- Home

- »

- Clinical Diagnostics

- »

-

Cervical Cancer Diagnostic Market Size, Share Report, 2030GVR Report cover

![Cervical Cancer Diagnostic Market Size, Share & Trends Report]()

Cervical Cancer Diagnostic Market (2024 - 2030) Size, Share & Trends Analysis Report By Test Type (Pap Testing Or Cytology Testing, HPV Testing, Colposcopy, Cervical Biopsies), By Age Group, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-127-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cervical Cancer Diagnostic Market Summary

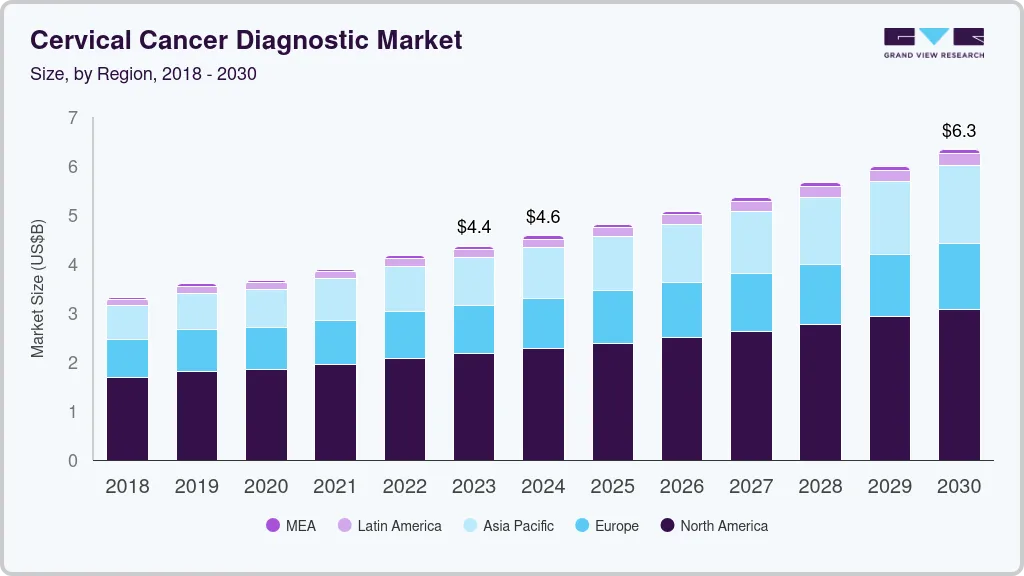

The global cervical cancer diagnostic market size was valued at USD 4.4 billion in 2023 and is projected to reach USD 6.3 billion by 2030, growing at a CAGR of 5.5% from 2024 to 2030. The increasing prevalence of cervical cancer in middle-aged women and the subsequent increase in screening and diagnostic tests are expected to boost the market over the forecast period.

Key Market Trends & Insights

- North America dominated the cervical cancer diagnostic market and held a share of 45.74% in 2022.

- The Asia Pacific cervical cancer diagnostic market is expected to expand at the fastest rate during the forecast period.

- Based on test type, the Pap testing segment dominated the market with a share of 33.06% in 2022.

- Based on age group, the 20-40 years segment dominated the market with a share of 84.12% in 2022.

- Based on end use, the diagnostic centers segment held a majority of the market share of 46.18% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 4.4 Billion

- 2030 Projected Market Size: USD 6.3 Billion

- CAGR (2024-2030): 5.5%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

As per the reports published by World Health Organization, cervical cancer is the fourth most common cancer among women globally. Furthermore, according to a statistics report published by the American Cancer Society, in 2023, about 13,960 estimated cases of invasive cervical cancer will be diagnosed, with around 4,310 women deaths in the U.S.Cervical cancer starts in the cervix region of the uterus in women, where abnormal cells start to grow, which can become cancerous cells in the future. Cervical cancer diagnostic tests aim to detect precancerous changes in cells and tissues. This early detection helps in a better cure for the disease. Cervical cancer can be treated very efficiently when detected early, and even if detected in later stages, it can be controlled with proper treatment. After age 30, women are advised to get regular pap smears and liquid-based cytology tests done for HPV.

The effects of lifestyle are also important in the case of cervical cancer. Women with unhealthy lifestyles are more prone to cervical cancer. Factors that are a part of lifestyle, such as Smoking, using oral contraceptive pills, and having poor genital cleanliness, can increase the chances of cervical cancer in women and act as driving forces for market growth.

According to the National Institute of Health (NIH), obesity in women also significantly impacts cervical cancer. Obese women are more prone to the disease when compared to women having a healthy weight. Early menarche and late menopause over an average age can also contribute to cervical cancer in women as it affects hormonal conditions and reproductive health. Cervical cancer spreads through sexual contact due to infection by HPV. Having multiple sexual partners can also increase the chances of getting affected by cervical cancer.

The COVID-19 pandemic significantly impacted the market because of the disturbances in the global supply chain. This resulted in a scarcity of the products used for screening worldwide. While post-pandemic, the demand for cervical cancer diagnostic products is rising due to the prevalence of cervical cancer.

The increase in government initiatives for the detection and treatment of cervical cancer and the rise in awareness about the disease shows the growing adoption of screening procedures such as pap tests and HPV testing. The presence of favorable policies related to reimbursement is a key factor anticipated to boost the number of screening tests over the forecast period. Technological advancements in new diagnostic equipment, diagnostic procedures, and screening techniques are expected to positively impact the market. Thus, technology is a key factor in the increase in the growth of this industry.

Developing countries are expected to contribute the most to the market due to an increase in research and development activities and the development of biotechnological industries. Increasing awareness about cervical cancer screening techniques and their importance drives the market's growth.

Test Type Insights

The market is segmented into Pap testing, HPV testing, Colposcopy, Cervical biopsies, Cystoscopy, and others based on test type. The Pap testing segment dominated the market with a share of 33.06% in 2022. Followed by HPV testing with a share of 30.3%. Before any symptoms appear, a pap test can help to detect cervical cancer. Cervical cancer is more easily treated if discovered early, with the help of a pap test. The Pap test is more popular among testing techniques owing to its convenience.

The HPV testing segment is expected to witness the fastest growth during the forecast period from 2023 to 2030 due to the rise in the number of patients with HPV. HPV testing is used for detecting the Human Papilloma Virus, one of the major potential causes of Cervical cancer. By detecting the presence of HPV, the onset of cervical cancer can also be detected.

Age group Insights

Based on age, there are two segments of the cervical cancer diagnostic market. One segment includes women aged between 20-40 years, and the other segment includes women above 40 years.

In 2022, the segment with 20-40 years dominated the market with a market share of 84.12%. This segment is expected to maintain its dominance throughout the forecasting period. The major chunk of sexually active women lies between this age group, and the lifestyle factors such as alcohol consumption, smoking, and obesity can be observed more in women of this age group. In comparison, women above 40 years are at a relatively lower risk.

End Use Insights

Based on end use, the market is segmented into hospitals, laboratories, and diagnostic centers. The diagnostic centers segment held a majority of the market share of 46.18% in 2022 due to the availability of many service options and devices in diagnostic centers. Thus, patients prefer diagnostic canters more than hospitals or labs for diagnosis.

The diagnostic center segment is expected to be the fastest-growing segment and maintain its dominance throughout the forecasting period with a CAGR of 6%. The COVID-19 pandemic compelled the diagnostic market to interact with consumers. People began focusing more on preventative measures, which increased the need for testing. Due to the convenience of testing at home, home diagnostics are expected to experience a surge during the forecast period.

Regional Insights

North America dominated the cervical cancer diagnostic market and held a share of 45.74% in 2022. The increasing number of patients suffering from cervical cancer, requiring the adoption of cervical cancer detection techniques, increased competition among market players, and significant expenditure on research and development are attributed to the market growth in North America. There has been a steady growth in the number of cervical cancer patients from various U.S. and Canada states, fueling demand for cervical cancer diagnostic tools.

The Asia Pacific segment is expected to expand at the fastest rate during the forecast period due to the rising occurrence of cervical cancer, rapidly expanding healthcare infrastructure, growing government backing, and an increasing number of startups in developing countries of India and China. The increase in expenditure on research and development activities also fuels the growth of this region's cervical cancer diagnostic market.

Key Companies & Market Share Insights

Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. The market players are focusing on expansion and diversification, partnerships, acquisitions, and mergers to strengthen their market presence. For instance, in November 2021, Becton Dickinson and Company announced the launch of an automated cervical cancer screening system with its FDA approval. This system uses robots and sample management software algorithms and is expected to set a new benchmark in automation for disease molecular testing.

In March 2021, Oncgnostics GmbH, a company that provides cancer tests, announced its strategic collaboration with EUROIMMUN, a company that provides immunodiagnostic laboratory solutions to distribute ‘GynTect’ which is an advanced cervical cancer test. As a part of this collaboration, EUROIMMUN will be marketing GynTect in European countries including Italy, Poland, Turkey, and Portugal. Some of the key players in the global cervical cancer diagnostic market are

-

Abbott Laboratories

-

Quigan NV

-

Thermo Fisher Scientific Inc

-

Carl Zeiss AG

-

Dickinson and Company

-

Hologic Inc

-

CooperSurgical Inc

-

Siemens Healthineers

Cervical Cancer Diagnostic Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.6 billion

Revenue forecast in 2030

USD 6.3 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, age group, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, Saudi Arabia, South Africa ,UAE, Kuwait

Key companies profiled

Abbott Laboratories; Quigan NV; Thermo Fisher Scientific Inc; Carl Zeiss AG; Dickinson and Company; Hologic Inc; CooperSurgical Inc; Siemens Healthineers

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cervical Cancer Diagnostic Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cervical cancer diagnostic market on the basis of type, age-group, end use, and region:

-

Test Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Pap Testing (Cytology Testing)

-

HPV Testing

-

Colposcopy

-

Cervical Biopsies

-

Cystoscopy

-

-

Age Group Outlook (Revenue in USD Million, 2018 - 2030)

-

20-40 years

-

Above 40 years

-

-

End Use Outlook (Revenue in USD Million, 2018 - 2030)

-

Hospitals

-

Laboratories

-

Diagnostic centers

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cervical cancer diagnostic market size was estimated at USD 4.5 billion in 2022 and is expected to reach USD 4.7 billion in 2023.

b. The global cervical cancer diagnostic market is expected to grow at a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 7.0 billion by 2030.

b. North America dominated the cervical cancer diagnostic market with a share of 45.7% in 2022. This is attributable to the growing prevalence of cervical cancer in the region and increasing awareness regarding early diagnosis can be attributed to the large share of the region.

b. Some key players operating in the cervical cancer diagnostic market include Abbott Laboratories; Cooper Surgical, Inc.; Becton, Dickinson, and Company (BD); Hologic, Inc.; Quest Diagnostics; QIAGEN; Guided Therapeutics; Siemens; OncoHealth Corp.; Arbor Vita; Zilico Ltd.; and Beckman Coulter, Inc.

b. Key factors that are driving the market growth include growing adoption of screening procedures, such as Pap test and HPV testing, and the rising prevalence of cervical cancer globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.