- Home

- »

- Advanced Interior Materials

- »

-

Chiral Chromatography Columns Market Size Report, 2030GVR Report cover

![Chiral Chromatography Columns Market Size, Share & Trends Report]()

Chiral Chromatography Columns Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (High Performance Liquid), By Product (Pre-packed Columns), By Material, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-351-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chiral Chromatography Columns Market Summary

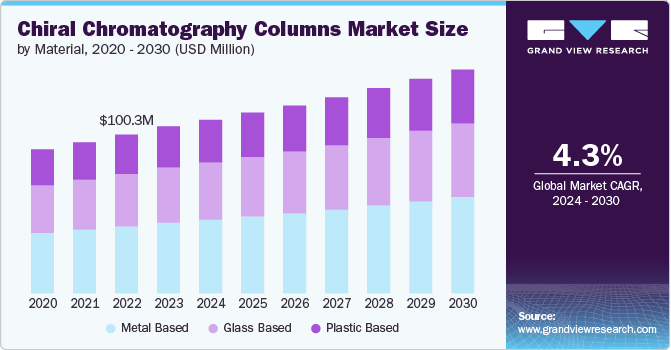

The global chiral chromatography columns market size was valued at USD 109.7 million in 2024 and is projected to reach USD 141.5 million by 2030, growing at a CAGR of 4.4% from 2025 to 2030. Prominent factors facilitating the growth of the market are technological advancements in chromatography instruments.

Key Market Trends & Insights

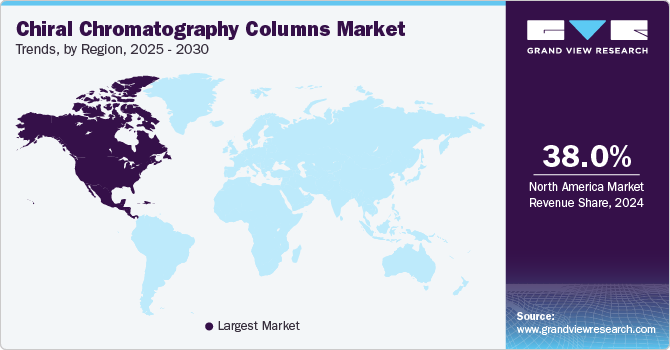

- North America chiral chromatography columns market dominated the global industry with the largest revenue share of 38.0% in 2024.

- Based on type, the High-performance liquid chromatography (HPLC) columns segment held the largest revenue share of 48.6% in 2024.

- Based on product, the pre-packed columns segment led the market and accounted for the largest revenue share of 76.6% in 2024.

- Based on material, the metal based segment dominated the global market and accounted for the largest revenue share of 41.3% in 2024.

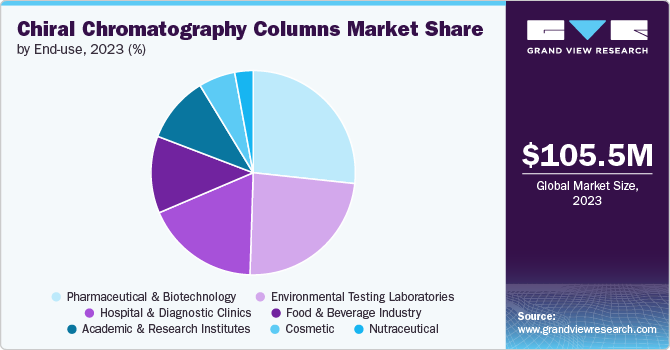

- Based on end use, the pharmaceutical & biotechnology segment held the dominant position in the global market with the largest revenue share of 26.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 109.7 Million

- 2030 Projected Market Size: USD 141.5 Million

- CAGR (2025-2030): 4.4%

- North America: Largest market in 2024

For instance, in February 2022, Sartorius acquired Novasep’s chromatography division after receiving approval from the U.S. Federal Trade Commission. The acquired portfolio includes chromatography systems designed for smaller biomolecules such as insulin, oligonucleotides, and peptides along with advanced systems for continuous biologics manufacturing.

Increasing R&D investments in the pharmaceutical and biotechnology industry is also fueling market growth. Pharmaceutical and biotechnology companies are investing significantly in research to develop new protein-related products for healthcare needs. Technologies such as chromatography, radiopharmaceuticals, and targeted therapies are crucial for protein separation and identification during drug discovery and development processes.

Developing economies, including India, China, Brazil, and others, offer high-growth opportunities for market players due to increasing research activities and adoption of analytical instruments. These countries present sustainable markets for life science instruments, driving the demand for chiral chromatography columns. In addition, the emphasis on environmentally friendly practices in chromatography, known as green chromatography, is creating growth avenues for market players. Green chromatography focuses on reducing waste generation, energy consumption, and hazardous chemicals used in chromatographic processes.

Furthermore, the growth of this sector is also driven by the cost-effective purification and process development of biological drugs. Moreover, the rapid expansion of the pharmaceutical, biotechnology, proteomics, and life science market through new product approvals and launches significantly influences industry dynamics.

Type Insights

High-performance liquid chromatography (HPLC) held the largest revenue share of 48.6% in 2024. HPLC is primarily driven by the need for accurate and precise separation of components in complex mixtures. The ability to separate, identify, and quantify specific compounds is crucial in various industries such as pharmaceuticals, food, environmental analysis, and research. High-performance liquid chromatography (HPLC) systems are designed to handle a wide range of sample types with high sensitivity and resolution, making them essential tools for quality control, research, and development processes.

Moreover, the growing demand for automation and efficiency in analytical processes further fuels the segment's growth. HPLC columns are becoming increasingly automated, allowing for higher throughput and reproducibility while minimizing manual intervention. This automation leads to improved productivity and reduced analysis time, making these systems indispensable in modern analytical laboratories.

The gas chromatography columns are expected to grow at a significant CAGR of 4.2% over the forecast period, driven by their ability to efficiently analyze volatile compounds. In addition, they provide high resolution and accuracy, which are crucial in pharmaceutical and environmental applications.

Product Insights

Pre-packed columns systems led the market and accounted for the largest revenue share of 76.6% in 2024. The growth is driven by the convenience offered by these products, as pre-packed columns come ready-to-use and eliminate the need for users to pack their own columns with chiral stationary phases. This saves time and effort in method development and optimization, making them ideal for laboratories with high sample throughput requirements. These products also offer reproducibility, as pre-packed columns are manufactured under controlled conditions, ensuring consistent performance from column to column. This reliability is crucial for obtaining accurate and reliable results in chiral separations.

Moreover, technological advancements in pre-packed columns with enhancement of performance help the market flourish. For instance, in March 2022, the machine learning model demonstrated exceptional predictive abilities for plate height and asymmetry, with the quality of packing being significantly impacted by backbone and functional mode. Therefore, the performance of prepacked columns is expected to have significant growth in the market with these new machine learning methods.

The empty columns are expected to grow at a CAGR of 3.4% over the forecast period, owing to their versatility and customization capabilities. Empty columns allow users to pack their own stationary phases, which can be tailored to specific applications, enhancing efficiency and cost-effectiveness.

Material Insights

The metal based segment dominated the global chiral chromatography columns market and accounted for the largest revenue share of 41.3% in 2024. The most common metal used for chromatography columns is the stainless-steel column. Inside the column, thin layers of stationary phase are present. The high strength of stainless steel can withstand the high pressure of pumps used in HPLC systems.

The plastic-based segment is expected to grow at a significant CAGR of 4.1% over the forecast period. The segment is expected to witness growth over the forecast period owing to the cost-effectiveness of the chromatography column. The economical nature of the chromatography columns also exhibits advantages such as lightweight packing and suitability for routine laboratory and academic analysis.

End Use Insights

The pharmaceutical & biotechnology segment held the dominant position in the global market with the largest revenue share of 26.4% in 2024. Pharmaceutical processing involves quality control and checking, which is an integral part of the industry to ensure the product’s purity and viability. The growth in pharmaceutical production across the world is expected to drive demand for the chiral chromatography columns market over the forecast period.

The environmental testing laboratories segment is anticipated to witness the fastest CAGR of 5.1% over the forecast period. The rising compliance in accordance with the regulations and codes, the demand for environmental testing for various industries is becoming essential which is likely to boost the growth of the choral chromatography column market over the forecast period.

Regional Insights

North America chiral chromatography columns market dominated the global industry with the largest revenue share of 38.0% in 2024. The shift towards green chemistry in the region has led to a growing demand for chromatography instruments that support sustainable and environmentally friendly practices. Chromatography is a widely used technique for separating mixtures into their individual components, making it essential in various industries such as pharmaceuticals, biotechnology, food and beverage, environmental analysis, and more. Moreover, the increasing demand for chiral separation chromatography columns driven by the adoption of green chemistry practices in North America is expected to have a ripple effect on the global market.

U.S. Chiral Chromatography Columns Market Trends

The chiral chromatography columns market in the U.S. led the North American market and held the largest revenue share in 2024 owing to different factors, such as innovative developments, a significant rise in unique product approvals, and launches driving chromatography market growth. For instance, in June 2022, Tosoh Bioscience LLC, headquartered in Pennsylvania, USA, unveiled SkillPak 50 and SkillPak 200 pre-packed columns with inner diameters of 2.5 cm and 5.0 cm respectively. These columns are specifically crafted for the process development of monoclonal antibodies, antibody fragments, antibody-drug conjugates, oligonucleotides, and viruses.

Asia Pacific Chiral Chromatography Columns Market Trends

The Asia Pacific chiral chromatography columns market is expected to grow at a CAGR of 4.7% over the forecast period, driven by factors such as increasing research and development activities in pharmaceuticals, biotechnology, food and beverage, and environmental analysis sectors. In addition, the market is witnessing a shift towards advanced technologies and innovative products to meet the growing need for high-resolution separation techniques. Furthermore, stringent regulations regarding drug safety and quality control are also contributing to the expansion of the chiral chromatography columns market in Asia Pacific.

Europe Chiral Chromatography Columns Market Trends

Europe chiral chromatography columns market is expected to witness lucrative growth over the forecast period. The growth is driven by the increasing adoption of pre-packed columns. Pre-packed columns offer a convenient solution for managing the time-consuming process of packing chromatography columns, which is particularly beneficial for industries and laboratories requiring efficient analytical volumes. The demand for prepacked columns is on the rise due to applications such as virus titer reduction testing, antibody purification, vaccine production, and recombinant protein purification. This trend is expected to continue dominating the European market for chiral chromatography columns as it provides a cost-effective and time-saving purification solution.

Key Chiral Chromatography Columns Company Insights

Some of the key players operating in the market include Agilent Technologies, Inc., GE Healthcare, Danaher, Thermo Fisher Scientific, Inc., among others.

-

Veolia Water Technologies is an American company that specializes in life science and clinical research. The company offers chromatography columns for HPLC and UPLC systems, including chiral chromatography columns.

-

Danaher Corporation, a company based in Washington, U.S., deals in biotechnology, diagnostics, and life sciences. The company offers chromatography columns via the Life Science business across the world.

Key Chiral Chromatography Columns Companies:

The following are the leading companies in the chiral chromatography columns market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies, Inc.

- Waters Corporation

- Thermo Fisher Scientific, Inc.

- Merck & Co., Inc

- Cytiva

- Danaher

- GE Healthcare

- Shimadzu Corporation

- Daicel Corporation

- Bio-Rad Laboratories

- Perkin Elmer

Recent Developments

-

In May 2024, Advanced Materials Technology (AMT) launched its HALO Elevate C18, which represents a significant advancement in the field of high-performance liquid chromatography (HPLC). This new stationary phase offers exceptional high pH stability and selectivity, addressing key challenges faced by chromatographers in various analytical applications.

-

In August 2023, Waters Corporation launched the XBridge Premier GTx BEH SEC columns specifically designed for gene therapy applications. These new columns are aimed at addressing the unique challenges faced in gene therapy research and development, offering high performance and reliability.

Chiral Chromatography Columns Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 114.2 million

Revenue forecast in 2030

USD 141.5 million

Growth Rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million/Billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, material, end use, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, Germany, France, Italy, Spain, UK, China, India, Japan, South Korea, Brazil, Argentina, Saudi Arabia, UAE, and South Africa.

Key companies profiled

Agilent Technologies, Inc.; Waters Corporation; Thermo Fisher Scientific, Inc.; Merck & Co., Inc.; Cytiva; Danaher; GE Healthcare; Shimadzu Corporation; Daicel Corporation; Bio-Rad Laboratories; Perkin Elmer.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chiral Chromatography Columns Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global chiral chromatography columns market report based on, type, product, material, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

High Performance Liquid Chromatography Columns

-

Gas Chromatography Columns

-

Solid Phase Extraction Columns

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-packed Columns

-

Empty Columns

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal Based

-

Glass Based

-

Plastic Based

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology

-

Academic & Research Institutes

-

Hospital and Diagnostic Clinics

-

Environmental Testing Laboratories

-

Food & Beverage Industry

-

Cosmetic Companies

-

Nutraceutical Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.