- Home

- »

- Beauty & Personal Care

- »

-

Clean Beauty Market Size, Share & Trends Report, 2030GVR Report cover

![Clean Beauty Market Size, Share & Trends Report]()

Clean Beauty Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Skincare, Haircare, Color Cosmetics), By End User (Men, Women), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-391-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Clean Beauty Market Summary

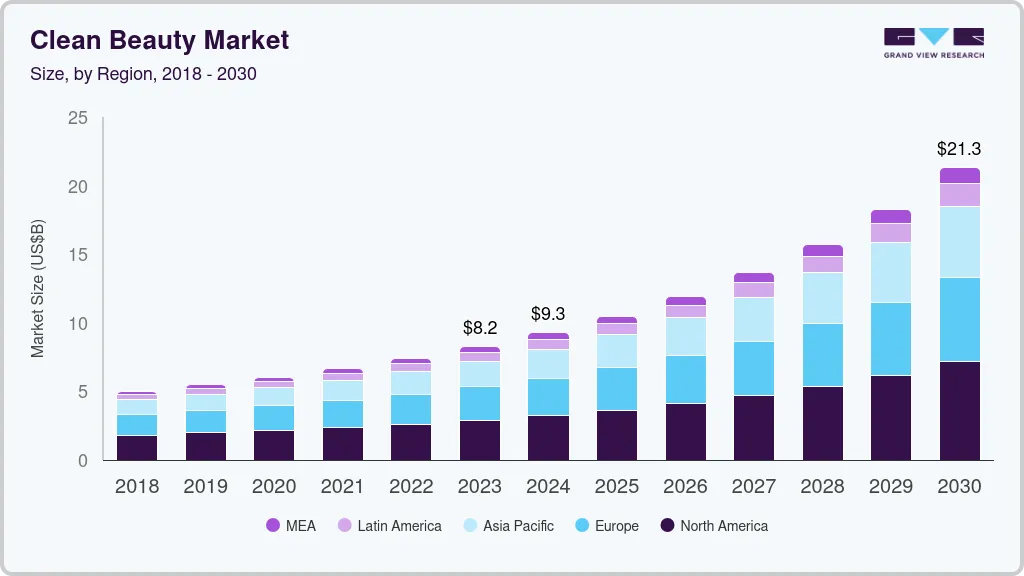

The global clean beauty market size was estimated at USD 8.25 billion in 2023 and is projected to reach USD 21.29 billion by 2030, growing at a CAGR of 14.8% from 2024 to 2030. The market growth is driven by increasing consumer concerns about the safety of cosmetic products, environmental impact, and potentially harmful ingredients in beauty and personal care products.

Key Market Trends & Insights

- The clean beauty market in North America accounted for a share of 35.08% of the global market revenue in 2023

- The clean beauty market in the U.S. is expected to grow at a CAGR of 14.5% from 2024 to 2030.

- By product, clean skincare products accounted for a revenue share of 41.70% in 2023.

- By end user, the demand for clean beauty products among women accounted for the largest revenue share of 83.63% in 2023.

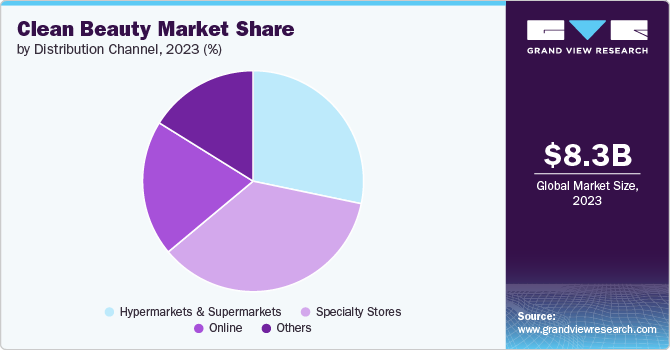

- By distribution channel, specialty store-driven sales accounted for a revenue share of 35.67% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.25 Billion

- 2030 Projected Market Size: USD 21.29 Billion

- CAGR (2024-2030): 14.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

As consumers demand cleaner, more natural products, companies are shifting towards "clean beauty" as the new standard.

The consumer believes clean beauty products are safer than traditional products and contain higher-quality, non-toxic ingredients, driving the market growth. However, differing definitions of "clean," "natural," and "green" have led to controversy, highlighting the need for better regulation and education in the market.

In recent years, the beauty industry has undergone a transformative shift towards sustainability, driven by a growing awareness among consumers of the environmental impact of traditional beauty products. This shift is related to the rising number of conscious consumers prioritizing transparency, ethical practices, and eco-friendly choices. Companies respond to this demand by reevaluating their formulations, incorporating natural and ethically sourced ingredients, and adopting innovative technologies to create high-performance, eco-friendly beauty products.

Collaborations and partnerships with retailers, celebrities & social media influencers, and other brands are helping the market participants to expand their reach and gain exposure to new customer segments. For instance, in November 2020, the biotech company Amyris partnered with Rosie Huntington-Whiteley, a well-known figure in the beauty industry, to launch a new brand, Clean Beauty Collective. Such brands combine celebrities' influence and biotech companies' expertise to manufacture sustainable and non-toxic products. Therefore, this partnership has the potential to drive innovation, expand consumer awareness, and increase the availability of clean beauty products, ultimately contributing to market growth.

The industry is characterized by a high degree of innovation and is witnessing a surge in interest, particularly in sustainable solutions. In March 2023, In-cosmetics Global, a leading event in this space, featured over 800 suppliers focusing on clean beauty, sustainability, and personalization. Exhibitors showcased innovation through their products, catering to the clean beauty trend.

Collaborations & strategic partnerships are driving the market growth. For instance, in October 2023, a collaboration between a lifestyle company, Goop, and mass retailers such as Target and Amazon to introduce Good.Clean.Goop, a lower-priced version of Goop's luxury wellness products, is a move to tap into the lower-cost market segment. The product line released on October 22, 2023, comprises facial cleansers, serums, body lotions, and nutritional chews. Brands aim to bring "clean beauty" to non-luxury lines by meeting strict clean standards at an accessible price point to expand into the mass market.

The impact of regulations on the market is low. Clean beauty products are not regulated, which has led to consumers relying on social media platforms to guide their searches. Federal regulations do not set standards for terms such as ‘clean beauty.’ This could be a major challenge to the long-term growth of the market.

The impact of substitutes on the market can be moderately significant. The availability of substitutes, such as conventional beauty products or other natural and organic brands, is likely to limit the sales of clean beauty products. However, the growing consumer awareness regarding clean beauty products and their benefits has led to a moderate competitive environment in the market from traditional beauty products.

Product Insights

Clean skincare products accounted for a revenue share of 41.70% in 2023. The clean beauty trend has gained significant traction on social media platforms like TikTok and Instagram, accumulating over 1.9 billion views on TikTok and 6.1 billion tags on Instagram, according to a Clean Beauty Survey 2023 by CleanHub. This surge in online engagement reflects a growing awareness among consumers regarding sustainable skincare and beauty products. According to the same survey, nearly 63% of the respondents look for products with natural ingredients that they believe are good for their skin. Therefore, the growing demand for sustainable skincare products with natural, non-toxic, and clean ingredients drives market growth.

Clean color cosmetic sales are expected to grow at a CAGR of 15.4% from 2024 to 2030. Clean makeup has increased consumer attention, particularly with increasing new product launches. For instance, ILIA Beauty launched Super Serum Skin Tint in February 2021, featuring natural ingredients. Furthermore, the influence of clean beauty celebrity brands such as Westman Atelier launching clean makeup such as weightless coverage for women over 50 drives the growing consumer attention, thereby driving the market growth.

End User Insights

The demand for clean beauty products among women accounted for the largest revenue share of 83.63% in 2023. According to a "Green Beauty Barometer" survey, women aged 35-54 emerge as the most aware in scrutinizing product labels, with a significant 65 percent actively checking the ingredients list. Women are increasingly mindful of the ingredients in their skincare and cosmetic products. They actively seek formulations free from harmful chemicals and emphasize transparency in ingredient sourcing and production practices. Beauty products marketed as clean highly appeal to women consumers who prioritize health, sustainability, and ethical practices in their beauty routines.

The demand for clean beauty products among men is expected to grow at a CAGR of 15.4% from 2024 to 2030. The growing availability of men’s skincare lines and the evolving preferences of male consumers regarding beauty products are driving the market growth. In response to the lack of accessible and affordable skincare options for men, November 2022 marked the launch of a skincare brand exclusively designed for men, ELVY Lab, which provides high-quality, clean, and science-backed products. Similarly, August 2022 marked the launch of a new men’s skincare range, Atwater, which offers clean and non-toxic formulations for men. Startups' entry to cater to the demand for clean beauty products among men is projected to drive market growth.

Distribution Channel Insights

Specialty store-driven sales accounted for a revenue share of 35.67% in 2023.Concerns among some consumers regarding the genuineness of products and the precision of online product descriptions have led to these consumers being more inclined to opt for purchases in brick-and-mortar stores, where they can personally verify the quality and authenticity of the items. A consumer survey conducted by NCSolutions in June 2021 revealed that American consumers (38%) expressed their intention to increase beauty product purchases in physical stores rather than online. Furthermore, consumers' inclination to procure beauty and personal care items from specialty stores increases as they can read ingredient labels before purchasing. Therefore, sales of clean beauty products through specialty stores will dominate the market throughout the forecast period.

Online sales are expected to witness a CAGR of 15.7% from 2024 to 2030. Mass-market retailers' strategic initiatives to expand their product offerings with clean beauty products and their sales presence through online modes contribute to market growth. For instance, in March 2023, Walmart launched Clean Beauty on the Walmart platform, a clean beauty shop featuring over 900 products, nearly 80% priced below USD 10. The platform adheres to over 1,200 ingredients, including acetone, aluminum, lead, talc, phthalates, parabens, etc.Walmart expanded its online presence by strategically partnering with British beauty retailer Space NK. Through this collaboration, Walmart introduced a selection of beauty products from Space NK, a brand offering clean beauty products, to its online platform.

Regional Insights

The clean beauty market in North America accounted for a share of 35.08% of the global market revenue in 2023. The beauty and cosmetics industry in North America has witnessed continuous innovation and the introduction of new and advanced products catering to diverse consumer needs and preferences. Consumers in the region are shifting from traditional beauty products to clean formulations that feature natural, sustainable, and non-toxic ingredients. The market in North America is also supported by a consumer base with strong purchasing power and a well-established retail infrastructure that drives sales.

U.S. Clean Beauty Market Trends

The clean beauty market in the U.S. is expected to grow at a CAGR of 14.5% from 2024 to 2030. This is attributed to increasing consumer awareness of beauty products' health and environmental impacts, a growing demand for natural and organic ingredients, and stringent regulations promoting transparency and safety. In addition, the rise of social media influencers and eco-conscious trends further fuels market growth.

Asia Pacific Clean Beauty Market Trends

The clean beauty market in Asia Pacific is expected to grow at a CAGR of 15.9% from 2024 to 2030. Clean beauty brands, such as Biossance and Dubai-based Skin Story, have expanded their presence in India in 2023, driven by the influence of celebrities and influencers. These brands are gaining popularity for their non-toxic, sustainable, and fragrance-free beauty products. Skin Story, known for its diverse makeup range, has extended its reach to Mumbai, India, where it offers clean and high-performance cosmetics. Biossance, promoted by global ambassador Reese Witherspoon, recently launched in India in September 2023, with its bestsellers gaining attention from skincare enthusiasts. Similarly, in June 2023, a U.S. clean beauty brand, The Detox Market, expanded its reach for Chinese consumers through e-commerce channels. The entrance and expansion of these clean beauty brands into the Asian market reflects a growing demand for ethical and clean beauty products, further contributing to the Asia Pacific market.

Key Clean Beauty Company Insights

Some of the key players operating in the clean beauty products market include ILIA Beauty,The Estée Lauder Companies, and e.l.f. Cosmetics, Inc.

-

ILIA Beauty is one of the key players in the market, offering clean, natural, and organic skincare and makeup products. The company features a diversified product portfolio. It also offers skincare-powdered makeup, which is marketed as ‘Clean’ and includes active levels of skincare ingredients to enhance skin health.

Grown Alchemist, RMS Beauty, and The Honest Company, Inc. are some of the emerging market participants in the clean beauty products market.

- RMS Beauty, founded in 2009 by master makeup artist Rose-Marie Swift, is an emerging player in the market. The company offers award-winning clean beauty products such as luminizers, concealers, bronzers, and powder blush. In addition to sustainable beauty offerings, it differentiates itself by offering virtual consultations and shade finders to gain consumer attention.

Key Clean Beauty Companies:

The following are the leading companies in the clean beauty market. These companies collectively hold the largest market share and dictate industry trends.

- ILIA Beauty

- The Estée Lauder Companies

- L'Oreal Paris

- Olaplex, Inc.

- Grown Alchemist

- John Paul Mitchell Systems

- Versed

- RMS Beauty

- e.l.f. Cosmetics, Inc.

- The Honest Company, Inc.

Recent Developments

-

In March 2023, Walmart launched a Clean Beauty shop with over 900 products, priced mostly under USD 10. The "Clean Beauty at Walmart" platform excludes over 1,200 ingredients, including acetone, aluminum, lead, talc, vitamin A and D3, phthalates, parabens, etc. This expansion and availability of clean beauty products through mass-market retailers will increase product accessibility for consumers, driving sales.

-

In October 2022, Amyris, a biotechnology company, launched EcoFabulous, a consumer brand focused on clean and sustainable beauty for Gen Z and younger millennial consumers. The brand offers skincare products and plans to introduce a comprehensive complexion and color cosmetics collection. With an emphasis on accessibility, EcoFabulous aims to cater to the diverse and eco-conscious Gen Z and Zillennial demographic, constituting over a quarter of the U.S. population. The brand prioritizes sustainability, offering refillable and recyclable packaging. The product line includes face oils and will expand to include a complexion line with 26 shades, lip gloss, lip and cheek tints, and eyeshadows.

Clean Beauty Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.28 billion

Revenue forecast in 2030

USD 21.29 billion

Growth rate

CAGR of 14.8% from 2024 to 2030

Actual data

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; UAE; South Africa

Key companies profiled

ILIA Beauty; The Estée Lauder Companies; L'Oreal Paris; Olaplex, Inc.; Grown Alchemist; John Paul Mitchell Systems; Versed; RMS Beauty, e.l.f.; Cosmetics, Inc.; The Honest Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clean Beauty Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global clean beauty market report based on product, end user, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Skincare

-

Face care

-

Body care

-

-

Haircare

-

Color cosmetics

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global clean beauty market was estimated at USD 8.25 billion in 2023 and is expected to reach USD 9.28 billion in 2024.

b. The global clean beauty market is expected to grow at a compound annual growth rate of 14.8% from 2024 to 2030 to reach USD 21.29 billion by 2030.

b. North America dominated the clean beauty market with a share of 35.08% in 2023. The growth of the regional market is driven on account of growing demand for natural and sustainable beauty products.

b. Some of the key players operating in the clean beauty market include ILIA Beauty, The Estée Lauder Companies, L'Oreal Paris, Olaplex, Inc., Grown Alchemist, John Paul Mitchell Systems, Versed, RMS Beauty, e.l.f. Cosmetics, Inc., and The Honest Company, Inc.

b. Key factors that are driving the clean beauty market growth include a rising consumer focus on the safety of skincare and beauty products, its environmental consequences, and the potential presence of harmful ingredients in beauty products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.