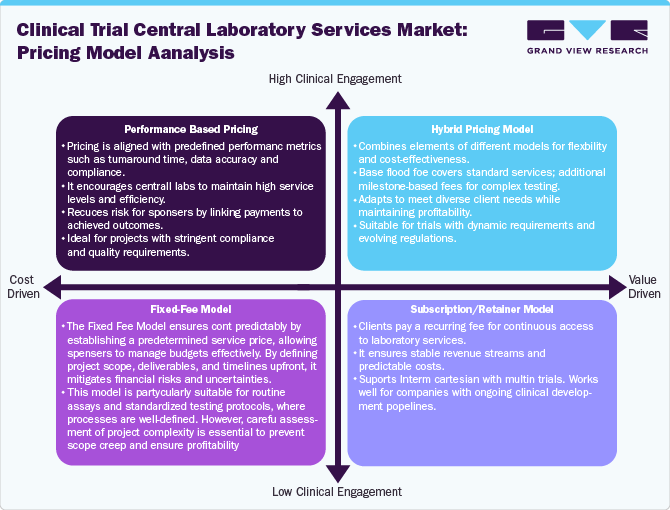

Pricing Model Analysis

Market Concentration & Characteristics

Advancements in diagnostic technologies, automation, and data analytics drive innovation in the clinical trial central laboratory services industry. Integrating AI and digital pathology enhances efficiency, while novel biomarker testing expands research possibilities.

Mergers and acquisitions play a crucial role in shaping the clinical trial central laboratory services industry, enabling companies to expand their capabilities and enhance service portfolios. Large players acquire specialized labs to strengthen their expertise in niche testing areas, such as genomics and immunoassays.

Regulatory frameworks significantly influence the operations of central laboratories, ensuring compliance with Good Clinical Laboratory Practices (GCLP) and data integrity standards. Evolving guidelines from agencies like the FDA and EMA drive the demand for clinical trial central laboratory services to comply with updated amendments.

Expanding service offerings is a key strategy for clinical trial central laboratories to remain competitive in the evolving clinical trial landscape. Central Labs increasingly integrate specialized testing, such as pharmacokinetics and companion diagnostics, to meet sponsor demands.

The geographical expansion enables central labs to support multinational clinical trials and meet growing demand in emerging markets. Establishing new facilities in Asia-Pacific, Latin America, and the Middle East helps companies reduce logistical challenges and regulatory barriers.

Service Insights

The biomarker testing services segment captured the highest market share in the clinical trial central laboratory services industry in 2024. The growth is due to its significant role in precision medicine and targeted therapies, especially in oncology and immunology trials. The increasing adoption of biomarkers for patient stratification and drug efficacy evaluation has significantly boosted the demand for these services.

The data management & reporting segment is expected to witness the fastest growth, driven by the increasing complexity of clinical trials and the rising demand for advanced digital solutions. Innovations in data integration, real-time monitoring, and regulatory compliance fuel the need for sophisticated reporting systems, making this segment a key area of expansion in the clinical trial ecosystem. Moreover, the growing adoption of decentralized trials and AI-driven analytics further accelerates demand in this segment.

Phase Insights

The Phase III segment dominated the clinical trial central laboratory services industry in 2024 due to its critical role in evaluating drug efficacy and safety before regulatory approval. These trials involve large patient populations, extensive laboratory testing, and stringent regulatory requirements, leading to a high demand for central lab services. Pharmaceutical companies allocate the majority of their clinical research budgets to Phase III studies, further contributing to their market dominance.

The Phase I segment is expected to experience the fastest growth rate during the forecast period. The growth is due to an increasing pipeline of innovative therapies, including cell and gene therapies. Advancements in biomarker testing and pharmacokinetics are improving early drug evaluation, leading to higher investments in Phase I trials.

Indication Insights

The oncology segment dominated the clinical trial central laboratory services industry in 2024 due to the increasing prevalence of cancer and the demand for novel immunotherapies and targeted therapies. Moreover, growing investments from pharmaceutical and biotechnology companies in oncology research further accelerate the clinical trial activity.

The infectious diseases segment is expected to experience the fastest growth rate during the forecast period. This growth is due to a growing demand for novel vaccines, antiviral therapies, and antimicrobial resistance research. Moreover, the post-pandemic landscape has increased the global focus on infectious disease preparedness, further driving investment in clinical trials.

End-use Insights

The pharmaceutical and biotechnology companies segment dominated the clinical trial central laboratory services industry in 2024. Pharmaceutical companies' significant R&D investments and focus on innovative drug development are driving the demand for central laboratory services. In addition, the rising adoption of precision medicine and targeted therapies has increased the need for specialized testing, including biomarker analysis and genomic profiling.

The contract research organizations (CROs) segment is expected to witness the fastest growth in the upcoming years.The increasing complexity of clinical research and regulatory requirements have made CROs necessary partners for trial execution. Technological advancements, including AI-driven analytics and decentralized trial solutions, enhance the efficiency of CRO-led studies.

Regional Insights

North America accounted for the largest market share of 39.4% in 2024 due to its strong clinical research infrastructure, high R&D investments, and the presence of leading pharmaceutical and biotechnology companies. The region’s stringent regulatory framework, including FDA guidelines, increased the demand for high-quality central laboratory services.

U.S. Clinical Trial Central Laboratory Services Market Trends

The clinical trial central laboratory services market in the U.S. is driven by the country’s dominance in pharmaceutical and biotechnology R&D, accounting for a significant share of global clinical trials. The U.S. has an extensive network of research institutions and CROs that rely on advanced laboratory services for biomarker testing, pathology, and pharmacokinetics analysis.

Europe Clinical Trial Central Laboratory Services Market Trends

The clinical trial central laboratory services market in Europe is experiencing growth due to the region’s strong clinical trial ecosystem and strict regulatory standards. The European Medicines Agency (EMA) mandates high-quality laboratory testing, boosting demand for specialized central lab services.

The UK clinical trial central laboratory services market held a significant share in 2024. The country’s growth is due to the robust life sciences sector and strong government initiatives to promote clinical research. The UK is a hub for early-stage trials, driving demand for biomarker testing, pharmacokinetics analysis, and genomics-based lab services. Regulatory reforms post-Brexit have also influenced the landscape, with new frameworks supporting faster drug approvals and efficient lab testing.

The clinical trial central laboratory services market in France is driven by the country’s expanding biopharmaceutical sector and increasing clinical trial activity. France has a well-established regulatory framework ensuring high-quality lab testing standards, boosting demand for central lab services. The growing focus on personalized medicine and immunotherapies is driving biomarker-based research.

Germany clinical trial central laboratory services market is anticipated to grow significantly over the forecast period due to the leadership in pharmaceutical innovation and biopharmaceutical manufacturing. Germany’s strict adherence to clinical trial regulations and high demand for biomarker-driven research fuel the need for advanced lab testing services. The country’s growing focus on rare diseases and oncology trials is increasing the demand for specialized laboratory solutions.

Asia Pacific Clinical Trial Central Laboratory Services Market Trends

The clinical trial central laboratory services market in Asia Pacific is projected to grow at the highest CAGR over the forecast period. The region’s growth is due to the rising number of clinical trials in countries like China, India, and Japan. Global pharmaceutical companies invest in the region to achieve cost-effective research and large patient populations. The growing focus on biosimilars, regenerative medicine, and oncology trials further drives demand for biomarker testing and genomic analysis in the central labs.

China clinical trial central laboratory services market is expected to grow over the forecast period. The country’s growth is due to its expanding pharmaceutical industry and increasing global collaborations in drug development. China’s regulatory reforms, including accepting international clinical trial data, encourage more clinical research activities. The rapid growth of oncology and infectious disease trials is boosting demand for biomarker testing and pharmacokinetics analysis.

The clinical trial central laboratory services market in Japan is witnessing significant growth over the forecast period. The country’s advancements in precision medicine, cell therapies, and regenerative medicine support the market growth. Japan’s strong regulatory framework and streamlined clinical trial approval processes have increased research activity. The growing adoption of AI and big data analytics in lab testing is improving efficiency and accuracy.

India clinical trial central laboratory services market is witnessing considerable growth due to the increasing government support. India is becoming a preferred destination for global clinical trials due to its large patient pool and regulatory reforms promoting faster approvals. The rising number of oncology and infectious disease trials is fueling demand for biomarker testing and pathology services.

Latin America Clinical Trial Central Laboratory Services Market Trends

The clinical trial central laboratory services marketinLatin America is projected to grow over the forecast period. The growth is supported by increasing pharmaceutical R&D investments and regulatory improvements in countries like Brazil and Mexico. The region’s increasing focus on vaccine development, oncology research, and infectious disease trials drives demand for advanced lab testing. Expanding partnerships between global pharmaceutical companies and local research institutions strengthen clinical trial capabilities.

The clinical trial central laboratory services market in Brazil is expected to grow over the forecast period. Brazil’s strong pharmaceutical industry and growing investments in biologics research drive demand for central laboratory services. Regulatory improvements and faster clinical trial approvals are also encouraging more research activities.

Key Clinical Trial Central Laboratory Services Company Insights

Key players in the market are actively enhancing their service offerings to meet the growing demand for specialized central laboratory services in clinical trials. Companies are investing in advanced technologies such as AI-driven data analytics, automated sample processing, and real-time monitoring to improve efficiency and accuracy. Strategic partnerships with pharmaceutical companies and CROs are expanding service capabilities, ensuring comprehensive support across all phases of clinical trials. For instance, in June 2024, QPS Holdings, LLC expanded its laboratory service capabilities. Adding a central laboratory, a leukoplakia cell therapy facility, and enhanced PBMC capabilities strengthened its existing bioanalysis, translational medicine, and peripheral blood mononuclear cell (PBMC) laboratories.

Key Clinical Trial Central Laboratory Services Companies:

The following are the leading companies in the clinical trial central laboratory Services market. These companies collectively hold the largest market share and dictate industry trends.

- Labcorp

- ICON plc

- Eurofins Scientific

- Thermo Fisher Scientific Inc.

- Medpace

- Q² Solutions

- Syneos Health

- Charles River Laboratories

- SGS

- LabConnect

Recent Developments

-

In December 2024, Eurofins Central Laboratory completed the acquisition of assets from DCL Pathology LLC, a College of American Pathologists accredited laboratory recognized for its expertise in clinical trial pathology services. This strategic move enhanced Eurofins' capabilities in women's health, urology, and oncology studies, reinforcing its position in the clinical trial sector.

-

In June 2024, Labcorp introduced Global Trial Connect, a suite of central laboratory solutions designed to expedite clinical trials, particularly at investigator sites. This initiative aimed to enhance trial efficiency, reduce data delays, and streamline workflows, fostering stronger collaborations between patients, investigators, and biopharma sponsors.

-

In September 2024, Eurofins Network announced the expansion of its biopharma product testing services in the U.S. by acquiring Infinity Laboratories, Inc. This acquisition aimed to broaden Eurofins' testing capabilities and service offerings within the biopharmaceutical sector.

Clinical Trial Central Laboratory Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.37 billion

Revenue forecast in 2030

USD 6.97 billion

Growth rate

CAGR of 9.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, phase, indication, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Labcorp: ICON plc; Eurofins Scientific; Thermo Fisher Scientific Inc.; Medpace; Q² Solutions; Syneos Health; Charles River Laboratories; SGS; LabConnect

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trial Central Laboratory Services Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical trial central laboratory services market based on service, phase, indication, end-use, and region:

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomarker Testing Services

-

Microbiology Services

-

Anatomic Pathology/Histology

-

Pharmacokinetics/Pharmacodynamics (PK/PD)

-

Genomic and Molecular Testing

-

Sample Collection and Processing

-

Logistics & Sample Management

-

Data Management & Reporting

-

Others

-

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiology

-

Neurology

-

Infectious Diseases

-

Immunology & Autoimmune Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

Contract Research Organizations

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trial central laboratory services market is expected to grow at a compound annual growth rate of 9.79% from 2025 to 2030 to reach USD 6.97 billion by 2030.

b. North America dominated the clinical trial central laboratory services market with a share of 39.4% in 2024. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance and constant research and development initiatives.

b. Some key players operating in the clinical trial central laboratory services market include Labcorp, ICON plc, Eurofins Scientific, Thermo Fisher Scientific Inc., Medpace, Q² Solutions, Syneos Health, Charles River Laboratories, SGS, LabConnect

b. Key factors that are driving the market growth include growing cases of chronic diseases coupled with growing demand for new treatment options, advancements in precision medicines and biomarker-driven clinical trials.

b. The global clinical trial central laboratory services market size was estimated at USD 4.03 billion in 2024 and is expected to reach USD 4.37 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.