- Home

- »

- HVAC & Construction

- »

-

Cleanroom Technology Market Size, Industry Report, 2030GVR Report cover

![Cleanroom Technology Market Size, Share & Trends Report]()

Cleanroom Technology Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Equipment, Consumables), Cleanroom Type (Softwall, Rigidwall), By Service (Professional Services, Managed Services), By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-157-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cleanroom Technology Market Summary

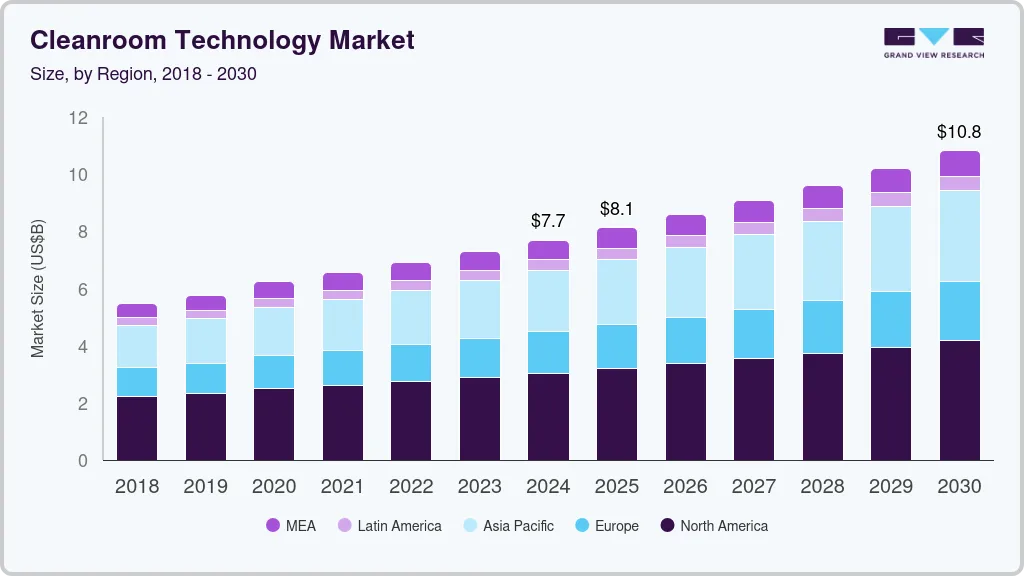

The global cleanroom technology market size was estimated at USD 7.69 billion in 2024 and is projected to reach USD 10.82 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. This growth is attributed to a surge in research and development activities, the rising prevalence of chronic diseases, and the escalating production of advanced electronic components.

Key Market Trends & Insights

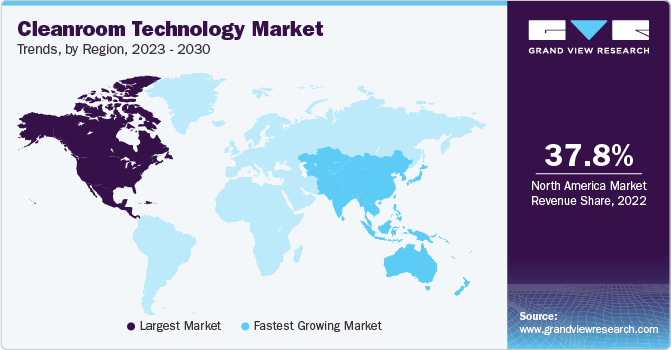

- North America cleanroom technology market led the overall market with revenue share of 39.4% in 2024.

- The cleanroom technology market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030.

- By product, the consumables segment dominated the market with a share of 55.2% in 2024.

- By cleanroom type, the hardwall cleanroom segment dominated the market with a share of 45.3%.

Market Size & Forecast

- 2024 Market Size: USD 7.69 Billion

- 2030 Projected Market Size: USD 10.82 Billion

- CAGR (2025-2030): 5.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market is expanding rapidly due to the growing need for environments that are free from contamination in industries, including biotechnology, electronics, healthcare, and pharmaceuticals. Adopting cleanroom technology becomes essential when companies place a higher priority on regulatory compliance and quality control, as this protects patient safety and product integrity.

Increasing regulations in industries like healthcare and pharmaceuticals are pushing businesses to invest in cleanroom technologies to comply with strict standards and stay compliant. Continuous technological developments, such as the incorporation of automation and robots, are improving efficiency and effectiveness, which is further driving the market to grow.

Cleanroom technology is becoming increasingly crucial in pharmaceutical manufacturing as a result of expanding global healthcare spending and an increased emphasis on biopharmaceuticals and personalized treatment. However, the market faces challenges such high initial investment costs, maintenance costs, and the requirement for experienced workers despite the promising future. Furthermore, the COVID-19 pandemic has caused supply chain disruptions, which have an effect on how quickly cleanroom initiatives are implemented.

The cleanroom technology industry is expected to grow and change dynamically in the future due to several significant developments. It is predicted that ongoing technological tendencies will improve the effectiveness and real-time monitoring of cleanroom settings. These tendencies encompass the incorporation of clever generation and Industry 4.0 practices. There will possibly be a regular need for cleanrooms due to the boom of biotechnology and healthcare, with a developing emphasis on biopharmaceuticals and personalized medicine.

Simultaneously, the need for strict contamination control approaches in electronics manufacturing and semiconductor production is expected to propel the market growth. The increasing popularity of modular and flexible cleanrooms can be attributed to their affordability and versatility. The development of worldwide healthcare infrastructure, strict rules, and a renewed focus on sustainability and strength performance in cleanroom design are likely to bolster the growth of the market. With quality control, compliance, and advanced manufacturing processes still being top priorities for industries, the marketplace is predicted to develop substantially in the upcoming years.

COVID-19 Impact on the Cleanroom Technology Market

The industry has been significantly impacted by the COVID-19 pandemic, resulting in both short-term disruptions and long-term trends. Following the pandemic, supply chains were disrupted, leading to delays in the development and execution of cleanroom projects. Lockdowns, travel bans, and labor shortages made it difficult to deliver supplies and equipment on time, which slowed down the installation process. Furthermore, the increased need for medications and medical supplies to fight the virus highlighted how important cleanroom technology is to upholding strict hygienic standards throughout the manufacturing process, especially in the pharmaceutical and healthcare industries. Consequently, the pandemic increased understanding of the value of cleanroom technology in guaranteeing product safety, quality, and regulatory compliance.

In the long run, the pandemic is probably going to have an impact on the industry. Cleanroom facility investments are anticipated to continue as a result of the growing focus on pharmaceutical manufacturing readiness and healthcare infrastructure. Modular solutions that allow for scalability and quick deployment are becoming more and more popular, and the lessons learned from COVID-19 further emphasize the value of flexibility and adaptability in cleanroom design. The pandemic has accelerated trends in digital transformation, and as industries look to improve operational resilience and efficiency in the post-pandemic era, it is expected that the integration of cutting-edge technologies, like robotics and automation, within cleanrooms will gain momentum.

Product Insights

The consumables segment dominated the market with a share of 55.2% in 2024 and witnessing a CAGR of 5.4% during the forecast period. Consumables are essential for maintaining the hygienic conditions and integrity of the controlled environments as they decrease the chance of contamination. Everyday cleanroom operations depend on supplies like gloves, swabs, wipes, disinfectants, and apparel because they help regulate particle levels, get rid of microbes, and safeguard both products and workers. The need for high-quality and specialized consumables has increased as a result of rising regulatory standards and growing awareness of the significance of contamination control. The cleanroom consumables market is anticipated to grow due to the continued demand for dependable and efficient instruments to uphold the perfect conditions necessary in cleanroom environments, as industries prioritize product quality and compliance.

The consumables segment is further bifurcated into safety consumables, including gloves and apparels, among other safety consumables and cleaning consumables, including wipes, disinfectants, and other cleaning consumables. Consumables for cleaning and safety are essential to the careful upkeep of cleanroom environments, guaranteeing the highest standards of cleanliness and safety. Safety supplies like gloves, facemasks, and clothes are essential for avoiding human contamination and protecting workers and manufactured goods. These products add to the overall cleanliness of the controlled environment since they are made to adhere to stringent requirements for microbiological and particulate control.

However, for regular cleaning and decontamination procedures, cleaning consumables like wipes, swabs, disinfectants, and cleaning solutions are necessary. They aid in keeping the cleanroom at the designated levels by removing dust, particles, and possible contaminants from workstations, equipment, and surfaces. The need to maintain product quality, comply with regulations, and establish a controlled environment that supports cleanroom technology-dependent industries like biotechnology, electronics, healthcare, and pharmaceuticals is what drives the demand for these safety and cleaning consumables.

The equipment segment is anticipated to witness faster growth, growing at a CAGR of 6.5% throughout the forecast period. Establishing and maintaining controlled environments that meet strict cleanliness standards requires the use of cleanroom equipment. These specialized equipment and tools are made to reduce the possibility of contamination in industries like biotechnology, electronics, healthcare, and pharmaceuticals. Laminar flow hoods, air showers, pass-through chambers, and high-efficiency particulate air (HEPA) filters are examples of cleanroom equipment.

Laminar flow hoods safeguard delicate processes with regulated and filtered airflow, and air showers act as personnel entryway decontamination units. Material transfers are made easier with pass-through chambers, which preserve the cleanroom environment. The elimination of microbes, particulate matter, and other air pollutants is guaranteed by HEPA filters. Adhering to regulatory requirements, preventing product defects, and maintaining the required cleanliness levels all depend on the choice and use of equipment. The need for sophisticated and specialized cleanroom equipment is anticipated to increase as industries continue to place a high priority on quality control and compliance, spurring continuous advancements in design and technology in this field.

Cleanroom Type Insights

The hardwall cleanroom segment dominated the market with a share of 45.3%. It is expected to grow at the fastest CAGR of 6.6% throughout the forecast period. A hardwall cleanrooms provide a stable structure to protect individuals or products, with the hardwall panels making it easier to regulate pressure within the contained environment. The walls and ceilings of hardwall cleanrooms are made of prefabricated panels. These panels can be made from various materials, including standard vinyl and Fiber-Reinforced Plastic (FRP). Because hardwall cleanrooms are built with permanent infrastructure, they are best suited for permanent or semi-permanent applications. Hardwall cleanrooms are designed to meet all the standards specified by the ISO cleanroom classification.

The softwall cleanroom segment is anticipated to grow at a CAGR of 5.1% throughout the forecast period. Softwall cleanrooms are a versatile and adaptable solution designed to provide a controlled environment with low levels of particulate contamination. Unlike traditional hardwall cleanrooms, they incorporate soft, transparent vinyl walls and entrances with improved flexibility and visibility. These lightweight and pliable walls allow for easy installation, modification, and expansion, making softwall cleanrooms an ideal choice for applications requiring flexibility in configuration. Softwall cleanrooms are inexpensive and can be modified into larger or smaller models or with different entry points. The cost-effectiveness and portability of soft wall cleanrooms drive the segment's growth in the overall market.

Service Type Insights

The professional services segment dominated the market with a 66.1% share in 2024. It is anticipated to grow at a CAGR of 5.3% during the forecast period. The professional services segment is further segmented into consultation services, budgeting and planning services, design and engineering services, construction and assembly services, testing and certification services, and preventative maintenance services. Professional services offer customers the expertise required to make the most of cleanroom technology solutions and services. Cleanroom facilities are complex, and various factors must be considered while investing in them. Moreover, the need for custom solutions across industries, depending on the product type, requires expert guidance. Several players in this market across the globe offer professional services for cleanrooms. The need for expertise due to the complexity of cleanrooms and the wide availability of professional services is driving the segment's growth.

The managed services segment is expected to witness at a faster CAGR of 7.0% throughout the forecast period. Managed services help manage day-to-day operations or activities of a cleanroom environment. They include services such as 24/7 technical support. Managed services actively help customers achieve business goals. Tools such as Building Management System (BMS) are used to monitor cleanroom equipment and facilities. A BMS, also called a Building Automation System (BAS), is a computer-based management system used in cleanrooms to control and monitor mechanical and electrical equipment installed on a secure site. Heating, cooling, power, ventilation, fire, lighting, and security systems are all examples of electrical and mechanical equipment required for the safe and effective operation of a cleanroom.

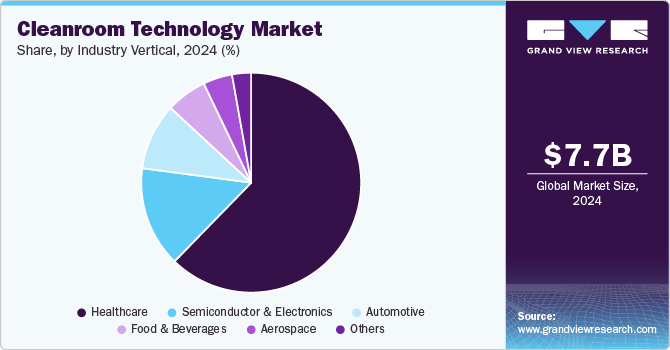

Industry Vertical Insights

The healthcare segment dominated the market with a revenue share of 62.3% in 2024 and witnessing the fastest CAGR of 6.3% during the forecast period. Pharmaceutical manufacturing, research, and medical procedures all depend heavily on cleanrooms, which are essential to maintaining their integrity and safety. Strict cleanliness guidelines are followed in these controlled environments to reduce the possibility of microbial contamination and preserve aseptic conditions. In the pharmaceutical industry, cleanrooms are essential to the production of sterile drugs and medical equipment. In the medical industry, these are critical for researching medical solutions, developing vaccines, and manufacturing life-saving medical devices and drugs. The cleanroom classification environment for the pharmaceutical & healthcare industry depends on the application. The environment must be highly sterile for medical research. Medical research cleanrooms usually fall between ISO Class 5 and ISO Class 7 of the ISO 14644-1 standards.

The semiconductor & electronics segment is anticipated to grow at a CAGR of 5.4% throughout the forecast period. Semiconductors are used in most electronic devices, from consumer devices such as smartphones and laptops to complex defense equipment and automobiles. They are produced with highly sensitive material and can be easily affected by environmental contaminants such as airborne particles and pollutants. Hence, semiconductor manufacturers use cleanrooms to maintain quality and reduce semiconductor failures. Advanced air filtration systems, such as high-efficiency particulate air (HEPA) and ultra-low penetration air (ULPA) filters, are employed to maintain the required cleanliness levels. Generally, semiconductor cleanrooms must comply with the International Organization for Standardization (ISO)’s ISO 14644-1 Class 4 to Class 6 requirements.

Regional Insights

North America cleanroom technology market led the overall market with revenue share of 39.4% in 2024, with the U.S. being a major contributor to the industry. The growth of this region is attributed to strict regulatory requirements and an emphasis on upholding premium manufacturing processes. Furthermore, several biotechnology and pharmaceutical companies in North America heavily depend on controlled environments for their research, development, and production. A significant factor in driving the need for cleanroom technology is the electronics sector, which includes the semiconductor manufacturing sector. The market's growth is further propelled by technological developments like the incorporation of automation and smart technologies. The market is expected to grow steadily in the region as it prioritizes innovation and regulatory compliance. This is because the region is seeing continuous advancements in cleanroom’s design, equipment, and consumables to meet the changing needs of various industries.

U.S. Cleanroom Technology Market Trends

The Cleanroom Technology market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. The region is a major hub for semiconductor manufacturing, pharmaceutical production, and aerospace industries. The increasing demand for advanced manufacturing technologies and stringent regulatory standards are driving the growth of the cleanroom technology market. The U.S. has a well-established ecosystem of cleanroom manufacturers, suppliers, and service providers, further contributing to the market's expansion.

Asia Pacific Cleanroom Technology Market Trends

The Asia Pacific is expected to develop substantially throughout the projection period and grow at the fastest CAGR of 6.9%. Rapid industrialization, increasing healthcare infrastructure investments, and the expansion of the electronics and pharmaceutical industries are some of the factors propelling the market growth. China, India, Japan, and South Korea are some of the major countries that contribute to the demand of cleanrooms to meet stringent cleanliness standards in production processes. The region's commitment to technological advancements and the adoption of cleanroom solutions to comply with international regulatory standards positions Asia Pacific as a key player in the global market. The market in this region is poised for continued expansion as industries prioritize quality control and contamination prevention in their manufacturing processes.

The cleanroom technology market in India is expected to grow at a significant CAGR from 2025 to 2030. India's emerging manufacturing sector, particularly in electronics and pharmaceuticals, is fueling the demand for cleanroom technology. The government's initiatives to promote manufacturing and the increasing focus on quality control are driving the market growth. However, challenges such as a lack of skilled labor and infrastructure limitations may hinder the market's full potential.

Japan cleanroom technology market in Japan is expected to grow at a significant CAGR from 2025 to 2030. Japan is a global leader in semiconductor manufacturing and precision engineering. The country's strong emphasis on research and development and its commitment to technological advancements are driving the demand for advanced cleanroom technology. The presence of leading semiconductor manufacturers and a robust supply chain are further contributing to the market's growth.

Europe Cleanroom Technology Market Trends

The Cleanroom Technology market in Europe is expected to grow at a significant CAGR from 2025 to 2030. The region's strong pharmaceutical industry, coupled with increasing investments in biotechnology and nanotechnology, is driving the demand for cleanroom technology. Germany and the UK are major markets for cleanroom technology in Europe, owing to the presence of a large number of pharmaceutical and biotech companies. However, economic uncertainties and regulatory challenges may impact the market's growth.

The UK cleanroom technology market is expected to grow at a significant CAGR from 2025 to 2030. The UK has a thriving pharmaceutical industry and a strong focus on life sciences research. The increasing demand for high-quality products and stringent regulatory standards are driving the adoption of cleanroom technology. However, Brexit-related uncertainties may impact the market's growth in the short term.

Key Cleanroom Technology Company Insights

The industry is marked by the presence of both established players and emerging entrants, fostering healthy competition, and driving innovations in equipment, consumables, and services. The key players in the market include Advanced Technology Group, CIMTechniques (SmartScan Technologies), Cleanrooms By United, Angstrom Technology, Elsisan (YI-BA Engineering. Ltd. Sti.), HEMCO Corporation, Kojair Tech Oy, Spetec GmbH, Terra Universal Inc., and Thomas Scientific, among others. These market players are aggressively pursuing strategies such as new product development and mergers & acquisitions to gain a significant share of the global market. Contamination control is becoming increasingly important in the pharmaceutical, biotechnology, healthcare, and electronics industries. As a result, the cleanroom technology market is highly competitive, with companies vying for market share by adapting to the changing needs of a wide range of clients.

Some key companies operating in the barcode printer market include Angstrom Technology, Thomas Scientific, and Advanced Technology Group, among others.

-

Angstrom Technology is a leading provider of advanced cleanroom solutions, offering a wide range of products and services to meet the diverse needs of industries such as semiconductor, pharmaceutical, and biotechnology. The company's core competencies include modular cleanroom design and construction, HVAC systems, and contamination control solutions. Angstrom Technology's strong focus on innovation and customer satisfaction has enabled it to establish a strong market position. However, the company faces intense competition from other established players in the industry.

-

Thomas Scientific is a well-established supplier of scientific equipment and laboratory supplies, including a wide range of cleanroom products. The company's extensive product portfolio, strong distribution network, and established brand reputation have made it a significant player in the cleanroom technology market. However, Thomas Scientific's competitive advantage lies in its ability to offer a comprehensive range of products and services. The company may face challenges from specialized cleanroom technology providers that offer more tailored solutions.

-

Advanced Technology Group (ATG) is a global provider of advanced cleanroom technology solutions, specializing in modular cleanroom systems, HVAC systems, and contamination control products. ATG's strong focus on innovation, quality, and customer service has enabled it to establish a strong market position. The company's ability to provide customized solutions and its global reach are key competitive advantages. However, ATG may face challenges from other global players in the industry, particularly in terms of pricing and delivery times.

Spetec GmbH and Terra Universal Inc. are some emerging companies in the target market.

-

Spetec GmbH is a German company specializing in the development and manufacturing of high-quality cleanroom products, including cleanroom garments, cleanroom consumables, and cleanroom cleaning systems. The company's strong focus on quality, innovation, and customer satisfaction has enabled it to establish a strong reputation in the industry. Spetec's competitive advantage lies in its ability to offer customized solutions and its commitment to sustainable practices. However, the company may face challenges from larger, more established competitors in terms of market reach and pricing.

-

Terra Universal Inc. is a leading provider of modular cleanroom and laboratory solutions. The company offers a wide range of products, including modular cleanroom systems, laboratory furniture, and contamination control products. Terra Universal's strong focus on innovation, quality, and customer service has enabled it to establish a strong market position. The company's ability to provide customized solutions and its extensive experience in the industry are key competitive advantages. However, Terra Universal may face challenges from other established players in the industry, particularly in terms of pricing and delivery times.

Key Cleanroom Technology Companies:

The following are the leading companies in the cleanroom technology market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Technology Group

- CIMTechniques (SmartScan Technologies)

- Cleanrooms By United

- Angstrom Technology

- Elsisan (YI-BA Engineering. Ltd. Sti.)

- HEMCO Corporation

- Kojair Tech Oy

- Spetec GmbH

- Terra Universal Inc.

- Thomas Scientific

Recent Developments

-

In October 2024, EAZER Maintenance, ABN Cleanroom Technology, and Hasselt University have collaborated to develop CleanAR, a digital tool that uses augmented reality to guide cleanroom cleaning. This innovative solution aims to improve cleaning precision and ensure adherence to cleanliness standards.

-

In April 2024, AES Clean Technology launched the CleanLock Module, a new airlock solution designed to enhance cleanliness and efficiency in cleanroom projects. This innovative module minimizes contamination risks by integrating advanced features like proprietary finishes, patented lighting, and controlled airflow. It provides a secure transition for personnel and materials entering and exiting cleanroom environments.

-

In February 2022, Angstrom Technology, a U.S.-based manufacturer, acquired Specific Environments Limited, a UK-based company specializing in cleanroom design and engineering. This acquisition, facilitated by Evolution CBS, demonstrates increased international interest in UK businesses with deep technical expertise. The deal will allow Specific Environments to leverage Angstrom's global resources to further enhance its offerings and expand its market reach.

Cleanroom Technology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.12 billion

Revenue forecast in 2030

USD 10.82 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Actual data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, cleanroom type, service, industry vertical, region

Regional scope

North America; Europe; Asia-Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Advanced Technology Group; CIMTechniques (SmartScan Technologies); Cleanrooms By United; Angstrom Technology; Elsisan (YI-BA Engineering. Ltd. Sti.); HEMCO Corporation; Kojair Tech Oy; Spetec GmbH; Terra Universal Inc.; Thomas Scientific

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cleanroom Technology Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cleanroom technology market based on product, cleanroom type, service, industry vertical, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Equipment

-

Fan Filter Units (FFU)

-

HVAC Systems

-

Laminar Air Flow Systems and Biosafety Cabinets

-

HEPA Filters

-

Others

-

-

Consumables

-

Safety Consumables

-

Gloves

-

Apparel

-

Other Safety Consumables

-

-

Cleaning Consumables

-

Wipes

-

Disinfectants

-

Other Cleaning Consumables

-

-

-

-

Cleanroom Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Softwall Cleanroom

-

Hardwall Cleanroom

-

Rigidwall Cleanroom

-

Others

-

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Professional Services

-

Consultation Services

-

Budgeting and Planning Services

-

Design and Engineering Services

-

Construction and Assembly Services

-

Testing and Certification Services

-

Preventative Maintenance Services

-

-

Managed Services

-

-

Industry Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Semiconductor & Electronics

-

Food & Beverages

-

Healthcare

-

Automotive

-

Aerospace

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cleanroom technology market size was estimated at USD 7.69 billion in 2024 and is expected to reach USD 8.12 billion in 2025.

b. The global cleanroom technology market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2030 to reach USD 10.82 billion by 2030.

b. North America dominated the cleanroom technology market with a share of 39.5% in 2024. This is attributable to the strict regulatory requirements and an emphasis on upholding premium manufacturing processes. Furthermore, the market's growth is propelled by technological developments like the incorporation of automation and smart technologies.

b. Some key players operating in the cleanroom technology market include Advanced Technology Group, CIMTechniques (SmartScan Technologies), Cleanrooms By United, Angstrom Technology, Elsisan (YI-BA Engineering. Ltd. Sti.), HEMCO Corporation, Kojair Tech Oy, Spetec GmbH, Terra Universal Inc., and Thomas Scientific, among others.

b. Key factors that are driving the market growth include a surge in research and development activities, the rising prevalence of chronic diseases, and the escalating production of advanced electronic components. The market is expanding rapidly due to the growing need for environments that are free from contamination in industries, including biotechnology, electronics, healthcare, and pharmaceuticals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.