- Home

- »

- Renewable Chemicals

- »

-

Cellulose Fiber Market Size, Share & Growth Report, 2030GVR Report cover

![Cellulose Fiber Market Size, Share & Trends Report]()

Cellulose Fiber Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Natural, Synthetic), By Application (Textile, Hygiene, Industrial), By Region, And Segment Forecasts

- Report ID: 978-1-68038-184-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cellulose Fiber Market Summary

The global cellulose fiber market size was estimated at USD 40,217.1 million in 2023 and is projected to reach USD 62,923.6 million by 2030, growing at a CAGR of 6.1% from 2024 to 2030. Rising environmental concerns across industries, coupled with demand for sustainably sourced material, technological advances in cellulose fiber production, and favorable government initiatives, have fueled substantial market growth in recent years.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- In terms of segment, natural accounted for a revenue of USD 40,217.1 million in 2023.

- Natural is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 40,217.1 Million

- 2030 Projected Market Size: USD 62,923.6 Million

- CAGR (2024-2030): 6.1%

- Asia Pacific: Largest market in 2023

The rapidly expanding textile, paper, and construction sectors are major consumers of cellulose fibers. As a result, their promising growth has positively affected the demand for cellulose fibers globally. As companies are increasingly collaborating for the sustainable sourcing of raw materials, the demand for cellulose fibers is expected to expand steadily over the forecast period.

Cellulose fibers are polymeric substances derived from the cell walls of plants and are renowned for their abundance, renewability, and biodegradability, which makes them an important raw material in various industries.For instance, in the textile business, they serve as a base for a wide range of fabrics, such as cotton, linen, and rayon. These fibers are valued for their comfort, breathability, and moisture-absorbing properties. Additionally, cellulose fibers find utility in paper production, where they provide the essential structural component. They are extracted from various plant sources, including cotton, hemp, tobacco, and wood. The large-scale use of paper across the world, particularly in educational institutes and commercial spaces, is expected to help this industry maintain a steady expansion through regular raw material supply.

Over the past few years, innovations in cellulose fiber production processes have helped enhance efficiency, reduce costs, and expand potential applications of this product, thereby stimulating market growth. For instance, in the construction industry, they are increasingly being utilized in the development of insulation materials, providing thermal and acoustic benefits. Production technologies are being introduced that can help both in the extraction of cellulose from plants and its recycling, ensuring this material’s circularity. Additionally,supportive government regulations worldwide promote sustainability and a greater use of renewable resources. These factors are responsible for creating a conducive environment for the cellulose fibers industry.

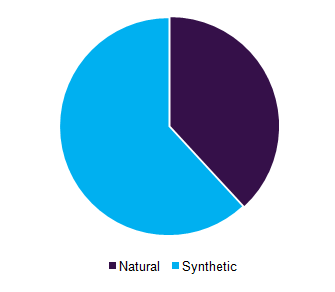

Product Insights

Synthetic products held the largest revenue share of 62.6% in the market in 2023. This is owing to the cost-effectiveness, scalability, and superior performance offered by man-made fibers. Synthetic fibers have various beneficial properties, such as durability, low absorbency, elasticity, and resistance to environmental factors when compared to natural fibers. These attributes make them particularly suitable for a wide array of applications, such as manufacturing industry-specific apparel, as well as in construction and other industries. Furthermore, the production of synthetic fibers is less reliant on climatic conditions and geography than natural fibers, ensuring a more stable and predictable supply chain.

Natural products segment is expected to grow at a significant CAGR during the forecast period. The increasing emphasis on environment-friendly and sustainable practices has led to a surge in demand for natural fibers, as they align with consumer preferences for environmentally responsible products.Natural cellulose fibers possess versatility and have utility across various industries, such as textiles, paper, and biocomposites, thereby expanding their market reach. A significant growth in utilization of these fibers is expected from industries in developing economies, owing to an increasing preference of middle-income level consumers in these countries for naturally sourced products.

Application Insights

In terms of application, textile accounted for the highest market share in 2023.The textile industry is an extensive consumer of cellulose fibers, utilizing them as a primary raw material in the production of a wide range of products, such as apparel, home furnishings, and industrial textiles. The consistent and substantial demand from this sector has been a primary driver of industry expansion.Cellulose fibers have applications in several textile products, ranging from casual wear to high-performance technical fabrics. This versatility has broadened the scope of use for cellulose fibers in this segment.

Meanwhile, the industrial segment is expected to advance at a notable CAGR over the forecast period. The sector's robust demand for cellulose fibers as a critical component in various manufacturing processes has been a primary driver of this segment’s expansion. Cellulose fibers possess unique physical properties such as high strength, absorbency, and biodegradability, making them crucial in applications spanning from construction and insulation to filtration and paper production. Moreover, advancements in cellulose fiber technology have expanded its application spectrum in the industrial sector. Innovations in fiber modification and processing have further enhanced their performance characteristics, solidifying the material's position as a preferred choice for various industrial applications.

Regional Insights

North America cellulose fiber market held a significant market share in 2023. The region has extensive forestlands, providing a robust and sustainable supply of wood pulp, which is the primary raw material for cellulose fiber production. North American companies have invested significantly in research and development activities to understand alternative uses of cellulose fibers. Additionally, a substantial demand for fashion apparel made from biodegradable fibers has been observed from the younger environment-conscious population in the region, driving market demand.

U.S. Cellulose Fiber Market Trends

The U.S. cellulose fiber market accounted for a considerable share of the regional market in 2023. A mature and technologically advanced pulp and paper industry has been established in the country for decades, providing a strong foundation for cellulose fiber manufacturing. Moreover, a substantial and growing domestic market for cellulose-based products, particularly in sectors such as hygiene, textiles, and construction, has driven production and innovation levels in the economy.

Europe Cellulose Fiber Market Trends

Europe cellulose fiber market held a notable market share in 2023. This is owing to the European Union’s increasing emphasis on ensuring sustainability across industries. For instance,the European Commission in 2022 prioritized making industries, especially textiles, more sustainable and circular. They promptly released the "EU Strategy for Sustainable and Circular Textiles" and announced comprehensive plans for a "Directive on Green Claims" in 2023.

Germany cellulose fiber market is among the prominent regional countries focusing on sustainable alternatives to wood-derived cellulose fibers. The economy is also home to several notable companies in this sector, such as CFF GmbH & Co. KG, JELU-WERK, and Kelheim Fibres GmbH, which helps in boosting the production of cellulose fibers. Cologne in Germany will be hosting the Cellulose Fibers Conference in 2025. This event will focus on the innovative uses of cellulose fibers in textile, packaging, and hygiene products. The conference will also focus upon biosynthetics and finding solutions for a sustainable and circular economy. Such initiatives are expected to increase awareness about these fibers in the country, driving market demand.

Asia Pacific Cellulose Fiber Market Trends

Asia Pacific led the market with a revenue share of 38.2% in 2023.This region houses well-established industrial and textile sectors, which are primary consumers of cellulose fibers. This substantial domestic demand has driven significant expansion in the production capacity of these fibers. Additionally, Asia Pacific possesses abundant timber resources, a critical input for cellulose fiber production. This readymade access to raw materials has provided a competitive advantage to regional manufacturers. These factors, along with the availability of affordable labor and strong government support, create a conducive environment for the growth of the cellulose fibers industry.

China cellulose fiber market accounted for the highest share of the regional market in 2023. The presence of prominent industry players such as Sateri, Tangshan Sanyou Xingda Chemical Fiber CO.,Ltd, and Jiangsu Aoyang Technology Co., Ltd. has ensured cost-competitive production of cellulose fibers. Furthermore, a growing demand from domestic consumers and neighboring economies such as India and Bangladesh, along with robust logistics and export networks, have made China a prominent supplier of cellulose fibers.

Key Cellulose Fiber Company Insights

Some key companies involved in the cellulose fibers market include LENZING AG, Grasim Industries Limited, and Sateri, among others.

-

LENZING AG is an Austrian manufacturer of wood-derived viscose fibers, textile fibers, modal fibers, and various other types of fibers used in the textile industry. The company offers its products under distinct brand names: TENCEL, VEOCEL, LENZING ECOVERO, and LENZING. TENCEL is the company’s flagship brand, offering three sustainable products - TENCEL Modal, TENCEL Lyocell, and TENCEL Lyocell Filament. LENZING produces its Lyocell fibers with the REFIBRA technology, which uses recycled cotton textile materials.

-

Grasim Industries Limited is a textile manufacturing company in India under the Aditya Birla Group. The company is a producer of viscose staple fibers, viscose filament yarn, textiles, insulators, chemicals, and paints. Viscose staple fibers produced by the company are used in apparel, home textiles, knit wear, dress materials, and other non-woven applications. The company additionally exports its viscose filament yarn to over 45 countries globally.

Key Cellulose Fiber Companies:

The following are the leading companies in the cellulose fiber market. These companies collectively hold the largest market share and dictate industry trends.

- LENZING AG

- Grasim Industries Limited (Aditya Birla Group)

- Sateri

- Södra

- Eastman Chemical Company

- Kelheim Fibres GmbH

- Tangshan Sanyou Xingda Chemical Fiber CO.,Ltd

- China Hi-Tech Group Corporation (CHTC)

- ENKA GmbH & Co. KG

- CFF GmbH & Co. KG

- Daicel Corporation

- Jiangsu Aoyang Technology Co. , Ltd

Recent Developments

-

In June 2024, LENZING AG announced its partnership with Diane von Furstenberg (DVF), wherein the companies will collaborate globally to bring LENZING’s ECOVERO and TENCEL fibers into mainstream fashion. DVF’s general fashion collection and certain accessories make use of these fibers, which are themselves made from sustainable wood sources, and are currently available in DVF online stores and physical stores globally.

-

In June 2024, Eastman announced the launch of ‘Naia Renew’ for the denim segment to advance its sustainability objectives, at the Denim Première Vision exhibition. This is a cellulosic acetate fiber that has been prepared from 40% certified recycled content and 60% sustainable wood pulp. Naia Renew is skin-friendly and hypoallergenic that has a soft touch, manages moisture and odor effectively, and offers improved spreading speed.

Cellulose Fiber Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 44.07 billion

Revenue Forecast in 2030

USD 62.92 billion

Growth Rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Austria; China; Japan; South Korea; India; Brazil; Argentina; Saudi Arabia

Key companies profiled

LENZING AG; Grasim Industries Limited (Aditya Birla Group); Sateri; Södra; Eastman Chemical Company; Kelheim Fibres GmbH; Tangshan Sanyou Xingda Chemical Fiber CO.,Ltd; China Hi-Tech Group Corporation (CHTC); ENKA GmbH & Co. KG; CFF GmbH & Co. KG; RYAM; Daicel Corporation; Jiangsu Aoyang Technology Co. , Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cellulose Fiber Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cellulose fiber market report based on product, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Textile

-

Hygiene

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Austria

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.