- Home

- »

- Homecare & Decor

- »

-

Cleaning And Hygiene Products Market, Industry Report 2033GVR Report cover

![Cleaning And Hygiene Products Market Size, Share & Trends Report]()

Cleaning And Hygiene Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Cleaning Tools, Personal Care, Kitchen Care, Fabric Care), By End-user (Healthcare, Food Service, Retail, Cruise, Commercial Laundry), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-182-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cleaning And Hygiene Products Market Summary

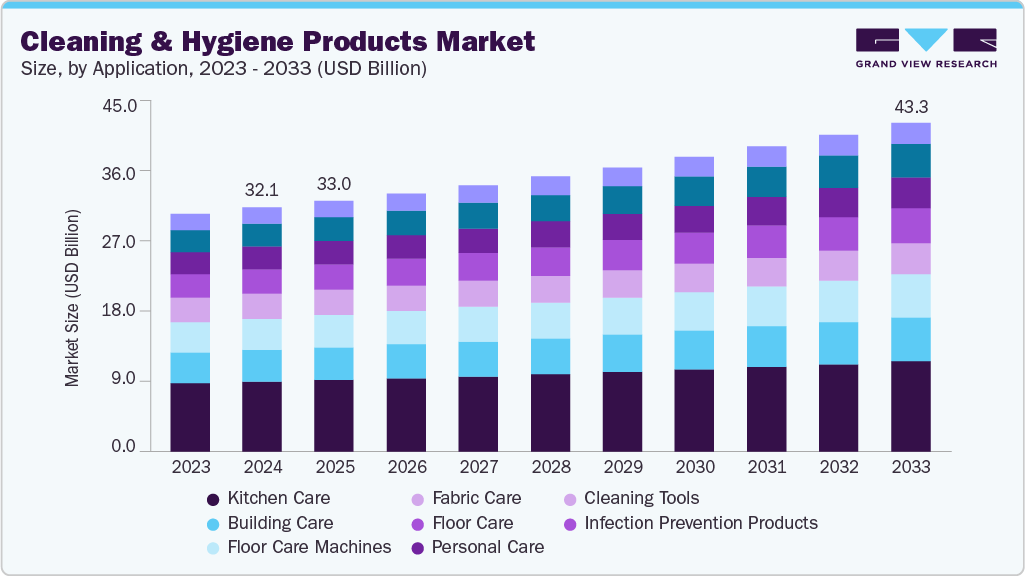

The global cleaning and hygiene products market size was estimated at USD 32,123.1 million in 2024 and is projected to reach USD 43,313.8 million by 2033, growing at a CAGR of 3.4% from 2025 to 2033. The market is driven by various factors, such as the increasing number of single-person households, rising disposable income, and heightened health and hygiene priorities among consumers, which have driven a surge in the demand for household cleaning products.

Key Market Trends & Insights

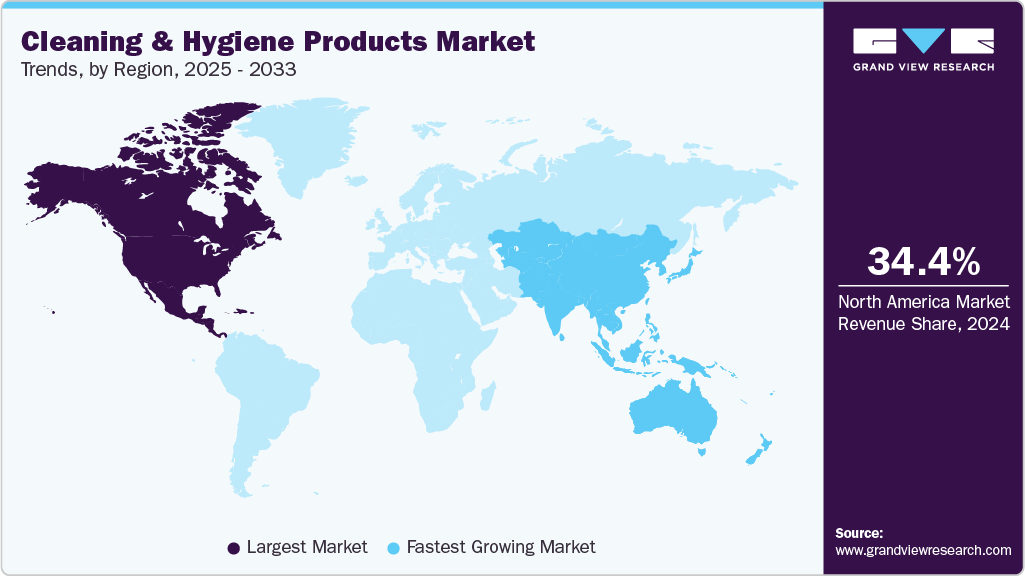

- North America cleaning and hygiene products market held the major share of 34.37% of the global cleaning and hygiene products market in 2024.

- The cleaning and hygiene products market in the U.S. holds the largest share in North America in 2024.

- By application, the kitchen care segment held the highest market share of 28.57% in 2024.

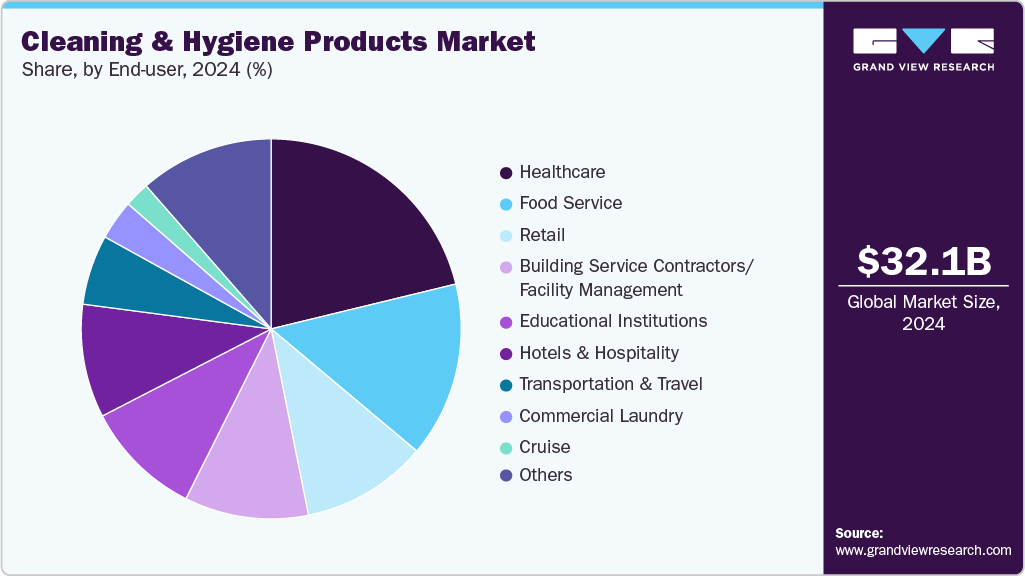

- Based on the end-user, the healthcare segment held the highest market shareof 21.21% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 32,123.1 Million

- 2033 Projected Market Size: USD 43,313.8 Million

- CAGR (2025-2033): 3.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, the market has witnessed ongoing product innovations, as numerous companies expand their product ranges, significantly transforming the industry landscape. The COVID-19 pandemic significantly heightened awareness regarding hygienic practices and household cleanliness globally. This increased awareness sparked an unprecedented surge in demand for cleaning products, resulting in a widespread shortage. Manufacturers ramped production capacity, notably boosting global sales within this market segment.The market is experiencing a notable push from consumers towards eco-friendly and sustainable household products. This shift is evident as customers seek cleaning items with 'natural' components, aiming to steer clear of harmful chemicals while reducing carbon emissions in both production and usage. Furthermore, the growing market for premium household products in developed nations such as the UK, the U.S., Canada, and Japan has contributed significantly to recent market expansion.

Commercial sectors are increasingly emphasizing cleanliness and hygiene, fueling substantial demand for multi-purpose cleaning products. These cleaners boast versatility, able to handle various tasks like floor and surface cleaning and glass maintenance, and effectively tackle challenging stains like oil and grease. The efficiency of using a single product for multiple functions is apparent, offering economic advantages and simplified management and storage.

The market has seen a notable increase in demand for cleaning products that prioritize safety and are devoid of harsh chemicals. Ammonia, a common ingredient in many cleaners, is often unpleasant. These products can adversely affect the overall visitor experience within bustling commercial spaces hosting numerous daily visitors. Moreover, individual’s sensitive to chemical cleaning products might exhibit allergic reactions such as sneezing, coughing, or watery eyes in severe cases.

Individual product preferences vary significantly and are influenced by psychographic, demographic, and behavioral aspects. Lifestyle choices and awareness notably shape consumer behavior. Sustaining consumer loyalty and product differentiation poses a challenge in the current market. The allure of innovative offerings often leads consumers away from sticking to a single brand or product. Small and medium-sized manufacturers face escalating difficulties in keeping pace with evolving consumer preferences, collectively impeding market growth.

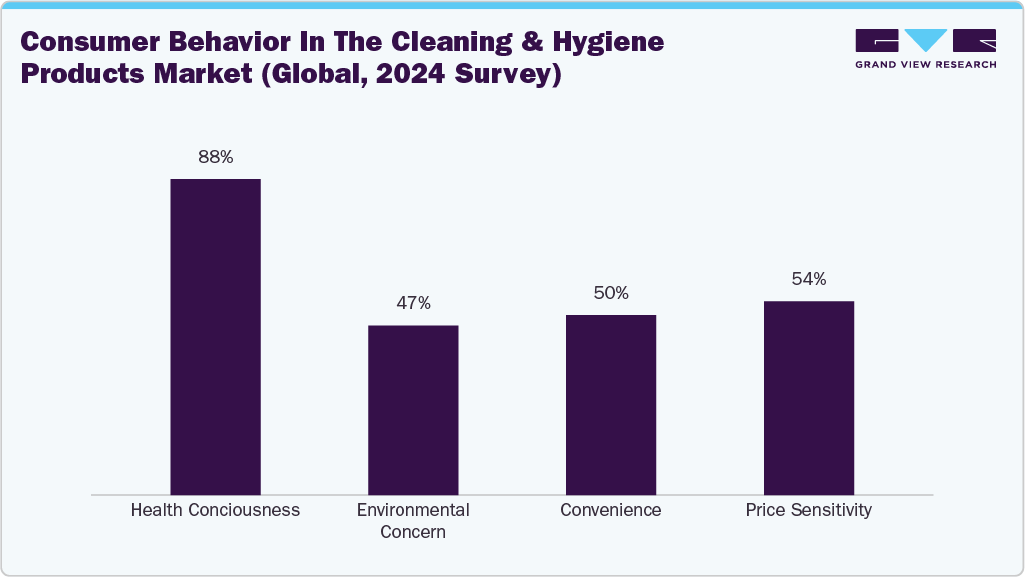

Consumer Surveys & Insights

Consumer behavior in the cleaning and hygiene products industry is significantly influenced by health consciousness, environmental concerns, convenience, and changing lifestyles. Over the past few years, a notable shift has been toward products promoting personal and ecological well-being. This trend is evident in consumers’ growing preference for eco-friendly, non-toxic, and sustainable products.

Health and hygiene have always been a priority, especially after global health crises like the COVID-19 pandemic. The demand for cleaning and disinfecting products surged during this period, and though it has normalized, hygiene remains a priority for many consumers. According to a survey by the American Cleaning Institute (ACI), 88% of consumers considered cleanliness a key determinant in choosing products, and nearly 50% of consumers are still using more disinfectant products post-pandemic than before. This shift underscores the continuing importance of hygiene in consumer behavior.

The convenience factor also plays a significant role in consumer behavior, especially with the rise of e-commerce. Online shopping has become a preferred channel for consumers purchasing cleaning and hygiene products. In addition, there is a growing shift towards multi-purpose cleaning products. Consumers are increasingly seeking products that offer versatility, saving time and money. For instance, multi-surface disinfectants and all-in-one cleaners have gained significant traction as they allow consumers to perform various tasks with a single product, which aligns with modern consumers' busy, time-pressed lifestyles.

Price sensitivity remains a strong factor for 54% consumers for budget-conscious shoppers. Consumers in emerging markets are particularly price-sensitive and often opt for affordable yet effective cleaning solutions. However, this does not necessarily mean they will compromise on quality, as efficacy and brand reputation are critical.

Application Insights

Based on application, the kitchen care segment led the market with the largest revenue share of 28.57% in 2024. The significant market share reflects the importance of maintaining hygiene in kitchens, driven by rising consumer awareness of food safety, sanitation, and the desire to maintain a clean and odor-free cooking space. Kitchen care products are considered essential in both household and commercial kitchens, making them a key driver of the overall cleaning products market. The growth of this segment is further bolstered by increasing consumer demand for eco-friendly and chemical-free products, as well as innovations in packaging and product formulations that enhance convenience and effectiveness.

The cleaning tools segment is experiencing steady growth, with an expected CAGR of 4.5% from 2025 to 2033. The demand for cleaning tools is largely driven by consumers’ increasing focus on cleanliness and convenience. A shift towards more efficient and durable tools, such as robotic vacuums and ergonomic cleaning devices, contributes to the sector's growth. In addition, the growing trend of DIY cleaning and home maintenance, coupled with the rise of online shopping, is boosting sales in this segment. As sustainability continues to be a priority for consumers, cleaning tool manufacturers are innovating with eco-friendly materials and reusable products, further supporting the segment's expansion in the coming years.

End-user Insights

Based on end-user, the healthcare segment led the market with a revenue share of 21.21% in 2024. This share reflects the importance of maintaining sanitary and infection-free environments in healthcare settings, including hospitals, clinics, nursing homes, and outpatient care facilities. Healthcare facilities require specialized cleaning products such as disinfectants, surface sanitizers, sterilizers, and infection control products to ensure patient safety and adhere to stringent hygiene standards.

The demand for cleaning and hygiene products in healthcare is driven by an increasing focus on preventing healthcare-associated infections (HAIs), rising awareness of patient safety, and the continuous need to maintain high cleanliness standards in medical facilities. In addition, the ongoing evolution of healthcare regulations and standards ensures sustained growth in the healthcare segment as hospitals and other healthcare facilities prioritize cleanliness to meet regulatory requirements and safeguard patient well-being.

The building service contractors/facility management category, based on end user, is projected to grow at a robust CAGR of 4.7% from 2025 to 2033. This category covers the cleaning and maintenance needs of commercial, residential, and industrial buildings, including offices, retail spaces, warehouses, and residential complexes. Facility management companies and building service contractors are critical in maintaining various properties' cleanliness, safety, and functionality. Market growth in this segment is largely fueled by the increasing number of commercial and residential buildings and the growing demand for professional cleaning services.

In addition, the rising trend of facility managers and contractors adopting sustainable and green cleaning solutions to meet environmental and health standards is contributing to the sector's expansion. As businesses and property owners prioritize hygiene and environmental responsibility, the facility management sector will remain a key end-user for cleaning products and services.

Regional Insights

North America dominates the cleaning and hygiene products market, capturing the largest market share of 34.37% in 2024. This significant market share is attributed to several factors, including the growing awareness of hygiene and cleanliness across residential and commercial sectors, and the region’s well-established distribution networks. The North American market benefits from an extensive retail infrastructure, including supermarkets, hypermarkets, pharmacies, and online platforms, which makes cleaning and hygiene products easily accessible to consumers.

In addition, the region's high standard of living, combined with increasing consumer health consciousness, has driven a strong demand for effective and safe cleaning products. The rise in health-related concerns, particularly during and after the pandemic, has also resulted in heightened demand for disinfectants, sanitizers, and surface cleaners, further solidifying North America's dominance in the market.

U.S. Cleaning And Hygiene Products Market Trends

The cleaning and hygiene products market in the U.S. holds the largest share in North America in 2024, driven by several key factors shaping consumer behavior and market dynamics. As one of the most developed economies globally, the U.S. boasts a large, diverse consumer base that increasingly values hygiene, cleanliness, and sanitation across residential and commercial spaces. The country’s heightened focus on health and safety, particularly in light of the COVID-19 pandemic, has led to a sustained demand for disinfectants, surface cleaners, hand sanitizers, and other hygiene products. Increasing consumer consciousness about preventing infections and maintaining clean environments has made hygiene products essential in households, workplaces, schools, healthcare facilities, and public spaces.

Asia Pacific Cleaning And Hygiene Products Market Trends

The cleaning and hygiene products market in the Asia Pacific region is experiencing the highest CAGR from 2025 to 2033. This dynamic market growth is driven by rapid urbanization, rising disposable incomes, increasing consumer awareness about hygiene, and the expanding middle class across key countries such as China, India, Japan, and Southeast Asia. The region’s market growth is also influenced by a shift toward more advanced cleaning technologies, increasing product availability, and expanding e-commerce platforms.

One of the primary drivers of growth in the Asia Pacific region is the surge in demand for hygiene and cleaning products in residential and commercial settings. In countries like China and India, the rising focus on personal and environmental hygiene, particularly during the COVID-19 pandemic, has significantly boosted sales. As consumers become more health-conscious, the demand for cleaning solutions that offer protection against germs, bacteria, and viruses continues to rise. With its increasing number of young, health-conscious consumers, the region's population is more likely to invest in high-quality cleaning products to maintain personal hygiene and ensure the cleanliness of their homes and workplaces.

Europe Cleaning And Hygiene Products Market Trends

The cleaning and hygiene products market in Europe is experiencing steady growth. Strong demand for cleaning solutions is driven by increased awareness of hygiene, environmental sustainability, and innovative product offerings. The market is highly competitive, with well-established manufacturers across Western and Eastern Europe contributing to the sector's growth. In Europe, regional manufacturers have a significant presence in the market, with several companies leading in product innovation, sustainability, and market reach. Henkel, a key player in the European cleaning products market, is recognized for its strong portfolio of products, including popular brands such as Persil (laundry detergents), Bref (toilet cleaners), and Pril (dishwashing liquids). Henkel has focused on product innovation, particularly on developing sustainable solutions. For example, Henkel introduced a line of cleaning products with biodegradable packaging and refillable bottles to reduce plastic waste. The company has committed to making 100% of its packaging recyclable or reusable by 2025, in line with growing environmental concerns among European consumers.

Similarly, Reckitt Benckiser (RB) has seen significant success in the region with its wide range of cleaning products, such as Lysol, Vanish, and Cillit Bang. Reckitt's strategy focuses on leveraging digital technology and e-commerce platforms to reach consumers in both urban and rural areas. The company has also adapted to the increasing demand for green cleaning solutions and expanded its European product range to include more sustainable, plant-based cleaning options.

Key Cleaning And Hygiene Products Company Insights

The global market is dynamic and includes established global brands and emerging players. Companies continuously adapt to consumer preferences and expand their offerings to strengthen their market positions. As hygiene and cleanliness remain top priorities for consumers and businesses worldwide, the market is shifting toward more sustainable, eco-friendly, and innovative products.

-

Procter & Gamble (P&G) is one of the market's largest and most well-known companies. Based in Cincinnati, Ohio, P&G's extensive portfolio includes some of the most recognizable global cleaning brands, such as Tide (laundry detergent), Ariel, Mr. Clean, and Febreze (air fresheners). The company is known for its commitment to innovation and sustainability, with initiatives to reduce its environmental footprint. P&G has made significant strides in producing biodegradable, recyclable packaging and has committed to using 100% recyclable or reusable packaging by 2030. The company's extensive retail and online presence and its focus on continuous product improvement position it as a global market leader.

-

Reckitt Benckiser (RB) is another major global cleaning and hygiene player. Headquartered in Slough, UK, Reckitt Benckiser offers a broad range of cleaning, hygiene, and health products under brands like Lysol, Finish, Dettol, and Vanish. The company is a recognized leader in disinfectant and surface care, with products widely used in households and commercial establishments. Reckitt Benckiser has focused on expanding its portfolio with a strong emphasis on eco-friendly products, particularly in the cleaning and sanitizing categories, to meet the rising consumer demand for sustainability. With operations in over 60 countries, the company continues strengthening its market presence through product innovation and commitment to health and hygiene.

Key Cleaning And Hygiene Products Companies:

The following are the leading companies in the cleaning and hygiene products market. These companies collectively hold the largest market share and dictate industry trends.

- Colgate-Palmolive Company

- The Procter & Gamble Company

- Henkel AG & Co. KGaA

- Unilever plc

- Reckitt Benckiser Group plc

- Church & Dwight Co., Inc.

- Kao Corporation

- S.C. Johnson & Son Inc.

- McBride plc

- Vikara Services Pvt. Ltd. (THE BETTER HOME)

Recent Developments

-

In August 2025, Procter & Gamble (P&G) launched its inaugural "Clean Future Week" in Tokyo, marking a strategic expansion into the Asian cleaning and hygiene market. Scheduled from September 15-18 at the Tokyo International Forum, the event will feature product demonstrations, workshops, and discussions centered around P&G’s latest innovations in sustainable cleaning products. Highlighting eco-friendly offerings from brands such as Tide, Ariel, and Mr. Clean, the initiative also showcases P&G’s new biodegradable packaging and refill stations. In partnership with Japan’s Ministry of the Environment, this event underscores P&G’s commitment to sustainability. It strengthens its presence in the growing demand for environmentally responsible cleaning solutions across the Asia-Pacific region.

-

In February 2025, Reckitt Benckiser (RB) partnered with the World Health Organization (WHO) to launch a new line of hygiene and disinfectant products to support global health initiatives. The collaboration focuses on providing affordable and effective cleaning solutions to low-income communities while promoting hygiene education. The launch occurred during the World Health Assembly in Geneva, where Reckitt hosted an interactive hygiene education booth, educating visitors on the importance of sanitation in preventing disease outbreaks. This partnership strengthens RB’s position in the global market while aligning its product range with international health standards and initiatives to reduce health risks due to poor sanitation.

Cleaning And Hygiene Products Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 33,026.1 million

Revenue forecast in 2033

USD 43,313.8 million

Growth rate (revenue)

CAGR of 3.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa; Central America; Caribbean Islands

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; Spain; France; Russia; China; India; Australia; New Zealand; South Korea; Japan; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Colgate-Palmolive Company; The Procter & Gamble Company; Henkel AG & Co. KGaA; Unilever plc; Reckitt Benckiser Group plc; Church & Dwight Co., Inc.; Kao Corporation; S.C. Johnson & Son Inc.; McBride plc; Vikara Services Pvt. Ltd. (The Better Home)

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cleaning And Hygiene Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cleaning and hygiene products market based on application, end-user, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cleaning Tools

-

Personal Care

-

Infection Prevention Products

-

Floor Care

-

Building Care

-

Floor Care Machines

-

Kitchen Care

-

Fabric Care

-

-

End-user Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare

-

Food Service

-

Hotels & Hospitality

-

Building Service Contractors/Facility Management

-

Retail

-

Educational Institutions

-

Transportation and Travel

-

Commercial Laundry

-

Cruise

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Italy

-

Spain

-

-

Asia Pacific

-

Australia

-

New Zealand

-

India

-

Japan

-

China

-

South Korea

-

-

Latin America

-

Argentina

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Central America

-

Caribbean Islands

-

Frequently Asked Questions About This Report

b. The global cleaning and hygiene products market was estimated at USD 32,123.1 million in 2024 and is expected to reach USD 33,026.1 million in 2025.

b. The global cleaning and hygiene products market is expected to grow at a compound annual growth rate of 3.4% from 2025 to 2033 to reach USD 43,313.8 million by 2033.

b. North America dominated the cleaning and hygiene products market with a share of 34.37% in 2024. This significant market share is attributed to several factors, including the growing awareness of hygiene and cleanliness across both residential and commercial sectors, and the region’s well-established distribution networks.

b. Some of the key players operating in the cleaning and hygiene products market include Colgate-Palmolive Company; The Procter & Gamble Company; Henkel AG & Co. KGaA; Unilever PLC; Reckitt Benckiser Group PLC; Church & Dwight Co. Inc.; Kao Corporation, S.C. Johnson & Son Inc.; McBride PLC; and Vikara Services Pvt. Ltd (THE BETTER HOME).

b. Key factors that are driving the cleaning & hygiene products market growth include the higher prominence toward workplace cleanliness and hygiene coupled with the rising number of restaurants, hotels, and hospitals across regions, and rapid expansion in commercial constructions, particularly in developing economies such as India and China.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.