- Home

- »

- Renewable Chemicals

- »

-

Chemicals Digitalization Market Size & Share Report, 2030GVR Report cover

![Chemicals Digitalization Market Size, Share & Trends Report]()

Chemicals Digitalization Market (2024 - 2030) Size, Share & Trends Analysis Report, By Product (Specialty Chemicals, Petrochemicals & Polymers), By Process (Manufacturing, Packaging), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-304-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chemicals Digitalization Market Summary

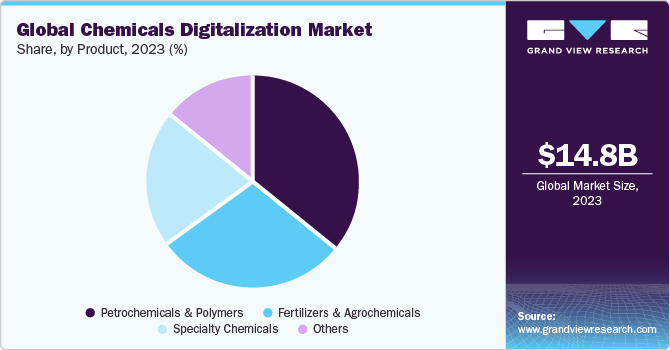

The global chemicals digitalization market size was estimated at USD 14.83 billion in 2023 and is projected to reach USD 60.13 billion by 2030, growing at a CAGR of 23.1% from 2024 to 2030. This growth can be attributed to the increasing adoption of automation, data analytics, and other technological advancements in businesses on a global scale.

Key Market Trends & Insights

- North America dominated the market with a revenue share of 36.9% in 2023.

- The chemicals digitalization market in the U.S. held the largest share of 33.7% in North America in 2023.

- Based on process, the manufacturing segment dominated the market with a revenue share of 31.6% in 2023.

- Based on product, the petrochemicals and polymers segment dominated the overall market with a revenue share of 36.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 14.83 Billion

- 2030 Projected Market Size: USD 60.13 Billion

- CAGR (2024-2030): 23.1%

- North America: Largest market in 2023

The increasing digitalization in the chemicals industry helps manufacturers increase competitiveness, production capacity, and customer satisfaction.Digitalization enables chemical companies to streamline operations, optimize processes, and reduce costs. By leveraging data and analytics, companies can identify areas for improvement, automate manual tasks, and enhance productivity. Digitalization also plays a key role in enabling chemical companies to collaborate with other industry players, suppliers, and customers. By leveraging digital platforms and technologies, companies can share data, knowledge, and resources, leading to improved collaboration and faster innovation.

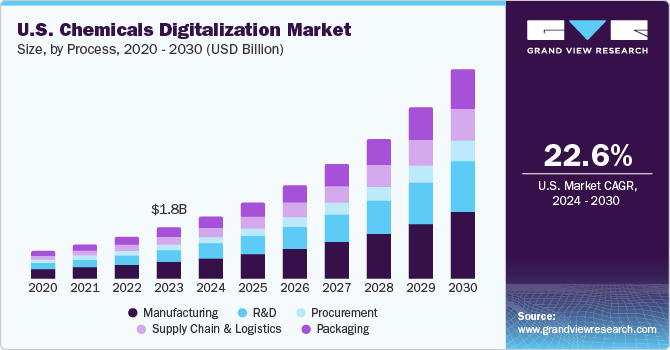

Factors such as the rising need for continuous and efficient manufacturing methods, adoption of advanced digital technologies, and increasing demand for better scheduling of batch production are driving the growth of the digital chemicals industry market in the U.S. Various end-user industries of the U.S. chemical digitalization market, such as water treatment, automobiles, electronics, and personal care products, are experiencing notable growth, which is expected to have a positive impact on the demand for specialty chemicals digitalization in the country.

The Internet of Things (IoT) is playing a significant role in the digitalization of the chemicals industry. By connecting devices, sensors, and equipment, companies can collect real-time data, monitor processes, and optimize operations. IoT-enabled solutions are being used for asset management, predictive maintenance, and supply chain optimization. AI and ML technologies are being utilized in the chemicals industry to analyze large datasets, identify patterns, and make data-driven decisions. These technologies enable predictive analytics, process optimization, and quality control. AI-powered virtual assistants and chatbots are also being used to enhance customer service.

While the digitalization of the chemicals industry offers numerous benefits, there are also some challenges and restraints to this growing phenomenon. The digitalization of the chemicals industry involves the collection, storage, and analysis of large amounts of data. Ensuring data security and privacy is a critical challenge for chemical companies as they need to implement robust cybersecurity measures and comply with data protection regulations to safeguard sensitive information.

Market Concentration & Characteristics

The chemicals digitalization market exhibits characteristics of a moderately consolidated market, which is evident in the distribution of market share among a group of large firms. This consolidation is driven by several factors, including the high degree of innovation within the industry. With the adoption of advanced digital technologies driving transformative changes, the degree of innovation in the market has been substantial. For instance, the market for polymers and chemicals used in additive manufacturing is growing at a rapid pace, with tailored polymers and chemicals opening up opportunities for innovation and commercialization for companies involved in photopolymers and high-performance thermoplastics.

Regulations play a significant role in shaping the global chemicals digitalization market. With the growing demand for green and ethical products, environmental and social governance (ESG) issues are impacting businesses across the sector. The chemicals industry is responding to regulatory directives, customer preferences, and boardroom guidance, leading to a shift toward sustainable and environmentally friendly products.

The market's diversification and the need to manage complex portfolios of brands with different market characteristics reflect the influence of end-user concentration and the demand for tailored products. The industry is witnessing the rise of co-manufacturing businesses and third-party logistics (3PLs) organizations, allowing new entrants to compete in consumer markets with limited investment in expensive manufacturing and supply chain assets, further influencing market dynamics.

Process Insights

The manufacturing sector dominated the market with a revenue share of 31.6% in 2023. Digitalization plays a crucial role in optimizing manufacturing operations, improving efficiency, and ensuring product quality. The implementation of advanced process control systems and real-time monitoring enables companies to optimize production parameters, reduce waste, and enhance overall productivity. This digital transformation in manufacturing allows companies to respond quickly to changing market demands, customize products, and improve time-to-market.

The R&D process segment in the global chemicals digitalization market focuses on innovation, product development, and improving existing chemical formulations. Digitalization has revolutionized R&D by enabling virtual simulations, data analytics, and the use of machine learning algorithms. Computer-aided design (CAD) and computer-aided engineering (CAE) tools allow researchers to model and simulate chemical reactions, predict product performance, and optimize formulations before physical testing.

The procurement process segment involves sourcing, obtaining, and paying for goods and services required for chemical production. Digitalization has transformed procurement by streamlining supplier management, automating purchase orders, and optimizing inventory management. Digital procurement platforms enable companies to connect with a global network of suppliers, compare prices, and negotiate contracts more efficiently.

Product Insights

The petrochemicals and polymers segment dominated the overall market with a revenue share of 36.2% in 2023. These chemicals are integral to a wide range of industries, including plastics, packaging, clothing, digital devices, medical equipment, and detergents. Polyethylene terephthalate (PET) bottles, made from ethylene and paraxylene, are widely used for packaging beverages and personal care products. Moreover, polymers and plastics are essential in the automotive industry for manufacturing lightweight components, improving fuel efficiency, and reducing emissions.

The specialty chemicals segment covers a wide range of products, including adhesives and sealants, agrochemicals, construction & electronic chemicals, flavors and fragrances, polymers, and surfactants, among others. These chemicals are used in various applications to improve the durability, performance, and aesthetics of products, enhance the efficiency of industrial processes, and provide specific functionalities in different end-use industries.

Fertilizers provide essential nutrients to plants, while agrochemicals, including pesticides, herbicides, and fungicides, protect crops from pests and diseases. Digitalization in this segment involves precision agriculture techniques, such as remote sensing, data analytics, and IoT-enabled devices, to optimize fertilizer application, monitor crop health, and improve resource efficiency. Smart farming solutions utilize sensors and data analytics to determine the precise number of fertilizers needed for specific areas of a field, reducing waste and environmental impact.

Regional Insights

North America dominated the market with a revenue share of 36.9% in 2023. The region is known for its advanced technological infrastructure, strong research & development capabilities, and a robust chemicals industry. Companies in North America are at the forefront of digitalization efforts, leveraging technologies such as AI, IoT, and data analytics to optimize manufacturing processes, enhance product development, and improve supply chain management. North America is witnessing the adoption of digital solutions in areas such as precision agriculture, where farmers are leveraging data-driven insights to optimize crop production and resource utilization.

U.S. Chemicals Digitalization Market Trends

The chemicals digitalization market in the U.S. held the largest share of 33.7% in North America in 2023. This can be attributed to the advanced technological infrastructure and strong research and development capabilities of the country. The U.S. is at the forefront of digitalization efforts in the chemicals industry.

Europe Chemicals Digitalization Market Trends

The chemicals digitalization market in Europe was the second-largest regional market in 2023. The region is characterized by the presence of a strong chemicals industry and is known for its focus on sustainability and environmental regulations. Digitalization in Europe is driving innovation and efficiency across various chemical processes.

The German chemicals digitalization market held the largest share of the overall Europe market in 2023. This can be mainly attributed to the digital innovations in areas such as sustainable chemistry and green technologies, which leverage digitalization to enhance sustainability and reduce environmental impact.

The chemicals digitalization market in the UK is expected to grow at a significant CAGR from 2024 to 2030. Companies in the UK are leveraging digital technologies to optimize their manufacturing processes, enhance product development, and improve supply chain efficiency.

Asia Pacific Chemicals Digitalization Market Trends

The chemicals digitalization market in Asia Pacificis expected to grow at a significant pace from 2024 to 2030. The region is witnessing significant investments in digital technologies and has demonstrated a strong focus on industrial automation and smart manufacturing. Companies in Asia Pacific are leveraging digitalization to enhance operational efficiency, improve product quality, and drive innovation.

The chemicals digitalization market in China is estimated to grow at a significant CAGR from 2024 to 2030. With its vast market size and investments in digital technologies, China is driving digitalization across various industries, including chemicals.

The Indian chemicals digitalization market is expected to grow significantly due to its growing chemicals industry and the government’s focus on digital transformation. India is embracing digitalization to enhance operational efficiency and drive innovation.

Central & South America Chemicals Digitalization Market Trends

The chemicals digitalization market in Central & South America is anticipated to witness significant growth from 2024 to 2030. The region has a growing chemicals industry and is witnessing increased investments in digital technologies. In the agrochemicals sector in the region, digital solutions are being utilized to optimize fertilizer application, monitor crop health, and improve resource efficiency.

The Brazil chemicals digitalization market is estimated to grow at a significant CAGR over the forecast period. Digital solutions are being adopted in areas such as logistics and distribution, where technologies like blockchain and IoT are being used to enhance traceability, reduce counterfeiting, and improve overall supply chain transparency.

Middle East & Africa Chemicals Digitalization Market Trends

The chemicals digitalization market in MEA is growing due to rapid growth of digitalization in the country. Rising investments in digitalization is also expected to contribute to this growth. The adoption of digital solutions in the region is driving innovation, improving operational efficiency, and enhancing sustainability across the chemicals industry.

The Saudi Arabia chemicals digitalization market is expected to grow at a significant CAGR over the forecast period, due to the adoption of digital solutions in areas such as sustainability and environmental management, where digital tools are being used to monitor and reduce environmental impacts of the chemicals industry.

Key Chemicals Digitalization Company Insights

The competitive landscape of the chemicals digitalization market is characterized by an increasing adoption of digital solutions to address sustainability challenges and enhance competitiveness. The major players in the industry are leveraging digital technologies to improve operational efficiency, reduce waste, and minimize environmental impact. The competitive landscape is also witnessing a major shift as new players from oil & gas-producing countries and high-growth developing markets such as China and India have increased their pace of digitalization to compete with traditional players around the globe.

Some of the key players operating in the market include:

-

Siemens AG provides advanced process control systems, real-time monitoring solutions, and automation technologies to improve manufacturing processes in the chemicals industry

-

General Electric provides advanced analytics, IoT-enabled devices, and automation technologies that enable chemical companies to optimize their manufacturing processes, improve product quality, and enhance supply chain management

Key Chemicals Digitalization Companies:

The following are the leading companies in the chemicals digitalization market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens AG

- General Electric

- ABB Ltd.

- Rockwell Automation

- Emerson Electric

- Honeywell International

- Yokogawa Electric Corporation

- Mitsubishi Chemical Group Corporation

- Solvay

Recent Developments

-

In December 2023, Henkel Adhesives announced its collaboration with Tata Consultancy Services (TCS) to standardize the ordering processes across its national subsidiaries and optimize the processes under Henkel’s customer service departments

-

In July 2023, Reliance Industries Limited (RIL) announced its agreement with Digital Realty and Brookfield Infrastructure to invest in setting up and developing data centers around India

Chemicals Digitalization Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.28 billion

Revenue forecast in 2030

USD 60.13 billion

Growth rate

CAGR of 23.1% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, process, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Siemens AG; General Electric; ABB Ltd.; Rockwell Automation; Emerson Electric; Honeywell International; Yokogawa Electric Corporation; Mitsubishi Chemical Group Corporation; Solvay; HP Enterprise Development LP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chemicals Digitalization Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global chemicals digitalization market report based on product, process, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Specialty Chemicals

-

Petrochemicals & Polymers

-

Fertilizers & Agrochemicals

-

Others

-

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

R&D

-

Procurement

-

Supply Chain & Logistics

-

Packaging

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global chemicals digitalization market size was estimated at USD 14.83 billion in 2023 and is expected to reach USD 17.28 billion in 2024.

b. The global chemicals digitalization market is expected to grow at a compound annual growth rate of 23.1% from 2024 to 2030 to reach USD 60.13 billion by 2030.

b. North America dominated the chemicals digitalization market with a share of 36.8% in 2023. This is attributable to advanced technological infrastructure, strong research and development capabilities, and a robust chemicals industry.

b. Some key players operating in the chemicals digitalization market include Siemens AG, General Electric, ABB Ltd., Rockwell Automation, Emerson Electric, Honeywell International, Yokogawa Electric Corporation, Mitsubishi Chemical Corporation, Solvay and HP Enterprise.

b. Key factors that are driving the market growth include increasing use of automation, data analytics and other technological advancements in businesses around the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.