- Home

- »

- Plastics, Polymers & Resins

- »

-

Cellulosic Polymers Market Size, Share, Growth Report 2030GVR Report cover

![Cellulosic Polymers Market Size, Share & Trends Report]()

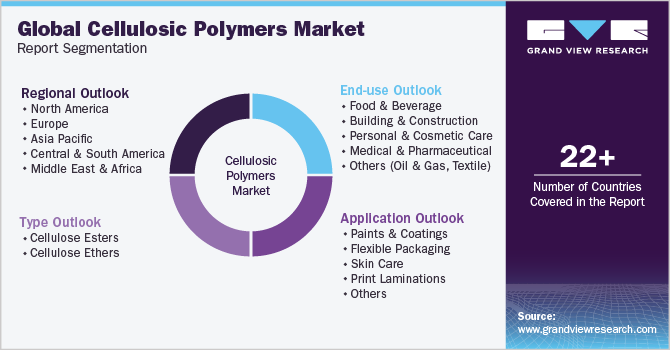

Cellulosic Polymers Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Cellulose Ethers, Cellulose Esters), By Application (Paints & Coatings, Skin Care), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-132-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cellulosic Polymers Market Size & Trends

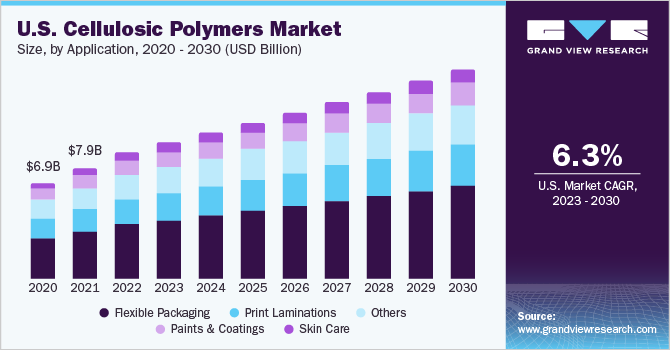

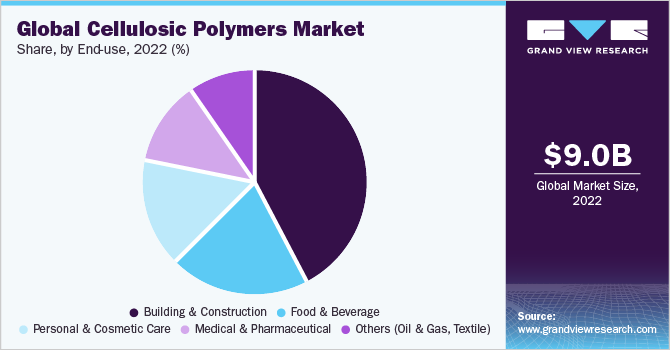

The global cellulosic polymers market size was estimated at USD 9.02 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. Rising demand for biopolymers and the shifting of plastic resin manufacturers toward sustainability has propelled the manufacturers to introduce cellulosic polymers for utilization across the end-use industries, such as food & beverage, building & construction, personal & cosmetic care, and others. Cellulosic polymers, especially cellulose ether polymers are majorly used across the paints & coatings industry as thickening agents for waterborne paints. Furthermore, a reduction in the degree of polymerization of these polymers results in the loss of the paint viscosity.

The rising demand for paints & coatings in line with the growing building & construction industry is anticipated to propel the demand for cellulosic polymers during the forecast period. The continuous evolution of consumer tastes and preferences, followed by the increasing demand for healthier, more natural, and sustainable foods has driven innovation and new product development in the food & beverage industry. Furthermore, a growing focus on health and wellness has led to increased demand for organic, non-GMO, and functional foods and beverages.

This, in turn, has propelled the demand for cellulosic-based food packaging, which is anticipated to boost the demand for cellulosic polymers across the country. In addition, rising demand from the growing population and supporting government policies & regulations have propelled the building & construction industry across the U.S. According to the United States Census Bureau, the construction spending during July 2023 was estimated to be USD 1,972.60 billion. Such investments across the country are anticipated to propel the demand for cellulosic polymers from the building & construction industry for the manufacturing of paints & coatings.

Type Insights

The cellulose ethers segment dominated the market in 2022 and accounted for a revenue share of above 52.0%. Cellulose ethers are water-soluble polymers used as thickeners, stabilizers, and viscosity modifiers across various industries including medical & pharmaceuticals, food & beverage, building & construction, and others. The cellulose ethers segment was followed by cellulose esters, which are commonly derived from natural cellulose by the reaction of anhydrides, organic acids, and acid chlorides.

These esters have witnessed major traction from the medical & pharmaceutical industry for the manufacturing of medical applications, such as membranes for osmotic pump technologies, coating applications, and microencapsulation. Furthermore, cellulose esters are utilized as binders in the production of adhesives, paints, and inks since they provide high film-forming attributes and adhesive strength. In addition, these esters are utilized to produce dissolving pulp, further processed to manufacture products, such as cellulose acetate tow, used in cigarette filters, and cellulose acetate flake, used in the production of plastics and films.

Application Insights

The flexible packaging segment dominated the market in 2022 and accounted for the largest share of more than 43.0% of the overall revenue. Cellulosic polymers are majorly used for the manufacturing of cellophane in the form of regenerated cellulose. Cellophane is a thin and transparent biodegradable film, which is commonly used across food packaging owing to its low permeability to oils, air, bacteria, and water.

The print lamination segment accounted for a revenue share of above 20.0% in 2022 owing to the high demand for cellulosic polymers in the form of cellulose fibers for printing lamination. Increasing demand for printed messages for advertisement has propelled the demand for cellulose fibers for manufacturing laminations, which are highly durable and flexible.

End-use Insights

The building & construction segment dominated the global market in 2022 and accounted for the largest share of more than 42.0% of the overall revenue. Paints & coatings require thickening agents for viscosity control, which is majorly provided by the addition of cellulosic polymers in paints & coatings.

The food & beverage segment accounted for the revenue share of more than 19.0% in 2022. Since cellulosic polymers are derived from renewable resources, primarily including wood pulp & cotton, they are a popular form of resin for companies shifting toward sustainability.

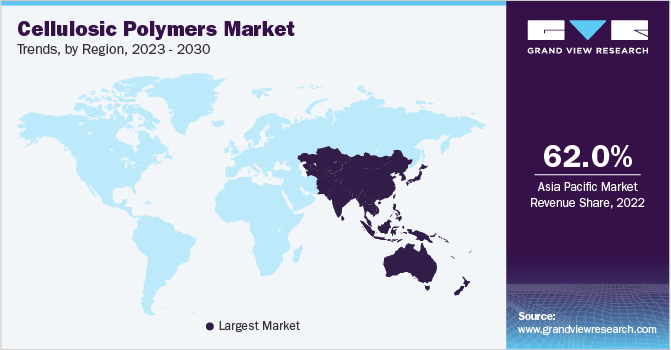

Regional Insights

Asia Pacific was the dominant regional market in 2022 and accounted for the largest share of over 62.0% of the overall revenue. The majority traction for the demand for cellulosic polymers was fuelled by the rapidly growing building & construction industry across emerging economies including India and China. The industrial and manufacturing sectors in Asia Pacific have been attracting significant investments from leading MNCs. The availability of cheap labor and proximity to raw material suppliers are further luring investors to the region. China and India are expected to mainly drive the regional market growth over the forecast period.

North America is also estimated to have considerable growth in the years to come. The construction industry in North America is expected to witness significant growth over the coming years owing to the high demand for non-residential construction projects, such as hospitals, commercial buildings, and colleges. The implementation of the Affordable Healthcare Act is also expected to stimulate the construction of a greater number of healthcare units and hospitals, which, in turn, is expected to boost the product demand across the building & construction industry in the region over the forecast period.

Key Companies & Market Share Insights

Research activities focused on new materials, which combine several properties, are projected to gain wide acceptance in this industry in the coming years. Some of the prominent companies operating in the global cellulosic polymers market include:

-

Nouryon Chemicals Holding B.V.

-

CP Kelco U.S., Inc.

-

Ashland

-

Shin-Etsu Chemical, Co., Ltd.

-

Celanese Corporation

-

Daicel Corporation

-

Eastman Chemical Company

-

Lenzing AG

-

Dow, Inc.

-

Mitsubishi Chemical Group Corporation

-

Grasim Industries Limited

-

Sappi Europe SA

Cellulosic Polymers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.69 billion

Revenue forecast in 2030

USD 14.88 billion

Growth rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR (%) from 2023 to 2030

Report coverage

Revenue and volume forecast, company profiles, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; The Netherlands; Spain; China; India; Japan; South Korea; Australia; Indonesia; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Nouryon Chemicals Holding B.V.; CP Kelco U.S., Inc.; Ashland; Shin-Etsu Chemical, Co., Ltd.; Celanese Corp.; Daicel Corp.; Eastman Chemical Company; Lenzing AG; Dow, Inc.; Mitsubishi Chemical Group Corp.; Grasim Industries Ltd.; Sappi Europe SA

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cellulosic Polymers Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cellulosic polymers market report on the basis of type, application, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cellulose Esters

-

Cellulose Acetate

-

Others (CAB & CAP)

-

-

Cellulose Ethers

-

Regenerated Cellulose

-

Fibres (Viscose, Modal, Lyocell, and Cupro)

-

Films (Hydrated Cellulose Foil)

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Flexible Packaging

-

Skin Care

-

Print Laminations

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Building & Construction

-

Personal & Cosmetic Care

-

Medical & Pharmaceutical

-

Others (Oil & Gas, Textile)

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

The Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cellulosic polymers market size was estimated at USD 9.02 billion in 2022 and is expected to reach USD 9.69 billion in 2023.

b. The global cellulosic polymers market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 14.88 billion by 2030.

b. Cellulose ethers accounted to the largest share in cellulosic polymers market with a revenue share of 52.52% in 2022.

b. Major players present across the market include Nouryon Chemicals Holding B.V.; CP Kelco U.S., Inc.; Ashland; Shin-Etsu Chemical, Co., Ltd.; Celanese Corporation; Daicel Corporation; Eastman Chemical Company; Lenzing AG; Dow, Inc.; Mitsubishi Chemical Group Corporation; Grasim Industries Limited; and Sappi Europe SA

b. Cost-effectiveness and advancement in technology are factors propelling the demand for cellulosic polymers from end-use industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.